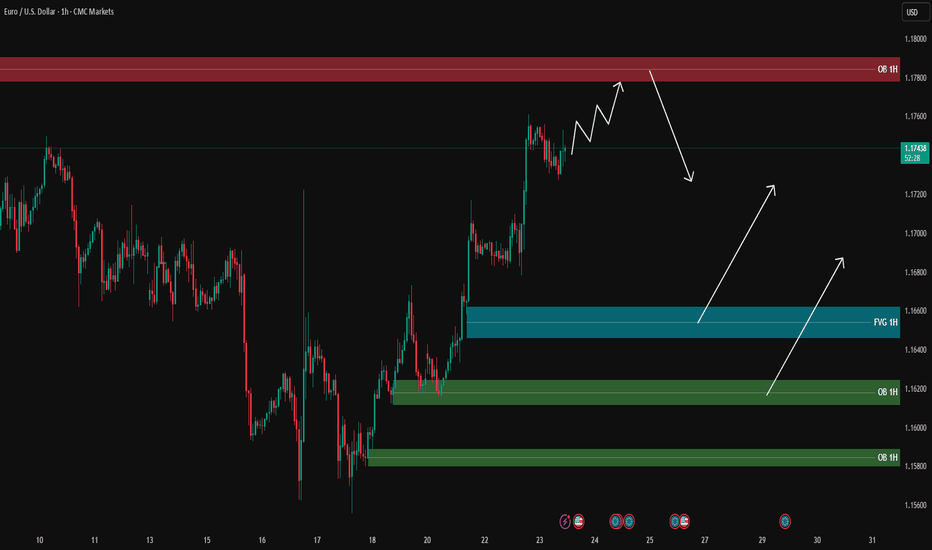

EURUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is moving strongly towards the 1H supply zone (around 1.1780), and it is likely to reach this area first before pulling back.

During the pullback, the blue FVG and green OB zones below are key areas for potential long entries:

🔹 FVG 1H around 1.1660

🔹 OB 1H around 1.1620

🔹 OB 1H around 1.1580

📌 Plan:

1️⃣ If the price reaches the upper supply zone, we will look for short scalps with confirmation on the lower timeframe (5M/3M).

2️⃣ After the pullback to lower zones, we will look for long opportunities with PA confirmation.

🎯 Long targets after pullback: 1.1700 – 1.1720, potentially 1.1750.

❌ No entry without confirmation.

Eruusdshort

EU - Short to take 4H liquidity Smart Money Concepts (SMC) Analysis

1. Liquidity Sweep

There was a clear liquidity grab at the recent swing high.

Price aggressively spiked above previous highs (buy-side liquidity), tapping into the premium zone of the prior range.

2. Supply Zone

The purple zone you marked aligns with a Bearish Order Block (OB) or supply zone.

Price tapped into it, showing signs of rejection — validating this as a potential distribution point.

3. Break of Structure

Price broke below a short-term higher low, indicating a shift in market structure from bullish to bearish.

This break is key for institutional confirmation of a bearish intention.

ICT Concepts Analysis

1.Liquidity Pools

Prior highs were engineered liquidity, meant to induce breakout buyers.

Once swept, Smart Money used this liquidity to fill sell orders.

2.Optimal Trade Entry (OTE) Zone

After the sweep and move into the supply zone, the rejection fits the OTE concept — entering after a retracement between the 61.8%–79% Fibonacci zone of the recent bearish leg.

3. Fair Value Gap (FVG)

Likely unfilled FVGs (imbalance zones) exist below current price.

Price is now targeting these inefficiencies — a common ICT target.

Conclusion & Projection

- The white curved arrow on the chart implies bearish expectation.

- The rejection from the supply zone + liquidity sweep + BOS signals strong sell-side intent.

- Target areas would be:

Sell-side liquidity below recent lows (around 1.1280 and potentially 1.1260).

Thanks for your time.....

Trading Through Turbulence: EUR/USD Strategies Amid U.S. Fiscal The current economic indicators, alongside commentary from key Federal Reserve officials, suggest a cautious approach towards the EUR/USD pair. With the U.S. showing no immediate intent to cut interest rates due to a robust labor market and unresolved inflation targets, traders should prepare for potential dollar strength and volatility in the currency markets. The anticipation of a "hard landing" for the U.S. economy further complicates the landscape, warranting a strategic approach to trading the EUR/USD pair.

1. U.S. Interest Rate Outlook:

Federal Reserve Bank of Atlanta President Raphael Bostic's recent statements highlight a significant resistance to cutting interest rates in the near term. The robustness of the U.S. labor market and the economy, coupled with inflation not convincingly on track to meet the 2% target, suggests that the dollar might remain strong. Bostic's remarks underscore the uncertainty surrounding inflation, indicating that the Fed is not yet convinced that inflationary pressures are sufficiently under control to warrant a change in monetary policy. This stance is crucial for EUR/USD traders, as interest rate expectations are a primary driver of currency movements. The Fed's cautious approach may bolster the dollar, creating resistance against EUR gains.

2. Market Reactions and Treasury Movements:

The reaction to Bostic’s comments was immediate, with Treasuries falling and holding their decline, reflecting market adjustments to the expectations of continued strong U.S. monetary policy. Conversely, Jupiter Asset Management's move to increase its Treasury holdings to a record suggests a hedging strategy against a potential economic downturn. For EUR/USD traders, these dynamics indicate a flight to safety and potential volatility, with a strong dollar scenario possibly prevailing in the short term.

3. Equity Market Inflows and Implications for the Dollar:

Significant inflows into global equity funds, especially following substantial sell-offs in U.S. stocks by Japanese and Chinese funds, hint at a complex investment landscape. The S&P 500 and Nasdaq futures' rise indicates investor optimism or speculative positioning, potentially impacting the dollar by influencing risk sentiment. For the EUR/USD, this could mean short-term bullish signals for the dollar, especially if equity market strength translates into confidence in the U.S. economy.

4. Inflation Concerns and Labor Market Strength:

The anticipated high CPI and potential for a similarly high Producer Price Index (PPI) could extinguish hopes for an interest rate cut, further strengthening the dollar. The persistent strength of the U.S. labor market suggests that inflation may not be easily tamed, reinforcing the Fed's cautious stance on rate cuts. For EUR/USD traders, this means monitoring U.S. economic indicators closely, as signs of sustained inflation or labor market overheating could prompt adjustments in trading strategies, favoring the dollar.

The EUR/USD trading environment is marked by uncertainty, with a robust U.S. economy and unresolved inflation concerns suggesting a cautious approach. Traders should remain vigilant, adapting strategies to navigate potential volatility and the implications of U.S. monetary policy on currency movements.

EURUSD Long Term Sell Trading IdeaHello Traders

In This Chart EURUSD DAILY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR/USD Outlook

A potential bearish opportunity on EUR/USD . The current market conditions suggest that a downward movement might be in play.

Risk Management: Remember that trading involves risk, and it's important to only risk a small portion of your capital on any single trade. Adjust your position size accordingly.

Disclaimer:

This is not financial advice. Always do your own research and consider seeking professional advice before making any trading decisions.

EURUSD BUY | Day Trading Analysis With Volume ProfileHello Traders, here is the full analysis.

Watch strong action at the current levels for BUY . GOOD LUCK! Great BUY opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

Support the idea with like and follow my profile TO SEE MORE.

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

Patience is the If You Have Any Question, Feel Free To Ask 🤗

Just follow chart with idea and analysis and when you are ready come in THE GROVE | VIP GROUP, earn more and safe, wait for the signal at the right moment and make money with us💰

eurusd next Sell Opportunity Dear Traders, check the price action in 1 minute TF for bearish change in market structure. then mark your POI for entry tight sl. please don't jump in market blindly. protect your equity first. Comment down your views let's discuss.

If you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

BEST OF LUCK

EURUSD SHORT TERM INTRADAY IDEAIntraday Analysis - EURUSD - ( 2nd MAR 2023 )

Similar to GOLD , will be looking for shorts on EURUSD. Overall bias stays as bearish. However we have EUR CPI during London session later.

If cpi comes out as per forecasted , or higher than forecasted, EURUSD will have a short lived rally to greater sell side liquidity zones as marked in the charts. However do note that the move may be short lived and could possibly be corrected the next day or the following week.

Why high CPI means EUR rally ?

Understand that CPI is a strong indicator of inflation. With high inflation , higher interest rates have to be implemented to combat inflation which will cause the strength of EUR to increase.

It is possible to take advantage of CPI data buys or shorts but risk lesser

HRHR BUYS AT 1.06850

MRMR BUYS AT 1.07300

HRHR SELLS AT 1.07900

MRMR SELLS AT 1.06800

SAFEST SELLS AT 1.05800

NOT ADVISIBLE TO TRADE NEWS FOR ROOKIE TRADERS

EUR/USD: Sell at the range of 1.0610-1.0620.

Yesterday, the US Commerce Department released January durable goods data, which showed a significant decline, causing concerns about the US economy and triggering a drop in the US dollar index. Today, the US dollar index is expected to return to a slow upward trend, so it may be appropriate to buy at a low level. Correspondingly, for the EUR/USD currency pair, it may be advisable to sell on rallies today. Based on the market situation, the following suggestions are given for reference:

Sell at the range of 1.0610-1.0620, with a stop loss of 20 points and targets at 1.0590, 1.0570, and 1.0550.

TVC:DXY FX:EURUSD OANDA:EURUSD FOREXCOM:EURUSD

EURUSD BUY AND SELL SETUP 4HREURUSD 4HR :

Currently EURUSD in Sideways and Choppy.....There are two possible Trades...

If the Market Crosses Weekly Resistance Zone..Then Wait for Retest and GO LONG.

If the Market Fails to cross..then it will move downwards towards Daily Support Zone..

Once it crosses Support Zone Wait for Retest and then Go SHORT...

EURUSD - Flag Pattern Weekly - Amazing!EURUSD is showing a really nice continuation pattern for the main trend with a target of 0,86 over the next 12 to 18 months

We form a symmetrical triangle with high probability of going in the same direction of the main trend

This is a swing position trade. SELL and hold for a while

EUR/USD (SHORT) Dear Traders & Followers,

There is a possibility to go SHORT from current price

to the level 1.1000,1.9000,if price break 1.9000 level then market goes to 1.0750 .

Note: Everything works with Best money management.

Note: Please leave comments for any query.

Disclaimer: Trade at your own risk.

Good Luck...!!

Regards,