ETH/USDT 15m SETUP.ETH/USDT 15m Setup 🚀

Price is approaching a clean POI (Order Block + Imbalance zone).

Expect a short-term dip into the zone followed by a bullish reaction.

📌 Trade Idea:

Wait for price to tap the POI

Look for bullish confirmation

Target upside continuation after liquidity grab & structure shift

High probability long setup incoming!

ETHUSDTPERP

Important Trend Determination Area: 3708.87-3762.33

Hello, traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

(ETHUSDT 1D Chart)

The price began to rise after breaking above the important 2419.83-2706.15 area.

This can be interpreted as the beginning of a step-up trend, with an upward breakout of the HA-High ~ DOM(60) range.

The HA-High ~ DOM(60) range corresponds to the 2581.59-2681.60 range.

This suggests that the price is currently testing whether a second step-up trend will continue or whether it will simply end as the first step-up trend.

The HA-High ~ DOM(60) range is currently 3708.87-3762.33.

Therefore, if the price rises above 3708.87-3762.33 and maintains this level through the upcoming volatility period, a second step-up trend is expected.

The conditions for this are as follows:

- The K value of the StochRSI indicator must rise from the oversold zone and show an upward trend with K > D. - The OBV indicator must rise above the High Line and maintain an upward trend.

- The TC (Trend Check) indicator must continue its upward trend. (If possible, it's best to stay above 0.)

The next volatility period for ETH is expected to last from around August 6th to 10th.

However, it's worth keeping an eye on the movements during the BTC volatility period.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

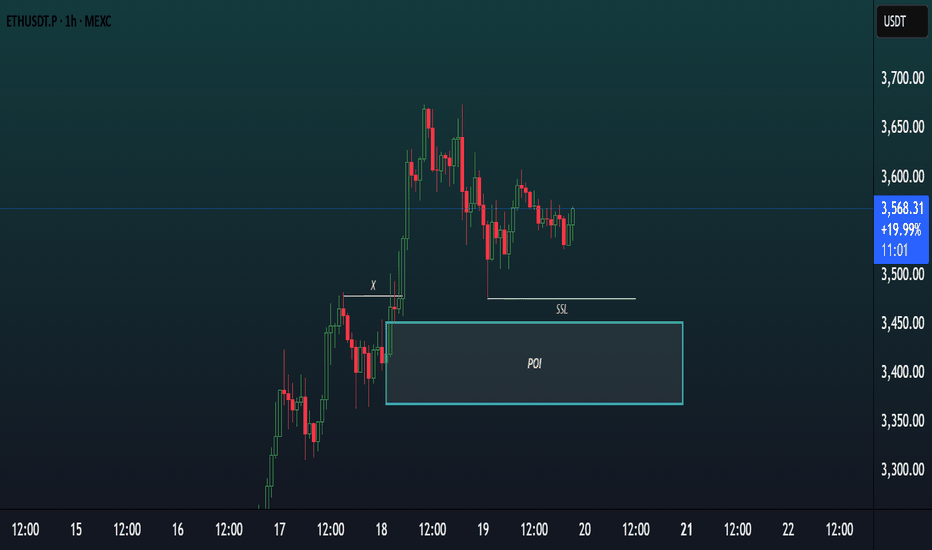

ETH NEXT MOVE AND BUY ZONE.1. Market Structure:

ETH/USDT broke previous structure highs (marked with X), confirming a bullish trend shift.

Price made a strong impulsive move upward after that break, forming higher highs and higher lows, indicating smart money accumulation.

2. Price Action & Current Retracement:

After forming a recent peak near $3,950, ETH entered into a retracement.

The retracement is currently holding above key liquidity and demand zones, showing signs of healthy correction rather than reversal.

3. Liquidity Grab – Sell-Side Liquidity (SSL):

There is Sell-Side Liquidity (SSL) resting below $3,700, which has not yet been taken out.

Smart money often targets such liquidity before initiating a new leg up — this makes SSL a potential magnet for price.

4. Fair Value Gap (FVG) + Demand Zone (POI):

Just below the SSL lies a confluence zone:

A clear Fair Value Gap (FVG) between approximately $3,680–$3,700, showing inefficiency in price.

A Demand Zone (POI) below that, between $3,640–$3,680, representing the origin of the bullish move that broke structure.

This zone provides high-probability support and a potential area of smart money re-entry.

5. Trade Setup Expectation:

Scenario: Price is likely to:

Sweep SSL below $3,700.

Tap into the FVG + Demand Zone.

Show bullish confirmation (like a bullish engulfing, Choch/BOS on lower timeframe).

Entry: After confirmation inside demand zone.

Stop Loss: Below demand zone (~$3,620).

Take Profit 1: Retest recent high at $3,950.

Take Profit 2: Extension toward $4,050–$4,100 based on higher timeframe targets.

✅

Summary:

ETH/USDT is in a bullish structure but currently pulling back. A sweep of sell-side liquidity (SSL) and a tap into the FVG + Demand Zone around $3,640–$3,700 is expected. After confirmation, it offers a high-probability long setup, aligning with smart money accumulation logic.

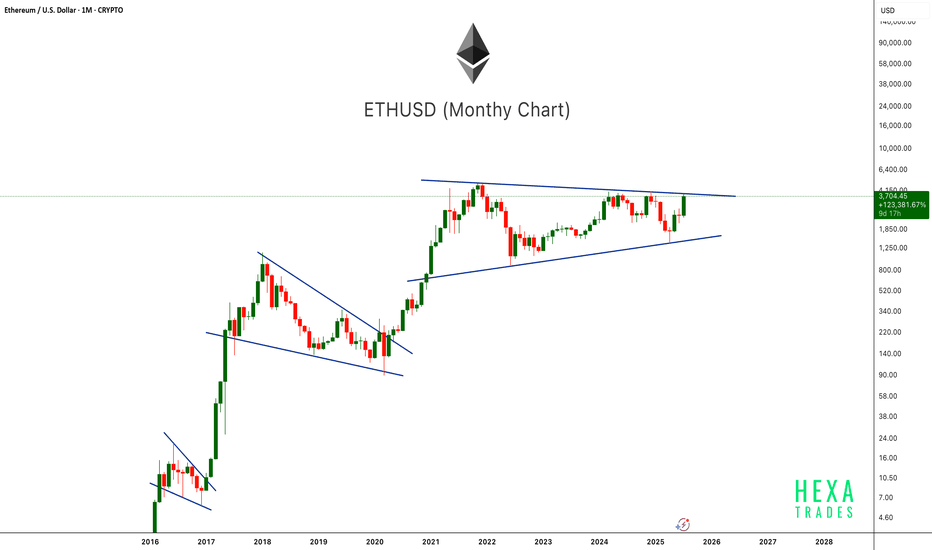

ETH Broadening Wedge Formation !BINANCE:ETHUSDT is forming a broadening wedge pattern on the weekly chart, a structure that often signals high volatility and strong momentum once the price breaks out. This setup is reminiscent of ETH’s 2019–2020 pattern, which also formed as a broadening wedge before breaking to the upside and triggering a historic rally to new all-time highs.

Currently, ETH is pressing against the upper resistance line of the wedge near the $3,900–$4100 zone, a level that has acted as major resistance multiple times in recent months. A decisive breakout above this barrier could ignite strong bullish momentum, opening the path toward the $6,000–$10,000 range.

Cheers

Hexa

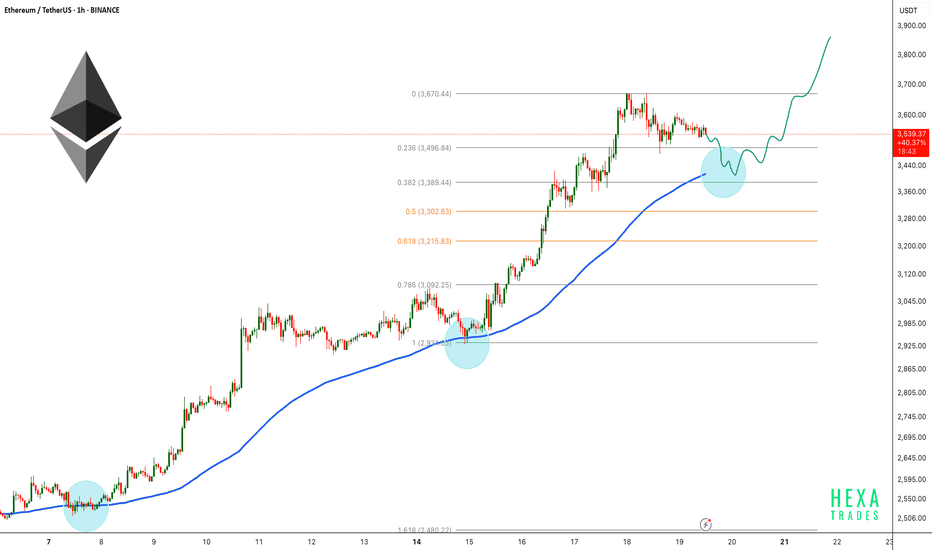

Ethereum Ready to Attack Resistances — Time to Long ETH?Ethereum ( BINANCE:ETHUSDT ) fell to the Support zone($3,538-$3,442) and Support lines as I expected in the previous idea .

Ethereum is currently trading near the Support zone($3,538-$3,442) , Support lines , and Cumulative Long Liquidation Leverage($3,559-$3,524) .

In terms of Elliott Wave theory , it seems that Ethereum has completed the main wave 4 . The main wave 4 has an Expanding Flat structure(ABC/3-3-5) . To confirm the main wave 4, we must wait for the Resistance zone($3,771-$3,677) and Resistance lines to be broken.

I expect Ethereum to trend higher in the coming hours and attack the Resistance lines and Resistance zone($3,771-$3,677) .

Cumulative Short Liquidation Leverage: $3,672-$3,645

Note: Stop Loss: $3,450 =Worst

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

#ETH is in a complex consolidation phase📊#ETH is in a complex consolidation phase 👀

🧠From a structural perspective, the previous long uptrend has ended, so we should be wary of a deeper correction. We are currently in the middle of a complex consolidation, so there are many contradictions.

➡️Thus, if you want to participate in a long trade, you need to patiently observe whether this period of sideways consolidation can continue and a bullish structure can be established.

➡️If you want to participate in a short trade, you need to patiently wait for a break below the yellow support zone on the daily chart. This will then turn into resistance, and then look for short signals within that resistance zone.

🤜If you like my analysis, please like 💖 and share 💬

BITGET:ETHUSDT.P

ETH Bearish Divergence!CRYPTOCAP:ETH has been in a strong uptrend, printing consistent higher highs (HH) and higher lows (HL). However, on the daily chart, the price has now reached a critical resistance zone near the $3,800–$4,000 range.

Key Points:

🔸 Bearish RSI Divergence

While price action has formed a new higher high, the RSI has printed a lower high, signaling bearish divergence.

This indicates that upward momentum is weakening even as price attempts to push higher — a common early warning of a possible short-term reversal.

🔸 Fibonacci Retracement Levels

The fib 0.382 at $3240 and 0.5 and 0.618 retracement levels are sitting around $3,000 and $2,800, respectively, potential targets if a correction follows.

🔸 Volume Profile

Volume is gradually declining as price approaches resistance, suggesting buyer exhaustion.

If the price breaks above the $4,000 psychological resistance, we could see a strong bullish move.

ETH is facing strong resistance after a powerful rally, with RSI bearish divergence and weakening momentum hinting at a possible short-term pullback. We should be cautious entering fresh longs here without confirmation.

Support: $3,200, $3,000, and $2,800

Cheers

Hexa

BINANCE:ETHUSDT BITSTAMP:ETHUSD

ETH at Critical Resistance + Liquidation Zone | Time to Short?Today I want to analyze Ethereum ( BINANCE:ETHUSDT ) on the 1-hour time frame . Is there a short position opportunity?

Please stay with me.

Ethereum is currently trading near a Heavy Resistance zone($4,390-$3,950) , Cumulative Short Liquidation Leverage($3,983-$3,878) and the $4,000 ( round number ). $4,000 could be a psychological number to sell .

In terms of Elliott Wave theory , Ethereum appears to have completed the main wave 3 at $3,860 and is currently completing the main wave 4 . The main wave 4 could have a Double Three Correction(WXY) or Expanding Flat(ABC/3-3-5) , with the Expanding Flat structure being more likely .

One of the reasons why shorting Ethereum could be better than shorting Bitcoin right now is that ETHBTC ( BINANCE:ETHBTC ) is currently trading above the ascending channel and is likely to correct to Fibonacci levels .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

I expect Ethereum to drop to at least the Potential Reversal Zone(PRZ) and attack the Support lines ( Second target ) .

Cumulative Long Liquidation Leverage: $3,591-$3,543

CME Gap: $3,461-$3,417

Note: Stop Loss: $4,023

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

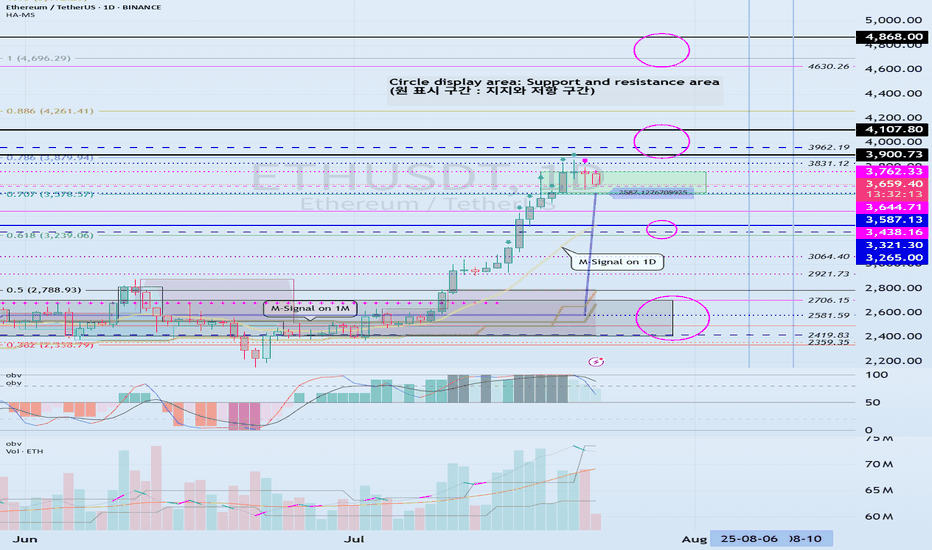

The key point to watch is whether it can rise to 3900.73-4107.80

Hello, traders. Nice to meet you.

If you "Follow," you'll always get the latest information quickly.

Have a great day.

-------------------------------------

(ETHUSDT 1D Chart)

The upward trend continues, with the M-Signal on the 1D chart > M-Signal on the 1W chart > M-Signal on the 1M chart.

Therefore, if the price holds above 3265.0-3321.30, a medium- to long-term uptrend is likely.

Currently, the HA-High ~ DOM(60) range is formed across the 3265.0-3762.33 range on the 1M, 1W, and 1D charts.

Therefore, the key question is whether support is found within the 3265.0-3762.33 range.

-

While the price is trending upward along the short-term trendline, if it falls below the short-term trendline and encounters resistance by falling below the M-Signal indicator on the 1D chart, a decline to the 3265.0-3321.30 range is likely.

ETH's volatility period is expected to last from August 6th to 10th.

The key point to watch is whether it can rise above the 3900.73-4107.80 range after this volatility period.

-

Since the StochRSI indicator has entered an oversold zone, the downside is likely to be limited.

Since the OBV indicator of the Low Line ~ High Line channel remains OBV > OBVEMA, a significant decline is unlikely.

However, since the TC (Trend Check) indicator is below zero, selling pressure is dominant.

Therefore, a decline below 3708.87 could lead to further declines. However, as previously mentioned, the decline is likely to be limited, so a significant decline is not expected.

Once the M-Signal indicator on the 1D chart is encountered, the trend is expected to re-establish itself.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

ETHUSDT Classic Cup PatternEthereum is forming a textbook Cup pattern on the 1H chart, signaling a strong bullish setup. After a rounded bottom forming the “cup,” ETH is now pushing toward the neckline resistance around $3,870. A confirmed breakout above this level could lead to a powerful upward move.

Cheers

Hexa

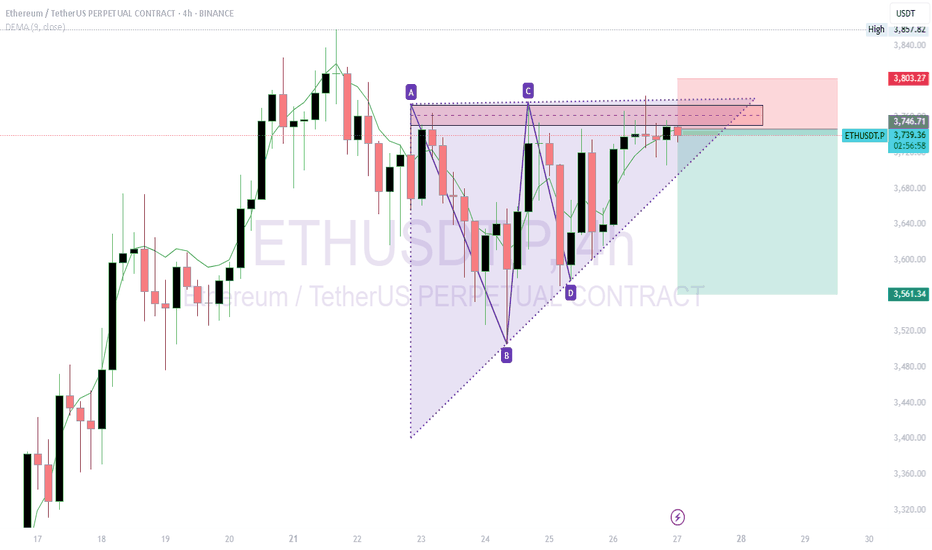

ETHUSDT Short Trade IdeaShort ETHUSDT at $3,745.22 with a target of $3,561.34.

Reason for Short: The 4-hour chart shows a symmetrical triangle pattern with resistance around $3,745-$3,800. The price is testing this upper trendline, and a recent bearish candle suggests potential rejection. The DEMA at $3,747.75 indicates overextension, supporting a pullback.

What I See: Heavy sell pressure is forming near $3,745, with the triangle nearing a breakout/breakdown point. Support lies around $3,561, aligning with prior lows.

Stop Loss: Set at $3,802, above the recent high and triangle resistance, to avoid a bullish breakout.

Trade Rationale: A breakdown from the triangle with volume confirmation could drive the price to $3,561. The tight stop above resistance minimizes risk while targeting a key support level.

Check if HA-High indicator is forming at 3587.13

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ETHUSDT 1D chart)

HA-High indicator is showing that it is about to form at 3587.13.

Accordingly, if the HA-High indicator is newly created, the support in the 3587.13-3762.33 section is an important issue.

If it falls below 3587.13, it is likely to touch the M-Signal indicator on the 1D chart.

Therefore, we should check whether it touches the area around 3265.0-3321.30 and rises.

-

This can be seen as a time to test whether it will continue the first step-up trend while rising in the important section of 2419.83-2706.15.

ETH's volatility period is around August 6-10, but we should check what kind of movement it shows after passing the volatility period of BTC.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain more details when the bear market starts.

------------------------------------------------------

ETH Ready to Pop!ETHUSD is once again testing the upper boundary of a long-term symmetrical triangle on the monthly chart. This pattern has been forming since the 2021 peak, showing consistently higher lows and lower highs. Previous breakouts from similar consolidation patterns (2017 and 2020) led to massive rallies. With the current monthly candle showing strong bullish momentum, a confirmed breakout above this structure could mark the beginning of Ethereum's next major bull run. Keep an eye on the breakout level for confirmation.

Cheers

Hexa

ETH Healthy Retest Before Next Rally!Ethereum continues to trade within a strong uptrend on the 1-hour chart, respecting the 100 EMA consistently throughout the rally. After a strong impulse move, the price is now consolidating near the recent highs.

ETH price could retest the 0.382 Fibonacci level and the 100 EMA before continuing upward. A successful retest would signal strength and could lead to a bullish continuation toward the $3900 - $4000 range.

Similar historical retests of the 100 EMA led to strong rallies, and we could see a repeat of that pattern if support holds.

Cheers

Hexa

BITSTAMP:ETHUSD CRYPTOCAP:ETH

Chart Analysis (ETHUSDT, 1H)This chart showcases a Smart Money Concepts (SMC) style analysis on the 1-hour timeframe of ETHUSDT.P, focusing on a potential bullish setup.

Key Elements:

POI (Point of Interest)

A demand zone is clearly marked around the $3,400–$3,460 area, highlighted as a potential reversal zone where price may react bullishly.

SSL (Sell-Side Liquidity)

Sell-side liquidity has been swept below a recent low, indicating a possible liquidity grab before a reversal.

X (Previous Break of Structure)

Point “X” marks a significant BOS (Break of Structure) indicating bullish intent in prior price action.

Current Price Action

Price recently tapped into the POI, swept SSL, and is now consolidating slightly above the zone — suggesting accumulation or preparation for a bullish move.

Bias:

Bullish — Expecting a possible reversal or continuation to the upside after liquidity sweep and POI mitigation.

ETHUSDT Gearing Up for Explosive MoveBINANCE:ETHUSDT has been trading inside an ascending triangle pattern for the past 1,600 days. The price is now moving toward the triangle's resistance zone with strong volume support. A confirmed breakout above this resistance could trigger a powerful bullish move, with potential targets in the $6,000–$8,000 range.

Cheers

Hexa🧘♀️

BITSTAMP:ETHUSD

ETH Breaks Key Resistance – $6K Possible if Wedge BreaksETHUSDT has broken out above a key horizontal resistance zone that has historically acted as a strong support and resistance level. This zone, marked in blue, has seen multiple rejections and bounces over the past year, confirming its significance.

The recent breakout above this zone indicates a shift in market structure and suggests growing bullish momentum. The price action shows a clean move above resistance, with potential for a retest before continuing higher. The market is also forming a long-term broadening wedge pattern. The next target lies near the upper resistance of the wedge, around $4,000. If the price breaks above this broadening wedge, it could open the path toward the $6,000 level.

Regards

Hexa

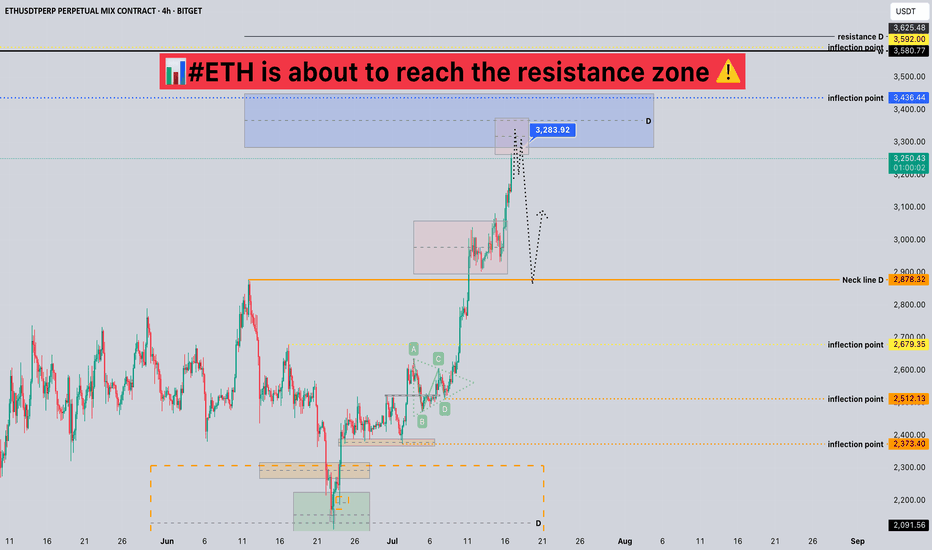

#ETH is about to reach the resistance zone 📊#ETH is about to reach the resistance zone ⚠️

🧠From a structural perspective, we are about to reach the resistance zone at the daily level, so we need to be wary of the risk of a pullback. If your cost price does not have much advantage, then please remember to lock in profits in time.

➡️New long trades need to wait patiently for a pullback to occur before participating, or the trend is relatively strong, and continue to consolidate sideways to form a new long structure to continue the long trend, otherwise we can't chase the rise near the resistance zone.

Will we start a pullback from here? Let's see 👀

🤜If you like my analysis, please like 💖 and share 💬

BITGET:ETHUSDT.P

Ethereum Analysis – Vitalik’s Gas Cap Proposal Adds PressureToday, I want to show you the possible moves for Ethereum ( BINANCE:ETHUSDT ) this week.

Please stay with me .

Let’s first take a look at the important news that has come for Ethereum in the last 24 hours :

Ethereum’s Gas Cap Proposal Sparks Concerns

Ethereum co-founder Vitalik Buterin recently proposed EIP-7983 , introducing a gas limit cap to prevent potential DoS (Denial of Service) attacks on the network.

Bearish Takeaways:

This proposal reveals a current vulnerability in Ethereum’s infrastructure. If gas limits grow unchecked, nodes may fail to sync, leading to possible network instability.

Imposing a gas cap could temporarily reduce transaction throughput, affecting DeFi protocols and NFT platforms that rely on Ethereum’s scalability.

The market tends to react cautiously to core protocol changes, and this uncertainty could trigger short-term selling pressure.

Bullish Counterpoints:

The cap aims to strengthen the network’s long-term stability against spam and DoS attacks.

It’s still in the proposal stage, with no immediate impact on users or network performance.

Conclusion:

While the long-term impact may be positive, the short-term uncertainty and exposed risks provide a bearish narrative for Ethereum, especially amid growing competition from alternative chains.

--------------------------------------

Now let's take a look at the Ethereum chart on the 4-hour time frame .

Ethereum is currently trading near the Heavy Resistance zone($2,929-$2,652) and Resistance lines , and is also trying to break the Support line .

In terms of the Elliott Wave theory , it seems that Ethereum has completed the Zigzag Correction(ABC/5-3-5) , so we can expect the next bearish wave .

I expect Ethereum to fall to at least $2,433 AFTER breaking the Support line, and if the Support zone($2,491-$2,323) is broken, we should expect further declines.

Second Target: $2,374

Note: Stop Loss (SL) = $2,689= Worst Stop Loss(SL)

Please respect each other's ideas and express them politely if you agree or disagree.

Ethereum Analyze (ETHUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

#ETH Ascending Triangle📊#ETH Ascending Triangle 📉

🧠From a structural perspective, the bullish target near the neckline support area has been achieved, so there is an expectation of a pullback.

➡️From a graphical perspective, there is an ascending triangle superimposed inside the ascending wedge. Generally, we regard such models as bearish models. Therefore, with the support of multiple decline expectations, we should not chase the rise here! ! !

🤜If you like my analysis, please like 💖 and share 💬 BITGET:ETHUSDT.P

Sunday, 6 July 2025 - ETH/USDT.P ShortTrading Journal Entry: ETH/USDT SHORT

Date of Entry: July 7, 2025

Asset: ETH/USDT Perpetual Futures

Position: SHORT

Entry Price: $2,580.00

Stop Loss: $2,615.00

Take Profit: $2,510.00

Risk/Reward Ratio: 2.00:1

Setup Grade: A+

1. Core Thesis

The trade is a high-confluence short position designed to capitalize on a probable liquidity hunt below an obvious daily support level. The core thesis is that the market is incentivized to purge over-leveraged longs, whose positions are revealed by order flow data, within the context of a clear daily downtrend.

2. High-Timeframe Context (The Strategic Landscape)

My analysis began with a top-down approach to understand the broader market environment.

Weekly Context: The market is in a large-scale consolidation range. This tells us that expecting a massive, sustained trend breakout is a lower probability. Instead, trading between major support and resistance zones is the governing dynamic.

Daily Context: The immediate trend on the daily chart is bearish. Price had established a series of lower highs and lower lows, bringing it down to a major area of historical support and the Volume Profile Point of Control (POC) around the ~$2,550 zone. This created the central conflict: a bearish trend meeting a significant support level. A naive analysis would be to buy this support.

3. Order Flow & Sentiment Analysis (The Deciding Factor)

This layer of analysis was the key to resolving the trend vs. support conflict and formed the backbone of my bearish bias.

Liquidation Analysis: The liquidation maps revealed a very large and proximate pool of long liquidations clustered between $2,470 and $2,500. This liquidity acts as a powerful magnet for price, as market makers are incentivized to push price toward these zones to absorb orders.

Funding Rate Analysis: Funding rates across almost all exchanges were consistently positive. This provided clear evidence that derivative traders were predominantly positioned long, were paying a premium to maintain those longs, and were betting on the daily support holding. This identified a crowded trade.

Synthesis: The presence of a large downside liquidity target (the "magnet") combined with a vulnerable and crowded group of participants (the "fuel") created a high-probability scenario for a contrarian move. The path of least resistance was for the market to push through the "obvious" support to liquidate these longs.

4. Tactical Execution (The Entry Trigger)

With a firm directional bias, the final step was to find a low-risk entry.

4-Hour Structure: The price action at the daily support level was weak. The 4H chart showed a low-volume, sideways consolidation, not a strong bullish rejection. This lack of a decisive bounce was my first clue that the support was fragile.

1-Hour Entry Pattern: I identified the perfect entry trigger by observing the 1H chart.

Price staged a minor rally toward the $2,580 resistance level.

Crucially, this rally occurred on visibly declining volume, signaling a lack of genuine buying interest. It was a corrective, not an impulsive, move.

My entry at $2,580 was placed at a clear support-turned-resistance flip zone, allowing us to short into weakness at a favorable price.

5. Risk Management (The Trade's Foundation)

Stop Loss ($2,615): The SL was not an arbitrary price but a logical invalidation point. It was placed just above a recent 1H structural swing high. A move above this level would have proven the "weak rally" thesis incorrect and signaled that buyers had taken control.

Take Profit ($2,510): The TP was chosen for two reasons:

Rule Compliance: It mathematically secured my required 2:1 risk/reward ratio.

Strategic Placement: It sits just ahead of the psychological $2,500 level and the densest part of the liquidation pool, increasing the probability of a fill before any potential support-driven bounce.

This trade represents a textbook example of my strategy: using high-timeframe analysis to build a directional bias, confirming it with order flow and liquidity data, and executing with precision on a low-timeframe pattern, all while adhering to strict risk management rules.