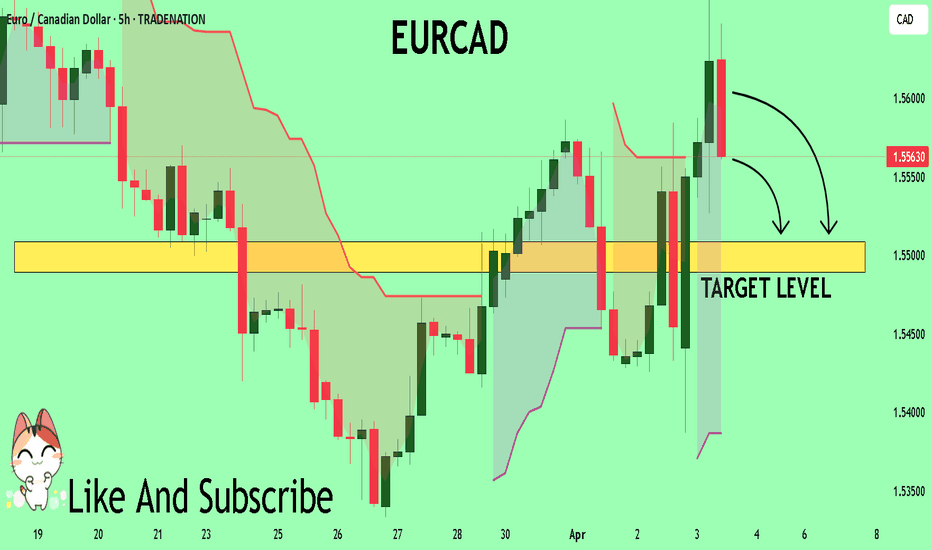

EURCAD: Short Signal Explained

EURCAD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell EURCAD

Entry Level - 1.5767

Sl - 1.5868

Tp - 1.5567

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

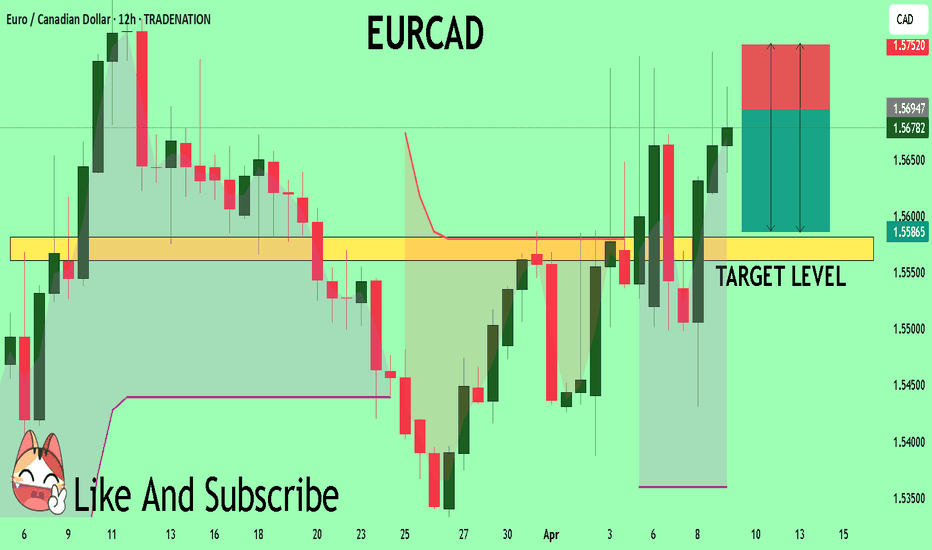

Eurcad!

EUR_CAD LOCAL REBOUND COMING|LONG|

✅EUR_CAD is trading in

A strong uptrend and the pair

Made a local correction on Friday

To retest the local horizontal

Support level of 1.5700 so

A bullish continuation is to

Be expected but a small

Lot size use is advised

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD: Short Trading Opportunity

EURCAD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURCAD

Entry Point - 1.5748

Stop Loss - 1.5828

Take Profit - 1.5595

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURCAD A Fall Expected! SELL!

My dear subscribers,

This is my opinion on the EURCAD next move:

The instrument tests an important psychological level 1.5572

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.5508

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD Breakdown Watch–Bearish Divergence + Fundamental WeaknessEURCAD rallied into a key turncoat zone (former resistance → support)

Currently consolidating within this zone and showing clear RSI bearish divergence on both 1H and 4H timeframes.

Price is losing momentum while macro and seasonal factors align for a short bias.

🔍 Macro & Seasonality Confluence:

EUR Fundamentals: Worsening LEI, Endogenous & Exogenous scores

CAD Stability: Mildly bearish, but stronger than EUR

Seasonal Bias: EURCAD turns bearish after April 15

EURCAD A Fall Expected! SELL!

My dear subscribers,

EURCAD looks like it will make a good move, and here are the details:

The market is trading on 1.5694 pivot level.

Bias - Bearish

My Stop Loss - 1.5752

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.5581

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCAD Resistance , All eyes on SellingHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURCAD Buy signal on 2023 fractal.It's been too long since we last looked on the EURCAD pair (November 29 2024, see chart below) but it delivered nonetheless our 1.500 Target:

Thit time the price is consolidating after a strong February rally and posts a similar pattern to October 2022 - January 2023. The 1D RSI sequences between those fractals are identical and it is not technically unreasonable to expect again the bullish trend to be resumed and target the 1.382 Fibonacci extension at 1.62500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURCAD: Bearish Continuation & Short Signal

EURCAD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short EURUSD

Entry - 1.5599

Sl - 1.5656

Tp - 1.5491

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/CAD Forex Bank Heist Plan (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/CAD "Euro vs Loonie" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (1.54200) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 1.56000 (swing / Day Trade Basis) Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.51600 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/CAD "Euro vs Loonie" Forex Bank Heist Plan (Scalping / Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/CAD H4 | Potential pullback opportunity?EUR/CAD could fall towards an overlap support and potentially bounce off this level to climb higher.

Buy entry is at 1.5596 which is an overlap support.

Stop loss is at 1.5488 which is a level that lies underneath a swing-low support and the 61.8% Fibonacci retracement.

Take profit is at 1.5737 which is a multi-swing-high resistance that aligns with the 78.6% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EUR-CAD Free Signal! Sell!

Hello,Traders!

EUR-CAD is making some

Bullish gains but the pair

Is approaching a horizontal

Resistance level of 1.5577

From where we can enter

A short trade with the

Target Level of 1.5508

And the Stop Loss of 1.5592

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

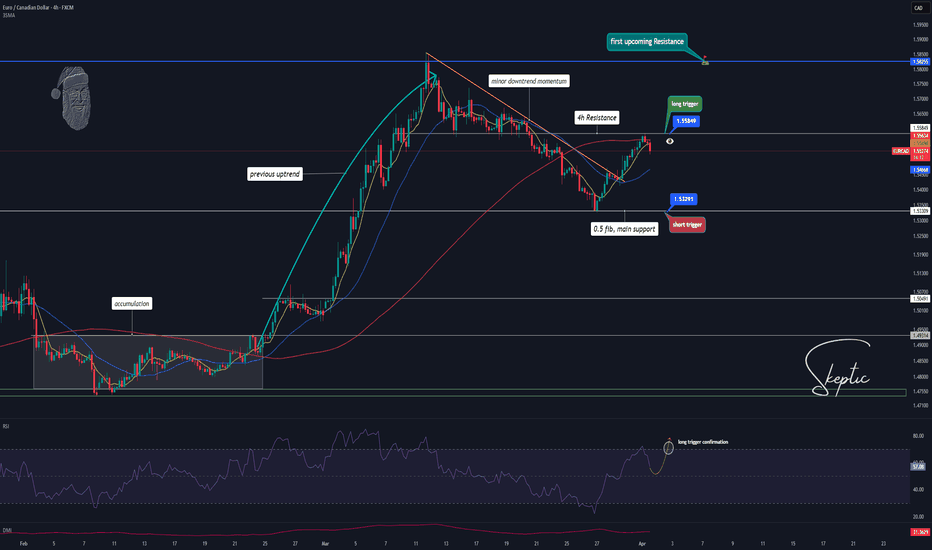

Skeptic | EUR/CAD at Crossroads: 1.55849 vs. 1.53291Welcome back, guys! 👋 I'm Skeptic.

Today, we’re diving deep into EUR/CAD, analyzing key levels and potential triggers. 🔍

Market Structure & Current Outlook

Looking at the 4H time frame , we initially saw an accumulation phase from February 3rd to February 24th. After breaking out from the accumulation range, price rallied strongly, continuing the major uptrend until 1.58552 .

Following this peak, EUR/CAD entered a corrective phase, forming a secondary downtrend that retraced to the 0.5 Fibonacci level.

Now, the minor downtrend has broken , signaling a potential continuation of the major 4H uptrend. With strong confluence for a bullish move, we’ll be looking for a long setup, but we’ll also prepare for a potential short trigger in case price reverses. Remember, as traders, we analyze the market from both perspectives and execute based on confirmations—skeptical eyes always! 🔮👽

📈 Bullish Scenario (Long Setup):

🔹 Trigger: Break & close above 1.55849

🔹 Confirmation: 7 SMA below the breakout candle

RSI entering overbought zone

🔹 Invalidation: Rejection & close back below 1.54325

📉 Bearish Scenario (Short Setup):

🔹 Trigger: Drop below 1.53291

🔹 Confirmation: RSI entering oversold zone

⚠️ Key Notes & Risk Management

🔹 Fundamentals:

This Friday is NFP day, a crucial event that could create volatility in the market.

Always consider fundamental catalysts when executing trades.

🔹 Risk Management:

Avoid overleveraging.

Wait for confirmed breaks before entering positions.

Stick to your trading plan and stop-loss strategy.

Stay sharp, and I’ll see you in the next analysis! 🚀

Bearish revrsal off pullback resistance?EUR/CAD is rising towards the pivot and could reverse to the 1st support which is a pullback support.

Pivot: 1.5629

1st Support: 1.5420

1st Resistance: 1.5731

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/CAD BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

EUR/CAD pair is trading in a local downtrend which know by looking at the previous 1W candle which is red. On the 1H timeframe the pair is going up. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 1.542 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

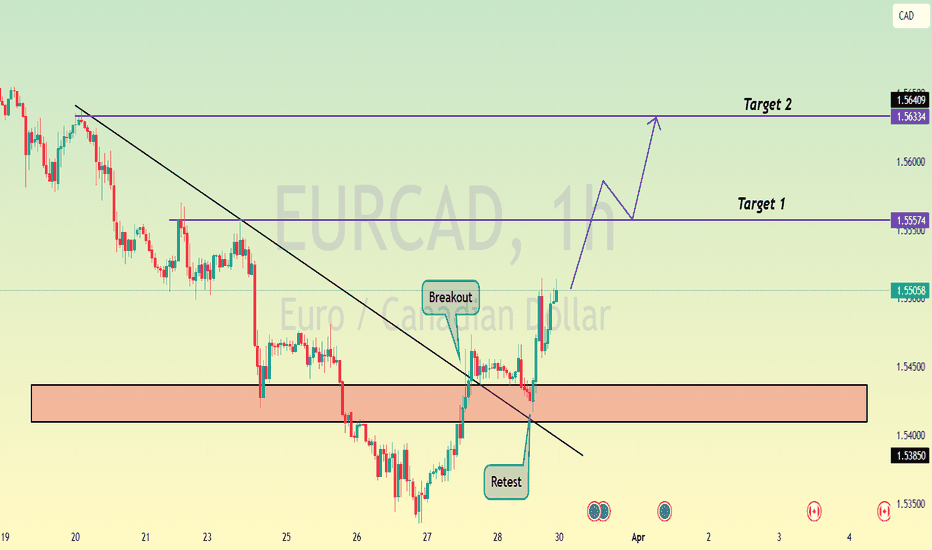

EURCAD , Successful Trendline Break , Ready for BullHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EURCAD Resistance , All eyes on SellingHello Traders

In This Chart EURCAD HOURLY Forex Forecast By FOREX PLANET

today EURCAD analysis 👆

🟢This Chart includes_ (EURCAD market update)

🟢What is The Next Opportunity on EURCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Bearish reversal off pulback resistance?EUR/CAD is rising towards the resistance level which is a pullback resistance that line sup with the 38.2% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.5548

Why we like it:

There is a pullback resistance level that line sup with the 38.2% Fibonacci retracement.

Stop loss: 1.5695

Why we like it:

There is a pullback resistance level that line sup with the 71% Fibonacci retracement.

Take profit: 1.5340

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.