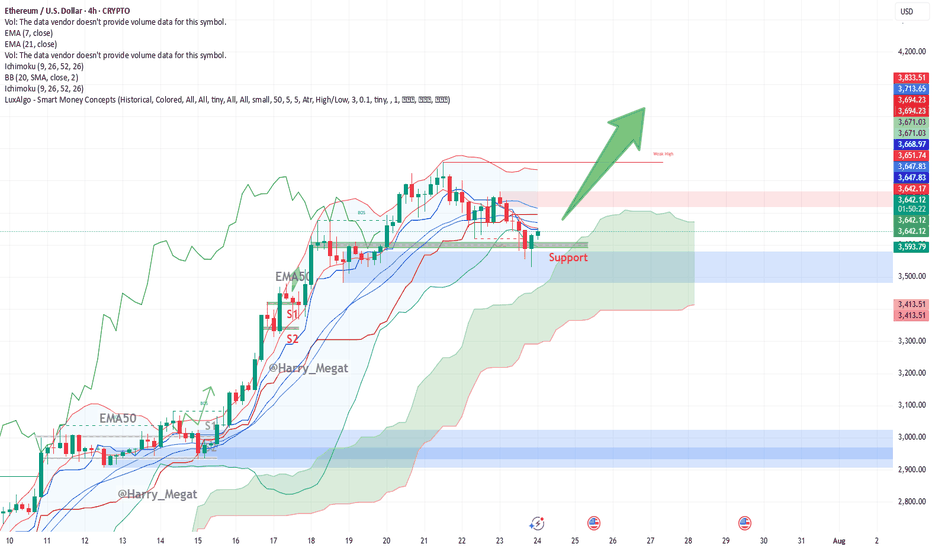

Ethereum (ETH/USD) 4-hour chart Technical AnalysisThis Ethereum (ETH/USD) 4-hour chart presents a **bullish setup**. Let’s break it down:

**Chart Overview:**

* **Price at the time of chart:** \~\$3,650

* **Support Zone:** \~\$3,615–3,630 (highlighted in green box)

* **Indicators:**

* **EMA 7 (Red):** \~\$3,653.87

* **EMA 21 (Blue):** \~\$3,669.75

* **Bullish Signal:** Large upward green arrow suggests expectation of a breakout rally from current support.

**Technical Analysis:**

**1. Bullish Bounce at Support**

* ETH tested the **horizontal support zone** multiple times, showing strong demand.

* The recent candle shows a **wick rejection** from the support zone — indicating buyer strength.

**2. Moving Averages**

* Price is trying to reclaim above the **EMA7**, with EMA21 nearby (\~\$3,670).

* A **bullish crossover** or strong candle close above both EMAs could confirm upside continuation.

**3. Structure**

* Previous resistance (\~\$3,615) has turned into **new support** — a classic bullish flip.

* The large green arrow projects a **potential breakout move**, targeting higher highs possibly above **\$3,750+**, then **\$3,900+**.

**Trade Setup Idea:**

| Type | Entry | Stop Loss | Take Profit 1 | Take Profit 2 |

| Long | \$3,655–3,660 | Below \$3,600 | \$3,750 | \$3,900+ |

**Watch Out For:**

* Rejection near EMA21 (\$3,670)

* False breakout if volume is weak

* Macro risk or sudden BTC movement dragging ETH

**Conclusion:**

The chart signals a **bullish bias** if ETH maintains above the support zone and reclaims both EMAs. A clean break above \~\$3,670–3,700 could spark further upside toward \$3,900+.

Ethusdlong

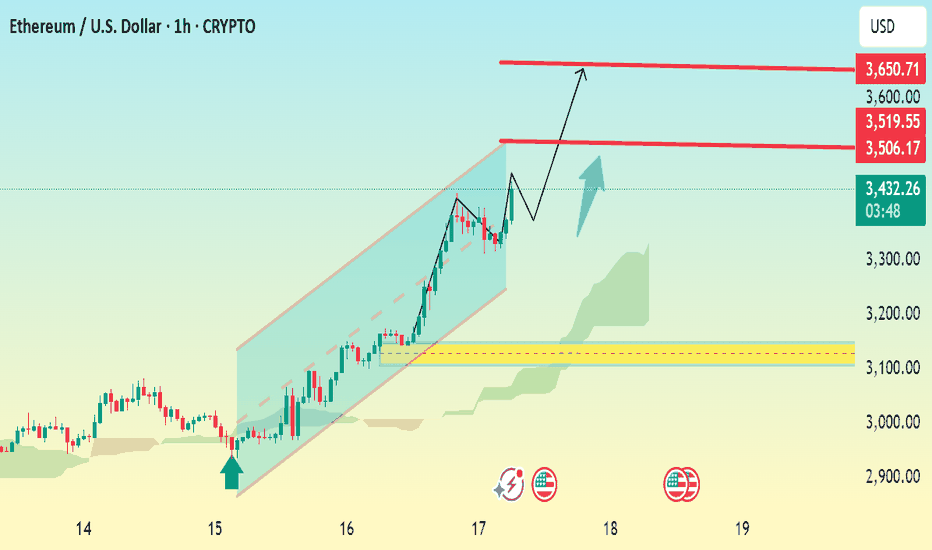

ETHUSD 1h Bullish Reversal SetupChart Analysis Summary:

Current Price:

$3,429.21 (at the time of the screenshot)

Trend:

Strong uptrend within a bullish ascending channel.

Price has been respecting the trendline and moving upward steadily.

Key Chart Patterns & Tools:

Ascending Channel: ETH is trading within an upward sloping channel, suggesting bullish momentum.

Ichimoku Cloud (green): Price is trading well above the cloud, reinforcing bullish sentiment.

Breakout Structure: The chart shows a small consolidation/pullback with a projected bullish breakout.

📈 Key Levels:

Type Price Level (USD) Notes

Current 3,429.21 Live price

Resistance 1 3,506.17 Minor resistance

Resistance 2 3,519.55 Immediate breakout target

Final Target 3,650.71 Major resistance and potential price objective

🧭 Price Action Forecast:

If ETH holds above $3,429 and breaks above $3,519.55, the path toward $3,650 remains open.

A small pullback (as indicated by the blue arrow) is expected before continuation.

As long as price remains within or near the ascending channel, the bullish scenario .

✅ Bullish Confirmation:

Break and retest of $3,519.55.

Continued support above the Ichimoku cloud.

Holding the trendline from the ascending channel.

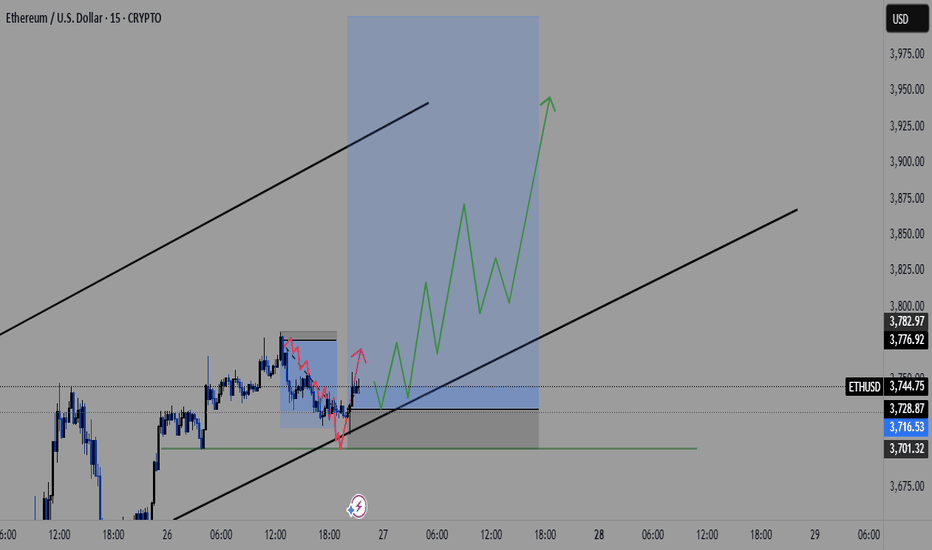

ETHUSD Long Setup: Targeting $4,000 After Bullish Reversal from ETH just swept the previous lows near $3,650–$3,700, clearing liquidity and flipping that zone into fresh support. This classic price action move often precedes expansion, and ETH looks primed for a continuation toward $4,000 in the coming sessions.

🧠 Technical Analysis

Previous Highs Swept: ETH took out the prior highs around $3,650–$3,700, trapping late shorts and grabbing liquidity.

Break of Structure: We've seen a clear bullish market structure form on the 4H and daily TFs, with higher highs and higher lows intact.

Support Zones:

$3,650–$3,700 (former resistance, now flipped support)

$3,550 (consolidation base before breakout)

Resistance Zones:

$3,950–$4,000 (psychological level + previous 2024 highs)

$4,100+ (weekly imbalance and potential extension zone)

Now that ETH has cleared short-term liquidity and confirmed demand on the retest, the path of least resistance appears to be up.

🔍 Fundamental Outlook

ETH ETF Narrative: Market anticipation for spot ETH ETF approval is heating up, boosting demand and institutional interest.

Reduced Sell Pressure: With the Shanghai upgrade long behind us, staking continues to increase, reducing circulating supply.

Macro Tailwinds: Risk-on sentiment in the broader market is aiding crypto momentum, especially for large-cap assets like ETH.

🎯 Target: $4,000

📉 Invalidated Below: $3,550 (if reclaimed by bears, invalidates bullish thesis)

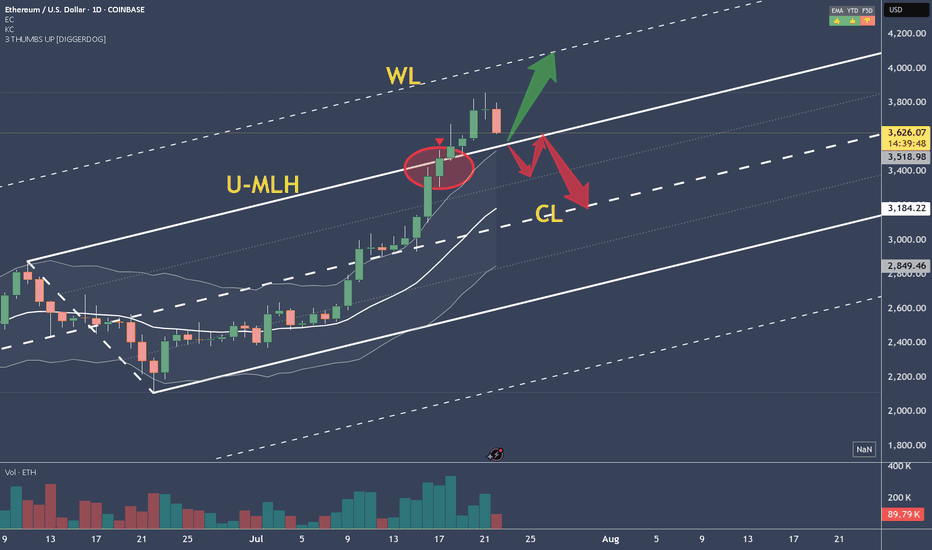

ETHUSD - Decision TimeWhat do make of the current situation?

What if you are long?

Here's what to expect:

a) support at the U-MLH, further advancing up to the WL

b) open & close within the Fork. If so, there's a 95% Chance of price dumping down to the Centerline.

Taking 50% off the table is never bad.

50% money in the pocket if price falls down to the Centerline.

Or if it advances up to the WL, you still have 50% that generates profits.

Either way, you have a winner on your hands.

Don't let it dig into a Looser!

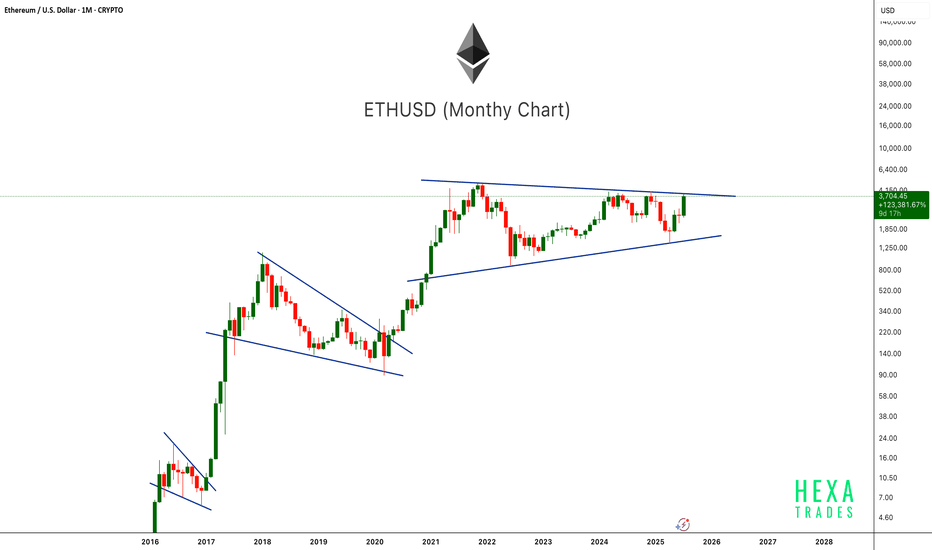

ETH Ready to Pop!ETHUSD is once again testing the upper boundary of a long-term symmetrical triangle on the monthly chart. This pattern has been forming since the 2021 peak, showing consistently higher lows and lower highs. Previous breakouts from similar consolidation patterns (2017 and 2020) led to massive rallies. With the current monthly candle showing strong bullish momentum, a confirmed breakout above this structure could mark the beginning of Ethereum's next major bull run. Keep an eye on the breakout level for confirmation.

Cheers

Hexa

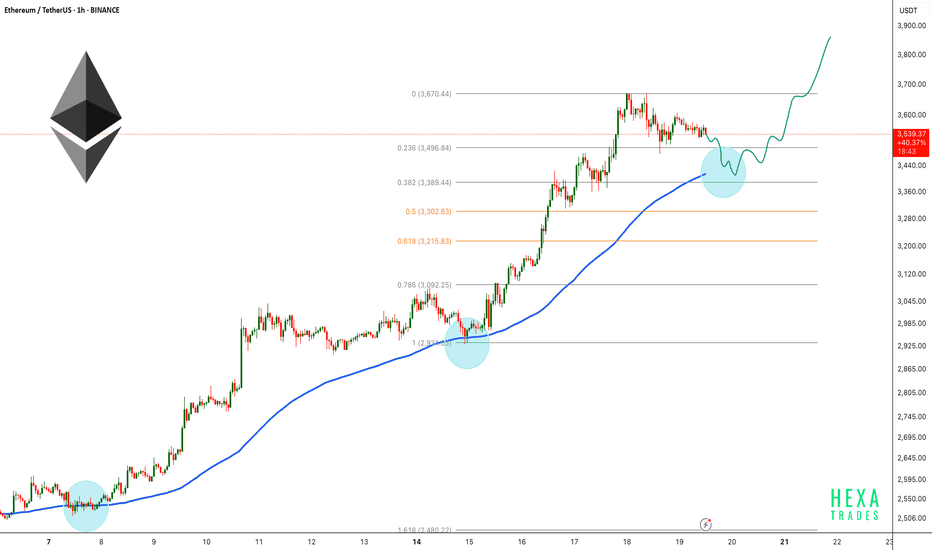

ETH Healthy Retest Before Next Rally!Ethereum continues to trade within a strong uptrend on the 1-hour chart, respecting the 100 EMA consistently throughout the rally. After a strong impulse move, the price is now consolidating near the recent highs.

ETH price could retest the 0.382 Fibonacci level and the 100 EMA before continuing upward. A successful retest would signal strength and could lead to a bullish continuation toward the $3900 - $4000 range.

Similar historical retests of the 100 EMA led to strong rallies, and we could see a repeat of that pattern if support holds.

Cheers

Hexa

BITSTAMP:ETHUSD CRYPTOCAP:ETH

ETHUSDT Gearing Up for Explosive MoveBINANCE:ETHUSDT has been trading inside an ascending triangle pattern for the past 1,600 days. The price is now moving toward the triangle's resistance zone with strong volume support. A confirmed breakout above this resistance could trigger a powerful bullish move, with potential targets in the $6,000–$8,000 range.

Cheers

Hexa🧘♀️

BITSTAMP:ETHUSD

ETHEREM ETHUSD LONG TECHNICAL CHART IDEAEthereum (ETHUSD) Technical Outlook – Short-Term Levels and Potential Targets

📊 Key Insights:

First Below Support: 2560 USDT

Starting Journey: 2600 USDT

Resistance Zone: 2630–2650 USDT

Target on Breakdown: 2440 USDT

Market Structure:

After a period of consolidation between 2560 and 2600, ETHUSD has initiated a sharp upward move towards the resistance zone near 2630–2650. The chart projects a possible rejection from this resistance area, suggesting a potential pullback targeting 2440 if support fails to hold.

✅ Key Considerations:

Watch for price action confirmation around 2630–2650.

A sustained break above resistance could invalidate the short-term bearish scenario.

The target zone of 2440 aligns with prior support and could offer buying interest

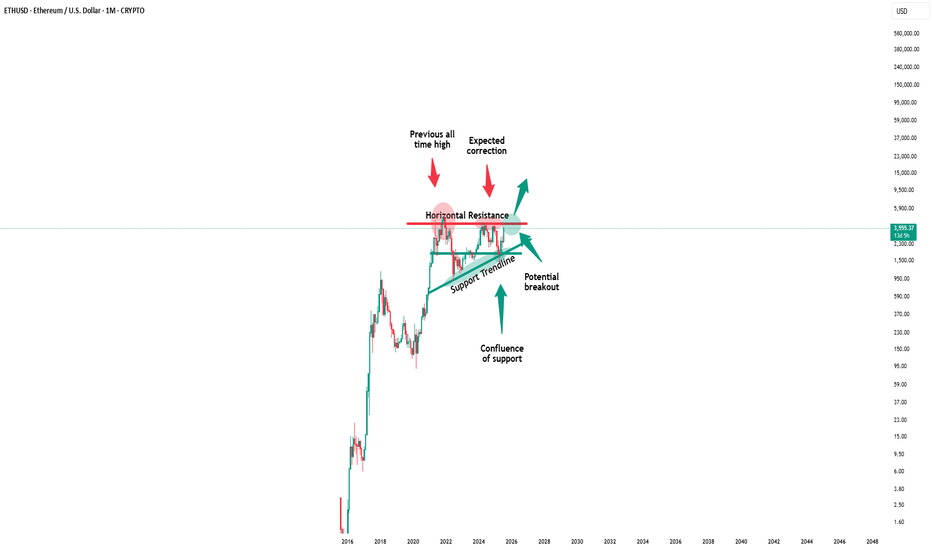

Ethereum - Finally new all time highs!🔬Ethereum ( CRYPTO:ETHUSD ) will break out now:

🔎Analysis summary:

For more than four years, Ethereum has overall been moving sideways. However now Ethereum is once again retesting previous all time highs and preparing a bullish breakout. Multiple retests are generally considered bullish so the breakout is very likely to happen any time soon.

📝Levels to watch:

$4.000

🙏🏻#LONGTERMVISION

SwingTraderPhil

(ETH/USD) Bullish Setup: Entry at $2,422 with Target at $2,521 a1. Entry Point: ~2,422.2

This is the suggested buy area based on a recent bounce from the support zone

2. Support Zone (Purple Box):

Bottom boundary: ~2,392.4

Top boundary: ~2,408.4

Price has bounced multiple times here, showing strong buying interest.

3. Resistance Point: ~2,463.9

A clear horizontal resistance line, previously tested.

4. EA Target Point: ~2,522.1

A bullish target if the price breaks above the resistance level.

🔶 Highlighted Patterns / Markers

Orange Circles: Indicate key swing highs and lows — possibly used to identify double tops/bottoms or rejection/wick zones.

Blue Arrows: Illustrate the anticipated move from:

Entry (2,408.1) → Resistance (2,463.9) → Target (2,521.2)

Target gain = +111.7 USD (+4.64%)

🔻 Stop Loss Level

Set just below the support box at ~2,392.4

Protects from false breakouts or deeper pullbacks.

📈 Strategy Outlook

Bullish Bias: The setup expects a breakout from the current price range.

Risk-Reward Ratio: Appears favorable — tight stop and wide target.

Confirmation Needed: A solid breakout and hold above 2,423–2,425 may be the early confirmation signal.

📌 Summary

Element Value

Entry Point ~2,422.2

Stop Loss ~2,392.4

Resistance ~2,463.9

Target (TP) ~2,521.2

R:R Ratio Approx. 3:1

Bias Bullish

ETH/USD ROBBERY IN PROGRESS! Long Now, Exit Before Bears Attack!🚨 ETH/USD HEIST ALERT: Bullish Loot Before the Trap! 🚨

Thief Trading Style: Steal Profits & Escape Before the Cops Arrive!

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 The Ethereum vault is WIDE OPEN! Time to execute the Thief Trading Strategy—bullish momentum is primed for a heist. Long entries only! Target the highs, then vanish before the overbought trap snaps shut.

🔑 Heist Plan (Day/Swing Trade)

🎯 Entry: "The vault is unguarded—swipe bullish loot at any price!"

Pro Tip: Use buy limits within 15-30min for pullback entries (recent swing lows/highs).

🛑 Stop Loss:

Thief SL (4H): 2240.0 (Nearest swing low)

Adjust SL based on risk, lot size & multiple orders.

🏴☠️ Target: 2800.0 (or escape earlier if bears ambush!)

⚡ Scalpers’ Quick Loot:

Only scalp LONG!

Big wallets? Charge in! Small wallets? Join swing traders & rob smart.

Trailing SL = Your Escape Rope!

📢 Why Ethereum?

🐂 Bullish momentum + strong fundamentals = Perfect heist conditions!

(Check COT reports, macro trends & sentiment— check 👉🔗!)

⚠️ WARNING: Cops (Bears) Are Setting Traps!

Avoid fresh trades during news!

Trailing SL = Lock profits & run!

💥 BOOST THIS HEIST!

🔥 More boosts = Faster profits!

🚀 Daily robberies = Easy money!

Stay tuned—next heist coming soon! 🤑💎 (Like & Follow for more loot!)

ETH Long / Buy SetupAs of many times mentioned that, will short eth above 3k or 3k, but it still shows Bullish momentum no sign of weakness, maybe this entry triggers during weekend due too low volume, search for ifvg, if any 1D or 4hr Bullish fvg truns into bearish ifvg then will take short on ETH. For now will take long with SL and proper risk management.

ETH Ready for Lift-Off: Traders Eye +14% Surge Toward $2,813Ethereum has been consolidating in a large sideways range after recovering from a steep decline earlier this year. The chart clearly shows a defined support zone and key resistance area, with price currently trading just above mid-range and attempting to reclaim bullish momentum.

Chart Structure Highlights

• Support Zone: Around $2,231 – $2,232, which has been tested multiple times and held firmly, confirming strong demand here.

• Key Resistance / Take Profit Area: Near $2,813, a major level where price was repeatedly rejected in the past.

• Consolidation Box: A ~50-day range between support and resistance, suggesting accumulation.

• Recent Price Action: ETH is attempting to break out of the upper side of this consolidation, with buyers gradually stepping in.

Trade Setup

✅ Entry Zone: $2,450–$2,460

ETH is currently near this area, which represents a conservative breakout attempt from the range. Traders may look for confirmation candles closing above $2,460 for added conviction.

✅ Stop Loss: $2,231

Placed just below the lower edge of the support zone to protect against a failed breakout and renewed selling.

✅ Take Profit Target: $2,813

This is the key resistance level marked on the chart, offering approximately +14% upside from the entry.

Reward-to-Risk Profile

• Potential Reward: ~$353 (+14.3%)

• Potential Risk: ~$228 (-9.2%)

• Reward:Risk Ratio: ~1.55:1

Summary of the Setup

Ethereum has spent nearly 50 days consolidating between $2,230 and $2,813, and is now threatening a breakout to the upside. This creates a favorable swing trade scenario with a clear invalidation level below the strong support zone. A sustained move above the consolidation could target the $2,813 resistance in the coming weeks.

ETHUSD - Could ETH hit $800 before the next bull run?ETHUSD looks very bearish in my opinion. Strong bearish divergence on the MACD. Any substantial time ETH has stayed under the MACD zeroline has lead to very bearish price action. This price recovery is currently hitting very strong resistance area. With the Israel/Iran war looming, and the deflationary crash risks with oil dumping, I'm getting very defensive sentiment at this moment. I'll be in cash until we get further confirmation on the price action.

"Bearish Reversal Opportunity Following Supply Zone Rejection"1. Double Top Formation (Resistance Level Identified)

The chart displays a clear double top structure at the 2,760–2,800 USDT level.

This level has acted as a strong supply zone (highlighted in red), where price previously reversed, indicating heavy selling interest.

Current price action has retested this resistance zone and shown signs of rejection.

2. Liquidity Sweeps & False Breakouts

On the left side of the chart, an aggressive downward wick (marked with a blue arrow) suggests a liquidity sweep below a key low before strong bullish momentum returned.

This type of price action indicates smart money involvement, designed to remove weak hands before pushing price higher.

3. Accumulation Phases (Sideways Consolidation)

Multiple accumulation ranges are highlighted with blue rectangles.

These ranges show horizontal consolidation, where price builds up energy before breakout.

The most recent breakout led to a vertical rally toward the resistance zone, signaling an end of the accumulation and a start of distribution.

4. Double Bottom Support Structure

Identified near the 2,480 level, marked by red circles.

This level has historically acted as demand/support, evidenced by multiple bounces from this price zone.

Now highlighted with a grey zone, it is projected to act as the next key support area.

5. Bearish Projection

A large black arrow suggests a forecasted bearish move from the current high (~2,800) back to the support zone (~2,480).

This aligns with the idea of a mean reversion or pullback after a strong bullish impulse.

---

Conclusion & Trade Idea:

🔻 Bias: Bearish (Short-term)

The chart presents a classic reversal pattern with a double top at a well-defined supply zone.

Entry could be considered after confirmation of rejection from this level.

🧠 Trade Plan Suggestion:

Entry: Short near 2,780–2,800 after bearish confirmation (e.g., bearish engulfing candle or break of structure).

Target: 2,480 (support zone).

Stop Loss: Above 2,820 (recent high).

Risk-Reward: Approximately 1:2.5 or better depending on execution.

ETHUSD long - prebreakout formationI am seeing a 'pre-breakout buildup' on ETHUSD. Price is being carried by the 50ema for extended periods. The preceding trend before this sideways movement was bullish (so is bitcoin). There is a squeeze in progress, and we are seeing consistently higher lows.

I see this PA as a high probability breakout potential in the next week or so.

ETH/USD – Key Support Holding, Eyes on 3000 for Upside TargetEthereum is maintaining a strong bullish structure within a clearly defined ascending channel. Recent price action shows a successful retest of the lower channel boundary and the horizontal support zone around 2477 – 2450.

🔹 Support & Trendline Confluence:

The support zone at 2477–2450 is aligned with the lower boundary of the rising channel.

Multiple successful retests of this trendline indicate strong demand in this area.

🔹 Bullish Scenario:

As long as the 2477–2450 support zone holds, ETH/USD has a good chance to resume its upward move.

The next target for bulls is the 161.8% Fibonacci extension level at 2997.24, which coincides with the upper channel boundary.

📌 Plan:

Long positions are favored as long as price holds above 2450.

Targeting 2997, with intermediate steps of confirming higher lows.

📉 Invalidation:

A break and daily close below 2450 would invalidate this bullish scenario and suggest further downside.

This is a classic “buy-the-dip” scenario within an established uptrend, offering a favorable risk/reward opportunity.

My first recording for ETHUSD - FxDollars - {25/05/2025}Educational Analysis says that ETHUSD may give countertrend opportunities from this range, according to my technical analysis.

Broker - bitstamp

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.