Ethereum at Key Supply — Short-Term Sell OpportunityHello everybody!

Ethereum has reached a strong supply/resistance area in the daily timeframe.

As we see on the chart, lower highs have started to forming.

In addition to that, an upward trendline has been broken.

Keeping in mind that overall trend is bullish, we can look to short time sell positions here.

The first target can be 3300-3400.

If the price breaks below 3300, we can expect it to go lower toward 3100 area.

Manage your risk and trade safe!

Ethshort

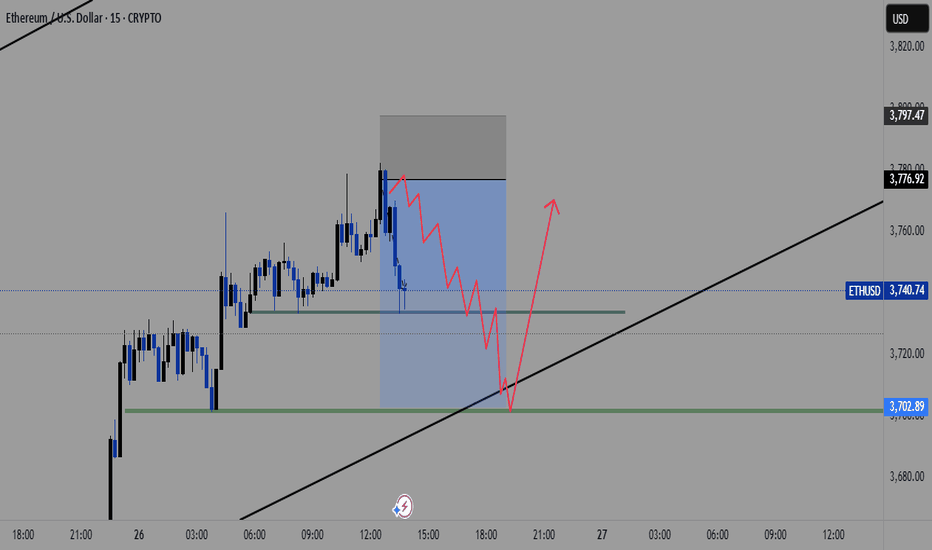

ETH to $3700 Before a Major Bounce?Ethereum has been showing signs of exhaustion after its recent rally. I'm watching the $3700 level closely — it's a key support zone that has acted as both resistance and support in the past.

🟦 If ETH pulls back to this area, I expect it to find strong buying interest, potentially leading to a significant bounce and continuation of the bullish trend.

📌 Scenario I'm Watching:

🔻 Pullback to the $3700 support zone

📉 Shakeout or stop hunt below previous lows

💚 Followed by a strong bullish reversal — possible move toward $4000+

Why $3700?

Confluence of previous highs/lows

Psychological round number

Potential liquidity pocket

Not Financial Advice!

This is a scenario I'm tracking, not a guarantee. As always, wait for confirmation (e.g. bullish engulfing, RSI divergence, volume spike) before jumping in.

📉 If $3700 fails decisively, I'll reassess — next support likely around $3550–3600.

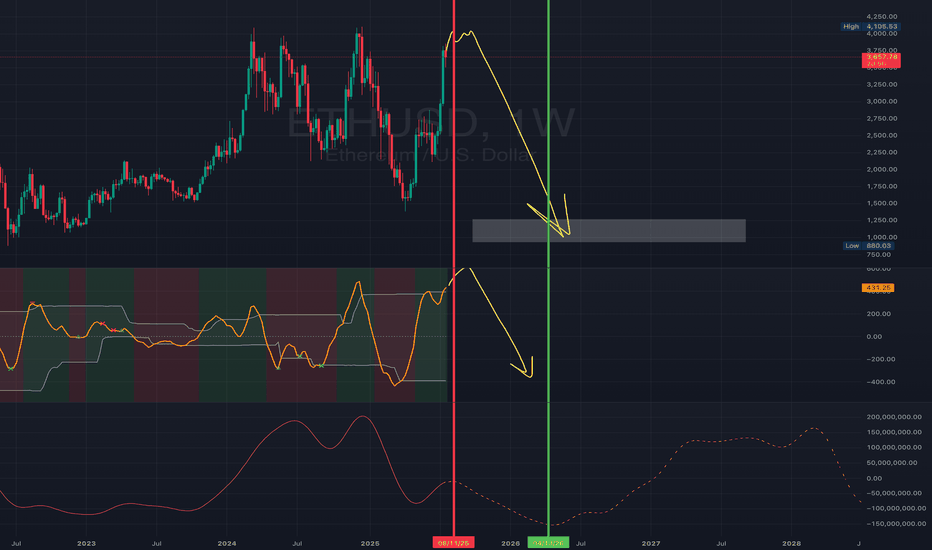

THE END OF ETHI think they’re about to trap all of you in the most popular alts.

Bitcoin. Ethereum. XRP. Solana. ADA. DOGE. PEPE. You name it.

The end of ETH is near.

🟩 Green = I’m buying

🟥 Red = I’m selling

Last time we predicted the drop from $4,000 to $1,400.

This time I want to see ETH under $1,000.

Good luck holding your bags when the market rug gets pulled.

I’m not here for likes — I’m here for entries. Stay sharp. 🧠📉

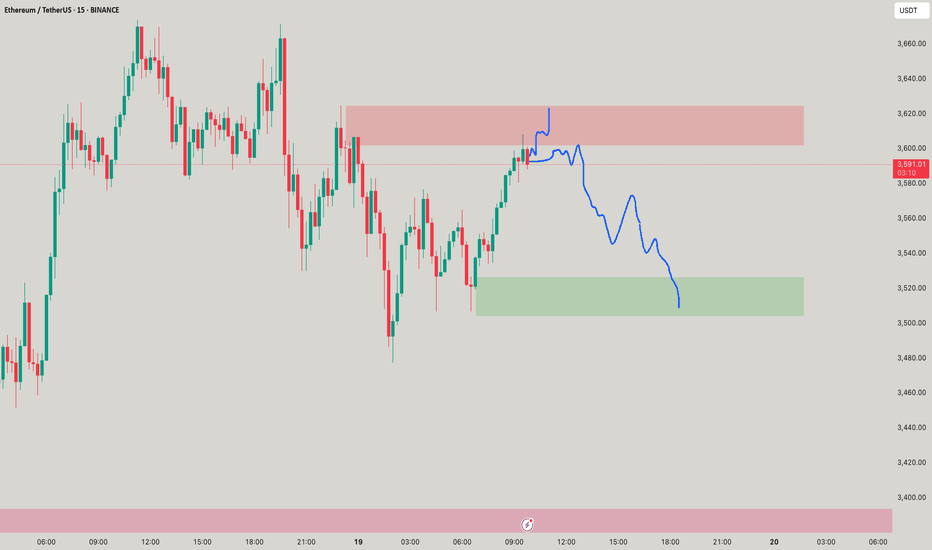

ETH-----Sell around 3690, target 3615 areaTechnical analysis of ETH contract on July 25:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern was single negative and single positive, the price was at a high level, and the attached indicator was golden cross and running with shrinking volume. From the big trend, the current trend is in a weak trend, the price rebound is not strong and has not continued, the trend is prone to fall under pressure and test the low point downward, so the trend has changed; the short-cycle hourly chart yesterday hit a high in the US market and fell under pressure in the Asian morning. The current K-line pattern is continuous negative, the price is at a low level, and the attached indicator is dead cross running. It is highly likely that the decline will continue during the day. Yesterday's low point of 3500 is the position that needs to be paid attention to today. The current hourly chart resistance is near the 3695 area.

Today's ETH short-term contract trading strategy:

Sell in the 3690 area after the rebound, stop loss in the 3720 area, and target the 3615 area;

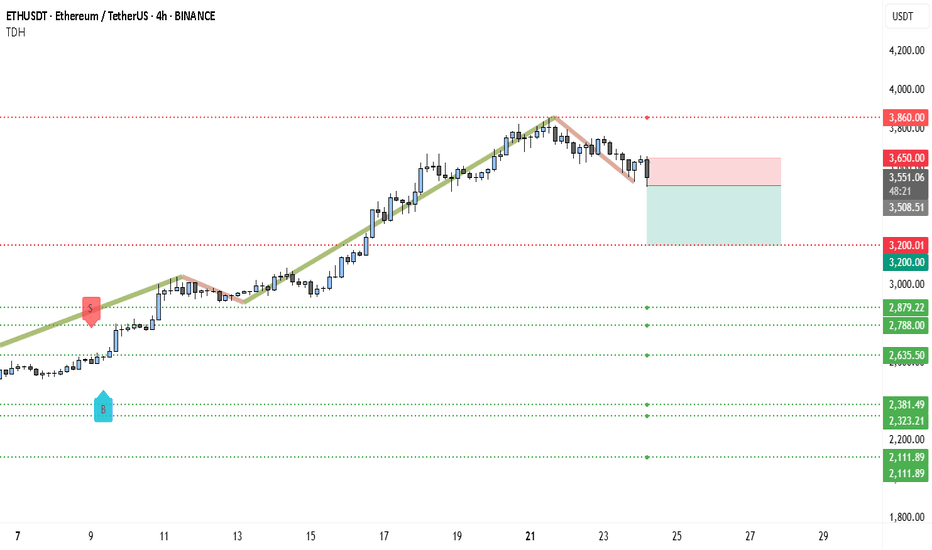

ETH Just Lost Key Support — Next Stop: $2,879?Ethereum (ETH) appears to be losing steam on the 4-hour chart as it fails to sustain above the critical $3,860 resistance level. After a strong rally, the price structure has started showing signs of exhaustion — the previous bullish momentum has clearly stalled, and ETH is now forming lower highs and lower lows. This breakdown marks a potential shift in trend, especially considering the clean rejection from $3,860 with several upper-wick rejections signaling aggressive selling pressure.

The green ascending trendline, which supported ETH throughout its recent rally, has been breached. Price has broken below the trendline and is now moving in a declining structure highlighted by the recent bearish wave. Sellers have stepped in, and the most recent candles indicate a bearish continuation setup forming just below a failed support-turned-resistance near $3,533.

There’s a visible trade setup taking shape:

• Entry: $3,530–$3,550 (post-retest of broken trend support)

• Stop-loss: $3,650 (above recent local highs)

• Target 1: $3,200 (key support level)

• Target 2: $2,879

• Target 3 (extended): $2,635 if downside pressure intensifies

This short setup offers a solid risk-reward ratio, especially if momentum accelerates below $3,500. The sell signal seen earlier aligns with this potential reversal zone, and unless ETH reclaims $3,650 with volume, the bears look likely to stay in control.

In summary, ETH on the 4H timeframe is now trading below major support, with a bearish structure, trendline breakdown, and rejection at resistance — all aligning for a short-biased move in the coming sessions. Any bullish invalidation would require ETH to push and close above $3,650 convincingly. Until then, the path of least resistance appears downward.

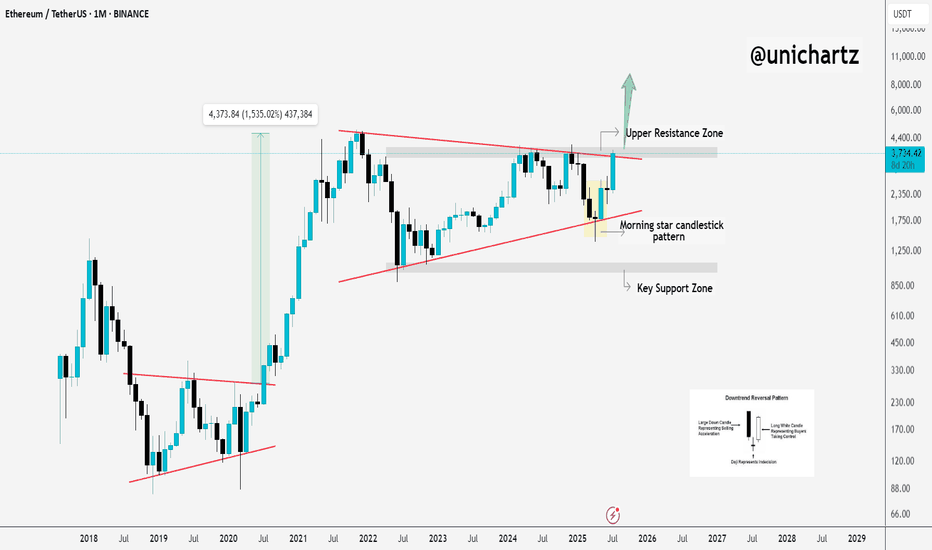

Ethereum Breakout Could Spark the Next Altseason!A Massive Altseason Is Brewing… 🚀

Ethereum just flashed a major monthly breakout after printing a clean Morning Star reversal right at key support.

Now it's pushing against the upper resistance zone, a structure that held it back for over two years.

If CRYPTOCAP:ETH breaks and closes above this level, it won’t just be bullish for Ethereum — it could ignite the biggest altcoin season since 2021.

Why it matters:

📌 ETH is the heart of the altcoin ecosystem.

📌Historical breakouts like this led to 1500%+ moves.

📌The pattern and price action are lining up perfectly again.

Once Ethereum breaks cleanly above $4,000, expect altcoins to explode across the board — Layer 2s, DeFi, AI tokens, and even the meme coins could all start flying.

Keep your eyes on ETH. Its breakout is the spark… the altseason fire is coming.

DYOR | Not Financial Advice

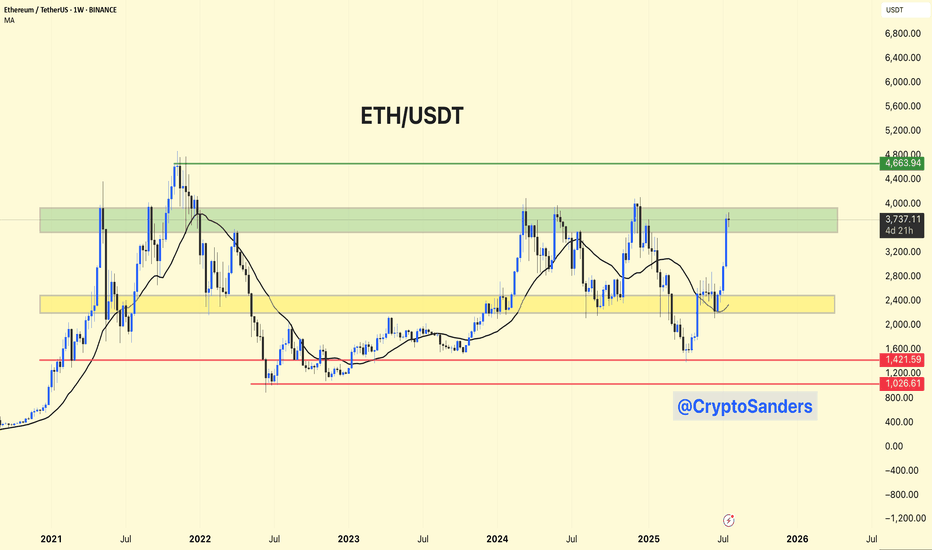

ETH/USDT – Weekly Chart Analysis !! ETH/USDT – Weekly Chart Analysis

ETH is testing a major historical resistance between $3,700 – $4,000 (highlighted green zone).

A clean breakout above this level could push price toward the next key resistance at ~$4,660.

Previous accumulation zone around $2,400 – $2,800 (yellow box) now acts as strong support.

Long-term floor at $1,420 and $1,025, though currently far below.

Bullish Breakout Potential: If ETH sustains above the green resistance, it may retest $4,660+.

A failure to break above $4K could lead to a healthy pullback toward the yellow zone (~$2,800).

Stay updated and manage your risk accordingly.

DYOR | NFA

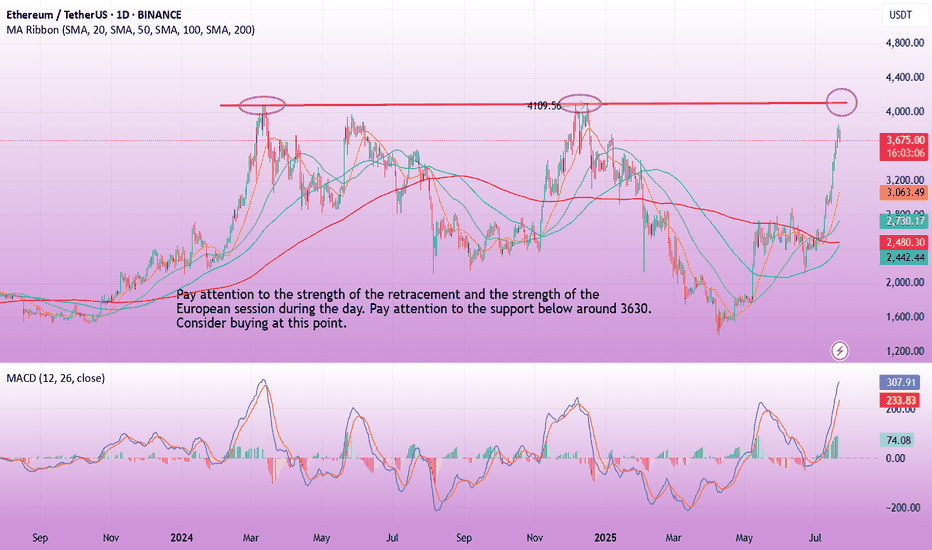

ETH-----Sell around 3680, target 3650-3630 areaTechnical analysis of ETH contract on July 22:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern continued to rise, the price was above the moving average, and the attached indicator was running in a golden cross. The overall upward trend was still very obvious, and yesterday's decline can be regarded as a correction based on the current trend. The price just returned to the support of the moving average, and the strong support position was near the 3630 area; the short-cycle hourly chart currently has a continuous negative K-line pattern, the price is below the moving average, and the attached indicator is running in a dead cross, so let's look at the retracement trend during the day, and pay attention to the 3630 area below the support.

Today's ETH short-term contract trading strategy:

The current price is 3680, short, stop loss in the 3745 area, and the target is the 3650-3630 area;

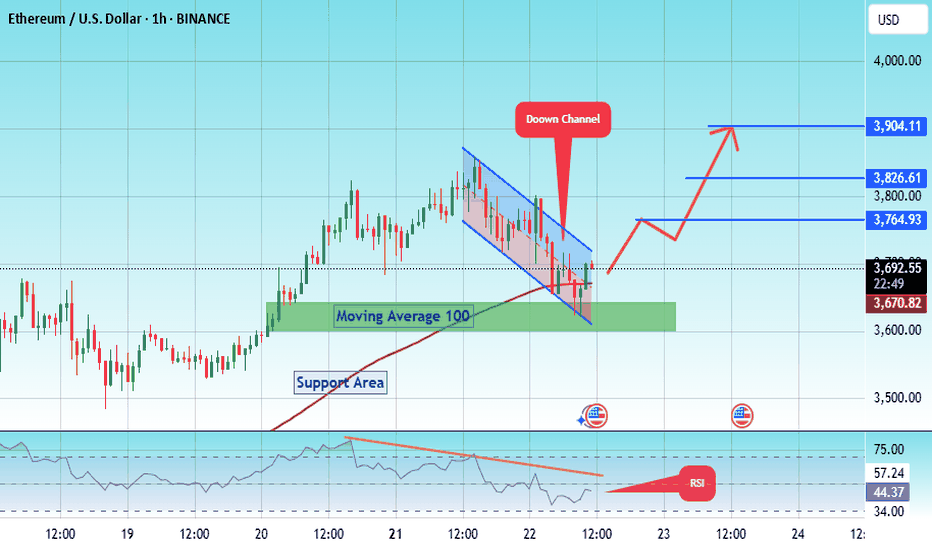

#ETH/USDT SETUP ,Bought From $3696#ETH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 3640.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3600, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 3696.

First target: 3764.

Second target: 3826.

Third target: 3904.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ETHUSD heading towards the top of the D1 frame✏️ CRYPTO:ETHUSD is in a strong uptrend towards the resistance zone of the 3800 daily frame. There are not many conditions for the sellers to jump in and reverse the current trend. Wait for the price reaction at the resistance of the D1 frame to consider the SELL strategy. Because currently if BUY is too Fomo.

📉 Key Levels

Sell trigger: Rejection from 3800

Target 3400, potentially 3,380

Leave your comments on the idea. I am happy to read your views.

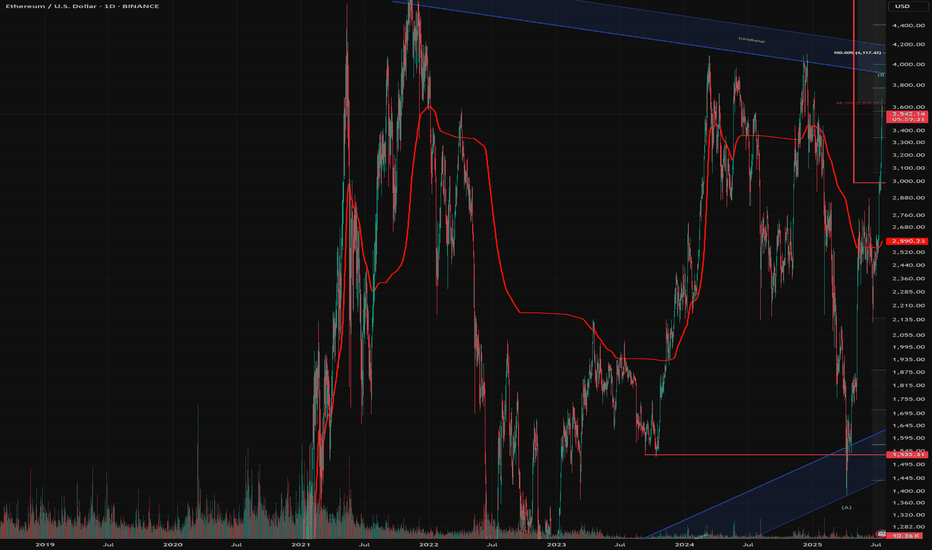

Ethereum is going to 2000 then new ATH

Alright, let's talk about what I see coming for Ethereum. I’ve been deep-diving into these charts, especially that weekly one where I’ve highlighted the past moves and percentages. I'm using these patterns as a guide to try and anticipate where Ethereum is heading next. I'm going to set aside any kind of trading advice, and focus on what I see the market doing next.

Key Observations From Past Cycles

Looking at Ethereum's history, I’m seeing a pretty clear cycle of large price swings:

Massive Rallies: Ethereum has a history of powerful bull runs, where the price can surge by hundreds, or even thousands of percent. I need to be aware of these to understand the potential of the coin.

Substantial Corrections: These rallies are always followed by substantial corrections, which range from about 30%, to upwards of 80%. This is important to see as any retracement can be devastating to a trader.

My Prediction For The Next Move:

Based on those historical patterns, here’s what I see as the most probable outcome for Ethereum's next move:

Anticipated Retracement: I’m expecting a retracement, or a pullback following the recent gains. Ethereum tends to make large retracements after a period of growth, and I am anticipating this will happen again soon. I want to see the price find a solid level of support, as this will be important to the next move up. Based on historical price action, I expect the next support levels to be somewhere around $2000 to $2500.

The Next Upside Move: After that pullback, I anticipate a strong upside move.

The magnitude of this move is unclear, but the data on the chart shows we could be looking at a move upwards of 100%, and maybe even more. I want to be watching that very carefully when it happens.

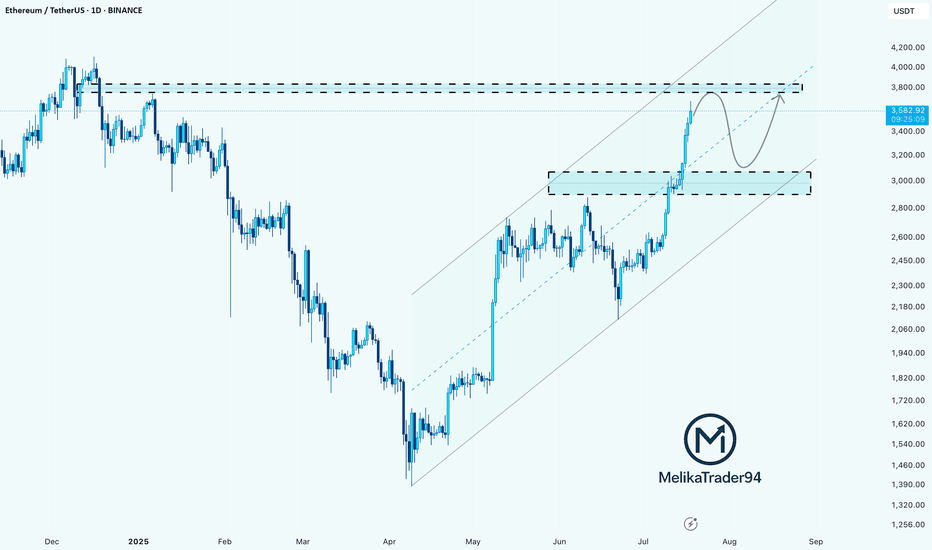

ETH Approaching Major Resistance – Expecting Pullback Hello guys!

Ethereum has been rallying strongly within a well-respected ascending channel, pushing past key levels and now approaching a major resistance zone around $3,900–$4,000.

According to the chart structure, it looks like price could soon react from this resistance, leading to a pullback into the $3,000–$3,200 demand zone, which aligns with the midline of the channel.

This would be a healthy correction before potentially continuing the bullish trend and attempting a clean breakout toward new highs.

ETH is still bullish, but it may need to retest support before continuation.

Watch for a bounce from the $3,000–$3,200 zone for a high-probability long opportunity.

ETHUSDT | Two Opportunities. One Smart Approach.I’ve been closely watching how buyers behave under the green line — and they’re clearly not backing down. But what really catches my eye is the blue box , a clean demand zone I’ve seen act as a launchpad in the past.

You don’t need to jump in blindly.

Depending on your risk appetite, both levels are valid. But if you wait for a 15-minute breakout confirmation on the low timeframe before acting on either, your odds of success increase significantly.

This is how I keep my win rate high, waiting for the market to prove itself first.

“I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break in the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long.”

Most traders rush in. You wait smart. That’s the edge.

Choose wisely. Follow closely.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

MY VIEW ON ETH - BULLISH & BEARISHMy analysis of Ethereum (ETH): Bullish and bearish scenario

The analysis of Ethereum is currently quite complex. The price structure does not show clear impulses in the form of classic wave movements, but frequently overlapping patterns that indicate ABC correction waves.

I therefore present both my primary and an alternative scenario for a bullish (rising) and a bearish (falling) trend.

Primary bullish scenario:

Wave 2 seems to be completed at the lower end of the blue trend channel and at the 70.70-% FiB. We could currently be in red wave 3. However, the structure of this movement is more reminiscent of an ABC formation, which could indicate a weaker impulse.

Should the price break through the upper edge of the blue trend channel and exceed the 100% Fibonacci level at around USD 4,424, several important Fibonacci zones would converge in the “profit area” marked in red. In this case, a setback as part of the red wave 4 could not be ruled out.

Alternative (bearish) scenario:

It is possible that the blue V-wave could turn into a white ABC structure. In this case, an additional wave 4 would be omitted, which could result in a stronger sell-off.

Secondary scenario - bearish:

If Ethereum fails to play out the primary bullish count scenario, I expect that we will continue to be in an overarching correction phase. This assessment also fits in with the typical market slowdown during the summer months.

In this case, a green ABC correction could form, whereby wave C could theoretically still rise to the 100% Fibonacci level at USD 4,416. However, this would be an overextended wave B.

In addition, we are already in the area of the sales or profit zone, which indicates that only a limited rise is possible.

Subsequently, I expect a stronger downward movement towards the green buy area between the 1.618 Fibonacci level and around USD 1,866.

LEAVE YOUR COMMENTS AND ASSESSMENT

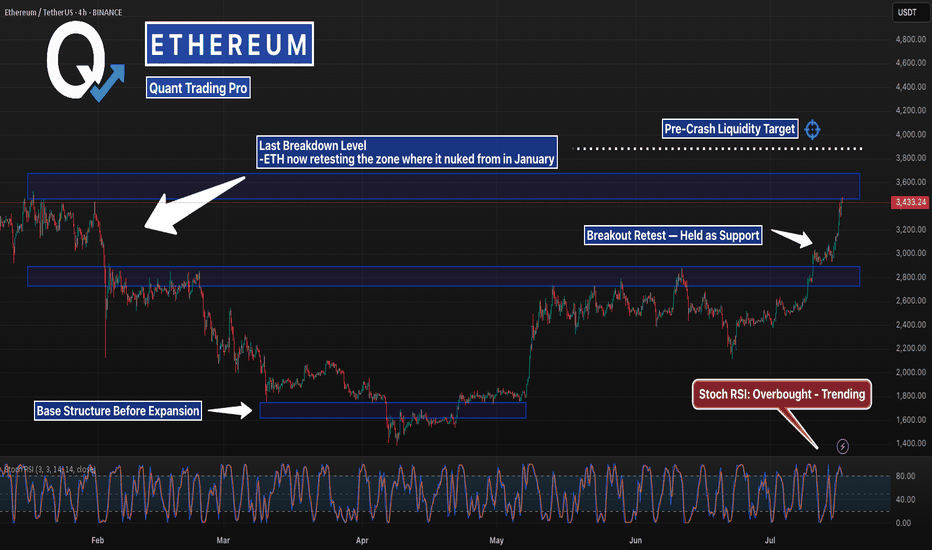

This Level Crashed ETH Last Time… It’s BackETH just blasted back into the same zone it collapsed from in January — but this time the structure underneath is stronger, tighter, and holding.

Stoch RSI is stretched, but bullish momentum remains intact. If it clears $3,870, lights out.

#Ethereum #ETHUSD #CryptoCharts #BreakoutLevels #ChartAnalysis #TradingView #QuantTradingPro #CryptoTraders #BacktestEverything

Ethereum:Daily signalhello guys👋

According to the drop we had, you can see that buyers came in and the price had a good growth, and after that a trading range was made in which the price got stuck.

Now, considering that the price is in the trading range and it seems that the buyers have shown their support, it is possible to step into the specified support areas with risk and capital management and move up to the set goals.

🔥Follow us for more signals🔥

*Trade safely with us*

When does Bolran start?Read carefullyhello friends👋

💰Many of you are asking when Bolran will start or if it will start at all, we decided to explain it to you in a full post.

Well, you can see the Ethereum chart moving in a channel, and with a drop, it created a big fear that a fall is coming, and meanwhile, the buyers returned the price to above 2000 dollars with a strong and unexpected return.

✅️Now the price is stuck in the specified box between 2200 and 2500, and if this range is maintained, the price will easily move up to the range of 3200 in the first wave, and if it fails to maintain this range, the price will fall below 1500 dollars.

🧐Now, in our opinion, due to the rapid return of the price from the channel, this failure is a fake channel and the range will be maintained, and we are likely to see Ethereum rise in the coming weeks.

🤔You know that Ethereum is the leader of altcoins, and if it grows, important altcoins will grow, which is the beginning of Bolran, and there are important altcoins that can be used for good profit.

🌟You can join us if you like.🌟

🔥Follow us for more signals🔥

*Trade safely with us*