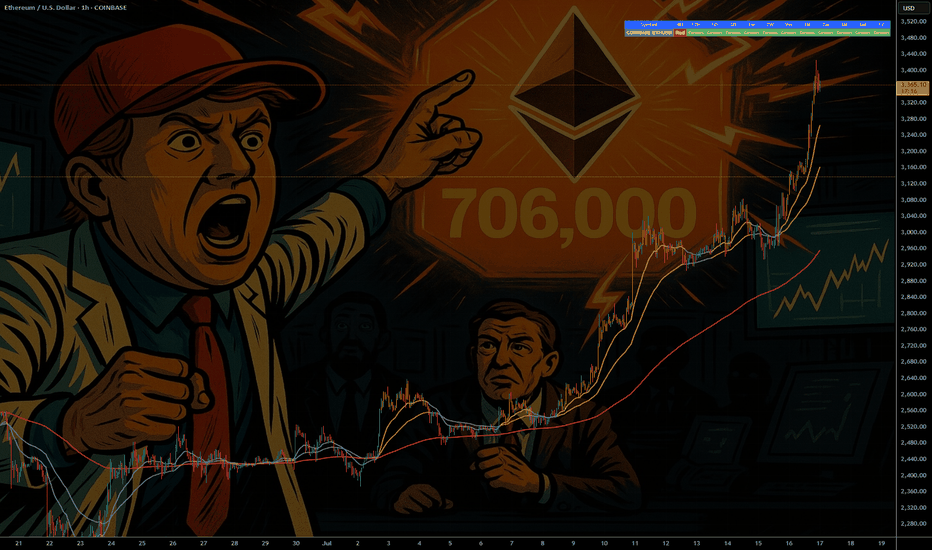

ETH - If You Know ...... You Know whats Coming

NYSE:BLK $BUIDL tokenized U.S.-Treasury fund launched on COINBASE:ETHUSD in Mar 2024—Wall Street is already settling real dollars on-chain.

NYSE:JPM JPMD stablecoin just went live on Base (an COINBASE:ETHUSD L2), piping wholesale payments from a $4 T balance-sheet straight through COINBASE:ETHUSD rails.

COINBASE:ETHUSD isn’t just riding the next crypto cycle—it’s becoming Wall Street’s settlement layer. From BlackRock’s on-chain Treasury fund to JPMorgan’s and soon Bank of America’s dollar tokens, a tidal wave of institutional stable-coin flows is lining up behind ETH. Fewer coins, more real-world volume—if you know, you know what’s coming.

NYSE:BAC CEO says they’ll issue a dollar-backed token the moment regulators nod—another tier-1 bank boarding the Ethereum train.

Stablecoin cap has blasted past $230 B , with 80 %+ of all on-chain transfers riding Ethereum (plus BSC) blocks.

Corporate settlements via stablecoins grew 25 % YoY in 2024 as multinationals replaced SWIFT with instant on-chain clearing.

Daily stablecoin throughput averages $7 B—each hop burning ETH and tightening supply.

BCG projects tokenized real-world assets to exceed $16 T by 2030 , with EVM chains as the default plumbing.

Over 500 M wallets already interact with stablecoins , a 30 % YoY surge led by emerging-market demand.

L2s like BINANCE:ARBUSDT & BINANCE:OPUSDT cut transaction fees 35 % yet still settle back to mainnet—meaning ETH captures the fee stream and the burn.

Bottom line: a tidal wave of bank-grade stablecoins + tokenized assets is lining up behind ETH; supply shrinks, demand soars—if you know, you know what’s coming.

quote] Marty Boots | 17-Year Trader — smash that , hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

ETHEUR

"Ethereum Is The New Bitcoin" - Tom Lee ETH / Stablecoins Are the ChatGPT of Crypto

Stablecoins are exploding in adoption — just like ChatGPT took over AI and Ethereum is the engine driving that revolution. In this post, we break down 10 reasons why Tom Lee is extremely bullish on Ethereum and why it could be the single most important digital asset in the future of finance . If you're sleeping on ETH, this might be your wake-up call.

Top 10 Bullish Points from Tom Lee on Ethereum:

• Ethereum is the backbone of stablecoins , which Tom Lee compares to the “ChatGPT of crypto” due to their viral adoption and massive utility.

• Over 51% of all stablecoins operate on Ethereum , contributing to around 30% of the network’s total fees.

• Ethereum network fees could 10x as stablecoin usage grows from $250 billion to $2 trillion.

• Ethereum is positioned to lead the tokenization of real-world assets , including stocks and real estate.

• ETH could reach $10,000 if asset tokenization becomes a mainstream financial practice.

• Ethereum has a regulatory edge in the U.S. , making it the preferred platform for compliant financial innovation.

• A $250 million ETH treasury strategy is underway , aiming to use Ethereum as a long-term reserve asset.

• Institutions will buy and stake ETH to secure stablecoin networks, making ETH the “next Bitcoin.”

• Ethereum dominates the crypto ecosystem , with nearly 60% of activity including DeFi, NFTs, and dApps built on its chain.

• HODL ETH for long-term growth , as its utility, demand, and institutional support continue to rise.

Conclusion:

Ethereum isn’t just a Layer 1 blockchain — it’s becoming the core financial infrastructure for the digital age . As stablecoins expand and institutions enter, ETH could be the most asymmetric opportunity in crypto right now.

📢 Drop a like, leave your thoughts in the comments, and don’t forget to follow for more powerful macro + crypto insights. 👍👍

Why Ethereum’s Will 10×🚀 Ethereum’s Next 10×: Why bank-grade adoption + the stable-coin avalanche make a moonshot look conservative

Big banks are building on-chain right now. JPMorgan & Bank of America began 2025 pilots for dollar-backed tokens that settle on Ethereum, while Societe Generale just unveiled its USD CoinVertible stable-coin on main-net.

Stable-coins already move more money than Visa + Mastercard combined. $27.6 trillion flowed through stable-coins in 2024—most of it routed over Ethereum block-space.

Ethereum clears four-fifths of that stable-coin volume. More than 80 % of all stable-coin transactions occur on ETH or its L2s, locking in network effects that rivals can’t match.

ETF wall-of-money is already hitting the gate. 2025 Ethereum ETFs posted a record $743 million month of inflows—the strongest vote of institutional confidence to date.

ETH supply keeps shrinking while demand spikes. Post-Merge burn has removed roughly 332 k ETH, flipping issuance negative; base-line inflation is now < –1.3 %/yr.

30 million ETH is locked in staking, slicing liquid float by 25 %. The yield engine tightens supply just as banks and ETFs need inventory.

Real-world assets are going token-native. Tokenized bond issuance jumped 260 % in 2024 to €3 billion, and virtually every pilot settles on ERC-standards.

Layer-2 roll-ups slashed average gas fees to <$4. Cheaper block-space makes day-to-day payments viable, driving still more stable-coin throughput (and fee burn).

User base is exploding toward mass scale. Active ETH wallets hit 127 million—up 22 % YoY—showing that retail, devs, and institutions are onboarding together.

Energy-efficient PoS removes the last ESG roadblock. With > 99 % less energy use than PoW chains, Ethereum checks the sustainability box that banks and asset managers need for wide-open deployment.

Bottom line: when TradFi giants plug directly into Ethereum rails and stable-coins dwarf legacy payment rails, every transfer torches a little more supply. Add the ETF flywheel and a vanishing float, and a 10× move shifts from “moon-boy” to math.

OTHER EXAMPLES

TSLA

www.tradingview.com

Total 2

www.tradingview.com

MartyBoots here—trading for 17 years, and I would like to hear YOUR take!

👉 Can Ethereum really 10× from here? Drop your best argument below, hit the 👍 if you learned something, and smash that Follow to stay in the loop on every crypto deep-dive I post.

ETH/USDT Price Action Analysis — Bullish Continuation Expected 📊 ETH/USDT Price Action Analysis — Bullish Continuation Expected 🚀

🔍 Chart Overview (as of June 9, 2025):

This chart of ETH/USDT highlights a well-defined support and resistance structure, projecting a potential bullish move toward a main resistance target at $2,788.00.

🧱 Key Zones:

🔵 Support Zone: $2,440 – $2,480

Price rebounded strongly from this area, showing buyer interest and liquidity absorption.

🟠 Resistance Zone: $2,660 – $2,690

Previously rejected zone where supply overtook demand. Price must break and hold above this for further upside.

🔺 Main Resistance Target: $2,788.00

If resistance is cleared, this is the next major supply area, acting as a potential take-profit level.

📈 Price Action Insight:

Price is currently hovering near $2,538.37, approaching resistance.

The chart suggests a potential breakout scenario after a short consolidation.

A bullish breakout above $2,690 could trigger a sharp rally toward the $2,788 target.

The chart projects a pullback-retest pattern (break, retest, and continuation) before the final leg up.

⚠️ Risk Management:

Invalidation Level: $2,381.49

A break below this level would invalidate the bullish setup and could lead to further downside.

✅ Summary:

Bias: Bullish 📈

Entry Area: Break and retest above resistance zone ($2,660–2,690) 🔓

Target: $2,788 🎯

Invalidation: Below $2,381.49 🚫

📌 Note: Always use proper risk management and confirm breakouts with volume or momentum indicators (e.g., RSI, MACD).

Whales ACCUMULATING ETH 🚨MartyBoots here , I have been trading for 17 years and sharing my thoughts on ETH here.🚨

.

🚨 COINBASE:ETHUSD is looking beautiful , very interesting chart for more upside

and is now into support🚨

Here is a link to Trading View news section showing whales accumulating COINBASE:ETHUSD

Do not miss out on COINBASE:ETHUSD as this is a great opportunity

Watch video for more details

SOL Vs ETH - Make Life Changing Money MartyBoots here , I have been trading for 17 years and sharing my thoughts on SOL here based on ETH fractal.

SOL is looking beautiful , very strong chart for more upside

Very similar to ETH which on the new monthly

Do not miss out on SOL as this is a great opportunity

Watch video for more details

PARABOLIC STRUCTURE - ETH vs UNI MartyBoots here , I have been trading for 17 years and sharing my thoughts on UNI here.

UNI is looking like its building a parabolic structure, very strong chart for more upside

Very similar to ETH which is up nearly 1000% increase from these levels

Do not miss out on UNI as this is a great opportunity

Watch video for more details

ETH - This will take timeThe fourth wave of major degree, clearly forming a big triangle since its last all time high (wave 3 of major degree). Triangle c - wave should come to end between 1.900 and 1.850 fulfilling the monthly bearish pattern at 1.899.71 as well as testing the monthly bullish pattern at 1.853,60. I do not expect to see a new ATH for this year.

ETH - on the winning track?If we were into crypto and wanted to make a quick buck, we would probably buy Etherium now for around $2600 and hold it.

The reason: the Bitcoin/Etherium ratio is at a low point, i.e. if you still believe in crypto market gains at all, now would probably be the right time to stock up on Etherium. To sell it again in time, of course. We think at $3900 or so.

We're talking 50% gain until X-Mas!

As always, this is not a trading recommendation, just an idea to share. Use your own head and make your own decisions.

ETH - Preparing for the ETF launch THIS WEEK MartyBoots here. I have been trading for 17 years and I am here to share my ideas with you to help the Crypto space. The Bull market is here

Even tho the bull market is here ETH has not fully mooned yet there is still time to buy on DIPS . The market has just hit a critical level . This is a bullish structure and dips are buys, when these dips happen ETH can start its move higher . This needs to be watched carefully.

ETH can get very bullish with this ETF launch so we need to watch carefully

Please watch the video for more information

AVAX Will MOON Like ETH MartyBoots here. I have been trading for 17 years and I am here to share my ideas with you to help the Crypto space. The Bull market is here

AVAX has had a very strong breakout , These breakouts can often continue longer than people think. AVAX is retesting the neckline here and should follow ETH into a bull market and parabolic move . It should continue to moon with some patience. This has very good market structure and good price action . These structures are how you can make good returns on investment / on your trade

Please watch the video for more information

ETHEUR Rainy SummerHi Traders!

so far so good ETHEUR

Now we seem to have a little problem though!!

we have a good resistance at about 1600..

if we keep it we will go up if not we will see lower numbers.

but in the long term we will see quite large numbers!!

huge caution with the SL AND TP

be very careful with Risk Management

DOGE MOON Vs ETH MOON MartyBoots here. I have been trading for 17 years and I am here to share my ideas with you to help the Crypto space.

DOGE broke out very big from my last video , its not too late to get on board . It will have a nice move in very near future but watch the video to find out when it can moon . Very important information

It has very good structure and price action Similar to Ethereum last bull market

its a moon structure

Please watch the video for more information

have a great weekend

Ethereum Forecast: Navigating Market VolatilityAnticipating an upward trajectory towards $2,500 to $2,750, caution remains key amidst the cryptocurrency market's inherent volatility. Each downturn appears as a potential buying window, yet prudence in position sizing is advised. Institutional maneuvers and U.S. interest rate fluctuations may impact Ethereum. While declining rates could enhance crypto appeal, be prepared for the market's characteristic volatility amid potential buying opportunities during dips.

Ethereum's Dilemma: Surge to $2,500 or Face Decline?Ethereum traders are at a pivotal point as $2,300 proves to be a crucial battleground. Sustaining upward momentum here could lead to a significant rally towards the coveted $2,500 resistance, instilling renewed market confidence. Conversely, bears aim to breach the $2,200 support, potentially triggering a notable downturn with $2,000 as a possible target. The increasing availability of Ethereum on exchanges adds complexity, highlighting the delicate balance between market sentiment and technical factors shaping Ethereum's future path.

"Ethereum Price Targets a 5% Increase, Testing $2,141 High"The price of Ethereum (ETH) is poised for a 5% increase, aiming to test the highest level within the $2,141 range before a potential correction. The trend-breaking tool continues to play a supportive role as a key level, with immediate support standing at $2,029, maintaining its position above the ETH peaks. Similar to Bitcoin, the RSI indicator is on the verge of crossing above the signal line, indicating the potential for an upward move.

However, if sellers take control, Ethereum's price could fall into the supply zone, acting as a trend-breaking tool, confirming a continuation of the southward movement by breaking and closing below the midpoint of this order block at $1,935.

The downturn may extrapolate, causing Ethereum's price to bring the trend-breaking tool back into the supply zone below the support level of $1,864.

Ethereum Price Struggles to Maintain $1,935 Support LevelThe price of Ethereum (ETH) is at risk of losing a crucial support level at $1,935, marking the midpoint of the supply zone that has become a breaking point for the extended bullish trend ranging from $1,864 to $2,004. If the $1,935 level fails to hold firm, it could spell disaster for token holders, with ETH potentially sliding down to the psychological level of $1,800 or, in severe cases, rendering the bullish argument ineffective below $1,753.

Both the RSI and AO indicators support this outlook, trending southward as momentum continues to weaken. On the flip side, increasing buying pressure is substantial enough to demonstrate Ethereum's ability to overcome the supply barrier mentioned above at $2,009, fostering optimism and potentially propelling ETH back onto the upward trend. This could result in a price increase to $2,136, representing a 10% gain from the current level.

Ethereum Price Signals Potential 60% Surge Ethereum is showing signs of a significant breakout, forming an ascending triangle pattern with three higher lows and three nearly equal highs since June 2022. A decisive weekly close above the $2,000 horizontal resistance could trigger a 43% surge to $2,943.

Currently, Ethereum is holding above the support of the Momentum Reversal Indicator (MRI) at $1,936, indicating potential strength. If Bitcoin's price remains stable, Ethereum is expected to rally towards $2,943, facing resistance at $2,539.

While the target is theoretically $2,943, Ethereum could surpass this and reach $3,186, implying a 60% increase. Conversely, a failure to maintain support above $1,936 may lead to a correction towards $1,795. A weekly close below $1,547 would invalidate the bullish scenario, potentially pushing Ethereum down to $1,309.

Is ETH about to breakout? Is Crypto going to do a Microsoft?Eth has yet to breakout of base

Being the leading ecosystem it is somewhat surprising Eth has yet to breakout of the base formed tho it does offer a potential opportunity. If Eth can run then it has a few open bar candles on the weekly that would be ideal to close out.

The rotational opportunities if holding eth post eth breakout are great

If Eth breakouts of this base then many smaller coins (esp eth based) are likely to continuing moving up. So the opportunity to compound eth profits by rotating post breakout is grand. This opportunity is not as highly provided to those who just hold the smaller caps that are waiting for either a btc or eth breakout.

MSFT makes up 1/4 of the big4 tech companies that dominate S&P500

S&P500 and bitcoin are correlated so far. With MSFT leading the big4 tech companies and MSFT breaking ATH then it gives the impression there may be room for crypto to do similar things (should trend continue).