ETH (5 year of accumulation!)ETH / USDT

📌 Background: i shared an analysis about ETH/BTC chart and i predicted the ultimate bottom, from which ETH/BTC pumped 52% and ETH/USDT pumped 97% in few days !

you can check previous analysis: click here

📌 Today we have different chart against stable coin … Ethereum is being accumulated since 5 years in mega accumulation range with 2 major stop-loss hunt (long and short)

📌 What IF ?

What if ETH made a breakout throughout this accumulation ? i think we can see scenario like that in the green candles in my chart

DO YOU AGREE ?

Ethsudt

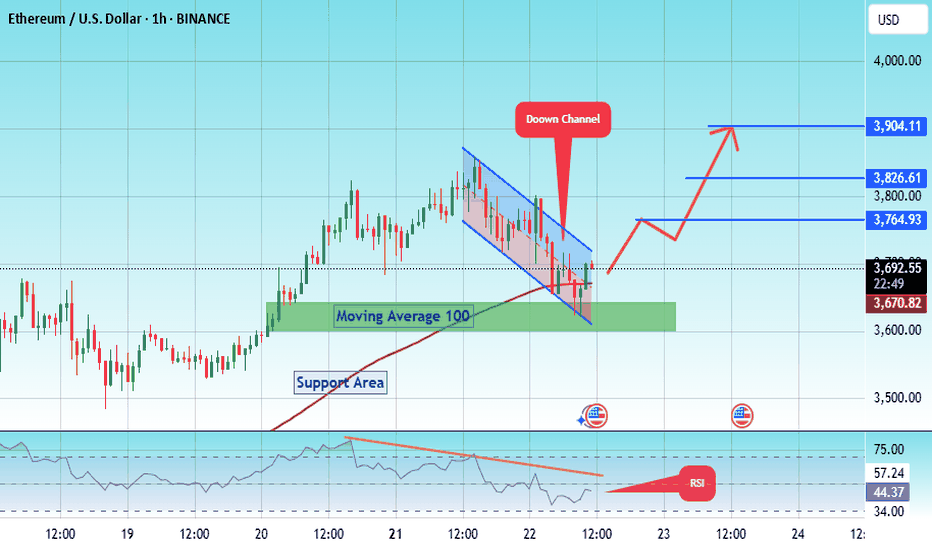

#ETH/USDT SETUP ,Bought From $3696#ETH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 3640.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3600, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 3696.

First target: 3764.

Second target: 3826.

Third target: 3904.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#ETH/USDT#ETH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2460.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 2540

First target: 2582

Second target: 2646

Third target: 2717

Ethereum (ETH): Bullish momentumEthereum (ETH): Gaining Strength as BTC Flows Shift

Ethereum is entering a key momentum shift, signaling the beginning of a bullish cycle as it starts absorbing liquidity from Bitcoin. Over the past seven days, BTC has seen a -1% decline, while ETH has gained +3.8%, indicating a potential rotation of capital into ETH.

This shift marks the start of Ethereum's next breakout phase, as it prepares to challenge the critical $4,400 resistance from May 2021. Successfully breaking this level could pave the way for a new all-time high, with a long-term target of $6,600 by the end of 2025.

Key Levels to Watch

Short-Term Target: $4,400 – Breaking this level confirms Ethereum’s strength.

Mid-Term Resistance: $5,200–$5,500 – A breakout above this range would accelerate the bullish scenario.

Long-Term Target: $6,600 by late 2025, fueled by capital inflows and increasing ETH dominance.

Conclusion: ETH Entering a Bullish Phase

Ethereum is showing early signs of strength, with capital rotation from BTC supporting a potential major breakout. The next critical step is breaking $4,400, which could open the path toward a new all-time high and a long-term bull run toward $6,600. The market is now shifting, and ETH is positioning itself as a dominant player in the next phase of the bull market.

Ethereum Holds Strong – $4K Target in Sight?#Ethereum has bounced off its long-term trendline support for the third time, maintaining a strong bullish structure.

Upcoming Resistance is at $2,900 and $3,250, with $4,000 as the next major target.

A sustained move above $2,900 could push ETH toward $3,250.

A breakout above $3,250 would confirm further upside. Losing trendline support may invalidate this setup.

DYOR, NFA

ETHUSDT TRADING POINT UPDATE >READ THE CHAPTIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup Ethusdt looking higher level pullback up trend 📈 RSl and EME) INDICATOR) Technical patterns Ethusdt bullish trend 📈🚀 4TF Close above EMA) More bullish )

Key Resistance level 3342+3431+3525+3749 +4111

Key support level 3052 - 2979 - 2920

Support 💫 My hard analysis setup like And Following 🤝 me that star ✨ game 🎮

"Ethereum (ETH) Technical Analysis | Long-Term Breakout Potentia1. Overall Chart Pattern:

On the weekly timeframe, Ethereum is forming a long-term symmetrical triangle.

This pattern indicates price consolidation, which can lead to a strong breakout in either direction.

2. Key Resistance Levels:

$3,500 - $3,700:

This range acts as a significant resistance and has previously halted price rallies.

$4,800:

If the first resistance is broken, this level becomes the next target.

$7,300:

A long-term target in case of a breakout above the triangle's upper boundary.

Ethereum (ETH) Technical Analysis Based on the Chart:

1. Overall Chart Pattern:

On the weekly timeframe, Ethereum is forming a long-term symmetrical triangle.

This pattern indicates price consolidation, which can lead to a strong breakout in either direction.

2. Key Resistance Levels:

$3,500 - $3,700:

This range acts as a significant resistance and has previously halted price rallies.

$4,800:

If the first resistance is broken, this level becomes the next target.

$7,300:

A long-term target in case of a breakout above the triangle's upper boundary.

3. Key Support Levels:

$3,000:

A strong support zone and the intersection of the triangle’s lower trendline.

$2,500:

A critical support in case the initial support is breached.

4. Price Pattern Analysis:

The symmetrical triangle pattern suggests price consolidation, which could lead to a strong move once the price breaks either the upper or lower boundary of the triangle.

Bullish Scenario:

A breakout above the $3,500 level could push the price toward the next resistances at $4,800 and $7,300.

Bearish Scenario:

A break below the $3,000 support might drive the price toward $2,500 or even lower levels.

Suggested Trading Scenarios:

Long Position:

Entry Condition:

Breakout above $3,500 with increasing volume.

Targets:

Target 1: $4,800

Target 2: $7,300

Stop Loss:

Below $3,300

Short Position:

Entry Condition:

Break below the $3,000 support.

Targets:

Target 1: $2,500

Target 2: $2,000

Stop Loss:

Above $3,200

Fibonacci Analysis for ETH/USDT (4H Chart)Based on the Fibonacci retracement levels shown in the chart:

Current Trend:

The price is in an uptrend, breaking above key Fibonacci resistance levels. The breakout above the 0.618 level at $3,589 is a bullish signal, and the price is approaching the 1.0 Fibonacci extension level at $3,726.

Key Levels:

Support Levels:

0.618 level at $3,589: Immediate support if the price pulls back.

0.5 level at $3,357: A critical area for a stronger retracement if the price fails to sustain momentum.

0.382 level at $3,441: A secondary support zone for any minor correction.

Resistance Levels:

Current resistance at $3,726, corresponding to the 1.0 Fibonacci level. A confirmed breakout here could lead to further upside momentum.

Price Action Observations:

The higher highs and higher lows indicate continued bullish momentum. The candles show strong buying pressure, and the Fibonacci levels align with potential zones for retracement and continuation.

Trading Plan:

For Long Positions:

Enter on a pullback to $3,589 or $3,357 with tight stop-losses below the 0.5 level.

Target: Breakout above $3,726 to aim for new highs around $3,800 or more.

For Short Positions:

If the price fails to sustain above $3,726, consider shorting with targets at the 0.618 and 0.5 levels.

Momentum Confirmation:

Volume and momentum indicators should confirm the breakout above $3,726 for a sustained move higher.

This analysis highlights ETH/USDT's bullish potential, with critical retracement and extension levels providing trading opportunities.

ETH Price Setup: Why $2,840 Could Spark the Next Big Move

BINANCE:ETHUSD has been underperforming compared to BINANCE:BTCUSD and some other major cryptocurrencies, yet recent developments hint at a potential shift. Despite facing a significant resistance cluster, ETH has shown resilience by breaking above a key volume profile Point of Control (POC) level on the higher timeframe, signaling the early stages of a bullish sentiment shift.

However, to sustain this momentum, CRYPTOCAP:ETH needs to conquer a critical resistance zone, marked by a 1-week Fair Value Gap (1W FVG) and a 1-day Order Block (1D OB) – a challenging area that will likely test ETH’s ability to break out.

Chart Analysis: Key Levels to Watch

Major Resistance Zone (1W FVG & 1D OB)

The most immediate challenge for ETH is closing above the resistance zone around $2,840. This area is crucial because it combines a 1W FVG and 1D OB, both of which create a barrier that ETH needs to break through for the next leg up.

A decisive close above this level on the daily chart would turn the 1D OB into a breaker block, potentially flipping it from resistance to support and laying the foundation for a more sustained bullish displacement.

Volume Profile POC Breakout

ETH has already broken above the higher timeframe volume profile Point of Control (POC), a positive sign that suggests market interest and liquidity are shifting upwards. This break above the POC adds to the semi-bullish case, as it often signals a potential move towards filling the FVG above.

Entry Into the 1W FVG (SIBI)

Should ETH successfully close above the $2,840 level, it would enter the 1W FVG, opening up the possibility for a larger upward move. Once in this zone, buyers could gain confidence, triggering additional buy-side liquidity and a rally towards $3,100 - $3,300.

Trade Setups

Swing Trade Setup

Entry: Look for a close above $2,840. Ideally, wait for a retest of this level to confirm it as a breaker block before entering long.

Target:

Primary Target: $3,100 - within the 1W FVG zone.

Secondary Target: $3,300 - higher end of the FVG, where resistance may intensify.

Stop Loss: Set below the 1D OB, around $2,750, to protect against a failed breakout and retracement.

Rationale: A breakout and successful retest of $2,840 would signal strength, allowing ETH to push into the FVG and potentially rally toward $3,300. If buyers are strong, this could lead to a medium-term bullish trend.

Scalping Setup

Entry: Enter long on quick pullbacks to $2,750 - $2,770, close to the 1D OB support zone, or during any small dips within this range.

Target:

First target at $2,840 for a quick profit.

Second target around $2,900 - $2,950 if momentum is strong.

Stop Loss: $2,730, slightly below the 1D OB level to protect against larger sell-offs.

Rationale: For scalpers, buying dips around the 1D OB level provides a quick entry with a high probability of retesting the resistance at $2,840. This setup allows for short-term gains while taking advantage of potential volatility near the key resistance area.

Looking forward to hearing your thoughts on this!

Trade safe folks,

Cheers

ETH (Crypto ETHEREUM) SELL TF H4 TP = 2286.86On the H4 chart the trend started on Sept. 27. (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 2286.86

This level, which I have outlined above, is certainly not a “finish” level. But it is the level that has the “highest percentage of hits on target.”

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

ETH (Crypto ETHEREUM-USD) BUY TF H4 TP = 3347On the H4 chart the trend started on Aug. 08 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 3347

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

Technical Analysis of Ethereum (ETH/USDT) by Blaž FabjanTechnical Analysis of Ethereum (ETH/USDT)

Chart Overview:

The chart depicts the ETH/USDT price action on a 4-hour timeframe, showcasing a falling wedge pattern, which is generally considered a bullish reversal pattern. Here are the key observations:

Falling Wedge Pattern:

The falling wedge is marked clearly, indicating a potential upward breakout. The pattern is confirmed by the higher lows and lower highs converging towards the apex.

Support and Resistance Levels:

Resistance Zones: $3,600 - $3,800 and $4,000.

Support Zones: $3,200 - $3,400.

Volume: The volume is relatively low but picking up near support zones, which is a typical characteristic before a breakout.

Indicators:

VMC Cipher B: Showing potential divergences with green dots indicating possible bullish momentum.

RSI (14): Currently at 42.06, suggesting the market is not overbought and has room to move up.

Stochastic RSI: Showing oversold conditions, which could indicate a buying opportunity as it crosses upwards.

Trading Plan

Intraday Trading

Strategy: Use support and resistance levels for quick trades.

Entry: Buy near the support zone ($3,200 - $3,400) when confirmed by bullish indicators (e.g., green dots on VMC Cipher B).

Target: Sell near the first resistance zone ($3,600 - $3,800).

Stop Loss: Place a stop loss below $3,200 to manage risk.

Scalping

Strategy: Take advantage of small price movements within the support and resistance zones.

Entry: Buy on minor pullbacks within the wedge near $3,300 - $3,400.

Target: Aim for small profits at $3,450 - $3,500.

Stop Loss: Place tight stop losses around $3,280 to minimize losses on quick trades.

Swing Trading

Strategy: Capitalize on the potential breakout from the falling wedge.

Entry: Buy once price breaks and retests the upper trendline of the wedge around $3,500 with confirmation from volume increase.

Target: First target at $3,800, with a potential move to $4,000.

Stop Loss: Place a stop loss below the retest level, around $3,400.

Conclusion and Advice

Given the technical indicators and the falling wedge pattern, Ethereum (ETH) is showing signs of a bullish reversal. Traders should consider the following:

Long Positions: Favorable for all trading strategies (intraday, scalping, and swing trading) as the pattern and indicators suggest an upward movement. Enter positions near support levels and on confirmed breakouts.

Short Positions: Not advisable at this stage unless there's a confirmed breakdown below the support zone of $3,200, which could invalidate the bullish pattern.

Recommendation: Based on the chart, a long position is recommended with careful attention to the support and resistance levels. Monitor the indicators for any shifts in momentum and adjust the trading strategy accordingly. Always use stop losses to manage risk effectively.

Ethereum (ETH) Technical Analysis and Trade IdeaIn a recent rally, Ethereum demonstrated significant momentum. In our video analysis, we delve into potential long positions, contingent upon price meeting our entry criteria. Observing the 4-hour chart, we note a prior bearish trend that has now been disrupted by a bullish break in market structure. My bias leans toward a long position, but it remains subject to price action developments outlined in the video.

Disclaimer: This content is not financial advice.

ETH 4.5k around May 13, 2024Bullish reversal had actually happened since early Jan 2023 but no one believed me. I was extremely early and made a whole year worth of salary (based on my last job as CTO) for 2023 and I have nothing to worry about for the rest of this year.

Here I'm seeing the potential bullish move to 4,595-ish around May 13, 2024.

We have up to early October to maintain the current momentum. If all good, ETH would break the upside of the resistance trend line to move into upper side of 2500 and beyond.

Will update more when time comes. Til then, let's laugh into disbelief at my idea for ETH 2024 @ $4,595

*** This is my secret technique in which I will not reveal how but it has been working accurately so far. I can teach, you will need to find your way to reach out to me. Good luck!

*** NFA DYOR HFSP KFC McD BBQ