ETH/USDT Trade Setup: Bullish Trend, Entry Zone & More🚀 ETH/USDT Trade Setup 💸📊

Keeping a close eye on Ethereum paired with USDT right now. 🔍📈

ETH has been holding a solid bullish trend, with healthy pullbacks into value zones that have repeatedly offered discounted long entries. 🛒⚡

I’m bullish overall, looking to trade with the trend. Looking for ETH to dip into my preferred entry zone. 🎯

🛡️ Stop-loss to go just beneath the most recent swing low to keep risk tight and controlled.

In this video, I cover:

🔹 How I apply Fibonacci tools to dial in my entry points and targets

🔹 My full ETH game plan, including the zones I'm watching and how I’m managing this setup

⚠️ Not financial advice. Always do your own due diligence and risk management.

💬 Are you trading ETH right now? What are your thoughts? Let me know in the comments below! 👇🔥

Ethpriceanalysis

ETH/USDT At A Premium — What’s Next? Smart Entry Strategy!I'm currently analyzing ETH/USDT 🧠💹 — Ethereum has been in a strong bullish trend, recently pushing into all-time highs 🚀🔝. While the momentum remains intact, price is now trading at a premium 🏷️, and I’m cautious about entering long at these elevated levels ⚠️.

In the video, we break down the trend, market structure, and price action with precision 📊🧱. I also explore potential entry scenarios that align with low-risk, high-probability setups 🎯🔍 — ideal for those waiting for the right moment to engage without chasing the move.

You'll also get a deep dive into my Trend Continuation Strategy 🔄📈 — a powerful framework for identifying smart entries in trending markets.

🛑 This is not financial advice

Bull Flag Forming on ETH/BTC – Altcoins About to Explode?$ETH/BTC just broke a key resistance line and is now forming a bullish flag — this is big for altcoins.

Why? Because when ETH starts gaining strength against BTC, it often signals the beginning of an altcoin rotation. Ethereum usually leads the pack — and when its BTC pair is bullish, altcoins tend to follow with strong momentum.

The breakout followed by a bull flag consolidation suggests continuation is likely. If ETH/BTC pushes higher from here, we could see capital flow from Bitcoin into altcoins, igniting the next leg of altseason.

Altcoins may be gearing up — stay sharp.

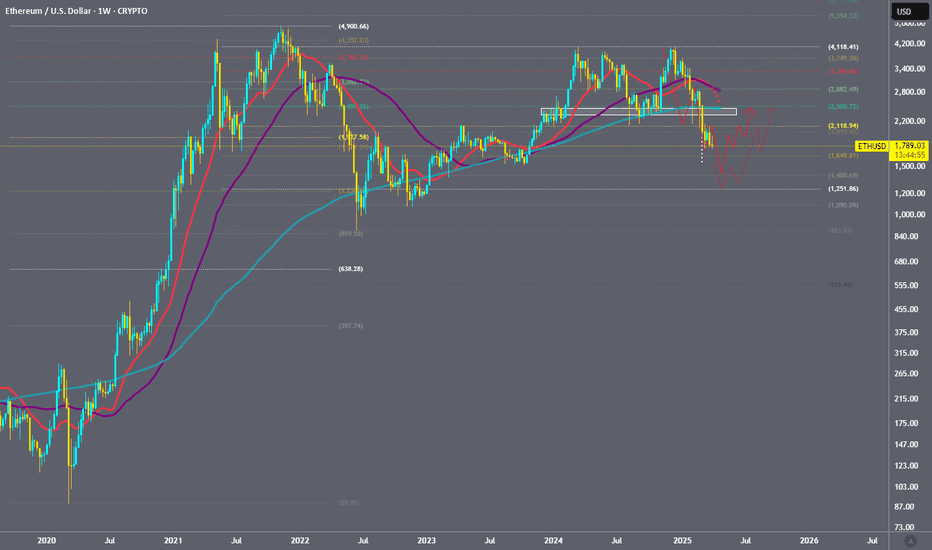

Ethereum 4H - Wyckoff?It is always very difficult to understand the dynamics with fragmented volumes, where peaks almost always coincide with an abrupt move.

This is Ethereum on 4H, a position I am following, although I prefer larger timeframes.

I am not currently trading, but rather holding pending better times.

Remember to be careful, these are delicate and dangerous times, especially for those who are not so experienced.

You can copy the setup and follow it by yourself.

ETH Update — RSI Divergence & Double Top FormingEthereum is showing a clear RSI divergence paired with a developing double top, making this a key area to manage risk.

I’ve personally taken profit on my longs and am watching how price reacts in this range.

- Next resistance: $2,840

- Key support: $2,200

Right now, I don’t like the risk-to-reward of holding. There’s more downside exposure than upside potential from this level — at least until structure confirms otherwise.

$ETHUSDT - Major Breakout Alert! CRYPTOCAP:ETH has officially broken out of a long-standing descending parallel channel on the daily chart — a key structural shift in market sentiment. This breakout is further supported by a successful close above the 50 EMA, which had acted as dynamic resistance throughout the downtrend.

Key Technical Developments:

- Broke out of a descending parallel channel

- Closed above 50 EMA for the first time in weeks

- Strong daily candle with 8% gain confirms momentum shift

Immediate Support: $1,790 (former resistance zone turned support)

Next Major Resistance: $2,393

This is the mid-zone before ETH challenges the broader supply area around $2,550–2,850.

This breakout mirrors Ethereum's typical behavior during previous cycle expansions — grinding accumulation followed by aggressive breakout moves. The confluence of the EMA breakout and channel structure suggests we could be looking at the beginning of a broader trend reversal.

Trading Plan:

Retests towards $1,850–$1,790 can offer high R:R entries.

Watch for continuation patterns or consolidation above $2,000 for the next push.

CRYPTOCAP:ETH is reclaiming momentum — if BTC remains stable, this move could expand quickly.

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

Ethereum Golden Cross: ETH Eyes $3,000 BreakoutEthereum Flashes Golden Cross: A Bullish Beacon or a Fleeting Glimmer for the $3,000 Target?

The cryptocurrency market is once again abuzz with technical signals, and this time, Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is in the spotlight. Traders and analysts are keenly observing a "Golden Cross" that has recently manifested on Ethereum's price charts. This classic bullish indicator has historically been associated with potential upward momentum, igniting discussions and hopes among investors: could this be the catalyst that propels ETH bulls to conquer the coveted $3,000 price level?

Understanding the Golden Cross: A Primer

Before diving into Ethereum's specific prospects, it's crucial to understand what a Golden Cross signifies. In technical analysis, a Golden Cross occurs when a shorter-term moving average (MA) of an asset's price crosses above a longer-term moving average. Most commonly, this involves the 50-day moving average (50-MA) moving above the 200-day moving average (200-MA).

The rationale behind its bullish interpretation is straightforward: the 50-MA reflects the average price over the last 50 trading days, representing recent momentum. The 200-MA, on the other hand, represents the longer-term trend. When the shorter-term momentum (50-MA) surpasses the longer-term trend (200-MA) from below, it suggests that the recent buying pressure and positive price action are strong enough to potentially shift the overall market sentiment and initiate a more sustained uptrend.

However, it's vital to approach this signal with a degree of caution. The Golden Cross is a lagging indicator, meaning it confirms a trend that has already been underway for some time, rather than predicting a future one with certainty. By the time a Golden Cross appears, a significant portion of the initial upward move might have already occurred. Furthermore, like all technical indicators, it's not infallible. False signals can happen, where a Golden Cross appears but fails to lead to a sustained rally, sometimes even preceding a market downturn. Therefore, while a Golden Cross is a positive sign, it’s best used in conjunction with other indicators and a broader market analysis.

Ethereum's Current Landscape and the Significance of the Signal

For Ethereum, the appearance of a Golden Cross is a noteworthy development, especially considering its price action in recent months. After periods of consolidation and navigating broader market uncertainties, such a signal can inject a fresh wave of optimism. It often attracts trend-following traders and algorithms programmed to react to such patterns, potentially increasing buying pressure.

The journey towards $3,000 for Ethereum is not just a numerical target; it represents a significant psychological level. Reclaiming this mark would signify a strong recovery and could pave the way for further exploration of higher price territories. The Golden Cross, in this context, acts as a technical validation for bulls who believe in Ethereum's underlying fundamentals and its potential for growth.

Factors Fueling the Bullish Case for ETH to $3,000

Several factors, beyond the Golden Cross itself, could support a bullish push for Ethereum towards the $3,000 milestone:

1. Strong Network Fundamentals: Ethereum continues to be the dominant smart contract platform, hosting the vast majority of decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and a burgeoning ecosystem of Layer 2 scaling solutions. Ongoing development, such as progress on future upgrades aimed at enhancing scalability and efficiency (like proto-danksharding with EIP-4844), bolsters long-term confidence.

2. The Impact of "The Merge" and Staking: The transition to a Proof-of-Stake (PoS) consensus mechanism (The Merge) has fundamentally changed Ethereum's tokenomics. It significantly reduced new ETH issuance and, coupled with the EIP-1559 fee-burning mechanism, has often made ETH deflationary during periods of high network activity. The growth in staked ETH, which secures the network and earns rewards for stakers, also reduces the liquid supply available on exchanges, potentially creating upward price pressure.

3. Layer 2 Scaling Solutions Gaining Traction: Solutions like Arbitrum, Optimism, zkSync, and StarkNet are increasingly handling a significant portion of Ethereum's transaction load. This alleviates congestion on the mainnet, reduces gas fees for users interacting with these Layer 2s, and improves the overall user experience, making the Ethereum ecosystem more attractive and scalable. As these solutions mature and gain wider adoption, they enhance Ethereum's value proposition.

4. Renewed Institutional Interest: While institutional adoption of crypto can be cyclical, a clear bullish signal like a Golden Cross, combined with improving macroeconomic conditions or regulatory clarity, could reignite interest from larger financial players looking for exposure to digital assets beyond Bitcoin. Ethereum's utility and its role as a platform for decentralized applications make it an attractive candidate for institutional portfolios.

5. Positive Market Sentiment: The cryptocurrency market is heavily influenced by sentiment. A Golden Cross can contribute to a positive feedback loop: the signal encourages buying, which pushes prices up, further reinforcing bullish sentiment and attracting more participants. If Bitcoin, the market leader, also shows strength, it often creates a favorable environment for altcoins like Ethereum to rally.

6. Growing NFT and DeFi Ecosystems: Despite market fluctuations, innovation within the NFT and DeFi sectors on Ethereum continues. New use cases, improved user interfaces, and greater mainstream adoption of these technologies can drive demand for ETH, which is used to pay for transactions and interact with these applications.

Potential Headwinds and Obstacles on the Path to $3,000

Despite the optimism generated by the Golden Cross, several challenges could hinder Ethereum's ascent to $3,000:

1. Macroeconomic Uncertainty: Broader economic factors, such as inflation rates, interest rate policies by central banks, and geopolitical events, can significantly impact risk assets, including cryptocurrencies. A deteriorating macroeconomic outlook could dampen investor appetite and stall any potential rally.

2. Regulatory Scrutiny: The regulatory landscape for cryptocurrencies remains a significant unknown in many jurisdictions. Unfavorable regulations or enforcement actions targeting Ethereum, DeFi, or staking could negatively impact its price.

3. Technical Resistance Levels: The path to $3,000 is likely to encounter several technical resistance levels where selling pressure might increase. Traders will be closely watching these zones, and failure to break through them decisively could lead to pullbacks.

4. Profit-Taking: As the price of ETH rises, especially after a significant signal like a Golden Cross, traders who bought at lower levels may decide to take profits, creating selling pressure that needs to be absorbed by new buyers for the uptrend to continue.

5. Competition: While Ethereum is the dominant player, it faces ongoing competition from other Layer 1 blockchains (e.g., Solana, Avalanche, BNB Chain) that also aim to offer scalable smart contract platforms. Significant advancements or adoption shifts towards competitors could impact Ethereum's market share and sentiment.

6. The "False Signal" Risk: As mentioned earlier, no technical indicator is perfect. The Golden Cross could prove to be a false signal if broader market conditions turn bearish or if unforeseen negative catalysts emerge.

Conclusion: A Promising Signal, But Prudence is Key

The appearance of a Golden Cross on Ethereum's charts is undeniably a positive development that warrants attention. It provides a technical basis for bullish optimism and could indeed be a contributing factor if ETH is to make a sustained push towards the $3,000 mark. The combination of this signal with Ethereum's strong network fundamentals, ongoing technological advancements, and the deflationary pressures from its tokenomics paints a compelling picture for potential price appreciation.

However, investors should approach this scenario with a balanced perspective. The Golden Cross is a piece of the puzzle, not the entire picture. Its predictive power is enhanced when considered alongside other market indicators, fundamental analysis, and the overall macroeconomic environment. While bulls may feel emboldened by this signal, the path to $3,000 will likely involve navigating volatility, overcoming resistance levels, and contending with potential external shocks.

Ultimately, whether Ethereum can leverage this Golden Cross to reach $3,000 will depend on a confluence of factors: sustained buying momentum, continued positive developments within the Ethereum ecosystem, a favorable broader market sentiment, and the absence of significant negative catalysts. For now, the Golden Cross serves as a beacon of hope for ETH holders, but diligent research, risk management, and an awareness of the inherent uncertainties in the crypto market remain paramount.

ETH-----Sell around 2600-2630, target 2550-2580 areaTechnical analysis of ETH contract on May 16:

Today, the large-cycle daily level closed with a small negative line yesterday, and the K-line pattern was a single positive line with continuous negative lines. The price was consolidating at a high level. The attached indicator golden cross was running with a shrinking volume. Although the current trend signal of Ethereum is not as obvious as that of the big cake, we can see that the price rebounded yesterday and did not break upward, which shows that the price is still suppressed to a certain extent; the current pressure position of the short-term hourly chart is near the 2650 area, and the low point support is in the 2425 area. In terms of trend rules, the high point on the 11th was under pressure in the 2630 area, and the 12th was also under pressure in the 2630 area. Although the current price is at a high level, it does not continue the trend of breaking high, so it is easy to be under pressure and retreat.

Therefore, today's ETH short-term contract trading strategy: short in the 2600-2630 area, stop loss in the 2660 area, and target the 2550-2580 area;

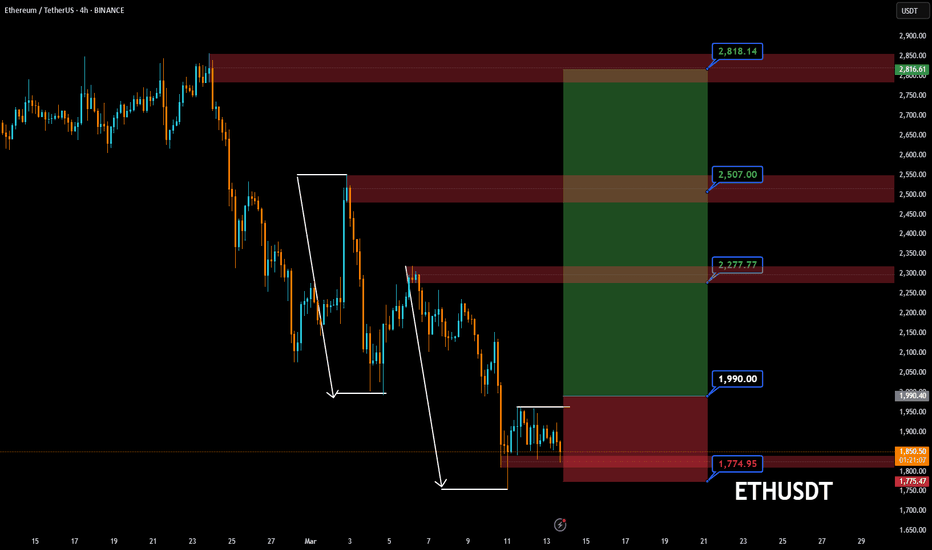

ETH Overextended: Eyeing a Retracement from Key Liquidity ZoneTechnical Analysis: ETH/USDT Daily/4H and 30m Chart 🚨

Ethereum (ETH) has experienced a powerful rally, surging from the $1,900 region to above $2,500 in just a few sessions. This explosive move has pushed price into a previous area of significant resistance, where a large liquidity pool is likely sitting. The current daily candle structure shows signs of hesitation, with smaller bodies and wicks indicating potential exhaustion at these highs.

Given the overextended nature of this move 📈 and the fact that ETH is now trading at a premium relative to its recent range, a retracement back toward equilibrium is probable. If price action breaks below the current range low (the most recent swing low on the daily), this could confirm a distribution phase 🏦 and open up a short opportunity.

I'm watching for a clear break and close below the range low to trigger a potential short setup. My expectation is for price to revisit the mid-range or even the origin of the recent rally, where demand may step in again. Until then, patience is key—let the market show its hand before entering.

Key Points:

ETH is overextended and trading into previous highs with heavy liquidity 💧

Signs of exhaustion are emerging at the top of the move

A break below the current range low could confirm distribution and offer a short setup 🔻

Targeting a retracement toward equilibrium, possibly the $2,000–$2,200 zone 🚨

ETH/USDT 15-Min Chart Analysis – Bullish Setup with Trade PlanThis chart shows a bullish scenario for ETH/USDT on the 15-minute timeframe. Price is consolidating above a key support zone, indicating potential for a strong upward move.

📈 Trade Idea (Long Setup):

Entry Zone: $2,300 – $2,310 (red support zone)

Stop-Loss: Below $2,280

Targets:

🎯 Target 1: $2,388.70

🎯 Target 2: $2,428.47

🎯 Target 3: $2,492.75

🟢 Bias: Bullish (if price respects the support zone and forms reversal confirmation)

Note: Wait for a bullish confirmation candle or bullish divergence before entering. This setup is based on potential support reaction.

Ethereum's $2k Crossroads: Squeeze Up or Crash Down?Ethereum at a Crossroads: Eyeing $2,000 Amidst Short Squeeze Hopes, Crash Warnings, and Existential Questions

Ethereum (ETH), the bedrock of decentralized finance (DeFi) and the engine behind countless non-fungible tokens (NFTs), finds itself ensnared in a complex web of conflicting market signals and divergent analyst opinions. On one hand, recent price action shows resilience, with ETH powering through previous resistance levels and setting its sights on the psychologically significant $2,000 mark. This move is potentially bolstered by intriguing on-chain data, such as declining supply on major exchanges like Binance, sparking whispers of an impending short squeeze. Yet, casting a long shadow over this optimism are stark warnings: technical analysts point to rare, potentially bearish patterns forming, prominent trading firms question its fundamental value proposition compared to Bitcoin (BTC), highlighting its staggering year-to-date losses, and some even provocatively label it more akin to a "memecoin."

This cacophony of bullish hopes and bearish alerts places Ethereum at a critical juncture. Is the recent surge the beginning of a sustained recovery, fueled by tightening supply and renewed developer activity? Or is it merely a deceptive bounce within a larger downtrend, vulnerable to a potential crash as underlying weaknesses and unfavorable comparisons to Bitcoin take hold? Dissecting these opposing narratives is crucial for understanding the intense battleground Ethereum's price chart has become.

The Bullish Ascent: Powering Through Resistance, Eyeing $2,000

The immediate catalyst for renewed optimism stems from Ethereum's recent price performance. After a period of consolidation and, at times, significant downward pressure, ETH has demonstrated notable strength. Headlines proclaiming "Ethereum Price Powers Through Resistance — Eyes on $2,000?" capture this sentiment. Breaking through previously established resistance levels (potentially building on support found around the $1,800 mark) is a technically significant event. It suggests buyers are stepping in with enough conviction to overcome selling pressure that had previously capped advances.

Successfully reclaiming and holding levels above former resistance transforms these zones into potential new support floors, providing a base for further upward movement. The $2,000 level looms large, not just as a round number, but often as a key area of historical price interaction – a zone where significant buying or selling interest has previously materialized. A decisive break above $2,000 could inject further confidence into the market, potentially attracting momentum traders and reinforcing the bullish narrative.

The Binance Supply Drop and Short Squeeze Speculation

Adding intrigue to the bullish case is the observation of declining Ether supply on major exchanges, specifically Binance. Exchange supply is a closely watched metric. When the amount of ETH held on exchanges decreases, it generally implies that investors are withdrawing their coins to private wallets, often for longer-term holding ("HODLing") or for use within the DeFi ecosystem (staking, lending, etc.). This reduction in readily available supply on exchanges can, in theory, create a tighter market.

This dynamic fuels speculation about a potential "short squeeze." A short squeeze occurs when the price of an asset starts to rise rapidly, forcing traders who had bet against it (short sellers) to buy back the asset to close their positions and cut their losses. This forced buying adds further upward pressure on the price, creating a rapid, cascading effect. If a significant number of traders have shorted ETH, anticipating further price declines, a sustained move upwards coupled with shrinking exchange supply could create the conditions for such a squeeze, dramatically accelerating the price towards and potentially beyond the $2,000 target. While short squeezes are relatively rare and difficult to predict accurately, the declining supply on a major platform like Binance certainly adds a compelling element to the bullish thesis.

Underlying Strengths: The Long-Term Vision

Beyond short-term price action and supply dynamics, Ethereum's bulls point to its fundamental strengths. The successful transition to Proof-of-Stake (PoS) via "The Merge" was a monumental technical achievement, drastically reducing the network's energy consumption and changing its tokenomics by potentially making ETH a deflationary asset under certain conditions (where more ETH is "burned" via transaction fees than is issued as staking rewards). Ongoing scalability upgrades, often referred to under the umbrella of Ethereum 2.0 developments (like proto-danksharding via EIP-4844), aim to reduce transaction fees and increase throughput, making the network more efficient and attractive for developers and users.

Ethereum remains the dominant platform for smart contracts, DeFi applications, and NFT marketplaces. Its vast developer community, established network effects, and continuous innovation pipeline are often cited as core long-term value drivers that short-term price volatility cannot erase. For believers in Ethereum's vision, the current price levels, even after the recent bounce, might represent an opportunity to accumulate an asset with significant future potential.

The Bearish Counter-Narrative: Red Alerts and Worrying Comparisons

However, the optimism is heavily tempered by significant bearish signals and critiques. This serves as a stark warning. Technical analysis involves studying chart patterns and indicators to forecast future price movements. While the specific "rare pattern" isn't detailed, the emergence of such signals often causes significant concern among traders. Patterns like head-and-shoulders tops, descending triangles, or bearish divergences on key indicators can suggest that upward momentum is waning and a significant price decline could be imminent. Such technical warnings cannot be easily dismissed, especially when they align with other concerning factors.

The Stark Reality: Underperformance and the "Memecoin" Jab

Perhaps the most damaging critique comes from the direct comparison with Bitcoin and the assessment of Ethereum's recent performance. A large year-to-date drop is a brutal statistic, especially when Bitcoin, while also volatile, may have fared comparatively better during the same period (depending on the exact timeframe and BTC's own fluctuations).

Why the "memecoin" comparison? Memecoins are typically characterized by extreme volatility, price movements driven largely by social media hype and sentiment rather than clear fundamental value, and a lack of a distinct, widely accepted use case beyond speculation. While some calling Ethereum a memecoin is hyperbolic – given its vast ecosystem and utility – the critique likely stems from its recent high volatility and its struggle to maintain value relative to Bitcoin. The trading firm's assertion that Ether's "risk-reward is now unjustifiable compared to Bitcoin" encapsulates this view. They likely argue that Bitcoin's clearer narrative as a potential store of value or "digital gold," potentially bolstered by institutional adoption via ETFs, offers a more compelling investment case with potentially less downside risk compared to Ethereum, which faces ongoing scalability challenges, competition from other Layer 1 blockchains, and perhaps greater regulatory uncertainty regarding its status (security vs. commodity).

This underperformance raises difficult questions. If Ethereum is the backbone of Web3, why has its price struggled so much relative to its peers or even its own potential? Possible contributing factors include:

1. Capital Rotation: The excitement and capital inflows surrounding spot Bitcoin ETFs may have drawn investment away from Ethereum and other altcoins.

2. Regulatory Uncertainty: Ongoing debates, particularly in the US, about whether ETH should be classified as a security could be creating hesitancy among institutional investors.

3. Competition: Numerous alternative Layer 1 blockchains (Solana, Avalanche, etc.) are competing fiercely for developers and users, potentially fragmenting the market share Ethereum once dominated.

4. Post-Merge Narrative Shift: While technically successful, the immediate post-Merge price action was underwhelming for many, and the narrative focus may have shifted elsewhere.

Synthesizing the Dichotomy: A Market Divided

Ethereum's current situation is a textbook example of a market grappling with deeply conflicting data points and narratives.

• Bullish Signals: Price breaking resistance, targeting $2k, falling exchange supply, potential short squeeze, ongoing network development, strong ecosystem.

• Bearish Signals: Severe YTD underperformance, concerning technical patterns ("red alert"), critical comparisons to Bitcoin's risk/reward, being labeled "memecoin-like" by traders, regulatory overhang, Layer 1 competition.

This dichotomy creates significant uncertainty. Is the falling supply on Binance a sign of HODLer conviction paving the way for a short squeeze, or simply users moving assets to DeFi protocols, with little bearing on immediate price direction? Is the push towards $2,000 the start of a real trend reversal, or a bull trap set by bearish technical patterns? Is Ethereum's fundamental value being overlooked amidst short-term noise, or are the critiques about its risk/reward profile relative to Bitcoin valid warnings?

Investor Sentiment and Key Factors to Watch

This environment fosters polarized investor sentiment. Optimists see a buying opportunity, focusing on the recent strength and long-term potential. Pessimists see confirmation of underlying weakness and prepare for further declines. The path forward will likely be determined by several key factors:

1. Bitcoin's Trajectory: As the market leader, Bitcoin's price action heavily influences the broader crypto market, including Ethereum. Continued strength in BTC could provide a tailwind for ETH.

2. Technical Levels: Whether ETH can decisively breach and hold $2,000, or if it gets rejected, will be a critical short-term indicator. Equally important is whether current support levels hold during any pullbacks.

3. Exchange Flows & On-Chain Data: Continued monitoring of exchange supply, staking activity, and transaction volumes will provide clues about investor behavior.

4. Regulatory Developments: Any clarification on Ethereum's regulatory status, particularly in the US, could significantly impact sentiment.

5. Macroeconomic Environment: Broader market risk appetite, influenced by inflation, interest rates, and economic growth prospects, will continue to play a role.

Conclusion: Navigating Ethereum's Uncertain Path

Ethereum stands at a precarious crossroads. The recent climb towards $2,000, supported by encouraging signs like falling exchange supply, offers a glimmer of hope for bulls anticipating a recovery and perhaps even a short squeeze. However, this optimism is aggressively challenged by alarming technical warnings, significant underperformance compared to market expectations and Bitcoin, and pointed critiques questioning its current investment viability.

The "memecoin" comparison, while harsh, reflects a genuine frustration and concern among some market observers about ETH's volatility and perceived lack of decisive direction relative to the "digital gold" narrative solidifying around Bitcoin. The formation of rare bearish patterns adds a layer of technical urgency to these concerns.

Ultimately, the market remains deeply divided on Ethereum's immediate future. The battle between the potential for a supply-driven squeeze towards $2,000 and the risk of a pattern-induced crash is palpable. Investors must weigh the platform's undeniable long-term technological significance and ecosystem strength against the immediate headwinds of poor recent performance, regulatory ambiguity, and concerning technical signals. The coming weeks are likely to be crucial in determining whether Ethereum can overcome the prevailing skepticism and validate the recent bullish momentum, or if the bears will regain control, confirming the warnings of a continued downturn. The price action around the $2,000 level will be a key battleground in this ongoing struggle.

Disclaimer: The information presented in this article is for informational and educational purposes only. It is based on the analysis of the provided headlines and general market knowledge. It does not constitute financial advice. Investing in cryptocurrencies involves significant risk, including the potential loss of principal. Readers should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.

Can ETH Really Hit $80K? Adoption Trends and Technicals Say, YESEthereum’s adoption is booming in 2025, with over 50 major enterprises building on its network, a 21.7% global crypto ownership share, and $102 billion in stablecoin volume. Daily transactions hit $13.74 billion, and new addresses doubled to 200,000 in January 2025. The 3W chart shows ETH at $1,859.1, oversold (Stochastic RSI -101.5), hinting at a potential bounce. A 43x increase to $80K would need a $40 trillion market cap—steep but not impossible given historical 400x growth (2016–2021). Layer 2 scaling and ETF inflows support the bull case, but competition from Solana and privacy concerns could hinder the journey. What do you think? Or am I just insane?

Ethereum Up 30% — But Is This the Start of a Trend Reversal..?Ethereum Up 30% — But Is This the Start of a Trend Reversal..?

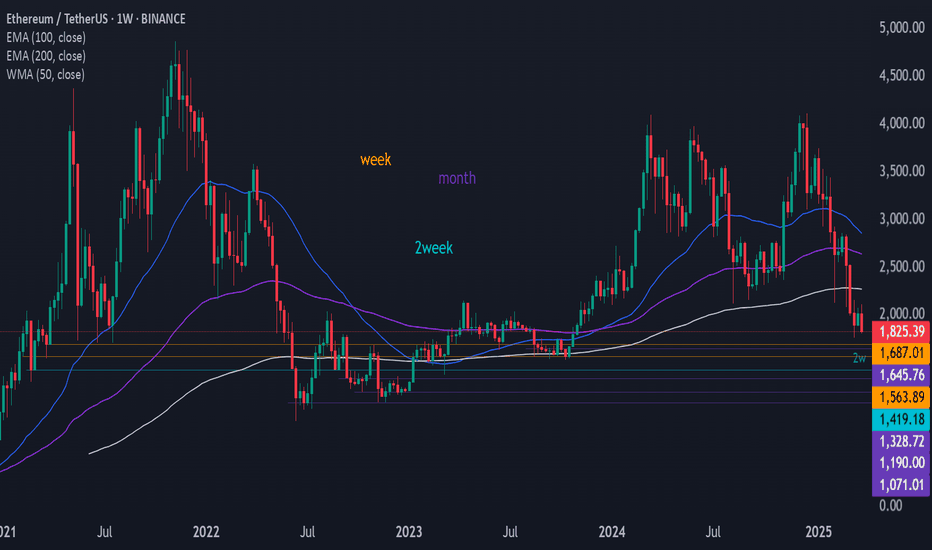

Ethereum has seen a notable bounce this month, climbing approximately 30% from its local bottom of $1,400 to its current level around $1,800. While this rally might appear promising at first glance, a deeper look at the daily timeframe reveals a more cautious picture.

Despite the recent price surge, Ethereum remains technically in a **downtrend**. A well-respected downtrend continues to hold as resistance, and ETH is currently **retesting this trendline**. This point of contact now sets the stage for two potential scenarios:

**Scenario 1: Rejection from the Trendline**

If Ethereum fails to break above the trendline, it’s likely to face **rejection**, which could send the price back toward the $1,400 level. A revisit to this support zone would form a **potential double bottom**, a classic reversal pattern. If that plays out, we could then start to look for signs of a genuine trend reversal.

**Scenario 2: Breakout Above the Trendline**

On the other hand, if ETH manages to **break through the trendline**, that alone shouldn't be a green light to go long just yet. There’s a significant resistance level sitting around **$2,100**, which has previously acted as a ceiling for price action. A true breakout would require Ethereum not only to cross this level but also to **sustain above it for 2–3 days**. Only then could a long position be considered relatively safer, with upside targets extending to **$2,800** and even **$4,000**.

**Final Thoughts**

While the recent rally is encouraging, it's essential to remain cautious. The downtrend isn't officially over until key technical levels are cleared and held. Until Ethereum breaks above both the downtrend and the $2,100 resistance zone — and proves its strength with sustained movement — the **best strategy may be to sit on the sidelines** and let the market play out.

Patience often pays in crypto — and right now, **watching closely** could be the smartest move.

ETH-----Buy around 1715, target 1800 areaTechnical analysis of ETH contract on April 23: Today, the large-cycle daily level closed with a big positive line yesterday, and the K-line pattern continued to rise. The price stood above the moving average, and the attached indicator was running in a golden cross. The current rise in the big trend is obvious. The previous high pressure position of 1700 is currently converted into the support position below, so the main idea is to keep retracement and do more; the short-term four-hour chart K-line pattern continued to rise, and the attached indicator was running in a golden cross, but the price deviated from the moving average and returned to the moving average support area of 1715. The hourly chart hit the high point in the morning and then came under pressure. From this point of view, it is likely to be a correction trend during the day, and the strength mainly focuses on the strength of the European session.

Therefore, today's ETH short-term contract trading strategy: sell at the current price of 1790, stop loss in the 1820 area, target 1735-1715 area, buy at the 1715 area, stop loss in the 1685 area, target 1800 area;

ETH-----Sell around 1600, target 1530-1505 areaTechnical analysis of ETH contract on April 11:

Today, the large-cycle daily level closed with a small negative line yesterday, and the K-line pattern was a single positive line with continuous negative lines. The price was below the moving average, and the attached indicator was dead cross. The downward trend in the big trend is still very obvious. Yesterday, we also explained that the suppression at the weekly level was very obvious, so it is difficult to break the high, continue, and form a trend. This is what we need to clarify first; the short-cycle hourly chart yesterday continued to fall in the European session and the US session, and the price support rebounded in the early morning. This is also expected. The right shoulder pressure of the head and shoulders top pattern is near the 1600 area. Yesterday, it reached the low point and rebounded to the right shoulder peak and then fell to complete the head and shoulders top pattern. Isn’t this very clear?

Therefore, today’s ETH short-term contract trading strategy: sell at the rebound 1600 area, stop loss at the 1630 area, and target the 1530-1505 area;

ETH CHART: I FOUND THE BOTTOM!HERE IS MY FUNDA REASON OR NEWS WHY I THINK THIS IS THE LAST DROP~! BEFORE WE RECOVER AND START THE BUILDING OF CRYPTO!

Price Decline and Market Sentiment: Ethereum's price has dropped below $1,800, marking a significant decline of over 45% since the start of the year. This has raised concerns about its market stability, with some analysts predicting further drops to $1,550 if key resistance levels aren't reclaimed.

Investor Sentiment and FUD: Fear, uncertainty, and doubt (FUD) have led to increased selling pressure. Retail traders have been offloading ETH holdings, resulting in reduced trading volumes and network activity. Active addresses and transaction volumes have also declined, signaling lower demand!

Technical Challenges and Resistance Levels: Ethereum has struggled to break past critical resistance levels, such as $1,900. Its failure to reclaim these levels has validated bearish patterns, with some analysts warning of a potential drop to 17-month lows!

Macroeconomic Factors: Broader economic uncertainties, including geopolitical events like tariffs, have contributed to Ethereum's struggles. These factors have added to the negative sentiment in both the financial and crypto markets.

Network Activity and Whale Behavior: While some large investors (whales) are accumulating ETH, the overall network activity has seen a decline. This mixed behavior has created uncertainty about the asset's short-term trajectory

ETHUSDT (4H) Analysis - Support, Resistance & Profit Opportunit🔥 ETHUSDT (4H) Analysis - Support, Resistance & Profit Opportunities

Based on the ETHUSDT (4H) chart, here are key support and resistance zones that can guide your trading decisions.

⸻

📌 1. Key Support & Resistance Levels

Price Level (USDT) Role Significance

2,858.82 Strong Resistance Sell target if price tests this level

2,732.76 Fibonacci 0.886 Resistance Potential retracement point

2,622.17 Fibonacci 0.786 Resistance Key level for bullish continuation

2,436.40 Fibonacci 0.618 Resistance If broken, potential bullish trend shift

2,305.91 First Resistance Breaking above could lead to further gains

2,125.10 First Support Key level for buyers to step in

1,928.14 Current Price Attempting recovery

1,861.48 Secondary Support Important level for a rebound

1,753.00 Strong Support If broken, potential further downside

1,492.03 Stop Loss Level Below this, long-term downtrend risk increases

⸻

📊 2. Trading Strategies

💰 ✅ Long (Buy) Strategy

• Wait for a retest at the support zone 1,861 - 1,753 USDT

• Set a Stop Loss below 1,700 USDT

• Target Take Profit (TP) levels at 2,125 - 2,305 - 2,436 USDT

🔥 Aggressive Entry:

• If the price breaks above 2,305 USDT with strong volume, consider a Follow Buy targeting 2,436 - 2,622 USDT

⸻

📉 ❌ Short (Sell) Strategy

• If price rejects at 2,305 - 2,436 USDT with bearish signals (Bearish Engulfing / Shooting Star)

• Set a Stop Loss above 2,450 USDT

• Target TP levels at 2,125 - 1,928 - 1,861 USDT

⚠️ If price breaks below 1,753 USDT, it may drop further to 1,500 USDT

⸻

🔎 3. Key Signals to Watch

✅ If price breaks 2,305 USDT with high volume, bullish continuation is likely.

❌ If price gets rejected at 2,305 - 2,436 USDT, a pullback may occur.

⚠️ If price breaks below 1,753 USDT, strong selling pressure could follow.

⸻

💡 Summary

• ETH is recovering from 1,928 USDT support

• Breaking 2,305 USDT could lead to 2,436 - 2,622 USDT

• Failure to break could result in a retest of 1,861 - 1,753 USDT