Is Your Altcoin on the Chopping Block?-Update: Originally posted on July 8, 2025… but swiftly vanished into the void by a moderator (rookie mistake—I neglected the sacred posting rules). Turns out, publishing has rules… that I did not interpret accurately?

To my loyal circle of 5 followers: if this feels like déjà vu, my sincerest apologies for the rerun. But with the winds shifting and the drums beating for alts season, I figured it was worth a resurrection.

Let the thrills—and the calls—begin. 🎭📈

Whenever you see “-Update:” that’s the latest as of today — 07/18/25.

Is Your Altcoin on the Chopping Block? 🪓

Brace yourself—this might sting.

Odds are, your favorite altcoin is walking a tightrope. And while I’m not here to spread doom, I am here to give you a wake-up call. Don’t shoot the messenger.

TradingView recently dropped a chart that cuts through the noise: Total3ESBTC.

It’s a ratio of the Total Crypto Market Cap (minus BTC, ETH, and stablecoins) to Bitcoin.

Translation?

👉 A clear, undistorted look at how the altcoin market is actually doing—without ETH clouding the view or stablecoins muddying the waters.

Think of it like night-vision goggles for spotting altcoin strength—or weakness—in the shadows of BTC dominance.

Perfect tool to sniff out market rotation—that sweet spot where Bitcoin hands the baton to alts or rips it back.

So why should you care?

Because the writing's on the wall... and most altcoins might not survive what's coming.

Let’s break it down:

ZOOMED OUT – MONTHLY VIEW 🔭

Before every major altcoin run, there’s always a major low.

You’ll notice three big ones:

🔴 March 2017 (Pink Line)

🟣 Dec 2017 (Purple Line)

🟢 Jan 2021 (Green Line)

Yes, some individual alts have pumped. A few even went full parabolic.

But if altcoins as a whole were ready to fly? They would've taken off already.

-Update: Yes, they finally did it this week… but hold that excitement—there’s more to the story.

Instead, the altcoin ratio broke a critical support (White Line) back in May... and even closed below it. That’s not bullish—it’s a red flag flapping in the wind.

– Update: We just sliced through that white line, but for most alt’s to stay strong, we need a monthly close above it.

Strangely enough (or coincidental, if you believe in coincidences) ...

🗓️ All the major altcoin market highs happened in MAY.

Not once. Not twice. Every. Single. Time.

🔴 May 2017

🟣 May 2018

🟢 May 2021

Call it coincidence. Call it cycle magic.

Maybe it’s a message from the crypto gods—and they don’t whisper for no reason.

So if we just had another May, and the ratio is still sliding with no reversal in sight… ask yourself:

Was that the high?

Or are we still heading toward the low that resets the board?

Here’s the hard pill 💊

If altcoins are ever going to go up again, odds are they’ll need to hit one of these historical lows first.

That’s not a prediction. It’s just how the markets have moved before major alt run.

📉 That means more pain ahead.

We’re talking potential drops of:

🔻 -32% to revisit Dec '17 levels

🔻 -51% to retest Jan '21 lows

🔻 -85% if we go full wipeout to March '17

Harsh? Yeah.

But better you hear it now than wonder “what happened?” when the floor caves in.

The worst part?

Most won’t believe this until it’s already too late.

-Update: Those lows haven’t been tested yet—might be wise to hold off on loading your bags to the brim. Patience pays.

Now here’s the uncomfortable twist:

There’s a legit case to be made that we may never see another “real” alt season again.

Why?

🪙 Liquidity is being siphoned by stablecoins

📈 Speculation is migrating to AI stocks

⚠️ Risk appetite is narrowing

Altcoins used to be the Wild West. Now? They’re the illiquid backyard of a global casino.

BUT… Let’s put on our degen-tinted glasses for a second.

Suppose the Fed hits the panic button:

🛩️ Rates cut

💸 QE returns

🚁 Helicopter money rains from the sky (not that they’d ever do that… right?)

– Update: Crypto Week is announced and broadcasted to the herd.

What happens then?

That’s when this chart—this ugly, broken, bleeding chart—might finally spring back to life.

– Update: Clearing those lows would’ve made this week feel a lot more convincing. But if you’re looking for signs of life—ETH/BTC chart might just be lighting the way. 🚀

Stay Sharp! 🐋R hUNTING!

THIS IS NOT FINANCIAL ADVICE. FOR EDUTAINMENT PUPOSES ONLY.

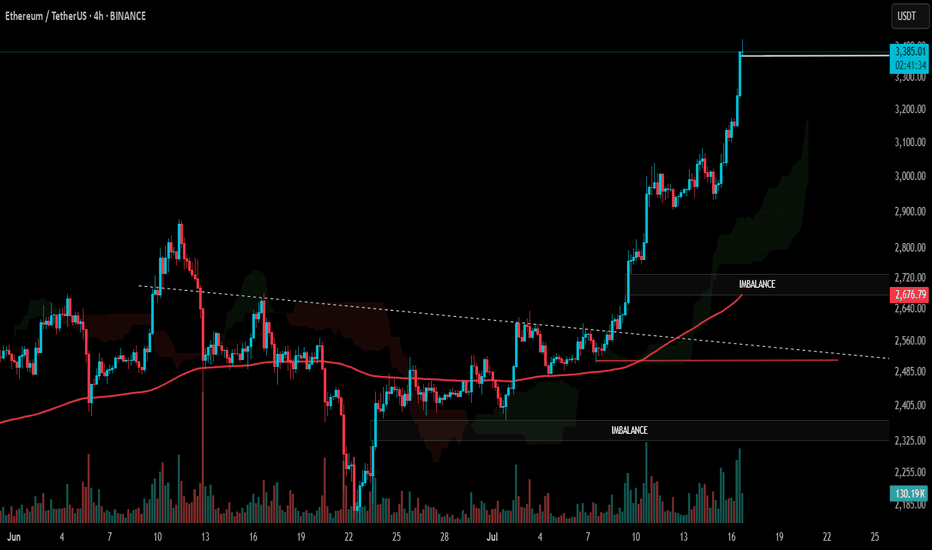

ETH-D

Is ETH Season Officially Here? 🚀🐾 Ethereum Breaking Out – Is ETH Season Officially Here? 📈💥

Ethereum is showing strength across the board — outperforming Bitcoin, reclaiming trendline support, and eyeing a possible breakout continuation. While macro narratives swirl (crypto legislation, rate cut vibes, political tailwinds), ETH is finally doing what ETH does best — lead.

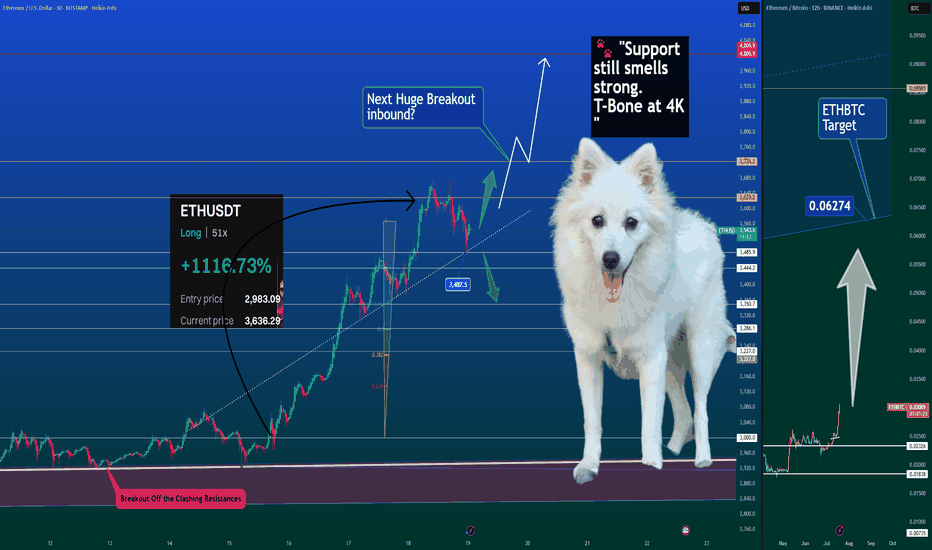

📊 Chart Breakdown:

ETHUSDT is respecting the dotted trendline off the breakout.

Price is hovering around $3487 support, an area that aligns with Fib retracement and the last impulse base.

If bulls can maintain structure, $4000–$4050 is a natural magnet above.

📈 On the ETHBTC side, we’re aiming for the 0.06274 level — this ratio breakout is classic ETH season behavior, where Ethereum not only rises but pulls the rest of the market with it.

👀 And yes… even Elon my Dog is sniffing this one out:

🐾 "Support still smells strong. T-Bone at 4K." Then we go higher for the Cow.

📊 Order Flow Data Confirms:

Premium: Still slightly negative — market hasn’t fully rotated in.

Funding: Light and positive — sustainable, not euphoric.

Open Interest: Saw a soft reset — leverage was cleared out, opening room to rally.

Spot volume: Steady and supportive, not chasing.

🔥 +1116% ROI from the last long from $2,983.09. If you’re holding ETH — you’re holding the mic right now. Let's not drop it.

This could just be the beginning — and when ETH leads, the rest tends to follow.

Elon and the whole 🐶 Dog Team are on high alert. Breakout energy is thick.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

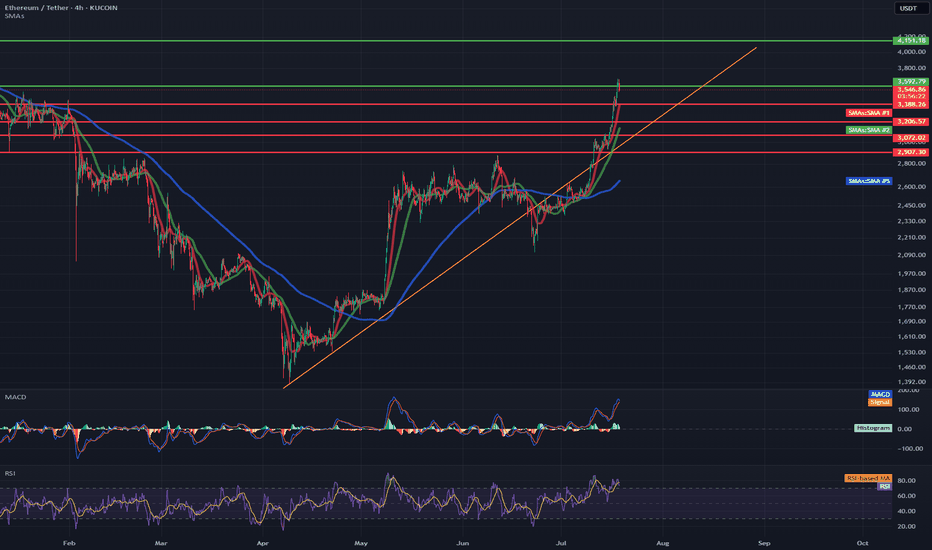

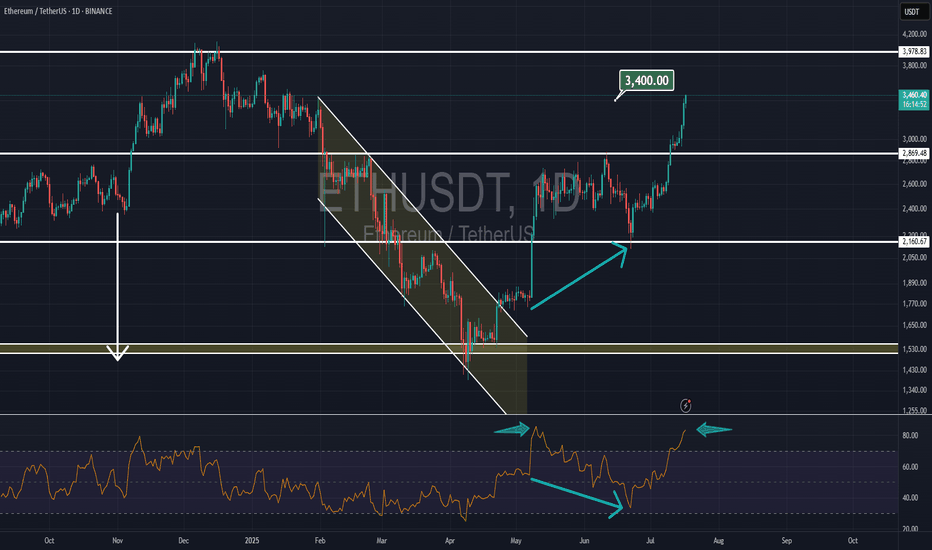

ETH/USDT 4H Chart✅ Market Trend and Structure:

Uptrend: The highlighted orange trend line shows continuous growth since mid-April. The price is trading above the 50- and 200-period moving averages (EMA and SMA), confirming bullish sentiment.

Current price: around 3556 USDT – very close to local highs.

Resistance break in the 3200–3300 USDT area, which now acts as support.

📈 Technical Levels:

Resistance (red horizontal lines):

3600–3650 USDT – local resistance resulting from market reaction.

3888 USDT – next historical resistance level.

4133 USDT – established long-term target (green dashed line at the top).

Support:

3300 USDT – strong support after a previous breakout.

3080 USDT – previous high, now the next support level.

3070 / 2900 USDT – key technical support levels in the event of a larger correction.

📊 Indicators:

MACD:

The MACD is in a strongly bullish zone, but:

The histogram is flattening.

A bearish crossover pattern is possible in the following candles – a signal of weakening momentum.

RSI:

RSI ~74 – is in the overbought zone, which often heralds a correction or at least consolidation.

A value above 70 confirms the bullish trend but may suggest that momentum is overheated.

📌 Conclusions and Scenarios:

🔼 Upside Scenario (trend continuation):

If the price remains above 3300–3350 USDT, it could move towards 3888, and then 4133 USDT.

A break above 3650 USDT on heavy volume will be a strong continuation signal.

🔽 Corrective scenario (short-term pullback):

The RSI and MACD suggest a possible correction.

Potential pullback to:

3300 USDT (retest of previous resistance as support).

SMA 200 (~2600 USDT) with a deeper downward move.

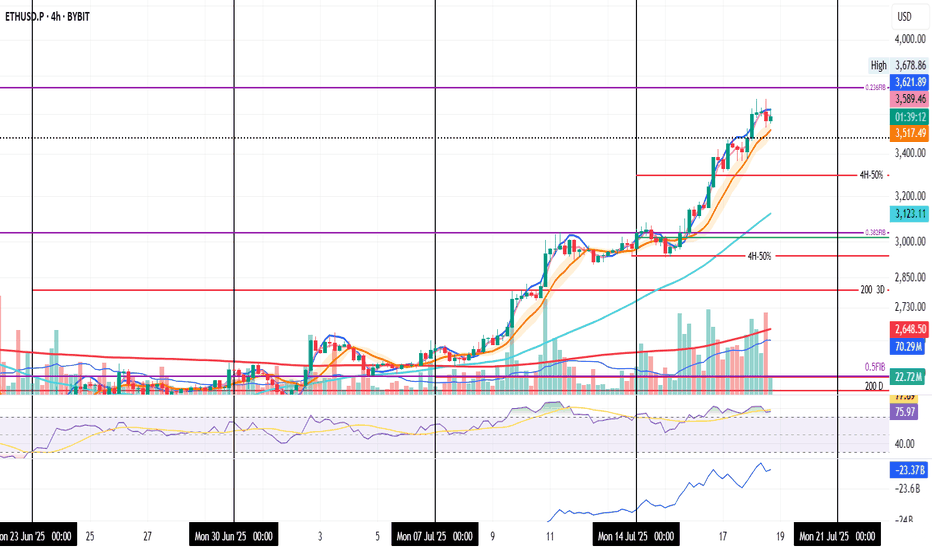

*ETH 4H — Charging the 0.236 @3700$ETH on the 4H is getting ready to charge the 0.236 Fib level.

MLR > SMA > BB Center — momentum is aligned.

Volume confirms the move.

Even though I don't enjoy it — and last time I sold just a part of the position too soon —

I placed a partial TP again. It needs to be done. The market can always turn.

We’ll be here to see it unfold.

Always take profits and manage risk.

Interaction is welcome.

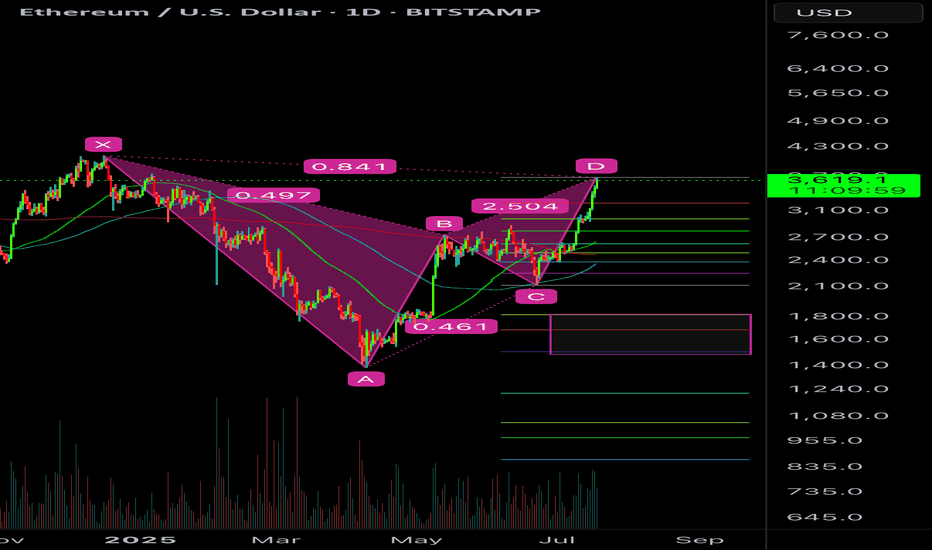

ETH BEARISH BAT POTENTIALETH can go slightly higher but it’s at/near the .886 retracement and meets a valid bearish bat pattern.

I would be targeting a full move if it is unable to break above the .886.

Too many euphoric here. The move has been really scammy off the hype news of Genius Act which everyone saw coming. Expect a sell the news event and BTC.D bounce would destroy alts for one last capitulation most alts may drop 40-50% from here. Then the real bull will start.

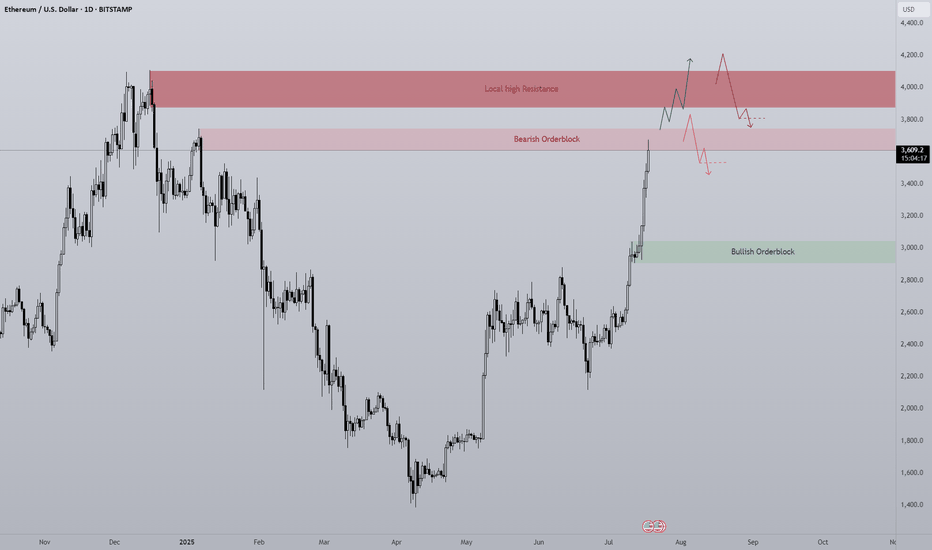

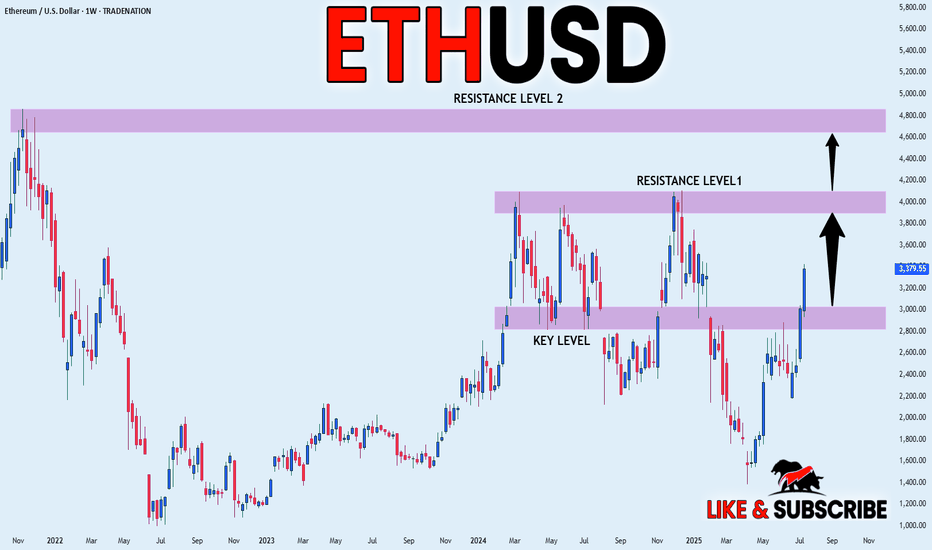

ETH 1D Overview Finally we are seeing altcoins regaining lost ground on Bitcoin and the second largest crypto by market cap is rallying strong.

Since ETH has such strength currently the opportunity to short is quite slim with high risk, however I think it's important to see where ETH may find some resistance or if a pullback was to happen, where would it come from?

The first level is the bearish orderblock level that has just been tapped as of writing. This area previously began the sell-off at the end of 2024 by confirming a new lower high. Naturally this area will present problems for the bulls and so a potential pullback could be initiated from this level. I would like to see a sweep of the stop loss positions just above the area and then a SFP to confirm the pullback is in motion.

Should the bearish orderblock fail the next clear level is the daily local top around $4000. A big even level and the area that started 5 months of downtrend. IMO the most likely level where longs will take profit. I do think if we see any form of consolidation between the bearish orderblock and the local high the bulls will look to carry the rally on, shallow pullbacks maintain momentum

Ten out of the last eleven days have been green candles with the only one day being red just above a key high, I expect if we are to get a pullback that bullish orderblock area ($2900-3000) to be retested as support. Therefor if any of the above areas initiate a pullback this area should provide support and therefor a long entry.

To clarify I am in no way bearish about Ethereum, this is just a plan for different eventualities.

DeGRAM | ETHUSD above the resistance area📊 Technical Analysis

● Price burst through the 12-week compression roof, converting the 2 990 supply into support and printing the strongest close since March.

● The pull-back just retested both the purple trend-fan and the 2 960 flip zone; the active rising channel and flag depth map the next magnet at 3 410.

💡 Fundamental Analysis

● SEC’s 12 Jul request for updated spot-ETH ETF S-1s hints at imminent approval, fuelling fresh inflows.

● Glassnode reports the largest daily net-staking deposit since April, reducing exchange float and adding bid pressure.

✨ Summary

Long 2 960-3 000; holding above 2 990 targets 3 110 → 3 410. Bias void on an H4 close below 2 860.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

ETH/BTC - Finally Trend is reversing - After a long time we are finally seeing a change in the trend of ETH/BTC pair.

- Compared to BTC, ETH was underperforming for last couple of years and we are seeing some strength in ETH

- If this trend continue we can finally see some new ATH on ETH

Entry: 0.02633

StopLoss: 0.02125

TP1: 0.02825

TP2: 0.03168

TP3: 0.03592

Don't forget to keep stop loss. Stay tuned for more updates

Cheers

GreenCrypto

#ETHUSDT #4h (Bitget Futures) Ascending channel on resistanceEthereum printed a gravestone doji followed by a shooting star, RSI is overbought, local top seems in.

⚡️⚡️ #ETH/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Short)

Leverage: Isolated (9.0X)

Amount: 5.0%

Entry Zone:

2996.99 - 3050.49

Take-Profit Targets:

1) 2864.25

2) 2744.02

3) 2623.80

Stop Targets:

1) 3157.46

Published By: @Zblaba

CRYPTOCAP:ETH BITGET:ETHUSDT.P #4h #Ethereum #PoS ethereum.org

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +47.5% | +83.3% | +119.0%

Possible Loss= -39.8%

Estimated Gaintime= 1-2 weeks

ETH vs 200MA: Another TestETH on the daily has been pushed back so many times by the 200MA. Will price conquer it this time? I guess we’ll just have to wait and see.

Today is Friday, July 4th, so probably a long weekend for most traders. Somehow, price got pushed back again. Just a hunch, but I believe long traders are touching grass this weekend while sellers are grinding.

Anyway, we now have a support zone under price, made up of the 200MA and the 0.5 Fib — which, in theory, should hold against any attempts to push the price lower this weekend.

Always take profits and manage risk.

Interaction is welcome.

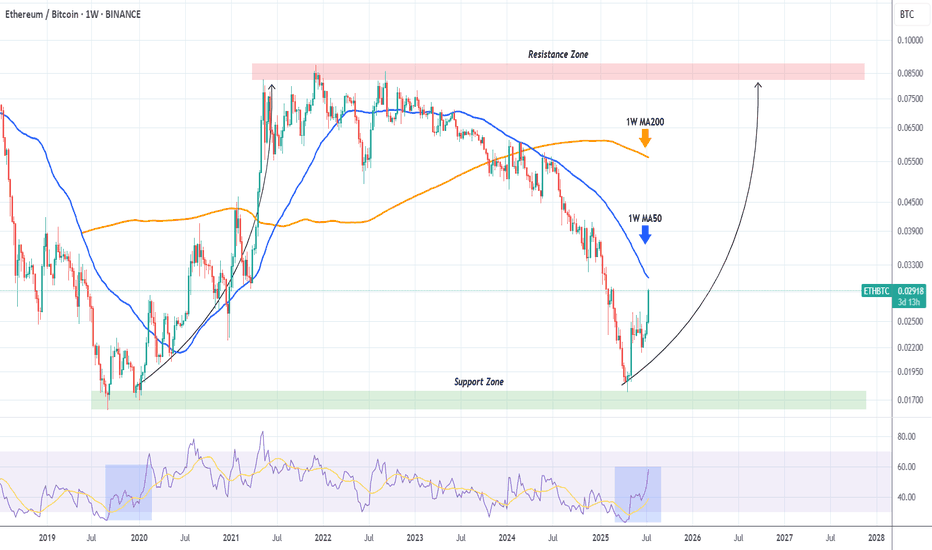

ETHBTC shows that Ethereum will outperform Bitcoin MASSIVELY!The ETHBTC pair has been rebounding hyper aggressively after the April 21 2025 Low on the 6-year Support Zone, and is now facing it's most important test, the 1W MA50 (blue trend-line).

This trend-line has been its Resistance since basically March 13 2023, so if broken, it will be a massive bullish break-out signal.

In fact during the 2020 - 2021 Bullish Leg, once the price broke above the 1W MA50, the market got the final confirmation of the upcoming long-term rally.

We expect Ethereum to outperform Bitcoin for the rest of the year at least.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ETHUSDT minor trendsEthereum BINANCE:ETHUSDT is downtrend with lower highs from the bottom is nearly finished 📉 . For a stronger rise, it needs to stabilize above $2500 ⚡. Mid-term targets are $3300 (end of second leg) and $3700 (major resistance) 🎯. Key supports are $2500, $2070, $1800, and $1550, the base where the uptrend began 🛡️.

Supports & Resistances:

Supports: \$2500, \$2070, \$1800, \$1550

Resistances: \$2500 (critical level), \$3300, \$3700

ETHEREUM Roara Map (1D)The previous phase of Ethereum appears to have been a completed diametric, and now it seems we are in a flat pattern.

It can be said that we are currently in wave B of the flat, which itself appears to be a diametric.

This diametric could even extend to the 4300–4800 range.

The green zone is the rebuy area.

A daily candle close below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

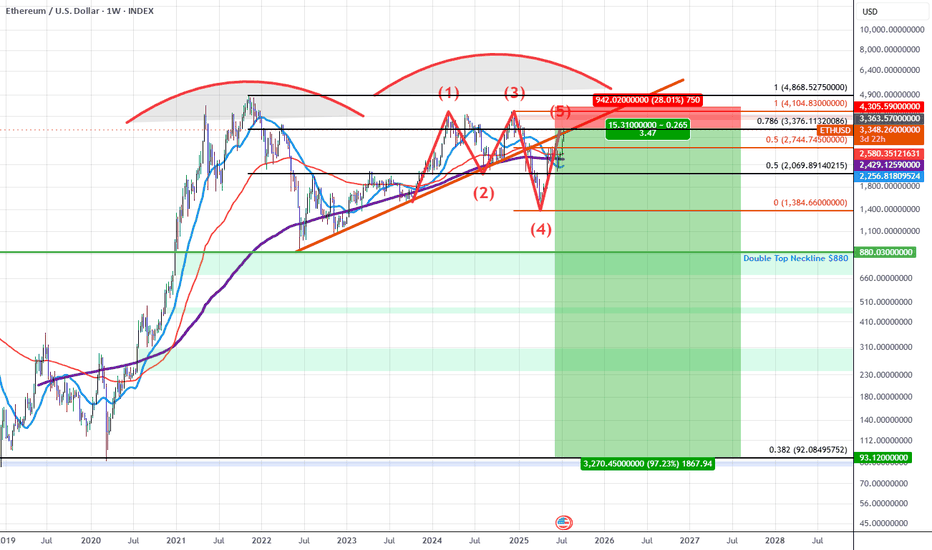

ETHUSD: Double Top into A Bearish 5-0 Breakdown (Extended)Updated Commentary: ETH has extended a bit further than projected as the Pattern Completed at the 0.618 but ETH gapped into the 0.786 instead. The gap up aligned with an upside gap fill on the CME futures as well as a gap fill on the grayscale ETH futures ETF $ETHE. The easier move from here to simply add to the ETH shorts and adjust the stop to be above the previous highs while sizing up at the 0.786 and playing off this gap higher as an anomaly. Beyond this, my view on ETH at the current 0.786 retrace remains the same as the original Idea posted as ETH rose into the initial 0.618 PCZ the details of which I will also include once again below as it still remains relevant.

ETH for the last 5 years has been developing a Double Topping pattern which has put in a series of lower highs during the most recent 2nd run up. As we've confirmed these lower highs we've broken down below trendline and are finding resistance at the trendline which happens to have confluence with the PCZ of a Bearish 5-0 wave formation near a 0.786 retrace.

As we begin to find weakness and Bearish price action begins I suspect price will make it's way towards the neckline of the double top aligning with the $880 price level if ETH breaks below that level there will be no significant support until it reaches the all-time 0.382 retrace down at around $92.10.

In short it seems ETH is in the early stages of a macro breakdown which could result in value declines greater than 80%.

I also suspect that we will see many of the assets that ran up significantly going into this week to sharply reverse those run-ups as this week comes to a close and the new week begins mainly due to the effects of OpEx, this includes: Bitcoin, MSTR, SOL, XLC, META, and BTBT. Long-dated Put accumulation on these assets at these levels is far easier to manage than naked short positions and that's how I will go about positioning here.

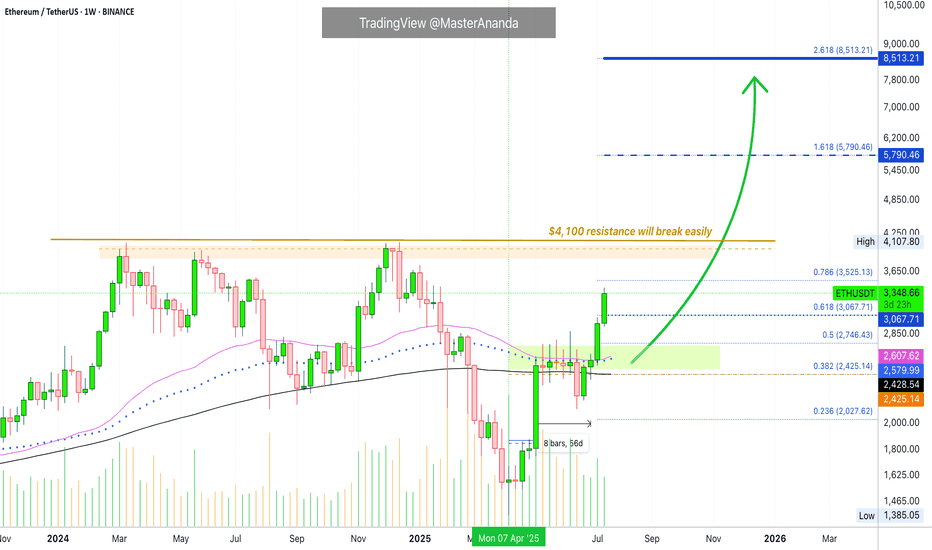

Ethereum · Going beyond $5,790 · $8,513 Next TargetThe eight weeks of consolidation, 56 days, happened as compressed (sandwich style) action right in-between MA200 and EMA55/89.

The EMA55/89 duo worked as resistance while MA200 worked as support.

Before a major move the market always tends to produce a form of shakeout. Sometimes it is call a bear-trap, a shakeout, a liquidity-hunt or stop-loss hunt event, a failed signal, etc.

Here Ether (ETHUSDT) closed below MA200 one week just to recover the next. In this case, we will call it a failed breakdown but we know this is a way to liquidate over leveraged long-traders, also a way to catch unsuspecting bears ready to short. The conclusion is simple, Ether recovered the next week above MA200 and the following week above EMA55/89 which worked as resistance for six weeks. With these levels behind us, the market is full green.

Notice the last two candles, big huge green candle. That is because resistance is no more.

With no resistance to stop prices from rising, Ethereum started to grow and we are now in full blown bullish mode.

The last major high sits at $4,107. This is an easy target, the minimum. Once support is tested the action moves toward resistance and this is where we are headed.

Some people will wonder if resistance will break or hold. Some unsuspecting bears, again, will even short at resistance thinking this is the logical move, they will lose all.

The truth is that this resistance and major high will break easily, we know this based on marketwide action and Bitcoin, Bitcoin is hitting new all-time highs every other day. In this way, we know that Ethereum will soon catch up and do the same.

Many altcoins are moving forward and growing, and some already conquered their December 2024 high price. This is another indication that shows Ether will not stay behind.

Whatever you do when Ethereum goes up, do not short. You can short if you are going to close the short after just a few hours or a few days, but instead of shorting a bullish trend, go LONG and enjoy maximum profits on the way up.

» Ethereum will break $6,000 and move toward $8,500 and beyond in the long-run.

You read it here first.

Thanks a lot for your continued support.

Resistance will break and the altcoins market will continue to grow. Not only for a few months but for a very long time.

When correction time comes, it will last a few months, we will get higher lows and then additional growth. Think of the pattern that came up on Bitcoin but with the altcoins; long-term growth.

Namaste.

ETHEREUM WILL KEEP GROWING|LONG|

✅ETHEREUM is trading in a

Strong uptrend and the coin

Broke the important horizontal level

Of 3000$ which is now a support

And we are very bullish biased

And we think that ETH will

Reach at least the previous ATH

Of just short of 5000$ but the

First target is to reach and break

A resistance level of 4100$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#ETH Update #4 – July 17, 2025#ETH Update #4 – July 17, 2025

Ethereum is currently facing a significant resistance zone. The recent bullish move has been very steep, which often leads to a correction. If that happens, the first potential retracement level is around $3,010.

If Ethereum continues to rally without correcting, the next upside target is $3,700. However, USDT Dominance has reached a support level. If that support holds, we could see capital rotation into USDT, accelerating a pullback in ETH.

At this point, a slowdown in Ethereum’s momentum is likely. If you're holding altcoins, it might be a good moment to take some profits.

BRIEFING Week #29-30 : BTC stalling, ETH & then Alts ?Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Major Breakout– Ethereum Broke Free from 'Clashing Resistances'🚀💥 Major Breakout – Ethereum Broke Free from the Clashing Resistances 🔓🟣

ETH has finally done it.

After months of battling overlapping resistances — the Clashing Stones, as we called them — Ethereum has broken out, and $2,912 is now acting as support, not resistance.

This breakout isn't just technical, it’s structural.

The previous 1-2-3 rejection setup has now been invalidated.

🔎 Chart Summary:

✅ $2,912 = confirmed breakout zone

🎯 Destination 1: $4,881 (if Vitalik’s asleep 😴)

🚀 Destination 2: $6,443 (if he wakes up 💡)

🔭 Scroll up for Destination 3

This is the real ETH breakout we’ve waited for — not hopium, not chop. This is clear structure.

If BTC stabilizes near 114,921+, ETH could enter outperformance mode and gain serious traction on the ETH/BTC chart.

📢 Keep your eyes on narrative catalysts:

ETH ETF, L2 growth, and Vitalik waking up...

We are officially off the resistance — and heading to where few have charted before.

One Love,

The FXPROFESSOR 💙

📌 Long — as long as $2,912 holds. If it fails, you already know what to do.

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

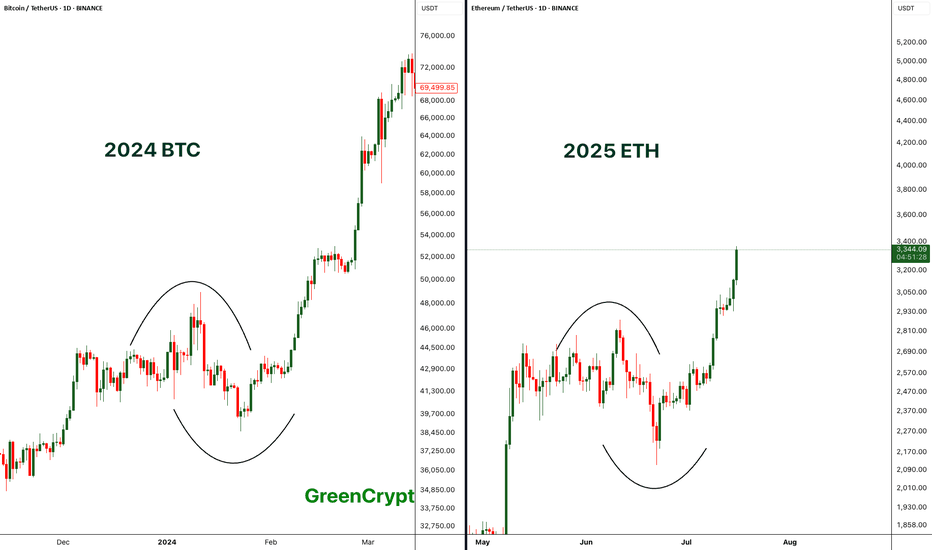

Comparing BTC 2024 with ETH 2025 - Perfect Match- If compare the chart pattern of BTC from 2024 with the current 2025 ETH pattern, wee see exactly similar chart patterns being formed here.

- Price started consolidating then it had fake breakout towards both the sides and finally the real breakout.

- BTC breakout push the price towards the new all time high above 69K, if we ETH follows similar trend then we can expect new all time high on ETH.

Let's see how it plays out.

Stay tuned for more updates.

Cheers

GreenCrypto