ETH ANALYSIS AND NEXT TRADE IDEA.ETHUSDT is trading at 2060$, if we look its previous chart then we can see a clear MS after liquidity sweep which cause bullish structual moves and also did bullish BOS. I have found OB+FVG+SSL setup in the move which caused BOS. And this is our buy zone for next 2200 target.

ETHUSDT

Ethereum (ETH/USDT) 1D Chart Update ETH is still trading inside a descending channel, showing signs of a possible reversal. The price is bouncing off support levels around $1,750-$1,830, with a possible retest of higher resistance levels. The 50-day moving average (red line) is acting as a dynamic resistance above the price.

Bullish scenario: ETH needs to sustain above $1,830 to confirm a short-term correction. If ETH breaks the $2,200-$2,400 resistance zone, a rally toward $2,800-$3,000 could follow.

Bearish scenario: Rejection at the resistance could push ETH back towards $1,830 and possibly $1,750. A loss of $1,750 could trigger a further decline towards $1,600.

Resistance: $2,200, $2,400, $2,800

Support: $1,830, $1,750, $1,600

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

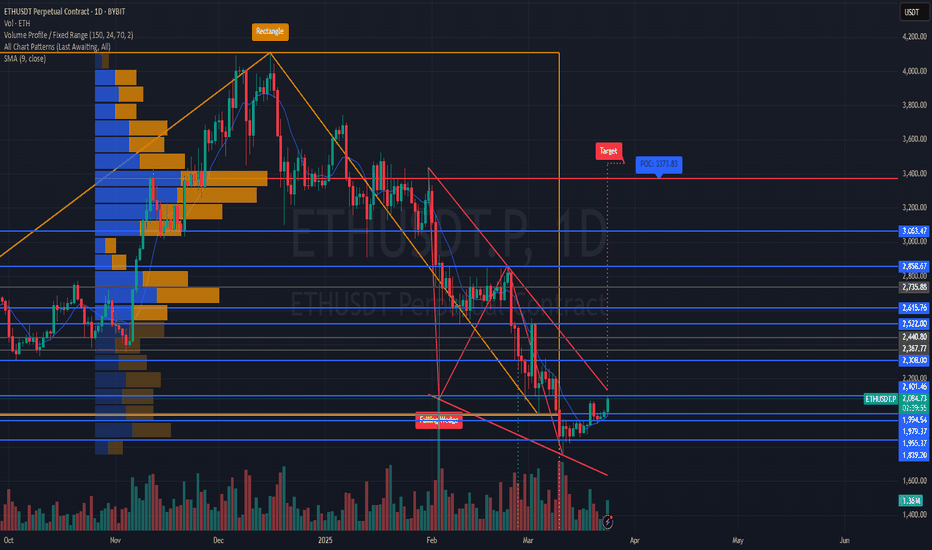

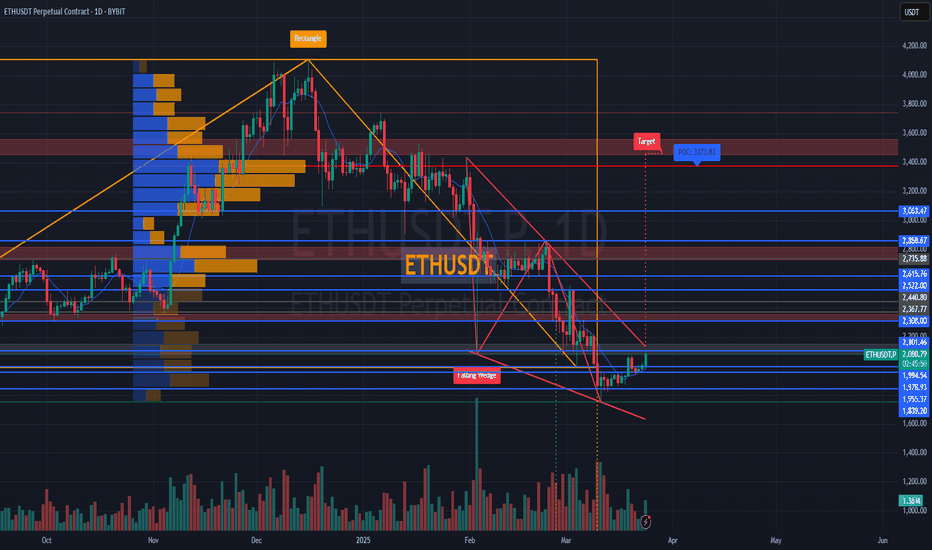

#ETHUSDT is forming a potential mid-term reversal📉 LONG BYBIT:ETHUSDT.P from $2102.90

🛡 Stop loss at $2083.00

🕒 Timeframe: 1D (Mid-term idea)

✅ Overview:

➡️ BYBIT:ETHUSDT.P Falling Wedge breakout confirmed on the daily chart.

➡️ Successful retest of the $1,955–$2,041 zone.

➡️ Holding above $2,101 opens the way to higher levels.

➡️ Volume is increasing post-breakout — confirming buyer interest.

➡️ Next strong resistance block lies between $2,308–$2,522.

🎯 TP Targets:

💎 TP 1: $2112.00 — nearest resistance and key liquidity zone.

💎 TP 2: $2125.00 — a critical daily level, zone of pullback from previous drop.

💎 TP 3: $2134.00 — potential impulse target toward major POC ($3,373).

📢 If price fails to hold above $2,068 and breaks below $2,041 — the setup is invalidated.

📢 A retest of $2,101 from below may be needed before a stronger upward move.

📢 Volume support at $1,955 is critical for the bullish case.

🚀 BYBIT:ETHUSDT.P is forming a potential mid-term reversal — if price holds above $2,101, a move toward $2,200+ and beyond is expected.

Awakening of #ETH – Return of the Bulls and Wedge Breakout📊 Overview of the BYBIT:ETHUSDT.P Situation on 4H and 1D Timeframes

✅ Trend and Technical Indicators:

➡️ The chart shows a strong downtrend that began in late December 2024, when the price dropped from a peak of around 3400 USDT to 1620 USDT by March 2025.

➡️ A correction followed, with the price recovering to around 2100 USDT, where it is currently consolidating.

✅ Volume: The volume at the bottom of the chart was high during the drop, confirming the strength of the bearish trend. Now, volume is decreasing, which may indicate a weakening momentum.

✅ Patterns: A Rising Wedge pattern is forming on the chart — typically a bearish signal, especially after a strong downtrend. This may suggest a potential reversal to the downside.

➡️ A Falling Wedge pattern appeared earlier, and its breakout upward gave a short-term bullish impulse.

✅ Positive Factors:

➡️ Price bounced from a strong support level at 1620 USDT, which gives bulls hope for recovery.

➡️ Declining volume may indicate seller exhaustion.

➡️ The earlier breakout of the Falling Wedge supports the current correction.

✅ Negative Factors:

➡️ The Rising Wedge now forming is a bearish pattern, and a breakdown could lead to further decline.

➡️ The overall trend remains bearish, and price has yet to break through key resistance levels (e.g., 2400 USDT).

➡️ The crypto market, especially BYBIT:ETHUSDT.P remains volatile, and external factors (news, macroeconomic conditions) could significantly impact movement.

📉 4H Timeframe:

➡️ A Rising Wedge is forming; price is testing the upper boundary of the wedge and a key resistance level at $2,101.

➡️ There's a potential retracement zone targeting $1,839 — aligned with the lower edge of the wedge and a liquidity area.

➡️ Support exists at $2,068 and $2,041, but if the wedge breaks downward, the decline may accelerate.

➡️ Volume is increasing, confirming active participation and the importance of this zone.

📈 1D Timeframe:

➡️ BYBIT:ETHUSDT.P bounced from a demand zone and is currently testing the $2,100 area.

➡️ The next strong resistance lies between $2,308–$2,367, and the previous downtrend hasn’t been fully broken yet.

➡️ There's a glimmer of strength on the daily (a +4.5% candle with notable volume), but the move is not yet confirmed as a sustained uptrend.

➡️ A breakout from the Falling Wedge is confirmed — a bullish pattern that played out.

➡️ Price has broken above the descending channel (orange line), increasing the likelihood of a trend reversal.

➡️ The measured target from the wedge breakout is around POC $3,373, aligning with previous volume accumulation — ambitious but logical.

⚠️ Risks / Limitations:

➡️ If price fails to hold above $2,101 and drops below $2,068, a return to $1,955 or even $1,839 is possible.

➡️ Volume is present but the momentum must be confirmed in the next 1–2 days.

📍Important Note:

👉 On 4H – a bearish setup is forming.

👉 On 1D – a weak recovery attempt, still under pressure.

👉 A reaction from the $2,100 zone is critical: either a rejection downward (per the wedge), or a breakout that invalidates the bearish setup.

👉 This area is a decision zone — a key point for planning potential trades.

📢 Conclusion: A breakout, retest, and confirmation of the structure and volume are visible.

🔵 Bullish Scenario:

➡️ The Falling Wedge breakout confirms a bullish impulse. The target at 3373.83 USDT looks realistic long-term, if price breaks 2100 USDT and holds above 2400 USDT.

➡️ To confirm this scenario, we need volume growth and a breakout of major resistance levels (e.g., 2400 USDT and above).

🔴 Bearish Scenario:

➡️ The Rising Wedge identified earlier remains valid. If this pattern plays out, the price may drop to 1901.73 USDT or even lower, to 1620 USDT.

➡️ The long-term downtrend (marked by a red line) is still intact, supporting the bearish outlook.

📉 LONG BYBIT:ETHUSDT.P from $2102.90

🛡 Stop loss at $2083.00

🕒 Timeframe: 1D (Mid-term idea)

✅ Overview:

➡️ BYBIT:ETHUSDT.P Falling Wedge breakout confirmed on the daily chart.

➡️ Successful retest of the $1,955–$2,041 zone.

➡️ Holding above $2,101 opens the way to higher levels.

➡️ Volume is increasing post-breakout — confirming buyer interest.

➡️ Next strong resistance block lies between $2,308–$2,522.

🎯 TP Targets:

💎 TP 1: $2112.00 — nearest resistance and key liquidity zone.

💎 TP 2: $2125.00 — a critical daily level, zone of pullback from previous drop.

💎 TP 3: $2134.00 — potential impulse target toward major POC ($3,373).

📢 If price fails to hold above $2,068 and breaks below $2,041 — the setup is invalidated.

📢 A retest of $2,101 from below may be needed before a stronger upward move.

📢 Volume support at $1,955 is critical for the bullish case.

🚀 BYBIT:ETHUSDT.P is forming a potential mid-term reversal — if price holds above $2,101, a move toward $2,200+ and beyond is expected.

ETHUSDT, I love pattern in chart ...Hello everyone

We backed after a long time by one the powerful analysis on Ethereum.

According to the chart you can see the price movement is sideway, the reason of that for proving this reason is the parallel channel.

At first, the price show us a downward triangle and because of that we expect the price should break the triangle and rising up , the second reason is the price and candle encounter to the one of the important dynamic supporter from the past , and third reason for the rising is the price is near to the below of the channel and the market is so weak and this is what our want and THIS TIME IS TO BUY , ok ??

JUST BUY BUY BUY BUY guys , TRUST US

If you have any question or need help

send us messages

Thank you

AA

ETH/USDT Weekly Chart – Bullish Bounce!📊 ETH/USDT Weekly Chart – Bullish Bounce!

Ethereum just printed a strong bounce from the macro ascending trendline, holding structure since 2020. This confirms continued bullish strength on the higher timeframe. 🔥

🔹 Key Highlights:

Price is pushing up slowly to hit the major weekly resistance around $2800.

Next bullish target: $2,800 resistance zone, also aligns with the EMA cluster.

📈 A breakout above $2,800 could open the doors for $4,000+ in the coming months.

🧠 Watching for volume + some fundamental catalyst.

Do hit the like button if you like my updates.

#Peace

ETH/USDT 1DAY CHART UPDATE !!ETH is still trading inside a descending channel, with the price close to key support.

Support Zone Holding: The $1,750–$1,830 area has provided a strong support base.

Ichimoku Cloud Resistance: The red Ichimoku Cloud above is acting as a crucial

resistance barrier.

Bullish Scenario:

If ETH breaks out of the descending channel, the first major resistance to watch is $2,400–$2,600 (cloud resistance).

A confirmed breakout could lead to a move towards $4,000+.

Bearish Continuation :

If ETH fails to break out, it could retest the $1,750–$1,830 support area.

A breakdown below $1,750 could open the door to lower levels around $1,600.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

ETHUSD Ethereum Update 21/03/2025We have seen the upward impulse and the correction. I'm waiting for internal liquidity to be reached and for the price to rise to 2200+ in the next 2 weeks.

Best regards, EXCAVO

_____________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH BUY ZONE / ACCUMULATING LEVELBINANCE:ETHUSDT is looking bullish after retracing to 1900-2000 region. It should be noted that the same region was previous resistance which ETH broke in Dec 23' before making a new swing high.

This is a great buying zone technically for someone who does not trade and wants to buy/hold BINANCE:ETHUSDT for the long term!

UNIUSDT UPDATEUNIUSDT is a cryptocurrency trading at $6.780. Its target price is $10.000, indicating a potential 50%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about UNIUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. UNIUSDT is poised for a potential breakout and substantial gains.

The key is whether there is support near 1935.34

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

The important support and resistance zones have changed as it has fallen below the long-term upward trend line (1).

After March 18, the key is whether ETH can maintain its price by receiving support near 1935.34 and rising above the M-Signal indicator on the 1D chart, that is, the Fibonacci ratio of 0.236 (2090.85).

If it falls after receiving resistance near 1935.34, it is possible that it will fall to around 1340.12, so you should also consider a response plan for this.

-

In order to turn into an uptrend, the price must rise above the M-Signal indicator on the 1M chart and maintain it.

To do so, the price must be maintained near the Fibonacci ratio of 0.382 (2647.80).

-

Therefore, if it rises after receiving support near 1935.34,

1st: M-Signal on the 1D chart (Fibonacci ratio of 0.236 (2090.85))

2nd: M-Signal on the 1M chart (Fibonacci ratio of 0.382 (2647.80))

You should respond depending on whether there is support near the 1st and 2nd above.

Currently, the StochRSI indicator is showing signs of entering the overbought zone, so even if there is an additional rise, it is expected to eventually show a downward trend.

In order to ignore this law, an explosive trading volume or favorable market news is required.

-

(30m chart)

Since the StochRSI indicator is in the oversold zone, it is highly likely to rise even if it continues to fall further.

However, since it is a 30m chart, you should respond based on day trading or short-term trading.

Since the HA-High (1936.67) indicator and the BW (100) (1944.96) indicator are located near 1935.34, we can see that it is forming a resistance zone.

Therefore, even if there is an additional rise, it seems likely to be resisted in this resistance zone (1936.67-1944.96).

If it falls below 1923.43,

1st: Heikin Ashi's Close on the 1D chart

2nd: HA-Low indicator (1885.30)

3rd: 1865.10

We need to check if it is supported near the 1st-3rd above.

-

Therefore, if it is supported and rises near 1935.34,

1st: M-Signal on 1D chart (Fibonacci ratio 0.236 (2090.85))

2nd: M-Signal on 1M chart (Fibonacci ratio 0.382 (2647.80))

You need to respond depending on whether there is support near the 1st and 2nd above.

Since the StochRSI indicator is currently showing signs of entering the overbought zone, it is expected that it will eventually show a downward trend even if there is an additional rise.

In order to ignore this law, an explosive trading volume or favorable market conditions must occur.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, you can see that the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we expect that we will not see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

In other words, it is the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, it is expected that this Fibonacci ratio will be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

How to view and respond to this is up to you.

When the ATH is updated, there are no support and resistance points, so the Fibonacci ratio can be used appropriately.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous when used as support and resistance.

This is because the user must directly select the important selection points required to create Fibonacci.

Therefore, since it is expressed differently depending on how the user specifies the selection points, it can be useful for chart analysis, but it can be seen as ambiguous when used for trading strategies.

1st : 44234.54

2nd : 61383.23

3rd : 89126.41

101875.70-106275.10 (Overshooting)

4th : 134018.28

151166.97-157451.83 (Overshooting)

5th : 178910.15

-----------------

Bitcoin's Wild Ride: Will It Moon or Crash and Burn?Ah, Bitcoin—the digital rollercoaster we all love to hate. Currently lounging around $84,000 , but what's next? Let's dive into the crystal ball of crypto predictions, shall we? 🔮

The Bullish Dreamers:

Derivatives Delight: Some analysts are giddy over derivatives metrics, suggesting Bitcoin is "poised" to reclaim the $90,000 level in the coming weeks. Because who doesn't love a good gamble?

The Bearish Realists:

Death Cross Drama: Hold onto your hats! Bitcoin is flirting with a "death cross," where the 50-day moving average dips below the 200-day. Historically, this is like the crypto version of a horror movie—cue the dramatic music.

Support Level Shenanigans: If Bitcoin can't muster the strength to stay above $81,000, we might be sliding down to $76,000 faster than you can say "HODL."

The Fence-Sitters:

FOMC Follies: All eyes are on the upcoming Federal Open Market Committee meeting. Will they hike rates? Will they cut? Will they order pizza for lunch? Their decisions could send Bitcoin on a joyride or a nosedive.

So, what's the takeaway? Is Bitcoin gearing up for a moon mission, or are we strapping in for a freefall? As always, keep your wits about you, and maybe a parachute handy. 🎢🪂

If you want the deeper breakdown (the one nobody’s telling you), drop a comment or DM me. Maybe I’ll let you in on the real insights. 👀🔥

Disclaimer: This is not financial advice. Always do your own research before diving into the crypto abyss.

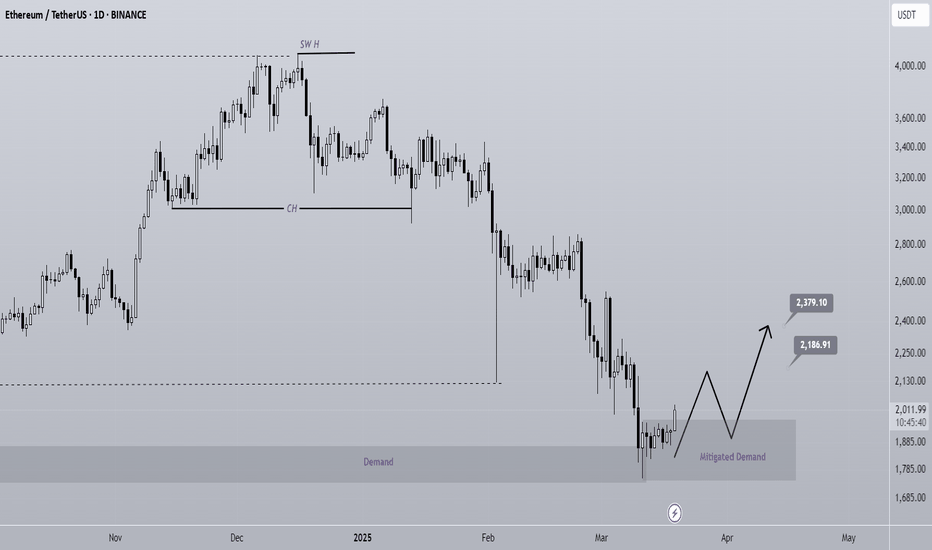

ETH is bullish (1D)Before anything else, you should know that Ethereum's structure in higher time frames is bearish. However, we currently expect an internal pullback to higher levels because the price has reached a significant zone.

The expectation is that the price will move from the mitigated demand zone toward the targets.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

ETH Looks Bullish (1D)Before anything else, you should know that Ethereum's structure in higher time frames is bearish. However, we currently expect an internal pullback to higher levels because the price has reached a significant zone.

The expectation is that the price will move from the mitigated demand zone toward the targets.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

ETH Analysis (1D)Ethereum is approaching a support level.

The risk-to-reward ratio is not very attractive since we are in a bearish trend, but we expect a reaction to the green zone.

There are two targets ahead of the price, which we have marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

KDAUSDT UPDATEKDAUSDT is a cryptocurrency trading at $0.4898. Its target price is $0.8000, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about KDAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. KDAUSDT is poised for a potential breakout and substantial gains.

ETH is preparing to get out of range and pull a face-melterETH might finally be getting ready to break out of that range we've been trading in since it broke down $2000 level.

If the selling pressure eases with the news coming in, and we don't see a massive whale shorting, putting downward pressure yet again, ETH might ultimately have a chance to break out to the upside and reclaim the psychological $2000 level. The rest will be better if we get some momentum afterwards.

Stay hard, stay alert.

ETH1! (Ethereum Futures - CME) Analysis Based on Gap Filling📉📈 ETH1! (Ethereum Futures - CME) Analysis Based on Gap Filling

On the daily chart of Ethereum Futures (ETH1!) on the CME, three significant price gaps can be observed. Historically, these gaps tend to get filled over time. Based on market cycles, we estimate that around 200 days remain until the end of the crypto bull cycle, after which the bear cycle may begin.

🔹 Key CME Gap Levels:

🔸 Lower Gap: $1450 - $1550 (Largest Gap)

🔸 Mid Gap: $2550 - $2625

🔸 Upper Gap: $2900 - $3200

📌 Trade Setup Suggestion:

✅ Entry: $1480

⛔ Stop Loss: $1300

🎯 Target: $3200

🔥 Risk management and confirmation signals using price action are recommended. If the price reacts at the $2550 - $2625 level, partial profit-taking could be a good strategy.

🧐 What do you think about this analysis? Do you also expect these gaps to be filled? 🤔👇

#Ethereum #ETH #CME #Crypto #Futures #TechnicalAnalysis #TradingView

ALTS MARKET CAP ANALYSIS. Altcoin Market Cap Analysis: Potential Rebound or Breakdown?

The altcoin market cap is currently bouncing off the support trendline of its ascending triangle pattern, which indicates a potential bullish continuation.

Ascending Triangle Support:

The market cap is testing a key support trendline within an ascending triangle, which is typically a bullish formation.

Sustaining above this level strengthens the case for a breakout.

Ichimoku Cloud Indicates Bullish Momentum:

The Ichimoku Cloud is turning supportive, which indicates an improving market sentiment.

A move above the cloud could confirm bullish momentum.

Possible Scenario:

If the price sustains above the trendline, the altcoin could see a strong bounce, leading to further gains.

A breakout above the resistance level of the triangle would confirm a larger uptrend.

A break below the support would invalidate the bullish structure.

This could lead to a deeper correction, which indicates increasing risk.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA

ETH/USDT Weekly Chart Analysis. The Ethereum (ETH/USDT) weekly chart suggests a potential bullish reversal from a key support area. Here are the details of the analysis:

Support area: Around $1,750 – $1,830, where the price recently rebounded.

Resistance levels:

First target: $4,015

Key resistance: $4,663, which marks a key breakout level.

ETH has bounced off historical support levels, indicating potential accumulation.

If the price sustains above $1,800, the next target is $4,015, followed by $4,663 if the momentum continues.

A break below $1,747 – $1,700 could lead to further declines, with the next strong support near $1,053.

Look for a confirmation of a breakout above $2,000 to confirm a strong uptrend.

Keep an eye on volume and indicators (RSI, MACD) for further confirmation of momentum.

Risk management is important in volatile market conditions.

If you found this analysis helpful, hit the Like button and share your thoughts or questions in the comments below. Your feedback matters!

Thanks for your support!

DYOR. NFA