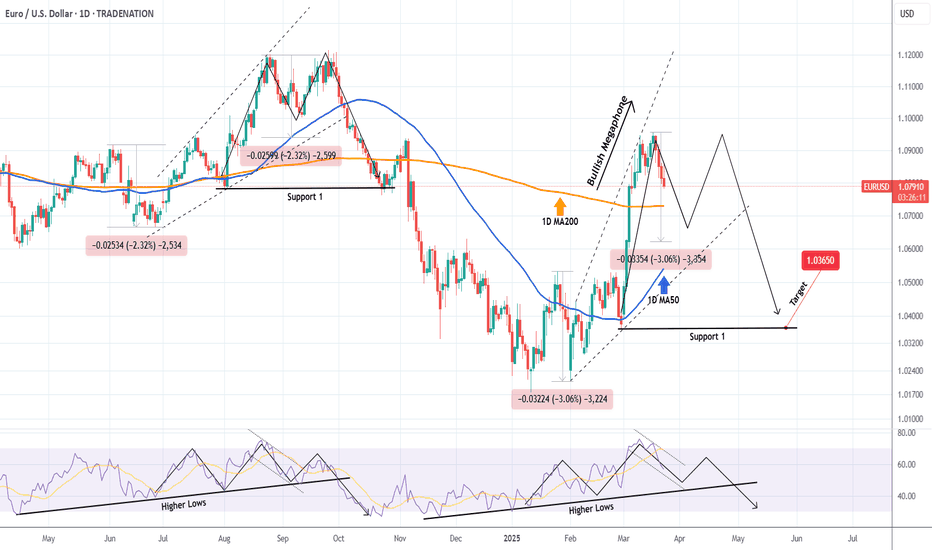

EURUSD 4H Bearish Cross starting the peak formation.The EURUSD pair posted a strong rebound last week, which is along the lines of our long-term bearish structure estimate, similar to the September 2024 Top.

The 4H MA50/100 Bearish Cross that was formed on Thursday, simply confirms that the pattern goes according to plan as on September 06 2024, the price got rejected after its completion and then rebounded to test Resistance 1 before the ultimate market peak.

We still expect a similar development, with our ultimate long-term Target being 1.03650, just above Support 1.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EUR

EURUSD - what’s next?Here is our in-depth view and update on EURUSD . Potential opportunities and what to look out for. This is a long-term overview on the pair sharing possible entries and important Key Levels .

Alright first, let’s take a step back and take a look at EURUSD from a bigger perspective.

After making such a huge upside move, we are expecting EURUSD to have some sort of a correction or a pullback to the downside. After that we got a sell off on EURUSD and just today we hit the 50% correction level at around 1.08442 . After failing to break to the upside we can expect more sells to be in play. Any breaks to the downside from the current price will confirm this. Although TVC:DXY is not as strong at the moment, it still is a global reserve currency . We seen that in play last week when we saw massive upside on OANDA:XAUUSD and on TVC:DXY . We must understand that investors are also pouring their money into DXY as it is a global reserve currency. I still personally believe TVC:DXY holds more strength against TVC:EXY hence why I am still looking to short the pair.

Scenario 1: SELLS from current price

With the instant sell, we are risking a possible pullback and continuations to the upside however, DXY is looking like it will reverse. Failing to break to the upside can also be taken as a confirmation for potential sells.

Scenario 2: BUYS at the break of the Key Level (around 1.085)

With the break to the upside, we can expect more buys to come in play possibly targeting previous highs on EURUSD at around 1.09444.

KEY NOTES

- DXY possible reversal to the upside.

- Breaks above the KL and to the upside would confirm higher highs.

- EURUSD has completed the 50% correction to the upside.

- DXY is the global reserve currency.

Happy trading!

FxPocket

Bullish bounce?EUR/NOK is reacting off the pivot which has been idetified as a pullback support and a bounce from this level could indicate a double bottom pattern which might lead to a potential price rise to the 1st resistance.

Pivot: 11.28684

1st Support: 11.18417

1st Resistance: 11.18417

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bearish reversal?EUR/USD is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.0876

Why we like it:

There is a pullback resistance that lines up with the 61.8% Fibonacci retracement.

Stop loss: 1.0948

Why we like it:

There is a pullback resistance.

Take profit: 1.0799

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Check out my Week 14 Trade Analysis for 2025!Hello fellow traders , my regular and new friends!

How was your trading this week?

For me i did a couple of trades, namely on the EurNzd, Usdjpy and snp500.

Took a lost on snp500.

Usdjpy was so so

Eurnzd was not bad :)

Which are the pairs you have traded?

NFP for this week, do take note. What should we keep an eye on?

Do check out my recorded video for more insights!

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

Bullish bounce?EUR/GBP is reacting off the pivot and could bounce to the 1st resistance.

Pivot: 0.8337

1st Support: 0.8310

1st Resistance: 0.8377

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop off 38.2% Fibonacci resistance?EUR/USD is rising towards the resistance level which is a pullback resistance that line sup with the 38.2% Fibonacci retracement and could drop from this level to our take profit.

Entry: 1.0833

Why we like it:

There is a pullback resistance level that lines up with the 38.2% Fibonacci retracement.

Stop loss: 1.0884

Why we like it:

There is a pullback resistance level that lines up with the 61.8% Fibonacci retracement.

Take profit: 1.0706

Why we like it:

There is a pullback support level that lines up with the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal off pulback resistance?EUR/CAD is rising towards the resistance level which is a pullback resistance that line sup with the 38.2% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.5548

Why we like it:

There is a pullback resistance level that line sup with the 38.2% Fibonacci retracement.

Stop loss: 1.5695

Why we like it:

There is a pullback resistance level that line sup with the 71% Fibonacci retracement.

Take profit: 1.5340

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Euro can drop to 1.0650 points, breaking support levelHello traders, I want share with you my opinion about Euro. Earlier, the price was moving inside a range, bouncing between the boundaries and forming a buyer zone near the lower support area. After several rebounds, EUR started to grow and eventually broke out from the range, making a strong upward impulse. The growth continued with a breakout through the support level, which later turned into a support area. From there, the price continued its bullish trend, but after touching the resistance line, it turned around and entered a correction phase. Over the last few sessions, Euro has been forming a pennant pattern, trading between the resistance line and the support line. Now the price is consolidating near the apex of the pennant, showing weak momentum. I expect a false breakout to the upside, followed by a sharp decline from the resistance line. In this scenario, the price would likely break through the current support area and move toward the 1.0650 points - this is my TP1. Given the recent price structure, the correction phase, and the weakening bullish pressure, I remain bearish and anticipate further decline. Please share this idea with your friends and click Boost 🚀

EURJPY Setup IdeaLooking for a long entry, limit order set....

Here is my logic from left to right: we have an short term "double top" forming inside a higher time frame up trend, I'm looking for a run on the stops of traders going short.

We found support at a bullish liquidity pocket (bottom red spot) = Bullish sign

Price completed a bullish harmonic (that grey double top structure is a harmonic) = Bullish sign

Price gave me entry signal with H1 break of structure (blue zone) = Bullish sign

We have equal lows sitting just above the blue line (X's) = Bullish sign

My target is the next red zone even though im projecting this pair to go much higher.

Earlier this week in my newsletter, I gave two zones to look for buy reactions in for EURJPY.

(the huge purple zone on the left, and the bottom red zone within it which currently has a +75 pip reaction.)

Feel free to check it out, the link is in my post signature, and profile bio.

Cheers 🍻

Bearish drop?The Fiber (EUR/USD) has reacted off the pivot and could drop to the 1st support.

Pivot: 1.0835

1st Support: 1.0722

1st Resistance: 1.0911

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

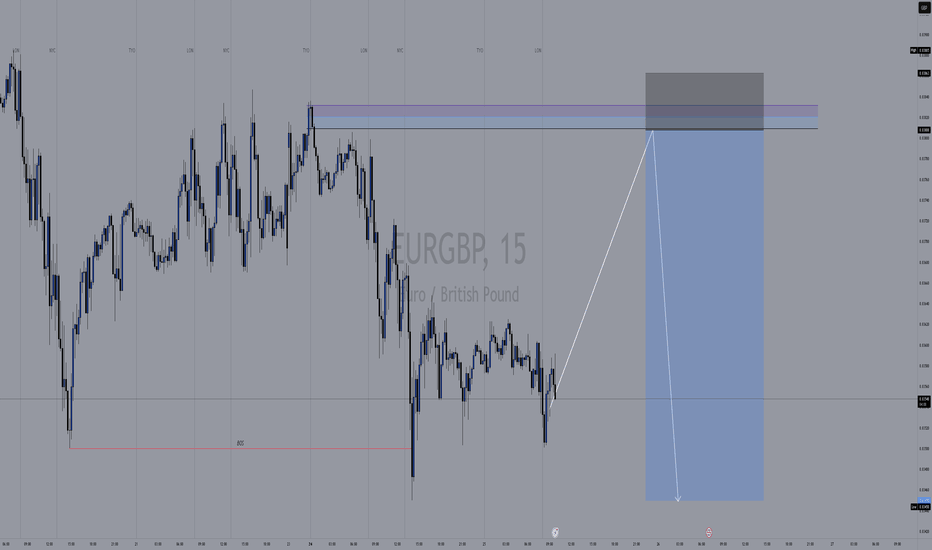

EURGBP SELLTracking EUR/GBP on the 15-minute timeframe, we see a potential short opportunity from a key supply zone.

Key Zones & Setup:

🟣 Bearish Order Block (Supply Zone): 0.83800 - 0.83830

This area acted as strong resistance, where institutional traders likely positioned sell orders.

Expecting price to push into this zone before reversing lower.

Break of Structure (BOS) on lower timeframes (M5/M1) is needed for confirmation.

🔵 Target Area (Demand Zone): 0.83450

If the supply zone holds, price could drop toward this key demand level.

This zone aligns with previous BOS levels and price reactions.

Trade Plan:

📈 Waiting for price to push into the supply zone (0.83800 - 0.83830).

🔎 Looking for BOS on lower timeframes (M5/M1) before shorting.

✅ Entering a sell position upon confirmation.

🎯 Targeting the 0.83450 demand zone.

⚠️ Stop-loss above 0.83830 to manage risk.

Market Outlook:

If price fails to break structure, we avoid shorts and reassess.

This setup follows smart money concepts (SMC) with a focus on BOS and order blocks.

💬 What do you think? Are you seeing the same setup? 🚀🔥

Bears give the USD a break, EUR/USD pullback may not be overThe retracement higher for the US dollar is finally underway, which also shows further upside potential. And this is why I am wary of being long EUR/USD over the foreseeable future, even if I suspect it is poised to break to new highs in the coming weeks.

Matt Simpson, Market Analyst at City Index and Forex.com

Weekly Analysis for Week 13 2025!Hello fellow traders , my regular and new friends!

Did you managed to get some pips from EURUSD before the mid week reversal ?

Or did you catch some pips from EJ as well?

No? Missed out on it? No worries, check out my trading analysis for next week (week 13) to get some insights and tips for the potential moves in the Forex market!

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

Bearish reversal?EUR/NZD is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.89747

Why we like it:

There is a pullback resistance level that line sup with the 61.8% Fibonacci retracement.

Stop loss: 1.90810

Why we like it:

There is a pullback resistance level that lines up with he 78.6% Fibonacci retracement.

Take profit: 1.8743

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURUSD Forming the new long-term Top.The EURUSD pair continues to trade within a Bullish Megaphone pattern and is about to complete today the 4th straight red 1D candle.

This is technically a top formation as the 1D RSI went from overbought (above 70.00) to below 60.00. Technically a downtrend gets confirmed when the price breaks below the 1D MA50 (blue trend-line) so until it does, the probability for another short-term bounce there isn't small. This is what took place in September 2024.

Once the 1D MA50 breaks though, we expect a test of Support 1 at 1.03650, as it happened on October 23 2024.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EUR/USD LONG 4H

Hello, I am Forex Trader Andrea Russo, and today I want to share with you a strategy I have adopted for a position on EUR/USD. I will analyze the reasoning behind my choice and the setup I am using to maximize opportunities, minimizing risk.

The trade setup

I decided to enter EUR/USD with an entry level at 1.08483, setting a stop loss (SL) at 1.08095 and a take profit (TP) at 1.0944. This trade is based on a series of technical and fundamental factors that suggest a probable continuation of the upward movement.

Technical analysis

My decision is supported by some key technical signals:

Uptrend: The EUR/USD cross has shown good recent strength, supported by a series of higher lows.

Support at 1.08095: The SL level has been set below the main support to protect the trade from a potential reversal.

Resistance at 1.0944: The TP was calculated based on a major resistance level that could serve as a target for a significant upside move.

Fundamental Analysis

From a fundamental perspective, there are several elements that are positively influencing EUR/USD:

Divergent monetary policies: The prospect of more hawkish ECB policies versus the Fed is supporting the euro.

Macroeconomic factors: Recent data on economic growth expectations in the eurozone provide a favorable backdrop for the cross to rise.

Risk/reward ratio

With a stop loss set at 1.08095 and a take profit at 1.0944, the risk/reward ratio of this trade is optimal, standing at around 1:2. This setup allows you to contain your risk and aim for a significant gain.

Trade Management

Once the position is opened, I will monitor the market movements and keep an eye on key indicators to assess any adjustments. If prices move quickly towards the TP, I may consider partially closing the position to protect profits.

Conclusion

This trade represents an interesting opportunity in a dynamic and variable market. Risk management remains the cornerstone of any winning strategy, and with a well-calculated setup like this, we aim to make the most of market conditions.

EURUSD BUYWe have a specific type of divergence on the 1-hour timeframe ⏳, indicating a potential drop 📉 in the higher timeframe. On the other hand, the lower 15-minute timeframe 🕒 gives us a buying perspective 📈. So, the analysis will be as shown in the image.

#eurusd #ForexTrading #PriceAction #ForexSignals #TradingAnalysis 💹

EURUSD Potential DownsidesHey Traders, in today's trading session we are monitoring EURUSD for a selling opportunity around 1.08500 zone, EURUSD is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 1.08500 support and resistance area.

Trade safe, Joe.

EURUSD Channel Down bottomed. Short term buy.EURUSD is trading inside a (1h) Channel Down pattern, which just reached its bottom.

Last time that happened, the market rallied by 1.25%.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 1.09200 (+1.25%).

Tips:

1. The RSI (1h) is trading on higher lows, which is a bullish divegernce in contrast to the price's lower lows. Standard bottom signal.

Please like, follow and comment!!

EUR/GBP LONG 4H

Hi, my name is Russo Andrea and I am a Forex Trader. Today I want to talk to you about a trading strategy that I am considering on EUR/GBP, a very interesting pair for those who, like me, operate in the currency markets.

The idea behind this trade is to go LONG on EUR/GBP. After analyzing the technical data and fundamentals, I believe that there is an interesting profit opportunity. Here are the details of my strategy:

Entry Point: 0.83781

Stop Loss (SL): 0.8550

Take Profit (TP): 0.84168

Trade Rationale: This trade is based on a combination of technical and fundamental analysis. Looking at the charts, we have a key support near the 0.83781 area, which represents an ideal level to open a long position. Technical indicators, such as RSI and moving averages, are showing signs of a possible bullish reversal.

On the other hand, my Stop Loss at 0.8550 was strategically placed to limit losses if the market moves against us, while still maintaining an acceptable risk for this trade. The Take Profit at 0.84168, on the other hand, represents a realistic level of profit based on previous resistances.

Risk Management: Risk management is essential in trading. It is important to always stick to your plan, without being influenced by emotions. With this trade, I am maintaining a balanced risk/reward ratio, increasing the probability of success in the long term.