Ethereumusd

ETHUSD formed bullish Shark | Upto 25% potential movePriceline of Ethereum / US Dollar cryptocurrency is has formed a bullish Shark pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this area.

I have used Fibonacci sequence to set the targets:

Buy between: 156.93 to 148.77

Sell between: 167.54 to 187.39

Regards,

Atif Akbar (moon333)

Ethereum (ETH)- ETHUSD-Buying Opportunity- 287% Profit Expected!Ethereum (ETH) - ETHUSD - Technical Analysis - 287% Profit Expected

Big Trade Coming With Huge ROI..

Based on AB=CD pattern , Time Ratio & Gann Analysis, It's a potential long position with great returns :)

In a lower time-frame (4hrs) this long position has also been confirmed.

Target Profit Range - 198 - 422

(55%-287% Profit Expected)

TP - 1 - 198

TP - 2 - 244

TP - 3 - 296

TP - 4 - 347

TP - 5 - 422

Buying Zone! Long Position

Early Entry Trigger Point - $121 -$135

Ideal Entry Trigger Point - $102 - $116

Adjust your Stop Loss according to your lot size,

account equity, strategy & money management.

***If you want to get in this trade from this point 174.8 you can still make 39.7% profit till TP2 is reached, however, there is a very high probability that price may continue to move down towards my ideal entry point., It is recommended to enter with a smaller lot size if you want to go long right away & manage your stop loss accordingly.

Good Luck.!

Disclaimer - This is not financial advice. This is my personal view and analysis of this chart.

If you follow this idea please plan your trade according to your lot size and account equity.

Don't forget to like, comment & follow , If you agree with my analysis :)

DBL bottom on ETHUSD signals retraceFollowing double bottom pattern formation the price is generally believed to rise at least to its target level, calculated as follows:

T = R + H,

Where:

T = TP (target level);

R – resistance level (recent local high);

H — higher high (fluctuates based on basic indicators)

S – stop-limit (distance between current price and prior resistance levels).

T = $187.70

S = $176.58

R = $184.86

H = Blue horizontal

Disclaimer

NOT financial advise. Just magic from your local sorcery. Trade responsibly!

-@a1mTarabichi

Following up from previous analysis As we can see the $180 mark has held as a stable support level for my trade 2 days ago which I entered at $180 with 25x leverage, only a few dollars have risen so far, however this can rise to $190 or $195 with a small spike in volume. Any increase in BTC price can also reflect well here.

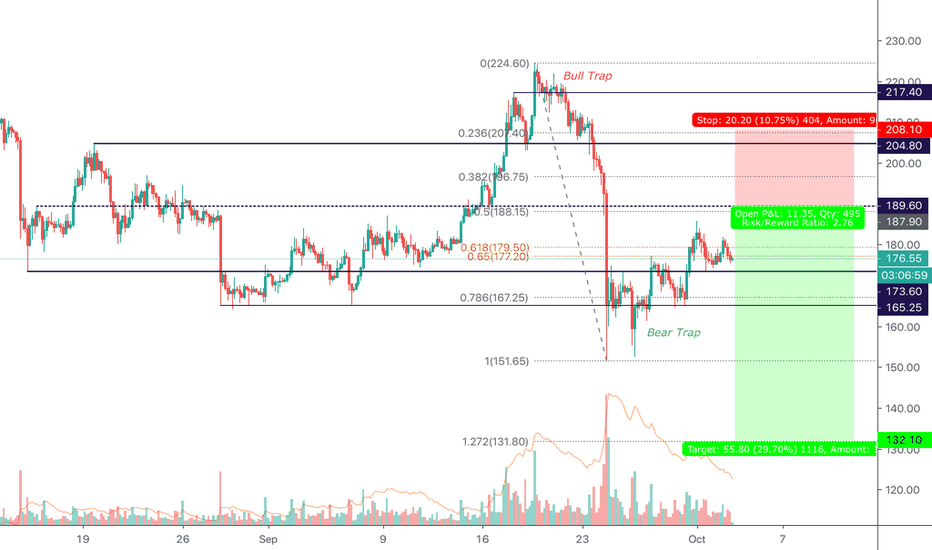

ETH/USD Price Action Analysis | Hopes & DespairsEthereum has got back in the Trading Range after a significant Bear Trap. Most of the bears are already got hunted and if not, will be hunted in the next up move along with the hopes of the bulls. That intersection of both, is where our entry initiates.

Entry: 187.9

SL: 208.1

TP-1: 152.1

TP-2: 132.1

R/R: 2.76

Please let me know if you have any suggestions or any ideas to add. I can also give you more detailed explanation for this specific trade setup.

The ideas published here are not financial advices.

Ichimoku Analysis for EthereumGood day dear readers,

Bitcoin has broken down and is indicating to go even lower. Normally this is bad news for the altcoins but when bitcoin is consolidating, altcoins have an opportunity to move up a little.

With Ethereum leading the way.

Ethereum on the medium timeframe (4H) is looking quite bullish. Since the 6th of October we have ripped from 0.010 up to 0.022, a nice 37% increase.

On the 4 Hour chart, We can see that the Ichimoku cloud is in a nice bullish trend, and if we can break above 0.022 I am expecting to continue the uptrend.

My target for now is the upper edge of the cloud on the daily: 0.025 and I am willing to take a 5% risk for my stop-loss.

Kind regards, R2.

ETHUSD formed bullish BAT | A buying opportunityPriceline of Ethereum / US Dollar cryptocurrency is forming a bullish BAT pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this area.

I have used Fibonacci sequence to set the targets:

Buy between: 172.84 to 166.91

Sell between: 174.42 to 182.35

Regards,

Atif Akbar (moon333)

Ethereum Just Broke Out of its Consolidation...or did it?As we suggested earlier today, Ethereum broke out of its consolidation zone to the upside. It managed to close above on the 4-hourly which is significant. However, it was not able to close above the 0.382 retracement level. It did exceed the level briefly before reversing below in the candlestick which is yet to close. If the Fibonacci level is strong enough as resistance, it could be that this was a false breakout of the consolidation zone, and the market may soon return to it.

This isn't a particularly strong bearish sign yet. The market is still above the consolidation zone, and hasn't yet closed below the 0.382 level. It's likely that the 0.382 level will act as short term resistance, causing the market to hover around where it is briefly before continuing into a new bullish trend following the breakout.

For the short term, the most important events to consider are whether the market has fallen back into the consolidation zone, and whether it has broken above the 0.382 retracement level. These events will be the most telling of the market's sentiment.

Ethereum Just Broke Out of its Consolidation...or did it?As we suggested earlier today, Ethereum broke out of its consolidation zone to the upside. It managed to close above on the 4-hourly which is significant. However, it was not able to close above the 0.382 retracement level. It did exceed the level briefly before reversing below in the candlestick which is yet to close. If the Fibonacci level is strong enough as resistance, it could be that this was a false breakout of the consolidation zone, and the market may soon return to it.

This isn't a particularly strong bearish sign yet. The market is still above the consolidation zone, and hasn't yet closed below the 0.382 level. It's likely that the 0.382 level will act as short term resistance, causing the market to hover around where it is briefly before continuing into a new bullish trend following the breakout.

For the short term, the most important events to consider are whether the market has fallen back into the consolidation zone, and whether it has broken above the 0.382 retracement level. These events will be the most telling of the market's sentiment.

ETHUSD formed bullish Crab | Upto 15% expectedThe priceline of Ethereum / US Dollar has formed a bullish Crab pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this zone.

I have used Fibonacci sequence to set the targets:

Buy between: 196.10 to 188.24

Sell between: 202.20 to 216.97

Regards,

Atif Akbar (moon333)

ETHUSD today analysis, 190923. Rebound after fall to around $190Hello my friends. It's Crypto Ranger K.

First of all, fortunately, for the last few days, I think the price is flowing as I expected.

One thing that bothers me is that today's candle bottom is higher than yesterday's candle bottom.

I think there are three reasons for the weakening of the decline.

First of all, I think it's far from the 5day line due to a sharp drop in prices over the past few days.

The second reason is that the intersection of the 200-day line and the 10-day line acts as a support, and finally, the current position is the place where the trading volume is concentrated.

In fact, when I saw this part yesterday morning, I thought about the possibility that the price would rise from this point.

I still think there is some possibility.

ETH will fall if BTC doesOK, so we have BTC potentially falling, so Ethereum price should do the same. Where we may expect it to bounce? Nearest support zones are at 210-211, then 205, then 195-197. Support zones are targets for shorts and potential long entries.

Nearest resistance is at 216 and 218 - consider it as short entry zone