ETH/USDT 1H: Bearish Structure with Potential Bounce ETH/USDT 1H: Bearish Structure with Potential Bounce – Long Setup from Discount Zone

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $1,796.97, currently bearish after breaking equilibrium zone.

Hidden bearish divergence visible on RSI, suggesting weakening bullish pressure.

Smart Money likely accumulating positions in the $1,740 – $1,760 discount zone.

Trade Setup (Long Bias):

Entry: Optimal between $1,795 – $1,805 range.

Targets:

T1: $1,840

T2: $1,860

Stop Loss: $1,765 (below recent low).

Risk Score:

8/10 – Smart Money accumulation supports the setup, but confirmation bounce from support is crucial for entry.

Key Observations:

Resistance at $1,820 (previous high) acting as local cap.

Support solid at $1,760 (discount zone), strong reaction expected.

Premium zone between $1,840 – $1,860 ideal for scaling out profits.

Smart Money potentially setting up shorts from premium zone for later liquidity grab below $1,740.

Recommendation:

Wait for clear confirmation of support hold before entering longs.

Manage risk carefully; consider partial scaling at $1,840 and securing full profits at $1,860.

Monitor price action at $1,820 resistance for possible early signs of rejection.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Ethlongsetup

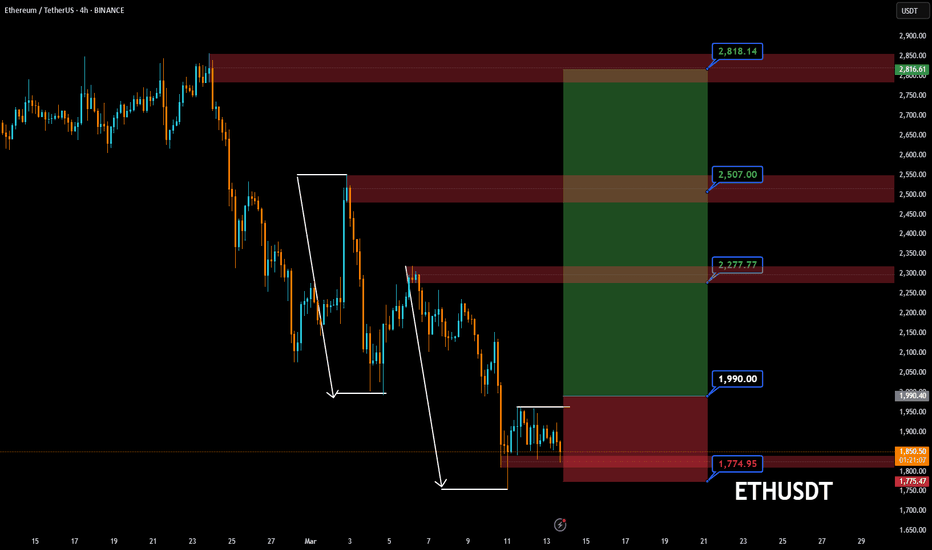

ETH TO THE MOON TRADEETHUSDT Weekly Analysis | 3M & 12M Supply/Demand Zones

Currently, Ethereum (ETHUSDT) is trading around $1803, sitting close to major higher timeframe zones:

3-Month Supply/Demand Zone: ~$1691

12-Month Supply/Demand Zone: ~$1557

Price has reacted strongly near the 3M S/D zone after a multi-month decline. Holding above this zone could indicate a potential bottom formation.

Reminder:

This is not financial advice. Always do your own research and trade with proper risk management.

Ethereum Hits Support – Time to Load Up?🎢 The Great 112‑Day Drop

What happened? Over the past 112 days, ETH tumbled –66%, sliding from $4109 down to $1383 and oh yeah, it even poked its nose below the January 2018 all-time high. 7 years ago!

Support Zone: 0.786 + Volume Profile

0.786 Fib: $1,570.85 (drawn from the 2022 low $870.80 to that $4109 high).

5‑Year POC: $1565

Hold Tight: For 2 weeks, the 0.786 level has acted as support, bouncing price right back up.

Sell in May and go away? Rather buy in May and grab some gains on the way?

Trade Blueprint: Your Ethereum Game Plan

Entry Zone: $1570.85

Stop Loss: Below $1369.79

Profit Targets: $1800, $2000 ,$2500, $3000

Risk/Reward: Risk ≈13%, Reward ≈91%, a solid 7:1 R:R

DCA

Missed the perfect entry? No drama... dollar‑cost average between $1700 and $1500.

Keep an eye on the monthly open at $1822. Bulls need to break this resistance zone.

Bottom Line

Ethereum’s –66% dive has handed us a golden ticket at the 0.786 fib and 5‑year POC. This is one of those “buy the dip” moments.

________________________________

💬 Found this helpful? Drop a like and comment below. Want TA on another coin? Let me know and I’ll break it down for you.

Happy trading everyone! 💪

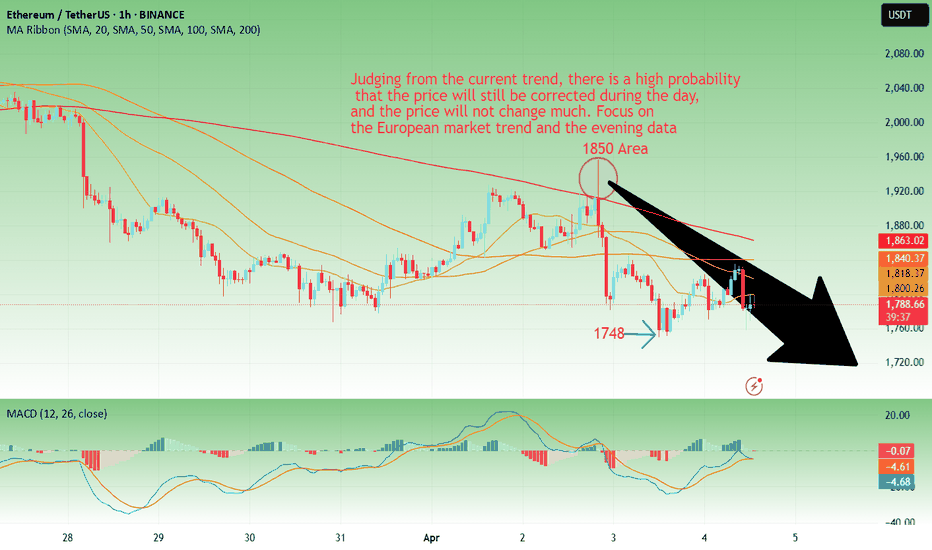

ETH-----Sell around 1825, target 1750 areaTechnical analysis of ETH contract on April 4: Today, the daily level of the large cycle closed with a small positive line yesterday, and the K-line pattern was a single positive line with continuous negative lines. The price is still below the moving average and is obviously suppressed. The fast and slow lines of the attached indicator continue to close negative today, so the pattern will cross downward. Therefore, the general trend remains unchanged and continues to be bearish. Trading remains short-term and risk control is done well; the short-term price decline yesterday broke the previous low of 1750, but did not continue. The current price fluctuates within the range and there is not much movement. From the perspective of various technical indicators, the four-hour chart is a continuous negative line, and the intraday price is suppressed, so the trend is still bearish, and the previous correction high is near 1850.

Today's ETH short-term contract trading strategy: sell at the 1825 area, stop loss at the 1855 area, and target the 1750 area;

ETH-----More around 1865 target 1800 areaTechnical analysis of ETH contract on March 30: Today, the large-cycle daily level closed with a small negative line yesterday, the K-line pattern continued to fall, the price was below the moving average, and the attached indicator was running with a golden cross and shrinking volume. The big trend was still very obvious, but I would like to remind you that the current price deviates from the moving average, and if there is a rebound trend in the future, it is also a correction trend. Don't be misled; the short-cycle hourly chart showed that the European market fell and the US market continued to break the low yesterday, and the morning support rebounded and corrected. The current K-line pattern continued to rise, and the attached indicator was running with a golden cross, so it still needs to be corrected within the day, and the high point of the US market correction yesterday was in the 1865 area.

Today's ETH short-term contract trading strategy: sell at the rebound 1865 area, stop loss in the 1895 area, and target the 1800 area;

ETHUSD ETHEREUM Long in short termVery hard week for ETHEREUM:

In my opinion eth has a good chance at this level to climb higher

It has nearly brokeen every possible support,but nobuilding signs of deivergences.

The strategy is short term

Never the less ,Trump´s policy is not good nor for crypto neither for other markets.

And thereforwe should think only in short term,taking chances.

On monday /tuesdays positive ton of the white house,on wed/ to Friday aggressive tons,at the weekend then again taming tone of the white house.

This will accompany us until 2029.

Ofcourse it wont be easy.For no one.

Therefor i make 5-10 different strategies,different apporches.

In case the profit targets hit,then its is ok.If not I immediately cut the positions.

STop is below themajor support.

If that level breaks,ETH will potentially fall to 1100-1250. Idont hope,that it happens.But these days,I expect always the unexpected.You may do this,too.

Position sizing: depends on your risk appetite.

I would use stops in any case....Good luck

Ethereum at the Crossroads: Breakdown or Breakout?Ethereum has seen a steep 60% drop from its highs, but recent activity suggests it might be entering a key transition phase. I’ve entered a long position here with a wide target in place, waiting for clear signs of bullish momentum before adding more size.

Technically, ETH is holding above a strong low on the daily and attempting to reclaim territory beneath a descending trendline. The market has been compressing tightly, and we could soon see expansion either direction. If this is indeed a base forming, it offers a great R:R.

The invalidation lies below the $1,500 daily close—anything below that negates the idea of a shift and brings the $1,000 psychological level into focus. Until then, I treat this as a potential bottom formation trade.

Technicals

• Downtrend structure: ETH has been in a macro downtrend but is showing early signs of compression and possible trend reversal.

• Descending trendline resistance in play. A daily close above it would be significant.

• 2000–2100 remains a psychological resistance zone.

• RSI & Stoch below neutral, indicating room to move up if pressure builds.

• Invalidation below $1,500 (daily close).

Fundamentals

• Massive accumulation: Over 2.11M ETH added to accumulation addresses in March alone.

• Supply squeeze: ETH on exchanges dropped to a 10-year low, down 16.4% from 7 weeks ago.

• Open interest rising: Futures market open interest climbed from 9.40M to 10.10M ETH in just three days—showing derivative trader confidence.

• Ethereum Pectra upgrade scheduled, promising long-term improvements in staking, fees, and transaction management.

• If bullish catalysts align, this accumulation phase could spark a breakout move back toward $2,800–3,000 in Q2.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

ETH BUY ZONE / ACCUMULATING LEVELBINANCE:ETHUSDT is looking bullish after retracing to 1900-2000 region. It should be noted that the same region was previous resistance which ETH broke in Dec 23' before making a new swing high.

This is a great buying zone technically for someone who does not trade and wants to buy/hold BINANCE:ETHUSDT for the long term!

Ethereum (ETH/USD) Breakout – Next Targets $2,328 & Beyond!

Overview:

Ethereum has been in a downtrend, forming a descending channel, but it recently found strong support at $1,764 and has now broken out of a range-bound consolidation. This could be the beginning of a bullish move towards higher resistance levels.

Key Market Structure Analysis:

🔸 Previous Downtrend: ETH was trading within a bearish channel, creating lower highs and lower lows before bottoming out.

🔸 Accumulation Phase: A sideways consolidation range between $1,764 - $2,017 formed after the downtrend, signaling potential accumulation.

🔸 Breakout Confirmation: ETH has broken above the $2,017 resistance, suggesting that buyers are stepping in.

Potential Trade Setup:

✅ Bullish Scenario:

A successful breakout retest around $2,000 - $1,950 could provide an entry opportunity.

Upside targets:

🎯 $2,328.95 – Major resistance level from previous price action.

🎯 $2,559.17 – Next key resistance if momentum continues.

⚠️ Bearish Scenario (Invalidation):

A drop below $1,950 - $1,900 could push ETH back into the previous range.

Losing the $1,764 support could lead to a retest of $1,600 or lower.

Final Thoughts:

Ethereum is showing strength after breaking out of a key consolidation range. If the breakout holds, ETH could be gearing up for a strong rally toward $2,328 - $2,559. However, a retest of the breakout zone may provide a better risk-to-reward entry.

What do you think? Will ETH push toward $2,328 next? Drop your thoughts below! 🔥📈

"ETH/USDT 1H: Bullish Reversal in Play – Targeting $2,280?ETH/USDT 1H: Bullish Reversal in Play – Targeting $2,280?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Market Structure (Confidence Level: 8/10):

Bullish reversal forming after testing $1,800 support.

RSI confirms hidden bullish divergence, with higher lows on RSI while price made lower lows.

Smart Money Analysis:

Strong order block formed at $1,880, reinforcing demand.

Break of market structure at $1,950, confirming a shift in trend.

Institutional accumulation visible in the volume profile, suggesting Smart Money positioning.

Trade Setup:

Entry: $1,953 - $1,960 (current retest).

Targets:

T1: $2,120 (Fair Value Gap fill).

T2: $2,280 (high-timeframe resistance).

Stop Loss: $1,880 (below recent swing low).

Risk Score:

7/10 – Favorable risk-to-reward, but a stoprun below $1,900 remains a risk.

Market Maker Activity:

Currently engineering a stoprun below $1,900, likely before a continued move higher.

Volume increasing on bullish moves, confirming institutional buying interest.

Key Levels:

Support: $1,880, $1,800.

Resistance: $2,120, $2,280.

Recommendation:

Long positions remain favorable at the $1,953 - $1,960 entry zone.

Monitor for a stoprun below $1,900 as liquidity is being engineered before continuation.

Manage risk tightly, as Smart Money is accumulating ahead of a potential breakout.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

ETH(based on NEo wave)This supercycle is a nice nature triangle which E wave is ending and its look like a diamon diametrical.

so I will update it for the confirmation, I think ALTseason is so close and we can see that happening soon but this season take about 400 to 450 days and after that there is a huge CRASH!

ETH → Gearing Up for $10,000!? Or $1,200? Let's Answer.Ethereum finally fell into my buy zone this past week and I was able to buy with an average price of $2,185.18. This is a target I've been watching for months in anticipation. The best part is that it may go lower!

How do we trade this? 🤔

ETH has landed on a key support area of $2,100 and is now flirting with falling to the .236 Fib level at $1,800. A final target would be around $1,500 which brings us back into the bear market range. ETH formed a triple top over the course of 2024 and as expected, it pulled back hard with the alt market.

Bitcoin Dominance has been in a bull trend since the last cycle and hasn't shown any signs of weakness yet. Currently at 62%, it could jump up to 70% easily. Until it drops, ETH and the alts are going to remain bleeding out.

I'm targeting the previous all-time high for a first profit target, around $4,800. Whether I take profits at that level depends on the price action leading up to it. If we get a strong push with strong candle closes leading up to that price, I'll likely hang on. Otherwise, I may take 25% of my position off the table and look for a potential re-entry.

Final target price is $6,750, just below the 1.618 Fib level. This level also corresponds with a measured move target if the price attempts $4,000, pulls back to the 3-Year Support, then moves up again. I believe $10,000 ETH is absolutely possible for this run, but given how slumpy the alt market is, I don't see that probability being as high as the previous high of $7,000. This is why I'm taking my profits before that 1.618 Fib level is hit.

💡 Trade Idea 💡

Long Entry: $2,185.18

🟥 Stop Loss: $700

✅ Take Profit #1: $4,800

✅ Take Profit #2: $6,750

⚖️ Risk/Reward Ratio: 1:3

🔑 Key Takeaways 🔑

1. 2024 Triple top led to a retrace down to the 2023 range.

2. First buy at $2,185.18, potential buy at $1,800 and $1,500

3. Stop loss at $700 below the 2022 bear market low

4. Holding the position until the previous all-time high around $4,850 where the first take profit waits. $6,750 is the second take profit just before the 1.618 fib level

5. Weekly RSI is near 34.00 and below the Moving Average. This is a good level to buy.

💰 Trading Tip 💰

Ascending Wedges signal an increased probability of a bear breakout. Combined with three pushes up in a bull trend and strong sell bars (candles with large wicks on their tops), creates conditions where a counter-trend trade is reasonable.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and Follow to learn more about:

1. Reading Price Action

2. Chart Analysis

3. Trade Management

4. Trading Psychology