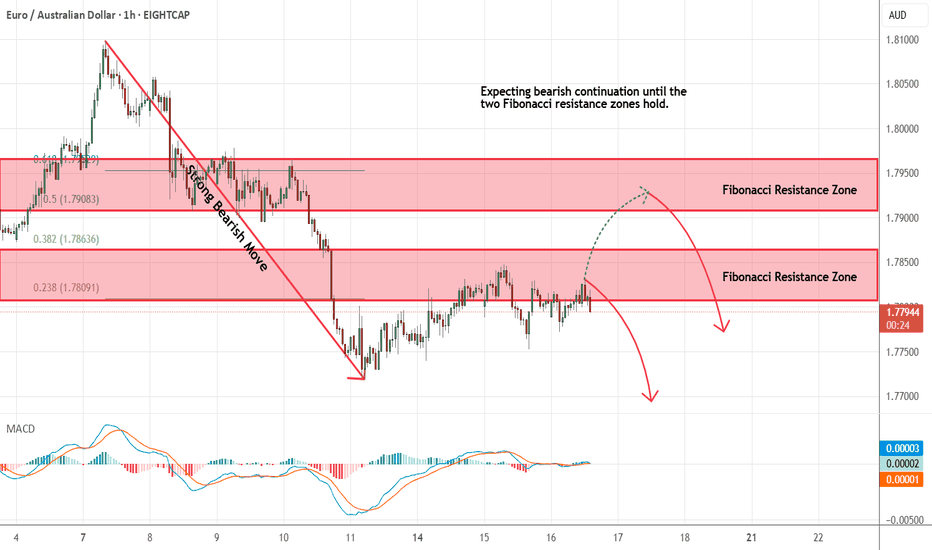

EURAUD - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Euraudbearish

EUR/AUD "Euro vs Aussie" Forex Bank Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/AUD "Euro vs Aussie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (1.81000) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.74500 (or) Escape Before the Target

💰💵💴💸EUR/AUD "Euro vs Aussie" Forex Market Heist Plan (Day / Swing Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/AUD "Euro vs Aussie" Forex Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/AUD "Euro vs Aussie" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise placing Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 1.66000 (swing Trade Basis) Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 1.62700 (or) Escape Before the Target

Secondary Target - 1.61000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/AUD "Euro vs Aussie" Forex Market is currently experiencing a Bearish trend., driven by several key factors.

🌞Market Overview

Current Price: 1.64624

30-Day High: 1.6734

30-Day Low: 1.5931

30-Day Average: 1.6231

🌞Fundamental Analysis

Economic Trends: The European economy is expected to grow, driven by a rebound in consumer spending and investment

Interest Rates: The European Central Bank is expected to maintain low interest rates, supporting the euro

🌞Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for commodities, including Australian exports

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for commodities and supporting the Australian dollar

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting currency markets

🌞COT Data

Non-Commercial Traders (Institutional):

Net Short Positions: 40%

Open Interest: 80,000 contracts

Commercial Traders (Companies):

Net Long Positions: 25%

Open Interest: 50,000 contracts

Non-Reportable Traders (Small Traders):

Net Short Positions: 35%

Open Interest: 30,000 contracts

COT Ratio: 1.8 (indicating a bearish trend)

🌞Sentimental Analysis

Institutional Sentiment: 55% bearish, 45% bullish

Retail Sentiment: 50% bearish, 50% bullish

Market Mood: The overall market mood is bearish, with a sentiment score of -20

🌞Positioning Analysis

Institutional Traders: Net short positions increased by 10% over the past week, indicating growing bearish sentiment

Retail Traders: Net short positions decreased by 5% over the past week, indicating decreasing bearish sentiment

Leverage: The average leverage used by traders has decreased to 2.2, indicating decreasing confidence in the market

🌞Overall Outlook

The overall outlook for EUR/AUD is bearish, driven by a combination of fundamental, technical, and sentimental factors. The expected growth in the Australian economy, low interest rates, and bearish market sentiment are all supporting the bearish trend. However, investors should remain cautious of potential upside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

euraud analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURAUD (Bearish)“The Trend is your best friend”

This statement holds true in all aspects of trading; and in this case with EURAUD, we see an example of this.

Remember, Trading is basically “strategic gambling” when simplified to the average person. However, if we can form multiple confluences along with price action and market structure, our probabilitys go up.

**Remember Risk Management and Candlestick Confirmation before blindly entering any trade**

EURAUD Trading Plan 28/Feb/2024Hello Traders,

Hope you all are doing good!!

I expect EURAUD to go Down after completing this wave.

Look for your SELL setups.

Please follow me and like if you agree or this idea helps you out in your trading plan.

Disclaimer: This is just an idea. Please do your own analysis before opening a position. Always use SL & proper risk management.

Market can evolve anytime, hence, always do your analysis and learn trade management before following any idea.

EURAUD Technical Analysis And Trade IdeaRecently, the EURAUD has exhibited a robust downtrend. This video offers an intricate analysis of this trend, thoroughly scrutinizing price actions and unveiling prospective trading opportunities by extensively reviewing both the weekly and daily charts. Prepare for a comprehensive evaluation of price fluctuations, market trends, trend analysis, and essential technical elements. It's imperative to highlight that the content shared here is solely for educational purposes and should not be misconstrued as financial guidance.

EURAUD Long Term Selling Trading IdeaHello Traders

In This Chart EURAUD HOURLY Forex Forecast By FOREX PLANET

today EURAUD analysis 👆

🟢This Chart includes_ (EURAUD market update)

🟢What is The Next Opportunity on EURAUD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURAUD SHORT The price make nice break out for short trade with many confirmation on it, as you all can see channel pattern from daily price already touch the upper resistance channel pattern with nice breakout from the flag pattern and resistance area. The price also make nice big red candle confirmation so i assuming it will low as target. Remember your money management !

EURAUD Short Scenario

Entry - In the supply zone

Target - 1.45680

Invalidation - 1.48820

Risk to reward ratio - 8

Technical confirmations

Full cycle of Elliot wave impulsive part is done and now the corrective part(ABC) needs to be finished towards C. Price has reached the supply zone forming the B wave.

Technical confirmations

Unemployment report in Australia comes on Thursday. The market consensus stands at 35.0 thousand for August, which would be a huge rebound after the -40.9 thousand reading in July.

Australian GDP grew by 0.2 percent in Q2 2022, from 0.7 to 0.9.

EURAUD possible sell zone!!EURAUD ( D) has formed a daily hanging man on an important level of resistance. There is a high probability that the price will have another drop as after the monthly close, it has formed a monthly very strong bearish engulfing pattern means a long-term down trend resumed.

If you enjoy this content, press like button :)

EUR/AUD - SELLMonthly:

1. Impulse

2. Brake of previous structure

3. Correction on lower timeframe

Looks bearish at this moment

Weekly:

We can see more clearly on the Weekly timeframe

the impulse, brake of structure and correction.

Looks bearish at this moment.

Daily:

Fibonacci is added from lower timeframe

1.Impulse

2.Correction

3. Engulfing Daily candle from Fibonacci level

Going to make a entry on 4h timeframe

4H:

Bearish Engulfing candles and pinbars from fibonacci levels. Good time for entry

RR 1:4