Etfs

Good buy with DGAZ for 12% ReturnGood swing trade on DGAZ for a 12% return as it looks like it will bounce off of the 1 hour EMA. DGAZ has been on an upward trend on the 1 hour graph.

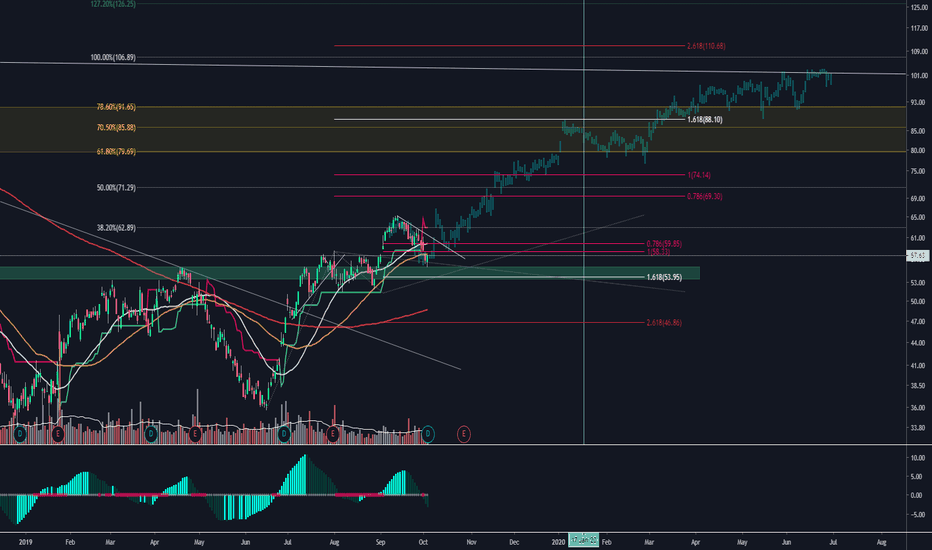

Buy UWT for potential 20%+ returnUWT (Oil) is extremely undervalued in comparison to its price over the past couple years. Great buy for a potential 20%+ return.

JDST bullish; Gold prices likely bearish given US-China deal?JDST looks to be bullish, making higher lows in the recent weeks. Couple reasons why I think it's on the uptrend:

- Phase one of the China trade deal concluded bringing some stability to the world economy; generally this should reduce the demand for gold, lowering prices and increasing JDST, a gold miner BEAR.

- Gold prices have a very strong resistance around 1540 from May of 2012. It's already touched that resistance late September/early August this year and would need some serious momentum or world news to break that resistance, such as the US-China trade deal falling apart. I believe it's more likely that gold prices are on the way down, making an ETF like JDST increase.

What do you think? Please leave a comment with your thoughts!

WESTERN DIGITAL/WDC - LONG POSITIONI share my longterm expectation of this trade.

Memory prices stabilizing. This could bring great gains for this stock in the longterm view.

I am in this trade for a long time. But for those who are not in this trade yet...we got a pinbar on the 4H, which is first good sign for the entry if you still hesitate.

You can also wait for the daily candle confirmation.

LABU - watch the volume and trend lineBiotech has had a hard time of it lately due to both political risks related to the election and litigation risks from the opioid epidemic. All of this, of course, on top of broad market weakness due to the China trade war.

However, biotech earnings are better than most sectors this season, so the bear market likely won't continue forever. I've drawn a trend line on my 1-hour chart and am watching for an upward breakout. Today we had some nice volume come in as we recovered from oversold on the daily chart and achieved our first green day for some time. However, we fell short of the minimum 6 million shares I'd like to see to signify a true reversal. We also fell short of breaking my trend line.

I expect LABU will fall to about 25.50 before it's likely to get a real bounce.

Two alternatives to trade $VIXVIX Alternatives:

The chart shows two investable alternatives to trade the $VIX, these assets are $TVIX and $VXX.

Semiconductors need ascending triangle break to continueThe ascending triangle is one of my favorite chart patterns. To confirm a breakout, we need to enter the corner of the triangle and then break above the previous high that forms the top of the triangle. A confirmed breakout usually results in a move about half the height of the triangle, or about $9 per share in this case. One nice thing about this chart pattern is that it allows for a fairly tight stop loss. If we breach that lower trendline, the pattern is broken and we can exit quickly.

UGAZ Potential Buy Opportunity 7% ReturnNatural Gas has been consolidating after huge sell off today. UGAZ and Natural Gas has potential to bounce off the 1 hour 180 day EMA for a 7% return. Wait for confirmation of higher lows and higher highs before entering trade. Observe UGAZ during market open for confirmation of upward push.

Strong Buy Signal on the U.S. Internet Stocks.The FDN (First Trust Dow Jones Internet Index Fund) which essentially covers the U.S. Internet Stocks, is now comfortably trading above the MA50 on the 1D chart on strong bullish candle action (RSI = 69.026, MACD = 2.230, Highs/Lows = 3.3271). Through this price action a strong buy signal has emerged and has to do with the similarities of the mid 2018 - 2019 price action with the late 2015 - mid 2016 sequence. Not only the MA periods (Death Cross followed by a Golden Cross) and candle action (Highs, Lows, consolidation phases) are virtually identical but also the price ranges (-27% decline from highs).

If a +21.50% rise follows, then the peak of the current bullish sequence would be near 161.00. We are long on this asset.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

DWT Potential Buy for 5% returnCrude Oil looks like it can potentially sell off which will drive DWT up. Look for higher highs during market open and for Crude Oil to sell of for a potential 5% return in one day.

XLF: Strong buy opportunity.The Financial Select Sector SPDR is trading within t 1D Channel Up (RSI = 64.631, MACD = 0.090, Highs/Lows = 0.4050) and todays pull back is only a technical reaction to the RSI approaching 70.000 on 4H. Both the MA50 and MA200 are supporting which is a very bullish development. Our TP is 29.10.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

XLRE: Sell opportunity on recurring pattern.The Real Estate Select Sector SPDR (XLRE) reached a new All Time High today extending the aggressive bullish run since the start of the year. The candle pattern is very similar to the February - August 2016 when it made a peak after a +28.60% rise and declined below the MA200 with a first stop at -9%. The current price action appears to be following this pattern and is close to completing both the +28.60% rise parameter and the 175 day duration parameter. We are taking a short aiming at repeating the -9% initial decline (34.50) towards the MA200.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

SPY Long Term Trend AnalysisAs a trader, I have been trained to see things in probabilities because nobody can tell the future but over years through Technical Analysis and learning to trust my gut, I found that I can find the most probable outcomes with an 80% certainty. If you appreciate my analysis and would like to see more please give me a like, follow my page and I will keep you posted on future price action.