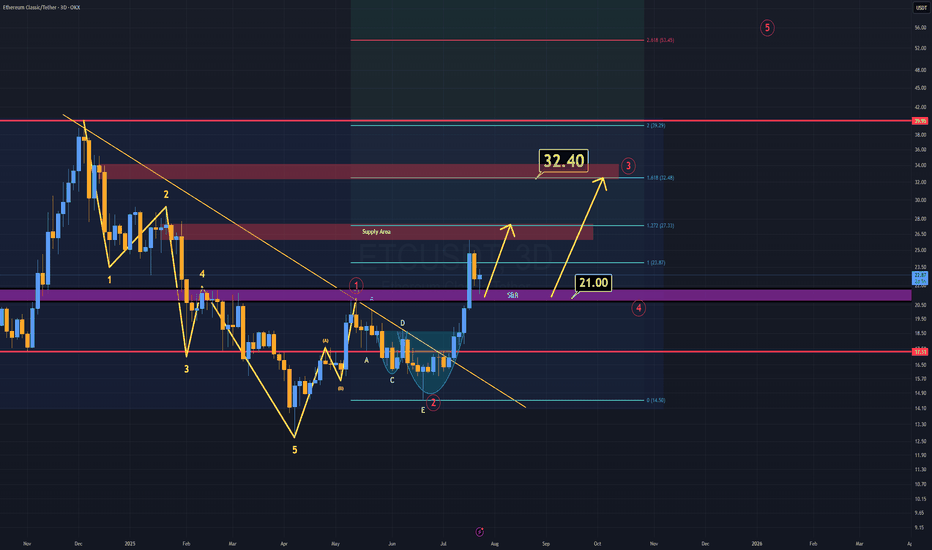

ETC Analysis (3D)ETC is showing a strong bullish structure, just like many other altcoins.

The key difference? ETC has already confirmed its breakout.

As long as ETC holds above the $21 level, I believe the minimum target sits at $32 in the coming weeks.

According to Elliott Wave Theory, that $32 region also marks the end of wave 3, which perfectly aligns with a daily supply block, a strong technical confluence.

Recently, ETC tapped the rebuy zone, highlighted in purple (S/R zone) on the chart.

Lower timeframes also support this bullish continuation scenario.

Momentum is on the side of the bulls.

S wishes you the best of luck!

ETCUSD

#ETC/USDT Forming Strong Bullish Potential#ETC

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 21.80, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 21.20.

Entry price: 22.50

First target: 23.70

Second target: 24.66

Third target: 25.90

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

ETC/USD – Weekly Chart Overview Ethereum Classic is trading at a key long-term support zone, bouncing from the lower bound of a multi-year ascending channel. Historically, this zone has triggered large rallies (2019, 2020, 2021).

Major resistance levels are stacked at $24, $42, $77, and $103. If the price holds above $22–24 and breaks out with volume, it could retest the mid/high zones of the channel.

Structure remains bullish above $20. Break and hold above $26–27 may signal the start of a new macro wave.

Ethereum Classic:Buying opportunity?hello friends 👋

Considering the price drop we had, you can see that buyers are coming in less and less in the support areas that we specified for you, and this can be a good signal to buy in these areas step by step with capital and risk management and move to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

#ETC/USDT#ETC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 16.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading for stability above the 100 moving average.

Entry price: 16.50

First target: 17

Second target: 17.50

Third target: 18

Is #ETC Ready For a Breakdown or Will it Recover From Here? Yello Paradisers! Have you checked what’s unfolding on #ETCUSDT lately? Let's look at the latest moves of #EthereumClassic:

💎#ETC has been trading inside a descending triangle for weeks, and once again, it failed to break above its strong descending resistance line, with the 50 & 200 EMAs acting as a dynamic ceiling on every rally attempt. These two indicators are stacking against the bulls, reinforcing the overhead pressure and keeping ETC pinned below key resistance levels.

💎The red zone between $18.60 and $19.20 has been acting as a strong resistance area and that’s exactly where the last bounce got rejected. The setup is clear: as long as price remains below this red supply zone, any short-term bullish case is invalidated. Each rejection here only fuels further downside conviction.

💎Unless we see a high-volume breakout and hold above $19.20, the structure remains extremely vulnerable. This is the invalidation level for the bearish thesis. If bulls can't flip that, the current pattern suggests continuation to the downside.

💎#ETCUSD is currently hovering around $16.50, with short-term bounces being aggressively absorbed. The mid-term support zone around $12.49 is likely the first magnet for price, but don’t get too comfortable there. The real target lies deeper: the strong support zone around $10.78 is shaping up to be the key smart money reaccumulation area if the selling intensifies. This is where real interest may return—but only after retail gets flushed.

Trade smart, Paradisers. This setup will reward only the disciplined.

MyCryptoParadise

iFeel the success🌴

Ethereum Classic ETC price analysisToday, we will talk about the prospects for the #ETC price

For those who have been in the crypto market not a long, we remind you that the primordial from the House of Targaryen #Ethereum was #EthereumClassic

But its fork CRYPTOCAP:ETH has surpassed it tenfold...

The moral is better to be “flexible” and adapt to situations and opportunities, not stubborn...

But perhaps soon the price of OKX:ETCUSDT will shoot up after a super long consolidation with a base around $15.

1⃣ In 2017, the #ETC price made more than 5000% growth after almost a year of consolidation

2⃣ In 2021, the #ETC price rose by more than 2000% after 2 years of consolidation

3⃣ Now the corrective consolidation of the OKX:ETCUSD price has been going on for more than 4 years, maybe it's time to start a rapid wave of growth by at least +1000-1500% ?)

By the way, did you notice the pattern? write in the comments !)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#ETC/USDT#ETC

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 16.50, which acts as strong support from which the price can rebound.

Entry price: 16.62

First target: 16.80

Second target: 17.00

Third target: 17.24

ETCUSDT: Breakdown or Bounce? A Critical Move Is Coming!Yello, Paradisers! Is ETCUSDT about to collapse further, or are the bulls ready to fight back? Let’s break it down!

💎#ETCUSDT remains in a strong downtrend, continuously rejecting the descending resistance and struggling to hold above key levels. Recently, the price tested the imbalance zone at $18.995 but got smacked down, a clear sign that sellers are still in control.

💎Adding further bearish confirmation, the 50 EMA has crossed below the 200 EMA, reinforcing the downside momentum. This classic death cross signals that sellers have the upper hand, increasing the probability of further declines.

💎If ETC retests the $18.995 supply zone and faces rejection again, expect another leg down toward $17.590 and potentially the major support at $16.576. A failure to find strong buying interest at these levels would confirm further downside continuation.

💎However, if ETC manages to break and hold above $18.995, it could signal strength. In this case, price may push toward $21.288, but it must first clear $19.288 with strong volume to invalidate the bearish setup. A confirmed breakout would shift momentum bullish, opening the door for a potential rally toward $22 and beyond.

Stay patient, Paradisers! The market always rewards discipline. If we see confirmation, we take action. If not, we wait. Trade smart, not fast! 🎖

MyCryptoParadise

iFeel the success 🌴

etc longterm buy"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

TRUMP's crypto euphoria is almost over? #BTC $111K TOP 1-20-25TRUMP's crypto euphoria is almost over? #BTC in the overbought zone and built bearish divergence, ready for bearish reversal, so far no bearish reversal signal yet.

Be ready for bearish reversal form #BTC top level around $111-112K!!!

#BTCUSD #BCHUSD #ETHUSD #ETCUSD #ADAUSD #TONUSD #SOLUSD

Could you please like and subscribe for it.

Thank you so much and Good Luck to all of you!

ETC LONGAnalysis:

We are currently observing an accumulation phase in the market as the price tests a significant support level. This area is crucial for determining if the market will rebound or break further down.

The monthly open is highlighted, showing that price action has been trading below this level.

A potential breakout to the upside is expected, with the conservative target set around $32. This aligns with previous resistance zones, where price has struggled to break above.

If the price breaks above the $32 mark, the next potential target would be near the PMH (Previous Monthly High) at around $40.

Trade Plan:

Buy at current price levels near $24.34 with a stop loss just below the support (around $21).

Target 1: $32 (Conservative Target)

Target 2: $40 (PMH)

Risk Management:

Keep stop-loss orders below the accumulation zone to limit risk in case of a breakdown.

Note:

This setup is based on technical analysis and assumes that the market continues to show signs of a bullish reversal. Keep track of broader market trends and adjust accordingly.

etcusdt midtem long"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

etc usdt"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Ethereum Classic ETC price is just starting to riseGod willing, we will be able to see CRYPTOCAP:ETC at $50 in this growth wave

Then a slight correction and a possible breakout of the OKX:ETCUSDT price to storm $100

At the moment, the #EthereumClassic price is forming a pattern very similar to the one that #Dogecoin used to form, don't you think? 👇

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Something cooking with ETC Ethereum Classic?Chart opens a possibility for a bullish multicycle continuation for ETCUSD chart. Key zones to watch are in blue. One more level to conquer to make this upward movement definitive and sustainable. If it goes beyond 47 dollars, it opens pathway to ATH with no resistance until 175 dollars.

etherium classic etc usdt daily analyses

time frame daily

risk rewards ratio >1.5

although today we heard a lot about alt season but

my analyse is base on price action and support and resistance

etc moves up and down in parallel lines and my target is top of that.

we have 2 resistance boxes ( red boxes in the chart ) ,if ETC can break those boxes , it can pump to 39 $

Ethereum Classic ($ETC) will show a classic H&S patternEthereum Classic is one of the few old assets that has yet to fire. It will follow the same scenario as XRP, LINK, XLM and others. I love the Head and Shoulders pattern that the market maker often plays on old assets. The simplest reason why Ethereum Classic is being pumped is its age. The global market maker has been accumulating old assets for a large number of years and it's time to reveal the cards. I expect a price hike to the area of 170-180$ and further correction.

Best regards, Horban Brothers.