Ethereum (ETH) Forecast with NEoWave1M Cash Data Chart

Based on the price size of wave-B, it appears that a flat pattern with a regular wave-B is forming. In this pattern, wave -C typically retraces the entirety of wave -B, though a flat with a C-failure may occur at times.

Our primary scenario suggests that wave -C could conclude within the 1000–1200 range, indicating a flat with a C -failure. However, if the price breaks strongly through the 1000–1200 range and consolidates below this level, wave-C might extend to the 700–807 range.

ETH-D

ETHEREUM BEARISH BREAKOUT|SHORT|

✅ETHEREUM keeps falling

Down and the price made a

Bearish breakout of the

Key horizontal level of 1600$

And the breakout is confirmed

So we are bearish biased

And we will be expecting a

Further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Solana vs. Ethereum: Why Investors Are Turning to Solana in 2025In recent months, a growing shift in sentiment has been observed among crypto investors: many are increasingly eyeing Solana (SOL) as a strong alternative to Ethereum (ETH). The comparison chart above, plotting Solana’s price action alongside Ethereum's, reveals that despite ETH retracing back to October 2023 levels, SOL is still holding higher support zones—a sign of relative strength and growing market confidence.

But why exactly is Solana capturing investor attention more than Ethereum in 2025? Let’s dive into the technical, fundamental, and sentiment-driven reasons behind this evolving preference.

___________________

📊 Technical Outlook: Solana Holding Strong

Ethereum (red line) has dropped back to its October 2023 price levels (~$1500), reflecting a broader altcoin weakness.

Solana, on the other hand, is still trading above $100, even though the macro market has turned bearish.

SOL has tested and respected the long-term ascending trendline that began in early 2023, while holding above a key horizontal support near $68–$82.

This divergence in structure suggests stronger buy-side interest and support zones forming on Solana, while Ethereum appears to be losing momentum.

___________________

🧬 Fundamental Comparison: Solana vs. Ethereum

Solana’s technical design gives it a speed and cost edge that appeals to users and developers building consumer-facing applications like NFTs, GameFi, and micro-transactions. Ethereum remains the institutional and DeFi heavyweight, but it’s starting to feel the pressure of competition in usability and scalability.

___________________

💬 Investor Sentiment: What’s Driving the Shift?

User Experience

Solana offers near-instant confirmation and negligible fees, making it ideal for gaming, NFTs, and mainstream use cases. Ethereum's scaling solution rollouts are still clunky and fragmented (Layer 2s like Arbitrum, Optimism, etc.), creating friction.

Vibrant Ecosystem Growth

Solana’s ecosystem is experiencing a boom in dApps, especially with high-profile launches like Jupiter, Marinade, and Phantom wallet integration. The mobile-first approach (Saga phone initiative) and deeper ties with consumer apps are also pushing adoption.

Performance During Market Pullbacks

As seen in the chart, SOL is showing relative strength during market corrections, indicating long-term accumulation rather than panic selling.

Narrative Momentum

The "ETH killer" narrative has found new life with Solana's resurgence. While Ethereum focuses on L2 scaling and abstract complexity, Solana is betting on a simpler, high-performance monolithic chain.

Were To Buy BITCOINMartyBoots here , I have been trading for 17 years and sharing my thoughts on COINBASE:BTCUSD here.

.

BTC is very interesting chart for now that it has dipped 30% and trying to find support.

Do not miss out on BTC at the important levels as this will be a great opportunity

Watch video for more details

$ETH why is it cancelled? Things you porobably need to know.There are several reasons why CRYPTOCAP:ETH is being sidelined—some obvious, others you may not have considered. Here's my analysis.

Let’s be clear: something is wrong in this cycle, and the ETF providers are at the heart of the problem.

The famous line, *"there is no second best"*, rings true—because they ensure no one overshadows their main asset: $BTC.

They’ve already tried to destroy crypto outright—really hard—and failed. The elites are 100% devoted to the USD; it’s their lifeblood. Crypto, especially stablecoins like USDT or USDC, became a competitor, and they did everything possible to wreck the market. When direct attacks didn’t work, they turned to a new strategy: controlling it from the inside.

They embraced crypto, and now they’re making billions off crypto enthusiasts who mistakenly believe these players are here for their benefit. This won’t last forever, but that’s a topic for another day.

Now, let’s address why Ethereum is underperforming—and why it’s likely to continue.

### 1. **Corruption in the Proof-of-Stake System**

All PoS systems rely on staking: the more you stake, the more rewards you earn. Typical staking rewards in crypto average about 10% APR, significantly higher than traditional bank interest rates.

But here’s the catch: these rewards are minted, creating inflation because more coins are constantly being dumped into the market. This results in a class of "retired" investors who stake massive amounts, live off their staking rewards, and sell them without ever touching their capital. This creates constant sell pressure on PoS coins.

The Ethereum Foundation controls how much staking is rewarded. Because it’s run by the same people staking, their vested interest is to keep APRs high, even though this fuels inflation. Ironically, Ethereum’s inflation rivals the USD—a troubling reality for a crypto meant to outperform traditional finance.

### 2. **Ethereum’s Ripple Effect on the Market**

Most altcoins rely on Solidity smart contracts, meaning Ethereum’s performance directly impacts the broader altcoin market. When Ethereum underperforms, it drags down Layer 2 solutions, DeFi projects, and the entire altcoin ecosystem.

Knowing this, why did ETF providers rush to approve ETH ETFs? Simple: *“There is no second best.”*

By taming Ethereum, ETF providers manipulate the market to keep Bitcoin afloat, cancel bear markets, and kill any chance of an altseason. On-chain data shows their strategy: when they buy Bitcoin, they sell Ethereum. This frustrates altcoin holders, pushing them to dump their bags and pivot toward—guess what—Bitcoin.

### 3. **The ETF Trojan Horse**

Ethereum, with its corrupt foundation, is the perfect tool for entities like BlackRock to maintain Bitcoin dominance. By doing so, they effectively prevent bear markets and suppress altseasons.

But this strategy has an endpoint. ETFs will milk the crypto space for as much profit as possible. Once they’ve extracted enough, they’ll dump their holdings, funneling all that capital back into USD. This has been their plan all along.

When that happens, the crypto market—including Bitcoin—will crash. Ethereum’s role has essentially been to funnel cash into Bitcoin, making it easier for institutions to accumulate wealth before transferring it all back into USD.

---

In short, Ethereum is being used as a tool in the ETF providers' larger scheme. It’s not about creating a thriving ecosystem but about maintaining dominance, controlling markets, and ultimately cashing out into the USD.

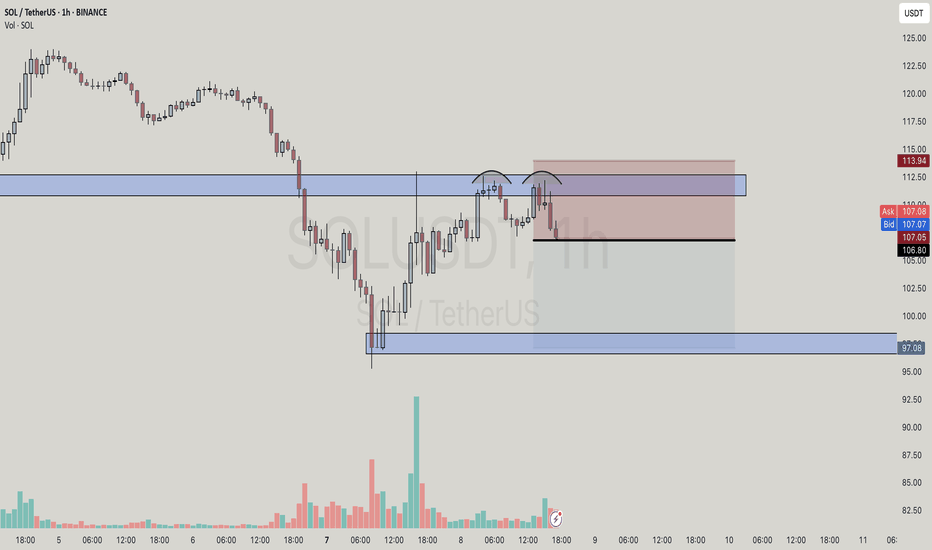

Ethereum - Expecting Retraces Before Prior Continuation LowerH1 - Bearish trend pattern in the form of lower highs, lower lows structure.

Strong bearish momentum

Lower lows on the moving averages of the MACD indicator.

Expecting retraces and further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH Outlook after the Dip. What to expect NOW?Finally, the price broke the wedge, and the price experienced a significant drop. I think now is the time for ETH to rise again to 1900 . STRONG SUPPORT 1400 .

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

eth buy midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Ethereum will be in the bears' control in the mid-term (1D)Based on the recent pivot formations, momentum, and wave degrees, we are observing signs of a deeper correction on the Ethereum chart, which we find necessary to warn about.

As you know, we follow technical evidence and signals to provide analysis—we do not predict the market but rather analyze it step by step.

From the point where we placed the red arrow on the chart, Ethereum's price-time correction has begun.

It appears that an ABC pattern is forming, with wave B now completed or nearing completion after losing the trendline (red dashed line).

Wave C should align with the previous waves in degree and have a longer duration than wave A.

Since wave B retraced close to the top of wave A, wave C’s price correction may not fall too far below the low of wave A.

We have two possible scenarios: either Demand 1 will be the market bottom, or Demand 2.

A daily candle closing above the invalidation level would invalidate this analysis. Let's see how it plays out.

invalidation level : 2941$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

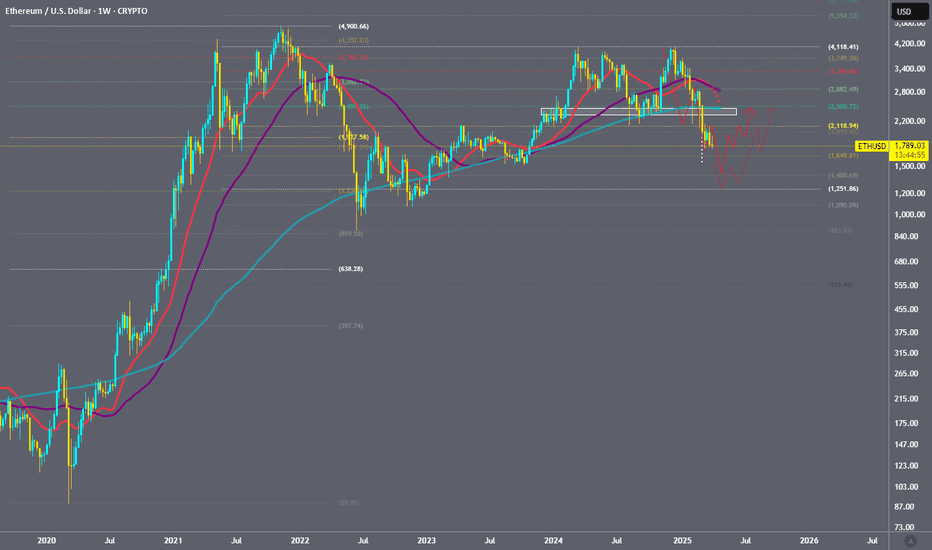

Ethereum Weekly Analysis: Double Top BreakdownHello guys!

Ethereum has formed a clear double top pattern on the weekly timeframe — a strong bearish reversal signal. The pattern is confirmed by:

🔹 A break of the ascending trendline

🔹 Strong rejection from the $3,200–$3,400 resistance zone

🔹 Current price action hovering near $1,780

🧭 Target of the double top pattern lies in the $1,350–$1,450 zone — aligned with a low-volume area on the volume profile, which could act as a magnet for price.

Key Takeaways:

If ETH fails to reclaim the $2,000 zone, more downside pressure is likely.

A bounce may occur in the target zone, providing a possible mid-term long opportunity.

📌 Stay cautious and watch for reaction zones, especially if ETH reaches the $1,400 region.

You can buy it at $1400!

Ethereum 20% Crash: Temporary Setback or a Buy Opportunity?Hello, Traders!

Ethereum experienced a significant drop, plunging over 20% in just one day and hitting its lowest point since last August.

ETH price found strong support at $2130 and I don’t expect further downfall beyond this level unless broader market conditions deteriorate.

One of the key technical developments was Ethereum breaking the crucial $2800 support zone, which is a bearish signal for the continuation of the uptrend.

However, a quick recovery above this level could reignite bullish momentum and bring buyers back into the market. W

atching how ETH reacts to this resistance will be crucial in the coming days.

The main catalyst for this sell-off was Trump’s decision to impose tariffs on Canada, Mexico, and China, which triggered a broader risk-off sentiment in global markets.

The crypto space, being highly sensitive to macroeconomic events, saw a sharp reaction, with Ethereum and other major altcoins suffering deep corrections.

Despite the current bearish outlook, there is one major reason why Ethereum is likely to recover quickly — the upcoming Pectra upgrade, set to take place next month.

Historically, ETH has seen strong rallies leading up to major network upgrades, and I expect a similar pattern to unfold this time.

If the market stabilizes and sentiment shifts, Ethereum could reclaim lost ground and resume its long-term bullish trajectory.

For now, the key levels to watch are $2130 as support and $2800 as resistance.

A break above $2800 could signal a strong reversal, while failure to hold $2130 might open the door for deeper corrections

Please don’t forget to boost this idea and leave your comments below.

ITS TIME , FINAL WAVE FOR BITCOIN HAS BEGAN The final wave for Bitcoin has officially started; 200k by September 2025 is the call. So far, since October 2024, we have been getting every macro move correct. Going to avoid repeating a lot of content from the previous two TAs; check it out below.

The lower high on the RSI called the momentum shift on this one; it was clear.

December 17th, 2024, calling for a pullback down to 82k for wave 4 to complete; it hit 77k, pretty close.

So last time, I was wrestling with two different dates for a cycle top; the first one was May 2025, and the second was September 2025.

It is clear to me now that mid to late September 2025, Bitcoin will peak at around 200k. It could go slightly higher, but the 185-200k region has a higher outcome.

So, I've been using this small-time Fib, and last time when we hit the 0.618, it was the breakout week for Bitcoin from the long range. We're here again; this week is the big pivot and start of wave 5.

The hash ribbon has confirmed a buy signal, and more importantly, it flashed buy in my Time Fibonacci week. Amazing. If you've been with me for years, you already know that this is the best signal for Bitcoin there is. It is so damn good; this gives so much more weight to my thesis.

Stars seem to align again. They constantly try to shake you out; this is the game. Who is going to fade the hash ribbon buy? It's been the easiest play time and time again.

Seriously, though, for just a moment—are you really going to fade the hash ribbon? :)

ETH CHART: I FOUND THE BOTTOM!HERE IS MY FUNDA REASON OR NEWS WHY I THINK THIS IS THE LAST DROP~! BEFORE WE RECOVER AND START THE BUILDING OF CRYPTO!

Price Decline and Market Sentiment: Ethereum's price has dropped below $1,800, marking a significant decline of over 45% since the start of the year. This has raised concerns about its market stability, with some analysts predicting further drops to $1,550 if key resistance levels aren't reclaimed.

Investor Sentiment and FUD: Fear, uncertainty, and doubt (FUD) have led to increased selling pressure. Retail traders have been offloading ETH holdings, resulting in reduced trading volumes and network activity. Active addresses and transaction volumes have also declined, signaling lower demand!

Technical Challenges and Resistance Levels: Ethereum has struggled to break past critical resistance levels, such as $1,900. Its failure to reclaim these levels has validated bearish patterns, with some analysts warning of a potential drop to 17-month lows!

Macroeconomic Factors: Broader economic uncertainties, including geopolitical events like tariffs, have contributed to Ethereum's struggles. These factors have added to the negative sentiment in both the financial and crypto markets.

Network Activity and Whale Behavior: While some large investors (whales) are accumulating ETH, the overall network activity has seen a decline. This mixed behavior has created uncertainty about the asset's short-term trajectory

LTCUSD Litecoin OH NO TARIFFS! Everyone SELL NOW!The market reacted to the tariffs negatively as expected. I don't think these tariffs will last long. Countries will cave and remove their tariffs. Bottom line is they need us more than we need them. Once global free and easier trade starts you're going to see a boom cycle like never before. This is the bottom and the beginning of the biggest bull run you'll ever see. I don't get involved in politics but this move that Trump made with the tariffs is going to be a major positive for the USA and the world moving forward. This isnt 1929, we live in a much more advanced world now. Collapses and depressions are a thing of the past in my opinion.

As for Litecoin I see it coming down to test around $70 dollars by the middle of April. This is also timed almost perfectly to the 2017 run Litecoin had, coincidentally trump was starting his first term in 2017 as well. Also timed perfectly to when tax day is over for USA.

Many have capitulated and sold everything thinking a giant recession is coming, or a war, or a collapse, or aliens, or you name it people are scared of their own shadows lately. Like a plague of Grackles where one gets spooked and the whole lot of them get scared and take off when they dont even know why. This is how the markets work though, most will make the wrong decision so the few who made the right decision can profit from their mistakes. Once the market starts to run again those who sold will think its just a fake pump or dead cat bounce and wont buy in. Then the market will continue to rise and rise and finally when its near an all time high those who capitulated and sold early will fomo back in and buy the top to provide liquidity for those who were called crazy for buying the bottom. Its a cycle thats been happening since markets started.

So Im sticking with my predictions for Litecoin, I am not falling for this bear trap crap. Im doubling down. This is not financial advice. This is just my opinion.

Will ETH finally change direction?ETH is approaching support at $1,559, but here you can see how the price has fallen below the upward trend line, which could have resulted in a stronger rebound. When support is broken, you can still see a strong support level at $997, to which we can see a decline.

Only when the trend changes direction will ETH have to face resistance levels at $1,889, then $2,151, and then $2,560 before we see any major upward movements.

The Stoch RSI indicator shows us moving along a line where we could previously observe strong price rebounds, while the RSI indicator itself, taking into account the interval of one weekend, shows us approaching the level we last touched during the bear market bottom.

BRIEFING Week #14 : What a Mess !Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil