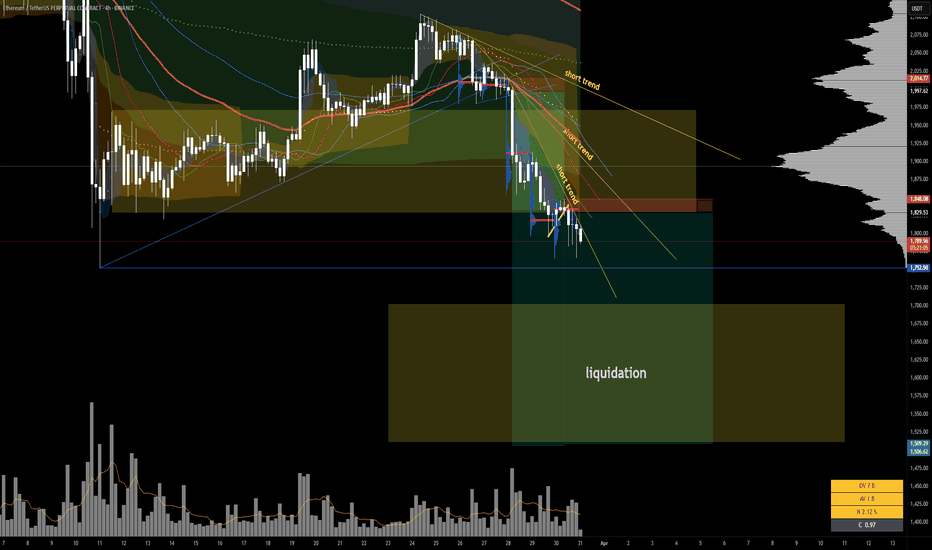

LONG ON ETHEREUM (ETH/USD)Ethereum has given a change of character (choc) to the upside on the 4 hour timeframe...

followed by a nice sweep of engineered liquidity!

Its currently respecting a key demand are and I believe it will now rise for 300-500 points this week.

I am buying Eth to the next level of resistance.

ETH-D

BRIEFING Week #13 : ETH offers perfect opportunityHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

ETH - is the worst over ? Can we expect reversal ?As shown in the chart, ETH has reached the trendline support and is currently trading near a key support zone. This critical level will determine whether ETH initiates a reversal from its long-term downtrend that began last December.

I anticipate this support to hold, leading to a strong rebound in ETH's price. If the reversal occurs from this zone, ETH could reach its peak around Q4 2025.

Let’s see how it unfolds!

Cheers,

GreenCrypto

ETH Ready for PUMP or what ?Currently, ETH is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

New opportunities for earning money on VIPTo date, we have come close to a change in the quarter and a high probability of increased volatility. The second half of the monthly candle on ether opened in the negative zone, which gives a signal to hold sales until the end of the quarter. However, in recent days, individual coins have the opportunity to work out their accumulated potential with a bullish reversal of the monthly candle. VIB is currently the most oversold coin without the monitoring tag. Against the background of the pinbar of the last monthly candle, there were few buyers this month, but technical buy signals were left up to a 0.1 retest even with the current market position.

In an optimistic scenario, today's daily candle may turn bullish with continued purchases until the end of the quarter. Negative statistics on the United States today may contribute to this. In the case of a reversal in the current quarter, the target may be a local breakout and retest of the trend line formed by the previous breakdown.

With less volatility and strong statistics coming out in the US today, the probability of a rebound from the retest of past hows in the range of 0.110-125 and a transition to a flat near the key long-term level of 0.075 +-15 prevails. In this case, the start of purchases may be delayed until the opening of a new quarter, or the next announcement on the assignment of the monitoring tag.

The main long-term support is 0.035, a hike below which is possible only under extraordinary circumstances with the withdrawal of ether by 1,500, the dominance of alcoins by 7.5% or the assignment of the monitoring tag. Given the current oversold conditions and high targets, assigning the tag will only give a temporary departure below 0.035 with further growth to 0.075, similar to vidt.

In addition to vib, among coins without the monitoring tag, so far I am considering only pda with a possible new wave of growth, especially if the tag is not assigned in the new month.

The coins that already have the monitoring tag are the most oversold on binance, due to which they have shown good growth impulses in the last two weeks against the background of attempts to reverse the quarter. Before the next delisting announcement, there is time for new waves to reverse the current quarter under an optimistic scenario, as vidt shows, and a pullback already in the new quarterly candle. The most interesting scalping companies among this group today are uft troy alpaca with a growth potential of up to 100%+ and cream nuls with a possible growth of up to 50%+.

ETHUSD ETHEREUM Long in short termVery hard week for ETHEREUM:

In my opinion eth has a good chance at this level to climb higher

It has nearly brokeen every possible support,but nobuilding signs of deivergences.

The strategy is short term

Never the less ,Trump´s policy is not good nor for crypto neither for other markets.

And thereforwe should think only in short term,taking chances.

On monday /tuesdays positive ton of the white house,on wed/ to Friday aggressive tons,at the weekend then again taming tone of the white house.

This will accompany us until 2029.

Ofcourse it wont be easy.For no one.

Therefor i make 5-10 different strategies,different apporches.

In case the profit targets hit,then its is ok.If not I immediately cut the positions.

STop is below themajor support.

If that level breaks,ETH will potentially fall to 1100-1250. Idont hope,that it happens.But these days,I expect always the unexpected.You may do this,too.

Position sizing: depends on your risk appetite.

I would use stops in any case....Good luck

Jambo update!!BYBIT:JUSDT.P

An update on jambo, i pasted the screenshot of my first interest on the chart so you guys get a better idea of what im talking about. I would keep this in mind as it gives a good example of what patience looks like.

We are down at a price that looks great, now it would make sense to wait for a reaction at this deep support zone on the weekly chart... if the 4hr from here reacts nicely, ill be watching for a retracement to snipe from the 15m.

Ill update again, I've only got two outcomes!!

Ethereum’s Rebound: V-Shaped Surge to an October 2025 PeakI have come today with a new ETH perspective, one that I think is more accurate than my last ETH TA.

Take a look here at how I got this one wrong, mainly because I was counting too much on this diagonal support to hold. Why didn’t it hold? Because there were too many traders looking at it, and when too many people are watching, the opposite happens, and it breaks.

I would advise looking at this TA first before you carry on with this one because the two tie together neatly.

My view is that from here, we will start a V-shaped recovery that will send ETH to $15,000–$18,000 by mid-October 2025. There is a very interesting fractal playing out that I discovered.

So, my alarm went off with this "Wyckoff Spring" indicator. It has only fired off two other times in history: once at the bottom of the COVID crash and the other time at the December 2016 bottom when ETH was just $8. So, I thought, well, let’s take a look to see if the first cycle has anything interesting.

As soon as I flipped to the daily chart, I immediately saw similarities. What if ETH is forming the fractal from the first cycle before the massive run-up? The timeframe and the drawdown percentages are nearly the same, the fractal is nearly identical, and the fact is, the Wyckoff Spring has fired off now, forming this fractal like in 2016. What are the chances…?

When you overlay the fractal, it lines up with mid-October 2025.

I have scanned the entire history of ETH, and I cannot find a fractal closer to this one. This could very well be the pico bottom for ETH this year.

BTC - What's next BTC Update – March 28, 2025

Quick update on where BTC is at and what I’m watching next.

We finally broke out of that daily downtrend — nice little shift in structure. Price is chilling around $85K right now, sitting just below that FWB:88K –$90K resistance, which is still a pretty strong zone to crack.

Key Levels I’m Watching:

🔴 Major Resistance:

FWB:88K –$90K – First big test. If bulls push through this, could get spicy.

$100K–$105K – Big macro level. Expect sellers to step in heavy here if we make it that far.

🟢 Major Support:

$75K–$78K – Solid higher timeframe support zone. Great bounce area if we dip.

$70K – 2021 ATH retest level. Would still be macro bullish unless that breaks.

🟡 Local Zones:

$84K – Acting as intraday support for now. Holding this could lead to a push higher.

GETTEX:82K – Another local support. If that breaks, next stop is probably mid/high 70s.

What I’m Thinking:

As long as we hold $84K, we’ve got a shot at pushing into FWB:88K –$90K again. Break that and it’s game on toward $100K+. But if we lose $84K and especially GETTEX:82K , I’m watching for a retest of the $75K–$78K zone. That’d still be a healthy pullback, nothing to panic about.

All in all... structure looks solid, levels are clear, let’s just stay patient and let price do its thing. I’ll keep you all posted if anything major changes 🔔

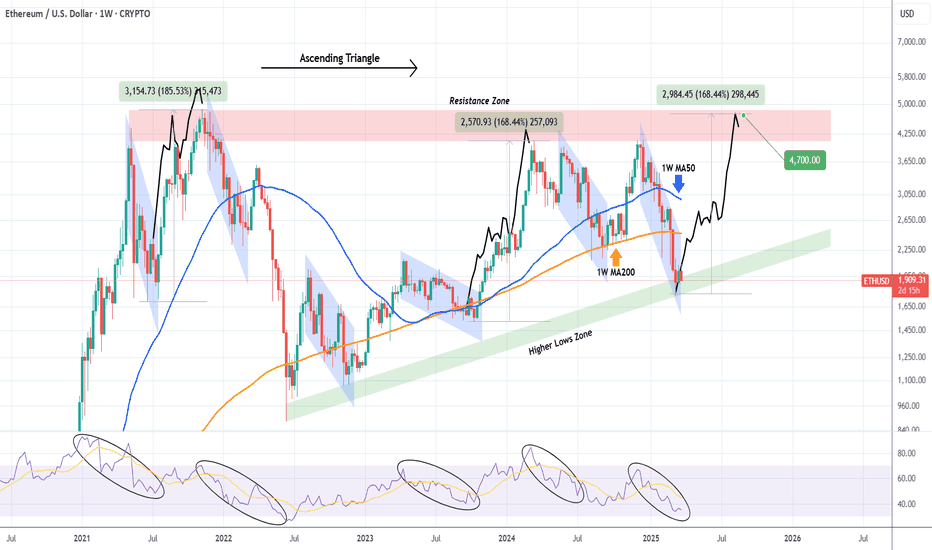

ETHEREUM Ascending Triangle bottomed and is targeting $4700.Ethereum (ETHUSD) hit 2 weeks ago the bottom (Higher Lows Zone) of its 4-year Ascending Triangle pattern, following the recent 3-month correction. That correction has technically been the pattern's Bearish Leg and during those 4 years we've had another 5 similar to this, all with the exception of one, producing a Higher High.

This is actually more similar to the October 09 2023 and June 21 2021 bottoms, so at worst we should get a +168.44% rally from here that will interestingly enough test the Triangle's top (Resistance Zone) a $4700.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Ethereum targetting 1,912$ or 1,776$I see here 2 possibilities.

First look at the uptrend break and retested. Therefore, it may drop to a lower Fibonacci level which is 1,912$

The other option is the triple top formation target which is around 1,776$

* What i share here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose all your money.

The Global BTC Shake out is coming before 1 million BTC in 2037I believe it worth stating that we might be in a moment where bitcoin is gonna shake everyone out and make everyone sell or at least all those who think 1 million BTC is coming soon. The great Bitcoin reset cycle will occur eventually before true mass adoption... we could very well retest $15,000 as bottom sometime next year.. if true BUY and hodl and invest consistantly for a whole decade and reap the reward of a 1 million bitcoin probably in 2037-38 and Bitcoin by then will be nearly on par with golds market cap by then or below it. And youll become among the weathiest of the wealth.

ETH - Will the support hold ?CRYPTO:ETHUSD (1W CHART) Technical Analysis Update

ETH is currently trading at $2007 and showing overall bullish sentiment after hitting the support. We are seeing minor retracement from the support zone. If this support holds we can expect bullish trend and reach the resistance around 4k. New ATH for ETH depends on breaking the resistance around previous ATH.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

ETH - As long as the $1,950 holds...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After breaking above the $2,000 level, ETH has been overall bullish trading within the rising orange channel.

Moreover, it is retesting as strong support zone, so we will be looking for longs as long as the $1,950 level holds.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower orange trendline acting as a non-horizontal support.

📚 As per my trading style:

As #ETH approaches the blue arrow zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

$NASDAQ420 May Be Set for 1000% Surge Amidst Falling Wedge The price of Nasdaq420 ($NASDAQ420) coin may be gearing up for a massive price surge amidst a steep falling wedge pattern. The token Nasdaq420 ($NASDAQ420) created on the Ethereum blockchain is a metaphysical evolution of the Nasdaq100, harnessing vibrational energy to manifest the community's truest desires.

The asset since creation surge to $15.51 million in market cap before consolidating to $1.59 Million in market cap. Albeit not listed on any CEX, the token's price chart depicts a bullish reversal is brewing with a 1000% surge in sight. With the tokens immediate competitor $SPX6900 performing brilliantly well, Nasdaq420 ($NASDAQ420) will be poised to mirror such moves and bring light to its project and the community.

With the Relative Strength Index (RSI) at 53 Nasdaq420 ($NASDAQ420) has been holding the bears for long in the $1 million market cap support zone. With an active community of 2600 on Telegram, 2972 on X (formerly Twitter), Nasdaq420 ($NASDAQ420) might just be the next gem in the Ethereum memecoinomy.

Nasdaq420 Price Live Data

The live Nasdaq420 price today is $0.001593 USD with a 24-hour trading volume of $14,041.94 USD. Nasdaq420 is down 2.82% in the last 24 hours, with a live market cap of $1,593,336.2. The circulating supply is 1,000,000,000 NASDAQ420 and the max. supply is 1,000,000,000 NASDAQ420.

The key is whether it can rise to 2271.0-2356.31

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The April TradingView competition is sponsored by PEPPERSTONE.

Accordingly, we will look at the coins (tokens) and items that can be traded in the competition.

I will talk about the ETHUSD chart.

--------------------------------------

(ETHUSD 1W)

If you look at the 1W chart, you can see how important the current price position is.

If it continues to decline this time, it is likely to fall to around 1337.54.

Therefore, the key is whether it can maintain the price by rising near the Fibonacci ratio of 0.236 (2089.91).

In order to turn upward on the 1W chart, it must rise near the Fibonacci ratio of 0.382 (2646.14) and maintain the price.

-

(1D chart)

Since the HA-Low indicator on the 1D chart is formed at the point of 1935.88, the key is whether it can receive support and rise near this area.

If it does not and falls below 1871.55, it is highly likely to fall to around 1626.95.

-

The M-Signal indicator on the 1W and 1M charts is passing near the Fibonacci ratio of 0.382 (2646.14).

Therefore, in order to turn into an uptrend, the price must rise above the M-Signal indicator on the 1W and 1M charts and be maintained.

To do so, we need to see if it can naturally rise above the M-Signal indicator on the 1W and 1M charts while maintaining the price by rising around 2271.0-2356.31.

However, in order to continue the uptrend, it is expected that the price must rise above the Fibonacci ratio of 0.382 (2646.14) and be maintained.

-

If the OBV does not rise above the upper line of the price channel and show an uptrend, it is likely that it will be difficult to sustain even if an uptrend appears.

The StochRSI indicator is showing a downward trend in the overbought zone.

Therefore, if the StochRSI indicator turns upward again and maintains the price around 1935.88, it is expected that it will lead to an attempt to rise to around 2271.0.

Therefore, when the competition started,

- If the StochRSI indicator did not turn upward,

- If the OBV did not rise above the upper line and showed an upward trend,

- If it did not receive support near 1935.88, it is expected that the SHORT position would be advantageous.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems that it has been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point of interest is whether they can be supported and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio of 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

ETHEREUM Is $14000 even possible??Short answer? Yes it is.

Ethereum / ETHUSD is trading inside a 7 year Channel Up and lately has found itself under the 0.618 Fibonacci retracement level for the first time since November 2020.

This is technically a temporary overreaction like the bullish breakout over the 0.382 Fib in March 2024.

Based on the final year rallies inside this Channel Up, we can clearly see that, though very optimistic, $14000 is within reach and won't even be at the top of the Channel Up.

Follow us, like the idea and leave a comment below!!

ETH Chart - SECRET in the INVERTETH is losing ground quickly after a nasty bearish pattern formed in the weekly.

The bearish M-pattern we're currently observing in the macro timeframe:

We know this is a bearish patter, not only because we've seen it many times before but also because it is the opposite of the W-Bottom. (we can actually confirm this by flipping the chart):

In this case, the bullish confirmation would have been a support retest of the neckline:

And so, if we flip it again back to the original view - the opposite can be true. As we get rejected on the resistance line, an even lower price is likely:

____________________

BINANCE:ETHUSDT

Solana (SOL) 22.03.2025In the near term, Solana (SOL) is showing a desire to return to its price channel, but further asset allocation is likely to be delayed until the summer of 2025. Despite the possible optimistic outlook for growth, it is worth preparing for corrective moves in September. SOL is among the three assets where market makers are already active, which may indicate artificial liquidity maintenance or position accumulation.

Significant growth is likely to be expected in Ethereum (ETH), while recent momentum is more likely to manifest itself in Bitcoin (BTC) and Solana (SOL). The long-awaited altcoin season may start soon, which requires investors to be more selective. It is recommended to reallocate capital from fundamental assets to high-risk instruments with growth potential, keeping a balance between risk and return.

Special attention should be paid to the Solana ecosystem, where promising projects such as PRCL are already present, which emphasizes the technological and investment attractiveness of blockchain.

Alex Kostenich,

Horban Brothers.

Ethereum ETH Will Crash After Small PumpHello, Skyrexians!

Recently we have already told that potentially BINANCE:ETHUSDT has been finished the correction and is ready to reach $7-10k, but today we recalculated waves and can tell that one more leg down will happen with the high probability.

Let's take a look at the daily chart. Minimum Awesome Oscillator wave tells us that recent dump was only wave 3. Now asset is in wave 4. When AO crosses zero line it means that the min requirement for the wave 4 has been complete. At this point price shall reach the target area at 0.38-0.5 Fibonacci approximately at $2600. There we have to be very careful and if will see the bearish divergent bar the wave 5 will come. The target is $1600.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!