OTHERS.D at important support, crypto rally coming?Upcoming period could be more positive?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting? Check my other analysis too.

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

ETH-D

TOTAL Marketcap at important support?Upcoming period could be more positive?

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

BTC trend support?Will BTC end its downtrend? Bitcoin coming to an important support level. If it breaks down further, a sharp decline may continue to other support, but if it holds at support (77500), the upcoming period could be more positive.

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

ONDObeen looking at this for a while... a strong and must to be added on spot portfolio

structures across most of alts are invalidated... BTC and ETH are taking their key levels and we are in the final stage of capitulation

will reupdate all the charts (I'm holding) after the dust settles

Bull Run isn't over... wait for consolidation and we can have our alts rally in a few weeks

(ETH) ethereum "nft land"I was recently looking into NFTs on Opensea and while doing so I noticed there are far more NFTs from people based on the Ethereum blockchain compared to the other offerings on Opensea. Even though Solana (SOL) is on the forefront of popularity with Meme projects Opensea does not offer an exclusive Solana chain to provide NFT ideas. Hence, there is not an easy way to compare to amount of Solana projects to Ethereum projects being built, developed and/or offered. It would be interesting to see the comparison of NFTs on Solana versus Ethereum. Ethereum reduced their transactions with a transition to Proof-Of-Stake and since then the number of Ethereum NFTs must be growing. While the news is on a constant watch for new meme projects, tokens, the Opensea network for many other blockchains is not growing as nearly rapidly as Ethereum.

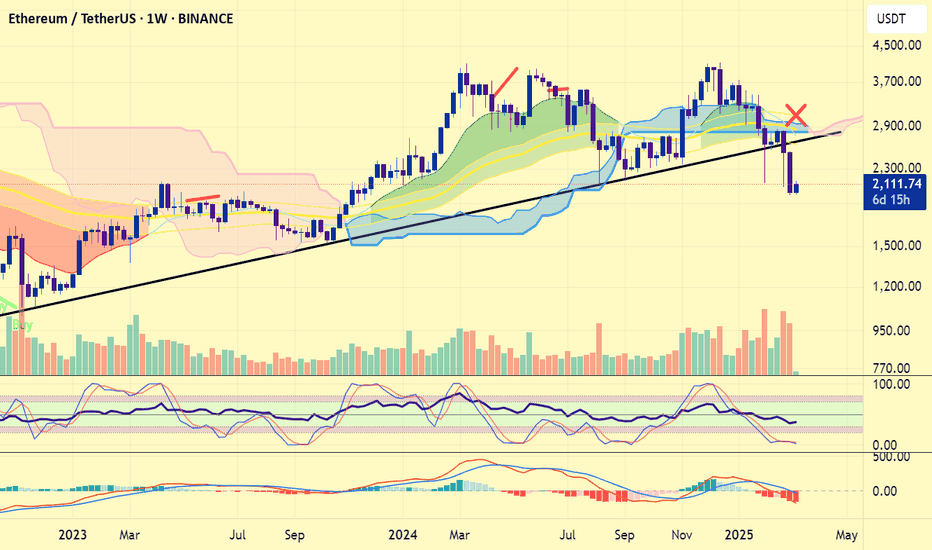

ETHEREUM price is alarming...#ethereum price has closed a weekly candle below 3 years of trendline for the first time!.. This is the one negative only. The other fact is, #eth price has already declined from the weekly ichimoku cloud and lost support. These must not be underestimated. I' ve warned you about CRYPTOCAP:ETH price structure weakness weeks ago.

What' ll be next? Allrigt. ETH has took support this zone and is now testing 2000 usd support zone. To avoid this sign of "major weakness", #eth price must immediately reclaim 3000 usd and above with monthly candle close. With this weekly close, it' s now getting harder to shelter the trend reversal. For now 2000 usd moderate and 1450 usd are now strong support zones for #ethusd .Otherwise, things will get more serious in mid term. Not financial advice. DYOR.

Bitcoin will make a Breakout Chart Analysis:

1. Timeframe and Price Context

Timeframe: 4-hour chart (each candlestick represents 4 hours of trading).

Price Levels:

The current price is $92,812.72, with a slight decrease of 0.23% as of the latest data point.

The price range on the chart spans from approximately $80,000 to $108,255 (the recent peak).

Trend Overview:

Late 2024: Bitcoin experienced a strong uptrend, peaking near $108,255.

Early 2025: The price has corrected downward, forming a descending triangle pattern, with the current level at $92,812.72.

2. Key Patterns and Annotations

Descending Triangle:

The chart features a descending triangle pattern, a common consolidation pattern that can signal either a continuation of a downtrend or a reversal.

Upper Resistance: A horizontal resistance line around $108,255 (the recent peak where the price failed to sustain higher levels).

Lower Support: A descending trendline (sloping downward) that the price has been testing, currently near $92,000-$93,000.

The price is nearing the apex of the triangle, suggesting an imminent breakout (upward or downward).

Accumulation Zone:

The chart labels an "Accumulation Zone" near the $80,000-$85,000 range, indicating a potential area where large players (e.g., whales) may have been buying during the correction.

The current price ($92,812.72) is above this zone, suggesting a bounce or stabilization after reaching this support.

Breakout Prediction:

An upward arrow with a Bitcoin symbol points toward $120,000 or higher, indicating a potential bullish breakout targeting a new all-time high.

3. Support and Resistance Levels

Support:

The $92,000-$93,000 level is acting as immediate support, aligning with the lower boundary of the descending triangle.

The $80,000-$85,000 accumulation zone is a stronger support level, likely a key area of buying interest during the correction.

If this support fails, the next level could be around $75,000 (a psychological and historical support).

Resistance:

The $108,255 level is a major resistance, marking the recent high.

The next significant resistance could be around $120,000 (as suggested by the arrow), a psychological level and a potential new all-time high.

4. Volume and Momentum (Not Visible but Inferred)

Volume bars are not clearly visible, but typical behavior suggests:

Volume likely peaked during the rally to $108,255 and decreased during the correction as selling pressure eased.

A breakout would require a volume spike to confirm, especially if the price breaks above the descending trendline (around $100,000-$105,000).

Momentum indicators (e.g., RSI or MACD) could indicate if Bitcoin is oversold or showing bullish divergence, supporting a reversal.

5. Potential Scenarios

Bullish Breakout:

If Bitcoin breaks above the descending trendline (around $100,000-$105,000) with strong volume, it could confirm the breakout.

The target of $120,000 (a ~29% move from $92,812.72) is plausible, especially if whale accumulation in the $80,000-$85,000 zone drives momentum.

This aligns with the upward arrow and suggests a resumption of the prior uptrend.

Bearish Breakdown:

If the price fails to hold the $92,000-$93,000 support and breaks below, it could signal a bearish continuation.

The next support at $80,000-$85,000 would be tested, potentially leading to further downside toward $75,000.

Consolidation:

If the price remains within the triangle (between $92,000 and the descending trendline), it might continue to consolidate until a catalyst (e.g., market news, volume surge) triggers a move.

6. Market Context

Whale Activity: The accumulation zone at $80,000-$85,000 supports your earlier narrative of whales accumulating during corrections to set up a breakout. This could indicate strategic buying by large players.

Market Sentiment: As the leading cryptocurrency, Bitcoin’s price heavily influences altcoins like Ethereum and UNISWAP (from your previous charts). A bullish breakout in BTC could trigger similar moves in the broader market.

Timing: The chart’s position near the triangle’s apex suggests a breakout could occur within days to a week on a 4-hour timeframe, depending on market conditions.

ETHUSD The Week Ahead 10th March '25

Ethereum (ETH/USD) remains in a bearish trend, aligned with the longer-term prevailing downtrend. The price action suggests continued selling pressure, with critical resistance and support levels defining the next move.

Key Technical Levels

Immediate Resistance: $2,490 (previous support, now acting as resistance)

Major Resistance Levels:

$2,634

$2,785

Key Support Levels:

$2,100

$2,016

$1,906

Bearish Scenario: Rejection at $2,490

If ETH fails to break above $2,490, it would confirm the resistance level’s strength.

A bearish rejection from this zone could lead to renewed selling pressure.

Downside targets include $2,100, followed by deeper support at $2,016 and $1,906 over the longer timeframe.

Bullish Alternative: Breakout Confirmation

A daily close above $2,490 would invalidate the immediate bearish outlook.

A sustained breakout could trigger an upward move toward $2,634 as the next resistance level.

A continuation of buying momentum could lead to a rally toward $2,785, reinforcing a potential shift in market sentiment.

Conclusion

ETH/USD remains bearish unless it can reclaim and hold $2,490 as support. A rejection from this level could extend the downtrend, while a breakout above resistance would signal a potential trend reversal. Traders should monitor price action closely around these levels for confirmation of the next move

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

We are due a 2017 style ALT season.One for the memory banks!

Now

do we actually get what we are "owed" ?? :)

We don't know

and nothing is owed to us of couurse

But

Selling too soon could be quite disastrous... as many peopleI speak to say to me 5X - 10X I am out..

Which may be prudent

If you are out. Stay out and don't FOMO back in again near the tops

So it's best to scale out in my opinion

last cycle was a quite difficult Alt season ... some bag holders actually did not get to experience any euphoria

Hence why I am leaning to an exsplosive alt season

BTC at $70k doesn't feel euphoric

so what will it take?

And Then One Time Bitcoin Went From $30k To $30 MillionNever say never! I know it sounds crazy but what if this whole bitcoin move that we saw from inception to today was one giant cycle? What if this is the bottom of a larger cycle and we are about to see numbers that no one could ever even imagine are possible? What if everyone who is predicting Bitcoins's next move is near sighted and need to zoom out allloot further and see the larger cycle? What if Im crazy? Its all possible, and that would put Bitcoin's market cap at $600 TRILLION. Not impossible in my opinion. This is just my opinion and a wild one at that so dont take this as any sort of financial advice, Im just having fun here. Good luck out there.

Ethereum at Key Support Zone: Is a Counter-Trend Setting Up?Ethereum (ETH) is currently in a strong bearish trend 📉, but it has traded into a key support zone 🛑 and seems overextended, in my opinion. Looking at the price action and market structure on the daily and four-hour timeframes, we’re now seeing Ethereum form higher highs and higher lows on the four-hour chart 📊. While it’s still early, if we see a break above the current range high on the four-hour timeframe, there could be an opportunity for a counter-trend trade 🔄, targeting equilibrium ⚖️ and a previous imbalance highlighted in the video. As always, this is for educational purposes only and should not be taken as financial advice 💡.

ETH Monthly Massive Trianglejust noticed this and ETH on the monthly just retested it's previous high before the base of the run up, this is common but tested once as a wick earlier. Measured move and I used the fib extension tool 6.18s are yellowed, the base is blue, so a buy are is now, and then the triangle time line is 75 bars measured from the first wick from base trend line to upper trend line. dates back to last bull run on the monthly. Most triangles break out at about 66% so that's 50 bars July 1 from either the top or bottom that's the vertical red line. With RWAs on ETH built projects, some elsewhere but evm and Solana AVAX a front run 9K ETH is really not out or the question

almost forgot important

indicators

rsi trying to turn up

volatility hearing up

but stich and jewel heading downward

some more down may be in store

waiting on Hash ribbon BTC indicator on daily to flash a buy middle month new moon maybe crazy but bull full moon is the illuminati of Bitcoin Bat Signal to buy world wide now that's deep lol

Ethereum Update: $30,000 New All-Time High TargetDo you recognize this chart? It is the same chart, a simple chart. Ethereum is giving it all away. What one does, the rest follow. Ethereum is trading at $2,222.22 and the low happened at $1,990. Do you what this means? The bulls are in.

Good day, Saturday, moving to Sunday and doing great.

I hope you are having a wonderful day today, tomorrow, yesterday now and always.

The daily session is full green. (I love Ethereum.) The action is happening at the top of the candle/session, the same for the 2D timeframe which we are using today. This is a simple update. All I need to say is that market conditions stay the same. Bullish. Bullish. Bullish. We are going up next.

It takes time, a few days. But a few days means a few hundreds dollars higher.

It takes time, a few months. But a few months means several thousands dollars more.

It takes time, long-term. Ethereum will be trading above $10,000, maybe even above $20,000 to peak at an astonishing $30K. Wait, what? Yes...

Open the doors because we are going up, Cryptocurrency is here to stay.

The beginning is over Crypto is now a mature young boy and growing everyday. No longer a baby, no longer a child but soon to become an adult. We are face to face with the biggest growth spur for Crypto; Ethereum and Bitcoin.

We are going from childhood to adulthood, acceptance throughout the whole world. This means trillions of dollars worth of market cap. This means a better world.

A new means to exchange value. A technology for the future.

Money for the new generation. Money for generations to come.

In short, Crypto is going up.

Ethereum's chart continues to be bullish and current price action indicates consolidation before additional growth. Long-term support remains intact. Any trading above $2,000 is ultra good and bullish. If ETHUSDT ever moves lower, which is hard, this is a great opportunity to buy. If anything drops for a few minutes or for some hours and you have the great opportunity to be present in this event, buy-up and buy fast, because as soon as it drops it will recover the same day.

There is no drop. It is going up. Short, mid and long-term.

Hopefully, $30,000.

Thank you for reading.

Namaste.

Ethereum. Squeeze. Soon.Despite the growing narrative surrounding Ethereum's supposed decline, our analysis suggests that the asset is positioned for a potential revival. This contrarian signal presents an attractive opportunity for forward-looking investors. Notably, institutions with strategic foresight, such as those aligned with Trump-related entities, have recognized this potential. For instance, World Liberty Financial has allocated over 50% of its balance sheet to Ethereum ( CRYPTOCAP:ETH ), underscoring confidence in its long-term value proposition.

Technical Analysis

From a technical perspective, Ethereum’s price action exhibits constructive patterns that align with bullish expectations:

The completion of five distinct Elliot waves indicates a potential shift toward upward momentum. This structure often precedes significant price movements, suggesting Ethereum may be poised for a rally.

The ETHBTC trading pair demonstrates relative strength, signaling Ethereum's outperformance against Bitcoin. This divergence is a key indicator of capital rotation favoring Ethereum.

Recent price action reveals a bullish engulfing pattern, a classic reversal signal that highlights increasing buying pressure. This pattern reinforces the likelihood of upward movement.

Based on Fibonacci retracement analysis, Ethereum’s price is targeting key resistance levels at the 0.618 and 0.786 Fibonacci zones. These levels are supported by volume analysis, which confirms institutional interest and liquidity inflows.

In summary, Ethereum’s technical indicators, coupled with its strategic importance in the blockchain ecosystem, present a compelling case for accumulation. While market sentiment remains divided, contrarian positioning—supported by robust technical analysis and institutional adoption—suggests that Ethereum is well-positioned for a resurgence. Investors should consider this asset within a diversified portfolio framework, balancing risk and reward in alignment with long-term growth objectives.

Alex Kostenich,

Horban Brothers.