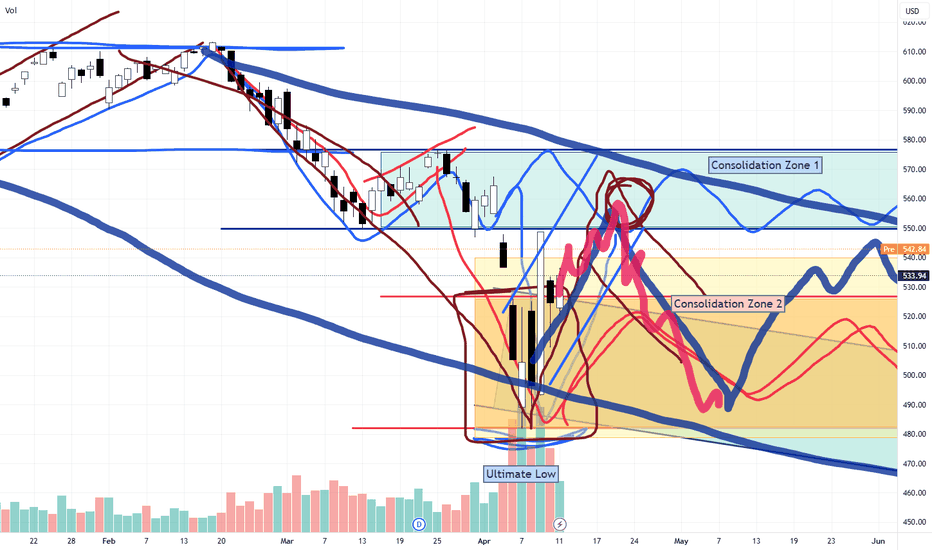

SPY/QQQ Plan Your Trade Update : Playing Into The Major BottomThis update highlights what I believe will be the last level of defense for price (support) on the SPY and why it is so important to HEDGE the markets right now.

The upward price move has reached the ULTIMATE HIGH (I believe) and is now moving into a Bullish EPP pattern (shifting into the downward pullback, then it will move into the flagging phase).

This flagging phase will be the deciding move (IMO) related to IF the markets attempt to break upward or downward near the current Fib 50% level.

This is why it is so important to HEDGE all open positions right now.

This battle zone in the markets (near the Fib 50% level) is not a guaranteed move higher or lower. Basically, we are watching the battle take place in live trading.

What we can do is try to rely on the EPP patterns and other formations to help guide us to the highest probable outcome, but we have to stay liquid and fluid as the markets trend.

Right now, I would suggest the breakdown (Major Low) outcome is about 70-80% likely. Thus, the breakaway (upside) outcome may be 20-30% likely based on my analysis.

But that could change if the SPY moves above $555.

Thank you again for all the great comments. I'm trying to help as many traders as I can. But this move to the 50% level is very "indecisive". So, I'm having to rely on Fibonacci Price Theory and other techniques (money management/HEDGING) as a way to protect my capital while I trade.

This is a great example of how you can learn techniques (beyond technical analysis) related to what to do when you really don't know what the markets may do in the near future.

The answer is HEDGE ACTIVE POSITIONS - or pull trades off (even if they are at a loss) and then HEDGE whatever you want to keep active.

No one is going to laugh when you tell them, "I protected my capital by hedging last week" when they are looking at severe losses and you are NOT looking as severe losses.

It is SMART TRADING.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

ES

SPY/QQQ Plan Your Trade For 4-28 : Inside Breakaway In TRENDToday's Inside Breakaway pattern in Trend mode suggests the SPY will attempt to break away from Friday's body range. The Weekly Bias turned to BULLISH last week.

I believe today's price move will be indicative of the rest of the week. We are moving into a very strong Major CRUSH pattern on Friday and I believe that pattern will be a big breakdown move in price.

Thus, I believe the early trading this week (today and tomorrow) will set the tone for the rest of the week.

If we see a rotation in price near the 550 level (to the downside) then my May Low pattern will likely transition into a price breakdown this week.

If we see more upside price action on Monday/Tuesday, then I would be very cautious of the end of this week as a sudden price breakdown may happen.

Gold and Silver will likely stay very muted for the next two trading days. The Canadian Elections will likely cause the US to briefly pause as one of our closest neighbors and trading partners moves through this pivotal election.

Bitcoin will also likely pause a bit in early trading this week and BTCUSD moves up to the $95-96k upper resistance area.

I suggest traders take advantage of this pause in price action to HEDGE their open positions. I believe the bigger move is still to the downside, but I also believe the markets could continue to push a bit higher before ROLLING into that May 2-5 Major Bottom.

At this point, near the 50% Fib retracement level, the markets could break in either direction. But I still believe the May 2-5 Major Bottom will play out as a unique lower low price level - below $525-530 on the SPY.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 4-25 : Inside Breakaway patternToday's Pattern is an Inside Breakaway pattern. I suggest this pattern could play a pivotal role in how the markets setup for the May 2 Major Bottom pattern I'm expecting.

You'll see in this video how any move to the upside could present a broadening of the consolidation range - resulting in even bigger price volatility going forward.

Yet, I believe the markets will stall and roll a bit downward/sideways today. Possibly resulting in a move back into the lower consolidation range as we ROLL off resistance.

As I suggested last weekend, I see no reason to assume the markets are "cleared for take-off" yet. Tariffs and political concerns are still driving uncertainty.

I think we are seeing Q1 earnings inflate the markets while the fundamental elements of the global markets are still somewhat unsettled.

I urge traders to HEDGE any open trades going into this weekend. If the markets don't make any clear moves today, hedge any positions you hold into next week.

Gold & Silver are showing signs of minor panic selling. I see that as traders wanting to retest the $3300/$33 levels for Gold/Silver.

I still believe Gold/Silver will skyrocket higher. But, probably not going to happen today.

BTCUSD is making an interesting move higher. Potentially invalidating the previous EPP pattern and/or setting up a very broad consolidation range.

It will be interesting to see how BTCUSD continues to trend over the next few months.

Remember, I'm hopefully helping all of you find ways to improve your trading and find better results.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SP500 what to expect next?As a seasoned trader with over a decade of experience navigating the markets, I’ve been closely monitoring the S&P 500’s current price action. The index is presently confined within a well-defined range, with resistance at 5,528 and support at 5,146, based on recent price behavior. We’ve observed a notable deviation below the lower boundary of this range, which often signals a potential reversal or absorption of liquidity before a move higher.

My analysis suggests the next likely target is the upper boundary of the range at 5,528, coinciding with a weekly Fair Value Gap (FVG) that has yet to be filled. Should the price approach this zone, I anticipate a strong market reaction, potentially driven by aggressive order flow as participants defend or challenge this key level. If the weekly FVG is invalidated—meaning price sweeps through this area without significant rejection—the S&P 500 could be poised to break out and target new all-time highs from its current position.

SPY/QQQ Plan Your Trade Update : EPP Flag Setup CompleteI created this video to highlight the current EPP Flag setup in the SPY/ES.

It is my opinion that the market are about ready to ROLL OVER into a downward trend because of this current EPP setup.

Once the FLAG forms (in this case a BULLISH FLAG), the next phase is a BREAKDOWN INTO CONSOLIDATION.

It is my belief the current FLAG will prompt a breakdown in price - moving into a lower consolidation range.

I'm highlighting this EPP pattern to help everyone learn how to use them more efficiently.

Get ready. If I'm right, we're going to see a big move downward over the next 2-4+ days.

Get some...

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

ES how to trade longs!On the 1-hour ES chart we identified an hourly oversold condition against our JLines bands and flagged a long plan this morning (see the 2:39 PM alert). We held the JLines 60 min curl as support, pulled the trigger near 5,375, and rode the move up to 5,475+ for a clean win.

Setup Details

Timeframe: 1 hour

Signal: Hourly JLines curl held in oversold zone

Entry: ~5,375 region

Target: 5,700 area

Outcome: Target reached, +100 handles

This is our repeatable process—spot the JLines support in an oversold zone, plan the entry, and lock in the move.

SPY/QQQ Plan Your Trade for 4-24 : Carryover PatternToday's Carryover pattern suggests we'll see similar price action today to what we saw yesterday.

We will very likely see a little support in early trading today, followed by a moderate meltdown-type trend.

I'm not expecting much to happen today - but we could get some news or other data that may prompt some type of bigger move in the markets.

Yesterday evening, I shared an "Update" video with everyone. In that video, I highlighted some of my active trades.

I've gotten a few messages from followers asking if I can share more data related to my trades. I'm sorry, but that won't happen in these FREE Plan Your Trade videos.

I shared some of my trades yesterday to highlight how I had moved into a moderate Short/PUT position, trying to stay ahead of the bigger market trend.

In other words, I'm not chasing the nickels. I'm setup to try to profit from the DOLLARS.

Gold and Silver may stay somewhat muted over the next 48 hours. But, I do expect them to try to melt upward.

BTCUSD appears to be setting up a BULL TRAP. I, personally, don't trust this upward price move because it is counter to the EPP price structure. I could be wrong.

But right now, I just don't trust the upside move in BTCUSD, knowing the SPY/QQQ should move into a deeper MAJOR LOW in early May.

Again, these videos are designed to help you build your skills and find your own style of trading.

I really do hope all of you are benefiting from my continued work to deliver these videos.

GET SOME...

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Update For 4-23 : Rally-111 PatternToday's pattern really showed up pre-market.

Where was the rally today? It happened before the US markets opened for business.

The SPY/QQQ had already moved up into my upper resistance area on strong buying overnight.

I knew I had to run my father around most of the day, so I booked my profits this morning and tried to catch one little SPY rally (that didn't work out).

So, I started taking some positions for next week's potential downtrend, and I thought, "How much risk am I taking on these trades if the markets continue to move upward?"

I realized I would be taking about $1000 to $1400 in total risk, but my expiration date is near May 16. So my target for any profit really needs to be before May 10th or so.

If the markets do what I expect, I'll be sitting back, watching my profits grow as the markets trend downward into my May 2 Major Bottom (I hope).

I created this video to highlight the now partially confirmed inverted EPP pattern that setup the Ultimate High in early trading today.

Now that we've completed the inverted EPP pattern, we should be looking for the ES/SPY/QQQ to move downward, shift into a sideways/upward price flag. Then, break down into the new Consolidation phase.

Essentially, if my EPP patterns play out well, I timed my move away from longs/calls and into shorts/puts almost perfectly. Now, I just need to sit back and wait for the markets to make a move.

This is what trading is all about. You can't kick the markets to do what you want them to do. You have to learn to take what the markets give you and fall in line with market trends.

When you do that well, profits start to fall into your lap (if you are patient).

Follow along as I break down these market trends and learn how to develop your own skills.

GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 4-23 : Rally-111 PatternToday's RALLY pattern suggests the SPY/QQQ will continue to push higher, possibly breaking upper resistance near $550/493.

As I suggested in this video, I believe the upward price trend bias will continue into Friday (4-25) and suddenly shift into a BEARISH price trend/bias early next week.

The May 2-5 Major Bottom cycle low, my research predicts, will happen and should prompt a fairly strong downward price trend as we near the end of April and head into early May.

Gold and Silver will likely consolidate a bit over the next 24-48 hours. So, this is a great time to pick lower entry price levels for LONGS/CALLS.

Ultimately, I'm still expecting Gold to rally above $3750 before the end of May and attempt to target $4500++ before the end of June.

BTCUSD is moving into a potential "INVALIDATION" phase. Although I'm currently estimating the probability of that invalidation at about 20-30%, it is still a valid price trend.

I believe BTCUSD will shift into a downward price trend as the markets continue to unwind excesses through the May, July, and October lows, according to my cycles.

The big opportunity for traders over the next 48 hours is playing the upward trend bias in the SPY/QQQ - then moving into a mode of preparation for next week's breakdown/downward price trend in the SPY/QQQ.

So, play it smart. Follow the chart and don't try to be a superhero.

Play what is in front of you and prepare for the bigger price swings headed into next week and beyond.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Update For 4-22 : EPP StructuresThis video highlights why the Excess Phase Peak pattern is so important for traders to understand and follow.

Imagine being able to see into the future and to be able to plan/project price action in a way that is like putting together building blocks (or Leggos).

That is what the Excess Phase Peak pattern represents for all traders.

Once you understand it and learn to use it, you'll see how it presents very clear opportunities for you to plan and execute fantastic trades in any market.

Fibonacci Price Theory, Energy Cycles, & The Excess Phase Peak patterns are really the core structures of price.

Elliot Wave is fantastic for "after the fact" type of analysis. IMO, you don't really know how the EW count is truly structured until after the current major wave structure is complete (meaning you are 2-3 waves into the new (counter-trend) structure.

Watch this video and try to think about how I'm taking the EPP patterns to learn to plan out opportunities for price based on STRUCTURE - not indicators or averages.

This is how the markets work.

Pay attention and GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY Plan Your Trade For 4-22 : Breakaway In Counter TrendToday's pattern suggests the markets are moving in a counter-trend mode and that we may see a Breakaway type of price bar.

The current trend is Bearish. Thus, I believe the current Counter-Trend is Bullish.

As many of you already know. I picked up some Calls off the lows yesterday after noticing a complete EPP pattern (Ultimate Low) setup about 75 minutes before the end of the regular trading day on 4-21.

My opinion, overall, is that we are still stuck within a consolidation phase. But that doesn't mean we can't see the SPY/QQQ move higher (toward the upper consolidation high) or roll back downward (toward the lower consolidation low).

I do believe we are moving into a moderate upward price trend over the next 3-4+ days where price will attempt to retest the 525-535+ level on the SPY, then ROLL into a top and start a sharp downtrend.

This volatility presents an incredible opportunity for traders. Staying ahead of these trends is key to improved success.

The SPY Cycle Patterns are fairly clear. We've moved into consolidation, and the price is very volatile. The Counter Trend pattern today may setup a 3-4+ day minor rally in the SPY/QQQ.

But, ultimately, I believe the SPY/QQQ will roll downward into the May Cycle lows - just as I have been predicting for the past 45+ days.

Don't get greedy. Play the immediate trend and learn to identify the EPP patterns on 5-minute charts.

Today should be a very good day for traders.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Plan Your Trade Update For 4-21 : Waiting For The EPP SetupThis video is, hopefully, going to help many of you learn to use the Excess Phase Peak (EPP) pattern more efficiently.

For months, I've been trying to teach all of you to use this pattern to efficiently identify and trade some of the biggest price moves.

Remember, price only does TWO THINGS - TREND or FLAG.

These components are essential to the EPP pattern setup.

First, price must TREND into a peak or trough.

Second, price must pullback from the peak or trough.

Third, price must move into a SIDEWAYS/FLAGGING formation.

Forth, price must break away from the sideways/flagging formation and attempt to TREND into the new consolidation phase.

Fifth, once the new consolidation phase starts, price will trend and flag within the consolidation range for a period of time - before...

Sixth, price will attempt to break up or down to the Ultimate High/Low.

This chart of the ES/SPY will show you how I used my analysis to "front-load" my positions before the Easter holiday weekend.

I've been telling all of you the markets would likely attempt to move a little bit higher, trying to target 525-535 (if we are lucky). Then, price would roll into a topping formation and move downward towards my May 3-6th low (estimate).

Last Thursday, I decided to throw on two positions to protect against any big news that may cause the markets to collapse over the holiday weekend.

I picked up :

4 SDS CALL options @ $23 expiring on May 16

3 XLF PUT options @ $47 expiring on May 16

Both of those trades worked out perfectly this morning. I booked 2 of the XLF and 2 of the SDS for profits near 1030 AM PT. Lovely.

Next, in between phone calls and loading up my car for a short trip, I noticed a beautiful EPP pattern setting up in the ES, and that EPP pattern has already reached what I believe to be the Ultimate Low.

I tried to get into 2 SPY Call options @ $512 and held my breath to see if I timed the entry well.

NOT.

I took a $280+ loss on those two Calls.

I waited a bit longer to see what price did, and after the price setup a base below $510 on the SPY, I loaded up on two more SPY Calls @ $510 and two SSO calls @ $67 about 70-80 minutes before the end of trading.

The way I looked at it, I already had my downside trades placed from last Thursday, and I just added some upside exposure while my downside trades were profitable.

I didn't know if the SPY would rally or not, but the EPP Ultimate Low setup suggested NOW is the time to buy.

So, I kept both downside and upside trades active to protect my account overnight.

The SPY rallied into the close, and I ended up making some nice profits off that EPP Ultimate Low.

Now, I'm going to wait to see what happens tomorrow morning and try to BOOK my upside trades in profits while letting my longer-term downside trades play out into early/mid May.

This is trading. The entire purpose of trading, like I trade, is to position for the best opportunities and try to catch the GIFTS the market throws at you as often as possible.

Nothing is guaranteed, but price ultimately shows us everything we need to know.

Watch this video to see if you understand the EPP Ultimate Low that prompted me to buy my CALLS today.

If so, then you are starting to GET IT, and that is a very big step towards improving your trading skills.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Global Supply Chains being Undone could be the cause of a (IV)I have been discussing the potential for a Super-Cycle wave (III) top in the US markets for the last couple years. To experience a wave (IV) of SUPERCYCLE PREPORTION, would be a consolidation of price action back to the 1929 stock market crash. The byproduct of this type of price action would be a decline of 50% or more (likely more) in the value of global stock markets. This type of asset price deflation would make anyone who watches the markets be inquisitive as to what would or even COULD cause such an event.

Would the dismantling of global supply chains, that have been in place since the early 1990’s, be the culprit?

I am starting to think the answer to that question is yes. This is not an indictment of the policy, but more an acknowledgement of the disruption and the possible aftermath.

The obvious concern is how do businesses plan? I would venture a guess business leaders will be challenged, and many may not survive. The cost equation becomes so skewed…how does one make money without passing the costs on to the consumer? That means higher inflation.

If this is the case, it’s possible digital assets become more of a safe haven which would be counter intuitive to hard asset value. This would mean that we will have endure a cycle of higher inflation, higher interest rates, and higher unemployment, coupled with lower economic growth. I cannot say this is how the forecasted price action is justified in the future. What I can say is the resulting price action will look very similar to the below.

SPY/QQQ Plan Your Trade For 4-21 : Inside Breakaway PatternToday's Inside Breakaway pattern may not show up as I would expect.

An Inside Breakaway pattern suggests the OPEN will be within the Body range of the previous bar - I don't see that happening today.

The Breakaway portion of the pattern is much more likely to happen today with Gold/Silver moving much higher and BTCUSD moving slightly higher today. It appears Safe-Haven assets are THE THING right now.

That would suggest the US Dollar and US-Dollar based assed would continue to fall (move downward) as devaluation and contraction in the global economy continues to play out.

If you watched my video (posted late last night), you already know my data suggests there is almost no reason for the markets to mount a rally right now. The only thing I can see that would drive a big rally from these lows would be some incredible news that the world is immediately going back to somewhat normal in terms of GCB spending and Global Trade. I don't see that happening.

I know there are a lot of emotions related to these Tariff wars and global trade. Heck, almost anything that goes on in the world right now is full of emotions.

I urge all traders to STEP BACK. Think of the markets like an engine that runs on the quality of AIR, FUEL, SPARK, LUBRICATION, STRUCTURAL MECHANICAL PARTS, & INTAKE/OUTPUT CAPACITY.

If you start to think about the markets (global markets) as a big engine, while thinking of individual economies (by country) as smaller engines, it starts to make a little more sense (at least in my mind).

Every country runs its own engine (see the components above). If some of those components are failing, then that country's economy will falter a bit.

And that faltering economy may put additional pressure on the global economy/engine.

It takes a lot to destroy a functional economy. I mean A LOT. War, Total Destruction of government/law/society. Maybe even some type of internal conflict.

But, even then, the economy will still have roots and will fall back to core elements.

So, don't worry about all of these people telling you "the world is going to CRASH in the next 2 years because of Trump". That is highly unlikely.

What is more likely is that the world will "re-settle expectations" related to future growth and output. Strengthening economies where needed and building up the core elements of global trade/economies over many months.

So, if you are worried or don't know what to do right now, move your positions into CASH and wait it out a bit.

There will be lots of opportunities for you to pick the right time to start trading again.

There is no reason why you have to try to FORCE the markets to adhere to your wants (they never do that anyway).

Just wait it out, keep learning, and plan/time your trade efficiently.

Get some...

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For The Week Of April 20-25 : CautionI want to thank all of you for the great comments and questions over the past few months.

I'm very impressed by all of you and how well many of you are picking up my techniques to improve your trading results.

This video is more of a Pre-Week review - telling you why I expect the markets to trade/trend a certain way over the next 5 to 25+ days (or longer).

Additionally, I want to remind all of you my research goes much deeper (behind the scenes) than what you see in these Plan Your Trade videos.

I know many of you rely on my morning videos and some of you have messaged me about how important my videos are in helping you prepare for the day's price range/trend.

Ultimately, I started doing these Plan Your Trade videos to highlight my SPY Cycle patterns and to prove my research is accurate and helpful. Obviously, if my technology/techniques were failures, I would be hearing about it from lots of people by now.

But that is not the case. It appears my SPY Cycle Patterns and other techniques/tools are very well appreciated and are really helping traders learn to build better skills for greater success.

And that is what this is all about.

Remember, I've been lucky enough to rub shoulders with some of the greatest traders/minds on the planet for the past 35+ years. Sometimes, we would sit down for Coffee and share ideas. Sometimes, they would hire me to explore something they thought was important (coding/research). At other times, we would simply show up at an event together and chat about life and the markets.

I was lucky.

I got into this industry in the late 1980s (a long time ago) and have continued to learn new things and build my skills over the past 35+ years.

Now, I'm trying to share some of that knowledge with all of you so you can carry this information forward and make a real difference in your life (finding success while trading).

One of the biggest things I continue to try to teach all of you is PATIENCE.

Right now, the markets are in a unique phase (consolidation in a downward trend). You are going to have to learn to WAIT for the best trade setups and try not to force the markets do to what you want.

If you are not sure what to trade, sit on the CASH until you see a better opportunity.

OK. This week, after Easter, should be fairly quiet. Tax day and Easter usually fall fairly close to one another. This year, they were on the same week.

The markets are usually very flat near Tax Day - so don't expect much in terms of trending.

Volatility is still elevated. So, we may see some wild price action this week. Trade smaller amounts if you are still unsure about direction/setups.

Get some...

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Are US Tariffs Similar To The COVID-19 Global DisruptionThis video is in response to a question asked by one of my followers on TradingView.

He specifically asked if the current US Tariffs create a similar situation to the COVID-19 supply disruptions and how it may result in longer-term market disruptions.

In this video, I try to answer these questions and highlight the differences I see related to what is happening now vs. the COVID-19 shutdown.

It is an interesting question.

I certainly see similarities, but I also see vast differences in terms of how the global markets are attempting to address the US tariff issues.

First, the current tariff issues are somewhat self-inflicted, not something like COVID-19 (unavoidable).

Second, the global central banks acted in concert to present immense liquidity to support a global shutdown with COVID. I don't see that happening right now.

Supply-side disruptions are evident, but we'll see how they play out over the next 60- 90+ days.

Longer-term, I hope these tariff issues are resolved before the global economy moves into a deeper recession. I will state that hard assets are likely to take a hit over the next 60-90+ days across the globe.

Any moderate (think 15 to 35%) slowdown in production, shipping, and consumption across the globe is going to be felt all over the planet. It is not going to be isolated to just one or two areas.

This is the smackdown that I don't believe anyone is really ready for. And that creates the urgency to resolve the tariff issues asap.

Hope this helps.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Video For 4-17 : Another BLANK dayToday's BLANK pattern in counter-trend mode is nothing to worry about.

As I research and document these patterns, there are patterns that appear frequently on the Daily price chart and there are others that appear more infrequently.

If I have not already marked these patterns and documented them, they have not appeared anywhere in the 11+ years of the Daily price data I use within the Lookup Engine.

Therefore, these are VERY RARE types of patterns - Extremely infrequent.

I will add that the secondary looking criteria show yesterday and today could be similar to "key top/bottom" types of price rotation. So, I do believe the current price level on the SPY (520-535) could prove to be very critical support/resistance going forward.

Tomorrow is Good Friday (no trading). So if you are going to take any trades today, make sure you remember to plan your exits for TODAY or NEXT WEEK (or later). You will not be able to exit stock/ETF trades tomorrow (sorry).

Gold is moving into a Momentum Rally, and I really want to see how that pattern plays out before the long holiday weekend.

Fingers crossed we see a BIG RALLY again today.

BTCUSD is still rolling into a downward price trend based on my EPP pattern structure. This downward trend aligns with my May 2 Major Bottom pattern for the SPY/QQQ. So I would expect BTCUSD to start to roll downward sometime near the middle/end of next week.

Remember, this weekend should be about your family, your friends, and your beliefs.

Relax and enjoy.

Get some...

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver #xauusd

SPY/QQQ Plan Your Trade For 4-15 : BLANK pattern day.As I stated in this video, last night I looked through the data and could not find any reference for this pattern going back more than 11 years. Same thing for tomorrow's pattern.

That means these are very RARE pattern setups and we'll have to watch to see how price action plays out today.

If there were no reference points over 11+ years of Daily price data (more than 2500 Daily Price Bars), then this is something very unique.

I believe today will act like a Reversal Bar. Potentially rallying off a lower opening price and setting up a type of Gap Lower Rally type of pattern - but that is just a guess.

At this point, trade smaller quantities until we see how price reacts this morning.

Gold and Silver make a BIG MOVE overnight - breaking above the $3300/$33 levels I suggested were critical psychological levels.

This is an INCREDIBLE rally in metals (thanks, China).

At this point, if you were long metals like I was, you can thank me all you want.

Be aware that metals will likely pause a bit above this psychological level, then start to move higher again.

The next big target is $3600-$3750 for Gold.

Bitcoin is doing exactly what I stated it would do - rolling into a top as demand for BTCUSD wanes. I believe the next low for BTCUSD will be closer to $60k-$63k. Pay attention.

Going to be a good day for everyone holding Gold/Silver/Miners CALLS (like I kept suggesting).

GOT SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 4-15 : Base Rally PatternToday's pattern suggests the SPY/QQQ have been busy forming a BASE and may transition into a moderate rally mode.

I believe this move will prompt the SPY to move above the $550 level, potentially targeting $555-565 over the next 48 hours.

This upward move could be related to news or Q1:2025 earnings.

I don't believe the markets really want to move downward at this time, although I do believe the markets will move into a topping pattern by the end of this week.

Gold and Silver are moving into BLANK pattern day, today. Given the fact that we are between rally patterns and the metals charts show a very clear FLAGGING formation (watch my video), I believe we are moving into a FLAG APEX that will prompt a move above $3300 (for Gold) and $33 (for Silver). It's just a matter of time.

BTCUSD is still struggling in the Consolidation phase. As I keep suggesting, I believe the next move for Bitcoin is to the downside. But, until we break this consolidation phase, price will continue to roll around within the consolidation range.

Remember, we are going to be moving back to more normal volatility. So you need to understand these huge daily ranges are going to vanish over the next 3-5+ days.

Volatility will likely move back to the 1% to 2.5% range very quickly.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 4-14 : Up-Down-Up PatternToday's pattern suggests the markets will move in a moderate upward price trend.

Although I don't expect anything huge today, I do believe the EPP structures/layers support this upward price move and that we'll see the SPY attempt to move back towards/above 550 over time.

The QQQ will likely follow the SPY higher over the next 5+ days.

Don't get too excited about this upward price move because it is structurally moving to setup a PEAK that will transition into a downtrend near April 22-25. This peak will create a downward price flag (a new inverted EPP) structure that will assist in developing a new sideways price structure carrying into June/July.

In other words, it looks like we are trapped between 480-585 on the SPY, and we will likely stay within that wide consolidation range for another 2-3 months.

Gold should attempt to rally this week, trying to break above $3300. I believe this is a critical level for Gold and also presents a breakaway level for Silver near $33.00

Bitcoin has moved into APEX VOLATILITY and will continue to trap BUYERS into believing BTCUSD is breaking away from the consolidation range. This is a BULL TRAP.

I believe BTCUSD will ROLL OVER within about 4-5 days - setting up a big breakdown move as the SPY/QQQ also roll downward in about 5+ days.

We still continue to see volatility and sideways price action. Still lots of opportunities for skilled traders.

Get Some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Overview For 4-12 : Thank youThis video is mostly a big thank you for all the great comments and questions over the past few weeks.

I've been posting these videos on TradingView for almost a year and the types of viewers/followers I've been gaining is incredible.

You guys & gals have really impressed me with your questions and engagement. Many of you follow me for months without ever commenting or asking any questions.

I received a call from a client/follower in Alberta last night and he reported last week's gains at over 300% by following my videos.

I received a message from another TV follower saying he's been following my videos for many months and, after a bad loss a few years back, he has decided to give trading another go.

I've stated it before and I'll keep saying it.. I'm not trying to scam you out of anything. I'm trying to show you the RIGHT SKILLS and TECHNIQUES for you to learn to become a better, more skilled trader.

The way I look at it is like this...

If I can teach you half of what I know and see on the charts, then you guys will be able to achieve so much greater success and have gained/retained the knowledge to do it on your own.

You watch me do it over and over on these charts. Guess what - you are LEARNING at the same time.

Now, after a couple of years of doing this and following my videos, you've GAINED an education on how to trade more efficiently, manage risk more efficiently, and achieve your trading goals (I hope).

Right now, I'm getting messages/comments from people saying they are making 200%, 300%, 500%, or more every week or two from my videos.

That is absolutely incredible. I just want to urge you to remember I'm not 100% perfect in predicting the markets. No one EVER really is 100% perfect at it.

In the long run, as long as you don't get super greedy, you'll survive any minor losses and live to trade another day.

That is probably the most important thing I can teach you - trade within a proper scale to your RISK LEVEL. Never BET THE FARM on your trades. Always have a 50% to 70% cash reserve.

Anyway. Thank you. I really appreciate all of you.

Hope you enjoy this video.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 4-11 : Break-Away in CarryoverToday's Break-away pattern suggests the SPY/QQQ will attempt to move (break) away from yesterday's Body range. I believe this trend, after the recent Ultimate Low in price, will be to the upside.

I know a lot of people are asking, "why do you think the markets are going to rally now - after you suggested the markets would trend downward?"

Things have changed now that we have a 90-day pause in the tariff wars. Yes, China is still an issue - but the rest of the world seems to have a pause on the tariff wars as negotiations continue.

I believe the removal of the tariff pressure on the markets will result in a moderate upward trend as we move into Q1:2025 earnings season.

Still, I don't believe we will see new ATHs anytime soon. But I do believe the 580+ level on the SPY is a potential high price level that can be reached before the end of April 2025.

Gold and Silver are moving into a GAP trend move today. I believe the GAP will be to the upside and I believe Gold and Silver will continue to rally.

Silver is really low in terms of comparison to Gold. Silver could make a very big move to the upside over the next 30+ days.

BTCUSD is still consolidating into the narrow range I suggested would happen before the bigger breakdown event near the end of April (into early May).

Everything is playing out just as I expected. The big change is the removal of the tariffs for 75+ nations (for now). That will give the markets some room to the upside and we need to understand how price structure is playing out into an A-B-C wave structure.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver