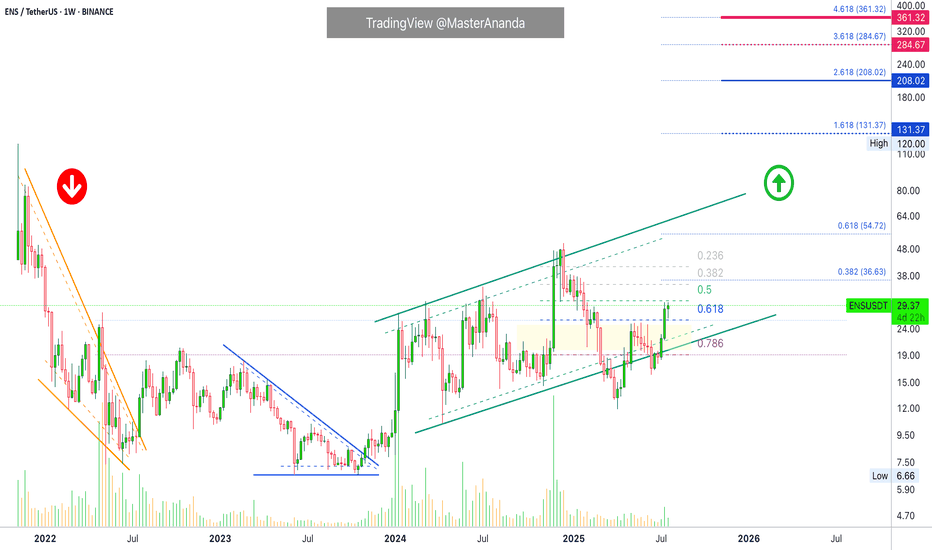

Ethereum Name Service Easy $131 Target · $208 Possible or HigherEthereum Name Service really took off in late 2023. March 2024 did nothing to this project. Here we can see an extended period of higher highs until December 2024. Many projects produced a major high in March 2024 to turn bearish until recently. In December, all of these produced a lower high. You can see how different this chart looks. This is a strong project the chart is saying.

There was a strong correction between December and April, this was a marketwide event. You can see how ENSUSDT moved below 0.786 Fib. retracement for several months just to recover. In June it remained below this level only briefly, for two weeks, and we are now full green.

Last week's candle closed above 0.618 Fib. retracement and we are back in the bullish zone. Full blown bullish as Ethereum Name Service is trading at the highest price since January 2025. Everything shows the market being ready for additional growth.

The recovery above support never supports a crash but instead a bullish continuation. For a crash, we would see a rejection or very weak action around resistance. Instead, we have full green candles with rising volume. Perfect conditions for higher prices. Just what we need and want to see.

The targets here are good, $131 and $208. I don't think this will be the end though and we have another wait and see. I think between $285 and $361 is a better prediction, these targets are also shown on the chart.

How far up do you think ENS will go?

Namaste.

ENS

ENS/USDT Weekly Outlook – “Massive Breakout Brewing from Base

Ethereum Name Service (ENS) is currently positioned at a critical inflection point on the weekly chart, signaling a high-probability setup for a massive bullish breakout after nearly 2 years of sideways consolidation and structural base building.

🔍 Technical Pattern Breakdown

This chart reveals a macro Ascending Triangle formation developing since late 2022, with higher lows consistently respecting a rising trendline support and price now retesting the golden pocket Fib zone.

Pattern Formed:

📐 Macro Ascending Triangle + Fibonacci Confluence Zone

📉 Long-Term Accumulation Range: $14.6 – $23.7

Trendline Support:

✅ Rising since 2023, showing buyers consistently stepping in at higher levels

Fibonacci Retracement:

🔑 Price currently sitting between 0.5–0.786 Fib zone from the 2023 rally:

0.5 = $18.33

0.618 = $16.82

0.786 = $14.68

🟢 Bullish Scenario – Potential Multi-Leg Rally

If price holds and rebounds from this support region, we could see a stepped breakout with key resistance levels being taken out one by one:

1. First Resistance – $23.73: Psychological and structural breakout level

2. Second Target – $30.48: Prior major rejection area

3. Third Target – $47.13: 2024 resistance high

4. Macro Target – $69.99 to $85.88: Full breakout potential from triangle width and historical ATH zone

🚀 Upside Potential from Current Levels (~$18): Over 350%

📈 This would confirm the end of the accumulation cycle and signal the start of a long-term bullish phase.

🔴 Bearish Scenario – Breakdown Risk

In the event of a confirmed weekly candle closing below $14.6, we invalidate the ascending triangle and shift bias toward bearish retracement:

Next Support: $10.00

Extreme Bearish Target: $6.65 (macro low from 2022)

🛑 Breakdown from this structure would suggest failure of the accumulation pattern and return to long-term bearish pressure.

💡 Strategic Insight

ENS is one of the rare altcoins currently forming a clean high-timeframe bullish setup. This is the kind of structure institutional or swing traders look for when anticipating early entries before explosive moves.

With a tight invalidation below $14.6 and multiple upside targets, this setup provides a strong risk-reward opportunity.

#ENS #ENSUSDT #AltcoinBreakout #CryptoSetup #Accumulation #TechnicalAnalysis #CryptoTrading #SwingTrade #Fibonacci #AscendingTriangle

Ethereum Name Servise ENS price analysisFor the second day in a row, trading volumes on the CRYPTOCAP:ETH futures market have exceeded those of CRYPTOCAP:BTC

(Is the market alpha returning or are profits being locked in? Write your thoughts in the comments ?)

💡 And we will write an analysis of the possible movement of the NYSE:ENS price — this is the #Ethereum Name Service management token, which is used to manage the protocol and influence pricing decisions for its .eth addresses and price oracle.

👌 Currently, all forces are preventing the OKX:ENSUSDT price from consolidating above $23.6. But when that happens, it will be a very safe level to buy on a retest.

📊 More risky, but with greater earning potential, are purchases at $17.50 and $14.50.

Set your “buckets” for purchases and wait for them to “fill up.”

And then, who knows, maybe in 2025, the price of NYSE:ENS will reach its ATH.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

The key is whether the price can hold above 25.06

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ENSUSDT 1D chart)

The key is whether the price can be maintained by rising above the important support and resistance zone of 20.93-25.06.

If it fails to rise, it is likely to fall to the support zone of 11.86-14.61, so you should think about a response plan for this.

However, the 20.93 point is a volume profile zone, so you should check whether it is supported when falling to this area.

If it starts to rise,

1st: 28.15

2nd: 33.54

The 1st and 2nd areas above are likely to act as resistance.

-

The indicators used as basic trading strategies are the HA-Low indicator and the HA-High indicator.

The basic trading strategy is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, if it is supported by the HA-High indicator and rises, it is likely to show a stepwise upward trend, and if it is resisted by the HA-Low indicator and falls, it is likely to show a stepwise downward trend.

Therefore, the trading method should be a split trading method.

The end of the stepwise upward trend is a decline, and the end of the stepwise downward trend is an increase.

Therefore, if you buy when the HA-High indicator is supported and rises, a short and quick response is required.

Accordingly, it is not recommended to use the HA-High indicator as the first purchase point.

If you are familiar with day trading, the HA-High indicator may also be a purchase point.

Currently, the HA-Low indicator is formed at the 14.61 point, and the HA-High indicator is formed at the 23.12 point.

-

Depending on the arrangement of the candles, the important support and resistance zones are in the 20.93-25.06 zone.

Therefore, regardless of the current HA-High indicator position, if it shows support above 25.06, it is a time to buy.

However, since the buy zone and resistance zone are close, a quick response is required.

Therefore, the support and resistance points drawn on the 1M, 1W, and 1D charts correspond to important trading strategy points.

In order to draw reliable support and resistance points, objective information is required.

Be careful because the support and resistance points drawn after starting a transaction may reflect your psychological state and become unreliable support and resistance points.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

ENSUSDT - GAMEPLANAlright everyone, focusing on ENSUSDT. The current price action suggests that the immediate target for this move is the blue line I've marked on the chart. This line represents a key level that the market is currently aiming for.

Beyond that, looking lower, you'll see a blue box that I consider to be a beautiful support zone. This area is where I anticipate strong buying interest could emerge, potentially halting any further downside.

As always, my approach is rooted in confirmation. If price reaches the blue line, I'll be scrutinizing the volume footprint to understand the true intentions of market participants. Are we seeing signs of distribution, or is there genuine momentum to push through? I'll also be watching for any CDV (Cumulative Delta Volume) divergences that might signal a shift in the underlying order flow.

Should price retreat towards that lower blue box, I'll be looking for low timeframe (LTF) confirmations to validate its strength as support. A clean retest and bounce from this zone, especially with an uptick in buying volume, would be a strong signal.

Remember, I exclusively focus on assets that show a sudden and significant increase in volume. This selective approach helps me concentrate on where the market is truly showing its hand. ENSUSDT's current movements, coupled with its potential to interact with these key levels, make it an interesting watch.

Keep these levels on your radar. The market is always speaking, and by paying attention to these nuances, we can decipher its true intentions. You can trust my perspective to guide you through these intricate market dynamics.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#ENS/USDT#ENS

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 22.00.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 22.37

First target: 22.80

Second target: 23.17

Third target: 23.69

Ethereum Name Service (ENS) Leaves Accumulation ZoneHere we have two accumulation zone. The "bottom" zone coming at the end of the 2022 bear market and in late 2023, between June and December. And the "higher low" zone which started after the early 2024 bullish breakout.

This latter zone was activated April-May 2024 (1), August-November 2024 (2) and March-April 2025 (3). With the last activation of this zone ENSUSDT ended its correction and is now bullish.

Last week was a consolidation week and within the next two weeks we can have a bullish continuation, the resumption of the bullish move that started with the 7-April low.

Good morning my fellow Cryptocurrency trader, how are you feeling in this wonderful week?

What is a good opportunity?

A project that has really good potential for growth and at the same time, high certainty, sure to grow and stable. This pair has those qualities.

We also want a good entry price and timing. Timing is good all across.

Entry prices could be better but that would be being greedy. If ENS can move beyond $100, easily, then anything below $25 can be a good entry. Of course, a price of $15 is many times better, but not everybody can buy at $15 at the same time. And being honest, it is not easy to catch the exact bottom. We can even see it happening but our finances might not be in the right place when this is happening or some other situation prevents us taking action, but it is never too late. The market always offers a second chance and this chance is now.

Ethereum Name Service has great potential for growth. My strategy is very simple, buy and hold. Set a sell order 300%-500% above my entry level, when it fills, look for a pair that is still trading at bottom prices and repeat.

If you are glued to your screen, you can track the market and sell higher. Or you can sell portions at each target, or you can hold long-term. There are many ways to approach the market, right now, it is not about selling but buying. Right now is the time to buy. Late 2025 is the time to sell.

Thank you for reading.

Namaste.

ENS SWING Trade SetupENS Showing strong momentum towards upside and dropped without touching POI, So it can go higher first then it may take correction, spot and future trader can take risk on this. Wait for the entries and enter from 20-19 level, if price reverse from any other point, then wait for the 4hrs candle closing above 26 and target the 30-32$ level. for scalp and day trading get long from 22.40 SL 21.65 and set tp 25.56 & 27.79$.

ENS — Eyeing the BreakoutSpotting early momentum on ENS — we've entered around 14.383, with a backup limit order waiting on x2 margin at 13.891 for a potential dip grab.

This setup shows solid structure and looks ready to test higher if we hold above key support. The chart’s shaping up for a possible leg up, and I’m eyeing targets at:

14.536 → 14.680 → 14.876 → 15.126 → 15.591

Stop is tight at 13.516 to protect capital. Let’s see how it plays out — looks like we might catch some real movement here.

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're curious.

Univers Of Signals| ENSUSDT Better Status Than AltcoinsLet's go together with one of the popular layer two coins that works in domain and address naming services for wallets and recently announced that it will launch layer two soon

🌐 Overview Bitcoin

Before starting the analysis, I want to remind you again that we moved the Bitcoin analysis section from the analysis section to a separate analysis at your request, so that we can discuss the status of Bitcoin in more detail every day and analyze its charts and dominances together.

This is the general analysis of Bitcoin dominance, which we promised you in the analysis to analyze separately and analyze it for you in longer time frames.

📊 Weekly Timeframe

On the weekly time frame, ENS is one of the bullish coins in the market that has a good situation ahead and has started its main upward movement before the start of 2025 and in late 2023

After the start of the main movement after the 9.99 break, we started our main upward trend and we can say that we broke our ceiling in terms of market cap and made a new ATH market cap

We are also on a curve line that is bullish and supportive in nature and if this line is broken, it shows us that the main upward trend has weakened and if we go below 15.90, we will see a trend change in MWC

For re-entry, the 47.68 break is an interesting trigger and you can buy again and if the exit trigger is below 15.90, you can exit and for now, I recommend You can't buy in this time frame

📈 Daily Timeframe

In the daily time frame, however, it has held its own more than the rest of the altcoins and is suffering in its daily box between 24.78 and 27.55, which happened after the rejection at 47.68.

Also, in this time frame, we have a trend line that if the price reaches it, we will have the possibility of reacting and we will use it as a tool to save profit in the lower time frame if we react to it.

Also, the rejection candle that closes from this resistance at 27.55 in the same way, we will have the possibility of continuing the downtrend, and if 24.78 is broken, we can move towards 20.81 and 15.90. And for buying, if this support is faked or the 35.98 trigger is activated, I will buy, and in this box, I will only I trade in futures

⏱ 4-Hour Timeframe

In the four-hour time frame, what happened is that we faked the resistance above the box, which increases the probability of breaking the support floor

📉 Short Position Trigger

you can open a position with this four-hour candle as a guide, but on the other hand, it is better to wait for the support to reach 24.79 and the reaction from it and then follow its breakdown

📈 Long Position Trigger

we need to return to the ceiling again for now, and if we return above the support level sooner, we can think more about breaking 27.91 and open a more confident long position .

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends

Long Entry Signal for ENS/USDT Based on the daily chart for ENSUSDT on Bybit, here's a concise analysis:

MLR vs. SMA: The MLR (blue) is above the SMA (pink), indicating a bullish trend.

MLR vs. BB Center: The MLR is above the BB Center Line (orange), suggesting bullish momentum.

PSAR: The PSAR dots (black) are under the price, confirming a bullish trend.

Price vs. SMA 200: The price is above the 200-period SMA (red), supporting a long-term bullish trend.

Current Strategy: Since all entry conditions for a long position are met (MLR above SMA, MLR above BB Center, PSAR under price, price above SMA 200), you might consider entering a long position.

Stop Loss (SL): Set the stop loss at the current level of the PSAR dots to manage risk.

Monitor My Idea: Keep monitoring my idea for any changes in trend or for potential profit-taking opportunities.

ENS Bulls Eyeing a Breakout—Can They Push Through?Yello, Paradisers! Is #ENS finally shaking off the selling pressure and preparing for a breakout? The price action suggests something big could be brewing!

💎#ENSUSDT is currently forming an ascending triangle pattern after a major correction—this is a sign that sellers are losing their grip, and momentum might soon shift in favor of the bulls. But the real battle is just ahead…

💎The critical breakout level stands at $28.80, with the pattern neckline resistance between $28.20 to $28.80 levels. A strong move above this zone would open the doors for a rally towards the moderate resistance at $30.05–$30.45. However, this region is no joke—it’s a challenging zone where bulls will need to prove their strength.

💎If buyers successfully break and hold above the challenging zone, ENS could confirm the bullish structure and push towards $33.50–$34.20 as the first key target. Expect some profit-taking around this level, but if momentum remains intact, the final pattern target of $37–$38 could be in play—right in line with historically strong resistance zones.

💎On the downside, ENS has reliable support at $26.60, with ascending support between $26.00 and $25.80. These levels should absorb selling pressure in case of a pullback. Below that, a strong base support at $24.40–$24.00 is developing—which is turning the tides in favor of bulls.

Paradisers, as always, patience and precision are key in this market. This isn’t a time for reckless trades—let the levels guide you, trade strategically, and stay disciplined.

MyCryptoParadise

iFeel the success🌴

(ENS) ethereum name service - "year of the dragon"The year of the dragon belonged to none other than Ethereum Name Service (ENS). Based on the looks of the chart the graph moved like a dragon and is shaped like a dragon so that is why I am giving ENS the award of the crypto of the year, crypto of 'The Year of The Dragon." What will 2025 unfold. This award is not an award for the best cryptocurrency in cryptocurrency so much as an award in correlation with the fragments and pieces of social culture and the activities people tend to follow and carry with them through their days, months, and even years.