How to Succeed in Trading (by Really, Really Trying)This was a recent post from a great trader and longtime colleague Jay Kaeppel

Sometimes it’s good to go back to the basics. So here goes.

Trading success comes from a “reality based” approach. It is NOT about “all the money I am going to make!” It IS about “formulating a plan” (see the questions below) AND “doing the right thing over and over and over again” (no matter how uncomfortable or unsexy those “things” may be).

Steps to Trading Success

Trading success comes from:

A) Having answers to the questions below

B) Remembering the answers through all of the inevitable ups and downs

What vehicles will you trade?

Will it be stocks, ETFs, mutual funds, futures, options, or something else? If you plan to trade futures or options understand that you will need a different account and/or approval from your brokerage firm. Likewise, note that you will need to learn about the unique quirks of futures and options BEFORE you start trading.

How much money will you commit to your trading account?

Whatever that amount is be sure to put the entire amount into your account. DO NOT make the mistake of saying “I only have x$’s but I am going to trade it as if it were y$’s. One good drawdown and you will pull the plug.

How much money will you commit to a single trade/position?

We are NOT talking here about how much of a loss you are willing to endure. We are simply talking about how much you will omit to the enter the trade. If you put 10% of your capital into a given stock or ETF that doesn’t mean you are going to risk the entire amount. This question has more to do with determining how diversified you will be.

How much money will you risk on a given trade/position?

Think in terms of percentages. I will risk 1%, 2%, 5%, 10%, whatever. There is no magic, or correct, number. But think of it this way – “if I experience 5 consecutive losing trades how much will my account be down?” If you can’t handle that number then you need to reduce your risk per trade.

How many different positions will I hold at one time? What is my maximum?

Buying and holding a portfolio stocks is different than actively trading. For active traders, holding a lot of positions at one time can be taxing – much more so than you might expect going in. Don’t learn this lesson the hard way.

Do you understand the mechanics of entering trading orders?

The vast majority of trading orders are placed on-line. Each brokerage firm has their own websites/platforms and each has their unique characteristics. “Paper trading” an be a disaster if you come away thinking you “have the touch” when it comes to making money. However, when it comes to learning the in’s and out’s of order placement BEFORE you actually start trading, it an be invaluable.

(Think of trading as sky diving and paper trading as watching virtual sky diving on your laptop. You get the idea, but the actual experience is significantly different).

What will cause me to enter a trade?

There are roughly a bazillion and one ways to trigger a “buy signal”. Some are great, some are awful, but the majority are somewhere sort of in the middle. Too many traders spend too much time looking for “that one great method”: of triggering signals. The truth is that if you allocate capital wisely, manage your risk (more to follow) the actual method you use to signal trades is just one more piece of the puzzle – NOT the be all, end all.

How will I enter a trade?

This sounds like the same question as the one above, but it is different. For an active trader, a buy signal may occur but he or she may wait for “the right time” to actually enter the market. For example, if an “oversold” indicator triggers a “buy” signal, a trader may wait until there is some sort of price confirmation (i.e., a high above the previous trading day, a close above a given moving average, etc.) rather than risking “trying to catch a falling safe.”

What will cause me to exit a trade with a loss?

The obvious one is a loss that reaches the maximum amount you are willing to risk per trade as established earlier. But there can be other factors. In some cases, if the criteria that caused you to enter the trade in the first place no longer is valid, it can make sense to “pull the plug” and move on to another opportunity. A simple example: you buy because price moves above a given moving average. Price then drops back below that moving average without reaching your “maximum loss” threshold.

What will cause you to exit a trade with a profit?

This one is easy to take for granted. Too many traders think, “Oh, once I get a decent profit I’ll just go ahead and take it.” But a lot depends on the type of methodology that you are using. If you are using a short-term trading system that looks for short-term “pops” in the market, then it might male sense to think in terms of setting “profit targets” and getting out while the getting is good. On the other hand, if you are using a trend-following method you will likely need to maintain the discipline to “let your profits run” in order to generate the big winning trades that virtually all trend-following methods need in order to offset all of the smaller loses that virtually all trend-following methods experience.

The problem comes when a short-term trader decides to “let it ride” or when a trend follower starts “cutting his or her profit short” by taking small profits.

Different Types of Trading Require a Different Mindset

Putting money into a mutual fund or a portfolio of stocks is far different than trading futures or even options. While you can be “hands on” with funds or stocks it is not necessarily a requirement (I still hold a mutual fund that I bought during the Reagan administration). With futures or options, you MUST be – and must be prepared to be – hands on.

Also, big percentage swings in equity are more a way of life in futures and options. I like options because they give you the ability to risk relatively small amounts of capital on any variety of opportunities – bullish, bearish, neutral, hedging and so forth.

I also like futures, but it does require a different level of emotional and financial commitment than most other forms of trading. Many years ago, I wrote about the following “Litmus Test for Futures Traders”. It goes like this:

To tell if you are prepared emotionally and financially to trade futures doe the following.

1. Got to your bank on a windy day.

2. Withdraw a minimum of $10,000 in cash

3. Go outside and start throwing your money up into the air until it all blows away

4. Go home and get back to your routine like nothing ever happened.

If you can pass this test then you are fully prepared to trade futures. If you cannot pass this test it simply means that you need to go into it with your eyes wide open regarding the potential risks (with the knowledge that something similar to what was just described can happen at any time).

Summary

In a perfect world a trader will have well thought out and detailed answers to all of the questions posed above BEFORE they risk their first dollar.

Jay Kaeppel

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services,

Etfs

BLK: Ran up to today's earnings, strong resistance overheadBLK had a run up ahead of its earnings report and then had a mild profit-taking day before the release. Volume is increasing as it reaches a stronger resistance level on today's earnings report reaction. Blackrock is the largest Derivatives Developer of Exchange Traded Products for the stock market. ETFs are its specialty.

$TASI Don't Sleep on Saudi ArabiaOne market that has quietly, but powerfully, performed well for 2019 year-to-date has been Saudia Arabia's Tadawul All Shares Index , up 13.82% as of April 3rd 2018.

On a macro level, the country has been buoyed by a resurgence in the price of oil , coupled with the "Risk On" feel supporting the markets since January 2019.

More interestingly, on a domestic level, the country has been support by global index makers, such as MSCI , promoting Saudi Arabian shares for inclusion into global benchmark indices, such as the MSCI Emerging Markets Index. This has been a boon for Saudia Arabian stocks, as Saudi shares have received billions in fund flows from global investors, and great exposure to global investors as this asset class opens up further.

Lastly, on a technical basis, the market technicals for Saudi shares are quite strong, with the price being supported by the 10-day EMA since December 2018. Furthermore, the Smart Money Index for the $TASI has risen steadily since January 2019, indicating strong flows into Saudia Arabian stocks.

We believe that this trend will continue for 2019 and recommend investors to have exposure to have exposure to Saudia Arabia. For investors who are interested in profiting from this trend, the ETF $KSA provides a great opportunity for investors.

AUDJPY - NeutralAUDJPY currency pair appears to be locked in an indecisive range between 79.606 & 77.753 cluster zones. Our outlook is neutral at the moment but might provide opportunities for range traders. Current price action warrants further observation in candle behavior as a daily close that completely engulfs previous day's candle (reverse hanging man) or a daily close near its terminus, might open up opportunities to the bottom of the range at 77.753 cluster zone.

However on the upside, a daily close above 79.606 cluster resistance zone should provide a healthy target focus on 82.272 over several weeks of bullish strength.

Happy Trading!!

www.trading-equity.com

www.facebook.com

AUDUSD LongThe AUDUSD is tracing out what appears to be the finishing stages of a downward move. Downward momentum appears to be finishing and our bias is largely bullish for the pair. However current downward move could still stretch to as low as 0.70191/0.70137 cluster zone. At this zone we expect to see strong buy orders enter the market if not before.

However, the bullish case shall be completely enforced if downward sloping blue dotted trend line as shown is penetrated at daily close. On daily close above downward trending blue dotted line, next target will open up in the 0.76690/0.76031 resistance zone.

Happy Trading!!

www.trading-equity.com

www.facebook.com

AUDCAD LongAUDCAD has assumed a bullish shape. Currently we anticipate consolidating into long positions just above the blue trend line shown with target in the 0.96388 region. However, any price move or price close on a daily basis below 0.9352 zone invalidates the bullish outlook

Happy Trading!

www.trading-equity.com

www.facebook.com

Dow Bears 1D done hibernating?Here is a Daily for SDOW (inverse dow shares)

Basic chart with long term support and Trend based fib extension meeting on or near current price levels with falling sell volume.

I also see the Nasdaq being at or near a falling wedge pattern trend line.. will update.

Good luck and safe trading .

SQM: Long term potential gains are astronomical...I think $SQM presents investors with massive reward to risk ratios here. Downside is minimal, whereas potential upside is huge. Prices can climb up to $281, in case of a quarterly uptrend, and eventually reach prices as high as $1841.65 over time, whilst paying a hefty dividend as well.

Electric vehicles are a huge source of ever growing demand for lithium, and $SQM is in a prime position to benefit from this trend. There's also the possibility of funds starting to accumulate shares, as new players enter the electric car battery metals ETF market.

Best of luck,

Ivan Labrie.

Predicting the volatility of the volatility. ETFs use VIX as a resource to automatically hedge their holdings. This requirement for hedging is expanding with the popularity of ETFs. The channel shows the range of price volatility due to ETP creator arbitrages to balance the ETFs' true value. I've outlined some short term predictions for the behavior of volatility. Remember, it's volatile to trade volatile stocks!

Natural GAS - Continuation Breakout - UNG UNG after incredible run has spent this past month in a very tight consolidation. the range started of wide but now has been getting tighter and tighter over the course of the last week. There are very few spots of momentum in this market right now.

Things I like about UNG right now.

Its seasonal

Volume Accumulation

One of the last spots of momentum in the markets

Horizons' BetaPro Goes Full Alpha in NovemberThe Horizons BetaPro Natural Gas 2x Daily Bear ETF (TSX:HNU) has gone CRAZY this month! I guess we're in for a cold winter??

Here are two pickups made by the AllTradeSignals Volume Pressure Gauge:

Trade #1 - 82% gain in 7 days

Trade #2 - 24% gain in 3 day

Doubling your investment in two trades... not too shabby!

Interested in the AllTradeSignals Volume Pressure Gauge? Get in touch with us here on TradingView!

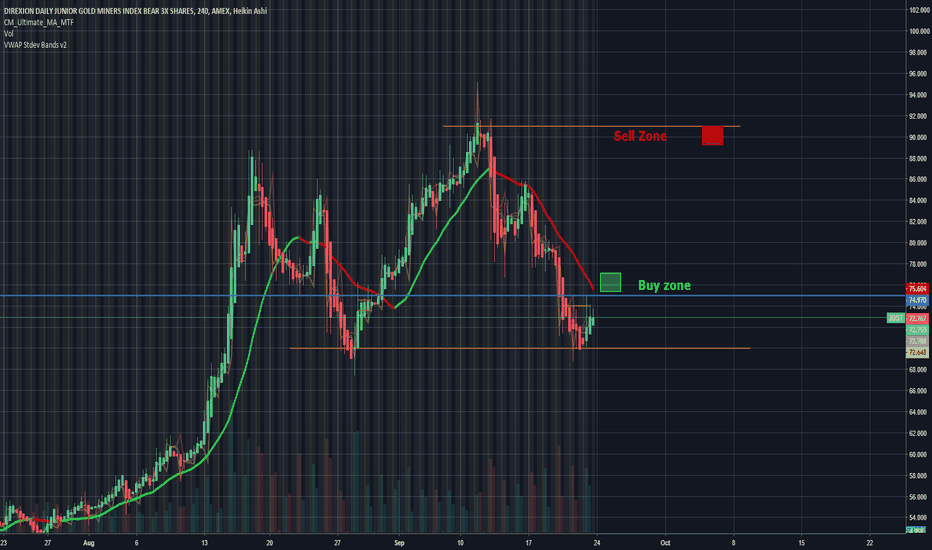

DECREASING CHANNEL on DUST ETFThe DIREXION DAILY GOLD MINERS INDEX BEAR 3X SHARES chart, in a one hour timeframe, has been forming a Decreasing Channel pattern, hitting three times the line above and two times the line below, in this case its advisable to observe the channel a little more until prices reaches one of the two lines to evaluate the opening of a position.