$CRSR: A Criminally Undervalued Tech StockMy ideas are included in the chart.

I don't think the technicals of this are very encouraging, nor is the fact that insiders can soon sell. But I do believe the fundamentals of this stock are solid.

My basic thesis is that given future prospects, this is significantly undervalued; something difficult to find in our current tech environment.

Let me know your ideas in the comments.

Esports

VISL chillin in historic channel, where will it break?Will we finally see VISL break up and out of this channel? It's been a relatively consistent area of support/resistance. With several potential catalysts to consider here (5G, general broadcast, telecom, esports) it will be interesting to see if these tailwinds act as a stronger catalyst.

"While it will likely focus on some as it relates to 5G penny stocks, esports could be another facet to consider. If you sift through some of the company’s blog posts, you’ll notice that Vislink’s partner, NEP Sweden, covered the “BLAST Premier Spring Series” last year. This is an international esports event featuring the world’s top esports teams competing in the first-person shooter game series Counter-Strike...NEP filmed the event using Vislink’s HCAMs feeding into a ULRX-LD all controlled by Vislink’s FocalPoint Camera Control System. While no further esports-related updates have come about from the company, a surge in the excitement surrounding esports could be something to take note of."

Quote Source: Hot Penny Stocks To Buy Now? 4 To Watch After Roblox (RBLX) IPO

BEPRO 🕹️ Buy the Dip 👨🚀 Ride the Ship 🚀There's a lot to like about this undervalued gaming crypto. While everyone is distracted by DeFi Swaps... go next-level and into DeFi Gaminig 3.0!

BEPRO did a crazy pump seemingly out of nowhere... but now that the dust has settled, it's time to do your research and possibly scale into this crypto gem. 💎

It's been under a major resistance level for 190+ days and indicators such as the On Balance Volume and Relative Strength Index shows clues... of resistance maybe flipping to support?

🚨 Please note: BEPRO can drop another 36% to $0.0028, but as a value investor, it's obvious that this can get to $0.01... 120% gain

(Risk to Reward 1:3)

"BEPRO Network aims to be the most useful codebase for building decentralized apps on Ethereum, Polkadot, and other blockchain-based ecosystems. Our job is to focus on building technology that adds value to entrepreneurs and product builders, so they can focus on making their startups a success. Our aim is to build a network around the BEPRO token and make it into a thriving decentralized economy."

⭐ Source:

www.bepro.network

⭐ Available on Kucoin:

www.kucoin.com

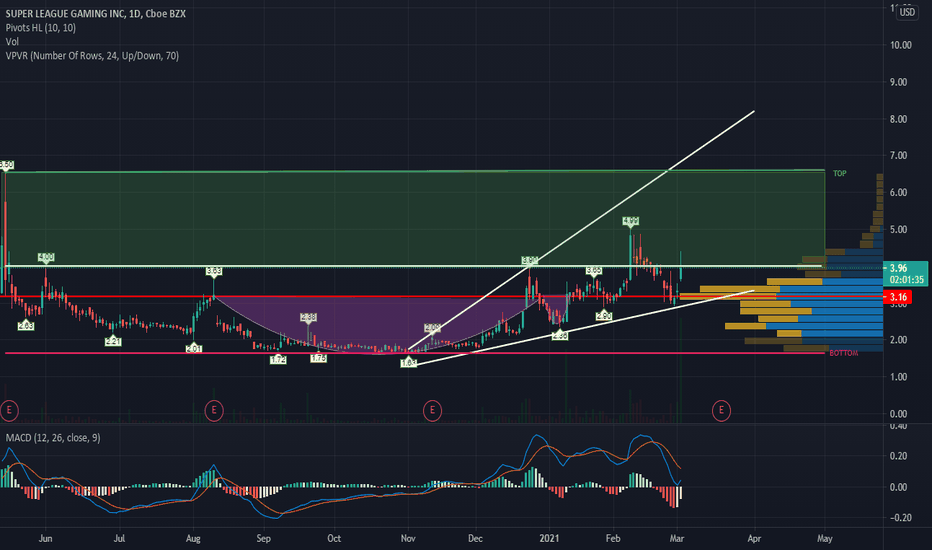

Short term Trade alert: SLGGESports play. Might jump again fast...

Let see how next 3 days play out.

Super League Gaming, Inc. engages in the provision of an amateur E-sports community and cloud-based content platform gaming services. It offers theater gaming, cloud, and team gaming services. The company was founded by John C. Miller, David Steigelfest, and Brett Morris on October 1, 2014 and is headquartered in Santa Monica, C

Esports Entertainment Group Files NJ Gaming License ApplicationEsports Entertainment Group Files NJ Gaming License Application

$GMBL today announced it submitted its gaming license application with the New Jersey Division of Gaming Enforcement ("NJDGE").

"This is our first gaming license application in the US, and once approved, we believe we will be the first esports-vertical focused sports book with a state license in the US,"

"According to a study from data firm Interpret, over 50% of U.S. esports fans said they are likely to engage in esports betting so we are confident that demand will be strong.

With a solid regulatory framework based on player protection, business stability, and growth, the New Jersey gaming industry has enjoyed exceptional growth in recent years.

finance.yahoo.com

FANS.C is likely starting a new leg upBullish Engulfing candle yesterday with a nice follow-through today. Very close to completing a bullish MACD cross which would confirm the start of new bullish trend.

ESE.V - Blue sky breakout on major acquisition newsBlue sky breakout from Double Bottom setup. Still undervalued in the eSports space.

-----

ESE Announces Acquisition of Global Esports and Gaming Infrastructure Company with $14M+ in Revenue

Positions ESE as One of the Largest Global Esports Infrastructure Companies

- Transaction anticipated to make ESE one of the largest esports infrastructure companies in the world, "bridging" esports companies with their fans and customers.

- In 2020, WPG generated revenue in excess of $14,000,000.

- The Transaction will add WPG's existing client base to ESE. Clients of WPG's subsidiary, WPG Racing Solutions, include one of the largest esports companies in the world, and one of the largest sports organizations.

- Acquisition will deliver on core strategic priorities of (1) increasing revenue, (2) expanding tier-1 client base, (3) strengthening technology stack, (4) expanding operational geography, (5) adding experienced executives to our Management, and (6) increasing platform scalability through WPG's nearly 100 staff.

VANCOUVER, BC, Feb. 16, 2021 /CNW/ - ESE Entertainment Inc. (TSXV: ESE) (OTCQB: ENTEF) (the "Company" or "ESE") is excited to announce that it has entered into a binding share purchase agreement (the "Agreement") to acquire 51% of the business of World Phoning Group Inc., Encore Telecom Inc., and their two European operating subsidiaries, WPG Racing Solutions and Foresight Resolutions (collectively, "WPG"), to further develop ESE's robust esports and entertainment infrastructure business.

Under the terms of the Agreement, all of the assets of WPG will be rolled into a newly incorporated Canadian company, World Performance Group (the "Corporation"). Upon completion of the Agreement, ESE will acquire 51% of the issued and outstanding shares of the Corporation (the "Transaction"). The purchase price will consist of (i) $138,019 in cash payable on the closing of the Transaction (the "Closing"), (ii) 585,156 common shares of the Company (each, a "Common Share") issuable on Closing and (iii) 6,664,845 Common Shares to be released in monthly installments over the 36 months following the Closing. Pursuant to the Agreement, ESE has also agreed to make an investment of $750,000 in the Corporation.

ESE will have the option to acquire the remaining 49% of the issued and outstanding shares of the Corporation at any time within 34 months following the Closing by (i) paying $624,613 in cash and (ii) issuing 2,500,000 Common Shares.

WPG's principal, Wayne Silver, will continue to serve as the Corporation's CEO going forward, integrating his team and infrastructure into ESE's existing operations. Mr. Silver will also serve as an advisor to ESE's board, bringing his experience and extensive network to the Company.

WPG is an enhanced solutions provider operating an infrastructure business for management of fan engagement for OTT & esports. WPG's team provides solutions in 10+ languages and works with its customers to build new and improved B2C & B2B processes that align with customers' brands, boost retention, enhance fan interaction, improve ROI and increase sales and profit margins. WPG provides bespoke, omni-channel solutions that encompass the traditional channels (voice, chat and email), social media channels (Twitter and Facebook) and embrace new community channels (Discord, Reddit, etc.) used by millennials and many of today's younger fans and Generation Z. In addition, WPG offers out-sourced network services, including B2B and B2C services, and a global telecom network through Encore Telecom Inc.

🎮 Esports Entertaiment: Lets gamble with GMBL to $48Hi mates, momentum rising on NASDAQ:GMBL significantly here and could be similar sentiment here like at NYSE:GME

EM1 Symmetrical TriangleSymmetrical Triangle Identified, price is likely to continue it's uptrend.

Recent positive announcements following the release of their Miggster Platform

● Emerge banks first cash receipts from the MIGGSTER platform totalling ~$8.3M

● MIGGSTER subscriptions continue to deliver strong daily growth

● The MIGGSTER platform was launched on 14 November 2020 and the first cash receipts represent gross

subscription fees receipted by Emerge in the 48 days since launch date.

Price Target

0.27

Sea Has a Bullish TriangleSea Ltd. Is one of the biggest companies people have never heard of – especially after this year’s big run from the $40s to the $180s.

The Singapore-based esports giant had a $90 billion market cap last week. That makes it comparable with Target (TGT) and CVS Health (CVS).

Trend followers may eye the chart for continuation higher into yearend. The first key feature is an ascending triangle that’s taken shape since early November. Roughly $187 is resistance at the top of the pattern.

Second, SE closed at $156.53 on November 10, slightly lower than its October 30 level. However, prices instantly snapped back the next session and have remained above those levels since, resulting in a false breakdown.

Third, the bounce occurred at the 50-day simple moving average (SMA), which SE has remained above since.

Finally, the stock has fought back above its 21-day exponential moving average (EMA) and stayed there for more than a week. That could be a sign it’s ready for another push higher.

TradeStation is a pioneer in the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

SPAC with a promising futureOn September 2nd FEAC announced their acquisition target of Skillz, a platform that enables esports tournaments on mobile apps. A product riding a few mega trends and being brought to market by the same partners who brought $DKNG to market in similar fashion. This looks to move upwards at break of the neckline, with first fib target above and second (not pictured) at 16.03.

"Skillz is pioneering the competitive mobile gaming experience, powering tournaments for thousands of game developers around the world, expanding and leading growth in the mobile gaming market. It is anticipated that in 2020, Skillz’s patented technology will power over two billion casual esports tournaments and facilitate $1.6 billion in paid entry fees for games hosted on its secure and proprietary platform."

Oversold bounce playPositive PR today brought this a bounce and the bottom may be in. While this stock has traded in the sub-$10 range for a while, it has previously been valued much higher.

Fib levels marked from July 31st high and recent high and market pullback. Entry at the purple marked fib would confirm its in an uptrend.

www.globenewswire.com

Bullish reversal with a gap to fill aboveUpdated from the earlier idea with adjusted fibs. Where the extension from March to recent monthly highs aligned, I used that fib as marked entry.

Solid uptrend established

Still oversold on the daily

Entry near the fib especially after a successful backtest as support would be a solid entry.

First gap comes from a large space in which there was no candle closures since the gap down; this may not be a technical gap down but may have an impact on price action. The true gap is small and marked within. Either way, this should make a nice move upward through that space.

UOS at convergence of multiple upward trendsUOSUSD pair shows a convergence of various high time frame up upward trends, including following an early stage parabolic move. UOS has held remarkably well during altcoins bloodbath with price dropping from 20 cents to 13 cents (-35%) and already back to 15.5 cents (-23%) compared to many altcoins selling off at 55-80% and barely any recoveries. Moreover, downward selling pressure has been very low volume, indicating that bots or algorithms holding small amounts of UOS were dumping and market participants quickly and aggressively buying dips. Altogether TA indicates a convergence of multiple upward trends and Fib extension is pointing to 40-44c range as the potential target for UOS within the next few weeks.

A more pessimistic scenario, marked in red indicates stagnation and downward ranging. However, breaking above 16.5 cents invalidates the pessmistic scenario already.

Medium term TP goal 40-44c

FA and roadmap for Q4 coupled with these technicals creates a powerful catalyst for positive price action.

FANS.C -- Multiple bullish divergences and promotional campaignFANS.C has formed a double bottom on the chart in the low .20s. Multiple bullish divergences on the Daily Chart with a strong pickup in Accumulation even as stock retraced to test the support line.

The original drop was caused by shares issued as part of recent acquisition but there are early signs of bullish momentum returning. The company is running a promotional campaign in the US and Canada which should help with volume needed to absorb the remaining cheap paper.

Good news flow. Expansion into the US market and sold new hires.

Ready for reversal and retest of ATHAfter a failed breakout and a pullback, oversold conditions may prompt this reversal. A long-legged Doji on the daily is further indicator of this. Fib levels drawn from recent highs to lows provide support and resistance levels, additional stop loss could be set to previous day's lows or percentage based on your risk level. Ideal entry would be retest of the entry fib as it may gap up over it.

FANS.C - eSports/Gambling Growth StoryFANS.C is in the right sector during the pandemic and has seen massive growth in the past few months. The stock is temporarily range bound due to the still open $5M financing announced last month. .42 - .45 is proving to be strong support zone. RSI briefly hit oversold area on the hourly today. The company plans strong promotional push following the closing of financing that could come any day.

Astralis Group and the Danish pandemic comebacks What a crazy lockdown period huh? I used the time to trim my expenses budget, plan ahead and free up more capital for investing.

I also learned a lot of cooking skills.

I also invested during the lockdown (As I do every month with excess capital). Here's the Astralis Group update.

Nobody is perfect, and I absolutely have taken a hit on this stock so far, but keep in mind that we are only a few months into a decade long trade.

Currently, we're in the accumulation phase for this stock, which means that excess capital is spread around this and other picks when available.

For clarity, I've posted the average price i've paid for the stock during the accumulation phase.

It's a simple strategy, but it can apply well to sectors / picks you determine will do well over a protracted period of time.

Astralis has resumed function as regular, and won most recently the CS:GO Road to Rio event.

June is going to be action packed for Astralis Group as both their League of Legends team and CS:GO teams clash off in the summer event qualifiers.

Positive outcomes and viewership numbers, combined with a more positive outlook on global reopening, could spark a rally around the june period, sending us up to test some resistance.