Breaking: SPX6900 ($SPX) Surged 21% Today The price of SPX6900 ( SP:SPX ) surged Nearly 25% today amidst breakout of a falling wedge.

Created on the Ethereum blockchain, SPX6900 is an advanced blockchain cryptography token coin capable of limitless possibilities and scientific utilization. With a growing momentum and hardworking community the coin seems to be a contender in the incoming bullrun speculated by traders.

As of the time of writing, SP:SPX is up 16.35% trading in tandem with the 1-month high axis. a break above that point could signal a trend continuation to the $0.70 - $0.80 pivot.

Similarly, should SP:SPX cool-off, immediate consolidation point resides in the 38.2% Fibonacci retracement point.

SPX6900 Price Live Data

The live SPX6900 price today is $0.616856 USD with a 24-hour trading volume of $45,031,583 USD. SPX6900 is up 21.61% in the last 24 hours, with a live market cap of $574,288,459 USD. It has a circulating supply of 930,993,090 SPX coins and a max. supply of 1,000,000,000 SPX coins.

Ethereum (Cryptocurrency)

How "Max Pain" Can Become Your Ally in ETH TradingImagine standing on the edge of a cliff, peering down at a raging river below. That’s the feeling traders experience as the options expiration date approaches. At this moment, all bets are off, and the market is primed for sharp movements. Have you ever wondered how to turn this uncertainty into an advantage?

Let’s break it down. The ETH market is buzzing with tension: open interest in options is soaring, and the ratio of in-the-money to out-of-the-money puts stands at 48% to 52%. This means nearly half of all puts have intrinsic value. Professional market participants, like skilled magicians, hedge their positions, transforming them into delta-neutral setups.

But how do they do this? Right, by buying futures! This is the hidden growth driver we’ve been witnessing over the past few days. While I won’t dive into other factors like news, it’s crucial to understand that this dynamic could be the key to success.

Now, let’s talk about “Max Pain.” The Max Pain level for this options series landed on the March 2nd trigger point, where we saw a powerful bullish candle. But are the bulls stuck there? I’m pretty sure they are. Now, we’re left to watch whether the market can break free from this grip.

Personally, I see an opportunity to open a short position. But let’s see if the “law of gravity” will hold true for Max Pain this time.

Stay tuned If you want to stay updated on forex and crypto trading nuances!

ETHUSD New trendETHUSD has currently successfully broken through the resistance level of 2,100 and has re-entered a new range.

Hold for the long term

💎💎💎 ETHUSD 💎💎💎

🎁 Buy@2050 - 2080

🎁 TP 2200 2300 2400 2500

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

ETH at a Make-or-Break Level – What’s Next?🚀 Hey Traders!

If you're getting value from this analysis, smash that 👍 & hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

🚨 ETH Update – Critical Level Ahead!

ETH is currently forming a symmetrical triangle on the 2-week timeframe and is now testing the lower trendline. With 4 days left before the candle closes, this level is crucial! 🔥

📌 What’s next?

✅ If ETH bounces from here, we could see a strong bullish move in the coming days.

❌ Invalidation: A close below $1850 could trigger further downside.

📉 Breakdown or Bounce? What’s your take? Drop your thoughts in the comments! 👇💬

🔔 Follow us for real-time updates and winning trade setups! 🚀

ETHUSDT, I love pattern in chart ...Hello everyone

We backed after a long time by one the powerful analysis on Ethereum.

According to the chart you can see the price movement is sideway, the reason of that for proving this reason is the parallel channel.

At first, the price show us a downward triangle and because of that we expect the price should break the triangle and rising up , the second reason is the price and candle encounter to the one of the important dynamic supporter from the past , and third reason for the rising is the price is near to the below of the channel and the market is so weak and this is what our want and THIS TIME IS TO BUY , ok ??

JUST BUY BUY BUY BUY guys , TRUST US

If you have any question or need help

send us messages

Thank you

AA

Ethereum at the Crossroads: Breakdown or Breakout?Ethereum has seen a steep 60% drop from its highs, but recent activity suggests it might be entering a key transition phase. I’ve entered a long position here with a wide target in place, waiting for clear signs of bullish momentum before adding more size.

Technically, ETH is holding above a strong low on the daily and attempting to reclaim territory beneath a descending trendline. The market has been compressing tightly, and we could soon see expansion either direction. If this is indeed a base forming, it offers a great R:R.

The invalidation lies below the $1,500 daily close—anything below that negates the idea of a shift and brings the $1,000 psychological level into focus. Until then, I treat this as a potential bottom formation trade.

Technicals

• Downtrend structure: ETH has been in a macro downtrend but is showing early signs of compression and possible trend reversal.

• Descending trendline resistance in play. A daily close above it would be significant.

• 2000–2100 remains a psychological resistance zone.

• RSI & Stoch below neutral, indicating room to move up if pressure builds.

• Invalidation below $1,500 (daily close).

Fundamentals

• Massive accumulation: Over 2.11M ETH added to accumulation addresses in March alone.

• Supply squeeze: ETH on exchanges dropped to a 10-year low, down 16.4% from 7 weeks ago.

• Open interest rising: Futures market open interest climbed from 9.40M to 10.10M ETH in just three days—showing derivative trader confidence.

• Ethereum Pectra upgrade scheduled, promising long-term improvements in staking, fees, and transaction management.

• If bullish catalysts align, this accumulation phase could spark a breakout move back toward $2,800–3,000 in Q2.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Eth to $2,500?Hello friends! Well, I'm sharing my opinion. Eth is feeling boring. There isn't much volatility, however, the rebound is clear. It's clear that it will be testing the $2,250 area. However, there are two scenarios:

A) A brief approach with a very sharp rejection.

B) A strong upward breakout to use the $2,250 area as support and reach the famed $2,500, which is a highly liquid area.

In conclusion, the price will seek the $2,250 area early in the week, and buying pressure will determine the final direction.

Disclaimer: This is only an opinion; it should not be used as investment advice or recommendation.

$LINA Set For 7000% Surge Amidst a Bullish Symmetrical TriangleLina a decentralized delta-one asset protocol capable of instantly creating synthetic assets with unlimited liquidity that opens traditional assets like commodities, forex, market indices and other thematic sectors to cryptocurrency users by supporting the creation of “Liquids” — Linear’s synthetic asset tokens, is set for a massive surge with a speculated 7,000% surge in the long run amidst a bullish symmetrical triangle that has been forming since for over 3 years now.

The token is currently oversold as seen by the RSI at 22, but this only makes the story interesting. Despite GETTEX:LINA down 45% today tanking hard amidst the markets volatility, GETTEX:LINA is offering early entry for traders to capitalise on this oversold territory and lack of momentum to kickstart a bullish renaissance.

With a market cap of $9.84M and listings on major exchanges like Binance, Bybit, Kucoin, MEXC, Houbi, etc. This is a good enough sign to capitalize on this opportunity presented by this altcoin.

Linear Finance Price Live Data

The live Linear Finance price today is $0.001174 USD with a 24-hour trading volume of $39,622,410 USD. Linear Finance is down 35.68% in the last 24 hours, with a live market cap of $9,043,949 USD. It has a circulating supply of 7,703,149,626 LINA coins and a max. supply of 10,000,000,000 LINA coins.

Could Pectra Upgrade leads Eth to 11K this cycle?

sentiment on ETH never has been that low while all the arguments against ETH will just be vanished with the upcoming Pectra upgrade

volume is as low as pre 2017 era so I think we can consider ourselves around June July 2017, when ETH made a ~70% retrace from 450 to 150 than peaked at 2K

Despite some delays I don't see why the upgrade will not happen...patience is key

_______

In a more technical view lets zoom to the daily timeframe

- its visible on the weekly chart: ETH bounced from weekly POC, saving it from collapse (?)

- around 0.5 fib now from low cycle to top cycle

- bounced back above that big blue trendline, its an important support that we dont want to loose

I would say the low has been done on the 11th of March, as for BTC

2 and a half possibilities here,

- bullish scenarios : I think there's too much stake on this asset, we bounce from here to see at least 2800 zone

either only up from now, either we go back to 1800 to make a double bottom, sort of H&S pattern kinda happening often at least this cycle

as long as we dont make a lower low this scenario is valid

in this scenario if the upgrade keep its promises and volume is back, I don't see why we wouldn retest new ATHs

- bearish scenario : we breakdown for a lower low aiming to 1600 area, the retest of the trendline above would fail and it would probably be the end of this bull market, that a lot of ppl have already called

______

fast check on whats happening if we zoom again:

Heres the 4H

4H closes in 1 hour but as you can see for now ETH pinged from that blue trendline i think we really dont want to loose

I bought a bit again today, lets see

cheeeers

ETHUSD Ethereum Update 21/03/2025We have seen the upward impulse and the correction. I'm waiting for internal liquidity to be reached and for the price to rise to 2200+ in the next 2 weeks.

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETHUSD Market Analysis: Technical Indicators and Bearish SentimeAs of now, ETHUSD has dropped to $1,961, registering a daily decline of $94.9. Earlier, it exhibited robust upward momentum, surging past the $2,000 threshold. However, it has since experienced a pronounced downturn.

In terms of technical analysis, although the MACD doesn't clearly indicate a trend, its histogram has transitioned from positive to negative and is shrinking, suggesting that bullish strength is waning. The KDJ indicator, with a reading of 90, is in overbought territory. The 4 - hour candlestick chart reveals a substantial price drop relative to earlier levels. Even though the last candlestick is bullish, the overall market sentiment remains bearish.

Recently, trading volume has dwindled. The phenomenon of prices rising while volume falls indicates a significant weakening of upward momentum.

The market may be influenced by profit - taking from the previous rally, which has triggered a selling frenzy. Moreover, external factors like macroeconomic conditions and regulatory policies could also be at play. If key support levels, such as $1,874, fail to be reclaimed, bears are likely to retain their dominance. Investors should vigilantly monitor these support levels and prudently adjust their investment strategies.

ETHUSD

sell@1980-2000

tp:1900

buy@1850-1870

1930-1950

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

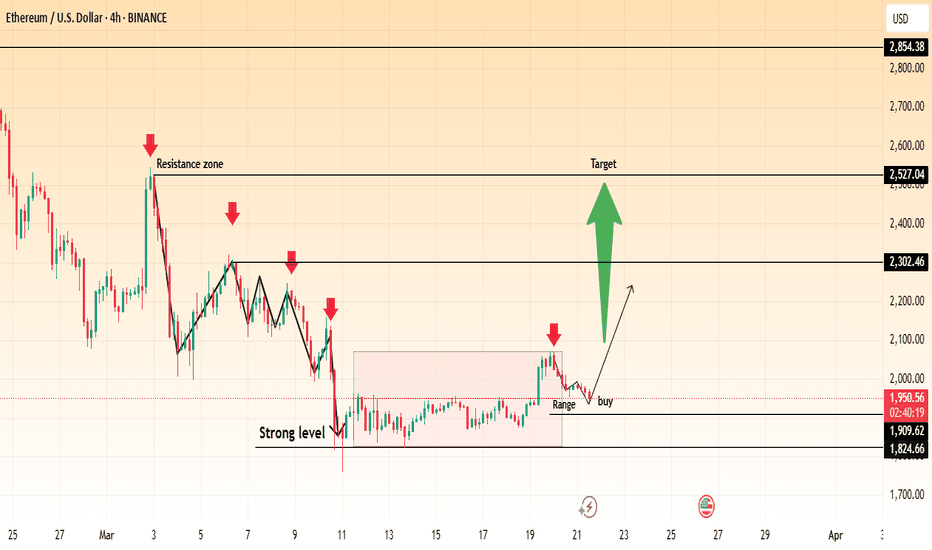

Ethereum (ETH/USD) – Potential Breakout from Range Towards $2,50📊 Chart Insights:

ETH/USD is currently ranging near the $1,950 zone, following a consolidation phase.

A strong resistance zone is visible between $2,302 - $2,527, which has historically acted as a rejection point.

Support levels are established around $1,824 - $1,909, forming a strong base for price action.

A breakout above the current range could signal a bullish move toward the $2,302 resistance level, with a further target at $2,527.

📈 Trading Plan:

✅ Entry: Buy above $1,966 on confirmation of breakout.

🎯 Targets: $2,302 and $2,527 for profit-taking.

❌ Stop Loss: Below $1,909 to manage risk.

📉 Bearish Scenario: If ETH fails to hold $1,909, a retest of $1,824 is possible.

🔥 Ethereum could see a strong rally if momentum builds above resistance! Are you ready?

ETH Eyeing Bullish Targets: $2,244 & $2,380On the 4‑hour chart, ETH appears to be carving out a descending wedge pattern (often a bullish formation) while the RSI is trending upward from oversold territory. Here are the key points to watch:

1.Descending Wedge:

- Price has bounced near the lower boundary of the wedge around the mid‑$1,900s.

A break above wedge resistance (roughly in the $2,000–$2,050 zone) could trigger accelerated upside.

2.Fibonacci & Price Targets:

- Expect 1 (~$2,244): First target aligns with a measured move out of the wedge and a key Fib extension zone.

- Expect 2 (~$2,380): Second target corresponds to a higher Fib extension (2.0–2.272), marking a stronger bullish continuation if momentum holds.

3.RSI Confirmation:

- The 4‑hour RSI is turning upward, suggesting improving bullish momentum. A sustained move above 50–55 on the RSI would strengthen the case for further upside.

4.Pullback Risk:

- If ETH fails to break wedge resistance, it may retest support in the $1,900 area. A close below that could delay or invalidate the bullish setup.

Overall, ETH’s structure and momentum suggest a potential move toward $2,244 initially, with a push to $2,380 if buyers maintain control. A break above the wedge and sustained bullish RSI would be the clearest signals for continuation to these higher levels.

Falling towards pullback support?Ethereum (ETH/USD) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which acts as a pullback resistance.

Pivot: 1,940.23

1st Support: 1,827.50

1st Resistance: 2,107.47

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.