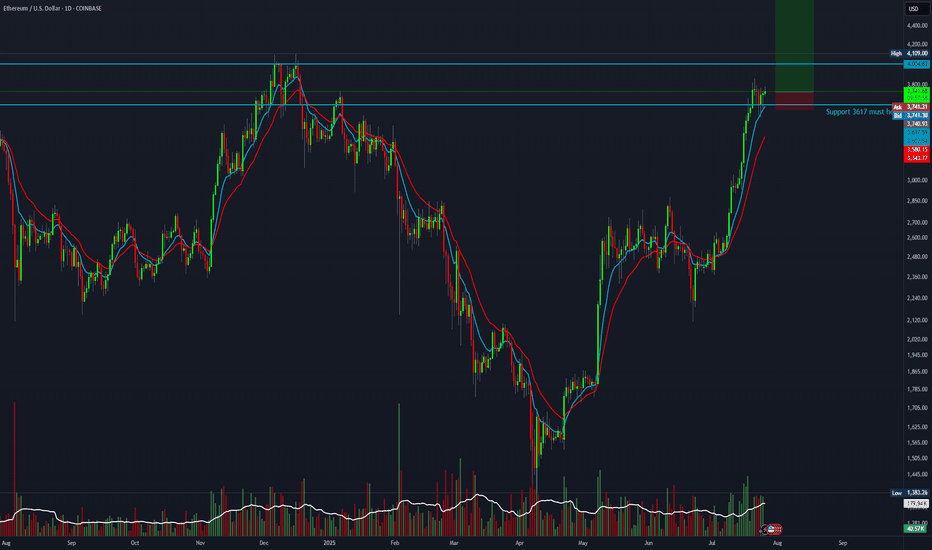

ETH/USDT | ETH Under Pressure – Watch $3500 Support!By analyzing the Ethereum chart on the weekly timeframe, we can see that after reaching the $3940 zone, ETH faced selling pressure and is now trading around $3540. If the price fails to hold the key $3500 support, a deeper decline is likely, with potential targets at $3040 first and possibly $2680 as the second bearish target.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Ethereum-bitcoin

ETH - BTC ETF News: What It Means for the Market+ China Rumors 🚨 ETH - BTC ETF News: What It Means for the Market + China Rumors 💥🌐

July just ended with a crypto bombshell 💣 — and the market is barely reacting.

Let’s break it down:

🧠 One part hard news.

🌀 One part geopolitical smoke.

🎯 All parts worth watching if you care about macro market shifts.

🏛️ SEC Approves Real BTC & ETH for ETF Flows (July 29)

Say goodbye to the cash-only ETF model.

The SEC now allows direct in-kind creation/redemption of Bitcoin and Ethereum in ETFs.

That means providers like BlackRock, Fidelity, VanEck can now use actual BTC/ETH, not just synthetic tracking.

✅ Bullish Impact:

💰 Real Spot Demand: ETF inflows = real crypto buying

🔄 Efficient Arbitrage: No middle step via cash = faster flows

🧱 TradFi + Crypto Merge: ETFs now settle with crypto — not just track it

🎯 Better Price Accuracy: Spot ETFs reflect true market value more cleanly

📉 The market reaction? Mild.

But don’t get it twisted — this is a structural reset, not a meme pump.

⚠️ But There’s a Bearish Angle:

🏦 Centralized Custody: Crypto now lives in Coinbase, Fireblocks vaults

⚠️ Network Risks: ETF performance now tied to ETH/BTC uptime

🧑⚖️ Regulatory Overreach: More hooks into validator networks, MEV relays

🌊 Volatility Risk: Panic redemptions = real BTC/ETH sold into open markets

Still, this is good news for Ethereum in particular.

Why? Because ETH isn’t just money — it’s infrastructure.

And now Wall Street is finally using it, not just watching it.

🇨🇳 And Then There’s China… Rumor or Tumor?

Crypto Twitter is swirling with unconfirmed whispers from July 29 that China may be prepping a major Bitcoin statement ahead of the BRICS summit.

But let’s be clear:

🚨 It’s a rumor. Or a tumor. 🧠

And like many tumors in crypto — there’s a 40% chance it brings bad news. 🤕

Still, here’s what’s being floated:

🧠 Speculations Include:

🔓 BTC re-legalization in “special finance zones” (HK-style)

🏦 BTC in national reserves (!)

🤖 CBDC integration or smart contract interoperability

⚒️ Return of official state-backed Bitcoin mining

🧯 But no official sources. Just geopolitics + timing.

China’s FUD/FOMO pattern is Bitcoin tradition — don’t get trapped by hopium.

But if even half of it is true... buckle up.

📈 Ethereum Leads the Charge — But Watch These Alts:

If ETFs go fully crypto-native, some sectors light up 🔥

🔹 1. Ethereum Layer 2s (ARB, OP, BASE)

→ ETF gas pressure = L2 scaling demand

🔹 2. DeFi Protocols (UNI, AAVE, LDO)

→ TradFi liquidity meets on-chain utility

🔹 3. ETH Staking Derivatives (LDO, RPL)

→ Institutions want yield = LSD narrative grows

🔹 4. Oracles (LINK)

→ ETFs need trusted on-chain data = Chainlink shines

🔹 5. BTC on ETH Bridges (ThorChain, tBTC)

→ If BTC flows into ETH-based ETFs, bridges light up

🚫 What I will Avoid:

❌ Memecoins – zero relevance to ETF flows

❌ GameFi – not part of TradFi’s roadmap

❌ Ghost Layer 1s – no users, no narrative, no pump

🧠 My Take:

ETH is building momentum toward $4,092 — the third breakout attempt on your 1-2-3 model.

🔥 The fuse is lit. Target? $6,036

Timing? Unknown. But structure is in place.

Meanwhile, Bitcoin Dominance is rising.

ETH is shining.

Solana — while powerful — continues paying the price for memecoin madness 💀

We’re entering a new phase — where ETFs settle with real crypto , China watches the stage, and macro money is warming up behind the curtain.

So stack smart.

Study the flows.

Don’t let silence fool you — the biggest moves come after the news fades.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

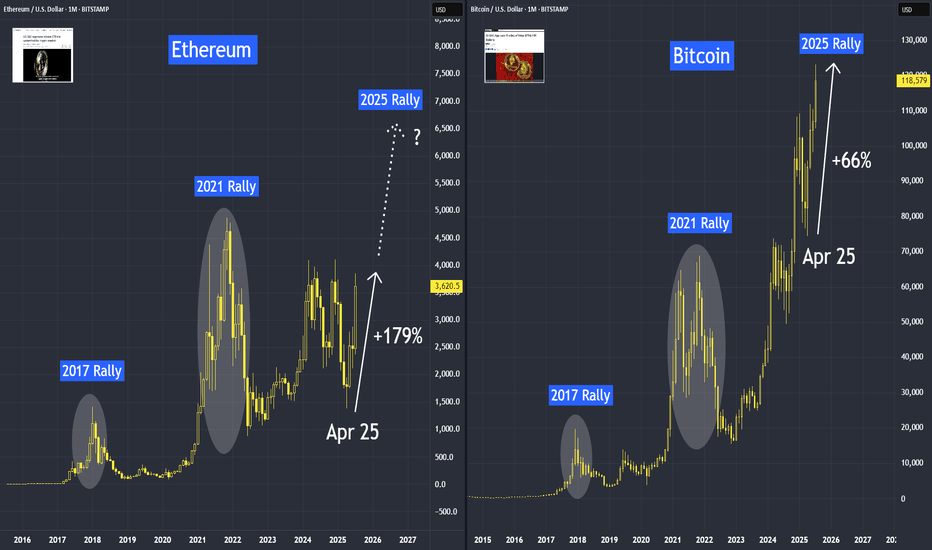

Cup and Handle Setup in Ethereum Since April trough, Ethereum has risen by 179%, delivering a higher rate of return than Bitcoin at 66%.

But most of our attention is on Bitcoin, breaking above the 120,000 level.

Why is Ethereum quietly gaining ground —and what does the future hold for Ethereum?

It's video version on its trading strategies:

Mirco Bitcoin Futures and Options

Ticker: MET

Minimum fluctuation:

$0.50 per ether = $0.05 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Ethereum bigger pictureToday we are measuring the difference between Ethereum's current price and its average price over a specific period. We see how far the current price deviates from its statistical average. This helps traders identify potential overbought and oversold conditions. Even though institutions and etfs have bought up over 32x the supply of Ether since May, it has showed in the past 36 Days with ether running over 80%, we look at reducing exposure as the risk remains for a correction in the short term.

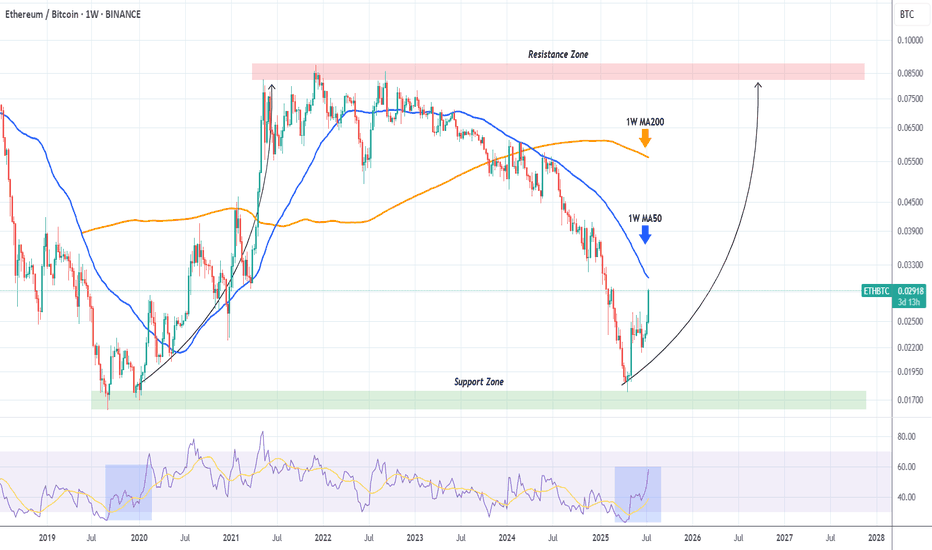

Ethereum Bitcoin pair bottom confirmed!As confirmed by CRYPTOCAP:ETH \ CRYPTOCAP:BTC momentum, we can say that a local bottom was seen at 2019 accumulation levels. With a major reversal from the current region, we can see major movements across Altcoins, with Ethereum being an undeniable leading force and leader for altcoins.

ETH/BTC vs btc dominanceethereum received a reaction as we expected from the current demand zone in the bitcoin pair, and it seems inevitable that the upward momentum from the current area will continue. on the bitcoin dominance side, the same situation exists, but I think we will witness a bearish absolute process.

Ethereum is Trending HigherSince April trough, Ethereum has risen by 179%, delivering a higher rate of return than Bitcoin at 66%. But most of our attention is on Bitcoin, breaking above the 120,000 level.

Why is Ethereum quietly gaining ground —and what does the future hold for Ethereum?

Mirco Bitcoin Futures and Options

Ticker: MET

Minimum fluctuation:

$0.50 per ether = $0.05 per contract

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

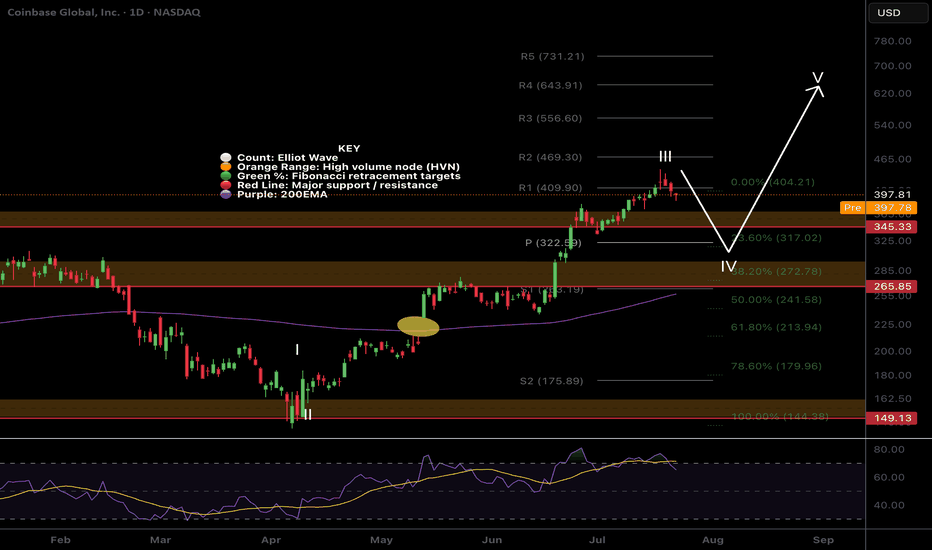

$COIN Wave 4 pullback?NASDAQ:COIN had a tremendous run, a text book Elliot wave 3 but has confirmed bearish divergence on the daily RSI.

The trend is strong so wave 4 could be shallow, only reaching the previous all time high, High Volume Node and 0.236 Fibonacci retracement and daily pivot point between $322-345

Further decline brings up the High Volume Node support at 0.382 Fib retracement and ascending daily 200EMA! Also a highly probable scenario!

Long term outlook remains around $600 target

Safe trading.

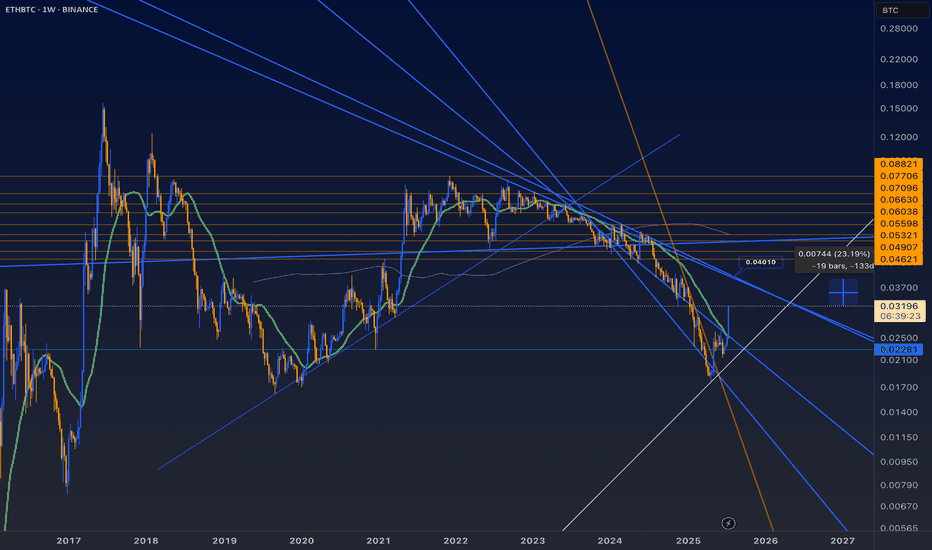

ETHBTC shows that Ethereum will outperform Bitcoin MASSIVELY!The ETHBTC pair has been rebounding hyper aggressively after the April 21 2025 Low on the 6-year Support Zone, and is now facing it's most important test, the 1W MA50 (blue trend-line).

This trend-line has been its Resistance since basically March 13 2023, so if broken, it will be a massive bullish break-out signal.

In fact during the 2020 - 2021 Bullish Leg, once the price broke above the 1W MA50, the market got the final confirmation of the upcoming long-term rally.

We expect Ethereum to outperform Bitcoin for the rest of the year at least.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

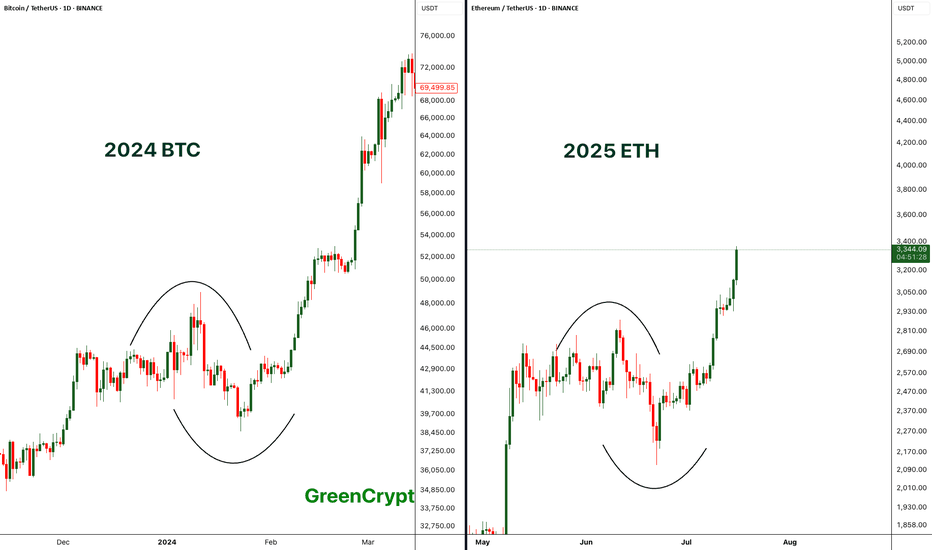

Comparing BTC 2024 with ETH 2025 - Perfect Match- If compare the chart pattern of BTC from 2024 with the current 2025 ETH pattern, wee see exactly similar chart patterns being formed here.

- Price started consolidating then it had fake breakout towards both the sides and finally the real breakout.

- BTC breakout push the price towards the new all time high above 69K, if we ETH follows similar trend then we can expect new all time high on ETH.

Let's see how it plays out.

Stay tuned for more updates.

Cheers

GreenCrypto

ETH/BTC: Golden Cross Reloaded?This is ETH/BTC on the daily chart.

A major event is about to unfold: the golden cross, where the 50MA crosses above the 200MA.

The last time this happened was in early 2020, around the same price zone, right after a bounce off the 2019 low double bottom and a rejection from the 0.5 Fib level, which sits halfway between the 2019 low and the 0.786 Fib.

In 2025, we’re seeing a strikingly similar pattern:

– Price bounced off the 2019 low

– Got rejected again from the 0.5 level

– And now appears to be gathering strength to flip that level and the 200MA to confirm the Golden Cross

Always take profits and manage risk.

Interaction is welcome.

ETHBTC: Ethereum to outperform massively Bitcoin.ETHBTC turned neutral again on its 1D technical outlook (RSI = 41.566, MACD = -0.00033, ADX = 21.423) as in the past 4 weeks it failed to extend the rebound of the April 14th bottom. Ahead of a MACD Bullish Cross, a little further correction to make a Double Bottom (DB) would make the pattern more bullish, much like the December 9th 2019 DB. That was the start of Ethereum's bull season. Similarly, we expect it to start outperforming Bitcoin massively and approach the R1 level (TP = 0.0800).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

ETH - Trading at crucial resistance levelBINANCE:ETHUSDT (1W CHART) Technical Analysis Update

ETH is currently trading at $2500 range and the price is at crucial resistance zone, previously ETH had one if its largest crash after this support line was broken, now the same support line is acting as resistance.

50 EMA is also acting as a strong resistance in this are.

ETH needs to breaks this resistance to reach the next resistance around 4k USDT. if ETH cross 3K then 4k is an easy target.

Im expecting this resistance to break in next couple of weeks.

Short term target 3100

Mid Term Target 4000

Long Term Target 7000-9000a

a

aRemember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

ETHBTC: Ethereum to gain massively against Bitcoin.Ethereum is overbought on its 1D technical outlook (RSI = 72.854, MACD = 228.230, ADX = 38.542) due to the rebound it initiated last week. Even though it is still on its very early stages, this rebound and statement of its strength is better viewed on the ETHBTC pair against Bitcoin. As you can see, ETHBTC bottomed on a level that it hasn't seen since January 6th 2020. The massive downtrend since 2023 is comparable to the one that started in 2018. Similar bottoms, similar 1W RSI sequences. We expect this rebound to be the main driver all the way to the 7 year Resistance level (R1). Traders of this pair can target 0.0800 on the long term.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

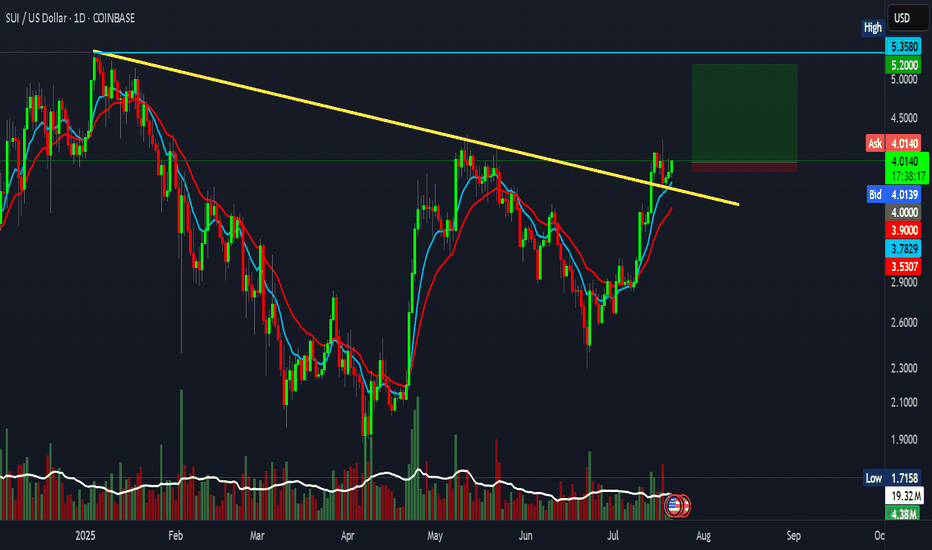

Welcome to ALT SEASON (Real) | BTC.D & ETH/BTCCRYPTOCAP:BTC.D is rejecting off 2021 POI and deviating this cycle's high having just closed the weekly under 64%. Coupled with CRYPTOCAP:ETH strength showing signs of a trend reversal after downtrending for 4-year against $BTC. Likely see CRYPTOCAP:ETH trade upwards of US$5000 this year as ETH outperforms BTC.

ALERT: ALT SEASON INCOMING? 🚨 ALERT: ALT SEASON INCOMING? 🚨

Take a close look at the BTC/ETH chart — we’re seeing early signs of a major rotation out of Bitcoin and into Ethereum and altcoins. Historically, when the BTC/ETH ratio starts to fall, it's a clear signal that capital is flowing into altcoins, marking the beginning of alt season.

🔍 The ratio is showing bearish divergence and approaching a key support zone. If this level breaks, ETH is likely to outperform BTC significantly — and we all know what follows: altcoins explode.

📉 BTC dominance is stalling, ETH gaining strength, and altcoins are waking up. The market is shifting. Don't get caught late.

🚀 Get ready. The alt season might just be starting now.

#AltSeason #Crypto #BTC #ETH #TradingView #CryptoTrends