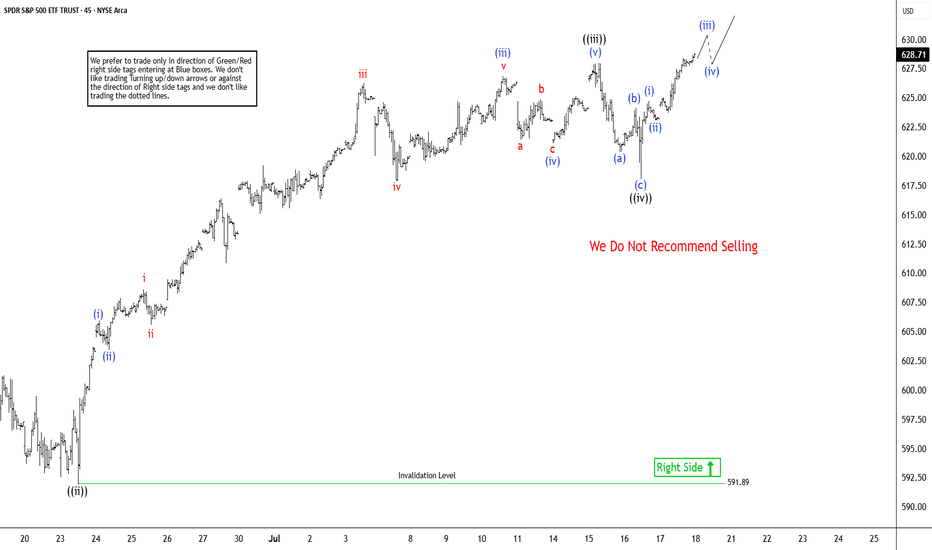

Elliott Wave Analysis: SPY Poised To Extend Higher In Bullish SeElliott Wave sequence in SPY (S&P 500 ETF) suggest bullish sequence in progress started from 4.07.2025 low. It expects two or few more highs to extend the impulse sequence from April-2025, while dips remain above 6.23.2025 low. SPY ended the daily corrective pullback in 3 swings at 480 low on 4.07.2025 low from February-2025 peak. Above there, it favors upside in bullish impulse sequence as broke above February-2025 high. Currently, it favors wave 3 of (1) & expect one more push higher from 7.16.2025 low in to 630.31 – 651.1 area before correcting in wave 4. In 4-hour, it placed 1 at 596.05 high, 2 at 573.26 low as shallow connector & extend higher in 3. Within 3, it placed ((i)) at 606.40 high, ((ii)) at 591.89 low, ((iii)) at 627.97 high & ((iv)) at 618.05 low.

In 1-hour above ((ii)) low of 591.89 low, it ended (i) at 605.96 high, (ii) at 603.17 low, (iii) at 626.87 high as extended move, (iv) at 620 low & (v) as ((iii)) at 627.97 high. Wave ((iv)) ended in 3 swing pullback as shallow connector slightly below 0.236 Fibonacci retracement of ((iii)). Within ((iii)), it ended (a) at 619.8 low, (b) at 624.12 high & (c) at 618.05 low on 7.16.2025 low (this week). Above there, it favors rally in ((v)) of 3 targeting in to 630.31 – 651.1 area before correcting in 4. Within ((v)), it placed (i) at 624.73 high, (ii) at 623.08 low & favors upside in (iii) of ((v)). We like to buy the pullback in clear 3, 7 or 11 swings correction at extreme area in 4 and later in (2) pullback, once finished (1) in 5 swings.

Es11

nasdaq daily technical say : fibo 161% 13333 is nasdaq target for short term nasdaq want touch daily chart fibo 61% =12500 see blue fibo in left side (after sell pinbar on higher time frame we can pick low size sell with Sl on pinbar high,ok?)

then it must pullback aand touch breaked trendline

still i advice 90% looking for buy in deep (after pinbar comes on 1hour or 4hour or daily chart come ) and hold it 7-8 day to new high

wonderful = see COT data (big banks net open orders,they on sell !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!?

what is bad scenario ? if red trendline break nasdaq can crash to 10.000 area (fibo 161% exactly 9700

if you have old sells against my last 3 month analyse=

1-if you are near margin call,you must put hedge buystop on last high(friday high) and never close that buy,,,wait and in next low close sells frist then wait for next high and close buy understand? if you close buy frist you will 0.00

2-if you are safe and your size is low,,,wait 20-30 day for above green arrow in 11900 ,close all sell and pick buy and hold30-40 day to high

wish you win my friends , think 1 month about this secret = stable profit secret is simple 1- stand on very very low size and fix size and very low levrage (max 1-20) big levrage =big size = margincall

2- always put Sl on last high,low ,,,eat SL not bad show pro trader high control on mind and powerfull skill , new traders want eat only TP and cant eat SL = margincall

www.tradingview.com

es, spy day trading for Apr 27th 2020SPX500 lines on chart are 5 to 8 points higher than the ES numbers posted below

This was the 8:300 premarket post;

ES today, The big multi day distribution is the real indicator to what the big picture market wants to do so pay attention to that when we got to those levels. But for today's trade ideas I am looking at 2840 and 2875 for the break outs and inside that for back and forth trading like we have been having. The primary idea I have is a opening move down possibly to the 2840-2845 area for a solid bounce to test or break the top boundary of 2875. The secondary idea will be a choppy back and forth muted action and will trade the tops and the bottoms of the range after it is established.

es, spy, day trading for Mar 13th 20202Markets after a bit of down in the overnight have now limited up 5% and leave me with less data to work with for the open, so putting red top at limit top.

I am using ES chart because the SPX500 chart did not limit close and mixes up data.

Right now markets look strong but open will tell me more and will bring updates, it is Friday and we either have a monster day or a very choppy day, at least that is my thoughts.

es, spy day trading for Feb 25th 2020Today looks like we are going to play around inside the over night zone and could be a very choppy day. Any substantial break of the red zone will be a strong indicator of what side of the market wants to take control. So looking for a back and forth trade until we clear this zone.

Bigger idea this is a balance at the bottom of a big move and could be telling us further down is coming unless we can clearly move above this range and hold it for some time.

es, spy, day trading for Feb 13th 2020Looking for ES to remain a back and forth trade until we can get a break out of this zone. there are many possible targets below if that side ever kicks in and lots of blue sky above, but both of these will take commitment after this range consolidation break.

Be careful of a small break that does not find commitment and just returns right back into the same same we have been in for a few days

es, spy, day trading for Feb 10th 2020Today there are many things that could be mentioned about the indices but the simplest is to watch teh red zone for a break or inside action. At this hour I do not have a leaning other than the flag mentioned Friday is still 100% in tack, so will take a strong bullish stance of it resolves upwardly.

es, spy, trading for Oct 15thThe overnight is balanced long but inside a 2 day distribution so once again inside a choppy trade range, it is a 11 to 12 point range so wide enough for nice profits, so watch this red zone for chippy action but also watch for reactive moves out of this range.

Looks to me that we get a opening down move that finds support and moves back up into Fridays upper areas.