ETHUSD ICTETH/USD Analysis: Potential Drop from the 2047 OB to 1760

Ethereum (ETH) is currently approaching a key Order Block (OB) at the 2047 level. Based on price action analysis and market structure, there is a high probability that ETH will face strong resistance at this level, leading to a potential bearish move towards the 1760 level.

Key Observations:

Order Block (OB) at 2047:

This level represents a significant supply zone where institutional traders might initiate sell positions.

Historical price reactions at this level indicate strong resistance.

Market Structure:

ETH is currently in an uptrend but approaching a key resistance zone.

If price rejects 2047, it could signal the beginning of a short-term bearish correction.

Liquidity & Stop Hunt:

Many traders might have stop-loss orders above 2047, making it an attractive zone for liquidity grabs before a potential reversal.

A fake breakout above this level could trigger a sharp sell-off.

Target Zone at 1760:

This level aligns with a previous demand zone and a key Fibonacci retracement level.

If ETH fails to maintain bullish momentum, 1760 could act as a strong support where buyers may re-enter the market.

Trading Plan:

Short Entry: Around 2047 (Confirmation with bearish price action, e.g., rejection wicks, bearish engulfing candles).

Stop Loss: Above 2080 (To avoid stop hunts and fake breakouts).

Take Profit: 1760 (Key demand zone and potential reversal area).

Conclusion:

ETHUSD is showing signs of potential rejection at the 2047 OB level, which could lead to a move towards 1760. Traders should monitor price action closely for confirmation before entering short positions. Risk management is essential, as breakouts above 2047 could invalidate the bearish scenario.

Ethreum

Ethereum ETH price analysis CRYPTOCAP:ETH price has dropped to the most critical point, where the upward trend is still in place and the structure is not broken.

Below $1700, personally, we will lose the desire to look towards #Ethereum

📈 In the meantime, we stick to positive thinking and expect the OKX:ETHUSDT price to move along the blue route: $3800 - $2600 - $6200 - $4200 - $7700 - $9700

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

"ETH/USDT 1H: Bullish Reversal in Play – Targeting $2,280?ETH/USDT 1H: Bullish Reversal in Play – Targeting $2,280?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Market Structure (Confidence Level: 8/10):

Bullish reversal forming after testing $1,800 support.

RSI confirms hidden bullish divergence, with higher lows on RSI while price made lower lows.

Smart Money Analysis:

Strong order block formed at $1,880, reinforcing demand.

Break of market structure at $1,950, confirming a shift in trend.

Institutional accumulation visible in the volume profile, suggesting Smart Money positioning.

Trade Setup:

Entry: $1,953 - $1,960 (current retest).

Targets:

T1: $2,120 (Fair Value Gap fill).

T2: $2,280 (high-timeframe resistance).

Stop Loss: $1,880 (below recent swing low).

Risk Score:

7/10 – Favorable risk-to-reward, but a stoprun below $1,900 remains a risk.

Market Maker Activity:

Currently engineering a stoprun below $1,900, likely before a continued move higher.

Volume increasing on bullish moves, confirming institutional buying interest.

Key Levels:

Support: $1,880, $1,800.

Resistance: $2,120, $2,280.

Recommendation:

Long positions remain favorable at the $1,953 - $1,960 entry zone.

Monitor for a stoprun below $1,900 as liquidity is being engineered before continuation.

Manage risk tightly, as Smart Money is accumulating ahead of a potential breakout.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

ETH(based on NEo wave)This supercycle is a nice nature triangle which E wave is ending and its look like a diamon diametrical.

so I will update it for the confirmation, I think ALTseason is so close and we can see that happening soon but this season take about 400 to 450 days and after that there is a huge CRASH!

Ethereum will move to the upside1. Current Price and Context

The current price of ETHUSD is $1,848.22, as indicated by the red label at the bottom right of the chart.

This price represents a significant decline from earlier highs, suggesting a corrective phase following a prior uptrend.

2. Price Movement and Trend

The chart shows a sharp upward movement starting in early 2024, with the price reaching a high near $4,000 (orange horizontal line).

After this peak, the price entered a correction phase, dropping steadily. The downward movement is marked by a descending triangle pattern, a bearish continuation pattern characterized by lower highs and a flat or slightly declining lower trendline.

The upper trendline of the descending triangle slopes downward, while the lower support level was initially around $2,100 (orange horizontal line labeled "Correction").

3. Breakdown and Support Levels

The price has recently broken below the $2,100 support level, which could indicate a continuation of the bearish trend or a potential exhaustion point.

The current price of $1,848.22 is near a significant low, with the chart suggesting this as an "Opportunity to go for long" (yellow annotation). This implies that some traders might see this as a potential reversal point to enter a long position, anticipating an upward move.

4. Potential Targets and Resistance

The chart projects a potential upside target near the previous high of $4,000 if the price reverses and breaks out of the descending triangle pattern.

The vertical orange line at $4,071 suggests a psychological or technical resistance level that the price approached earlier in the trend.

5. Technical Observations

Descending Triangle: This pattern often signals a continuation of a downtrend unless a strong bullish reversal occurs. The breakdown below $2,100 supports the bearish case, but the current low at $1,848.22 could act as a support zone if buying interest emerges.

Volume (not shown): Without volume data, it’s hard to confirm the strength of the breakdown or potential reversal. Typically, a breakout with high volume would carry more significance.

Timeframe: The 12-hour chart suggests this is a medium-term analysis, suitable for swing traders looking for opportunities over days or weeks.

6. Possible Scenarios

Bullish Scenario: If the price holds above $1,848.22 and starts to recover, it could test the $2,100 level again. A break above $2,100 with strong momentum might signal a return to the $4,000 range, aligning with the "Opportunity to go for long" annotation.

Bearish Scenario: If the price fails to hold $1,848.22 and continues to decline, it could test lower support levels (e.g., $1,500 or below), indicating further correction.

GREAT LONG OPPORTUNITY HAS COME✅ PREVIOUSLY ON ETH

We thought that it could be the bottom at 870.

We were waiting for the long opportunity after 2030.

✅WHERE WE ARE

ETH is at the strong support line. We expect the strong bullish impulse at the moment.

💡The absolute principle for trading💡

LONG- as low as possible

SHORT - as high as possible

PLEASE DO NOT FORGET TO SMASH LIKE👍🏻 AND FOLLOW ME❤ IT MOTIVATES ME TO THE NEXT IDEA! THANK YOU 🎉

*As long as 1073 remains unbroken, this idea is valid.

Positive days coming? ETH Crypto MarketWill Ethereum end its downtrend? Ethereum has been quite weak for a long time and is currently at an important support level. If it breaks down further, a sharp decline may continue, but if it holds the support, the upcoming period could be more positive.

Many cryptocurrency dominance charts, as well as Nasdaq and stock charts too, showing the same pattern. Is the reversal starting?

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

Crypto Markets See $3.8 Billion Outflow, What Does It Mean?Ethereum, Solana, and Toncoin were hit with multi-million outflows; but Bitcoin took the biggest hit with $2.59 billion in funding.

For the third week in a row, digital asset investment products have seen investors siphon off funds. This past week alone marked a historic $2.9 billion outflow, raising the cumulative figure to $3.8 billion in three weeks.

According to the latest edition of the Digital Asset Fund Flows Weekly Report, Bitcoin was hit the hardest by negative sentiment, suffering $2.59 billion in outflows last week, while short coin products attracted $2.3 million in inflows. Ethereum also faced heavy losses and received a record $300 million in outflows.

Toncoin was not immune, with investors siphoning off $22.6 million. Meanwhile, multi-asset products experienced $7.9 million in outflows, while Solana and Cardano saw outflows of $7.4 million and $1.2 million, respectively. Even blockchain stocks fell, losing $25.3 million.

Sui, on the other hand, saw inflows of $15.5 million, followed by XRP, which received $5 million, while Litecoin added $1 million in inflows.

Over the past week, outflows were broad, with the United States leading with $2.87 billion, followed by Switzerland with $73 million and Canada with $16.9 million. Sweden also recorded $14.5 million in outflows, while Brazil and Hong Kong saw $2.6 million and $2.5 million, respectively.

In contrast, Germany trended with $55.3 million in inflows as investors bought into the trend. Australia also recorded a modest inflow of $1 million. BITSTAMP:BTCUSD COINBASE:BTCUSD BYBIT:BTCUSDT.P BINANCE:BTCUSDT CRYPTO:ETHUSD

Is SOL/BTC following the ETH/BTC distribution pattern?

As the big red weekly candle closes for BTC, we should see some volatility this week.

Solana valued in BTC has exited a rectangular distribution topping pattern.

Failure to recapture the rectangular box and enter back into it in a spring like move is looking increasingly unlikely.

Ethereum valued in BTC followed a very similar pattern in Nov 2023, exiting the rectangular distribution rectangle and fell much much lower.

The 50 week (blue line) and 200 week (purple line) moving averages also follow a similar trajectory for both instruments / coins.

If SOL / BTC does not recover into the box, and fast I will be exiting a long term position I hold.

Defensive Strategy based on this chart and the USD chart warrants consideration

PUKA

Ethereum at a Key Level! ¿Rebound or More Drop?Hi traders! 🚀 I'm entering ETH/USD at a key zone. The price is testing support at $2,098, and while the trend is still weak, the RSI at 30 suggests we're in oversold territory. 👀

Trade Details:

🔸 Entry:$2,098 ✨

🔸 SMA 200:$2,213 → strong resistance.

🔸 SMA 20:$2,167 → could act as a barrier.

🔸 TP:$2,256 🟢

🔸 SL:$1,912 🔴

Clear risk management in place—let's see if we get the bounce! What do you think? 📉📈🔥

⚠️ Disclaimer: This is not financial advice. I'm just sharing my analysis and personal experience. Every trader should do their own research and manage their risk. 📢

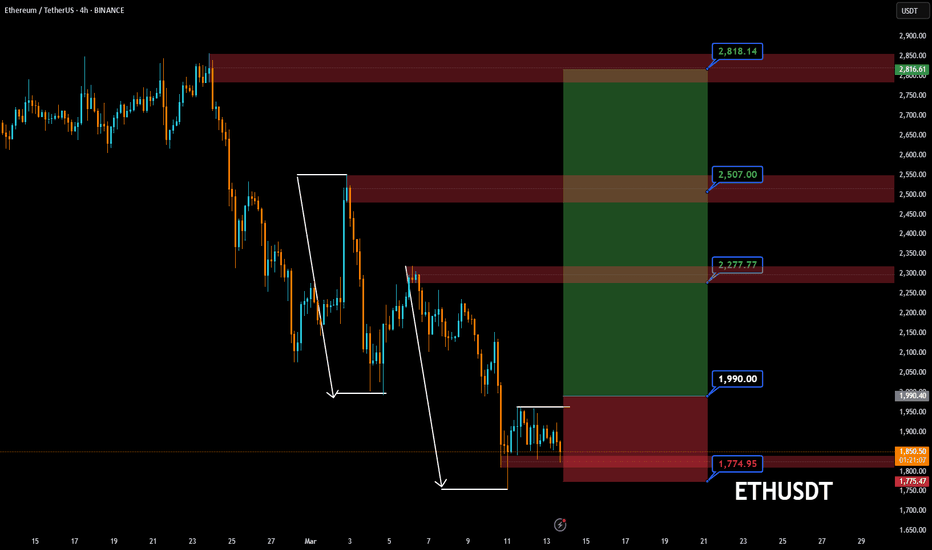

Ethereum at Key Support Zone: Is a Counter-Trend Setting Up?Ethereum (ETH) is currently in a strong bearish trend 📉, but it has traded into a key support zone 🛑 and seems overextended, in my opinion. Looking at the price action and market structure on the daily and four-hour timeframes, we’re now seeing Ethereum form higher highs and higher lows on the four-hour chart 📊. While it’s still early, if we see a break above the current range high on the four-hour timeframe, there could be an opportunity for a counter-trend trade 🔄, targeting equilibrium ⚖️ and a previous imbalance highlighted in the video. As always, this is for educational purposes only and should not be taken as financial advice 💡.

ETH Monthly Massive Trianglejust noticed this and ETH on the monthly just retested it's previous high before the base of the run up, this is common but tested once as a wick earlier. Measured move and I used the fib extension tool 6.18s are yellowed, the base is blue, so a buy are is now, and then the triangle time line is 75 bars measured from the first wick from base trend line to upper trend line. dates back to last bull run on the monthly. Most triangles break out at about 66% so that's 50 bars July 1 from either the top or bottom that's the vertical red line. With RWAs on ETH built projects, some elsewhere but evm and Solana AVAX a front run 9K ETH is really not out or the question

almost forgot important

indicators

rsi trying to turn up

volatility hearing up

but stich and jewel heading downward

some more down may be in store

waiting on Hash ribbon BTC indicator on daily to flash a buy middle month new moon maybe crazy but bull full moon is the illuminati of Bitcoin Bat Signal to buy world wide now that's deep lol

ETH/USDT 1H: Bullish Momentum – Next Target $2,520?ETH/USDT 1H: Bullish Momentum – Next Target $2,520?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure (Confidence 8/10) :

Price: $2,220, confirming a bullish structure from the discount zone.

Hidden bullish divergence confirmed on RSI (58.46), supporting upward momentum.

Market Makers (MMs) engineered a liquidity grab at $2,040, indicating strong accumulation.

Clean break above equilibrium at $2,200, signaling continuation.

Trade Recommendation:

Entry: Current price ($2,220) or pullback to $2,180.

Targets:

T1: $2,360

T2: $2,480

T3: $2,520

Stop Loss: $2,160 (below equilibrium zone).

Risk Score:

8/10 – Strong risk-to-reward setup with clear invalidation.

Market Maker Activity:

Accumulation phase complete at the $2,040 zone.

Currently engineering moves toward the premium zone ($2,520).

Likely targeting shorts above $2,360 before the next push.

Smart Money Insight:

Institutional accumulation is evident, with clear buying pressure.

Structure suggests another leg up, but traders should monitor resistance near $2,520 in the premium zone.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

#ETH/USDT#ETH

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a rebound from the lower limit of the descending channel, this support is at a price of 1950

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2236

First target 2340

Second target 2414

Third target 2530

ETHEREUM COIN ANALYSIS AND NEXT POSSIBLE MOVES!!CRYPTOCAP:ETH Coin Update!!

• Technically Overall CRYPTOCAP:ETH Structure look Bearish.

• Two major support areas are marked on a chart.. ( First Support 1950$-1880$ ) & ( 2nd support is 1550$ )

• Where you are able to add CRYPTOCAP:ETH For Long-term in your Portfolio & Also you are able to build trade setups on it... If price respect these levels🫡

Warning : DYOR Before taking any action🚨