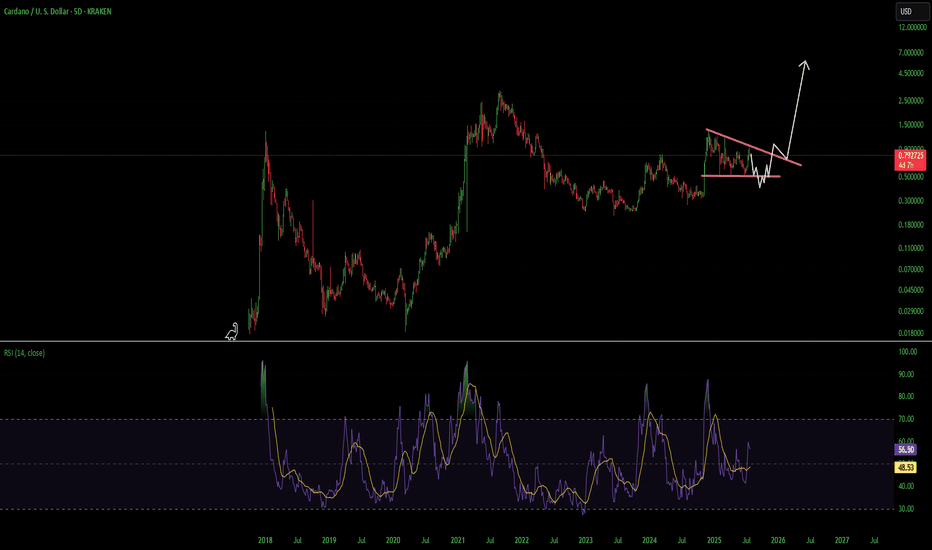

ADA Cardano Decsending Triangle Use Caution HereCardano had a heck of a move but i think its going to erase most if not all of it before it goes on its next leg up. A break over the overhead resistance line and finding support above would invalidate this. Not financial advice just my opinion. Thank you

Eth-usdt

Altseason is cancelled for now. But Should resume soon.If you're interested in altcoins, be sure to check out my ideas. I’m closely tracking CRYPTOCAP:BTC.D and CRYPTOCAP:OTHERS , and you’ll find plenty of valuable insights in those analyses.

So, what’s going on? My CRYPTOCAP:OTHERS prediction played out — May was bullish. But was it the real altseason? Not quite. The true altseason typically begins at the end of the Bitcoin cycle, and we’re not there yet.

Right now, we’re seeing price action reminiscent of December 2024. Bitcoin maximalists are aggressively buying BTC during a time it should be correcting, which is inflating BTC dominance and crushing any momentum for an altseason. They appear to be using altcoins as exit liquidity to pump BTC, especially as retail investors hesitate to buy Bitcoin above $100K.

What’s next?

The daily MACD suggests we’re entering a correction phase that could last around two weeks. A drop toward $1.2T is likely, as there's a major order block between the current level and that target. However, the real support lies below $900B — my "green box" — which I view as the ideal buy zone.

Historically, entries in this green box have offered 2x–3x returns on high-volatility altcoins from the top 100, especially in sectors like memes, DeFi, and AI.

I expect altcoins to correct into that zone in the coming weeks — keep an eye on it.

DYOR (Do Your Own Research).

#Crypto #Altcoins #Bitcoin #BTC #BTCdominance #Altseason #CryptoMarket #CryptoTrading #MACD #TechnicalAnalysis #DeFi #MemeCoins #AIcoins #AltcoinSeason #DYOR

ETH going up... 🚀 ETH/USDT Current Analysis 🚀

Ethereum (ETH) is currently trading around $2535. The ongoing bullish trend suggests potential target levels at $2780 and $2900.

🔄 However, a corrective phase is anticipated, which could pull the price back towards $2290 and $2120.

📈 In the long term, our price targets are set at $3200, $3800, and $4500.

Always exercise caution in the cryptocurrency market and stay informed about the latest developments! 💹

#Ethereum #ETH #Crypto #Investment

XRP Brief scenarioHi Traders,

This is my trading scenario.

Hope it can help you for your trading strategy.

Make sure this is just scenario. please plan your own trading strategy too.

Waiting is most important key to be a long term trader.

Emotion is just biological reaction from your hormone, memory and body.

Good luck.

Ethereum: Momentum Fueled by Growth and AdoptionEthereum: Momentum Fueled by Growth and Adoption

Ethereum (ETH) continued its upward trend over the past week, closely following

Bitcoin’s rally. The second-largest cryptocurrency by market capitalization is benefiting from a range of factors that reinforce its position as a leader in the blockchain space. With strong fundamentals, expanding use cases, and favorable seasonal trends, ETH’s price growth appears poised to continue.

Adoption and Network Usage

The growing adoption of Ethereum for a wide range of applications—ranging from decentralized finance (DeFi) to enterprise solutions—is a key driver of its rising value. Ethereum’s robust and versatile network continues to attract developers, businesses, and users, solidifying its role as the backbone of the blockchain ecosystem.

The Rise of DeFi and NFTs

The expansion of decentralized finance (DeFi) platforms, which leverage Ethereum’s smart contract capabilities, has created new opportunities for decentralized lending, borrowing, and trading. Simultaneously, the ongoing popularity of non-fungible tokens (NFTs) keeps Ethereum at the forefront of digital ownership and creative innovation.

Network Upgrades and Transaction Fee Burning

Technological improvements, such as Ethereum’s transition to proof-of-stake through the Merge, enhance network efficiency and sustainability. Additionally, the implementation of EIP-1559 introduced the burning of transaction fees, effectively reducing the supply of ETH and creating deflationary pressure, which can drive long-term price appreciation.

Institutional Investment and Ethereum ETFs

Institutional investors are increasingly entering the Ethereum market, driven by its utility and growth potential. One of the major catalysts has been the launch and increasing inflows into Ethereum-based ETFs, which provide a regulated and convenient way for institutional and retail investors to gain exposure to ETH. These inflows not only validate Ethereum’s role as a leading crypto asset but also contribute directly to its demand and price growth.

Seasonality and Market Momentum

Historically, the second half of December has often been a favorable period for cryptocurrency markets, including Ethereum. Factors such as increased trading activity, end-of-year portfolio adjustments, and overall market sentiment have historically supported upward trends during this time. Ethereum seems well-positioned to benefit from this seasonal tailwind, potentially pushing its price toward new highs.

Competition and Ecosystem Growth

Ethereum faces competition from other blockchain platforms, but its first-mover advantage, coupled with continuous innovation, helps it maintain a dominant position. The ecosystem of ERC-20 tokens—built on the Ethereum network—further strengthens its utility and value proposition.

Market Sentiment and Macroeconomic Factors

Positive market sentiment and media coverage contribute to Ethereum’s momentum. Broader macroeconomic factors, such as inflation and economic uncertainty, are also driving investors to explore alternatives like Ethereum as a hedge and growth asset.

Infrastructure and Partnerships

The continued development of infrastructure, including wallets, exchanges, and DeFi tools, makes Ethereum more accessible to users and investors. Strategic partnerships and collaborations within the blockchain space are also expanding Ethereum’s reach and utility.

Conclusion

Ethereum’s price growth is underpinned by a combination of strong network fundamentals, expanding use cases, increasing ETF inflows, and favorable seasonality. From DeFi and NFTs to network upgrades and institutional interest, Ethereum is positioned to continue its upward trajectory as we move into the traditionally bullish second half of December.

Will Ethereum leverage these advantages to reach new price milestones? Share your views and insights in the comments!

Ethereum: Momentum Fueled by Growth and AdoptionEthereum: Momentum Fueled by Growth and Adoption

Ethereum (ETH) continued its upward trend over the past week, closely following

Bitcoin’s rally. The second-largest cryptocurrency by market capitalization is benefiting from a range of factors that reinforce its position as a leader in the blockchain space. With strong fundamentals, expanding use cases, and favorable seasonal trends, ETH’s price growth appears poised to continue.

Adoption and Network Usage

The growing adoption of Ethereum for a wide range of applications—ranging from decentralized finance (DeFi) to enterprise solutions—is a key driver of its rising value. Ethereum’s robust and versatile network continues to attract developers, businesses, and users, solidifying its role as the backbone of the blockchain ecosystem.

The Rise of DeFi and NFTs

The expansion of decentralized finance (DeFi) platforms, which leverage Ethereum’s smart contract capabilities, has created new opportunities for decentralized lending, borrowing, and trading. Simultaneously, the ongoing popularity of non-fungible tokens (NFTs) keeps Ethereum at the forefront of digital ownership and creative innovation.

Network Upgrades and Transaction Fee Burning

Technological improvements, such as Ethereum’s transition to proof-of-stake through the Merge, enhance network efficiency and sustainability. Additionally, the implementation of EIP-1559 introduced the burning of transaction fees, effectively reducing the supply of ETH and creating deflationary pressure, which can drive long-term price appreciation.

Institutional Investment and Ethereum ETFs

Institutional investors are increasingly entering the Ethereum market, driven by its utility and growth potential. One of the major catalysts has been the launch and increasing inflows into Ethereum-based ETFs, which provide a regulated and convenient way for institutional and retail investors to gain exposure to ETH. These inflows not only validate Ethereum’s role as a leading crypto asset but also contribute directly to its demand and price growth.

Seasonality and Market Momentum

Historically, the second half of December has often been a favorable period for cryptocurrency markets, including Ethereum. Factors such as increased trading activity, end-of-year portfolio adjustments, and overall market sentiment have historically supported upward trends during this time. Ethereum seems well-positioned to benefit from this seasonal tailwind, potentially pushing its price toward new highs.

Competition and Ecosystem Growth

Ethereum faces competition from other blockchain platforms, but its first-mover advantage, coupled with continuous innovation, helps it maintain a dominant position. The ecosystem of ERC-20 tokens—built on the Ethereum network—further strengthens its utility and value proposition.

Market Sentiment and Macroeconomic Factors

Positive market sentiment and media coverage contribute to Ethereum’s momentum. Broader macroeconomic factors, such as inflation and economic uncertainty, are also driving investors to explore alternatives like Ethereum as a hedge and growth asset.

Infrastructure and Partnerships

The continued development of infrastructure, including wallets, exchanges, and DeFi tools, makes Ethereum more accessible to users and investors. Strategic partnerships and collaborations within the blockchain space are also expanding Ethereum’s reach and utility.

Conclusion

Ethereum’s price growth is underpinned by a combination of strong network fundamentals, expanding use cases, increasing ETF inflows, and favorable seasonality. From DeFi and NFTs to network upgrades and institutional interest, Ethereum is positioned to continue its upward trajectory as we move into the traditionally bullish second half of December.

Will Ethereum leverage these advantages to reach new price milestones? Share your views and insights in the comments!

Ethereum: Momentum Fueled by Growth and AdoptionEthereum: Momentum Fueled by Growth and Adoption

Ethereum (ETH) continued its upward trend over the past week, closely following

Bitcoin’s rally. The second-largest cryptocurrency by market capitalization is benefiting from a range of factors that reinforce its position as a leader in the blockchain space. With strong fundamentals, expanding use cases, and favorable seasonal trends, ETH’s price growth appears poised to continue.

Adoption and Network Usage

The growing adoption of Ethereum for a wide range of applications—ranging from decentralized finance (DeFi) to enterprise solutions—is a key driver of its rising value. Ethereum’s robust and versatile network continues to attract developers, businesses, and users, solidifying its role as the backbone of the blockchain ecosystem.

The Rise of DeFi and NFTs

The expansion of decentralized finance (DeFi) platforms, which leverage Ethereum’s smart contract capabilities, has created new opportunities for decentralized lending, borrowing, and trading. Simultaneously, the ongoing popularity of non-fungible tokens (NFTs) keeps Ethereum at the forefront of digital ownership and creative innovation.

Network Upgrades and Transaction Fee Burning

Technological improvements, such as Ethereum’s transition to proof-of-stake through the Merge, enhance network efficiency and sustainability. Additionally, the implementation of EIP-1559 introduced the burning of transaction fees, effectively reducing the supply of ETH and creating deflationary pressure, which can drive long-term price appreciation.

Institutional Investment and Ethereum ETFs

Institutional investors are increasingly entering the Ethereum market, driven by its utility and growth potential. One of the major catalysts has been the launch and increasing inflows into Ethereum-based ETFs, which provide a regulated and convenient way for institutional and retail investors to gain exposure to ETH. These inflows not only validate Ethereum’s role as a leading crypto asset but also contribute directly to its demand and price growth.

Seasonality and Market Momentum

Historically, the second half of December has often been a favorable period for cryptocurrency markets, including Ethereum. Factors such as increased trading activity, end-of-year portfolio adjustments, and overall market sentiment have historically supported upward trends during this time. Ethereum seems well-positioned to benefit from this seasonal tailwind, potentially pushing its price toward new highs.

Competition and Ecosystem Growth

Ethereum faces competition from other blockchain platforms, but its first-mover advantage, coupled with continuous innovation, helps it maintain a dominant position. The ecosystem of ERC-20 tokens—built on the Ethereum network—further strengthens its utility and value proposition.

Market Sentiment and Macroeconomic Factors

Positive market sentiment and media coverage contribute to Ethereum’s momentum. Broader macroeconomic factors, such as inflation and economic uncertainty, are also driving investors to explore alternatives like Ethereum as a hedge and growth asset.

Infrastructure and Partnerships

The continued development of infrastructure, including wallets, exchanges, and DeFi tools, makes Ethereum more accessible to users and investors. Strategic partnerships and collaborations within the blockchain space are also expanding Ethereum’s reach and utility.

Conclusion

Ethereum’s price growth is underpinned by a combination of strong network fundamentals, expanding use cases, increasing ETF inflows, and favorable seasonality. From DeFi and NFTs to network upgrades and institutional interest, Ethereum is positioned to continue its upward trajectory as we move into the traditionally bullish second half of December.

Will Ethereum leverage these advantages to reach new price milestones? Share your views and insights in the comments!

ETHUSDT.1DAnalyzing the ETH/USDT chart on a daily timeframe, we see a volatile and somewhat bearish trend emerging over the past few months. Here's a detailed breakdown of the chart, highlighting key resistance and support levels, along with insights from the MACD and RSI indicators.

Key Observations:

Trend Analysis: Ethereum has displayed a series of lower highs and lower lows since peaking, indicating a bearish trend. The trendline (R1) has consistently acted as a resistance, and the price is currently testing this line, suggesting a critical juncture.

Support and Resistance Levels:

Resistance Levels (R2 and R3): R2 at $3,043 and R3 at $4,105.80. These levels represent potential upside barriers in the event of a price reversal.

Support Level (S1): The significant support level is at $2,126.90. This level has historical relevance as a pivot point for price actions.

MACD Indicator: The MACD line is currently below the signal line and both are trending downward below the zero line, which traditionally indicates bearish momentum. However, the histogram suggests that the negative momentum is slowing, possibly pointing to an impending stabilization or reversal.

RSI Indicator: The RSI is around 36, which is nearing the oversold territory. This could indicate that the selling pressure might soon exhaust, offering potential for a bullish reversal if other factors align.

Technical Analysis and Conclusion:

The Ethereum market appears to be at a critical stage. The proximity to the major support at S1 and the nearing oversold conditions suggest that we could see a short-term reversal if the support holds. Investors and traders should watch for any bullish reversal patterns or a break above the trendline R1 as potential signs of a change in momentum.

However, a break below the support at $2,126.90 could lead to further declines, with the potential to test much lower levels, given the absence of immediate visible support below S1 on the chart.

Trading Strategy:

For Bullish Traders: Look for confirmation of a support hold at S1 and a potential bullish reversal pattern or a break above R1. If entering a long position, consider setting stop-loss orders below S1 to manage risks.

For Bearish Traders: Monitor for a sustained break below S1. If this occurs, consider entering short positions with a view to capitalize on further declines. Place stop-loss orders just above the most recent highs to limit potential losses.

As always, it's crucial to consider external factors such as market news, overall crypto market trends, and economic indicators that could influence Ethereum's price movements. Stay updated and adjust strategies accordingly.

Bitcoin Reversal After Hitting Demand AreaIn my two most recent BTC analyses I talked about an ideal area for entry in case BTC reversed from the top yellow resistance of the channel it has been trading in for 6 months at this point.

As expected, the green area on the chart has functioned as a huge area of demand, right in between the supports (yellow and purple). The drop was a bit more steep than initially anticipated due to a big sell-off in the stock markets, but the reversal is here nevertheless.

At this moment it's still unclear whether BTC will find its way up all the way towards the top of the channel yet again. The daily shooting-star wick suggests that bulls took over in the short-term, however.

As mentioned in previous analyses, BTC is currently trading in a longer term grey zone. I'm bullish above the top yellow resistance and bearish below the bottom purple support. It's not the time for long-term longs or shorts, in my view.

Remember my last ETH analysis where I talked about the initial bearish shock after the spot ETF approval (we saw the same with the BTC spot ETF). If the BTC ETF is any indication, we will enter a long-term trend from here.

ETHUSDT.1DIn my analysis of the Ethereum (ETH/USDT) daily chart, I've identified key technical elements that are crucial for understanding the current market dynamics. Firstly, it's important to note the failure of the Ichimoku calculation, which may necessitate reapplication or adjustment for a clearer analysis.

The Moving Average Convergence Divergence (MACD) shows a strong bearish momentum, indicated by the significant separation between the MACD line and the signal line, with the histogram trending downward. This suggests that the selling pressure has been increasing, potentially leading to further declines if not reversed soon.

The Relative Strength Index (RSI) is currently at 37.42, which is below the midline of 50 but not yet in the oversold territory (below 30). This positioning indicates that while there is bearish momentum, there might be room for further downward movement before the market is technically considered oversold.

From the price action, we observe that ETH has recently broken below the support level at $3,043, now acting as resistance (R1). This breakdown could signal a continued bearish trend towards the next support level (S1) at $2,126.90. If this level fails to hold, the decline could extend further, potentially testing much lower supports.

For potential recovery scenarios, ETH would need to reclaim and stabilize above $3,043 to alleviate immediate bearish pressure. A move above this level could open the path towards the next resistance at $4,105.80 (R2). However, given the current market conditions indicated by the MACD and RSI, such a bullish reversal might require significant volume and positive market catalysts.

In conclusion, the current technical setup suggests caution for ETH traders, with an emphasis on monitoring the $2,126.90 support level closely. A break below this could lead to significant losses, while a recovery above $3,043 might signal a short-term bullish reversal. As always, it's crucial to consider external market factors and news that could influence price movements beyond what technical indicators alone can predict.

#ETH/USDT#ETH

Ethereum price is moving in a descending channel on the 1-hour frame

The price is moving inside the channel perfectly, it is expected after a slight rise

Then the decline will continue to fill the price gap with a target of 2700

The market is expected to recover after that after filling the price gap

This decline is affected by the geopolitical events happening these days

The pattern is canceled in the event of a 4-hour close above 3200

ETHUSDT.1DUpon analyzing the ETH/USDT daily chart, it's clear that Ethereum has experienced a mix of bullish and bearish phases, with key resistance and support levels playing a pivotal role in its price movements. Let’s break down the crucial elements:

Support and Resistance Levels:

Support Level 1 (S1) is set at $2,780.64. This level has previously served as a turning point for price corrections and may provide a floor should the price drop further.

Support Level 2 (S2) at $2,126.90, which marks a critical area if a more significant sell-off occurs.

Resistance Level 1 (R1) at $4,105.80, representing a ceiling from previous price peaks that Ethereum might test if a bullish trend resumes.

Technical Indicators:

The MACD (Moving Average Convergence Divergence) is well below the zero line and shows a substantial bearish divergence. This indicates strong selling pressure and could suggest further downward movements unless there's a positive crossover soon.

The RSI (Relative Strength Index) is nearing the oversold territory but has not yet entered it, signaling that while selling pressure is high, there might be some potential for stabilization or a corrective rally if the market perceives ETH as undervalued.

Conclusion:

The current market position for ETH/USDT suggests a cautious approach. The negative MACD and approaching oversold RSI indicate a bearish trend, but these also bring potential for reversal scenarios, particularly near strong support levels like S1 and S2. Traders should watch for any signs of bullish reversals or stabilization at these supports, which could offer buying opportunities. Conversely, a break below S2 could lead to accelerated declines, and thus risk management strategies should be prioritized. The market's reaction at these key junctures will be critical in determining Ethereum's path in the coming weeks. As always, it's essential to stay updated with broader market trends and news that could influence Ethereum's price.

ETHUSDT.1DAnalyzing the ETH/USDT daily chart provides a comprehensive view of Ethereum's current market behavior and potential future movements based on the displayed technical indicators and patterns.

Current Market Position:

As of now, ETH/USDT is trading at around $3,267.79, showing a minor decline of 0.2% on the day. This follows a period of volatility where Ethereum tested various support and resistance levels.

Key Technical Indicators:

Support Levels (S1 and S2):

S1 ($2,837.73): This level has been tested several times in recent months and has provided a solid base for Ethereum. It currently serves as a crucial marker for the bearish threshold.

S2 ($2,112.62): This support level is significantly lower and has not been approached recently but remains an important psychological and technical support in case of a substantial market downturn.

Resistance Levels (R1 and R2):

R1 ($4,134.34): This resistance level has capped upward movements in the past and remains a key target for bullish momentum to overcome.

R2: This is extrapolated to be much higher and would likely come into play should Ethereum gain strong market enthusiasm, breaking past the previous highs.

Technical Indicators:

MACD (Moving Average Convergence Divergence):

The MACD line is below the signal line, indicating bearish momentum. The histogram, currently at zero, suggests a lack of strong momentum in either direction, pointing to potential consolidation.

RSI (Relative Strength Index):

The RSI is at 54.86, indicating a neutral position. This suggests that while the market isn't in overbought or oversold territory, it's balanced with a slight tilt towards bullish sentiment given it's above the 50 midpoint.

Chart Patterns:

The price movement of Ethereum within this timeframe shows a trading range forming, with the potential setup of a rectangle pattern between S1 and R1. This indicates that Ethereum is consolidating within these levels and could be preparing for a significant move once it breaks out of this range.

Conclusion:

The ETH/USDT pair shows signs of consolidation with a potential for breakout or breakdown depending on broader market sentiments and upcoming Ethereum network developments. The immediate focus should be on maintaining support at $2,837.73. A break below this level could signal a deeper retracement towards $2,112.62. Conversely, moving past $4,134.34 in a convincing fashion could initiate a new bullish phase aiming for higher resistances.

For traders, maintaining a close watch on these levels and adjusting stop-losses and take-profits accordingly would be prudent. Being vigilant about any news related to Ethereum that might impact market sentiment is also recommended, as crypto markets are particularly sensitive to news flows and regulatory developments.

ETHUSDT.1DThe Ethereum chart highlights a robust uptrend that started early this year, peaking in February before entering a consolidation phase. This pattern indicates strong buying interest followed by a phase where traders and investors are assessing their positions.

Key Technical Observations:

Resistance Levels (R1 and R2):

The first resistance (R1) is at $3,430.29, which previously acted as both support and resistance, indicating a pivotal price point.

The second resistance (R2) at $4,134.34 represents the peak of the recent price rally and is crucial for confirming a continuation of the bullish trend.

Support Levels (S1 and S2):

The primary support (S1) at $2,837.73 is critical as it lines up with historical price reactions and the Fibonacci retracement level of 0.5, a common reversal zone.

The secondary support (S2) at $2,112.62 is near the 0.618 Fibonacci retracement, often considered the last line of defense in a bullish market.

Fibonacci Retracement:

The Fibonacci levels are drawn from the low of $1,521 to the high of $4,093.92, and they help identify potential reversal points. The 0.5 and 0.618 levels are particularly significant due to their common usage as decision points in price action trading.

MACD (Moving Average Convergence Divergence):

The MACD line is currently below the signal line, and the histogram is in the negative territory, which suggests bearish momentum in the short term. This requires close monitoring as a potential crossover above the signal line could indicate a shift back to bullish momentum.

RSI (Relative Strength Index):

The RSI at 53.85 is near the midpoint of 50, which generally indicates a balance between buying and selling pressure. However, the slight tilt towards the oversold territory suggests that there might be an upcoming opportunity for buyers.

Conclusion and Strategy:

Given the current market conditions and the technical setup, my approach would be cautiously optimistic. I would consider entering long positions near the S1 level with a clear stop-loss order just below this level to protect against unexpected downturns. Any approach towards R1 should be viewed with readiness to take profits, especially if accompanied by signs of fading bullish momentum, such as declining volume or bearish divergences on the RSI or MACD.

Trading around these key technical levels with a well-defined risk management strategy could potentially capitalize on the volatility and provide significant returns. However, it’s crucial to remain vigilant and adapt to any new market developments that could affect Ethereum's price trajectory.

ETHUSDT.1DIn my analysis of the ETH/USDT daily chart, I've identified several critical elements that define the current state and possible future direction of Ethereum’s price action.

Technical Analysis Observations:

Chart Patterns and Key Levels:

Triangle Pattern: The price has been consolidating within a symmetrical triangle pattern, which generally indicates a period of indecision among traders. The apex of this pattern is approaching, suggesting that a breakout is imminent.

Support (S1 and S2):

S1 at $2,112.62: This level is crucial as it represents the lower boundary of the triangle. A break below could signal a significant bearish movement.

S2 at $2,500.00: This round number has psychological importance and may act as a minor psychological support if S1 breaks.

Resistance (R1 and R2):

R1 at $2,837.73: This is the upper boundary of the triangle. A breakout above could indicate bullish momentum.

R2 at $4,134.34: This represents a historical high and a long-term target in a bullish breakout scenario.

Indicators:

RSI (Relative Strength Index): Currently at 25.93, the RSI is deep in the oversold territory, suggesting that the market could be underpricing ETH, which may lead to a potential rebound or at least a stabilization of prices.

MACD (Moving Average Convergence Divergence): The MACD is below the signal line and the histogram indicates increasing bearish momentum. This could signify that despite the oversold condition, the market might still see further declines.

Conclusion:

The ETH/USDT pair is at a critical juncture with its price consolidating within a triangle pattern. The proximity of the RSI to oversold levels hints at a possible upward correction, especially if it coincides with a breakout above the triangle's upper trend line (R1). However, the bearish bias indicated by the MACD suggests that any bullish moves could be short-lived unless there is a significant shift in market sentiment or external market drivers.

Given the current setup, my approach would be to watch for a clear breakout of the triangle pattern, accompanied by an increase in volume, which would provide a more reliable signal for either a long or short position. A break above R1 could target R2, while a breakdown below S1 might test the $2,500 psychological level before moving to deeper supports. As always, setting appropriate stop losses and taking profit levels is crucial to manage risk in such volatile conditions.

ETHUSDT.1DIn this technical analysis of the Ethereum (ETH)/USDT daily chart on Binance, we are reviewing the primary technical indicators and price structures that might influence Ethereum's price movements in the near future.

Price Action and Support/Resistance Levels

The current price of ETH is approximately $3,042.48, showing a recent decline of about 1.93%. The chart identifies critical resistance (R1, R2, R3) and support levels (S1, S2, S3). The highest recent resistance is at $4,371.66, and support levels are situated at $3,293.19, $2,874.64, and $2,112.62. These levels are instrumental in determining potential turning points or consolidation zones in the market.

Technical Indicators

MACD (Moving Average Convergence Divergence): The MACD line below the signal line and a negative histogram suggest a bearish momentum is currently prevailing. The decreasing histogram height also indicates that the bearish momentum may be losing strength, which could mean a potential stabilization or reversal of the price movement soon.

RSI (Relative Strength Index): The RSI stands at approximately 55, indicating a neutral market condition. This level suggests that while the market is not in overbought or oversold territory, there is still room for either bullish or bearish developments depending on broader market cues.

Chart Patterns

The chart shows Ethereum in a descending channel pattern, indicating a potential continuation of the bearish trend if the upper boundary of the channel holds as resistance. The next key observation will be whether the price tests and respects the S1 support level, which could lead to a rebound towards R1.

Conclusion

Considering the present indicators and the price behavior within the descending channel, Ethereum appears to be navigating a bearish phase with the potential for testing further support levels, particularly if the current support at S1 fails to hold. The bearish MACD suggests caution, but the neutral RSI provides a slight buffer, indicating that not all bullish momentum is lost. Traders should watch for potential rebounds at major support levels or a break above the channel as signals for a trend reversal. As with any trading strategy in such volatile markets, setting stop losses and monitoring key resistance and support flips are advisable to manage risks effectively.

ETHUSDT.1DThe daily chart for Ethereum (ETH) against USDT provides a detailed view of the price movements and key levels that could indicate potential future actions:

Resistance Levels:

R1 ($4,126.11): This level has been a recent high and could act as the first significant resistance.

R2 ($4,371.66) and R3 ($4,752.50): These are the subsequent resistance levels that the price may encounter if it breaks past R1. R2 and R3 could serve as targets for taking profits if Ethereum enters a bullish phase.

Support Levels:

S1 ($3,301.24): This is the nearest support level where the price might find a floor if there's a pullback.

S2 ($2,874.64) and S3 ($2,112.62): These lower supports may come into play if there is a significant downward trend or market correction.

Current Market Position:

The price of ETH is currently hovering near $3,771.07, positioning it above S1 but below R1. This suggests some consolidation between these levels.

Technical Indicators:

MACD (Moving Average Convergence Divergence): The MACD is close to zero with a slight bullish histogram, suggesting that there might be a buildup in bullish momentum, although the signal isn’t strong yet.

RSI (Relative Strength Index) is at 66, which is moderately high but still below the overbought threshold of 70. This indicates that there might still be room for upward movement without immediate overbought concerns.

Market Sentiment:

The descending trendline from the peak in April to the present suggests that ETH has been under a bearish control but is now potentially trying to break this trend. A confirmed breakout above this trendline could signal a change in momentum to bullish.

Trading Strategy:

Bullish Scenario: Should ETH break above the descending trendline and R1, traders might consider long positions with targets at R2 and R3, setting stop losses just below R1.

Bearish Scenario: If ETH fails to break the descending trendline and drops below S1, this could indicate a continuation of the bearish trend, with potential targets at S2 and S3. Traders might look to short ETH or exit long positions to minimize losses.

Conclusion: Traders should monitor Ethereum’s reaction to the descending trendline closely. A breakout above this line and R1 could herald a new bullish phase targeting higher resistances. However, a failure to surpass these levels and a subsequent drop below S1 could extend the bearish sentiment. As always, market conditions, global economic factors, and news specific to Ethereum should be considered when making trading decisions.