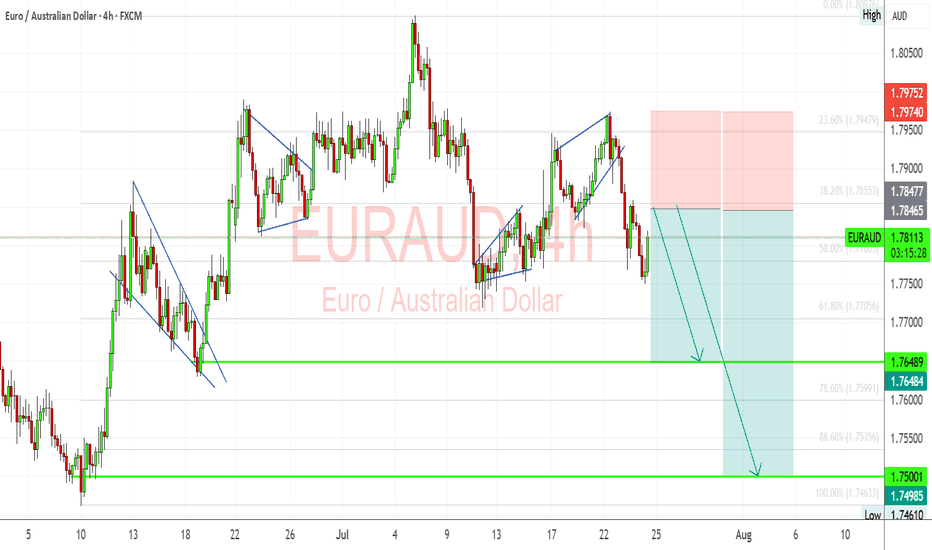

EUR/AUD Confirmed Downside Direction,Short Setup To Get 150 PipsHere is My 2H T.F Chart and if we have a look we will see that we have a very good breakout after this sideways movement , the price finally closed below my res and we have a good confirmation with 4H Bearish candle closure below my res so i`m waiting the price to go back to retest this broken res and then we can enter a sell trade . and if the price closed above my res with daily candle then this idea will not be valid anymore .

Euraudanalysis

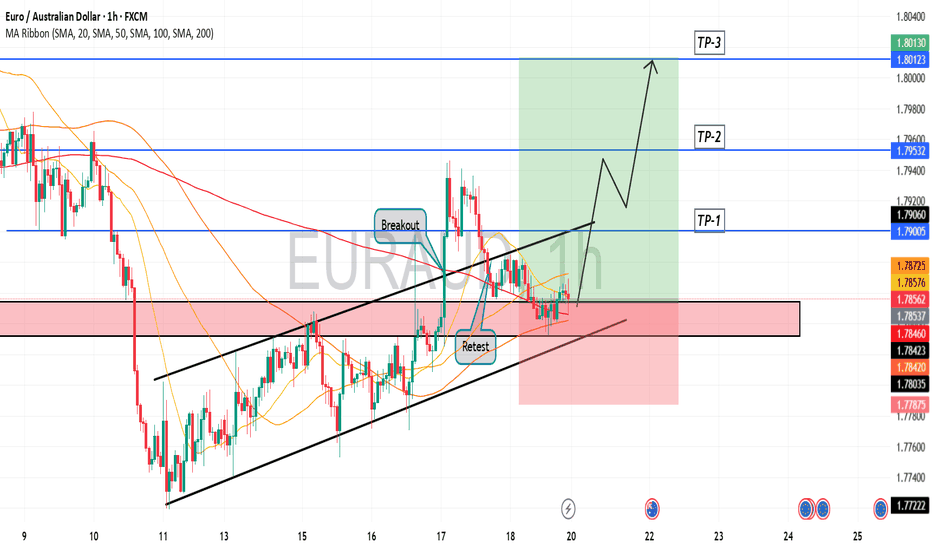

One Sweet Bullish Candle Above 50EMA… and I’m All Yours, 1.7940I’ve got a lovely 1H bullish range from 1.7733 to 1.7940 — pure potential.

Market gave me a 100-pip pullback/retracement from 1.7940 to 1.7840 — just a little mood swing. 😒

Now I’m patiently stalking...

If a bullish candle closes above my 50EMA,

I’m not thinking twice — I’m riding the bull! 🐂💥

SL? Depends on the candle’s vibe:

If it’s a strong Marubozu, I’ll trust it like a loyal partner — SL goes just below it.

TP? Straight to 1.7940 — no detours, no drama. 🎯

Wish me luck… and a Marubozu with commitment issues! 😂📉📈

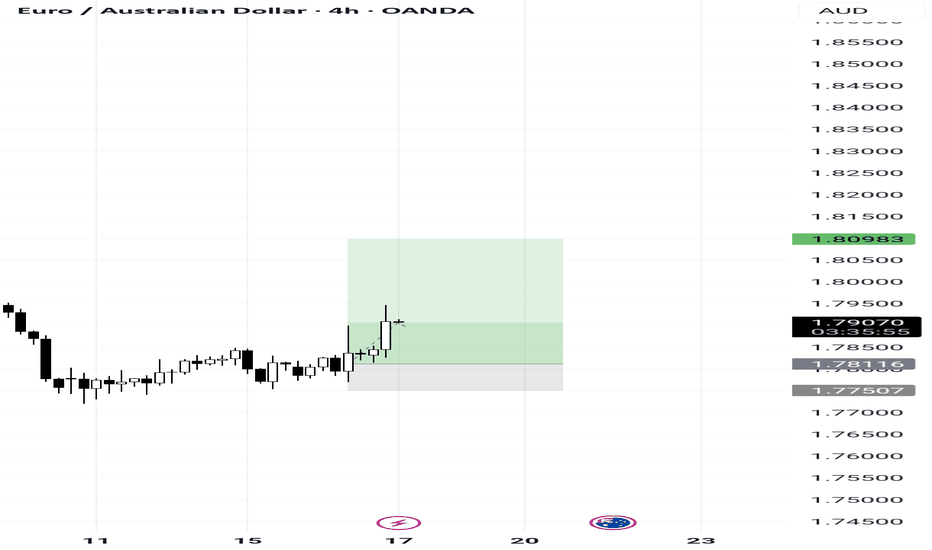

EURAUD Ready to Bounce? Key Support & Fundamentals Aligned!Today I want to share a Long position idea on EURAUD ( OANDA:EURAUD ) with you.

From a fundamental perspective , both the Euro (EUR) and Australian Dollar (AUD) are currently under pressure. However, the Aussie appears fundamentally weaker in the short term, making the EURAUD Long setup more favorable at this stage.

AUD Weakness :

The Reserve Bank of Australia (RBA) has held rates steady at 3.85%, but recent inflation data has dropped to 2.7%, the lowest in over 3 years.

Most economists now expect the RBA to cut rates in its next meeting in August, possibly by 25 basis points.

Slowing economic growth and dovish forward guidance from the central bank are weighing heavily on AUD sentiment.

EUR Outlook :

The European Central Bank (ECB) is also facing weak economic data, but is taking a more cautious approach toward cutting rates.

Despite softer PMIs and sluggish growth in countries like Germany and France, the ECB has not confirmed a near-term rate cut, keeping EUR relatively stable.

This divergence between the RBA’s dovish stance and the ECB’s pause is supportive of EUR strength against AUD.

Summary :

With the RBA likely to ease policy soon and the ECB holding ground for now, the interest rate differential favors EURAUD upside. Fundamentals point toward further weakness in AUD, making the EURAUD Long a strategically sound trade idea for the coming days.

-------------------------------------------

Now let's analyze the conditions of the EURAUD chart on the 4-hour time frame .

EURAUD is currently trading near the Support zone(1.772 AUD-1.763 AUD) , Potential Reversal Zone(PRZ) , and near the lower line of the descending channel .

According to Elliott Wave theory , EURAUD appears to have completed a Zigzag Correction(ABC/5-3-5) .

Also, we can see the Regular Divergence(RD+) between Consecutive Valleys .

I expect EURAUD to rise to at least 1.784 AUD .

Second Target: 1.792 AUD

Note: Stop Loss(SL): 1.762 AUD

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/Australian Dollar Analyze (EURAUD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Australian inflation and supportive commodity dynamics continue to boost AUD sentiment. Technically, the pair has broken down from a rising wedge, confirming bearish momentum and setting the stage for further declines toward key support near 1.7648 and potentially 1.7500.

🟢 Current Bias: Bearish

🔑 Key Fundamentals:

ECB: Markets expect the ECB to hold rates steady this week. While this ends a 7-year streak of cuts, the bank has turned cautiously neutral, with no clear signal of future tightening. Core inflation remains subdued, and growth momentum across Germany and the euro area is weak.

RBA & Australia: The RBA faces persistent inflation risks after the June CPI surprised to the upside, putting rate hikes back on the table. The Aussie dollar is drawing strength from this, especially with rising commodity prices and China's potential fiscal stimulus aiding demand-side confidence.

Macro Divergence: Australia’s macro picture is improving vs. the eurozone. AUD has tailwinds; EUR is under pressure from stagnant growth and tepid inflation outlook.

⚠️ Risks to Bias:

ECB Surprise: A sudden hawkish tone from the ECB (e.g., lifting forecasts or emphasizing wage-driven inflation risk) could spark short-term EUR upside.

RBA Softness: A dovish RBA pivot or weak Aussie data could weaken AUD strength and slow EURAUD downside.

Geopolitical Risk: Broader global volatility (e.g., US-China, oil disruptions) could cause flows into euro as a semi-safe haven.

📅 Key News/Events to Watch:

ECB Rate Decision & Press Conference – July 25

Eurozone Flash GDP + CPI – Next week

China industrial data (AUD-sensitive)

RBA August Meeting Statement (early Aug)

📉 Technical Breakdown (4H Chart):

Price broke bearish from a wedge consolidation.

Minor bullish pullbacks are being sold into, confirming a distribution phase.

Targets:

1st Target: 1.76480 (support & fib confluence)

2nd Target: 1.7500–1.7460 zone (major swing low)

Resistance: 1.7855–1.7975 zone is key invalidation area.

Structure favors lower highs & continuation patterns until support zones break.

🧭 Leader/Lagger Behavior:

AUD is leading the move. Strong CPI and China demand backdrop are fueling bullish AUD momentum.

EUR is lagging, tracking broader USD risk tone and internal Eurozone data weakness.

EURAUD is currently reactive to external forces rather than setting direction for other pairs.

✅ Summary: Bias and Watchpoints

Bias: Bearish

Fundamentals: Weak Eurozone growth vs. hotter Aussie inflation and hawkish RBA tone.

Risk: ECB hawkish tilt or a dovish shift from the RBA.

Event to Watch: ECB press conference and Aussie CPI commentary from policymakers.

Leader/Lagger: Lagger — following AUD strength rather than leading.

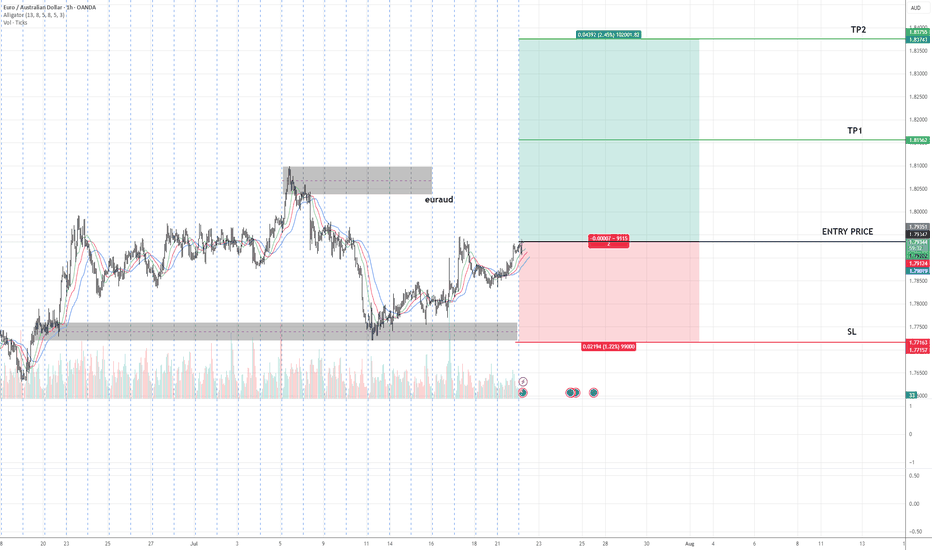

EURAUD | One Kiss from 1.7906 and I’m In – TP 140 Pips!The big picture of EURAUD is SELL possible up to 1.7750

Spot that H1 BUY range?

Inside it, there is conflict. A sneaky SELL range form inside it after rejection H4 BLUE LINE.

See that top blue line at 1.7916?

It got a gentle kiss from the H4 candle (REJECTION).

Then H1 already whispered, "a sweet breakout"!

📌LONG STORY SHORT, I'M SELL AROUND 1.7888 - 7906

If H4 comes and kisses one of the line (just a touch and wick), I’m SELLING — no more playing hard to get. 😘

Other wise, I’ll quietly cry in the corner

TP? 1.7750 — that’s a sweet 140-candlelit dinner!

WISH ME LUCK...!!!

EURAUD – Planning Ahead, Not PredictingAs usual, I have marked my level.

🎯 I’m waiting for the price to reach it and if a valid sell signal appears, I will enter a short position.

If the level is broken cleanly,

I’ll wait for a pullback and enter a buy trade.

We are just traders, not predictors.

We have no impact on the market —

we are just a tiny part of a huge system.

🧠 So I never say: “Price will come here, then must fall.”

That’s not my mindset.

My belief is simple:

Manage risk, be prepared for everything.

One trade won’t make me rich,

and I won’t let one trade destroy me.

📌 Stop-loss is the first and last rule.

Trading without a stop-loss is just gambling.

EURAUD Buy Setup – Advanced Analysis Entry: As marked on chart

🎯 TP1: As highlighted on chart

🎯 TP2: As highlighted on chart

🛑 SL: As defined on chart

📊 Technical Insight:

Price has completed a higher low formation, indicating the potential start of a new uptrend phase.

The market has shown an accumulation phase followed by a breakout above minor resistance, suggesting strong demand at current levels.

Volume analysis supports the breakout, with increased participation on bullish pushes and decreasing volume on retracements, confirming healthy trend dynamics.

📍 As long as price holds above the stop loss zone, we expect continuation towards TP1 and TP2 in line with the primary trend.

EURUAD is in the Buy directionHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURAUD SELL IDEAWe can only anticipate sells if price breaks out of the trendline,there has been rejection already on H4 due to a reaction from breakerblock.

EURAUD still looks bearish internally and if you look closely you will notice price is forming an expansion

But if price keeps keeps the bullish run which I doubt,we can anticipate the bullish move to continue as it has hit the 3rd touch on the trendline

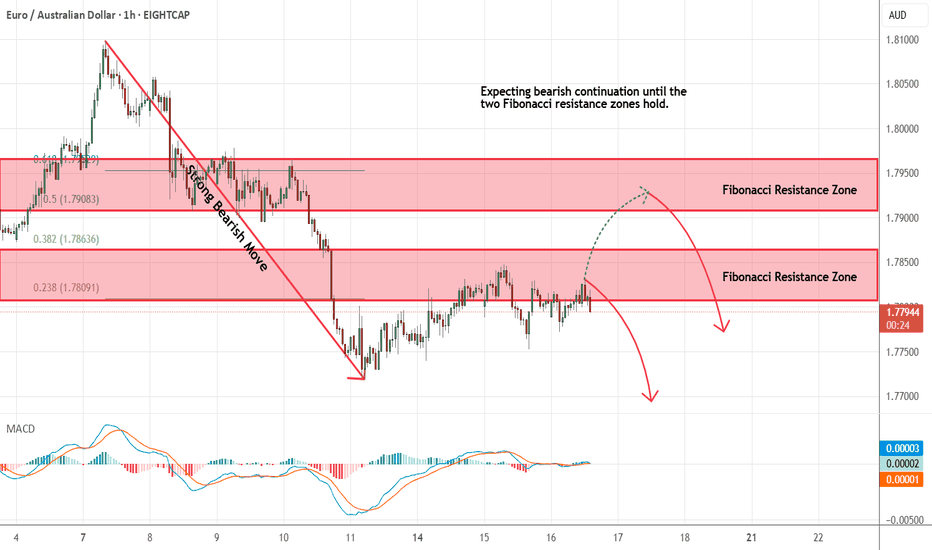

EURAUD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

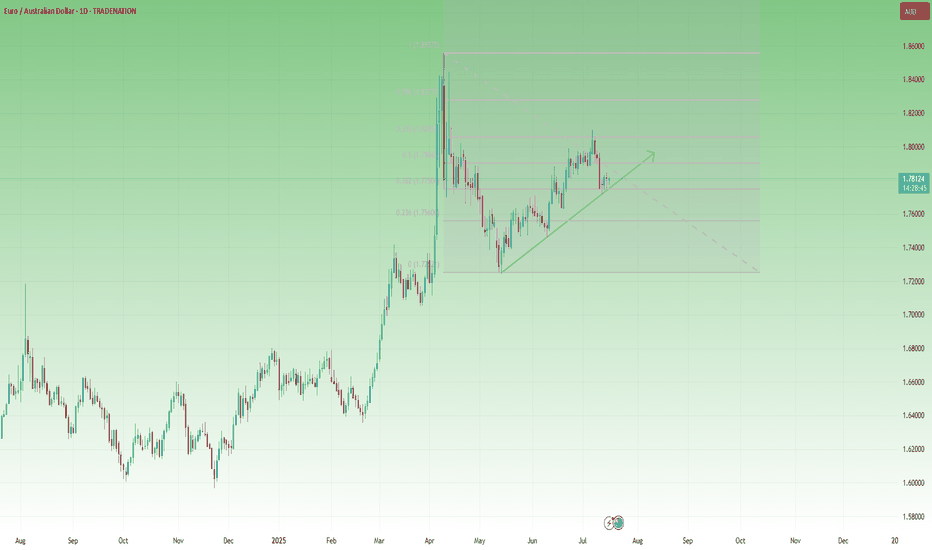

EURAUD Flag Forming Below 1.80 – Time to Sell the Rally?📈 The Big Picture

In mid-February, EURAUD exploded to the upside, gaining over 2000 pips in just two weeks. After peaking near 1.85, the pair corrected sharply, returning to more balanced levels around 1.72.

🕰️ What’s happened since?

The market has resumed its climb and just recently made a new local high at 1.81. On the surface, it looks like bulls are still in control – but a closer look reveals warning signs.

🔍 Key structure observations:

• The current rally appears to be a measured move, topping out near the 61.8% Fibonacci retracement of the previous drop

• Price structure is overlapping, suggesting weak momentum

• A large flag pattern is developing – typically bearish in this context

• The pair still trades above the ascending trendline, but a breakdown is looming

📍 Current price: 1.7805

🎯 Swing Trade Plan

From a swing trading perspective, I’m looking to sell rallies near the 1.80 zone, with:

• Negation: if the price breaks clearly above the recent high

• Target: the recent low around 1.7250 – where the last correction ended

________________________________________

📌 Conclusion:

EURAUD may have exhausted its bullish energy. The technical picture suggests we are in the late stage of the rally, with bearish patterns stacking up. Unless bulls manage a clean breakout above 1.80, this looks like a great place to position for a medium-term reversal. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EURUAD is in the Buy direction from the Third TouchHello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURAUD confirms the continuation of the bearish correction trendEURAUD has just broken the rising channel to start a downtrend. The confirmation is there with the h4 candle closing completely below the support zone of the Price Channel. This corrective downtrend can now extend to the support of 1.766. The support zone is a Break point at the moment 1.778 is a positive DCA point with a SELL Entry above.

Support: 1.778-1.766

Resistance: 1.790-1.797

Sell now: Resistance zone 1.79000

Target: 1.778 Support zone, followed by 1.766 lower zone

Sell Trigger: Break below 1.778

BUY Trigger: rejection 1.778 Support zone

Leave your comments on the idea. I am happy to read your views.

EURUAD is in the Buy direction from the Third Touch Hello Traders

In This Chart EUR/AUD 4 HOURLY Forex Forecast By FOREX PLANET

today EUR/AUD analysis 👆

🟢This Chart includes_ (EUR/AUD market update)

🟢What is The Next Opportunity on EUR/AUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

euraud sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/AUD Made Perfect Breakout , Long Setup Valid To Get 150 PipsHere is My 2H T.F Chart and if we have a look we will see that we have a very good breakout after this ascending triangle , the price finally closed above neckline for this pattern and we have a good confirmation so i`m waiting the price to go back to retest this broken neckline and then we can enter a buy trade . and if the price closed below my neckline with daily candle then this idea will not be valid anymore .

EURAUDBullish Continuation from a Bull Flag Pattern + Break of Structure

Bull Flag Pattern Formed

After a strong impulsive bullish move, the price forms a consolidation channel (flag), sloping slightly downward.

This is a classic bull flag pattern, indicating bullish continuation.

Break of Structure (BOS) Confirmed

The price broke above the flag, showing a BOS (Break of Structure) to the upside.

This confirms a potential continuation of the uptrend.

Fibonacci Confluence

Price retraced to the 61.8–78.6% Fibonacci zone (golden zone), which often acts as a strong reversal area in trending markets.

This gives a good risk-to-reward (R:R) opportunity.

Higher Highs and Higher Lows (Market Structure)

The market is forming HHs (Higher Highs) and HLs (Higher Lows) – typical of a healthy uptrend.

Demand Zones Below

Several demand zones (blue boxes) support price if it retraces.

The strong low marked adds structure-based support beneath the trade entry.

Risk-to-Reward (R:R) Setup

You’ve set a tight stop loss below structure and a larger take profit aiming at the -61.8% and 100% Fib extensions – a favorable R:R ratio

EUR/AUD 1H – Decision Point Ahead Breakout or Fakeout? Eyes on Confirmation Zone 👁️

EUR/AUD has finally tapped into a critical resistance at 1.79900, a level previously rejected with high volatility. The current price action is testing this ceiling, with signs of strength — but smart money waits for confirmation.

What We’re Seeing:

🔹 Uptrend Intact: All EMAs are aligned in bullish order.

🔹 Bullish Fair Value Gap (FVG) formed below — a potential area of demand.

🔹 Price now hovering inside the Confirmation Zone — marked by previous highs and psychological resistance.

🔹 Volume building gradually — but breakout volume not confirmed yet.

⚖️ Summary:

Trend: Upward

Structure: Breakout under test

Momentum: Bullish

Market Phase: Confirmation / decision point

Key Behavior: Watch for commitment or rejection without predicting it