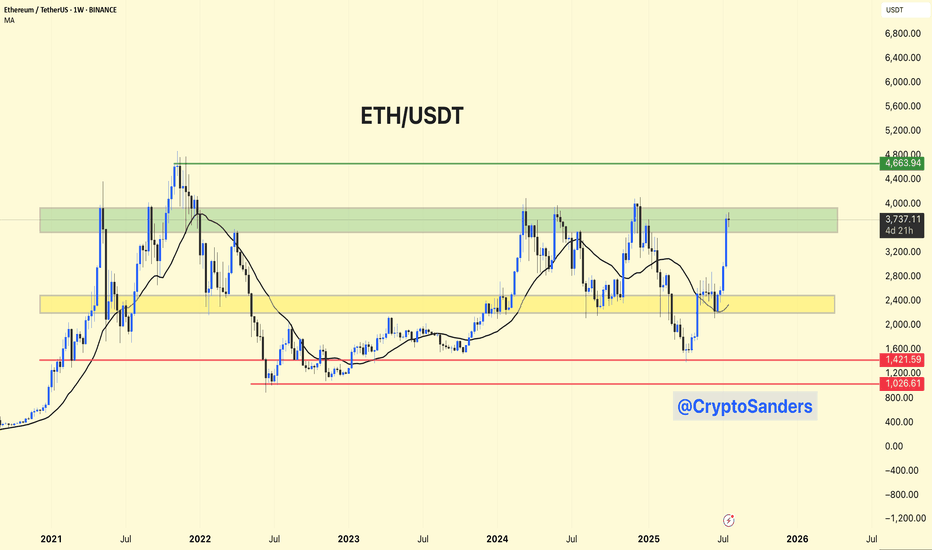

ETH/USDT – Weekly Chart Analysis !! ETH/USDT – Weekly Chart Analysis

ETH is testing a major historical resistance between $3,700 – $4,000 (highlighted green zone).

A clean breakout above this level could push price toward the next key resistance at ~$4,660.

Previous accumulation zone around $2,400 – $2,800 (yellow box) now acts as strong support.

Long-term floor at $1,420 and $1,025, though currently far below.

Bullish Breakout Potential: If ETH sustains above the green resistance, it may retest $4,660+.

A failure to break above $4K could lead to a healthy pullback toward the yellow zone (~$2,800).

Stay updated and manage your risk accordingly.

DYOR | NFA

Ethcoin

Everyone sees consolidation. I see positioningETH is holding just above a key fib cluster, showing signs of controlled distribution, not weakness. Smart Money doesn’t chase — they build positions while the crowd second-guesses.

The Structure:

Current Price: ~2,419

Local High (Premium): 2,482.09

Fib Retracements:

0.236 → 2,394.72 (mild correction)

0.382 → 2,340.68 (initial re-entry zone)

0.5 → 2,296.99 (ideal discount)

0.618 → 2,253.31 (deep entry, high confluence)

0.786 → 2,191.11 (structure last line)

Key Zones:

FVG already filled during the move up — imbalance mitigated

Order block (OB) at 2,191.11: high-probability reaction zone

Strategy Outlook:

Scenario A (Shallow pullback):

ETH tests 2,394 → 2,340, then continues the push to 2,482

→ Aggressive buyers step in early

Scenario B (Deeper sweep):

A drop to 2,296 → 2,253 opens the door for reaccumulation

→ Classic Smart Money trap before the next rally

Invalidation:

A break below 2,191 (and OB failure) kills this bullish narrative

Execution Logic:

Accumulation Zones:

Light: 2,340–2,296

Strong: 2,253–2,191 (discount reload)

Target:

2,482

Extension optional if momentum builds above recent highs

ETH – Rounded Distribution Before the Punch Higher?What we’re seeing here is a potential fakeout setup within a value zone.

Notice the rounded top formation — looks bearish — but price refuses to break the low. This often sets the stage for a sharp reversal.

Structure Breakdown:

Volume profile shows acceptance in current range

Rounded top shape implies weakness — but no breakdown = trap potential

Price holds a higher low inside the range = absorption

Green box marks ideal long entry area — well-defined invalidation below

Bullish case:

We’re watching for that reclaim of the mid-level → quick push into the upper range

Target zone = 2,618 (clean inefficiency fill + local top)

Bearish trap scenario invalidated if price closes below red box (stop hunt level)

Strategy bias:

This is a compression-reversal trap — fake weakness to trap shorts, then launch.

Patience pays here — if it reclaims and consolidates at the mid, it’s time to ride.

📊 More setups like this, early in structure, are shared inside the account description. Tap in for the breakdowns.

ETH didn’t rally — it cleared inefficiency and pausedThis isn’t the move. This is the setup for the move.

ETH tagged 2658.22 — premium — and stalled right where Smart Money pauses before redistributing or rotating.

Here’s how this lines up:

Price swept into the 0 fib (2658.22), then hesitated — that’s not weakness, that’s precision

Just below sits a clean FVG at 2594–2575, right between the 0.382–0.5 fibs

Below that: OB near 2527–2492 — last line of defense before momentum flips

Right now, ETH is offering a reactive pullback opportunity. If bulls hold 2594–2575 with a bounce, we rotate higher again. But if they don’t — 2527 becomes the decision zone.

Execution lens:

Ideal re-entry zone: 2594–2575

Invalidation: sustained close below 2555 = expect OB tap

If FVG holds, expect revisit of 2658 → extension toward 2680s

This setup isn’t done. It’s developing. Wait for price to speak — not hope.

For more plays built like this — mapped in advance, not after the fact — check the profile description

$STFX Up 116% in 7 Days—Is This the Next Big ETH Utility Token?The Ethereum-based memecoin $STFX has captured the attention of the crypto market, surging an impressive 116% over the past week. As the native token of the innovative STFX platform, $STFX combines the allure of DeFi functionality with the simplicity of memecoins, offering a unique proposition to traders and investors alike. With a hard-capped supply of 1 billion tokens and a current market capitalization of $11.2 million, $STFX may be positioned for explosive growth, both technically and fundamentally.

What Makes $STFX Unique?

$STFX powers the STFX platform, a decentralized ecosystem that introduces Single Trade Vaults (STVs). These DeFi vaults enable traders to propose trading strategies, raise funds from other users, and execute trades collaboratively. This model not only democratizes trading but also aligns incentives for both traders and investors.

Currently, $STFX operates across multiple blockchains, broadening its reach and usability. Despite its growing adoption, the token remains relatively under the radar, as it has not yet listed on any decentralized exchanges (DEXs) apart from MEXC. This presents a golden opportunity for early adopters to enter the market before institutional players and larger investors potentially drive up demand.

Technical Analysis

The daily price chart for $STFX indicates a bullish engulfing pattern—a strong reversal signal suggesting continued upward momentum. Complementing this, the Relative Strength Index (RSI) sits at 71.80, signaling bullish strength without entering extreme overbought territory.

Key technical levels include:

- Resistance: The pivot point lies above the one-month high, hinting at a potential breakout to higher price levels.

- Support: In the event of a correction, immediate support can be found at the one-month low of $0.008.

This technical setup suggests that $STFX may continue its upward trajectory, potentially breaching its previous highs as bullish momentum builds.

Growth Potential

With a current market cap of just $11.2 million, $STFX offers significant upside potential. If the token achieves a market cap of $50 million to $100 million—a realistic target given its innovative use case and growing popularity—early investors could see substantial returns.

The token’s unique utility within the STFX platform adds intrinsic value. As more traders adopt Single Trade Vaults and the platform gains traction, demand for $STFX is likely to increase. Additionally, the token’s hard-capped supply ensures scarcity, which could further drive price appreciation.

The Opportunity for Early Investors

$STFX’s limited presence on exchanges provides a window of opportunity for retail investors to accumulate the token before broader adoption occurs. With institutional interest in DeFi continuing to grow, $STFX’s innovative model could attract significant attention, potentially driving its market cap to new heights.

As of this writing, $STFX is trading within a bullish trend, up 13% on the day. For those looking to capitalize on its momentum, now might be the time to take a closer look at this emerging token.

Conclusion

The combination of $STFX’s innovative utility, strong technical indicators, and low market cap creates a compelling case for early investment. While risks remain—including the potential for short-term corrections—the long-term prospects for $STFX appear promising. As the platform’s adoption grows and the token gains visibility, $STFX could very well become a standout player in the Ethereum and DeFi ecosystems.

Investors should keep a close eye on $STFX’s technical and fundamental developments as it continues to carve out its niche in the rapidly evolving crypto landscape.

Research: As the merge approaches, on-chain data suggests ETH usShare

Xeggex

According to on-chain data, as the merge approaches, the dominant behavior across the Ethereum network is to HODL. Coins held by Ethereum investors are maturing to showcase a higher number of HODLers unwilling to sell.

Within the Ethereum ecosystem, just under 60% of investors have held for more than one year, compared with Bitcoin, which has 80% of HODLers holding for the same period of time.

However, we are now seeing 7-year holders (dark blue) of Ethereum start to increase. From July 28, the first 7-year holders began to show and now hold over 2% of the supply.

Ethereum: HODL Waves (Source: Glassnode)

Ethereum: HODL Waves (Source: Glassnode)

Given that Ethereum mined its first block in July 2015, coins that haven’t moved in 7-years are likely genesis coins that have never moved. As time goes on, it is expected that the 7-year HODLers will continue to grow as HODLers who entered the Ethereum ecosystem during the 2017 bull run start to emerge.

Unlike Bitcoin, Ethereum is not often referred to as a store of value. However, on-chain data suggests that 2% of Ethereum holders believe it could be. Depending on the activity of the network, Ethereum may also be deflationary after The Merge, which adds credence to this theory

Ethereum Ready For A Stellar Month! If Eth cracks the $4.8k line and holds, expect significant gains over the next month.

DYOR.

(In my opinion, majority of coins will be going up over the next couple of months. However, I do expect a significant fall in Jan and a continued down trend over the next 12 months so please be aware of this)