ETH at Critical Resistance + Liquidation Zone | Time to Short?Today I want to analyze Ethereum ( BINANCE:ETHUSDT ) on the 1-hour time frame . Is there a short position opportunity?

Please stay with me.

Ethereum is currently trading near a Heavy Resistance zone($4,390-$3,950) , Cumulative Short Liquidation Leverage($3,983-$3,878) and the $4,000 ( round number ). $4,000 could be a psychological number to sell .

In terms of Elliott Wave theory , Ethereum appears to have completed the main wave 3 at $3,860 and is currently completing the main wave 4 . The main wave 4 could have a Double Three Correction(WXY) or Expanding Flat(ABC/3-3-5) , with the Expanding Flat structure being more likely .

One of the reasons why shorting Ethereum could be better than shorting Bitcoin right now is that ETHBTC ( BINANCE:ETHBTC ) is currently trading above the ascending channel and is likely to correct to Fibonacci levels .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Ethereum to drop to at least the Potential Reversal Zone(PRZ) and attack the Support lines ( Second target ) .

Cumulative Long Liquidation Leverage: $3,591-$3,543

CME Gap: $3,461-$3,417

Note: Stop Loss: $4,023

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Ethusdtanalysis

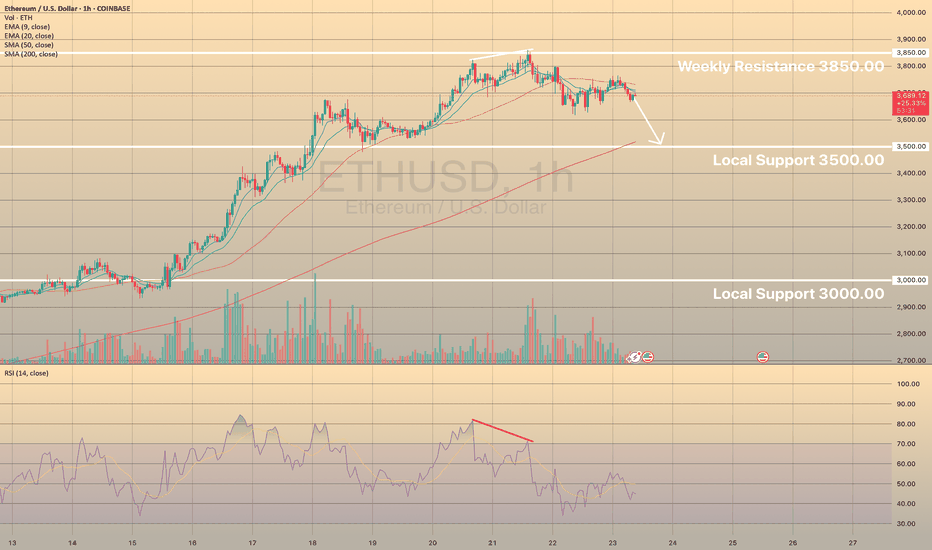

ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00

The ETHUSD has hit some resistance at around 3,850.00 this week. But it's since pulled back from that level, which might be a sign of a cooling trend. That's backed up by the RSI going bearish.

Right now, the price is below the 50 SMA on the 1-hour chart, indicating a mid-term downtrend.

We could see the price find some support at 3500.00 or so. Additionally the SMA 200 lays nearby, providing extra support here.

#ETHUSDT: Time For Big Price Distribution! Get Ready $5000ETH is currently in distribution and is on our target list. We expect a smooth price movement, potentially reaching $3100, $3800, and $5000. Use the entry zone to take a position; anything below the entry will invalidate the idea. Please use accurate risk management while trading.

Like, comment, and share this idea to encourage us to post more.

Team Setupsfx_

#ETHUSDT: Currently On The Way Towards Filling The FVG?ETCUSDT is currently experiencing a significant correction as the price approaches a pivotal juncture where a substantial bullish price reversal is anticipated, potentially propelling it to new all-time highs or even surpassing them. It is imperative to exercise meticulous risk management and conduct your own thorough analysis before engaging in any cryptocurrency trading or investment activities.

Should the price indeed undergo a major correction, it is likely to decline to our second designated area, where it is anticipated to fill the liquidity gap and subsequently reverse course, continuing its trajectory towards our established targets.

Please consider this analysis as a secondary influence only, or even solely for educational purposes. It is crucial to conduct your own independent analysis and risk management prior to engaging in any cryptocurrency trading or investment endeavours, as they inherently carry substantial financial risks.

We extend our best wishes and encourage you to trade safely and responsibly.

Should you wish to demonstrate your support, you are welcome to express your appreciation through likes, comments, or sharing this information.

Thank you for your consideration.

Have a pleasant weekend.

Team Setupsfx_

ETH/USD Setup | Thief Trading Blueprint for Profit.🔥🚨THE ETHEREUM HEIST PLAN: Thief-Style Trading Blueprint for Maximum Gains🚨🔥

💰Thief Mode: Activated | Time to Rob the Bulls 💰

📢🌍 Hello Money Makers, Crypto Crooks & Chart-Breaking Bandits! 🐱👤🤑💸

Welcome to the “Thief Trading Style” breakdown — a high-stakes, high-reward crypto market blueprint built on deep technical & fundamental intel. This isn’t your average strategy… it’s a full-blown heist on the ETH/USD market!

🧠 THE MASTER PLAN (ETH/USD – Day & Swing Trade)

🔎 Based on our Thief Mode analysis — blending market sentiment, trend psychology, and price action — Ethereum is ripe for a bullish robbery. We’re setting up shop at high-risk liquidity traps and targeting bearish overconfidence.

💥ENTRY STRATEGY – "The Vault Is Open, Time to Strike!" 💥

🟢 Go Long:

Swipe in on bullish momentum.

🕒 Set Buy Limit Orders at key pullback zones (swing highs/lows from 15m or 30m timeframes).

💼 Use DCA (Layered Orders) for multiple precision entries. The more layers, the stronger the loot stack.

🛑STOP LOSS – "Thief Rule: Don’t Get Caught"

📍Place SLs at logical swing highs/lows using the 1H timeframe

💡 Adjust according to lot size & how many entries you're stacking

Risk smart, steal smarter!

🎯TARGET – "Make the Escape at 2850.0 or Jump Early if Cops Close In!"

📌Set TP at 2960.0, or

📌Exit early if the market starts turning shady (exit before reversal signs appear)

⚔️SCALPER'S CODE – "Fast Hands Only!"

🧲Only scalp Long-side plays

🧠Use trailing SLs to protect stolen profits

💼Big wallets? Front-run the move

🪙Smaller bags? Team up with swing traders and follow the blueprint.

🚨MARKET CONTEXT – Why This Heist is Bulletproof

💥ETH/USD is showing bullish energy due to:

Macro & Fundamental Drivers

On-Chain Metrics showing accumulation

Sentiment Analysis leaning toward over-leveraged bears

Intermarket Correlation signaling rotation into altcoins

🔗Stay sharp, keep updated with: COT Reports, Macro Calendar, Crypto News Feeds

⚠️NEWS RELEASE WARNING – "Robbers Hate Surprises"

📛Avoid new entries during major news releases

📈Use Trailing Stop Losses to lock in profits

⛔Don’t leave positions unmanaged during volatility spikes

💖LOVE THE PLAN? THEN BOOST THE GANG!

🎯Tap the 🔥 Boost Button 🔥 and show support for the Thief Trading Style!

The more boosts, the more plans drop — let’s build a community of smart traders robbing the market legally (😉).

✍️DISCLAIMERS

📌This analysis is for educational purposes only — not financial advice.

📌Always trade within your own risk management rules.

📌Market conditions change fast — adapt, evolve, and don’t trade blindfolded.

🚀Stick around for more blueprints — the next heist is always just around the corner.

Until then… Lock. Load. Loot. 🐱👤🤑💰

ETH Long / Buy SetupAs of many times mentioned that, will short eth above 3k or 3k, but it still shows Bullish momentum no sign of weakness, maybe this entry triggers during weekend due too low volume, search for ifvg, if any 1D or 4hr Bullish fvg truns into bearish ifvg then will take short on ETH. For now will take long with SL and proper risk management.

ETH in Trouble? This Breakdown Could Be Just the BeginningYello, Paradisers — are you spotting the same warning signs we did before the last major ETH correction? If not, now’s the time to pay close attention.

💎ETHUSDT is currently showing multiple bearish signals across both higher and lower timeframes. On the higher timeframe, we’ve confirmed a bearish Change of Character (CHoCH), which is often the first major clue that momentum is shifting from bullish to bearish. This shift suggests that ETH could be preparing for a deeper move down.

💎On the 15-minute timeframe, price has reacted directly from the BPR zone. What adds even more weight to this reaction is the clear bearish divergence we’re seeing on the MACD indicator. Together, these signs point to increased bearish pressure in the short term.

💎More importantly, ETH has already taken out Internal Range Liquidity (IRL), which often sets the stage for a move toward the External Range Liquidity (ERL). When IRL gets swept and momentum remains bearish, it’s typically a sign that the market is hunting for liquidity on the other side of the range—and that’s exactly where we believe ETH is headed next.

💎That said, to take this setup with high confidence, we’re waiting for a clean bearish candlestick pattern to form. Confirmation is key. A solid entry backed by strong price action improves the probability of success and allows for tighter, more efficient risk management.

💎However, if ETH breaks out and closes decisively above our invalidation zone, the entire bearish idea is off the table. In that scenario, patience will be our best tool—we’ll wait for price action to realign and only re-enter the market once a new high-probability setup presents itself.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. Patience and discipline are what separate the professionals from the herd. Stick to the process, trust the strategy, and you’ll stay ahead of 90% of the market.

MyCryptoParadise

iFeel the success🌴

ETH/USDT Bullish Reversal Analysis Chart Overview:

Ethereum (ETH) has shown a strong bullish reversal from the support zone near $2,200, forming a V-shaped recovery pattern. The price is currently trading around $2,450, with upward momentum targeting the next key resistance level.

📌 Key Technical Highlights:

✅ Support Zone:

Clearly respected at $2,200 – $2,300 range

Multiple candle wicks suggest strong buyer interest

✅ Resistance Zone:

Major resistance expected around $2,900

Historical rejection indicates potential selling pressure

✅ Target Level:

Short-term target marked at $2,610 🟣

If momentum sustains, price could push towards this zone before facing resistance

📈 Bullish Momentum:

Strong breakout from downtrend channel

Formation of higher highs and higher lows

Price action respecting upward trend structure

🛠 Pattern Structure:

Reversal pattern after corrective phase

Bullish engulfing candles suggest continuation

📊 Forecast Path:

Two potential scenarios are outlined:

📈 A clean push to the $2,610 target, followed by consolidation

🔄 A short pullback to $2,374 before continuation to the target

⚠️ Conclusion:

ETH/USDT is showing bullish signs with potential to reach $2,610. Watch for consolidation or pullbacks as buying opportunities, but be cautious of heavy resistance above $2,900. Ideal for short- to mid-term bullish setups

ETH/USDT Bullish Reversal from Support Zone Chart Analysis:

The chart illustrates a range-bound consolidation with clear support around $2,381.45 and resistance near $2,556.54.

🔍 Key Observations:

✅ Multiple Support Tests: Price has tested the support zone several times (highlighted by orange circles) and respected it, indicating strong buying interest at the lower boundary.

📉 Fakeout and Recovery: A false breakout below support occurred, but the candle quickly reversed, signaling a bear trap and potential for bullish momentum.

🔼 Rejection Wick & Consolidation: A strong rejection wick on the most recent candlestick shows buyers defending the zone aggressively. The current price action shows consolidation — a bullish accumulation pattern.

🎯 Upside Target: Based on the range breakout projection, the price could potentially revisit the resistance zone at $2,556.54, marked as the TARGET on the chart.

📌 Technical Outlook:

🟢 Bias: Bullish as long as the price holds above $2,381.45.

💹 Entry Idea: Aggressive buyers may enter near current levels with a stop below the wick low.

🛑 Risk Level: Tight stop-loss needed as the structure relies heavily on support holding.

📈 Conclusion:

A classic range rebound setup is forming with potential for upside movement back toward resistance. A breakout above $2,556.54 could initiate a trend continuation rally

Ethereum (ETH/USDT) – Breakdown From Ascending TriangleEthereum failed to hold above the crucial resistance of $2,849 and has broken down from the ascending triangle on the 4H timeframe — invalidating the bullish breakout structure.

It seems to be consolidating and moving sideways in the range. The move is possible only if we break the channel either upside or downside.

Key Observations:

Ascending triangle fakeout followed by sharp rejection

RSI dropped from overbought (~70) to neutral zone (~46), showing weakening momentum

Current price: $2,537, testing local support at $2,384.90

Next major support zones: $2,242.98 and $1,852.48

Watch for further weakness below $2,384 — could accelerate downside toward $2,242 or lower.

Caution advised: Wait for the structure to rebuild before positioning it long.

This is not financial advice, please do your research before investing, as we are not responsible for any of your losses or profits.

Please like, share, and comment on this idea if you liked it.

#ETH #Ethereum #ETHUSDT

ETH/USDT – Bearish Reversal from Resistance Zone ETH/USDT – Bearish Reversal from Resistance Zone 📉

The chart above clearly illustrates a strong bearish setup on the ETH/USDT pair. Here's a professional breakdown:

📊 Technical Overview:

Resistance Zone (~2750–2850 USDT):

Marked by three distinct rejections (highlighted by red arrows).

Every attempt to break above this zone has resulted in a sharp price rejection, indicating strong selling pressure.

Current Price: 2529.69 USDT

Price has already broken below the immediate support formed after the last rejection.

The pair is now trending lower with bearish momentum.

Support Zone (~2250–2350 USDT):

This is the next major demand zone where previous accumulation took place.

The projection arrow indicates the likely path toward this area.

🔍 Price Action Insights:

Repeated failure to break resistance confirms a triple top pattern, a classic bearish reversal signal.

The recent sharp drop from the top is accompanied by strong bearish candles, showing momentum.

Minor consolidation might occur before continuation downward, as suggested by the zigzag arrow.

📉 Conclusion:

If bearish momentum sustains, ETH/USDT is likely to drop toward the 2,300 USDT support zone. A break below could open the door for even lower levels, while any bounce would need to reclaim the 2,700 USDT level to shift sentiment.

📌 Traders should watch for lower highs and bearish confirmations before entering short positions.

ETHUSDT - UniverseMetta - Signal#ETHUSDT - UniverseMetta - Signal

W1/D1 - Potential completion of the 1st wave on W1. If today closes without updating the last maximum, a fractal will form on D1, which may indicate the beginning of a potential correction from the level.

H4 - Formation of a 3-wave structure + breakout of the trend line. Stop behind the maximum of the 2nd wave, with possible false breakouts.

Entry: 2549.53

TP: 2412.82 - 2224.40 - 2035.28 - 1858.21

Stop: 2662.86

ETHUSDT Bullish Structure Intact: Higher Highs Continue#ETHUSDT – 1D Chart

Ethereum is in a strong uptrend, consistently forming higher highs (HH) and higher lows (LH).

Price recently broke above a key resistance zone after consolidating in an accumulation range. This breakout confirms bullish strength.

If ETH holds above this zone, we could see a continuation move to the upside in the coming days.

Structure remains bullish — trend is intact.

$ETH Pressing Resistance – A Break Above Could Fly!CRYPTOCAP:ETH Update

Ethereum is looking strong right now.

The price is pushing against a key resistance zone near $2,725 and forming higher lows showing pressure is building for a breakout.

If it breaks above this zone clearly, ETH could rally toward $4,000 (that’s a 55% upside).

Support to watch on the downside is around $2,465 if price pulls back.

Keep an eye on ETH, this breakout could be big.

DYOR, NFA

#ETH #Ethereum

ETH Staying Bullish – Break Above Could Target $3K+$ETH/USDT Update

ETH is moving strong, forming clear higher highs and higher lows. Right now, it’s ranging in an accumulation zone just below key resistance.

As long as it holds above the 50 EMA and recent low, the trend looks bullish. A breakout here could send it flying toward $3,000+.

Still healthy, still in play.

DYOR, NFA

ETHUSDT: Possible Minor to Major Corrections May HappenETHUSDT has a higher chance of experiencing a minor or major correction in the coming days, although we haven’t confirmed this yet. We need more confirmation before we can be certain about the future of ETH. However, if the price decides to undergo a major correction, it’s likely to drop to our second area, where it’s expected to fill the liquidity gap and then reverse, continuing towards our three targets.

Please use this analysis as secondary bias only or even only for educational purposes. Always conduct your own analysis and risk management before trading or investing in cryptocurrencies, as they carry significant financial risk. Good luck and trade safely.

If you want to support us, you can do so by liking the idea, commenting with your views, or sharing it.

Much love ❤️

Have a great weekend

Team Setupsfx_

ETH/USD "Ethereum vs U.S Dollar" Crypto Heist Plan (Day/Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the ETH/USD "Ethereum vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk YELLOW ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1840) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 3H timeframe (1650) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 2100 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸ETH/USD "Ethereum vs U.S Dollar" Crypto Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

$ETH Cooled Off After Pump – Healthy Correction Ahead?CRYPTOCAP:ETH pumped hard and touched $2,738 but now it’s pulling back a bit.

If you look at this 6H chart, you’ll notice price didn’t really take a healthy pause on the way up.

It just went straight up.

In my opinion, a pullback toward the $2,100–$2,150 zone would actually be a good thing. That area lines up with multiple supports, EMAs, previous breakout, and trendline, so it’s strong.

This type of dip could reset the momentum and build a base for the next rally.

Stay tuned and follow for more updates!

#Ethereum #ETHUSD #ETHUSDT

ETH Bulls on Alert: Is This the Move We've Been Waiting For?Yello Paradisers, did you catch that bullish breakout on ETH or are you still stuck waiting for confirmation?

💎Ethereum has officially broken out of its falling wedge pattern, which is a well-known bullish structure often signaling a trend reversal. What gives this breakout even more weight is that ETH has established a support zone exactly at the 200 EMA—an area that historically acts as a key level for institutional traders.

💎Adding to the bullish case, we’ve also identified a bullish divergence on the momentum indicators, which often suggests weakening selling pressure and the potential for upside. More importantly, there has been a clear bullish CHoCH (Change of Character), confirming that market structure is shifting in favor of the bulls. With all of these signals aligning, the probability of a continued bullish move is significantly higher.

💎However, the most disciplined traders understand that no setup is perfect without confirmation. A pullback to the support zone would offer a textbook opportunity for a high-risk-to-reward entry—ideal for bulls who are patiently waiting for a safer entry point rather than chasing the move. This kind of setup allows us to manage our risk properly and act only when the odds are clearly in our favor.

💎That said, if the price breaks down and closes below the support zone, the bullish idea is completely invalidated. This is the level where we draw the line and step aside. Being able to invalidate your own bias is what separates traders who survive from those who don't.

🎖We are playing it safe right now. If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest probability trading opportunities.

MyCryptoParadise

iFeel the success🌴