Everything goes according to plan!

Hello friends,

A Possible scenario is shown in the chart. As you know, this pattern is a Pennant (See attached Idea). It's taken me a little time to discover whether the pattern is a real pattern or a disguise, Now I know it's true.

ETC (4h)-Technical section:

RSI *** 53.73

DMI is Neutral

Oscillators:

Moving Average Convergence / Divergence *** Buy

Momentum Indicator*** Buy

Bull Bear Power is neutral

Moving Averages:

Ichimoku Cloud is neutral

Volume Weighted Moving Average *** Buy

Hull Moving Average *** sell

For more details, See attached Idea.

Why ETC?

ETCUSD

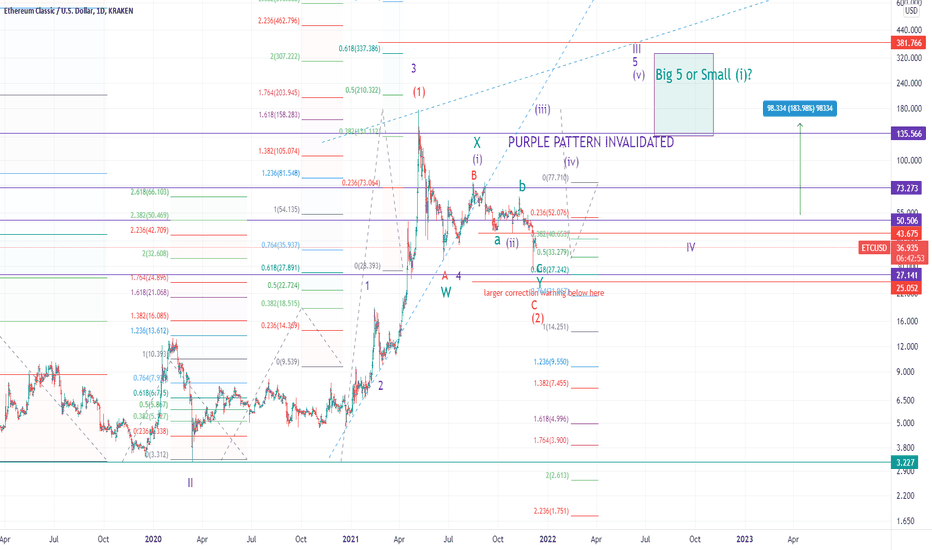

Ethereum Classic Invalidates its 1-2 Setup: Warning Shot?Ethereum Classic ( ETCUSD ) spiked down HARD along with the rest of the crypto universe between 12/3 and 12/4! The whole sector crashed so hard, in fact, that many technical supports were broken with ETC being no exception. Breaking below the 32-38 range means that ETC has pulled back LOWER than the origin-point of what we were calling the Subwave (i), so the purple primary impulsive path has been invalidated. We have more or less confirmed that the bearish red alt pattern is in effect.

More specifically, I have added the new GREEN pattern which interprets the correction from May 2021 to present-day as an Elliott Wave "double-zigzag", an uncommon but not rare formation. Double-zigzags (or double-threes) are 3-wave corrective patterns in which each subwave is ALSO a 3-wave corrective pattern. In the case of ETC, we have all zigzags for subwaves within the larger green double-zigzag pattern. In order to prevent confusion, we use W-X-Y nomenclature to describe the subwaves of a double-zigzag in Elliott Wave Theory.

While this invalidates our immediate upside setup that would've gotten us into the subwave (iii), it does also mean that we cannot project a top at this moment due to the lack of a clear (i)-(ii). And that may be a good thing because what we were calling ETC's subwave (i) was PATHETIC! This gives ETC and many other cryptos a mulligan to get us a better subwave (i). Relying solely on the big picture pattern we have at this moment, I would roughly expect any rally to take us to the 0.382-0.618 extensions of the larger structure from March 2020 - May 2021, which would fall between 131 and 337, but these are very crude estimates.

Other cryptos that have also invalidated their (i)-(ii) setups just like ETC are BCH, FIL and EOS . All of these cryptos were underperforming similarly with unimpressive subwave (i) extensions, and now they all have a blank slate to redeem themselves.

While there is a bit of 'doom and gloom' in these aforementioned cryptos, BTC , ETH, DOT, XLM and MATIC all have their upside setups still intact despite the big selloff. BTC barely hangs onto its nested 1-2,i-ii setup by a thread, but ETH pulled back almost perfectly. This means that our overall big picture targets for subwaves (iii) and (v) are still valid for these cryptos. Ethereum MUST continue to hold its 3307 major support while Bitcoin MUST hold its 39,600 major support. Failure of these two main cryptos to hold their majors supports would be a HUGE warning for the entire crypto space!

Finally, we have LTC, DASH, SOL and LINK. These cryptos invalidated their NESTED 1-2,i-ii setups but not their overall (i)-(ii) setups. What this means is that we can interpret their rallies from summer 2021 until this week as A-B-C 'corrective' rallies, which is indicative of these cryptos potentially continuing their overall structures in the form of 'ending diagonals'. Diagonals subdivide into 5-wave structures but are choppy with lots of overlap, and their subwaves take the form of 3-wave A-B-C structures.

I use Elliott Wave analysis to project price levels for different assets and asset classes. EW is a form a technical analysis that is absolutely NOT based on fundamentals. Please be aware that this video is not intended to act as financial advice. I am not a trained or certified financial professional. You may invest based on a strategy tailored to your own skill and risk-tolerance levels.

#ethereumclassic #ethereum #bitcoin #cryptocurrency #ethereummining

ETC/USD LONG SET UP(HODL)ETC/USD LONG SET UP

Bulls want to see further consolidation and then for big bullish volume to come in and drive Ethereum Classic up above the $65.33 level for confirmation the uptrend is still intact. The crypto has resistance above at $60.89 and $65.10.

Bears want to see big bearish volume come in and drop Ethereum Classic down below the $55.74 level, which could put the crypto in danger of losing the uptrend. Ethereum Classic has support below the level at $50.55 and $44.66.

SUPPORT- $39.00, $31.00/ $25.50

RESISTANCE- $50.50/ $63.00/ $75.50/$83.00/$100.00/$110.00/$117.00/$125.00/$150.00

Bitcoin (BTC) - December 7Hello?

Welcome, traders.

If you "follow", you can always get new information quickly.

Please also click "Like".

Have a nice day.

-------------------------------------

(XBTUSD 1W Chart) - Mid-Long-Term Perspective

Above the 27650.0-29350.0 section: An uptrend expected to continue.

Above 47010.0 point: Expected to create a new wave.

In order to accelerate the uptrend, it is expected that the CCI line must rise above the EMA line in the CCI-RC indicator.

(1D chart)

First resistance section: 60811.0-63634.5

Second resistance section: near the 72104.0 point

First support section: near 55164.5 point

Second support section: 46695.0-49518.0

We need to see if we can find support in the second support zone and move above the 50876.0 point.

A decline from the 45211.0 point will likely lead to a drop near the 38225.0 point, so we need to think about how to deal with it.

It needs to move above the 53976.5 point to turn into a short-term uptrend.

The next volatility period is around December 27th.

---------------------------------

(ETHUSDT 1D Chart)

First resistance section: near 5008.79 point

Second resistance section: 5553.35-5825.64

First support section: near point 3343.06

Second support section: 2275.68-2531.05

On the CCI-RC indicator around December 7th (December 6-8), we need to see if the CCI line can rise above the +100 point and above the EMA line.

An important point to continue the uptrend is the 4220.37 point.

Therefore, it is necessary to check whether the 4191.93-4464.22 section can support and rise.

A decline from the 3885.52 point could lead to a drop near the 3343.06 point, so you need to think about how to deal with it.

In the CCI-RC indicator, the CCI line fell below the EMA line and crossed more than 3 times.

Accordingly, if the CCI line and the EMA line cross at this time, it should rise above the EMA line and be maintained.

Otherwise, I would expect large volatility as the EMA line moves below the +100 point.

---------------------------------------------

Since the indicator consists of a formula of price and volume, changes appear later than movements in price and volume.

Therefore, it is good to use it to check whether the current price and volume movements are moving as expected.

I explained further below the analysis, but it is for the sake of understanding that the indicator moved like this and that the current price and volume moved like this.

I think indicators are a necessary tool to confirm your thoughts when it is difficult to understand the movement or direction of price and volume.

You may or may not use indicators.

If you can quickly organize your thoughts by using indicators, it is better to use indicators.

It can be a race against time when making trades, so you need to have good judgment.

However, if you have established and carried out all countermeasures for ups and downs before proceeding with the first trade, you can proceed with better trades.

----------------------------------

(BTCUSDTPERP 1D Chart)

First resistance section: 62697.4-65574.9

Second resistance section: near point 74207.2

First support section: near 56942.5 point

Second support section: near the 48310.2-51187.6 point

You need to check if you can get support and rise in the second support zone.

If it falls from the 47000 point, it could fall again near the 39677.8 point, so you need to think about how to deal with it.

In order to transition into an uptrend, the price must rise above the 53233.1 point to hold the price.

The next volatility period is around December 18th.

------------------------------------

(Market Cap Chart)

You should see how the flow of money changes rather than changes in the price chart.

So, you should check the trend of USDT chart and USDC chart.

(If the USDT and USDC charts are in an uptrend, the coin market is expected to continue the uptrend.)

It is necessary to check whether the same movement as section A is displayed on the USDT.D chart.

Therefore, we expect movement around the week that includes December 13th.

It remains to be seen whether a drop below the 2.910 point will lead to an uptrend, or a move above the 3.374 point for a short-term downtrend.

If the following phenomena do not occur, the coin market is expected to maintain an upward trend.

Prelude to a downtrend in the coin market

- BTC price drop

- BTC dominance rise

- USDT dominance rise

In that sense

BTC Dominance (BTC,D): Should rise above the 47.64-48.81 section.

USDT Dominance (USDT.D): Must rise above 3.374 point.

A phenomenon that can be seen as a change in the coin market to a downtrend

- USDT Chart: Falling below 58.376B

- USDC Chart: Falling below 23.858B

- BTC.D chart: rise above 56.78 points

- USDT.D chart: rise above 4.158 point

-------------------------------------------

(XBTUSD 1M Chart) - Big Trend

All patterns and waves can be known when they are completed, so it is best to conduct a trade that matches your average unit price rather than a trade based on prediction.

Looking at the big picture, I think 4-5 waves are going on.

Depending on how you interpret section A, the wave may be different.

Likewise, you need to be more careful in your trading, because the parts that have not yet been created may have the same flow as section A.

The expected ascent section is near the 80574.0-83397.0 section.

This is an expected value considering the fluctuation range that has risen from the 1st section to the 2nd section.

There are two large resistance intervals to move up to the expected level.

The two large resistance sections are sections a and b.

If it fails to break through section a upward, I think it can represent the same flow as section A.

If it rises above the 72104.0 point with this rise, it is expected that it will not fall below the 26K-29K section (maximum 21K section) even if a bear market continues.

If the 38K section is touched, it is expected to lead to a sharp rise.

------------------------------------------

We recommend that you trade with your average unit price.

This is because, if the price is below your average unit price, whether the price trend is in an upward trend or a downward trend, there is a high possibility that you will not be able to get a big profit due to the psychological burden.

The center of all trading starts with the average unit price at which you start trading.

If you ignore this, you may be trading in the wrong direction.

Therefore, it is important to find a way to lower the average unit price and adjust the proportion of the investment, ultimately allowing the funds corresponding to the profits to be able to regenerate themselves.

------------------------------------------------------------ -------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator moves accordingly with the movement of price and volume.

However, for convenience, we are talking in reverse for the interpretation of the indicator.

** The MRHAB-O and MRHAB-B indicators used in the chart are indicators of our channel that have not been released yet.

(Since it was not disclosed, you can use this chart without any restrictions by sharing this chart and copying and pasting the indicators.)

** The wRSI_SR indicator is an indicator created by adding settings and options to the existing Stochastic RSI indicator.

Therefore, the interpretation is the same as the traditional Stochastic RSI indicator. (K, D line -> R, S line)

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

---------------------------------

Ethereum Classic (ETC) Buy ZoneEthereum Classic (ETC) Buy Zone

--------------------

BIAS

Mid-Term : Bullish

Long-Term : Bullish

Now that we’ve seen a cool down in price action, Ethereum Classic has seen a ~10% drop towards $45.5 where it found strong support.

--------------------

$ETC/USDT SPOT SETUP

Entry Price : 44.65 - 46.6

TP 1 : 50.6

TP 2 : 54.5

TP 3 : 58.1

TP 4 : 62.3

TP 5 : 70.25

TP 6 : 76.35

TP 7 : 86

TP 8 : 99

SL : 39.45

*Maximum 5% of Portfolio.

*Unload 12.5% at each TP. Whenever TP 2 hits, Move stop loss to entry.

--------------------

Pennant Pattern (completed trend)Hello friends,

A Possible scenario is shown in the chart.

The pennant pattern is one that you often see right next to the bull flag pattern in the books. In the technical analysis, a pennant is a type of continuation pattern.

As you know, For a bullish trend, a break above resistance signals that the previous advance has resumed. The length of the pole can be applied to the resistance break pennant to estimate the Target.

it's the right time for you to buy.

Stop loss = (BTC < $ 50k)

ETC is weak but there's at least last final breath to be done...ETC looks very weak after its pump and to me there's noting to expect, however there's a good chance to visit $55 - $59 at least before squeezing down the support line.

I expect it to go below current support, and on its retest, complete 'W' pattern with massive fall down to $13.

ETC - false breakout as a good buying opportunity!Ethereum Classic broke through an important key level of $46.8. A lot of liquidations took place because of this drop. At the bottom, we can see that the volume has increased, which is a signal of large liquidations. This is a good signal, liquidations are fuel for continued growth.

In case of a false breakout of the 46.8 and 42.15 levels, there might be a good buying opportunity.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade.

ETC in short-termHello friends, A Possible scenario is shown in the chart.

Bull Flag Pattern:

The basic interpretation is that the pattern reveals that Bulls are waiting for better prices (Give it to them :) , but after breakout, Bulls are not waiting for better prices and are buying every chance they get (Catch ETC If you can). Although the price may fail to overcome the resistance several times, this does not lead to increased power for sellers.

ETC vs BNB:

Ethereum Classic (ETC):

$ 55.26 (Expect more big rises in the coming years)

Circulating Supply: 130,455,473.89 ETC

ATH $ 179 (55/179= 30% recovery)

and

Binance Coin (BNB)

$ 484.69

Circulating Supply: 166,801,148.00 BNB.

ATH $ 691 (484/691= 70% recovery)

It's up to you to decide which is better!

ETHUSE: Bull/Bear scenarios using Elliott Wave AnalysisCurrently we are tracking two scenarios with respect to Ether.

1) Bull base case: Currently we are completing the 'A' wave down (in red) to be followed by a 'B' wave bounce and which would then complete with a final 'C' wave down. This pattern also mirrors the fractal shown by the green circle that occurred September/October. This would be followed by a strong move higher (green arrow).

2) Bear base case: We have completed an ABC (purple) correction off the initial Eth A wave larger correction (Green ABC) from July/Aug. This scenario would have us visiting much lower levels over the next 12-18 months as we complete the final 'C' wave down.

Ethereum Classic (ETC) - November 13Hello?

Welcome, traders.

By "following", you can always get new information quickly.

Please also click "Like".

Have a nice day.

-------------------------------------

(ETCUSD 1W Chart) - Mid-Long-Term Perspective

Above the 16.722 point: the uptrend expected to continue

Over the 37.180-47.947 section: Expected to create a new wave.

(1D chart)

First resistance zone: near 69.480

Second resistance section: 91.012-101.779

Support section: 37.180-47.947

We are walking sideways in the section 47.947-69.480.

In particular, if the price maintains above the 57.934 point and breaks out of the downtrend line, I would expect the price to rise above the first resistance level.

If it falls from the support zone, there is a possibility that it will fall to the 16.722 point, so you need to trade cautiously.

At the CCI-RC indicator, there was an attempt to raise the CCI line above the +100 point.

If ETC price rises above the first resistance level, I expect the CCI line to rise above the +100 point.

The next volatility period is around December 7th (up to December 1-11).

------------------------------------------

(ETCBTC 1W chart)

Above 0.000970-0.001374 section: Expected to create a new wave.

------------------------------------------

We recommend that you trade with your average unit price.

This is because if the price is below your average unit price, whether it is in an upward trend or in a downward trend, there is a high possibility that you will not be able to get a big profit due to the psychological burden.

The center of all trading starts with the average unit price at which you start trading.

If you ignore this, you may be trading in the wrong direction.

Therefore, it is important to find a way to lower the average unit price and adjust the proportion of the investment, ultimately allowing the funds corresponding to the profits to regenerate themselves.

------------------------------------------------------------ -------------------------------------------

** All indicators are lagging indicators.

Therefore, it is important to be aware that the indicator moves accordingly with the movement of price and volume.

However, for the sake of convenience, we are talking in reverse for the interpretation of the indicator.

** The MRHAB-O and MRHAB-B indicators used in the chart are indicators of our channel that have not yet been released.

(Because it is not public, you can use this chart without any restrictions by sharing this chart and copying and pasting the indicators.)

** The wRSI_SR indicator is an indicator created by adding settings and options to the existing Stochastic RSI indicator.

Therefore, the interpretation is the same as the traditional Stochastic RSI indicator. (K, D line -> R, S line)

** The OBV indicator was re-created by applying a formula to the DepthHouse Trading indicator, an indicator disclosed by oh92. (Thanks for this.)

** Support or resistance is based on the closing price of the 1D chart.

** All descriptions are for reference only and do not guarantee a profit or loss in investment.

(Short-term Stop Loss can be said to be a point where profit and loss can be preserved or additional entry can be made through split trading. It is a short-term investment perspective.)

💥ETC LIKELY MOVE - LONG TO $133 OR SHORT TO $34Please support this idea with a LIKE👍 if you find it useful🥳

We have price currently in a symmetrical triangle after it broke out of the falling wedge.

After the next breakout, I expect price to either go long by 133% to $133 or short by 40% to $33.

What do you think?

Share your opinion in the comment section✍️

Follow me to receive more updates on ETHERUM CLASSIC (ETCUSDT ) 🤗

Happy Trading💰🥳🤗