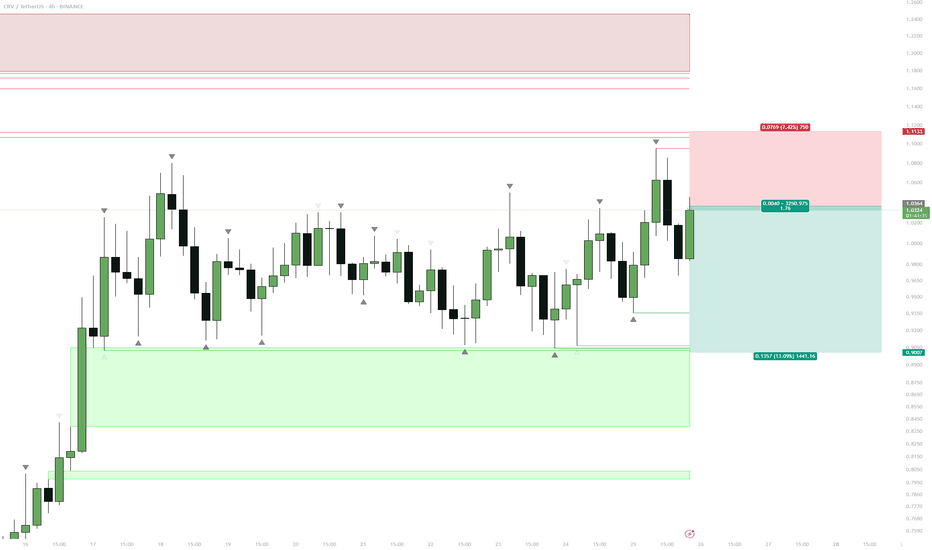

$CRV Equal Lows ShortExtended Range

CRV has been ranging for almost week with no clear direction.

Price has respected resistance above $1.10 multiple times.

Obvious Liquidity Pool

Multiple equal lows are sitting at the $0.90 level, a textbook liquidity magnet.

Market makers are likely to target this area before any substantial move higher.

Short Entry

Short from just above $1.00, stop above the range high.

Target is a sweep of the $0.90 lows.

Next Steps

Watch for signs of absorption or reversal if price wicks below $0.90.

Consider flipping long if strong buyback or deviation forms after the liquidity sweep.

Reasoning

CRV has spent week ranging, building up an obvious set of equal lows. This is classic “liquidity sitting on a platter” for larger players. Short setups are favored while the range top holds, aiming for a stop run below $0.90. After the sweep, be open to a fast reversal or potential swing long if bulls reclaim the level.

EQ

PEPE is prepping somethingPEPE is on the 4h charts in an EQ and can go both ways. We want to see a breakout with volume before jumping into the action. The TT is the recent ATH where it will trigger the stop losses and could correct to the GP or even 0.786 fib range.

The liquidity is just below the EQ and just above the recent ATH. A stop loss hunt to 0.0137 can be expected before we go up.

SPY & Elliot Wave TheorySPY: Using Elliot Wave Theory, predicting a move to 4.30 seems likely.

~RSI has room to go to 430, so it is not out of the question of possibility

~The VI looked like it was about to switch momentum to bullish, but the red line is starting to curve back upwards giving the question is it really a reversal to bullish yet?

~Using Elliot Wave theory's 5 part wave we have completed the first 4 parts and are in need of the fifth. This theory predicts group mentality overall and is often times the case.

~Previous waves hint that this may be the last bearish wave before the tides turns bullish

The importance of intelligence to tradingINTELLECTUAL QUOTIENT

The one we hear the most nonsense about and for 1 legit piece of info there are 500 TB of crap.

People are super insecure about this. Even in investing circles, where individuals are at or above average, still insecure.

Academics using Finnish data (because at 19-20 men have to pass an IQ test for the military) found that

25% top IQ (IQ > 110) make up 50% of market participants

25% bot IQ (IQ < 90) make up 9% of market participants

So virtually everyone reading this should be average or above, and I don't do simple magical indicators so that probably adds another filter.

Academics looked at tech stocks on the Helsinki stock exchange and found that in the sample period 1/1995-11/2002 the annualized returns (dividends etc included) were:

- For the 42% with the lowest IQ 9.52%. The 1rst to 4rth stanine. IQ <96. I'll call them INT 1-4.

- For the 4% with the highest IQ 14.45%. The 9th stanine. IQ > 126. I'll call them INT 9.

A significant difference. Remember the vast majority are passive investors that just follow the market as a whole.

Imagine 1/3 of a country invests, they have a separate life they're not all active.

Much of the difference in performance - which is monotonously correlated with IQ - comes from lower IQ individuals joining at the wrong time.

But even when ignoring the timing, and looking at returns as if they all joined equally over time (by adding weights to the data) scientists found that INT 9 (IQ > 126) returned 14.84% and INT 1-4 (IQ < 96) returned 12.65%.

So not only wrong timing but also wrong stock selection. I am guessing they regrouped 1-4 to not humiliate people with intellectual disability (INT 1)?

Sources:

papers.ssrn.com

papers.ssrn.com

Proven by science, all the big liars saying it does not matter are big liars trying to be liked.

About market timing. There is a clear pattern, it just jumps at you.

Page 61 of IQ, Trading Behavior, and Performance you can see for yourself so I'll keep it short:

Basically like it or not, people with an IQ over 105 (37% of the population), which already is the majority of market participants, are the ones buying during the bull market, and the average and below all rush in when prices start to go parabolic, making them go even more parabolic, smart people step away, and 1-5s hold the bag and keep buying when the price is clearly in a bear market (poor pattern recognition).

To all the people that joined crypto in 2017 and are going "oh no not me": The Finnish data set only looks at men over 20.

And the vast majority of those are well over 30. They had more than enough time to earn some money, hear about stocks, and get into investing.

The European demographic pyramid is really terrible. And of course older people invest more than broke young people that study or barely started to work.

People get into investing in waves. The tech bubble was when plenty of 20 yos (back then) got in. I didn't know I could invest by myself before 2017.

All of us 20-30s are just a tiny minority that makes no difference stat-wise compared to the vast number of middle aged workers and retirees.

For my defense I entered at the top, during the parabola but I was not a permabull, all the bagholding 1-5s were laughing at me for being bearish...

I like it here, how it is now.

If Bitcoin goes vertical to over 100K the 25% at the bottom will start to appear again. And start arguing. And making circular logic. And screaming. And sending threats. Oh boy.

INT 6 represents 17% of the general pop & in this data 23-24% of market participants, INT 7-9 23% of the general pop is 36-37% of market participants.

You know, even today after they lowered the level drastically, only 1/3 of people completes college education (or equivalent for us French), and they're not 1-4s.

Seems obvious to me that someone that struggles with a division won't be making money in the markets, do people think this is manual labor?

But whatever, as I said, IQ matters because these 4 things matter:

1. Pattern Recognition: The ability to understand the world through analogies. Predicting a crash because many elements are similar to the previous crash is not very different to looking at a bunch of dominos in an IQ test and guessing which one is next in the list.

2. Numbers skills: being able to quickly calculate risk, volatility, as well as understand probabilities. Good way to avoid holding a bag and waking up "Oh what? How am I down 75%? Didn't see that coming". You have to see that coming. You need to know how much you'll make or lose if the price goes up/down by x percent, how likely it is to happen using implied volatility, and much more.

3. Planning & Problem Solving: NEW problems. Not "learn by heart your school lesson" problems. Parrots and college professors do not make great traders. Learning by heart is useless. Every time it's different. "This time it's different". You can mix this with pattern recognition and it becomes obvious where I'm getting at: dumb money ALWAYS goes "this time it's different". You should be able to adapt to new variables, solve new problems, and be able to recognize how NOT different they are. All snowflakes are different. This is literally IQ at its finest and nothing more.

You either see the "different" pattern of dominos and can solve the problem or you don't have the IQ and simply do not see it (and insult people that do see it call them stupid and conspiracy theorists).

4. Dealing with a lot of info: being able to analyse much information, while ignoring distractions.

Academics that looked at data unsurprisingly found that higher IQ individuals had more diversified portfolios.

And also, higher IQ individuals are able to analyse more data as well as ignore distractions (according to a BBC article).

How to increase my IQ?

There is a way. Only 1 way I know of:

"Scientists found that multitasking reduced men IQ by 15 points, lowering them to the level of an 8 year old".

I am certain it's not like this for women, prob just reduces it by 5 points or something, or maybe 0 idk.

We men tunnel vision. So ye just focus on 1 goal only and get good at it.

This "multitasking" will make you a complete noob. Literally an 8 year old to be more precise :D.

Women have same average IQ as men also. I don't really know what the differences are for investing, probably not much.

They're probably better at being organised too. That's just... so bad for me you have no idea. What a mess.

Obviously it's also possible to learn about numbers and improve at it... And one learns to recognize snowflakes by studying plenty of snowflakes, regardless of his abilities (just will be easier for someone who scores higher that's all).

EMOTIONAL QUOTIENT

Why do I write so much? Good thing there is very little research about this, so not much to say.

First, no, women do not score higher (in IQ either btw). Just because there is the word "emotional" in it people assume silly things.

It's just a word. Irrelevant. So I'm calling it brzbjfbrhdjf from here on.

These are pretty self-explanatory honestly.

People with high brzbjfbrhdjf perform better than people with low brzbjfbrhdjf.

There are exceptions. I found that people with LOW empathy made better debt collectors XD Better serial killers too I bet!

A doc, not sure how serious, shows how they tested portfolio managers, and these had significantly higher brzbjfbrhdjf than average people.

There is very little research on brzbjfbrhdjf, as opposed to IQ that has a lot of it, but there sure is a lot of "understanding" media articles about brzbjfbrhdjf, saying how great it is, as there are tons of articles saying how awful IQ is (insecure much?) and none praising it or just listing some of the positives.

The market does not care where you bought, remember? It's about what the market is feeling, so go scream "BITCOIN IS GOING TO ZERO!" and find out if:

- They are mocking you (honestly): They are complacent, euphoric or thrilled, depends. Can't really teach this... Have to "feel it" idk.

- They are angry (includes mocking you but if you have high "empathy" & "social skills" you can tell they are mad): Anxious

- They go "pfff", "I'm over it", they sigh: Well capitulated and depressed, bottom?

So many people think the world revolves around them, and when there is someone they don't like they get persuaded that person is dumb or loses money XD

They think if they believe hard enough it will happen? I find it stupid, so the term "emotional" intelligence might be accurate, the intelligence part anyway.

I could go on but I think that's enough. If I find something interesting I'll share.

It might be more important than IQ, OR not be more important but since all investors have high IQ anyway then IQ won't matter but "EQ" will differentiate between the mediocre ones and great ones. Having both = jackpots. OF COURSE here we talk about people that put in the hours. Obviously just having "good genetics" won't make you Mr Olympia if you drink beer all day long and never work out, know what I mean?

People with low empathy can make money by the way, plenty of autists (famous for not being able to understand people feelings) are great money manager.

Remember Michael Burry? Predicted the housing crisis and shorted morgage swaps, great at stock picks. Famous now, made lots of money.

You know what else Michael Burry did? Short WAY too early. Because people were still way thrilled back then.

And he quit managing other people money (I doubt he understood their stress), in an interview he explains how they were mad even after he made them lots of money.

A guy with low empathy dealing with very emotional people (very emotional doesn't mean high "emotional" intelligence) and very little self-management (also little ba**s).

1. Self-Awareness: is the ability to understand how emotions affect yourself and other people.

2. Self-Management: is the ability to control impulsive decisions.

3. Motivation: is having a passion for what you do along with a curiosity for learning.

4. Empathy: as in the ability to understand how people feel (fear, euphoria, etc).

5. Social Skills: as in being aware of the people around you, people with different point of views.

The military gets the best results by filtering at entry. Rather than punish everyone because of some gamblers, regulators ought to filter at entry.

In some video game, would a MAGICIAN starting with 0 STR and built as a melee tank do well? No.

People with low "IQ" and "EQ" have nothing to do in this business. Better to do something else.

What else that I do not know. Society has a problem with low IQ individuals, there are no jobs for them. Tech advanced too fast humans can't keep up.

Just convince intelligent women to focus on their careers and give welfare to dumb ones when they have kids, that'll solve the problem long term!

I do not have autism (kinda disappointed), it's not that I do not KNOW this sounds distasteful to people, I am very aware of it, it's just that I don't give a rat's ass.

Not going to start lying to be popular. Plus everyone can keep burying their heads in the sand, things will just keep getting worse.

Specific to investing, people will low IQ/EQ will be told everyone can make it, buy a course or whatever, waste hundreds of hours, lose their money, quit. Oh great.

But for a moment they felt really good and had high hopes. High hopes that got completely crushed. Great. At least some bullshiter got to be the nice guy!

Most "1-4s" know they're not super smart and avoid the market, most people that get offended are 5+ but get offended in their name because they're so virtuous or something.

But idk recently they're trying to "democratize" investing, and all sort of random people with no clue what they are doing and a gambling mentality are jumping in to pump the pyramid scheme higher. This can only end badly. So I wonder, are the people pushing for this nonsense really "well intentioned"? Or just trying to keep the pyramid scheme alive a bit longer and pump their holdings at the expense of "useless eaters"?

EQ Watch for Resistance Breakout. Bullish FridayEQ reached top mover status as a gainer one day and a loser the following day.

Thursday, EQ was up +1.49% pre-market.

I predict stock moves at a steady pace toward $24 price target.

EQ is a mall biotech company researching Alzheimer's medicine.

Healthcare is our third-largest sector ($6.2 T).

Financials ($7.53 T) ranks second and information technology ($9.58 T) first.

Please always do your own research.

This is not advice.

I'm here to learn.

Thoughts?

EURNZD1. 4HR Bullish order block & EQ of that candlestick, As marked price tested the EQ before shooting up - where I'll be setting up longs when prices trades back towards that level.

2. 15M Bullish order block, another area of interest where I'll be setting up longs.

3. Where I don't want to see react. If it plays out to the downside piercing the marked S/R and OB then I'll be looking for shorts.