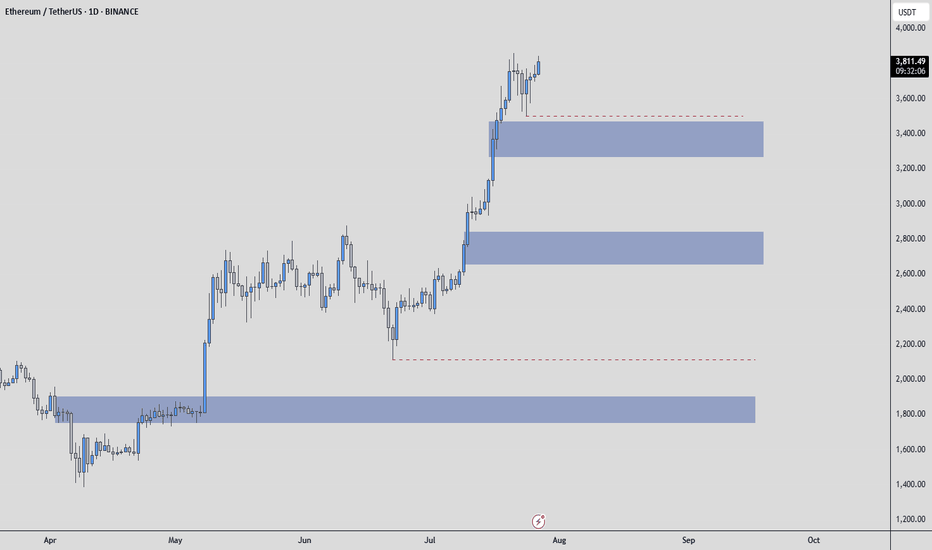

Ethereum - Possible Zones / How to use them ? Hello everyone, and special greetings to my dear friends who follow me, I hope you're happy that I helped you buy Ethereum at $2200.

Let's get to today's situation. There are many areas for Ethereum. The first blue box is the one I'd want to be the first buyer in.

I might want to be a buyer in the other blue boxes as well, but there will be increases even before these areas are reached.

I think the bottom blue box could be the one in the event of a Q3 correction.

What is a Q3 correction? All risk-on markets typically experience significant corrections in the third quarter of the year and struggle to recover from this correction until the end of the year.

The first blue box would be the first area I'd want to be in for any increases leading up to this correction.

HOW DO I GET INVOLVED!! THIS IS IMPORTANT BECAUSE SOME OF YOU LOSE MONEY WHEN BLUE BOXES ARE PULLED AWAY. THIS SHOULD NOT HAPPEN!!

When the price reaches the blue box, the transition is made to the 1-hour timeframe. Here, an upward breakout is sought, and during this breakout, the CDV is expected to be positive and rising. If these conditions are met, then RISK is taken. However, the entire amount of money isn't spent; it simply means that the conditions necessary to spend one bullet are met. One bullet is an amount that won't upset you too much; this varies for everyone.

I hope you use this analysis beneficially and profitably, because I want you to make a lot of money. Best wishes to you all, UmutTrades.

Ethereumusdt

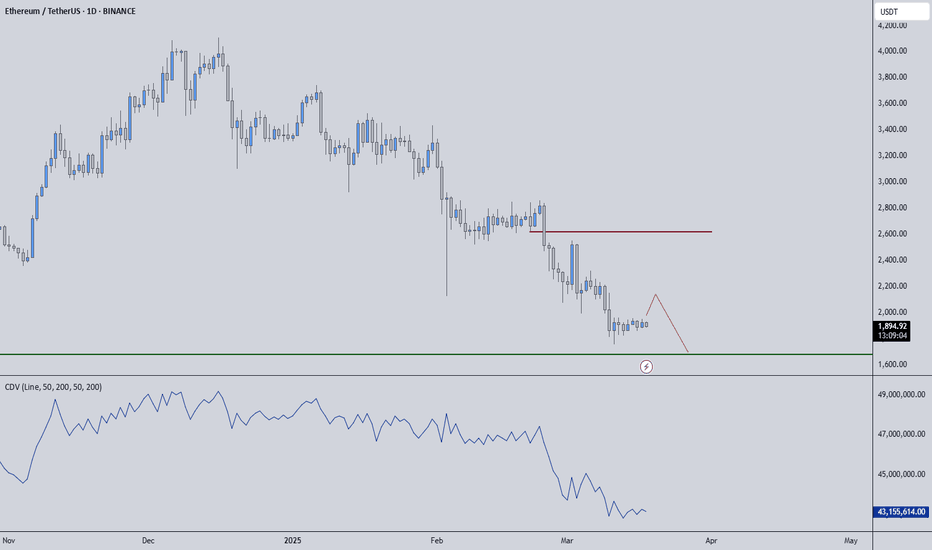

ETHUSDT – Eyes on the Green Line!ETHUSDT – Eyes on the Green Line!

“Momentum is building, and all signs point to the next key level—the green line is in play!”

🔥 Key Insights:

✅ Trend Remains Strong – No reason to fade the move.

✅ Green Line = Next Target – That’s where liquidity & reactions will matter.

✅ Pullbacks = Buying Opportunities – No FOMO, we wait for strategic entries.

💡 The Smart Plan:

Look for Dips to Load Up – Volume & CDV should confirm strength.

LTF Breakouts = Strong Entry Signals – Follow structure, not emotions.

Green Line = First Major Resistance – Expect reactions, manage risk accordingly.

“If momentum holds, Ethereum is headed straight for the green line—watch closely!” 🚀🔥

A tiny part of my runners;

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

Ethereum Not Dead- i know some peoples think ETH will go to 250$ or 500$, so wait for it...

- I've always maintained that I'm not a fan of ETH because of its scalability limitations and centralization, for that reason ETH needs some messy L1...L2...etc..

- That said, my opinion doesn’t matter much, ETH is here to stay. The Ethereum ecosystem hosts thousands of projects; I’d say it’s too big to fail.

- i used Bitstamp exchange to look further back in the chart's history.

- i simplified this monthly chart so much that even a 10 year old kid could understand it, just check the RSI low levels and compare it with previous years. Again, check the max RSI level for the previous ATHs.

- i won't discuss where to buy because, whether you get ETH at $1,800 or $1,500, the bull run for ETH and Altcoins hasn't started yet.

Happy Tr4Ding !

ETH (Ethereum): Approaching SupportTrade setup : Price broke below its 200-day moving average, which signaled downtrend. It bounced off $2,100 support and reached $2,800 resistance where it got rejected. Momentum is fading (MACD Histogram declining ). We would be buyers if price dips to $2,100 support again. The recent launch of nine ETH Spot ETFs could also boost demand for ETH. Learn to trade chart patterns in Lesson 8 and set Stop Loss levels in Lesson 9.

Pattern : Price is Approaching Support, which is a level where it could pause or reverse its recent decline, at least temporarily. Support is often a level where price has bounced up in the past, or potentially prior Resistance level that was broken. (concept known as polarity). Once price breaks below support, it can move lower to the next support level. Learn to trade key levels in Lesson 7.

Trend : Short-term trend is Strong Down, Medium-term trend is Strong Down and Long-term trend is Strong Down.

Momentum is Bullish but inflecting. MACD Line is still above MACD Signal Line but momentum may have peaked since MACD Histogram bars are declining, which suggests that momentum could be nearing a downswing. Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance : Nearest Support Zone is $2,400.00, then $2,100.00. Nearest Resistance Zone is $2,620.00, then $2,850.00.

ETH (Ethereum): Approaching ResistanceTrade setup : Price broke below its 200-day moving average, which signaled downtrend. However, it got oversold (RSI < 30) near $2,400 support and bounced up. Also notice the unusually high volume, which also suggests that a lot of sellers have already exited. Momentum is inflecting bullish again (MACD Histogram rising) and price could reach $2,850 resistance. This is a riskier trade setup because it’s a trend reversal not a trend continuation setup. It’s against the overall downtrend. The recent launch of nine ETH Spot ETFs could also boost demand for ETH. Learn to trade chart patterns in Lesson 8 and set Stop Loss levels in Lesson 9.

Pattern : Price is Approaching Resistance , which is a level where it could pause or reverse its recent advance, at least temporarily. Resistance is often a level where price got rejected in the past, or potentially prior Support level that was broken. (concept known as polarity). Once price breaks above resistance, it can advance higher to the next resistance level. Learn to trade key levels in Lesson 7.

Trend : Short-term trend is Strong Down, Medium-term trend is Strong Down and Long-term trend is Strong Down.

Momentum : Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance : Nearest Support Zone is $2,400.00, then $2,100.00. Nearest Resistance Zone is $2,620.00, then $2,850.00.

Brief ETH Analysis | Bearish Trend? Key S & R Levels 1D TFThe 1D TF chart for Ethereum shows a consolidation period following a significant uptrend. Key events include the publication of the U.S. Consumer Price Index (CPI) on May 12 and circulating news about the upcoming approval of the Ethereum spot ETF, which caused heightened market activity. On May 20, Ethereum's price surged by 21% in a single day, a significant movement compared to the typical 9 - 11% increases. This sharp rise was driven by speculative news and positive sentiment surrounding the potential ETF approval and favorable CPI data.

After this spike, the price entered a range, characterized by increased trading volumes but low volatility candles, indicating market indecision. Recently, an "Inside Bar" pattern has formed: the middle candlestick is a small bearish candle enclosed within the previous large bullish candle, with a potential bullish candle forming today. This pattern highlights market indecision and suggests a potential breakout in either direction.

Currently, Ethereum is testing a critical resistance level around $4K. A breakout above this level, accompanied by increased volume, could signal further upward movement. Conversely, failure to break this level might lead to a pullback towards the support zones.

The current chart analysis shows that ETH is approaching a significant resistance level around $4K, marked by a descending trend line. This resistance has been tested several times, underscoring its importance.

The volume profile indicates consolidation between key support and resistance levels:

◼️ Resistance Levels: Around $3.9K and $4.1K.

◼️ Local Support Levels: Around $3.7K and $3.5K.

◼️ Bullish Scenario: A breakout above $3.9K, accompanied by increasing trading volumes, could signal the continuation of the bullish trend towards the next resistance level around $4.1K.

◼️ Bearish Scenario: If the price fails to break through the resistance and falls below the $3.5K support level, it could indicate a potential bearish reversal or an extended consolidation phase.

Monitoring trading volumes and price movements around these key levels will be critical in predicting the next significant move.

Disclaimer: Content for seasoned traders only. Not financial advice. You bear sole responsibility for trading outcomes. ➖ DYOR 🧠 💡

ETH: Approaching SupportTrade setup : Price is in an Uptrend. Following a bullish breakout from a Descending Triangle pattern, price spiked up 25% and reached our near-term target of $4K. However, it got overbought (RSI ~ 70) and is pulling back on some profit taking.

Now we look for the right entry opportunity in Uptrend. We wait for price to either 1) break above $4K to signal continuation of uptrend, with +17% upside potential to its ATH of $4,700, or 2) pull back near $3,200 support for another swing trade entry in Uptrend with upside potential back to $4K. Learn to trade chart patterns in Lesson 8 and set Stop Loss levels in Lesson 9.

Pattern : Price is Approaching Support , which is a level where it could pause or reverse its recent decline, at least temporarily. Support is often a level where price has bounced up in the past, or potentially prior Resistance level that was broken. (concept known as polarity). Once price breaks below support, it can move lower to the next support level. Learn to trade key levels in Lesson 7.

Trend : Short-term trend is Up, Medium-term trend is Strong Up and Long-term trend is Up.

Momentum is Bullish but inflecting. MACD Line is still above MACD Signal Line but momentum may have peaked since MACD Histogram bars are declining, which suggests that momentum could be nearing a downswing. Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance : Nearest Support Zone is $3,200.00, then $2,930.00. Nearest Resistance Zone is $4,000.00, then $4,800.00.

ETH: Approaching ResistanceTrade setup : Price is in an Uptrend. Following a bullish breakout from a Descending Triangle pattern, price spiked up 25%, broke above $3,700 resistance and is approaching our near-term target of $4K. It's a bit overbought (RSI ~ 70). Now we look for the right entry opportunity in Uptrend. We wait for price to either 1) break above $4K to signal continuation of uptrend, with +17% upside potential to its ATH of $4,700, or 2) pull back near $3,750 key level for another swing trade entry in Uptrend with upside potential back to $4K . Learn to trade chart patterns in Lesson 8 and set Stop Loss levels in Lesson 9.

Pattern : Price is Approaching Resistance , which is a level where it could pause or reverse its recent advance, at least temporarily. Resistance is often a level where price got rejected in the past, or potentially prior Support level that was broken. (concept known as polarity). Once price breaks above resistance, it can advance higher to the next resistance level. Learn to trade key levels in Lesson 7.

Trend : Short-term trend is Strong Up, Medium-term trend is Strong Up and Long-term trend is Up.

Momentum is Bullish but inflecting. MACD Line is still above MACD Signal Line but momentum may have peaked since MACD Histogram bars are declining, which suggests that momentum could be nearing a downswing. Price is Overbought currently, based on RSI-14 levels (RSI > 70).

Support and Resistance : Nearest Support Zone is $3,200.00, then $2,930.00. Nearest Resistance Zone is $4,000.00, then $4,800.00.

ETH: Channel Down PatternTrade setup : Trends are mixed but price remains above 200-day moving average, which keeps the long-term uptrend intact. It’s now trading in a Channel Down pattern. With emerging patterns, traders who believe the price is likely to remain within its channel can initiate trades when the price fluctuates within its channel trendlines. With complete patterns (i.e. a breakout) – initiate a trade when the price breaks through the channel’s trendlines, either on the upper or lower side. When this happens, the price can move rapidly in the direction of that breakout. Learn to trade chart patterns in Lesson 8.

Trend : Neutral on Short- and Medium-Term basis and Uptrend on Long-Term basis.

Momentum is Mixed as MACD Line is above MACD Signal Line (Bullish) but RSI ~ 50 (Neutral).

Support and Resistance : Nearest Support Zone is $2,960 - $3,040, then $2,700. The nearest Resistance Zone is $3,600, then $4,000 and $4,800.

ETH: Pullback in UptrendTrade setup : After getting rejected 3x at $2,400 resistance, ETH finally had a bullish breakout from Sideways Channel ($2,150 - $2,400), which signals resumption of uptrend, with upside to $2,750 next. Price has now pulled back to retest that breakout level. Stop Loss (SL) at $2,270 (5% below breakout level). ETH is likely to benefit from upcoming launch (May 2024) of Ethereum Spot ETF.

Trend : Uptrend across all time horizons (Short- Medium- and Long-Term).

Momentum is Bullish but inflecting. MACD Line is above MACD Signal Line and RSI is above 55 but momentum may have peaked since MACD Histogram bars are declining, which suggests that momentum is weakening.

Support and Resistance : Nearest Support Zone is $2,400 (previous resistance), then $2,150. The nearest Resistance Zone is $2,750.

ETH: Sideways Channel BreakoutTrade setup : After getting rejected 3x at $2,400 resistance, ETH finally had a bullish breakout from Sideways Channel ($2,150 - $2,400), which signals resumption of uptrend, with upside to $2,750 next. Stop Loss (SL) at $2,270 (5% below breakout level). ETH is likely to benefit from upcoming launch (May 2024) of Ethereum Spot ETF. Which related altcoins will benefit?

Trend : Uptrend across all time horizons (Short- Medium- and Long-Term).

Momentum is Bullish (MACD Line is above MACD Signal Line and RSI is above 55).

Support and Resistance : Nearest Support Zone is $2,150 (previous resistance), then $2,000. The nearest Resistance Zone is $2,400, which it broke, then $2,750.

ETH: Approaching ResistanceTrade setup : Following a bullish breakout from Ascending Triangle pattern, above $2,150 key level, price has reached our target of $2,400 resistance. Now we wait for price to either 1) break above $2,400 to signal continuation of uptrend, with upside to $2,750 next, or 2) pull back near $2,150 support for a swing trade entry in Uptrend with upside potential back to $2,400.

Trend : Uptrend across all time horizons (Short- Medium- and Long-Term).

Momentum is Mixed as MACD Line is below MACD Signal Line (Bearish) but RSI ~ 50 (Neutral).

Support and Resistance : Nearest Support Zone is $2,150 (previous resistance), then $2,000. The nearest Resistance Zone is $2,400, then $2,500.

🚧Ethereum Analysis(Three Falling Peaks Pattern)🚧🎄Merry Christmas!

💫Happy Holidays! I hope all of your Christmas wishes come true.

✅ Ethereum(ETH) managed to form a Three Falling Peaks Pattern near the 🔴 Heavy Resistance zone($2,540_$2,300) 🔴 and 🟡 Price Reversal Zone (PRZ) 🟡.

📚What is the Three Falling Peaks Pattern❗️❓

🔸 The three falling peaks pattern consists of three peaks and two valleys of give or take equal size. The pattern has a downward slope meaning that each peak is lower than the last, and the same applies to the valleys.

🔸The three falling peaks pattern validly forms when, after the last peak, the price falls below the second valley signaling a market reversal and a large price drop.

🔨Also, Ethereum managed to break the Support line and 🟢Support zone($2,270_$2,245) 🟢.

🔔I expect Ethereum to continue its decline towards the next 🟢Support zone($2,167_$2,116) 🟢 after completing the pullback to the 🟢Support zone($2,270_$2,245)🟢 and Support line .

❗️⚠️Note⚠️❗️: An important point you should always remember is capital management and lack of greed.

Ethereum Analyze ( ETHUSDT), 1-hour time frame ⏰.

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Ethereum potential reversed price is 22002h time frame

-

Refer to the previous structure from Mar 27 to April 17

We can easily predict the next trend of ETH

Still have the potential to create harmonic pattern in near future.

With this analysis, timing to open short will be around 2200

Get ready for it!

ETH soon below 3kAgain, if we skip any thoughts of summer and a big drop to 800 USD per ETH, then we can look forward to a price around 2800 USD soon, then summer may come and the price of mine will drop, or we will skip it towards 9500 USD per ETH, let us be surprised , don't take any of my predictions seriously without your own TA and most of all enjoy your head with SL. I wish you safe trading.

I can always be 99% wrong, the wave is there for fun, we will have a massacre of manipulation, artificial volume, etc... it will be fun as always

ETH: Sideways ChannelEthereum (ETH) technical analysis:

Trade setup : Following a breakout of Ascending Triangle, ETH has entered an Uptrend and price has reached $1,700 resistance. It appears consolidating in a Sideways Channel. Now we wait for price to 1) break above $1,700 to resume Uptrend with upside to $2,000, or 2) pull back near $1,500 support for an attractive swing entry in Uptrend.

Pattern : Price is trading in a Sideways Channel , which is a neutral pattern (indication of market indecision). Trend Traders ought to wait for a breakout in either direction, although typically it breaks in the direction of the existing trend. Swing Traders can trade the range – Buy near Support and Sell near Resistance.

Trend : Uptrend across all time horizons (Short- Medium- and Long-Term).

Momentum is Mixed as MACD Line is below MACD Signal Line (Bearish) but RSI ~ 50 (Neutral).

Support and Resistance : Nearest Support Zone is $1,500 (previous resistance), then $1,250. The nearest Resistance Zone is $1,700, then $2,000.

#Ethereum - Thoughts out loud #6Good afternoon, dear colleagues!

I am glad to welcome everyone who wants to familiarize themselves with my vision of the current situation on this instrument.

Is it worth continuing? Please leave a comment.

Dear colleagues, I sincerely thank you all for your attention and wish you all success!

And remember one thing:

"sometimes you win, sometimes you learn"