Bitcoin Whales Going On Summer Vacation🚨 Wake Up, Crypto World! 🚨

🔹 Bernstein calls $200K 🔹 CNBC eyes $130K 🔹 BlackRock boasts IBIT is the fastest-growing ETF 🔹 Saylor claims $1M BTC 🔹 Thiel-backed crypto exchange Bullish - has confidentially filed for a US IPO …

Does this sound like "Institutions secretly acquiring Bitcoin"?

NO. This sounds like a desperate call for exit liquidity.

The real accumulation already happened, behind closed doors, away from the headlines. Now they need buyers. Retail FOMO is their exit strategy.

Don't be fooled enjoy the Summer Vacation. 🌴

#Bitcoin #Crypto #ExitLiquidity #MarketCycles #TakeProfits

CRYPTO:BTCUSD INDEX:BTCUSD TVC:GOLD TVC:SILVER NASDAQ:COIN NASDAQ:MSTR

ETF

BTC target months ago has been on point, "NEW" TargetsSo far our CRYPTOCAP:BTC 109 - 111k target has been MONEY!

Bitcoin hasn't been able to close above it all!!!

Showing Negative divergence on RSI & $ Flow on WEEKLY charts.

"New" CRYPTOCAP:BTC prediction?

Will stand by what we said previously. IMO there's good possibility we could see BTC going to the 170k area, extreme = 226K.

Monthly RSI doesn't peak until it hits 90's BUT there's Negative Divergence forming.

$ FLOW slowly diverging as well.

VOLUME DYING on SPOT. Not so bad on Futures.

2/2 Bitcoin looks similar to 2021Post 2 of 2

#Bitcoin is trading similarly to 2021.

Major difference? The move is more ORGANIZED today.

Volume is substantially more.

Did #BTC top, like really top?

We want to say no, but things can change!

Current:

$ Flow is much weaker vs December 24 top.

RSI is lower as well.

It looks like CRYPTOCAP:BTC will likely break 100k again, 95k IMO.

80k = IMPORTANT AREA!

1/2 Bitcoin call was good, so far, short term top in placeNot long after our post May 20th we began to sell some CRYPTOCAP:BTC ETF's. It was a good call, still have some, & we believe #Bitcoin still has consolidation in order.

We're waiting to see how the #BTC RSI reacts & wow it reacts to the Green Moving Avg.

Selling volume is light & this means that there is a LACK of BUYERS, at least for now.

#crypto

Please see our profile for more info on posts.

SPY: Bullish Outlook Based on Market StructureETF Strategy: Still Buying for 2025 Growth

I'm continuing to buy SPY and adding other strong ETFs like VEA, QQQ, and TQQQ. The market structure looks solid after the recent bounce, and I’m positioning for continued growth through the rest of 2025. My goal is to close the year with a strong percentage gain.

SPY (S&P500 ETF) - Price Testing Resistance Trendline - DailySPY (S&P500 ETF) price is currently testing a resistance trendline above ($593 to $595 price levels).

SPY price in the medium-term has been uptrending since April and May 2025.

SPY price in the short-term has been consolidating sideways, and a large volume breakout or breakdown has not occurred yet.

The 12EMA (blue line) has been holding as support for 5 trading days. Resistance targets to the upside would be $598 to $600.

The grey gap and the 26EMA (purple line) are downside support targets if a rally does not occur this month ($576 to $567).

Breaking news and tariff trade deals are supposed to occur in June and July 2025.

TOTAL Crypto Market Cap: Structural Breakout Aligns with Macros## 📊 TOTAL – Crypto Market Cap Ready for Expansion Phase?

---

### 🧵 **Summary**

The crypto market is showing signs of strong macro strength, with TOTAL reclaiming major support levels and forming a structurally bullish setup. Our multi-Fibonacci confluences and hidden bullish divergence point toward the possibility of a sustained breakout and new expansion leg toward \$4.9T and beyond.

This bullish view is further supported by powerful macro fundamentals expected over the next 8–10 months, including:

* Central bank rate cuts and liquidity expansion

* U.S. and EU regulatory clarity (stablecoins, ETFs, MiCA)

* Strong institutional adoption and geopolitical shifts

* Ethereum scaling upgrades and Bitcoin halving cycle effects

Together, these narratives form a compelling foundation for a broad-based market cap expansion.

---

### 📈 **Chart Context**

This is a **weekly chart of the TOTAL crypto market cap**, providing a bird’s-eye view of market cycles, macro structure, and capital flow across the entire ecosystem.

---

### 🧠 **Key Technical Observations**

* **Reclaim of \$3.02T level** (key support/fib level) signals macro bullish momentum.

* Market is forming **higher lows and bullish continuation structures**.

* **Support zones:** \$3.02T (reclaimed), \$2.57T (key pivot),

* **Resistance/TP zones:**

* **TP1 – \$3.75T** (100% trend-based fib + -27% retracement expansion)

* **TP2 – \$4.9T** (161.8% trend-based fib + -61.8% retracement expansion)

* **TP3 – \$6.9T** (261.8% fib extension target)

---

### 🧶 **Fibonacci Confluences and TP Logic**

We’ve employed both **standard Fibonacci retracement** and **trend-based extension** tools to build our target structure. The **1TP and 2TP zones** are defined by confluences between:

* **Retracement expansion levels** of **-27% and -61.8%**

* **Trend-based extension levels** of **100% and 161.8%**

If price reaches 2TP (~~\$4.9T) and **retraces toward the parallel legs** (100%–127%), this would confirm structural symmetry and open the door for a final push toward \*\*TP3 (~~\$6.9T)\*\* — the 261.8% extension.

---

### 🔍 **Indicators**

* **MACD Crossover** and rising histogram bars

* **Hidden Bullish Divergence** between MACD and price – a classic continuation signal

* Weekly trendline breakout from accumulation zone

---

### 🧠 **Fundamental Context**

While not directly charted, key macro catalysts like ETF approvals, global liquidity cycles, monetary easing, and increasing institutional interest will likely play a role in the next phase of expansion. This chart captures the structural readiness for that narrative.

## 📊 Fundamental Context (Extended Outlook: Mid-2025 to Early 2026)

Below is a detailed breakdown of upcoming macroeconomic, geopolitical, and crypto-specific developments sourced from:

* Bitwise Asset Management

* Fidelity Digital Assets

* ARK Invest

* CoinDesk, Reuters, Axios, WSJ

* CapitalWars, Cointelegraph, Coinpedia

* European Commission (MiCA regulations)

* U.S. Congressional records and SEC announcements

These events are chronologically aligned to support a structured macro bullish thesis for TOTAL market cap.

Bullish Crypto Catalysts (June 2025 – Feb 2026)

Summer 2025 (Jun–Aug): Monetary Easing and Regulatory Breakthroughs

Central Bank Policy Pivot: By mid-2025, major central banks are shifting toward easier policy. Market expectations indicate the U.S. Federal Reserve will stop tightening and begin cutting interest rates in 2025, with forecasts of up to three rate cuts by end-2025

bitwiseinvestments.eu

. Declining inflation and rising unemployment are pushing the Fed in this direction

bitwiseinvestments.eu

bitwiseinvestments.eu

. Easier monetary policy increases global liquidity and risk appetite, historically providing a tailwind for Bitcoin and crypto prices

bitwiseinvestments.eu

. In fact, global money supply is near record highs, a condition that in past cycles preceded major Bitcoin rallies

bitwiseinvestments.eu

. Should economic volatility worsen, the Fed has even signaled readiness to deploy fresh stimulus, which would inject more liquidity – “another tailwind for Bitcoin price growth”

nasdaq.com

.

Liquidity and Inflation Trends: With inflation trending down from earlier peaks, central banks like the Fed and European Central Bank are under less pressure to tighten. This opens the door for potential liquidity injections or QE if growth falters. Analysts note a strong correlation (often >84%) between expanding global M2 money supply and Bitcoin’s price rise

nasdaq.com

. There is typically a ~2-month lag for liquidity increases to flow into speculative assets like crypto

nasdaq.com

nasdaq.com

. The monetary easing expected in mid-2025 could therefore boost crypto markets by late summer, as new liquidity finds its way into higher-yielding investments. One projection even models Bitcoin retesting all-time highs (~$108K by June 2025) if global liquidity continues upward

nasdaq.com

– underscoring how “accelerated expansion of global liquidity” often aligns with crypto bull runs

nasdaq.com

.

U.S. Stablecoin Legislation: A landmark regulatory catalyst is anticipated in summer 2025: the first comprehensive U.S. crypto law, focused on stablecoins. The Senate has advanced the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act to a final vote

coindesk.com

. Passage of this bill (expected by mid-2025) would create a federal framework for stablecoin issuers, resolving a major regulatory gray area

coindesk.com

. Analysts call this “one of the most important regulatory developments in the history of crypto” – potentially even bigger than the approval of spot Bitcoin ETFs in impact

coindesk.com

. By enforcing prudential standards on stablecoin reserves and permitting licensed issuance, the law would legitimize stablecoins as a core part of the financial system. Bitwise predicts that clear rules could trigger a “multi-year crypto bull market,” with stablecoin market cap exploding from ~$245B to $2.5 trillion as mainstream adoption accelerates

coindesk.com

coindesk.com

. A U.S. law would also likely set a global precedent, encouraging other regions to integrate crypto-dollar tokens into commerce. Bottom line: expected stablecoin regulation in summer 2025 is a bullish game-changer, improving market integrity and unlocking new liquidity for crypto markets

coindesk.com

.

Regulatory Clarity in Europe: Meanwhile, Europe’s comprehensive MiCA regulations have fully taken effect as of late 2024, so by summer 2025 the EU has a unified crypto framework. This gives legal clarity to issuers, exchanges, and custodians across the 27-nation bloc

pymnts.com

skadden.com

. The harmonized rules (covering everything from stablecoin reserves to exchange licensing) are expected to expand Europe’s crypto market size by 15–20% in the coming years

dailyhodl.com

. With MiCA in force, firms can confidently launch crypto products EU-wide, and institutional investors have more protection. U.K. regulators are on a similar path – e.g. recognizing stablecoins as payment instruments – further globalizing the pro-crypto regulatory trend. By mid-2025, this regulatory thaw in major economies is improving investor sentiment. Goldman Sachs recently noted that 91% of crypto firms are gearing up for MiCA compliance – a sign that industry is preparing to scale under clearer rules

merklescience.com

merklescience.com

. Overall, the summer of 2025 marks a turning point: governments are embracing sensible crypto rules (rather than harsh crackdowns), reducing uncertainty and inviting institutional capital off the sidelines.

Initial ETF Impact: The first wave of U.S. spot crypto ETFs – approved in late 2023 and January 2024 – will have been trading for over a year by mid-2025

investopedia.com

. Their success is already far exceeding expectations: BlackRock’s iShares Bitcoin Trust amassed a record $52 billion AUM in its first year (the biggest ETF launch in history)

coindesk.com

, and other Bitcoin funds from Fidelity, ARK, and Bitwise quickly joined the top 20 U.S. ETF launches of all time

coindesk.com

. These products have unleashed pent-up retail and institutional demand by offering a regulated, convenient vehicle for crypto exposure

coindesk.com

. By summer 2025, ETF inflows are still robust, and many Wall Street analysts expect a second wave of approvals. Indeed, 2025 is being called “the Year of Crypto ETFs”

coindesk.com

. Observers predict dozens of new funds – including spot Ether, Solana, and XRP ETFs – could win approval under revamped SEC leadership in the post-2024 election environment

coindesk.com

. If so, late 2025 could see a broad menu of crypto ETF offerings, widening investor access to the asset class. This steady drumbeat of ETF launches and inflows adds a structural source of buy-pressure under crypto markets throughout 2025. (Notably, Bloomberg data showed over $1.7B poured into spot crypto ETFs in just the first week of 2025, on top of 2024’s flows

etf.com

.) In short, the ETF effect – “shocking the industry to its core” in year one

coindesk.com

– is set to grow even stronger in 2025, channeling more traditional capital into crypto.

U.S. Political Shift (Post-Election): The outcome of the Nov 2024 U.S. elections is a crucial backdrop by mid-2025. A new administration under President Donald Trump took office in January 2025 and immediately signaled a markedly pro-crypto policy stance. Within his first 100 days, Trump’s appointments to key financial agencies (SEC, CFTC, OCC) effectuated a “180° pivot” in crypto regulation from the prior administration

cnbc.com

. Industry observers describe a sharp policy reversal – where previously the sector faced hostility, now it’s courted as an engine of innovation. President Trump has publicly vowed to be “the first crypto-president,” hosting crypto industry leaders at the White House and promising to boost digital asset adoption

reuters.com

. He even floated creating a strategic Bitcoin reserve for the United States

reuters.com

– a striking show of support for Bitcoin’s role as a reserve asset (though it remains to be seen if this materializes). More tangibly, regulatory agencies have begun rolling back onerous rules. For example, the SEC under new leadership scrapped a prior accounting guideline that made bank crypto custody prohibitively expensive

reuters.com

. And the Office of the Comptroller of the Currency (OCC) has “paved the way” for banks to engage in crypto activities like custody and stablecoin issuance

reuters.com

. These changes in Washington brighten the outlook for crypto markets: with regulatory uncertainty fading, U.S. institutions feel more confident to participate. In essence, by mid-2025 the world’s largest capital market (the U.S.) is shifting from impeding crypto to embracing it, a narrative change that cannot be overstated in its bullish significance

coindesk.com

reuters.com

.

Geopolitical Easing and BRICS Actions: Global macro conditions in summer 2025 may also improve due to geopolitical developments. If major conflicts (like the Russia-Ukraine war) de-escalate or move toward resolution by late 2024 or 2025, it would remove a key source of risk-off sentiment. Lower geopolitical risk and easing of war-driven commodity shocks would help cool inflation (especially energy prices) and bolster global growth – factors that support risk asset rallies (crypto included). On another front, the BRICS nations (Brazil, Russia, India, China, South Africa + new members) are continuing their de-dollarization agenda in 2025. At the BRICS summit in October 2024, they discussed creating a new gold-backed reserve currency (“the Unit”) as an alternative to the U.S. dollar

investingnews.com

. They also announced a BRICS blockchain-based payment network (“BRICS Bridge”) to connect their financial systems via CBDCs, bypassing Western networks

investingnews.com

. Going into 2025, these initiatives are expected to progress (with Russia currently chairing BRICS). While a full-fledged BRICS currency may be years away (and faces hurdles

moderndiplomacy.eu

), the bloc’s move to settle more trade in non-USD currencies is already underway (by 2023, roughly 20% of oil trades were in other currencies)

investingnews.com

. Implication: A shift toward a more multi-polar currency world could weaken U.S. dollar dominance over time

investingnews.com

. For crypto, this trend is intriguing – as nations seek dollar alternatives, Bitcoin’s appeal as a neutral, supranational asset may rise. In sanctioned or economically volatile countries, both elites and the public might accelerate adoption of crypto for cross-border value storage. For example, U.S. sanctions on Russia and China have already catalyzed talk of reserve diversification

investingnews.com

. Fidelity analysts note that “rising inflation, currency debasement and fiscal deficits” globally are making Bitcoin strategically attractive for even nation-states and central banks

coindesk.com

coindesk.com

. Summing up: a backdrop of improving geopolitical stability (if realized) plus a weakening dollar regime provides a bullish macro and narrative case for borderless cryptocurrencies as we enter the second half of 2025.

Fall 2025 (Sep–Nov): Institutional Inflows, Adoption & Tech Upgrades

Surging Institutional Adoption: By autumn 2025, the cumulative effect of regulatory clarity and market maturation is a wave of institutional adoption unlike any prior cycle. In traditional finance, major U.S. banks and brokers are cautiously but steadily entering the crypto arena. Reuters reports that Wall Street banks are now receiving “green lights” from regulators to expand into crypto services, after years of hesitance

reuters.com

reuters.com

. Many top banks have been internally testing crypto trading and custody via pilot programs

reuters.com

. As one example, Charles Schwab’s CEO said in May 2025 that regulator signals are “flashing pretty green” for large firms, and confirmed Schwab plans to offer spot crypto trading to clients within a year

reuters.com

. Banks like BNY Mellon, State Street, and Citigroup – which collectively manage trillions – are expected to roll out crypto custody solutions by 2025, often via partnerships with crypto-native custodians

dlnews.com

. The OCC has explicitly authorized banks to handle crypto custody and stablecoins (under proper safeguards), removing a key barrier

reuters.com

. And the SEC’s friendlier stance under new leadership means banks no longer face punitive capital charges for holding digital assets

reuters.com

. The net effect is that by late 2025, institutional-grade crypto infrastructure is falling into place. More pension funds, endowments, and asset managers can allocate to crypto through familiar channels (regulated custodians, ETFs, prime brokers). Even conservative banking giants are warming up: Bank of America’s CEO stated the bank “will embrace cryptocurrencies for payments if regulations permit” and hinted at possibly launching a BOA stablecoin for settlement

reuters.com

. Likewise, Fidelity and BlackRock’s crypto units are expanding offerings after seeing outsized demand. This institutional legitimization dramatically expands the pool of potential investors in crypto markets, supporting a higher total market capitalization.

Crypto ETF Expansion: In Q4 2025, the roster of crypto-based ETFs and funds is likely to broaden further. As noted, analysts foresee 50+ crypto ETFs by end of 2025 under the pro-industry U.S. regulatory regime

coindesk.com

. By fall, we may see Ethereum spot ETFs (building on the successful Bitcoin products) and even funds for large-cap altcoins. For instance, Nate Geraci of The ETF Store predicts spot Solana and XRP ETFs are on the horizon in the U.S.

coindesk.com

. Internationally, Canada and Europe already have multiple crypto ETPs – their continued growth adds to global inflows. With a year of performance history by late ’25, crypto ETFs will likely start seeing allocations from more conservative institutions (insurance firms, corporate treasuries, etc.) that needed to observe initially. Fidelity’s strategists noted that in 2024 much of the ETF buying came from retail and independent advisors, but 2025 could bring uptake from hedge funds, RIAs, and pensions as comfort grows

coindesk.com

coindesk.com

. In summary, fall 2025 should witness accelerating capital inflows via investment vehicles, as crypto solidifies its place in mainstream portfolios. This sustained demand – “2025’s flows will easily surpass 2024’s” according to one strategist

coindesk.com

– provides a steady bid under crypto asset prices, reinforcing a bullish trend.

Nation-State and Sovereign Adoption: A notable development to watch in late 2025 is the entry of nation-states and public institutions into Bitcoin. Fidelity Digital Assets published a report calling 2025 a potential “game changer in terms of bitcoin adoption”, predicting that more nation-states, central banks, sovereign wealth funds, and treasuries will buy BTC as a strategic reserve asset

coindesk.com

. The rationale is that with rising inflation and heavy debt loads, governments face currency debasement and financial instability, making Bitcoin an attractive hedge

coindesk.com

. By Q4 2025, we could see early signs of this trend. For example, there are rumors that Russia and Brazil have explored holding Bitcoin reserves

fortune.com

, and Middle Eastern sovereign funds flush with petrodollars might quietly accumulate crypto as diversification. In the U.S., President Trump and crypto-friendly lawmakers like Senator Cynthia Lummis have openly discussed establishing a U.S. Bitcoin reserve or adding BTC to Treasury holdings

coindesk.com

. Lummis even introduced a “Bitcoin Reserve” bill in 2024, which if enacted would set a precedent for national adoption

coindesk.com

. While such bold moves might not happen overnight, even small allocations by governments or central banks would be symbolically massive. It would validate crypto’s role as “digital gold” and potentially ignite FOMO among other nations (a game theory dynamic Fidelity’s report alludes to). Thus by late 2025, any announcements of central banks buying Bitcoin or countries mining/holding crypto (similar to El Salvador’s earlier example) could spur a bullish frenzy. At minimum, the expectation of this “sovereign bid” provides a narrative supporting the market. As Fidelity’s analysts put it: not owning some Bitcoin may soon be seen as a greater risk for governments than owning it

coindesk.com

. Ethereum & Crypto Tech Upgrades: The latter part of 2025 is also packed with technological catalysts in the crypto sector, which can boost investor optimism. Chief among these is Ethereum’s roadmap milestones. Ethereum core developers plan to deliver major scaling improvements by end-2025 as part of “The Surge” phase

bitrue.com

. This includes fully rolling out sharding – splitting the blockchain into parallel “shards” – combined with widespread Layer-2 rollups, aiming to increase throughput to 100,000+ transactions per second

bitrue.com

. If Ethereum achieves this by Q4 2025, it would vastly lower fees and increase capacity, enabling a new wave of decentralized application growth. For users, that means faster, cheaper transactions; for the market, it means Ethereum becomes more valuable as utilization can skyrocket without bottlenecks. Progress is well underway: an intermediate upgrade (EIP-4844 “proto-danksharding”) was implemented earlier to boost Layer-2 efficiency, and the next major upgrade (code-named Pectra) is slated for Q1 2025 focusing on validator improvements and blob data throughput

fidelitydigitalassets.com

. After that, the final sharding implementation is expected. By late 2025, Ethereum’s evolution – including MEV mitigation (The Scourge) and Verkle trees for lighter nodes (The Verge) – should make the network more scalable, secure, and decentralized

bitrue.com

. These upgrades are bullish for the ecosystem: a more scalable Ethereum can host more DeFi, NFT, and gaming activity, attracting capital and users from traditional tech. Investors may speculate on ETH demand rising with network activity. Beyond Ethereum, other protocols (Solana, Cardano, Layer-2s like Arbitrum, etc.) also have roadmap milestones during this period, potentially improving their value propositions. Overall, the tech backdrop in late 2025 is one of significant improvement, which supports a positive market outlook – the infrastructure will be ready for mainstream scale just as interest returns.

Bitcoin Halving Aftermath: Although the Bitcoin halving took place in April 2024, its bullish impact historically materializes with a lag of 12-18 months. That puts late 2025 into early 2026 right in the window when the post-halving cycle may reach a euphoric phase. By fall 2025, Bitcoin’s supply issuance will have been at half its prior rate for ~18 months, potentially leading to a supply-demand squeeze if demand surges. ARK Invest notes that previous halvings (2012, 2016, 2020) all coincided with the early stages of major bull markets

ark-invest.com

. Indeed, by Q4 2025 we may see this pattern repeating. ARK’s analysts observed in late 2024 that Bitcoin remained roughly on track with its four-year cycle and expressed “optimism about prospects for the next 6–12 months” following the April 2024 halving

ark-invest.com

. That optimism appears well-founded if macro conditions and adoption trends align as discussed. By November 2025, Bitcoin could be approaching or exceeding its previous all-time high ( ~$69K from 2021) – some crypto analysts foresee six-figure prices during this cycle. Importantly, a rising Bitcoin tide tends to lift the entire crypto market cap. Late 2025 could see a broad rally across altcoins, often referred to as “altseason,” as new retail and institutional money, emboldened by Bitcoin’s strength, diversifies into higher-beta crypto assets. The expectation of the halving-driven bull cycle can itself become a self-fulfilling sentiment booster: investors position ahead of it, providing additional buy pressure. In summary, fall 2025 is poised to be the crescendo of the Bitcoin halving cycle, with historical analogues (2013, 2017, 2021) suggesting a powerful uptrend in crypto prices. Reduced BTC supply + peak cycle FOMO + all the fundamental drivers (ETF flows, low rates, tech upgrades) make this timeframe particularly conducive to a bullish market cap expansion.

Winter 2025–26 (Dec–Feb): Peak Momentum and Continued Tailwinds

Bull Market Momentum: Entering winter 2025/26, the crypto market could be in full bull mode. If the above developments play out, total crypto market capitalization may be approaching new highs by late 2025, driven by strong fundamentals and investor FOMO. Historically, the final leg of crypto bull markets sees parabolic gains and surging liquidity inflows. We might witness that in Dec 2025 – Feb 2026: exuberant sentiment, mainstream media coverage of Bitcoin “breaking records,” and increased retail participation. Unlike the 2017 and 2021 peaks, however, this cycle has far greater institutional involvement, which could imply more sustainable capital inflows (and possibly a larger magnitude of inflows). Key macro factors are likely to remain supportive through early 2026: central banks that began easing in 2024-25 may continue to hold rates low or even consider renewed asset purchases if economies are soft. For instance, if a mild U.S. recession hits in late 2025, the Fed and peers could respond with quantitative easing or liquidity facilities, effectively “printing” money that often finds its way into asset markets, including crypto

nasdaq.com

. China’s PBoC could also inject stimulus to boost growth, adding to global liquidity. Such actions would prolong the “risk-on” environment into 2026, delaying any end to the crypto uptrend. Additionally, global equity markets are projected to be strong in this scenario (buoyed by low rates and easing geopolitical tensions), and crypto’s correlation with equities means a rising stock tide lifts crypto too – as was observed in May 2025 when stock rallies coincided with BTC and ETH jumps

blockchain.news

blockchain.news

.

Investor Sentiment and Retail Revival: By early 2026, investor sentiment toward crypto could be the most bullish since 2021. With clear regulatory frameworks, high-profile endorsements (even governments buying in), and tech narratives (Web3, AI+blockchain, etc.), the stage is set for a positive feedback loop. Retail investors who largely sat out during the harsh 2022–23 bear market may fully return, spurred by “fear of missing out” as they see Bitcoin and popular altcoins climbing. This broadening of participation (from hedge funds down to everyday investors globally) increases market breadth and can drive total market cap to climactic heights. Notably, the availability of user-friendly investment onramps – e.g. spot crypto ETFs through any brokerage, crypto offerings integrated in fintech apps and banks – makes it much easier for average investors to allocate to crypto in 2025-26 than in past cycles. The removal of friction means inflows can ramp up faster and larger. Social media and pop culture hype also tend to peak in late-stage bulls; we might see Bitcoin and Ethereum becoming water-cooler talk again, drawing in new demographics. All of this contributes to strong sentiment and capital inflows in winter 2025/26, reinforcing the bullish outlook.

Continued Policy and Geopolitical Tailwinds: The policy landscape is expected to remain a tailwind into 2026. In the U.S., if the pro-crypto Trump administration stays aligned with its promises, we could see additional positive actions: perhaps tax clarity for digital assets, streamlined ETF approvals for more crypto categories, or even federal guidelines for banks to hold crypto on balance sheets. Such steps would further normalize crypto within the financial system. Regulatory coordination internationally might also improve – for example, G20 nations in 2025 have been working on a global crypto reporting framework and stablecoin standards, which, once implemented, reduce the risk of harsh crackdowns in any major economy. On the geopolitical front, the BRICS de-dollarization efforts might bear first fruit by 2026, such as increased trade settled in yuan, gold, or even Bitcoin. If Saudi Arabia (a new BRICS invitee) starts pricing some oil in non-USD, that could weaken dollar liquidity at the margins, and some of that displaced value might flow to alternative stores like crypto or gold. Additionally, by 2026 the world will be looking ahead to the next U.S. Presidential election cycle (2028) – typically, in the lead-up, administrations prefer supportive economic conditions. This could mean fiscal stimulus or at least no new financial regulations that rock markets, implying a benign policy environment for risk assets. In Europe, 2026 will see MiCA fully operational and possibly updated with new provisions for DeFi and NFTs, further integrating the crypto market. In sum, early 2026 should carry forward many of 2025’s positive drivers – ample liquidity, regulatory support, and growing mainstream acceptance – giving little reason to suspect an abrupt end to the bullish trend during this window.

Bitcoin Halving Cycle Peak: If history rhymes, the crypto market might reach a cycle peak somewhere around late 2025 or early 2026. Past bull cycles (2013, 2017, 2021) peaked roughly 12-18 months after the halving; a similar timeframe would put a possible top in the Dec 2025 – Feb 2026 period. That could mean Bitcoin at unprecedented price levels and total crypto market cap in multi-trillions, barring any unforeseen shocks. ARK Invest’s analysis as of late 2024 remained optimistic that Bitcoin was “in sync with historical cycles” and poised for strong performance into 2025

ark-invest.com

. By early 2026, those cycle dynamics (diminished new supply vs. surging demand) might reach a crescendo. One metric to watch is the stock-to-flow or issuance rate – post-halving Bitcoin’s inflation rate is below 1%, lower than gold’s, which can drive the digital gold narrative to its zenith at this point. Moreover, Ethereum’s upcoming transition to a deflationary issuance (with EIP-1559 fee burns and Proof-of-Stake) means ETH could also be seeing declining supply into 2026, potentially amplifying its price if demand spikes. Thus, both of the top crypto assets would have increasing scarcity dynamics during the period when interest is highest – a recipe for a dramatic run-up. Importantly, capital rotations within crypto during peak phases often send smaller altcoins skyrocketing (as investors seek outsized gains), temporarily boosting total market cap beyond just Bitcoin’s contribution. All told, the early 2026 period could represent the euphoric apex of this cycle’s bull market, supported by solid macro and fundamental fuel laid in the preceding months. Even if volatility will be high, the overall outlook through February 2026 remains strongly bullish for crypto’s total market capitalization, given the confluence of loose monetary conditions, favorable policy shifts, geopolitical diversification into crypto, institutional FOMO, and major network upgrades powering the narrative.

✨ Philosophical Reflection

In the ever-unfolding rhythm of cycles—accumulation, expansion, distribution, and reset—crypto mirrors the deeper architecture of nature and consciousness. Just as seeds lie dormant in winter awaiting the kiss of spring, so too does capital bide its time in the shadows before surging into momentum. The Fibonacci spirals found in shells, storms, and galaxies reappear in price action—offering not just numbers, but a language of emergence. What we witness in the TOTAL market cap is not just a breakout—it is a reawakening. A collective pulse of belief, liquidity, and intention. In this confluence of technical geometry and macroeconomic tides, the market becomes more than price—it becomes a story, a symbol, a signal. We don’t just analyze this chart—we read it like a sacred map, charting the ascent of value, vision, and velocity.

SP500 // Stock Market Still a Buy? Here’s My ETF ApproachUnlike the Forex market, in the stock market—even when we’re hitting new highs and running out of chart space—it still makes sense to continue accumulating positions in U.S. indices. For a more profitable and diversified approach, ETFs offer a wide range of options: SPY, TQQQ, QQQ, and international ones like VEA.

Where do you trade stocks? I'm curious to hear what platforms and strategies others are using.

If you have any questions about building a portfolio or selecting ETFs, feel free to reach out. Happy to share insights and help where I can.

Wishing you consistency and strong returns.

Sensitive supportHello friends

Considering the good growth we had, you can see that the price has corrected after reaching its ceiling and has reached a sensitive support.

Now, with the price correction, there is a good opportunity to buy in stages and with capital management and move towards the specified goals.

*Trade safely with us*

Europe’s Center is CRUMBLING: VGK on the Brink? 🚨 Europe’s Center is CRUMBLING: VGK on the Brink? 🚨

Europe’s elections just lit a FUSE! 💥 Poland (May 18), Portugal (May 18), and Romania (May 4 & 18) held off populists, but the center’s hanging by a thread—50% in Poland went right-wing, Portugal’s Chega is shaking things up.

Immigration and globalization fury could rattle EU trade & policy. 📉 VGK ($75.53) is inches from its yearly high ($75.56)—ready to crash or soar?

💡 Trade Idea: Plot VGK price action with election dates (May 4, May 18, June 1, 2025) to spot volatility breakouts. Watch for support near $70 or resistance at $76.

❓ Your Move? Will VGK tank or rally on Europe’s chaos? Drop your trade below! 👇

XRP : LONG FOR THIS WEEK !Hello friends

Considering the good growth we had, you can see that the price has formed a double top pattern and corrected after reaching its ceiling.

Now, with the price correction, there is a good opportunity to buy in stages and with capital management and move with it to the specified goals.

*Trade safely with us*

SPY BULLISH BREAKOUT|LONG|

✅SPY is trading in an

Uptrend and the index

Made a bullish breakout

Of the key horizontal level

Of 580.00$ and the breakout

Is confirmed so we will be

Expecting a further move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish sign but we think it pushes to MAJOR RESISTANCEYesterday CRYPTOCAP:BTC formed a BEARISH ENGULFING. We've spoken on this pattern countless times.

However, we didn't bring it up because we didn't/don't think it's relevant.

WHY? Look at the paltry volume. Bitcoin volume is SUPER LOW.

BTC is still in Bullish mode from Late 2022.

---

We turned Bullish again on CRYPTOCAP:BTC around early April:

A) We saw that huge Bitcoin selloff 4/7

2) Which reversed that same day

3) Followed by some buying a couple days later

4) More BTC accumulation 4/21 when it was under 88k

Major resistance coming up soon.

Pause HIGHLY LIKELY.

Ethereum and the Pectra Upgrade: ETH Growth PotentialEthereum is approaching a significant upgrade called Pectra, which, according to analysts at Trenovia Group, could become a major catalyst for ETH’s price appreciation—especially if network activity continues to rise.

What Does Pectra Bring?

Pectra continues Ethereum’s path toward greater technological maturity. The upgrade introduces enhancements to the Ethereum Virtual Machine (EVM), optimizes validator coordination, and strengthens smart contract security. As Trenovia Group highlights, such developments are essential to the platform's long-term competitiveness and stability.

Potential Impact on ETH Price

Based on Trenovia Group’s internal analysis, ETH could strengthen after the Pectra upgrade, assuming a rise in network engagement. Past events, such as The Merge, have historically driven price momentum. However, sustained growth depends on actual increases in user activity, transaction volumes, and new project deployments.

Network Activity as a Growth Indicator

Network usage is one of the most critical metrics tracked by Trenovia Group. A surge in active wallets, decentralized applications (dApps), and DeFi platforms often translates to higher demand for ETH. These indicators are at the core of our investment strategies and client advisory services.

Trenovia Group’s Position

As a company focused on digital asset analytics and blockchain innovation, Trenovia Group views Pectra as a strategically important upgrade. It further solidifies Ethereum’s role in decentralized finance and Web3. We will continue to deliver in-depth market insights and recommendations as the network evolves.

Conclusion

Ethereum is entering a new phase of development. Should the Pectra upgrade lead to a measurable increase in network activity, Trenovia Group anticipates a favorable environment for ETH growth, reaffirming its position as a leader in the crypto market.

$BTC, Bitcoin update: what is going on?🚨 Bitcoin Update: We've just seen a decent correction on CRYPTOCAP:BTC followed by a strong pump.

I’ve warned about this already — this pump is not organic. It's largely driven by institutions and Michael Saylor, using leverage.

📉 A healthy price movement should look like a staircase: move up, consolidate, reset the daily MACD, then push higher again.

Each rally should be followed by a slight pullback — that’s how sustainable trends are built.

❌ But this natural cycle is being disrupted.

Saylor and ETFs keep buying the top to prevent corrections. Some laugh and call it incompetence, but I believe it’s strategic.

These players don’t care about making money on trades.

Their goal is to inflate the value of their companies (or stock value), which are now heavily tied to Bitcoin’s price.

That’s why they don’t want BTC to consolidate.

Every time there's weakness, they step in to buy, preventing any pullback and forcing the price through resistances and fair value gaps.

🤖 The problem? Bots — which represent +80%+ of the trading volume — are not wired this way.

They sell when BTC is overbought and buy when it's oversold.

But with institutions disrupting this cycle, exchanges end up selling BTC, and whales scoop it up — leading to lower supply on exchanges.

Exchanges then have to buy BTC back at higher prices, sometimes even at a loss — often by printing billions in Tether (USDT) to compensate.

🎈 This entire mechanism is inflating Bitcoin’s price, exactly what Bitcoin maximalists want.

But it also kills the chance for an altseason, which usually comes after Bitcoin tops out.

📊 So what’s next?

Ideally, we get a consolidation to around $91K to avoid a major bearish divergence.

If BTC breaks below $90K, we could see GETTEX:82K — but given current conditions, that’s unlikely.

On the chart, RSI is high on daioly, Williams indicator is turning bearish and MACD too. These are all signs of a most needed consolidation. But as I explained, this is cancelled at the moment.

💰 Can institutions push BTC to a new all-time high?

Yes — they basically have unlimited capital and the money printer will turn back on by September.

But once again, altseason is postponed.

#Bitcoin #BTC #CryptoMarkets #MichaelSaylor #ETF #BTCAnalysis #Altseason #CryptoPump #MarketManipulation #BTCUpdate #Tether #CryptoWhales #DailyMACD #TechnicalAnalysis #CryptoInsights #Web3

What Does Lump Sum Investing Mean for Investors and Traders?What Does Lump Sum Investing Mean for Investors and Traders?

Lump sum investing is when an investor or trader commits a significant amount of capital to the market in one go rather than spreading it over time. This approach is believed to provide strong long-term returns but also comes with risks, particularly in volatile markets. This article explores how lump sum investing works, why investors and traders use it, potential risks, and strategies to manage exposure in different market conditions.

What Is Lump Sum Investing?

Lump sum investing is when an investor puts a significant amount of capital into the market at once, rather than spreading it over time. This approach is common when someone receives a windfall—such as an inheritance, bonus, or proceeds from closing an effective position—and decides to invest the full amount immediately.

Unlike dollar-cost averaging (DCA), which involves dividing an investment into smaller, regular parts, lump sum investing seeks to maximise market exposure from day one. The key argument of investors is that markets tend to rise over time. By investing upfront, capital has more time to grow, rather than sitting on the sidelines waiting to be deployed.

Lump sum investing isn’t limited to equities. It applies across asset classes, including forex, commodities, and fixed income. A trader taking a large position in a currency pair based on a strong technical setup is, in effect, making a lump sum investment—allocating its capital at once rather than scaling in gradually.

Institutional investors also use lump sum strategies, particularly when allocating large amounts into funds or rebalancing portfolios. However, while this method is believed to have strong long-term potential, it exposes investors and traders to market volatility, making risk management a key consideration.

Why Some Investors and Traders Use Lump Sum Investing

Lump sum investing is often used because it puts capital to work immediately, giving it more time to grow. Historical market data supports this approach—studies, including research from Vanguard, have claimed that potential returns are higher in lump sum vs dollar-cost averaging in most market conditions. This is because markets tend to rise over the long term, and waiting to invest can mean missing out on early gains.

Long-term investors typically deploy lump sums when they have high conviction in an asset or when a large amount of capital becomes available. For example, a fund manager rebalancing a portfolio or an individual investing an inheritance may decide to allocate the full amount upfront rather than spreading it out.

In Trading

Traders use lump sum investing differently. While some may use an approach similar to dollar-cost averaging and scale into a position, most traders will deploy capital when they see a high-probability setup. For instance, instead of spreading 1% risk across several trades, they will typically open a position with the entire 1% all at once.

Institutional investors also use lump sum strategies when making block trades or adjusting asset allocations. For example, a pension fund investing in equities after a market downturn may deploy capital in one move to take advantage of lower prices.

However, investing a lump sum of money isn’t just about maximising potential returns—it also involves risk, particularly in volatile markets. The next section explores the potential downsides of this approach.

Potential Risks of Lump Sum Investing

Lump sum investing comes with risks—particularly in volatile markets. The decision to invest everything at once means full exposure from day one, which can work against investors if the market moves against them after deployment. Some key risks to consider include:

Market Timing Risk

Investing a lump sum relies on deploying capital at a single point in time, making it sensitive to short-term market fluctuations. If an investor enters at a peak—such as before the 2008 financial crisis or the early 2022 market downturn—they could face an immediate drawdown. While long-term investors may recover, traders working on shorter timeframes have less room to absorb losses.

Volatility and Psychological Impact

Markets rarely move in a straight line. Lump sum investments can see rapid swings in value, which can be difficult for some investors to handle. Seeing a portfolio drop sharply after investing can lead to emotional decisions, such as panic selling or deviating from an original strategy. Traders face a similar issue when entering a full position—sudden volatility can trigger stop losses or force them to exit prematurely.

Liquidity Risk

For traders, placing a large order in a low-liquidity market can result in slippage, where the trade executes at a worse price than expected. This is especially relevant in forex, small-cap stocks, and commodities with lower trading volume.

How Lump Sum Investing Performs in Different Market Conditions

Market conditions play a major role in how lump sum investing performs. While historical data suggests it often outperforms spreading investments over time, short-term results can vary significantly depending on the broader trend.

Bull Markets

Lump sum investing tends to perform well in sustained uptrends. Since markets generally rise over time, deploying capital early allows one to take advantage of long-term growth. Research from Vanguard found that in about 68% of historical periods, lump sum investing outperformed dollar-cost averaging because assets had more time in the market. A strong bull market—like the one from 2009 to 2021—allowed lump sum investors to see considerable gains over time.

Bear Markets

Investing a lump sum just before a downturn exposes capital to immediate losses. For instance, an investor who entered the market in late 2007 would have faced steep drawdowns during the 2008 crash. Recovery took years, depending on the assets involved.

Although CFD traders can trade in rising and falling markets, the main challenge is to determine a trend reversal and avoid taking a full position just before it happens.

Sideways Markets

When prices move within a range without a clear trend, lump sum investing can be less effective. Investors may see stagnant returns if an asset moves sideways for extended periods, such as during the early 2000s. Traders in choppy markets often break positions into multiple entries to manage risk, rather than committing full capital at once.

Strategies to Potentially Reduce Risk with Lump Sum Investing

Lump sum investing involves full market exposure from the start, which means risk management plays a key role in avoiding unnecessary drawdowns. Understanding how to invest a lump sum of money wisely can help investors and traders potentially manage downside risks.

Assess Market Conditions

Deploying capital blindly can lead to poor outcomes. Investors often analyse valuations, interest rate trends, and macroeconomic factors before making large allocations. For traders, technical indicators such as support and resistance levels, moving averages, and momentum indicators help assess whether market conditions favour a full-position entry.

Diversification Across Assets and Sectors

One key concept in understanding how to invest a lump sum is diversification. Since allocating a lump sum to a single asset increases exposure to its price movements, some investors spread capital across multiple stocks, asset classes, or geographies to reduce concentration risk. A lump sum investment split between equities, bonds, and commodities can smooth out volatility, particularly in uncertain markets.

Hedging Strategies

Once they’ve decided what to do with a lump sum of money, some investors and traders hedge their positions. Opening opposite positions in correlated assets, trading stock pairs, or diversifying exposure across sectors in index trading can act as protection against downside moves, particularly in uncertain or high-volatility environments.

Position Sizing Adjustments

Traders concerned about volatility sometimes split a lump sum trade into staggered entries, adjusting size based on price action. This approach provides flexibility if market conditions shift unexpectedly.

The Bottom Line

Lump sum investing is a popular strategy among investors and traders, offering full market exposure from the start. While it has its advantages, managing risk is crucial, especially in volatile conditions.

FAQ

What Is Lump Sum Investment?

Lump sum investment is when an investor places a large amount of capital into an asset or market all at once instead of spreading purchases over time. This approach is common after receiving an inheritance, bonus, or proceeds from an asset sale. It provides immediate market exposure, which can be advantageous in rising markets but also increases the risk of short-term volatility.

What Is a Lump Sum Trading Strategy?

A lump sum trading strategy entails entering a trade with the entire position size in a single transaction, rather than gradually scaling in. Traders often use this approach when they have strong convictions in a setup. While it maximises potential returns if the market moves favourably, it also increases exposure to short-term price swings.

Is It Better to Invest Lump Sum or DCA?

Lump sum investing has historically outperformed dollar-cost averaging (DCA) in most market conditions because capital is exposed to growth sooner. However, DCA helps manage timing risk by spreading capital over time, making it a common choice for investors concerned about short-term market fluctuations.

What Are the Disadvantages of Lump Sum Investing?

The main risk is market timing—investing at a peak can lead to immediate losses. Lump sum investors also face higher short-term volatility, which can be psychologically challenging. In low-liquidity markets, executing large trades at once may lead to slippage, affecting execution prices.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

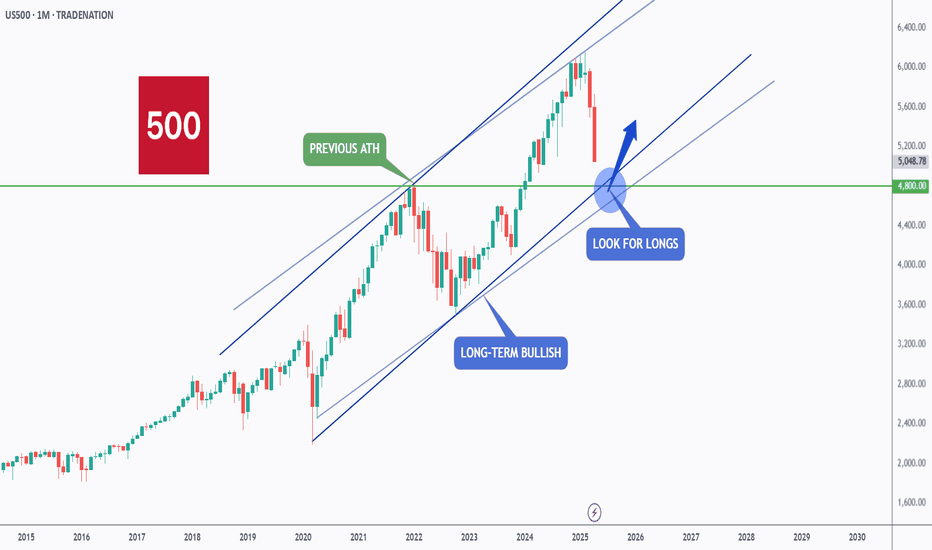

US500 - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈US500 has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting its previous all-time high at $4,800 and round number $5,000.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of previous ATH and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

28/04/25 Weekly OutlookLast weeks high: $95,778.66

Last weeks low: $84,688.21

Midpoint: $90,233.44

Last week Bitcoin ETFs recorded their second highest net inflows ever, $3.06B between April 21st-25th. The result of this buyside volume is evident on the chart as BTC breaks up into the mid $90k's, and in doing so is now back at the level in which BTC fell from originally to hit $74,500. As a result it is fair to say this area will be a big resistance level, but where is new support after this rally?

The aggressive nature of last weeks move up has left a number of areas of imbalance that the market does tend to revisit. Just below midpoint we have the $89,000-$90,000 area just below a key S/R level at $91,000. Dipping below this area into the FWB:88K 's briefly to sweep the demand and reclaiming $91,000 would be ideal for the bulls and very healthy for the next rally.

A less appealing area of imbalance for the bulls would be towards weekly low of $85,300-$86,300, that would be very painful for anyone longing a retest of the $91,000 area and from a HTF perspective would be a lower high and a SFP of the range midpoint, both bearish signals. The 4H 200 EMA is currently around that area at $87,000 too which would mean losing the level after just climbing back above it.

This week I'm looking at that first imbalance area to be a level of support for the next leg up, that's the ideal bullish scenario in my mind. A move below midpoint with acceptance is a red flag on this move and would start to look like a lower high bearish continuation.

Good luck this week!