EURAUD

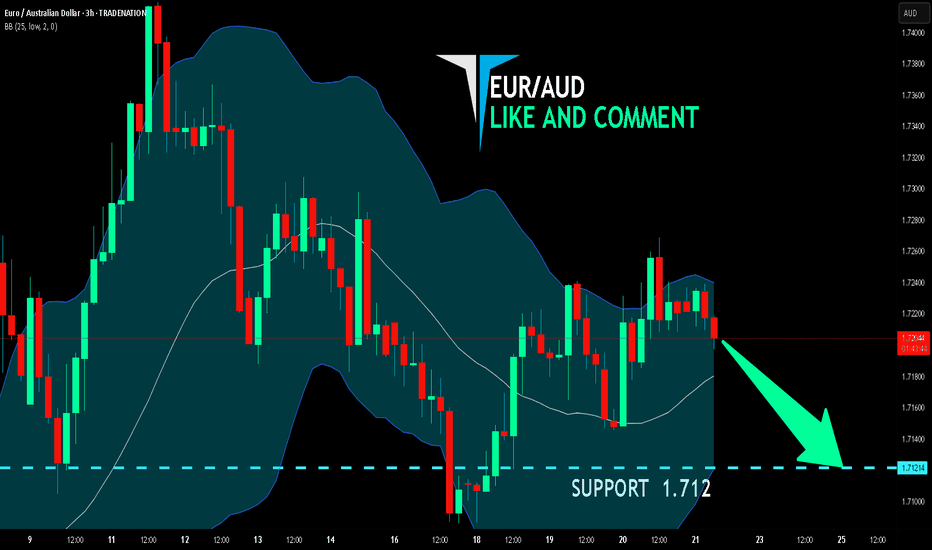

EUR/AUD BEARS ARE STRONG HERE|SHORT

Hello, Friends!

EUR/AUD pair is in the uptrend because previous week’s candle is green, while the price is clearly rising on the 3H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.712 because the pair overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURAUD Set To Grow! BUY!

My dear subscribers,

This is my opinion on the EURAUD next move:

The instrument tests an important psychological level 1.7135

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.7187

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURAUD consolidation towards the key trading level at 1.0750The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a bullish rebound from 1.7050, could extend the upside, targeting 1.7320, with further resistance at 1.7676 and 1.7800 over a longer timeframe.

Conversely, a confirmed break below 1.7050, with a daily close under this level, could signal a corrective pullback towards 1.6880 and 1.6800.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 1.7050 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EURAUD: Bearish Forecast & Outlook

Looking at the chart of EURAUD right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURAUD Will Move Higher! Long!

Here is our detailed technical review for EURAUD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 1.721.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 1.729 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

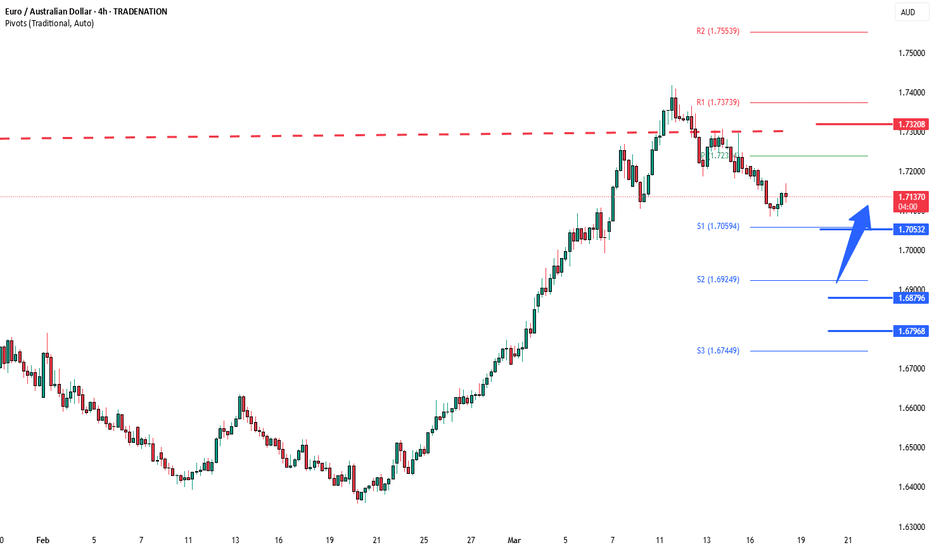

EURAUD Short Term Buy Idea Follow UpHi Traders, on March 13th I shared this "EURAUD Short Term Buy Idea"

We had a strong bullish momentum on the 4H chart and I mentioned that I expect pullbacks towards the marked key support zones and then a potential continuation higher.

Price has currently reached the first key support zone with the price developing a bullish divergence. Expecting the price to potentially move higher further from the first key support zone.

Until both the key support zones hold my short term view still remains bullish here.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

---------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD Corrective pullback supported at 1.0750

The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a bullish rebound from 1.7050, could extend the upside, targeting 1.7320, with further resistance at 1.7676 and 1.7800 over a longer timeframe.

Conversely, a confirmed break below 1.7050, with a daily close under this level, could signal a corrective pullback towards 1.6880 and 1.6800.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 1.7050 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

TradingView Idea for EUR/AUD (4H Chart)

Market Overview:

The EUR/AUD 4-hour chart displays a downtrend followed by a consolidation phase at a critical support zone. The price is currently reacting within a demand area, indicating a potential bullish reversal.

Key Levels:

Support Zone: ~1.7050 - 1.7100 (Highlighted in dark grey)

Resistance Zone: ~1.7200 (Short-term)

Target Level: ~1.74217

Potential Trade Scenarios:

Bullish Scenario: If the price holds above the support zone, we could see a rebound towards 1.7200, with further continuation towards the 1.74217 target.

Retest and Breakout: A slight pullback into the support zone, followed by a breakout above 1.7200, could confirm a strong buying momentum.

Bearish Risk: A failure to hold above support may lead to further downside continuation.

Trade Plan:

Entry: Look for bullish confirmation in the demand zone.

Stop Loss: Below the support zone (~1.7050).

Take Profit: First at 1.7200, then 1.74217 for an extended move.

Bias: Bullish if support holds, bearish if price breaks below.

EUR_AUD SUPPORT AHEAD|LONG|

✅EUR_AUD is making a bearish

Correction and will soon retest a

Key support level of 1.7100

While trading in a strong uptrend

So I think that the pair will make a rebound

And go up to retest the supply level above at 1.7260

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD The Week Ahead 17th March ‘25The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a bullish rebound from 1.7050, could extend the upside, targeting 1.7320, with further resistance at 1.7676 and 1.7800 over a longer timeframe.

Conversely, a confirmed break below 1.7050, with a daily close under this level, could signal a corrective pullback towards 1.6880 and 1.6800.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 1.7050 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

EUR/AUD "Euro vs Aussie" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/AUD "Euro vs Aussie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.66000 (swing Trade Basis) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 1.62700 (or) Escape Before the Target

Secondary Target - 1.61000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/AUD "Euro vs Aussie" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🌞Market Overview

Current Price: 1.64624

30-Day High: 1.6734

30-Day Low: 1.5931

30-Day Average: 1.6231

🌞Fundamental Analysis

Economic Trends: The European economy is expected to grow, driven by a rebound in consumer spending and investment

Interest Rates: The European Central Bank is expected to maintain low interest rates, supporting the euro

🌞Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for commodities, including Australian exports

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for commodities and supporting the Australian dollar

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting currency markets

🌞COT Data

Non-Commercial Traders (Institutional):

Net Short Positions: 40%

Open Interest: 80,000 contracts

Commercial Traders (Companies):

Net Long Positions: 25%

Open Interest: 50,000 contracts

Non-Reportable Traders (Small Traders):

Net Short Positions: 35%

Open Interest: 30,000 contracts

COT Ratio: 1.8 (indicating a bearish trend)

🌞Sentimental Analysis

Institutional Sentiment: 55% bearish, 45% bullish

Retail Sentiment: 50% bearish, 50% bullish

Market Mood: The overall market mood is bearish, with a sentiment score of -20

🌞Positioning Analysis

Institutional Traders: Net short positions increased by 10% over the past week, indicating growing bearish sentiment

Retail Traders: Net short positions decreased by 5% over the past week, indicating decreasing bearish sentiment

Leverage: The average leverage used by traders has decreased to 2.2, indicating decreasing confidence in the market

🌞Overall Outlook

The overall outlook for EUR/AUD is bearish, driven by a combination of fundamental, technical, and sentimental factors. The expected growth in the Australian economy, low interest rates, and bearish market sentiment are all supporting the bearish trend. However, investors should remain cautious of potential upside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR-AUD Will Go UP! Buy!

Hello,Traders!

EUR-AUD is trading in an

Uptrend and we are now

Seeing a nice bullish reaction

From the horizontal support

Of 1.7153 which reinforces our

Bullish bias and we will be

Expecting the pair grow more

With the target of 1.7417

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR/AUD D Closure Is Amazing , Short Setup Valid To Get 250 PipsWe have a very good daily closure in bearish in this pair and i think the price will go down a little after this huge movement to upside without any correction , so i think this res will be the best place tp can sell this pair and at least 250 pips target !

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURAUD challenging important resistance at 1.7330The EURAUD currency pair maintains a bullish sentiment, supported by the prevailing long-term uptrend. However, recent price action suggests an overextended bullish breakout, approaching significant resistance zones on both daily and weekly timeframes.

The key trading level to watch is 1.7050. A potential overbought pullback from current levels, followed by a bullish rebound from 1.7050, could extend the upside, targeting 1.7320, with further resistance at 1.7676 and 1.7800 over a longer timeframe.

Conversely, a confirmed break below 1.7050, with a daily close under this level, could signal a corrective pullback towards 1.6880 and 1.6800.

Conclusion:

While the broader trend remains bullish, the current overextended move suggests the possibility of short-term retracements. Holding 1.7050 as support will be critical for further upside continuation, while a breakdown below this level could trigger deeper corrections. Traders should monitor price action closely and adjust risk management accordingly.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.