ETH-D

Tons of bearish signals on ETH WeeklyI happened to see someone ask "when will ETH run?" So I just wanted to take a stab at the chart. I have never played this, but I noticed cycles. During it's IPO you can clearly see a head & shoulder. After the next bull cycle, a larger head and shoulder pattern. Currently we appear to be on the downside of a triple top; we are below the neck line. If price rallies to the neckline, I will watch for rejection to head lower toward range bottoms. If it breaks recent lows and retests, further downside. Let me see how I can get in on some action.

Any ETH chartists with insight?

Ethereum (ETH) XABCD Pattern – $3,000 Target Ahead?ETHUSDT is at $1,759 and we’ve got an XABCD harmonic pattern in play!

▸ From $1,516 (X) to $4,147 (A), then slow retracement to $2,120 (B), then a big spike to $4,120 (C), and crash to $1,385 (D).

▸ Now, the chart is eyeing $3,000 as the next big target!

▸ Watch $2,100 and $2,500 as resistance on the way up. $1,500 is key support – let’s see if it holds!

✉️ What’s your take?

Will ETH hit $3,000, or are we dipping first? Drop your thoughts! ⬇️

Ethereum (ETH/USDT) – Bullish Momentum Building Toward targetHello guys...

Ethereum has broken out of its long-term descending channel and is currently trading inside a smaller ascending channel, showing strong bullish momentum. After a "fake breakout" below major support around $1,400, ETH quickly reclaimed higher levels, suggesting a bear trap.

Currently, ETH is approaching the critical resistance zone around $2,000. As long as the price stays inside this rising structure and continues making higher lows, the bias remains bullish toward a test of the major resistance.

✅ A clear breakout above $2,000 could trigger a stronger move up.

⚠️ However, if the structure breaks down, we should watch for potential pullbacks.

___________________________

Key Levels to Watch:

Support: $1,720–$1,750 zone

Resistance: $2,000–$2,050 zone

Is ETH - Next 3,000?ETHUSDT – Market Insight & Price Structure

Ethereum has been shaping a falling wedge pattern over the past 2 to 3 months—a structure that typically suggests a bullish reversal. Recently, price action confirmed a breakout above the key resistance zone between $2034 and $2040, along with a clean break of the upper trendline of the wedge. These movements point to a strong bullish signal, suggesting potential continuation to the upside.

Currently, Ethereum is approaching a significant resistance level around $2860. If price reaches this zone, we’ll be watching closely for confirmed reversal signals to consider a potential short/sell setup.

On the other hand, the primary bullish trend trade remains valid near the $2160–$2150 support range. A long position will only be considered upon confirmation, such as a bullish engulfing candlestick pattern, market structure shift (MSS), or other trusted technical signals.

Disclaimer: This is not financial advice. Always do your own research (DYOR).

Support and Resistance Zone: 2273.58-2359.35

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(ETHUSDT 1M chart)

In order to turn upward on the 1M chart, the price must rise to the Fibonacci ratio range of 0.382 (2674.80) ~ 0.382 (2723.46) and maintain it.

Before that, the key is whether it can rise above the M-Signal indicator on the 1M chart.

-

(1W chart)

The key is whether the price can be maintained and rise above the M-Signal indicator of the 1W chart.

To do so, we need to check whether the price is maintained by rising near the right Fibonacci ratio 0.5 (2295.84).

In order to continue the uptrend in the medium to long term, the price must be maintained above the M-Signal indicator of the 1M chart.

Accordingly, the key is whether the price can rise above the M-Signal indicator of the 1M chart when the price is maintained by rising near the right Fibonacci ratio 0.5 (2295.84).

Therefore, it is expected that a breakout trade will be possible when the right Fibonacci ratio 0.5 (2295.84) is broken upward.

However, since the StochRSI indicator is showing signs of entering the overbought zone, the increase may be limited.

-

(1D chart)

It showed a big rise as it broke through the A section, that is, the 1861.57 point.

In any case, since it is currently below the M-Signal indicator of the 1M chart, we can see that there is still time to buy.

Therefore, as I mentioned earlier, we should focus on finding a buying point when the price rises above the M-Signal indicator of the 1M chart and maintains the price, or when it rises to the Fibonacci ratio range of 0.382 (2674.80) ~ 0.382 (2723.46) and maintains the price.

ETH is in a typical reverse arrangement (M-Signal of the 1M chart > M-Signal of the 1W chart > M-Signal of the 1D chart).

Therefore, we should focus on finding a buying point while watching the situation with a relaxed mind.

If it continues to rise like this,

1st: 2273.58-2359.35

2nd: 2627.18

3rd: 2921.73

We need to check if it can rise with support near the 1st-3rd above.

If not, if it falls, we need to check if it can support near 1861.57.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902(101875.70) ~ 2(106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

(BTC) Technical Outlook: Imminent ATH ReversalBitcoin’s rejection at ~$105 000 completes a classic A–B–C corrective pattern in a low-liquidity zone. Failure to hold $90 000–$85 000 will likely trigger a rapid decline toward the primary support at $32000. Only a weekly close above $105 000 on strong volume would invalidate this bearish outlook.

ETHEREUM BULLISH BREAKOUT|LONG|

✅ETHEREUM is growing finally

And the coin broke a key horizontal

Level of 2,200$ and the breakout

Is confirmed so we are bullish biased

And we will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Be careful with ETH !!!now is the time for ETH to rise again to 1900 . STRONG SUPPORT 1530 .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

A new probability for a bullrun over the weekendSince in the second half of the week there was an opportunity for the ether to take higher levels, I want to consider the events for the coming days in more detail. At the moment, the growth target is the test test of 2100-2150, then either the range will be broken, in which case a stable trend towards the test of 2250 can be expected on Saturday. If it fails to gain a foothold above 2100, then tomorrow a pullback to the opening of today's daily candle and a second test attempt of 2100-2150 on the weekend are likely.

With all the positivity, I would like to remind you that I mentioned purchases only in the first half of the month, in continuation of the April trend. From Sunday to Monday, there is a possibility of a major market drop if ether does not open the second half above 2250 and bitcoin above 100k. It is difficult to say what could serve as a signal, but positive statistics for the United States have already been released, as the first signal, there may be a collapse in oil at the beginning of the week to stimulate sales. It will be possible to judge further dynamics at the end of the week, but starting from Sunday afternoon, I recommend reducing work positions.

To date, following the tops, large-cap coins show a slight increase, and secondly, we can expect the start of a rampage through the rest of the coin market closer to Saturday. For large-cap coins, you should not expect large growth, since the growth period is still quite small, the probability of gaining large investments during such a period is small. In this regard, the growth waves can be up to 15-20%. Small-cap coins are likely to have a stormy weekend with breakouts of up to 70-100%.

I am primarily considering chess and fio for work, and koma adx pivx quick with slightly less potential for the latter. A bullrun is also likely for fantokens with speeds up to 3x, among which I primarily consider atm city acm.

Ethereum Future: Limited Upside Ahead?Ethereum price dropped roughly 25% since April 2 due to an overall market crash following Trump’s tariffs implementation.

Compared to the almost 40% drop back in February after the first tariff announcement, this time the correction wasn’t as harsh or brutal.

So what can we expect next from Ethereum in the coming weeks?

The main hope for ETH price remains the upcoming Pectra upgrade.

Historically, major Ethereum upgrades have acted as bullish catalysts — for example, ETH roughly doubled in price ahead of both the Merge and the Shanghai upgrade.

If history rhymes, we could see a similar pre-upgrade pump this time too.

However, even if that rally materializes, I expect it to be limited to the $3,000–$3,400 range. The market lacks the kind of momentum or macro tailwinds needed to push ETH beyond 4k in this cycle — unless there’s a major shift in sentiment.

Overall, I remain cautious. The broader crypto market seems to be rolling over, and Ethereum hasn't even reclaimed its ATH.

With the next bear cycle approaching, long-term bullish targets might need to be revised — at least for now.

Short-term bounce possible thanks to Pectra hype, but don’t expect miracles. ETH likely capped below 3.4k unless something big changes.

HolderStat┆ETHUSD breakout toward key resistanceAfter weeks of consolidation inside a symmetrical triangle, ETH has confirmed a bullish breakout with strong momentum. Price is now aiming for the $2800–$3000 sell zone, a key level from previous distribution. The breakout suggests increased buying pressure and a potential mid-term rally continuation.

💡 If ETH holds above the $1800 breakout zone, we could see a gradual climb toward $2800 in the coming weeks.

ETH ANALYSIS (12H)This analysis is an update of the analysis you see in the "Related publications" section

Ethereum has finally reached the flip zone.

Pay close attention: Ethereum dominance is sitting on monthly support, which is a level with strong bounce potential.

We have two possible scenarios for Ethereum | either it breaks through the flip zone, or it makes a correction and turns bullish again from around the bottom.

⚠️ What’s clear is that shorting Ethereum is risky and doesn’t make sense!

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

This Low Cap Alt will 20-50x (CULT DAO)This crypto cycle has been brutal for alts. There have been massive shakeouts over and over, a relentless onslaught of rug pulls and scams, and the "Pump.fun" casino on Solana that’s drained billions of retail liquidity and transferred it to the few.

The few always seem to win, and the many always seem to lose. Today, if you’re reading this, it might all change.

CULT DAO could easily 20-50x from now until October 2025. Let’s take a look at the MACD divergence.

### Technical Divergence

For 750 days, this bullish divergence has been forming on the histogram MACD. Every new low on price has formed a higher low on the MACD.

Let’s take a look at a case study of what happens when we get this form of divergence.

I traded this exact same pattern in 2022 that resulted in a nearly 425% move. The play function doesn’t work because they rebranded, and that ticker is no longer valid, but you can scroll to the bottom in my comments on that TA and see the move. I’ll post it under this as well.

As you can see, we got that 425% move. Currently, CULT DAO is showing exactly the same histogram divergence.

Here are some examples of zigzag impulses on low-cap alts. You tend not to get 5 waves; instead, you get this zigzag pattern. This is what I predict CULT DAO will do since it’s only a 5 million market cap.

We can also see in the chart that the 0.618 time Fibonacci level hits at the end of October 2025, which is exactly where I think the altcoin market will top. Check out previous TA on that.

This is only scratching the surface of what is to come for CULT DAO. I have presented to you the technical reason why a big move is stirring and why, at the apex of these divergences, the stars align, and you have the catalyst present itself, and boom—the explosive move comes all at once, and it will be extremely volatile because of its low market cap.

### Let’s Start with the Tokenomics

Every time someone sells or buys CULT DAO on Uniswap, there is a 0.40% tax that goes to a treasury. The top 50 stakers get to pass proposals that fund projects/investments. The idea is to remove the centralized component of funding a project.

121 projects have been funded over the last three years with 3 million dollars.

- Total CULT Funded: 479,751,081,214 CULT

- Total ETH Funded: 1,573 ETH

- Proposals Funded: 121

- Total USD Funded: $3,289,596

- Total ETH Burned: 303 ETH

Allocating these funds has been a learning process over the last three years, but every failure has been necessary in preparing the DAO for what’s to come next.

### The Big Catalyst

The creator of CULT DAO has been working on a blockchain that will function on a custom gas token—that’s right, and that custom token will be CULT DAO. You heard correctly.

Every transaction, every deployment on the blockchain will require the CULT DAO token as gas to execute. The implications are massive. There are multiple dApps that are currently being constructed on the Modulus blockchain.

A privacy-first zkEVM blockchain like Modulus means a scalable, Ethereum-compatible blockchain that prioritizes user privacy through zero-knowledge proofs, allowing optional private transactions while maintaining decentralization.

Modulus is a privacy-first zkEVM blockchain and is scheduled to release this year between April and August 2025. I hope now you’re starting to see the picture.

### CULT DAO and ETH Liquidity Pools

So, why does the price of CULT go down if there is currently very little volume? Well, CULT DAO and ETH liquidity pools are tied together, so if the ETH price goes down, so does CULT. In turn, if ETH goes up, so does CULT.

You can see that CULT is nearly at a 1:1 ratio with ETH for now, coming in at a 0.91 ratio.

In other words, if my thesis is correct about ETH and it goes to 15,000 dollars, the price of CULT would be as follows:

- ETH at $10,000:

CULT Price: $0.000005008 (4x increase).

Market Cap: $21.38M (4x increase).

- ETH at $15,000:

CULT Price: $0.000007512 (6x increase).

Market Cap: $32.08M (6x increase).

That’s right—if nobody even bought CULT, not one dollar, the base liquidity increase of ETH would bring the market cap to possibly 32 million, in other words, if you were thinking of buying ETH, why don’t you just buy CULT DAO?

You can buy ETH now; from this price, 15,000 is 7x, or you can buy CULT DAO, get 6x plus whatever extra volume is coming in. It seems like a logical play, really.

Everything you’ve seen so far is why I believe this MACD histogram divergence has been forming for 750 days. As I said, the stars will align at the apex, and the explosion will come.

### Unruggable and No Whales Controlling Supply

As you can see from the bubble map, the largest wallet that is not an exchange has a cluster total of 0.7%. The rest of the clusters you see in the image are basically exchange wallets, which are the red and dark green circles mostly.

Liquidity is also locked for over 200 years.

- Burned Supply = 1.29664T

- Circulating Supply (including staked) = 4.27T

- Staked Supply = 1.07599T

- Remaining Tradable Supply (excluding burned and staked) = 4.27T - 1.29664T - 1.07599T ≈ 1.89737T

So, no whales, and it’s not possible to rug because liquidity is locked.

### Modulus Blockchain Liquidity Injection

The average liquidity injection for DAOs in ZK would be anything from 200,000 to 10 million. Let’s assume it’s a $1M injection that is split 50/50 between CULT and ETH, a common practice for Uniswap-style pools.

- CULT Amount in Pool: At the current price of $0.000001252, $500,000 buys ~399.36B CULT ($500,000 ÷ $0.000001252).

It would increase the price to a 10 million market cap overnight.

### Conclusion

- Liquidity is locked for 200 years

- No whales

- Not possible to rug

- Mainnet launching this year

- ETH pools tied to CULT

- MACD histogram divergence

The target I have for CULT is just based on Fibonacci levels. Honestly, it’s unpredictable what will happen, how high it will go, or the impact the Modulus chain will have. 120 million is my low-end estimate; the macro Fibonacci is much higher.

The last extension puts it at a 1.4 billion market cap and 266x from where we are now.

This is where you want to be for the upcoming alt season—right here, down 98% with this massive divergence and all these factors that come into play. Just the mainnet launch and ETH going to 10,000 basically sends this to a 30-50 million market cap.

Cult DAO and Satoshi Nakamoto share a common ethos of decentralization and anti-centralization. We need to embrace this notion and bring back the power to the many. If CULT DAO hits 1.4 billion dollars, the treasury funds would be in the millions; we fund our own future.

moduluszk.io

cultdao.io

cultdao.io

coinmarketcap.com

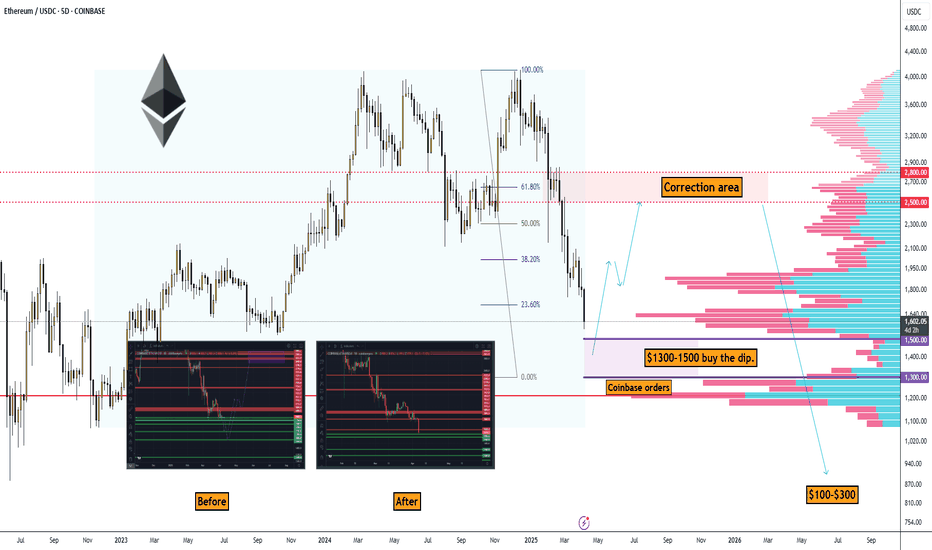

Ethereum: Correction to $1,300–$1,500 and Rise to $2,500–$2,800#Ethereum Price Analysis: Correction to $1,300–$1,500 Before Potential Rise to $2,500–$2,800

Let’s break down why Ethereum (ETH) might correct to the $1,300–$1,500 range and then potentially rise to $2,500–$2,800 (with increased risk beyond that).

Technical Analysis

On the ETH/USDC 5-day timeframe chart from Coinbase, key points confirm a correction to $1,300–$1,500:

1. Correction Target: $1,300–$1,500 ("Coinbase orders")

• Limit orders were placed on Coinbase before the drop.

2. Hyperliquid Liquidation Map

• According to the Hyperliquid Liquidation Map, the liquidation level for long traders is at $1,337.00, within the target zone of $1,300–$1,500.

• A price drop to this level could trigger a cascade of liquidations, and market makers might accumulate positions at the lowest prices, specifically in the liquidation area.

3. Elliott Waves

• We’re completing the 5th wave and starting to form a reversal. This event will roughly coincide with the S&P 500’s reversal.

What Event Could Trigger the Correction?

• An expected Bitcoin correction to $70,000–$76,000 could trigger Ethereum’s drop, as the altcoin market historically follows BTC.

• I’ve previously shared this Bitcoin idea; we’re waiting for it.

Potential Targets for Ethereum Before a Global Downturn

Look for an exit point in this area: $2,500.00–$2,800.00

➖ This is approximately the 61.8% Fibonacci level

➖ A significant area according to the Volume Profile

➖ Large sell orders on Binance at $2,500, $2,800, and $3,000

➖ On Coinbase, they’re getting smarter and splitting orders into 500–600 ETH.

➡️ In Summary for Ethereum

This makes the $1,300–$1,500 range attractive for buying the dip.

Ethereum Bear Market Over! $10,000 Before 2026 Confirmed!People were badmouthing Ethereum but look what is happening, more than 20% growth in a single day. Awesome right? But this is only the start, the last high will be reached and conquered easily, that I know for certain for sure it is true just watch.

In a previous analysis I mentioned that ETHUSDT was trading within a tight range support buy-zone, marked blue on this chart. This is also a higher low and consolidation was happening before what happened today. Bullish action confirmed. Real bullish action I should say because this action is coupled with really high volume. Confirming a very strong high in the coming weeks and days.

Here is what will happen, Ethereum will grow daily non-stop for months. Now, saying it (reading it) is one thing, experiencing will be something completely different, the market will become euphoric as everything grows.

Hundreds of billions worth of USD will be injected into the market, we already have 30 billions that came in recently but only some 10-15 billions are already in-play. This means that the whales still have 15 billion USD ready to buy, and they will continue to buy long-term. As this capital dries up, more and more players will get involved. Notice how the sentiment is still low. People know we are bullish but that is only the usual market participants, those that are part of the industry, the rest, the mass, they are not in yet. When the masses wake up, that will be very close to the top of the first bullish wave. 250 B$ coming in will change not only the Cryptocurrency market forever but also the global financial landscape.

Ethereum breaking bullish is just step one, there is more to come. Prepare for Ethereum to trade at around $10,000 before this year ends. Would you like to bet? I don't think so, we already won because we've been bullish since before 7-April, now it is time to enjoy the ride nothing more.

Adapt and change. The market always fluctuates from bullish to bearish, from bearish to sideways, from sideways to bullish and bullish the market will stay long-term.

Thank you for reading.

"Buy like it's the end of the world. —Master Ananda"

You can't go wrong when prices are low.

Thanks a lot for your continued support.

Namaste.