Ethereumforecast

Breaking: $PORK Approaching Key Fibonacci Levels for a Breakout PepeFork ($PORK) a memecoin created as a parody to the original CRYPTOCAP:PEPE coin is set to go parabolic amidst breaking out from the 61.5% Fibonacci retracement point, a level holding ground as the support pivot for $PORK.

The asset is trading with moderate momentum as hinted by the RSI at 43. $PORK is nearly approaching the 61.5% Fibonacci point and a bounced from that level would spark a bullish campaign for PepeFork ($PORK).

PepeFork Price Live Data

The live PepeFork price today is $4.75e-8 USD with a 24-hour trading volume of $2,431,278 USD. PepeFork is down 5.17% in the last 24 hours, with a live market cap of $18,706,640 USD. It has a circulating supply of 393,690,000,000,000 PORK coins and a max. supply of 420,690,000,000,000 PORK coins.

Ethereum Is About To Make Move !!!As Per current price action on Ethereum, Two Harmonic Patterns, Bat & Alt. Bat are forming on Ethereum, and right now price is at PRZ of both patterns. If price reclaims range low, then we may probably will see ethereum exploding upto mid range range high and even further beyond forming new ATH.

Why is Eth Falling? ETH/BTC Ratio Hits All-Time Low Since 2020Why is Ethereum Falling? ETH/BTC Ratio Hits All-Time Low Since 2020

The cryptocurrency market is a volatile landscape, constantly shifting and evolving. Recent data has revealed a significant development: the Ethereum to Bitcoin (ETH/BTC) ratio has plummeted to an all-time low since 2020. This stark decline, currently resting at a mere 0.02 has ignited a wave of speculation and concern within the crypto community, raising questions about Ethereum's current standing and future trajectory.

The ETH/BTC ratio serves as a crucial metric for comparing the relative performance of Ethereum against Bitcoin. When the ratio falls, it indicates that Bitcoin is outperforming Ethereum, and conversely, a rising ratio suggests Ethereum's ascendancy. The current dramatic drop highlights a significant divergence in the fortunes of these two leading cryptocurrencies.

The backdrop to this decline is multifaceted. Bitcoin, often seen as the “digital gold” of the crypto world, has exhibited remarkable resilience and strengthened its position. This consolidation is likely driven by several factors, including increased institutional adoption, regulatory clarity in some jurisdictions, and its established reputation as a store of value. These factors have contributed to a sense of stability and confidence in Bitcoin, attracting capital and bolstering its market position.

Ethereum, on the other hand, has faced challenges in maintaining its momentum. While it remains the leading platform for smart contracts and decentralized applications (dApps), it has struggled to keep pace with Bitcoin's surge. Several factors contribute to this relative underperformance.

Firstly, regulatory uncertainty surrounding Ethereum and its classification has cast a shadow over its future prospects. The evolving regulatory landscape, particularly in major economies like the United States, has created a sense of unease among investors. The lack of clear guidelines and the potential for stricter regulations have dampened enthusiasm and limited institutional investment.

Secondly, Ethereum has faced competition from emerging layer-1 blockchains that offer faster transaction speeds and lower fees. These “Ethereum killers,” as they are sometimes called, have attracted developers and users seeking alternatives to Ethereum's perceived limitations. While Ethereum has undergone significant upgrades, such as the transition to proof-of-stake (The Merge), the benefits have not yet translated into a sustained surge in its relative value.

Thirdly, the overall market sentiment has played a role. Bitcoin's narrative as a safe haven and store of value has resonated strongly during periods of economic uncertainty. In contrast, Ethereum, with its focus on innovation and development, is perceived as a riskier asset. When market volatility increases, investors often gravitate towards the perceived safety of Bitcoin.

The decline in the ETH/BTC ratio raises several critical questions. Is Ethereum in trouble? Is this a temporary setback or a sign of a more fundamental shift in the crypto landscape?

While the current situation is concerning, it is essential to consider the long-term potential of Ethereum. Its robust ecosystem, driven by a vibrant community of developers and innovators, remains a significant asset. Ethereum's role in powering decentralized finance (DeFi), non-fungible tokens (NFTs), and other emerging technologies positions it as a crucial player in the future of the internet.

Furthermore, Ethereum's ongoing development efforts, including layer-2 scaling solutions and future upgrades, aim to address its scalability and efficiency challenges. These improvements could potentially revitalize Ethereum's performance and restore its competitive edge.

However, the current market dynamics suggest that Ethereum faces an uphill battle. To regain its footing, it needs to overcome regulatory hurdles, address its scalability issues, and effectively communicate its value proposition to a broader audience.

The cryptocurrency market is notoriously unpredictable, and past performance is not indicative of future results. The ETH/BTC ratio could rebound, or it could continue its downward trajectory. The outcome will depend on a complex interplay of factors, including regulatory developments, technological advancements, and market sentiment.

In the meantime, the low ETH/BTC ratio serves as a stark reminder of the dynamic nature of the cryptocurrency market. It underscores the importance of diversification and the need for investors to consider the risks and potential rewards of each asset carefully.

The current situation also highlights the need for Ethereum developers and community members to focus on the core values of the project, and to continue to innovate and improve the technology. Ultimately, the success of Ethereum will depend on its ability to adapt to the changing landscape and deliver on its promise of a decentralized and equitable future.

In conclusion, while the record low ETH/BTC ratio raises concerns about Ethereum's current standing, it is premature to declare its demise. The cryptocurrency market is constantly evolving, and Ethereum's long-term potential remains significant. However, the current challenges demand a proactive and strategic approach to ensure its continued relevance and success in the years to come.

Ethereum Not Dead- i know some peoples think ETH will go to 250$ or 500$, so wait for it...

- I've always maintained that I'm not a fan of ETH because of its scalability limitations and centralization, for that reason ETH needs some messy L1...L2...etc..

- That said, my opinion doesn’t matter much, ETH is here to stay. The Ethereum ecosystem hosts thousands of projects; I’d say it’s too big to fail.

- i used Bitstamp exchange to look further back in the chart's history.

- i simplified this monthly chart so much that even a 10 year old kid could understand it, just check the RSI low levels and compare it with previous years. Again, check the max RSI level for the previous ATHs.

- i won't discuss where to buy because, whether you get ETH at $1,800 or $1,500, the bull run for ETH and Altcoins hasn't started yet.

Happy Tr4Ding !

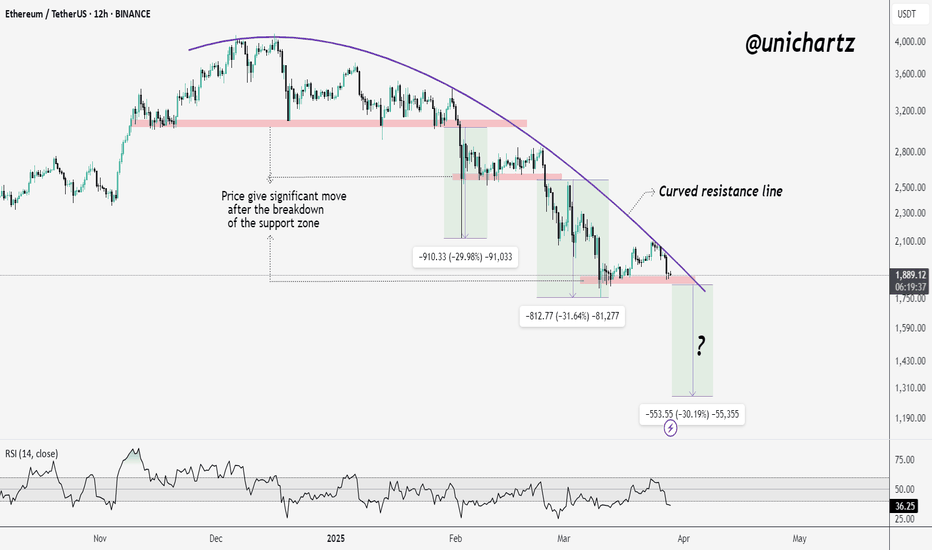

Will Ethereum Survive This Critical Level?Ethereum (ETH/USDT) on the 12-hour timeframe is currently displaying a strong downtrend structure, highlighted by a well-defined rounded top pattern and a descending arc acting as dynamic resistance. Since reaching its peak above $4,000, ETH has consistently printed lower highs and lower lows, respecting this curved resistance line.

The price is currently trading around $1,887, testing a significant horizontal support zone near $1,880–$1,900. This level has held multiple times in the past and now serves as a crucial line in the sand for bulls. If this support fails to hold, Ethereum could see further downside toward the next demand zones around $1,700 or even $1,600.

The RSI indicator stands at 36.11, which suggests that momentum is weak and the asset is nearing oversold territory. While this can often lead to short-term relief bounces, the overall trend remains bearish unless ETH breaks above the descending arc and reclaims key resistance levels near $2,050. A bullish scenario would require strong buying volume and a structure shift to higher highs

ETH Chart - SECRET in the INVERTETH is losing ground quickly after a nasty bearish pattern formed in the weekly.

The bearish M-pattern we're currently observing in the macro timeframe:

We know this is a bearish patter, not only because we've seen it many times before but also because it is the opposite of the W-Bottom. (we can actually confirm this by flipping the chart):

In this case, the bullish confirmation would have been a support retest of the neckline:

And so, if we flip it again back to the original view - the opposite can be true. As we get rejected on the resistance line, an even lower price is likely:

____________________

BINANCE:ETHUSDT

Ethereum ETH Will Crash After Small PumpHello, Skyrexians!

Recently we have already told that potentially BINANCE:ETHUSDT has been finished the correction and is ready to reach $7-10k, but today we recalculated waves and can tell that one more leg down will happen with the high probability.

Let's take a look at the daily chart. Minimum Awesome Oscillator wave tells us that recent dump was only wave 3. Now asset is in wave 4. When AO crosses zero line it means that the min requirement for the wave 4 has been complete. At this point price shall reach the target area at 0.38-0.5 Fibonacci approximately at $2600. There we have to be very careful and if will see the bearish divergent bar the wave 5 will come. The target is $1600.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

ETHUSD – Bullish Quasimodo + iH&S Breakout | Upside Targets!Ethereum (ETHUSD) has completed a textbook bullish Quasimodo pattern in confluence with an Inverse Head & Shoulders (iH&S) on the 15-minute timeframe. Price has broken out with strong bullish momentum, and the structure suggests more upside ahead.

📊 Technical Breakdown

1. Quasimodo Pattern

A well-defined Quasimodo reversal formed at the swing low, providing early signs of a bullish trend shift.

This pattern combines a higher low and reclaimed structure—offering an excellent base for trend continuation.

2. Inverse Head & Shoulders

Left Shoulder, Head, and Right Shoulder clearly structured with neckline breakout confirmed.

Breakout above neckline resulted in a 5.38% rally into minor resistance.

3. Bull Flag Formation

A short consolidation just below the recent highs resembles a bull flag, typically a continuation signal.

Breakout from the flag would trigger the next leg toward the final target.

🎯 Targets

Minimum Target: 2,121.41 — aligns with neckline projection.

Final Target: 2,229.90 — 6.27% projected move based on iH&S measured move.

📌 Trade Idea

Entry Zone: On bull flag breakout above 2,093

Stop Loss: Below 2,060 (flag low support)

TP1: 2,121

TP2: 2,229

🔎 Key Confluences

Pattern Breakouts ✅

Strong Momentum ✅

Clean Structure & Price Geometry ✅

ETH bulls have reclaimed short-term control. If momentum sustains, the upside targets are well within reach.

Breaking: SPX6900 ($SPX) Surged 21% Today The price of SPX6900 ( SP:SPX ) surged Nearly 25% today amidst breakout of a falling wedge.

Created on the Ethereum blockchain, SPX6900 is an advanced blockchain cryptography token coin capable of limitless possibilities and scientific utilization. With a growing momentum and hardworking community the coin seems to be a contender in the incoming bullrun speculated by traders.

As of the time of writing, SP:SPX is up 16.35% trading in tandem with the 1-month high axis. a break above that point could signal a trend continuation to the $0.70 - $0.80 pivot.

Similarly, should SP:SPX cool-off, immediate consolidation point resides in the 38.2% Fibonacci retracement point.

SPX6900 Price Live Data

The live SPX6900 price today is $0.616856 USD with a 24-hour trading volume of $45,031,583 USD. SPX6900 is up 21.61% in the last 24 hours, with a live market cap of $574,288,459 USD. It has a circulating supply of 930,993,090 SPX coins and a max. supply of 1,000,000,000 SPX coins.

$LEASH Set For A Surge Amidst Breaking Out of a Falling Wedge The Price of Doge Killer ($LEASH) is set for a massive surge amidst breaking out of a falling wedge pattern. A pattern formed on the start of January, 2025 that saw $LEASH lose about 33% of value albeit the general crypto landscape was bearish for over 3 weeks now.

We saw CRYPTOCAP:BTC swinging in the $80,000 - $86,000 axis, with CRYPTOCAP:ETH also swinging in the $1900- $2100 pivot. Additionally, should Doge Killer ($LEASH) token break the 1-month high pivot, a bullish continuation move is inevitable.

What Is Doge Killer (LEASH)?

Doge Killer (LEASH) is a token in the Shiba Inu (SHIB) ecosystem. Shiba Inu is commonly referred to as the “Dogecoin (DOGE) killer” because of its enormous popularity. SHIB grew to become the second-largest canine-inspired coin in the crypto space and aims to be the Ethereum (ETH)-based counterpart to Dogecoin’s Scrypt-based mining algorithm. Besides LEASH, there is also Bone ShibaSwap (BONE), another dog coin that is part of the Shiba universe, which can be traded on its own ShibaSwap decentralized exchange (DEX).

Doge Killer Price Live Data

The live Doge Killer price today is $173.74 USD with a 24-hour trading volume of $1,646,362 USD. Doge Killer is up 12.37% in the last 24 hours, with a live market cap of $18,485,943 USD. It has a circulating supply of 106,399 LEASH coins and the max. supply is not available.

Ethereum’s Trendline Support Holds Strong! Time to Long?CRYPTOCAP:ETH is currently testing a key support trendline, which has historically provided strong buying interest. This level has acted as a critical zone for bullish rebounds in previous market cycles.

The 100 EMA (Exponential Moving Average) is positioned above the price, indicating potential resistance on any recovery attempts. If ETH maintains support at this trendline, it could trigger a bounce towards the ATH resistance zone around $4,400.

DYOR, NFA

Please hit the like button and leave a comment!

Breaking: Ethereum Is Good Coin ($EBULL) Surged 66% TodayThe Ethereum is Good coin ($EBULL) a token used as Ethereum's mascot saw a noteworthy uptick in price surging 66% today a move we believe to have been related to the rise in the Ethereum price to reclaim the $2k pivot point.

The $EBULL token recently in the start of year underwent a Community Take Over (CTO) as the community took to their hands to make the project a worthwhile project under the Ethereum network. With backings from Vitalik Buterin and notable crypto exchanges like Poloniex, the $EBULL coin stands to be a coin or token worth hording in your wallet.

Technical Outlook

As of the time of writing, the $EBULL is up 35% trading with a bullish RSI of 71. The surge today was as a result of a breakout from a falling wedge pattern that saw $EBULL tanked to $968k in market cap from a high of $3.4 million just months ago.

$EBULL might encounter a reprieve in the $0.00011 support point before picking momentum up towards recent highs.

ETHEREUM IS GOOD Price Live Data

The live ETHEREUM IS GOOD price today is $0.000122 USD with a 24-hour trading volume of $103,532 USD. ETHEREUM IS GOOD is up 30.72% in the last 24 hours, with a live market cap of $1,215,331 USD. It has a circulating supply of 10,000,000,000 EBULL coins and a max. supply of 10,000,000,000 EBULL coins.

Ethereum Breaks Key Resistance: Bullish Setup for ETH 🚨 **Ethereum Breaks Key Resistance – Bullish Signal!** 🚨

After weeks of consolidation, Ethereum ( CRYPTOCAP:ETH ) has finally broken through a crucial resistance level, triggering a massive short squeeze that liquidated **$46 million** worth of short positions! 💥 This is a strong sign that market sentiment could be shifting to the upside.

Here’s the breakdown:

🔑 **Resistance Breakout**: Ethereum has successfully closed a **4-hour candle above** the key resistance level, signaling a potential trend reversal and continuation to the upside. The market is now eyeing the next major target at **$2100**.

📈 **Trade Setup**:

- **Entry Point**: We are looking for a **retest of the $1960 level** as support (previous resistance), which is a strong entry zone for a long position.

- **Stop Loss**: Set your stop loss just below the previous support level at **$1920** to manage risk effectively.

- **Target**: The next major resistance is around **$2100**, where we expect some price action to unfold. A break above this could signal further upside potential.

This breakout presents a clear opportunity for traders looking to capitalize on potential bullish momentum in Ethereum. Keep your eyes on the charts and manage risk appropriately! 🔍

**Remember**: As always, trade responsibly and stay updated on market conditions.

JUST IN: Ethereum ($ETH) reclaims $2,000The price of the first altcoin (I.e alternative coins) Ethereum ( CRYPTOCAP:ETH ) surged 5% to $2030 price levels reclaiminng the $2k price point. Albeit the general crypto landscape is facing consolidation CRYPTOCAP:ETH seems to break the nuance. This move by Ethereum is tandem with the incoming Ethereum upgrades called "Pectra Upgrade""

The Pectra upgrade is bringing faster transactions, lower fees, & better staking to ETH! With account abstraction (EIP-7702) & higher staking limits (EIP-7251), Ethereum is stepping up its game against Solana!

Technical Outlook

As of the time of writing, CRYPTOCAP:ETH is up 5.12% with a bullish Relative strength index (RSI) of 69 hinting at a continuous rising trend. The 38.2% Fibonacci retracement level is serving as pivot point a move to the $2300 zone would catalyse a bullish spree for Ethereum.

Ethereum Price Live Data

The live Ethereum price today is $2,027.90 USD with a 24-hour trading volume of $13,340,876,260 USD. Ethereum is up 7.20% in the last 24 hours. The current CoinMarketCap ranking is #2, with a live market cap of $244,618,878,972 USD. It has a circulating supply of 120,626,703 ETH coins and the max. supply is not available as per data from CMC.

Bullish ETH theories I think this could be a possible scenario for ETH's next breakout. I think it's possible because of the ETH ETFs that will most likely gain some traction over time, and retail will have to play "catch up" due to the price consolidation over these past years. The winds will turn, and I think everything will play out quite quickly when it happens.

I also think the FED will announce the end of QT today at the FOMC, which COULD trigger the next ETH bull run.

Looking at the ETH/BTC chart, I think this will trigger the next leg up and complete the pattern when looking at the weekly chart, testing the previous highs.

When I look at ETH relative to SOL/USD, it also looks bullish in the short term. I think this is quite reliable, but we will see over time. Although I think ETH will outperform both BTC and SOL and play catch-up with them both.

Conclusion: I have deployed most of my crypto portfolio to ETH now, believing ETH will give me the most beta in this bull run over the coming months. I know the sentiment looks quite bad at the moment for ETH, but I believe there is a saying: "Buy when others are fearful, sell when everybody is greedy." I think this is quite similar to value investing, and I believe there is a lot of value in BTC, ETH, and SOL.

Good luck! And share your thoughts, I like to discuss things like this. =)

The current ETH chart, incorporating my 'flash-crash' thesisThis chart illustrates the current ETH pattern, with my 'April flash crash thesis.'

I believe we will see another thrust lower into the marked lower ranges before a spring into the fifth wave. However, the fifth wave will be a "false breakout," as a flash crash in mid to late April is likely to occur, intentionally designed to sweep liquidity by liquidating overleveraged positions and triggering stop losses—only for the market to recover shortly thereafter and continue its breakout to the upside. This breakout will likely push beyond the pattern and take out the "Trump Election Pump" highs.

There could be some opportunities in the next 4 to 6 weeks, but with opportunity comes risk. Always use a proper risk management strategy suited to your skill level and wallet size.

Good luck, and always use a stop loss!

Ethereum's Current Consolidation: Will It Move Up or Down...?BINANCE:ETHUSDT Ethereum Consolidating Between $1820 and $1950: Will It Break Upside or Downside..?

Ethereum has been trading in a consolidation range between the $1820 and $1950 levels since last week. As the price oscillates within this range, market participants eagerly await a breakout in either direction. The big question is: will Ethereum break upwards or downwards? Let's analyze two potential scenarios based on key price levels and liquidation points.

Scenario 1: Upside Breakout and Potential Rally

One key level to watch is the $1950 resistance. Ethereum has struggled to break past this level, but if the price manages to break above and sustain above $1950, there is a significant upside potential.

Why? At the $1994 level, there is approximately $1.16 billion in liquidations waiting to happen. If Ethereum pushes past the $1950 resistance and approaches this $1994 mark, the surge of liquidations could provide the momentum for a continued rally.

In this scenario, a good strategy would be to wait for a retest of the $1950 level as support, confirming the breakout. If the price holds above this level, it may be a good time to enter a long position, riding the potential bullish move.

Scenario 2: Downside Breakout and Further Decline

On the other hand, if Ethereum fails to hold above the $1820 support and breaks below this level, a downside move could be on the horizon. The next significant support lies around the $1785 level, where around $900 million in liquidations are waiting.

A break below $1820 could trigger a sharp decline toward this liquidation point at $1785. In this case, entering a short position after a retest of the $1820 resistance-turned-support could offer a solid opportunity for traders looking to capitalize on the downtrend.

Conclusion

Ethereum’s consolidation between the $1820 and $1950 levels presents two distinct scenarios. If the price breaks above $1950 and sustains that level, there is upside potential, with liquidation at $1994 offering a bullish catalyst. However, a break below $1820 could open the door for further downside, with liquidations at $1785 triggering a possible downtrend.

Traders should keep a close eye on these levels for confirmation and act accordingly based on the direction Ethereum takes in the coming days.

Breaking: $PIKACH Set for a Comeback Built on the Ethereum blockchain, while simply paying homage to an adorable creature we all love and parody- the Pokémon or its creation Pikachu, $PIKACH is set to soar amidst a bounced from the 38.2% Fibonacci retracement that is presently acting as a support point.

A breakout above the 1-month high could catalyse a bullish move with 30% gains in sight.

With the Relative Strength Index (RSI) at 56 this metric validates the bullish thesis on $PIKACH.

Pikaboss Price Live Data

The live Pikaboss price today is $5.40e-8 USD with a 24-hour trading volume of $24,671.20 USD. Pikaboss is down 2.77% in the last 24 hours, with a live market cap of $22,726,087 USD. It has a circulating supply of 420,690,000,000,000 PIKA coins and a max. supply of 420,690,000,000,000 PIKA coins.

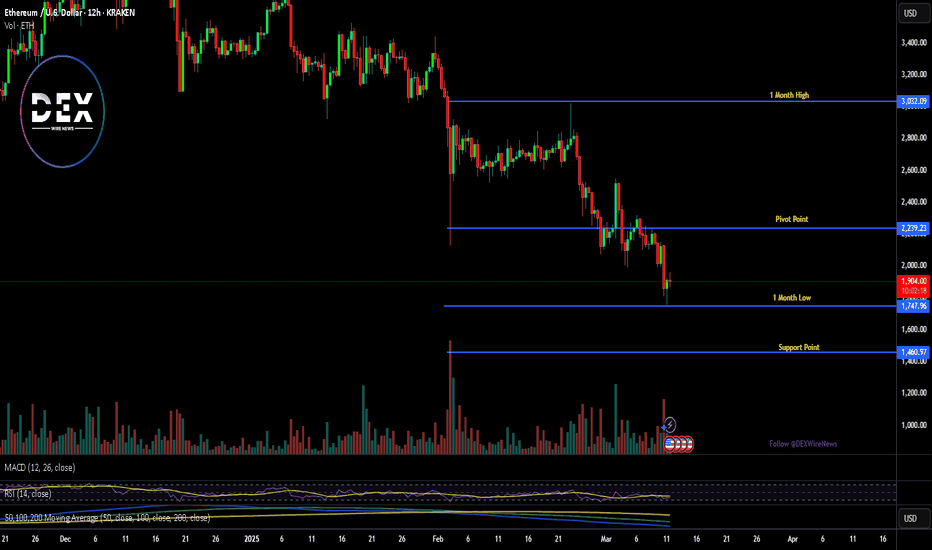

Breaking: Ethereum Dips 9% Today losing the $2k Price LevelEthereum today saw a noteworthy downtick with the asset dipping below the $2000 pivot zone. currently trading around the $1900 - $1700 price zones.

Ethereum is currently oversold as depicted by the Relative Strength Index (RSI) at 36. The 1-month low is acting as support point for Ethereum. Should selling pressure continue, CRYPTOCAP:ETH might tanked to $1000- 1400 price levels.

However, in the case of a price reversal, a break above the 65% Fibonacci retracement level could placed CRYPTOCAP:ETH on the cusp of a bullish spree.

Despite the bloodbath facing Ethereum albeit the general crypto landscape facing same, data from DefiLlama hints at a growing Defi landscape in the Ethereum blockchain with about $45.43 billion locked in Total Value Lock (TVL) and the volume growing in tandem with the TVL locked.

Presently up 2% trading at $1905 price point all eyes are set on the major pivots we mentioned above.

Ethereum at Critical Levels – Breakout or Breakdown for ETH?Ethereum (ETH) is looking heavily overextended right now 📊, with price action pressing into key support zones on the daily and weekly charts ⏳. The market is at a critical juncture, and a sharp pullback 📉 could be on the cards.

This could present a short-term counter-trend buying opportunity on the lower timeframes 💰, but if ETH pushes higher, it may offer a prime short setup 🎯.

⚠️ Not financial advice – trade smart and manage risk accordingly! 🚀

ETH → Gearing Up for $10,000!? Or $1,200? Let's Answer.Ethereum finally fell into my buy zone this past week and I was able to buy with an average price of $2,185.18. This is a target I've been watching for months in anticipation. The best part is that it may go lower!

How do we trade this? 🤔

ETH has landed on a key support area of $2,100 and is now flirting with falling to the .236 Fib level at $1,800. A final target would be around $1,500 which brings us back into the bear market range. ETH formed a triple top over the course of 2024 and as expected, it pulled back hard with the alt market.

Bitcoin Dominance has been in a bull trend since the last cycle and hasn't shown any signs of weakness yet. Currently at 62%, it could jump up to 70% easily. Until it drops, ETH and the alts are going to remain bleeding out.

I'm targeting the previous all-time high for a first profit target, around $4,800. Whether I take profits at that level depends on the price action leading up to it. If we get a strong push with strong candle closes leading up to that price, I'll likely hang on. Otherwise, I may take 25% of my position off the table and look for a potential re-entry.

Final target price is $6,750, just below the 1.618 Fib level. This level also corresponds with a measured move target if the price attempts $4,000, pulls back to the 3-Year Support, then moves up again. I believe $10,000 ETH is absolutely possible for this run, but given how slumpy the alt market is, I don't see that probability being as high as the previous high of $7,000. This is why I'm taking my profits before that 1.618 Fib level is hit.

💡 Trade Idea 💡

Long Entry: $2,185.18

🟥 Stop Loss: $700

✅ Take Profit #1: $4,800

✅ Take Profit #2: $6,750

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. 2024 Triple top led to a retrace down to the 2023 range.

2. First buy at $2,185.18, potential buy at $1,800 and $1,500

3. Stop loss at $700 below the 2022 bear market low

4. Holding the position until the previous all-time high around $4,850 where the first take profit waits. $6,750 is the second take profit just before the 1.618 fib level

5. Weekly RSI is near 34.00 and below the Moving Average. This is a good level to buy.

💰 Trading Tip 💰

Ascending Wedges signal an increased probability of a bear breakout. Combined with three pushes up in a bull trend and strong sell bars (candles with large wicks on their tops), creates conditions where a counter-trend trade is reasonable.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology