#ETH #ETHUSDT #ETHEREUM #LONG #SWING #Analysis #Setup #Eddy#ETH #ETHUSDT #ETHEREUM #LONG #SWING #Analysis #Setup #Eddy

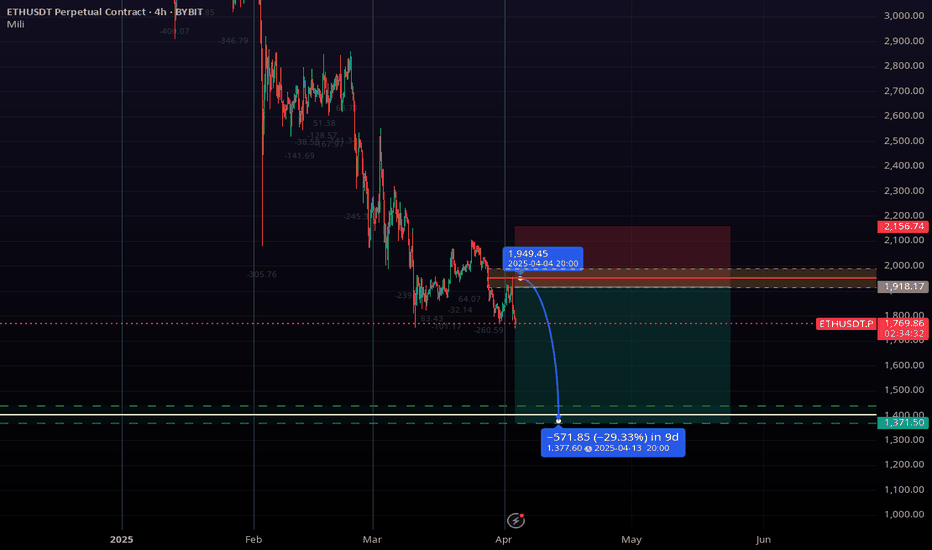

ETHUSDT.P Swing Long Analysis & Setup

Important area of the upper time frame for swing are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this Swing Setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

🗒 Note: The price can go much higher than the second target, and there is a possibility of a 500% pump on this currency. By observing risk and capital management, obtaining the necessary approvals, and saving profits in the targets, you can keep it for the pump.

⚠️ Warning : The stop loss is dramatic and large. Place the stop loss based on your strategy and after getting entry and confirmation on the entry point behind the last shadow that will be created. (( This is just my opinion and is not meant to be 100% correct, so be careful with your capital. ))

Spot Investing : ((long 'buy' position)) :

🟢 Entry 1 : 1800

🟢 Entry 2 : 1500

First entry point calculations :

⚪️ SL : 1370 ((23.89%))

⚫️ TP1 : 4500 ((150%))

⚫️ TP2 : 5000 ((177.78%))

⚫️ TP3 : 8000 ((344.44%))

⚫️ TP4 : 10000 ((455.56%))

‼️ Futures Trading Suggested Leverages : 3-5-7

The World Let it be Remembered...

Dr. #Eddy Sunshine

4/4/2025

Be successful and profitable.

Do you remember my first Ethereum swing long signal?

My first swing long signal was provided on Ethereum, which was spot pumped by more than 100% and was profitable :

ETH-D

ATOMUSDT Forming Inverse Head & Shoulders ATOMUSDT is currently forming a classic inverse head and shoulders pattern on the chart—a strong technical indicator often associated with trend reversals. This bullish pattern, combined with rising volume, suggests that a breakout may be on the horizon. The neckline is being tested, and a confirmed breakout could trigger a wave of buying interest as traders anticipate a significant upside move.

Volume is looking promising as buyers step in around key support zones, showing confidence in the potential of ATOM. With the broader market stabilizing and altcoins gaining momentum, ATOMUSDT could ride this wave for a projected gain of 50% to 60%+. The current technical setup aligns well with historical bullish reversals seen with this pattern.

Investors are increasingly paying attention to ATOM, not just for its price action but also for its utility in the Cosmos ecosystem. With strong fundamentals backing the project and a promising technical structure, this may be the beginning of a new uptrend. A successful breakout above resistance could bring renewed momentum and fresh highs in the short to medium term.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

(ETH) ethereum "update"Ethereum update. Nothing per se to analyze. More of an image to share with two indicators. Not much else to say here. It would be better if the average lines (pink and purple) had dots closer together. The further those dots become on a descent, the higher the likelihood there is of a big drop in price. We want the purple line to begin to curve in a reversal pattern for the price to recover from what is losing right now. Huge discount on Etheruem though, if you like that sort of thing, and Ethereum.

TURBO long-term outlookAfter completing its first cycle TURBO seems to stabilize around the 0.0010-0.0020$ region which marks the last ATH from 2023. What's interesting here is that TURBO follows the DOGE coin pattern levels almost to a T, in speedrun mode. It is absolutely not the same structure but it respects the same trading ranges and shows a lot of similarities, which is quite remarkable.

Watch out for this yearly trendline in the TURBO chart and expect some volatility for the next months. Breaking under 0.0010$ could potentially confirm a longer downtrend if we don't see a big impulsive bounce to the upside in the near future.

Bitcoin BTCUSD The Move Down Is OverI posted this chart in February 2027, I was unable to update it. This is playing out exactly how I predicted. Bitcoin loves these double tops and the corrections are textbook almost every time. Bitcoin may double bottom but on a closing basis on the 5 day I am predicting that Bitcoin will NOT close lower than the measured move. Wicks below sure but on a cloing basis which the Line chart shows we are right on track. I think that by the middle to late April we are above the previous high and en route to new all time highs. There is no bear market coming any time soon. Bitcoin is going to astronomical numbers, numbers most cant fathom. None of this is financial advice this is just my opinion. Like and follow for updates. Thank you

Ethereum Price Analysis: Is a Drop to $1,550 Imminent This Week?As of April 3, 2025, Ethereum (ETH) is trading at approximately $1,838 (based on recent market data), reflecting a precarious position in the crypto market. After a volatile start to the year, ETH has shed over 44% year-to-date and is now testing critical support levels. This analysis explores the potential for an 11% drop to the $1,550 range within the next few days (by the end of this week, April 6), driven by technical breakdowns, bearish on-chain signals, and broader market pressures.

Technical Analysis: Bearish Signals Mounting

On the daily chart, ETH has been struggling to maintain momentum above the $1,800 psychological level. After a brief bounce from its yearly low of $1,760 on March 11, the price has failed to reclaim the $2,000 mark—a key resistance zone that previously acted as support in late 2024. Here’s a breakdown of the technical setup:

Key Support Breach: The $1,800–$1,877 range has been a critical support zone, aligning with the 61.8% Fibonacci retracement level from the December 2024 high of $4,106 to the March 2025 low of $1,759. A close below $1,770 this week would confirm a breakdown, opening the door to the next major support at $1,550–$1,600, a level last tested in October 2023.

Bearish Pattern Confirmation: The 2-hour chart shows ETH completing a corrective structure (likely an A-B-C wave) after its March 19 peak at $2,070. If wave C mirrors wave A in length—a common Elliott Wave scenario—the target aligns near $1,550, coinciding with the 1.61 external Fibonacci retracement of the recent bounce.

Moving Averages: ETH is trading below both its 50-day SMA ($2,321) and 200-day SMA ($3,010), signaling a sustained bearish trend. The 50-day SMA, now sloping downward, acts as dynamic resistance, capping any relief rallies. A failure to reclaim this level soon reinforces the downside risk.

RSI Oversold but Weak : The 14-day Relative Strength Index (RSI) sits near 30, indicating oversold conditions. However, in strong downtrends, RSI can remain oversold for extended periods, as seen during ETH’s 2022 bear market. Momentum remains weak, with no bullish divergence to suggest an imminent reversal.

Target Projection : A drop from $1,838 to $1,550 represents an 11% decline, achievable within 2–3 days if selling pressure accelerates. The $1,550 level aligns with historical support and the long-term 78.6% Fibonacci retracement, making it a plausible target.

On-Chain Data: Selling Pressure Intensifies

On-chain metrics paint a grim picture, supporting the bearish technical outlook:

Exchange Reserves Rising: Ethereum’s exchange reserve has ticked up from 18.3 million ETH, reversing a multi-month decline. This suggests long-term holders or institutions are moving assets from cold storage to exchanges, potentially preparing to sell.

Whale Activity: Recent data shows significant whale sell-offs, with large transactions (over 100 ETH) spiking in the past 48 hours. This aligns with posts on X noting whale distribution near current levels, adding downward pressure.

DeFi Weakness: Ethereum’s dominance in decentralized finance (DeFi) is waning, with total value locked (TVL) dropping as competing Layer-1 chains gain traction. Reduced network activity undermines ETH’s utility-driven demand, a key pillar of its value proposition.

Staking Dynamics: While staking activity increased post-Shapella upgrade, the anticipated selling pressure from unstaked ETH continues to linger, especially as macroeconomic uncertainty prompts profit-taking.

Market Sentiment: Fear Dominates

The broader crypto market is reeling from macroeconomic headwinds. The U.S. Core PCE Index rose to 2.8% in February, exceeding the Federal Reserve’s 2% target, signaling persistent inflation. Higher interest rates for longer dampen risk-on assets like cryptocurrencies. Posts on X reflect growing pessimism, with some traders eyeing sub-$1,000 levels if $1,760 fails—a sentiment echoed by Ethereum’s 7% drop this week alone.

Bitcoin (BTC), trading near $82,000, has also faltered, dragging altcoins lower. ETH’s correlation with BTC remains high (around 0.9), and a failure to hold $80,000 for BTC could amplify ETH’s decline. Additionally, the lack of immediate catalysts—such as ETF approvals or major network upgrades—leaves ETH vulnerable to further capitulation.

Price Scenarios and Key Levels

Bearish Case (Base Scenario): A daily close below $1,770 triggers a swift move to $1,550–$1,600 by April 6. Volume spikes and panic selling could push it lower, though $1,550 offers strong historical support.

Bullish Rejection: A reclaim of $2,070 (the March 19 high) invalidates the bearish setup, potentially sparking a relief rally to $2,250. This seems unlikely without a significant BTC breakout or positive news.

Invalidation: A close above $2,120 this week would negate the short-term bearish thesis, though resistance at the 50-day SMA ($2,321) caps upside potential.

Trading Strategy

Entry: Short ETH below $1,770 with confirmation of increased volume.

Target: $1,550 (11% drop), with a stretch goal of $1,500 if momentum persists.

Stop Loss: $1,911 (intraday high from April 2), limiting risk to 4–5%.

Risk/Reward: Approximately 2.5:1, assuming a $1,550 target.

Conclusion

Ethereum’s technical setup, coupled with bearish on-chain signals and a fearful market, suggests an 11% drop to $1,550 is plausible by the end of this week (April 6, 2025). The $1,770 level is the line in the sand—watch it closely. While oversold conditions hint at a potential bounce, the lack of buying conviction and macro pressures tilt the odds toward further downside. Traders should monitor BTC’s price action and exchange inflows for confirmation. Stay nimble, and let the charts guide your next move.

Ethereum Elliot Wave Theory: $19,000 & Altcoins Market UpdateThe market is shaking but nothing truly changes. Ethereum is on a path that will end with a price above $10,000 USD. Ether (ETHUSDT) can easily trade at $11,111, $15,000 or even $19,000 in the latter part of 2025. Think about the market conditions and sentiment when Ether trades above 10K. Take a moment to think. Visualize. What do you see, hear, sense or feel?

The low was set March 10. Ethereum has been bearish since March 2024.

11-March 2024 was the main and first peak.

10-March 2025 was the main bottom and low.

An entire year of bearish action. The market never moves straight down nor straight up. The bullish action in late 2024 is part of a complex correction. It can be called an inverted correction within a long-term correction.

The last bear-market ended with a bottom being hit June 2022. This was followed by slow but steady growth; bullish consolidation. Prices were sideways but producing higher lows. Then a bullish wave developed to end 2023 and went through March 2024. March 2024 marked the end of this cycle and the start of a major, long-term complex correction. This correction ended last month. The end of the correction marks the start of the next bull-market cycle. The 2025 bull-market. This bull-market is not yet fully obvious but it will be clear within less than 2 months. There will be growth but for the majority of the participants to realize that yes, it is happening, it will take even longer.

Altcoins Market In General

Some projects bottomed in February, others in March. Most of them ended their correction in February 2025, there are always variations. This low is a long-term higher low. Many projects bottomed in late 2024. After a strong rise to end the year, we had a correction and this puts us in the current situation. Once the correction ends (already over) a new bullish impulse starts. The bullish impulse is composed of five waves. Three moves forward with two steps back.

➢ The first wave is up and green. Wave 1.

➢ The second wave is down and red. Wave 2.

➢ The third wave is the biggest wave. This wave tends to produce the highest volume and lots of momentum. Up and green. Wave 3.

➢ The fourth wave will be down and red and it will alternate the second wave. For example, if the second wave is long in duration, the fourth wave will be short. If the second wave is fast, the fourth wave will be slow. Etc. Wave 4.

➢ The fifth wave signals the end of the bullish impulse and this is the speculative wave. This is where anything is possible. Anything can happen within this wave. Trading volume will be lower compared to the third wave but new All-Time Highs are hit here and after this wave is over, the start of a new long-term correction or bear-market. Wave 5.

This is the map based on Elliot Wave Theory terminology. Everything is looking ready right now.

Signals are starting to show pointing to the start of major growth. What one does, the rest follows. Look at EOS. I just shared an article. Visit my profile and read it for a simple and quick example.

Don't be surprised when Ethereum trades above $10,000. Be prepared.

Take profits when prices are high and up.

The time to buy is now. Focus on the long-term.

Thanks a lot for your continued support.

Namaste.

ETHEREUM Huge bullish divergence targets $4000Ethereum / ETHUSD formed a Double Bottom while the 1day RSI was on a Rising Support.

This is a similar bottom formation like the September 6th 2024 Double Bottom.

Technically once the Falling Resistance breaks, the new bullish wave begins.

Target the bottom of the Resistance Zone at $4000.

Follow us, like the idea and leave a comment below!!

DOUBLE BOTTOM IN ETH / ETH TO $2,500Hello! We have confirmation of a double bottom. Eth has a bullish pattern, the price reached the liquidity zone at $1,780, took positions, and the price began to form a double bottom. The price of Eth has already gained liquidity, and on a weekly and daily chart, the price will be looking at $2,500. Remember that a weekly chart is for seeing results between 20-30 days and a weekly chart will be seeing results over a period of 3 months. It is not ruled out that the price remains in its range. However, the indicators, price action, and market sentiment tell us that Eth is suitable for long positions.

Ethereum is still in a downtrend... however... no fresh shortsETH is still in a downtrend and losing against Bitcoin. The real question is when will Ethereum show us proof of life? To confirm a pivot to the upside a clear CHOCH would be the key. Momentum and trend oscillator are bottomed out and looking for a slow grind up.

Full TA: Link in the BIO

SHIRO is Ready to Explode – The Rally Hasn’t Even Started YetWe’re watching SHIRO real close — and I gotta say, the pump potential is very real! After that correction that shook out all the paper hands, the lane’s open for new entries. Any fresh cash flow could send it flying 📈. SHIRO could easily smash through the SEED_TVCODER77_ETHBTCDATA:2B market cap in no time. And if they drop staking, get that Binance integration, and the Shiba profiles come back hyping it… it’s moon time for real 🌕✨

Let’s not forget: SHIRO NEKO comes from the same crew behind Shiba Inu, with the same team running it. Just look at where Shiba went, right?

That first billion? Just the beginning... SHIRO hasn’t even started its real pump yet.

Keep your eyes on it. 💅🚀 #SHIRO #CryptoGems BINANCE:BTCUSDT BINANCE:ETHUSD

ETH - Relief bounce on the 1-hour?Ethereum (ETH) is showing signs of potential exhaustion on the 1-hour timeframe, hinting at a possible relief bounce. Despite forming smaller lower lows and lower highs, which indicate a short-term downtrend, the reduced volatility and diminishing selling pressure suggest that bears may be losing momentum.

However, traders should remain cautious, as relief bounces in a downtrend can be short-lived. Confirmation from increased volume and a shift in market structure would strengthen the case for a more sustained recovery. At this moment ETH is still in a clear downtrend.

With a possible relief bounce it is an option to look for shorts at resistance areas to trade ETH back down. If ETH breaks it's current low it could get ugly with 1500 as a possible level.

On the daily timeframe is ETH at his supportlevel from the initial, drop a couple weeks ago. So with ETH on the daily support and on the 1-hour indicating for a possible short relief bounce we have to trade accordingly with risk management if you are opening shorts at this stage.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Mochi on Basewe are still in accumulation zone. last pump on january was for exit liquidity, some whales sold it and forget for the project and on another side come new whale who was DCA that downside pullback. Or just simple shakeout of weak hands who can't wait time)

I can show you any patern such as imbalance or order block / support level but in global we are still on same prices more than one year and i haven't seen any distribution yet.

By the way, Mochi is the oldest meme on Base network after Toshi, received grant from coinbase and named after CEO CB cat

Primer: Solana - A Blazing BlockchainCME Group’s newly launched Solana futures enable institutional grade access to the cryptocurrency, offering investors access to compelling relative value opportunities.

This paper provides a background to Solana in relation to other major blockchain networks and cryptocurrencies. Mint Finance will outline the execution of crypto market spread trades using CME futures in an upcoming paper.

Solana is a high-performance public blockchain launched in 2020 by Solana Labs, founded by Anatoly Yakovenko (a former Qualcomm engineer). Yakovenko first proposed Solana’s novel Proof of History (PoH) concept in 2017 as a solution to blockchain scalability. He assembled a founding team including former Qualcomm colleague Greg Fitzgerald and others and named the project after a California beach town.

Backed by early venture funding, Solana’s mainnet launched in March 2020. The vision was to enable ultra-fast, low-cost transactions for decentralized applications (e.g. DeFi, gaming), addressing limitations of Bitcoin & Ethereum in speed and fees.

Solana has grown rapidly to become one of the most used networks and amassed a market cap of USD 64 billion, making it one of the largest digital assets. What is behind the massive surge? Is it due to flip ETH as the home of DeFi?

How Does Solana’s Blockchain Rank?

While Solana’s low fees and fast transaction speeds have driven high trading volume, transaction count, and wallet growth, it still trails ETH in Total Value Locked (TVL). To achieve its high transaction throughput, Solana has made certain compromises on decentralization.

In terms of ecosystem development, Solana is seeing rapid growth. The Electric Capital 2024 developer report found Solana attracted the most new developers in 2024 – more than any other ecosystem (even Ethereum’s, despite Ethereum’s broader base).

Solana now has ~2,500 monthly active developers, second only to Ethereum’s ~8,900 (which includes many working on Layer-2s). This loyal & expanding developer base has been a key factor behind Solana’s explosive growth.

DEX Surge and Meme Coin Mania

Solana’s early growth was driven by NFTs, supported by low fees and a loyal community that made it a hub for NFT trading. These factors continued to attract users even after the NFT boom subsided. Its fast, low-cost blockchain and strong developer base have enabled the launch of many user-friendly and popular applications. More recently, Solana’s growth has been fuelled by surging decentralized exchange (DEX) volumes and a wave of meme coin minting.

By November 2024, meme coin trading accounted for an all-time high 65% of monthly DEX volume on Solana’s largest DEX, Raydium. Raydium even overtook Uniswap in monthly volume that month.

Solana’s advantages in cost and speed have been pivotal in this trend. Transaction fees on Solana are negligible and on-par with L2 chains. This cost advantage makes minting and trading low-value tokens (like meme coins) economically feasible on Solana but prohibitively expensive on Ethereum layer-1. Similarly, Solana’s block times (~0.4 seconds) and high throughput enable rapid trading. Traders can execute many rapid swaps on Solana DEXs without the delays and slippage that Ethereum’s ~12-second blocks and occasional congestion introduce. Solana’s speed and low fees thus attracted a flood of retail speculators for meme coins and high-frequency trading strategies.

Ethereum’s ecosystem still offers deeper liquidity and broader dApp selection, but Solana capitalized on specific niches (e.g. meme coins, real-time trading) where Ethereum’s costs are a barrier.

However, this explosive growth was not without turbulence. In early 2025, a “meme coin meltdown” saw activity cooling off after several scam tokens collapsed. By February 2025, Solana’s share of total on-chain DEX volume, which had topped 51% in January, retreated to 24% as some froth cleared.

Data Source: Artemis

Scandals like a fake “Libra” token (which vaporized $4.4B in market cap) and a Trump-themed token rug pull dented retail sentiment. Even so, Solana’s DEX volumes remain on par with Ethereum’s entire ecosystem (L1 + L2), a remarkable feat. VanEck’s Feb 2025 report noted that despite an 80%+ drop in new meme token launches since January, Solana DEX activity “is still holding its own – roughly matching the entire ETH ecosystem”.

In short, the meme coin mania has demonstrated Solana’s capacity to manage massive retail-driven bursts of activities that might overwhelm other chains.

Market Metrics For BTC, ETH, and SOL

Since the bottom of the bear market following the FTX collapse. Solana has delivered a stunning recovery, far outperforming both BTC and ETH, but the massive gains were partly explained by the much sharper decline following FTX.

During 2024, SOL performance moved in lockstep with BTC with both assets delivering stunning returns. However, the performance diverged sharply after Jan/2025, coinciding with the collapse in DEX trading volume. The sharp correction since has erased most of the 2024 gains while BTC has remained resilient.

Solana has, nevertheless, managed to outperform ETH which has suffered an even deeper correction over the past few months.

Data Source: TradingView

Historical volatility for all three assets shows a similar trend but differ in magnitude. SOL has the highest volatility while ETH follows second and BTC is least volatile. During spikes, the differences become exaggerated, but during lows, the values can reach similar lows.

For traders, higher volatility can be both an opportunity and a risk.

While SOL’s performance is positively correlated with both ETH and BTC, this correlation breaks frequently (more commonly with ETH) and these periods of divergence present compelling spread opportunities.

The trend for implied volatility (IV) is like HV with SOL’s IV the highest and Bitcoin’s IV the lowest. Recently, IV has started to edge up again following a decline through March.

Trading Solana and Crypto Spreads

With the launch of CME’s Solana and Micro Solana futures, investors can express views on Solana’s growth and take tactical positions that benefit from relative outperformance. Mint Finance will outline the execution of crypto market spread trades using CME futures in an upcoming paper.

CME Solana futures provide exposure to 500 SOL per futures contract and reference the CME CF Solana-Dollar Reference Rate.

CME Micro Solana futures offer a smaller notional value to create more balanced spreads and for fine-tuning exposure. The micro contract provides exposure to 25 SOL.

Additional details about the contract including margins, calendars, and specifications are available on the CME Solana product page .

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

ETH/BTC: The Macro Reversal Play of the Decade

This chart reveals one of the most significant setups in crypto - the ETH/BTC ratio bottoming at historical support and poised for a powerful mean reversion.

After a sustained downtrend through 2023-2024, the ETH/BTC pair has reached a critical inflection point at 0.0222, precisely where smart money accumulates. This level represents structural support dating back to 2020, creating the perfect foundation for a macro reversal.

Technical Structure:

- Perfect technical bottom at long-term channel support

- Currently at 0.0222 (near historical demand zone)

- SMA at 0.0496 providing clear target for initial move

- Projected 3-wave structure targeting 0.07 zone (+250% potential)

#Market Thesis:

We're witnessing the completion of a multi-year corrective phase that has reset ETH/BTC valuations to extreme levels. The projected path shows a powerful rally into mid-2025, targeting the previous resistance zone around 0.07.

Strategic Implications:

The ETH/BTC ratio acts as the perfect hedge against Bitcoin dominance decline. When capital rotates from Bitcoin into altcoins, Ethereum historically captures the first wave of this rotation before smaller caps.

Historical Context:

Every major crypto bull cycle has featured periods where Ethereum dramatically outperforms Bitcoin. The technical structure suggests we're entering exactly such a phase, with timing that aligns perfectly with post-halving capital rotation patterns.

This isn't just another trade - it's positioning for the major narrative shift of 2025.

K.I.S.S => ETHHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉 ETH Market Update – Keeping It Simple 📉

Since breaking below its last major low in December 2024, Ethereum (ETH) has been stuck in a bearish trend.

But don’t lose hope, bulls! 🐂

For the long-awaited altseason to kick off, ETH needs to flip the script and break above its last major high — currently sitting at $2,100.📈

Until then, patience is key. 🧘♂️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ETH - When will this downtrend finally stop?Ethereum (ETH) has been stuck in a prolonged downtrend, and the bearish scenario is now playing out. On the 4-hour chart, ETH recently broke below its rising trend line after forming a rising wedge that typically signals further downside. This breakdown confirms the potential for further downside.

At the same time, on the weekly timeframe, ETH has perfectly retested its resistance and failed to push higher, reinforcing overall market weakness. With failing to break resistance it is likely that ETH could face continued weakness and move towards the weekly support area at 1500.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Ethereum Not Dead- i know some peoples think ETH will go to 250$ or 500$, so wait for it...

- I've always maintained that I'm not a fan of ETH because of its scalability limitations and centralization, for that reason ETH needs some messy L1...L2...etc..

- That said, my opinion doesn’t matter much, ETH is here to stay. The Ethereum ecosystem hosts thousands of projects; I’d say it’s too big to fail.

- i used Bitstamp exchange to look further back in the chart's history.

- i simplified this monthly chart so much that even a 10 year old kid could understand it, just check the RSI low levels and compare it with previous years. Again, check the max RSI level for the previous ATHs.

- i won't discuss where to buy because, whether you get ETH at $1,800 or $1,500, the bull run for ETH and Altcoins hasn't started yet.

Happy Tr4Ding !

Heading into 50% Fibonacci resistance?Ethereum (ETH/USD) is rising towards the pivot which has been identified as a pullback resistance and could reverse to the 1st support.

Pivot: 1,945.48

1st Support: 1,751.48

1st Resistance: 2,038.68

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

ETH - 4 Red Monthly CandlesThis is the second time we’ve seen four consecutive red monthly candles for ETH. The last occurrence was during the 2018 bear market, where ETH crashed 88% from its peak.

This time, the four-month decline has resulted in a 57% drop so far. However, with the price now at a key support zone, I anticipate that the April 2025 candle will be green, signaling a strong recovery—potentially exceeding the previous month’s losses.

If April turns out to be another red month, we could see ETH dropping further toward the $1,300 level before finding a stronger bottom.

Let’s see how this plays out!

Cheers,

GreenCrypto