8-Weird Tricks to Crash the Real-Estate MarketSo one of my daily rants got long enough to warrant a Medium post. Whether you agree with it or not, I think I do have a plan mapped out for myself, at least financially speaking.

The tl;dr is that underlying trends don't really look good for the US real-estate market right now, despite record high gains in the last few years. Or maybe it's more accurate to say that the record gains is what *is* going to cause it to crash later on. Just like with #crypto, except more unpleasant, because it's tied to so many more things, and people.

When, I don't know. But "if" is no longer a question for me anymore.

ryangtanaka.medium.com

Estate

SHORT VNQ, GET OUT WHILE YOU CANI have been tracking this ETF for a long period of time. We just broke one-year resistance and clear evidence on the fib retracement (specifically level 0.5) shows that the price was weakening.

Technicals aside, there is no reason as to why this should move upwards. This pandemic has taken out firms with high leverage, left more than 25 million Americans jobless, and monetary policy hasn't been as effective because people haven't been going out. Not only that, but the government will also now have to think twice about their spending, as our debt has dramatically increased this year accompanied by a significant drop in tax revenue. Consumers have less income and are looking towards their savings to live through this pandemic.

As we move to reopen, firms will look to deleverage and cut spending. This means that unemployment will most certainly not go back to its previous levels anytime soon and the average American will be in no position to take in debt in the form of a mortgage. I'd even argue to some extent that many will look to sell their homes.

So how does this relate to VNQ? Home prices haven't adjusted because a decrease in supply helped remedy the decrease in demand. If you analyze active listing for the months of April, you will see that in almost every market, there has been a significantly smaller number of homes being listed. Hence, there have been fewer homes being sold at the price pre-virus. These price levels were already thought to be reaching a bubble, but with this sudden change in demand, these prices will correct most certainly. As we look to reopen, people will look to sell their houses. Realtors will push people to sell their homes. This increase in supply accompanied by the withstanding lack of demand will drive housing prices all the way down.

I expect we will see these prices fall in areas with typically less demand than others first. Looking at listings in suburban areas, we are already seeing sellers change listings and drop their price, with still no buyer. It is still early to get out as prices haven't adjusted and many cities haven't reopened.

Now, residential real estate accounts for 14.53% of VNQ. The problem lies in commercial real estate, 40.48% of VNQ. As said before, firms will want to deleverage and cut spending. Not only that, but offices will be dead anytime soon as many companies will want to remain online for the next quarter or two. The only downside will have to do with hospitals and clinics, but as we flatten the curve, the need for hospitals will not be any larger than the need for them a month or two ago. Regarding specialized REITs, there are going to be numbers of people that will not be able to pay rent or will find the price of rent too high in comparison to their income. All in all, all we can see is red!

Hopefully, this doesn't truly occur because many will be hurt by this crash, but it is hard not to warn against the inevitable.

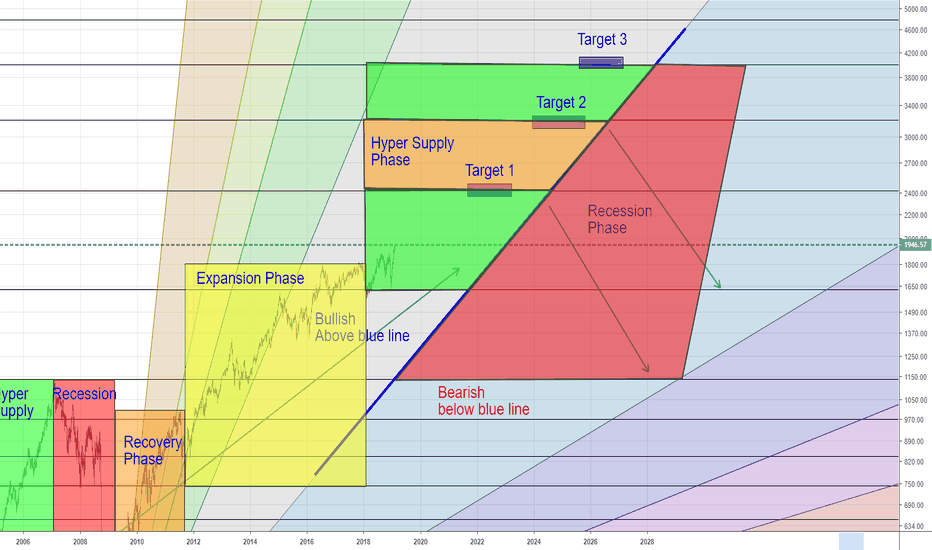

Real Estate Market CycleThe "Real Estate Market Cycle" is made up of four distinct phases.

Recovery

Expansion

Hyper Supply

Recession

There isn't an exact length of period of time each phase must last, but taken as a whole, the entire cycle averages 17 to 18 years from peak to peak.

Looking at the previous cycle (1989-2007) we can use Fibonacci and geometry to see where we currently are in the cycle and predict where we are going.

Currently, it appears that we are in the relatively early stages of hyper supply. This phase began with the passage of the Trump tax cuts and fuel was thrown on the fire with the capitulation of the Fed following the Christmas '18 blood bath in stocks.

The hyper supply phase can be lengthy but can also be short.

Absolute worst case, we have a year left in the hyper supply phase.

But more likely is we have 3+ years remaining. Somewhere between 3 and 7 years from now.

REAL ESTATEFundamentals:

-Secular Demographics Less Old People = More Supply

-Rising Interest rates = Less Demand

Technicals in the chart

Great Opportunity to buy farmland in South AmericaThis stock buys you land all over South America.

319,000 Hectares between Brazil and Paraguay, just to name a few (mostly in Brazil).

Exposure to an incredible emerging market.

Exposure to commodities long term (grain and sugar mostly, cattle as well)

Management is a powerhouse.

JP Morgan owns 7% of the float.

George Soros made this company happen.

Google Eduardo Elsztain - greatest Argentine real estate investor. He's LND's Chairman.

Commodity prices are depressed. As commodities rise in the future it will generate more income for farmland.

Brazilian currency has gotten crushed in the last 10 years. New strength in the Real will benefit Brazil's economy.

Company has no debt.

Excellent growth.

Farmland known for its fantastic risk/return profile (it's land in Brazil, Peru, Chile, Argentina, etc, not a technology fad).

Under $5 per share so institutions are not allowed to invest, yet. What happens when prices hover above $5 per share? Domestic institutions have this stock on their radar and capital flows one way.

Boo Ya.

Most importantly, we have a great looking chart.

Real-Estate Looking as Bearish as the Stock Market, Buy $DRVWhat is this chart? This is the MSCI Real-Estate Investment Trust (REIT) Index, it is the Index that DRV is backed by. DRV is a 3xLeveraged Short Real-Estate ETF.

Why is it important? Because if you buy DRV while RMZ is crashing you can make some pretty insane returns. If you look at the Elliott Wave count on this chart and on the related SPX500 chart you will see that the counts are basically the same, it appears that we are in the midst of a non-limiting triangle that is at the end of a double combination. This means that both the Stock Market and REITs are going to stop growing for the next year or two and then at some point, after the triangle is complete, they are going to collapse. This basically means that the entire US Economy is going to go to shit like it did in 2007-09. Since it is a double combination that would imply around an 80% retracement of the Bull run starting in 2009.

(SPX500 - Multi-year Elliott Wave Forecast...)

How do we know if this chart is correct? Well we already have the break down out of the channel, and triangles are generally pretty easy to detect even in the very early stages. It also appears that there is significant momentum resistance and we are finding some resistance underneath the channel as well. There's also a perfect double top with the peak we made in the beginning of 2007. At this point it would take a whole lot for this to actually be able to push above the high, and I'd say that it is more or less confirmed. If the high is broken then it may be a good idea to change to a neutral economic outlook until more data is available.

Remember that DRV is the big play here. The gains made from shorting RMZ are nothing compared to what DRV could be worth in a recession. The only reason we look at RMZ is because it is the underlying asset for DRV and because it's wave patterns are much more clear.

The clouds are definitely dark over Cyclical City, I would be seriously cautious about being invested in housing and anything that is cyclical in nature for the next couple of years. The market has had a good run for the last 7 years but now it looks like its time for the cycles to change and for the Economy to once again enter into a bearish period.

Another interesting thing I noticed when I accidentally analyzed the wrong chart, is that the MSCI Inc. Stock (The company that makes these Indices) looks like it could be reaching a peak. This would still be pretty speculative since there are no confirmations but it could be telling as to the overall strength of these indices and the stock market.

Real-Estate Not Looking Good? Buy $DRV (Elliott Wave Analysis)What is this chart? This is the Real-Estate Investment Trust (REIT) $MSCI it is the underlying asset for the 3xLeveraged Short Real-Estate ETF $DRV.

Why is it important? Because if you buy $DRV during a housing market crash you can make some pretty insane returns, and if you look at the Elliott Wave count (unconfirmed) you will see that $MSCI has possibly just completed Wave-c of an Extended Zigzag. Since it also ended with a terminal impulse it means that at a minimum Wave-c needs to be completely retraced but since we are completing an extended zigzag, and we are most likely in a triangle, it is highly unlikely that we'd retrace ALL of the entire zigzag because, based on my stock market count, we are in the 2nd "Three" of a major correction that started in 2000.

What does this mean? It means that if my chart is correct the Real-Estate market, and the US Economy, is about to collapse. The process will be slow and painful but this is a perfect starting point for it., the stock market is also reaching a nice high at this point it has basically triple topped. It seems like my related chart will probably continue to be right and the stock market growth will pretty much come to a halt and then the whole market will fall through the floor after about a year. I except there to be blood in the streets by the end of this. It will be at least as bad as 2007-09.

So how do we know if this chart is right? Well first of all it's still extremely speculative (lower probability), if you wait for it to first break the lower yellow line, and then to break the red and blue lines, it will have more or less confirmed the Wave-c impulse and also the entire Zigzag. If you wait until the blue line there is still plenty of profit left but you did miss out on quite a bit (especially on $DRV) so it may be a good idea to take the risk of being wrong and start moving capital into this trade now. Since Wave-c ends on a terminal it needs to retrace the terminal in 50% or less time it took, and typically its much faster than that. This means that if this chart does end up being right the housing market (and in particular $MSCI) is going to crash very fast and very hard within the next year.

How do we know if this chart is wrong? Well this would be the tippy top so if it moves up even a little bit from here it would be a good idea to stop-out and wait for a break down before taking this trade. That means that if you take the trade now on $DRV your R/R is over 1:1000. If you wait until there's a break down your R/R isn't quite as fantastic but the probability that this chart is correct increases substantially because it eliminates any other possibilities I may have overlooked.

Remember that $DRV is the big play here. The gains made from shorting $MSCI are nothing compared to what $DRV could be worth in a recession. The only reason we look at $MSCI is because it is the underlying asset for $DRV and because it's wave patterns are much more clear. Again this is a very speculative and risky trade at this point it's definitely not recommend that you get overly aggressive until this trade has more confirmations!

The clouds are definitely dark over Cyclical City, I would be seriously cautious about being invested in housing and anything that is cyclical in nature for the next couple of years. The market has had a good run for the last 7 years but now it looks like its time for the cycles to change and for the Economy to once again enter into a bearish period.

pennies to thousands candidateabove cloud

look for good 21 minute opening bar

cci strong think it will trend

relative strength money flow good

macd cross

on well strong cloud at 2.50 be careful

on daily right at 200 day make sure crosses

SPY Bear /crash indicator DSRE/DSEHThe rate of change in the ratio between the Dow Real Estate index and the Real Estate and Housing Dev index provides a reliable indicator for impending losses in SPY.

Setting a cut off of approximately 3.5 in the ROC (this can be tweaked) is useful.

This industry is primed to suffer more than any other.The chart above shows assorted real estate stocks, they aren't cherry picked and were random (except RAIT Financial), but you can see the trend.

Get the hell out of real estate. Seriously if you have any real estate or RAIT stocks it is a great time to sell. This housing market has gone nuts from the years of 0%. Rental vacancy rates are at a 30 year low and rental prices are through the roof (pardon the pun), with houses that would have a $700 mortgage going for $1200+ with ease. Housing prices are way up too and are around pre-crisis levels.

NO I AM NOT SAYING THIS IS ANOTHER HOUSING BUBBLE. I'm not stupid, c'mon.

Real estate stocks certainly haven't gone crazy in recent years, given residual investor uneasiness about the sector. However, many symbols have made some nice gains since '08 and they are going to get hammered. As you can see on the chart all these symbols are RAITs and real estate and they are sliding already. A rate hike, even if the FOMC says it's only .01%, will be seen as the start of higher interest rates and thus a decrease in home sales. So get some put options on the sector, I'd say go 4-12 months out with strikes 15%+ lower than last price, it'll pay off. Even if Yellen announces no rate hike in Dec., everyone thinks it's coming, and that's all it takes.

The housing market really does need it though, prices are getting a bit too high and rental prices are insane high. Also, don't confuse real estate stocks and bank/financial stocks, banks will benefit from the rate hike (increased lending and profits from interest).

Bullish Trade in MOVE: 63 times Usual VolumeMove, Inc. operates an online network of Websites for real estate search, finance, and moving and home enthusiasts in North America. MOVE is currently trading around $12.10 in a 52 week range of $9.91-$18.0036. The company’s stock has been underperforming the market this year with shares falling year to date. Options traders seem to think that this trend will reverseas order flow in XYZ has been decidedly bullish during today’s trading session. Earlier today a trader bought 2000 MOVE July 12.5 Calls for $.90. This is an extremely bullish order and involves this trader laying out $180,000 in total premium. With this order flow and this chart set up I believe XYZ is setting up well for a long.

Unusual Option Activity:

We define unusual option activity as large block trades that represent a large percentage of daily option volume. The block trade is considered “unusual” if the option volume is above the average daily volume over the past 22 days. At KeeneOnTheMarket.com we scan and analyze order flow from all of the major options exchanges in order to identify any unusual option activity.

Analyzing unusual order flow gives traders a window into what the positions that large institutional players have. The majority of unusual option activity can be traced back to hedge funds, mutual funds, and other large institutions. Knowing where these institutions are placing their bets can be hugely advantageous for any trader. These institutions have informational and technological advantages that the average trader doesn’t have, and the amount of time and analysis that goes into every one of their trades is substantial. We offer this service through our 7 hour daily LIVE trading room bit.ly or through Premium Twitter feed with all entries, exits, and unusual options activity tweeted all day long: bit.ly .

Order flow can however at times be deceiving. One might logically thing that a large block buyer of calls is bullish on the underlying. This is not always the case. Remember that a large number of participants in the equity options market are hedgers. Long calls are a hedge against short stock, and long puts are a hedge against long stock. With this in mind we have developed a 7 step trading plan that helps filter out unusual option activity that will not provide actionable trade setups. It is by using this plan that we are able to identify the most significant unusual options activity trades every day.

My Trade: I bought 150 MOVE July 12.5 Calls for $1.00

4 Targets: $1.15, $1.30, $1.50 and $1.75

Greeks of this Trade:

Delta: Long

Gamma: Long

Theta: Short

Vega: Long