Eurchflong

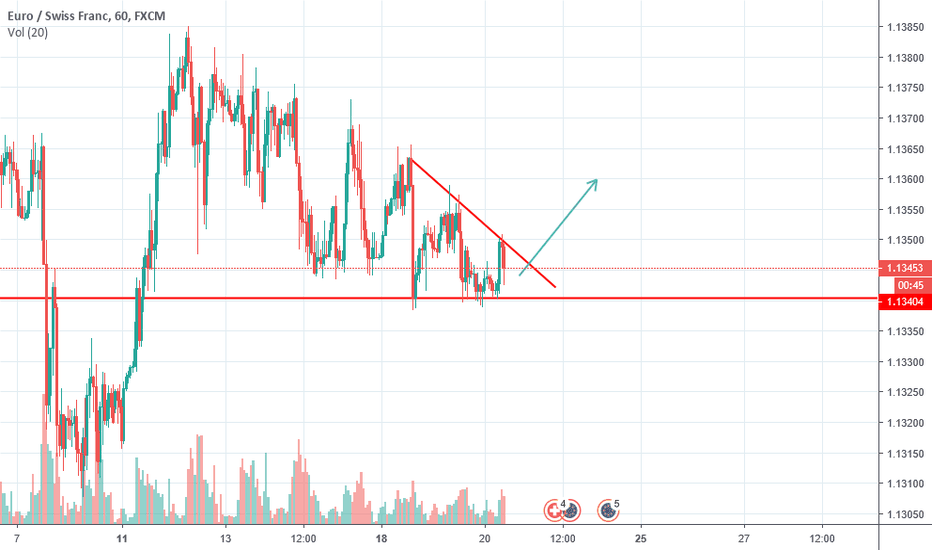

New trade idea EURCHFPrimary Trade Setup´:

We see a couple that we must have patience, we wait for the first re-evaluation to detect a new proof of the price that is natural to happen (unless they manipulate the price). We wait for the first re-evaluation or if the price goes down even more, we can enter directly in the indicated area since we would be accumulating the interest of the buyer.

EURCHF approaching resistance, potential drop! EURCHF is approaching our first resistance at 1.1260 (horizontal pullback resistance, 61.8% Fibonacci extension, 23.6% Fibonacci retracement) where a strong drop might occur below this level to our major support at 1.1182 (horizontal swing low support).

Ichimoku cloud is also showing signs of bearish pressure and RSI (21) is seeing a bearish exit.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

The #EURCHF is in an excellent potential areaStrong support in the 1.1185 area has already supported the eurchf price twice. It can be seen that every touch of the eurchf in the above support has led to an average price increase of 250 pips.

We can see that we have the exact same model in the Stochastic indicator that strengthens us the buying signal.

(In the case of breaking the support, of course, the signal will change from a buy signal to a sell signal)

Buy EURCHF:

Entry Price:1.1245

Stop loss: 1.1170

Take Profit: 1.1370

EURCHF approaching resistance, potential drop! EURCHF is approaching our first resistance at 1.1260 (horizontal pullback resistance, 61.8% Fibonacci extension, 23.6% Fibonacci retracement) where a strong drop might occur below this level to our major support at 1.1182.

Ichimoku cloud is also showing signs of bearish pressure.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

#EURCHF Time for some Bullish action?We can clearly see that FX:EURCHF is in the up-trend for 4 years.

Price bounce down from 1.20000 but, we noticed that price breakout from the bearish channel, which can indicate, it is only a pullback.

After a breakout price squeezed to fake out all early buyers.

Now we are in this triangle and, if we could get a push to up-side from this triangle then we should witness a nice bullish action

-plus, we have a nice bullish divergence.

Okay so summarizing

following analysis, I believe EURCHF have nice bullish potential, so I'm going to buy this pair in this week.

Let's go to work!

EURCHF approaching resistance, potential drop! EURCHF is approaching our first resistance at 1.1369 (horizontal swing high resistance, 61.8% Fibonacci retracement, 61.8% Fibonacci extension) where a strong drop might occur below this level pushing price down to our major support at 1.1332 (61.8% Fibonacci retracement).

Stochastic (21,5,3) is also approaching resistance where we might see a drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.