Natural Gas Bullish Reversal...Are the Lows in?U.S. natural gas inventories increased by 48 billion cubic feet last week to 3,123 Bcf, increasing the surplus over the five-year average.

Consensus / forecast was 37Billion Cubic feet.

Despite a much higher build than expected Nat gas saw positive price action.

This appears to simply be a dead cat bounce before we go lower.

A death cross on the daily chart has occurred. This signal often results in a small bounce before going lower.

EQT

Natural Gas Crisis: Profits were made!Nat Gas plunged to a 1-week low Monday on the outlook for cooler US temperatures.

A report came out that Nat gas has heat peak demand which is scaring investors.

Nat GAs equities got demolished which could indicate that this breakdown is real.

We got rejected off the daily 50 MA & Knifed through the 200 Daily MA.

Some clear technical breakdowns are now in affect.

We banked on EQT put options that ran over 400%. This trade was called out free on our channel. You tube Short.

Natural Gas - The Epic Reversal? Natural gas had an astonishing move to the upside. Closing up over 5% today.

This volatility can make all tarders head spin if youre not used to it.

Why did Nat gas pop today?

Partly from being oversold and into really good technical support, Natural gas inventories were released today at 10:30am.

The inventories showed a smaller build than the market expected which implies stronger demand. 56B consensus vs 53B actual.

This could potentially be the start to a new bullish trend.

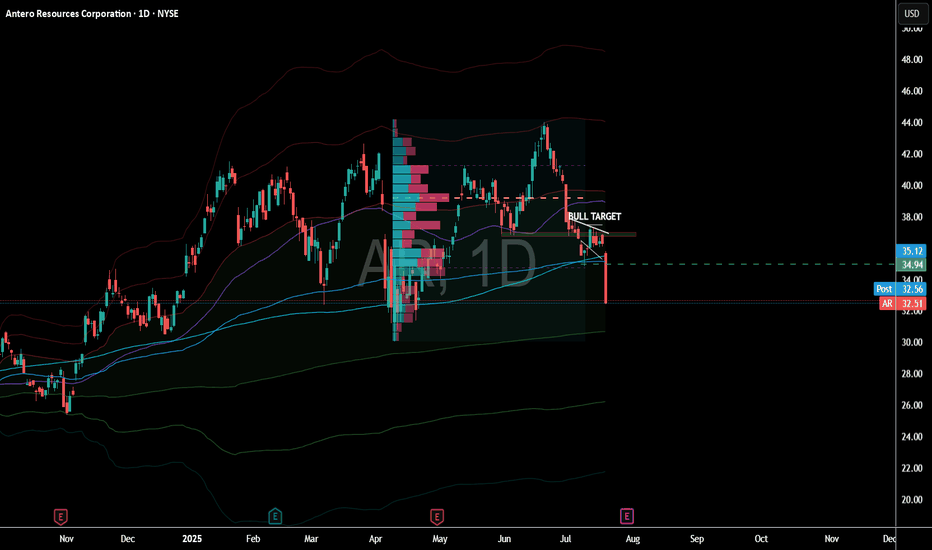

Names like EQT & AR hit some major support today. Some call options on these names have been accumulated.

NATURAL GAS - Who can Predict this wild beast?Natural gas got demolished today, down over 8%.

The one headline we saw hitting the tape that is having some partial influence:

"Vessel Arrives at LNG Canada to Load First Cargo, Strengthening Global Supply Outlook – LNG Recap"

Today, we did hedge our core long UNG position with a short dated $56 put on EQT.

We are already green on that trade and looking for $56 level to come into play.

Natural gas volatility sure trades in a world of its own which is why it is key to size accordingly.

Natural Gas - Silver Lining!Natural gas is ending the day with a daily bottoming tail.

Potentially forming an inverse head and shoulder pattern that takes us above the key $3.83 level.

We took profits on our EQT put hedge! The put contract went up over 100%

Lets see if Nat gas can build some pressure.

Navigating a Pullback in Natural GasNatural gas prices have been on a wild ride lately, with a recent pullback raising questions about the future of this energy source. This video provides insights into navigating this market volatility, offering actionable strategies for live trading in the midst of uncertainty.

Current weather forecasts for the U.S. show neither extreme heat nor cold—limiting heating or cooling demand. This typical spring-to-summer lull supports low prices .

Although rig counts in the U.S. are falling—the latest count shows an 8‑week decline—production remains ample. Storage levels remain healthy, and oversupply worries persist .

Natural gas rallied earlier today but faced resistance at the $4/mmBtu mark—a major psychological barrier. After hitting that ceiling, prices gave back gains, a typical sign of "rally exhaustion"

Natural Gas Explodes - Bullish Option ContractsTechnical Breakout Observed! Huge upside potential!

Inverse Head & Shoulders breakout on daily chart.

Weekly Bullish Cross 7/20 MA.

- Increased Demand: After a sluggish 2024, demand for natural gas is rebounding—especially for electricity generation in North America and Asia. This is tightening the market and pushing prices up.

- LNG Export Boom: New liquefied natural gas (LNG) export terminals, like the one coming online in British Columbia, are expanding shipping capacity. That’s opening up more international markets and driving up prices domestically.

- Geopolitical Tensions: Broader energy markets are reacting to instability in the Middle East, particularly between Iran and Israel. While this directly impacts oil, it also creates uncertainty across all energy commodities, including natural gas.

- Inventory and Supply Adjustments: After oversupply in 2024, producers are now recalibrating. But with inventories still low in some regions, prices are sensitive to even small disruptions

Natural Gas - Soaring Upside - Option Plays!Technical Breakout Observed! Huge upside potential

- Increased Demand: After a sluggish 2024, demand for natural gas is rebounding—especially for electricity generation in North America and Asia. This is tightening the market and pushing prices up.

- LNG Export Boom: New liquefied natural gas (LNG) export terminals, like the one coming online in British Columbia, are expanding shipping capacity. That’s opening up more international markets and driving up prices domestically.

- Geopolitical Tensions: Broader energy markets are reacting to instability in the Middle East, particularly between Iran and Israel. While this directly impacts oil, it also creates uncertainty across all energy commodities, including natural gas.

- Inventory and Supply Adjustments: After oversupply in 2024, producers are now recalibrating. But with inventories still low in some regions, prices are sensitive to even small disruptions

Do You Smell That...Natural Gas Burning!Recent Trends: The Energy Information Administration (EIA) reported the seventh consecutive weekly gain in inventories since late April, indicating a steady buildup ahead of summer demand.

Regional Highlights:

East: 340 Bcf

Midwest: 396 Bcf

Mountain: 166 Bcf

Pacific: 199 Bcf

South Central: 658 Bcf

Next inventory report is June 12 2025

June 5 - 122B Build

May 29 - 101B build

May 22 - 120B Build

These last builds have come in higher than consensus andd price is still holding.

A weekly Bullish cross of the 7 / 20 MA is about to occur. This indicates high provability of higher prices on the next few months if this can hold above the key MA's.

Natural Gas Roaring & SoaringNat gas had an epi +8% rally today.

The question is do the bull have more gas left in the tank or do the bears start to take over and press price lower?

We had news across the energy sector that spiked most energy assets.

Typically news based pops of this nature don't last.

If we get back above 3.84/3.85 then there might be a convincing opportunity to press this long

As of now i still lean bearish but holding no Nat Gas position.

Natural Gas Goes Kaboom!Profits have been secured I the Natural gas trade. That being said I still think Nat gas equities can push higher.

On the UNG chart we just saw the 20 day MA & 50 Day MA bullishly crossover each other.

Last time this happened Nat gas had a 4-5 day parabolic move.

The bulls must be careful to not push this commodity up too quickly because it makes the pattern less likely to have a continued breakout.

We are still putting in Lower weekly highs, so the next test of the most recent pivot high is going to be crucial.

If the bulls can trigger the weekly inverse head and shoulder pattern there's going to be a great long continuation opportunity. Until we break the pivot high & create a higher high traders must use caution now that we've had a large move occur.

AR, EQT, CPK, LNG are all set to push higher if Nat gas holds these gains.

Natural Gas: Weak Day / Strong WeekNatural gas had a bit of profit taking today and you can't blame the bulls for trimming especially since we did the same.

The Daily chart now needs a couple days of consolidation before another sustainable push.

The weekly chart recaptured the 50 Weekly MA...very good near term sign.

This can now be used as a support level to trade against for very tight stoploss swing traders.

As long as we remain above the breakout neckline we should be likely heading to retest 2.75 & $2.90

Levels below can cause nat gas to fail and fall substantially. Alway remembers the Weekly trend still has Lower highs in place.

Natural Gas turning bullish? Natural gas has now cleared a major resistance zone and is looking poised to head higher.

We have a beautiful daily and potential weekly inverse head and shoulder pattern developing.

The micro daily chart bullish pattern has triggered and gives us another +8-10% of upside.

However the really juicy pattern is the potential weekly chart set up.

If we breakout of the $2.90-$3 range we have a massive potential move to the upside brewing.

Natural Gas waking up? Nat gas showed some poise today.

Holding green in a red market where most commodities saw negative price action.

This is impressive to see because Nat gas has a long historical trend of diverging from many commodities.

The price action today also saw a red to green reversal further emphasizing the positive potential trend shift.

Nat gas stocks were discounted today despite the stronger price action in the commodity.

We remain bullish and long UNG, our call positions in the money.

Natural Gas: are bulls capitulating? The bulls have made 9 attempts at breaking out. All attempts have failed which has led us to this sharp decline.

Nat gas is holding the 20 day MA but it does look somewhat vulnerable to going lower.

The death cross is getting closer and closer as we approach the 50 MA & 200 MA downtrending intersection.

Our members stopped out of the second half of UNG in profits

I am now hoping and waiting for a sub $2 pierce retest. we shall see if we get it.

Natural gas is the downtrend resuming? Nat gas still fits all the criteria for a large downtrend.

Lower highs & Lower lows are still in place on the weekly timeframe.

This obviously swings probabilities in favour of lower price.

However historically were still at some oversold levels.

Just because this asset is oversold honest mean it can't go lower.

Im watching the daily 50MA & 200MA closely...do we get the death cross formation to occur again?

Usually this signal provides a near term bounce but medium term decline.

Natural Gas...bullish turnaround!Nat gas has carved out a nice potential base to move higher.

We have seen a failed breakdown whcih usualkly indicates a bullish reversal.

They say the biggest moves come from failed patterns an it certainly looks like a failed bearish trendline break.

If this is the case, Nat gas has a nice 15-20% upside before things get really interesting.

We may be witnessing a weekly inverse head & shouldrs pattern developing.

Time will tell but we are long.

Natural Gas...New All time lows? Natural gas has seen a failed breakout on the daily chart. After this failed breakout occured its been weeks of relentless sell side pressure.

We have lost key weekly and daily supports, which doesn't help the bullish case.

There is 1 small positive on the daily chart: a positive RSI bullish divergence.

Understanding how this commodity works, one should be prepared for a downside case of $1.60. Its not a guarantee but a possibility.

The Nat gas resource stocks are mixed and showing sings of volume accumulation.

I'm watching the $1.95 Gap fill on Nat Gas very closely. If the bulls defend that area we could rally quickly.

Keep your eye om the "Death Cross" signal, usually a buy signal for a short term bounce.

Natural gas...time to buy? Natural gas just keeps bleeding lower.

Despite the oversold intra day condition this commodity is finding no support.

Natural gas equities are mixed right now, but are definitely showing some signs of accumulation.

We think the next 2 support zones on Nat gas if we lose this critical area are $2.21 & $2.00

Beware Nat gas tends to overshoot.

This trendline we are holding right now connects through major lows going back to 2020.

Natural Gas Bleeding LowerNatural gas has seen negative price action since we got the golden cross.

The 50 & 200 moving average is touted as a bullish signal but often sold into in the near term.

This sell off in Nat gas is going quick and deep.

The problem with that is the sector is leveraged with triples & doubles.

If we complete the measured move down, we should see a bit lower price.

Intra day I would not be surprised for a sharp dead cat bounce.

Natural Gas: The Golden OpportunityNatural gas has seen a nice rejection off of 3.19.

A double top on nat gas is observed, does this mean we go lower?

In the near term perhaps some more consolidation is needed but the trend is setting up for the infamous golden cross.

If we get a bullish cross of the 50MA & 200MA this is a likely long term trend signal.

This signals higher probability of a bullish uptrend.

As we approach the elections, a potential trump win could influence the price.

Natural Gas: A Mega Move is BrewingNatural Gas has been a very volatile asset in recent sessions.

The price action in the 4 hour chart has triggered a bullish breakout.

The next bullish inverse head and shoulders pattern on the daily chart is starting to take shape. This pattern has not yet triggered.

If we see a breakout of this pattern there is about $1.50 of upside from the neckline.

Resource stocks are still holding up very well, granted so is the market.

A very similar structure is playing out on the weekly chart, regarding the 50 Weekly MA

If we see price trade in congruency we should see more upside this week and then potentially we may see some sellers the folling week