EURGBP

DeGRAM | EURGBP rebound in the channelEURGBP is in a descending channel between the trend lines.

The price is moving from the lower boundary of the channel and the support level.

The chart holds the support level, which has already acted as a rebound point.

We expect a rise after consolidation above the nearest retracement level.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP rebound from the lower boundary of the channelEURGBP is in a descending channel above the trend lines.

The price is moving from the lower boundary of the channel.

The chart has consolidated above the dynamic resistance and the 50% correction level.

We expect the rebound to continue.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EUR/GBP Chart Analysis – Double Bottom Reversal & Breakout Setup1. Market Structure & Context

The EUR/GBP daily chart presents a well-defined double bottom reversal pattern, indicating a potential trend shift from a prolonged downtrend to an uptrend.

The pair has been in a bearish phase, as reflected by the descending trendline.

However, price action suggests a possible trend reversal, as buyers are stepping in near a key demand zone.

A successful neckline breakout would confirm the bullish reversal, potentially leading to significant upside movement.

2. Key Chart Patterns & Technical Levels

A. Double Bottom Formation (Bullish Reversal Pattern)

The double bottom is a powerful reversal pattern, often signaling the end of a downtrend. It consists of two similar low points, forming a "W" shape.

Bottom 1: The first low was established around 0.8200 - 0.8250, where buyers initially stepped in to push prices higher.

Bottom 2: Price retested this demand zone, but sellers failed to push it lower, confirming a strong support level.

Bullish Significance: The inability of sellers to break below the support zone suggests the exhaustion of selling pressure and increasing buy-side interest.

B. Neckline Resistance & Potential Breakout Zone

The neckline resistance is drawn around 0.8450 - 0.8500, a key level where previous price rallies were rejected.

A breakout above this zone, ideally with strong bullish volume, would validate the double bottom pattern and trigger a bullish breakout trade.

C. Descending Trendline Breakout Attempt

The long-term downtrend resistance (trendline) has been holding since mid-2024.

Price is currently testing this trendline; a clear breakout and retest would add further confidence to the bullish bias.

3. Trade Setup & Execution Plan

A. Entry Strategy

There are two possible entry strategies, depending on risk appetite:

Aggressive Entry: Buy immediately upon a breakout above 0.8500, anticipating a strong rally.

Conservative Entry: Wait for a breakout + retest of the neckline before entering, ensuring confirmation.

B. Stop Loss & Risk Management

Stop Loss (SL): Placed below the recent swing low at 0.82029.

This level acts as the last line of defense for bulls; if price drops below it, the bullish thesis is invalidated.

C. Take Profit (TP) Targets

TP1: 0.86122 (first resistance zone, a previous swing high).

TP2: 0.87284 (higher resistance level, next supply zone).

These levels serve as potential profit-taking areas where sellers may re-enter the market.

4. Additional Technical Confluences Supporting Bullish Bias

✔ Key Support Zone Holding Strong – The price has bounced twice from the demand zone (0.8200 - 0.8250), confirming strong buyer interest.

✔ Volume Confirmation Needed – A breakout with high volume increases the probability of sustained bullish momentum.

✔ RSI & Momentum Indicators – If RSI crosses above 50, it would further confirm bullish momentum, supporting the breakout trade.

✔ Favorable Risk-to-Reward Ratio (RRR) – A well-defined stop loss & take profit strategy ensures an optimal trade setup.

5. Summary & Final Trading Plan

Current Market Bias: Bullish if neckline breaks (Double Bottom Confirmation).

Entry Confirmation: Look for a breakout above 0.8500 with strong volume.

Profit Targets:

TP1: 0.8612

TP2: 0.8728

Stop-Loss Level: Below 0.8202 to protect against fake breakouts.

🚀 Final Tip for Traders:

Monitor price action & volume closely. A breakout without volume may lead to a false move. Confirmation with bullish momentum is essential for a high-probability trade setup.

EUR-GBP Bearish Breakout! Sell!

Hello,Traders!

EUR-GBP made a bearish

Breakout of key horizontal

Level of 0.8353 so we are

Bearish biased and after

A potential pullback we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP: Growth & Bullish Forecast

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current EURGBP chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/GBP (1H) Symmetrical Triangle Breakdown – Trade SetupThe EUR/GBP 1-hour chart presents a symmetrical triangle formation that has now broken to the downside, signaling a bearish continuation. This pattern is widely recognized in technical analysis and often acts as a continuation or reversal pattern, depending on the breakout direction. In this case, the price has breached the lower support boundary, indicating that sellers have taken control of the market.

In this detailed analysis, we will explore the chart structure, key technical levels, potential trade setups, and risk management strategies to navigate this move efficiently.

1️⃣ Understanding the Symmetrical Triangle Formation

A symmetrical triangle occurs when price action creates lower highs and higher lows, forming two converging trendlines. This reflects a period of market indecision, where buyers and sellers are evenly matched until a breakout occurs.

📌 Key characteristics of this triangle:

✅ Converging Trendlines – Representing lower highs and higher lows, suggesting market compression.

✅ Price Consolidation – The pair traded within this structure, awaiting a catalyst for breakout.

✅ Breakout Direction – A breakdown from the support level confirms a bearish move.

Pattern Psychology:

A symmetrical triangle often precedes a significant price move. Traders and investors monitor the breakout direction to determine the next trend. Here, the breakdown below the lower boundary signals a continuation of the prevailing bearish trend.

2️⃣ Key Levels & Chart Structure

🔹 Resistance Zone (Upper Boundary) – 0.84227

The upper trendline acted as a strong resistance level, preventing price from breaking higher multiple times.

The yellow-highlighted area represents a supply zone, where selling pressure was dominant.

Price attempted to break above this region but failed, confirming bearish dominance.

🔹 Support Level (Lower Boundary) – 0.83500

The lower boundary of the triangle previously held as support, where buyers attempted to push the price higher.

However, once price broke below this support, it confirmed a bearish trend continuation.

The blue horizontal support line represents a potential retest area, where sellers may step in again.

🔹 Breakout Confirmation & Price Action

The chart clearly shows a bearish breakout, as price broke through the lower trendline.

Retest Probability: Many breakouts experience a pullback to the broken support (now resistance) before resuming the downtrend.

The dashed black lines illustrate the expected bearish move, with a potential decline towards 0.82815.

3️⃣ Trading Plan & Entry Strategy

Based on this setup, traders can capitalize on the bearish move using a structured trading plan:

📌 Bearish Trading Setup (Short Position)

✔ Entry Strategy:

Traders can enter a short position either immediately after the breakout or after a retest of the broken support at 0.83500 - 0.83700.

The ideal confirmation would be bearish candlestick patterns, such as an engulfing candle or pin bar rejection on the retest.

✔ Stop-Loss Placement:

To mitigate risk, a stop-loss should be placed above the previous resistance level (0.84227).

This ensures protection against fake breakouts or sudden reversals.

✔ Target Price (Take Profit Level):

The measured move of a symmetrical triangle breakout is typically equal to the height of the triangle.

Based on this projection, the expected target is around 0.82815, a significant support level.

Traders may also scale out at intermediate levels (0.83000) to lock in profits.

✔ Risk-Reward Ratio (RRR):

A well-structured trade here presents an attractive RRR of approximately 1:3, meaning the potential reward is three times the risk.

A higher RRR enhances the probability of profitability over multiple trades.

4️⃣ Market Context & Fundamental Analysis

🔍 Why Is EUR/GBP Dropping?

While technical patterns are valuable, traders must also consider fundamental factors that drive currency pairs.

🟢 Possible Bearish Catalysts for EUR/GBP:

GBP Strength: If the British Pound (GBP) strengthens due to strong economic data or hawkish Bank of England (BoE) policy, EUR/GBP may continue declining.

EUR Weakness: The Euro (EUR) may be under pressure due to weak GDP growth, higher inflation, or dovish European Central Bank (ECB) statements.

Geopolitical Events: Any negative news impacting the Eurozone (e.g., political instability) could trigger further selling pressure on EUR/GBP.

5️⃣ Risk Management & Alternative Scenarios

While the current outlook favors a bearish move, traders must remain prepared for alternative scenarios.

⚠ Alternative Scenarios: 📌 False Breakdown:

If price closes back above the support level (0.83500 - 0.83700), it could indicate a failed breakout, potentially leading to a bullish reversal.

In this case, a breakout above 0.84227 would invalidate the bearish setup.

📌 Sideways Consolidation:

If the price stalls around 0.83300 - 0.83500, the market may range before the next move.

Traders should wait for clear confirmation before entering new trades.

6️⃣ Summary & Key Takeaways

✅ Pattern Identified: Symmetrical Triangle Breakout (Bearish).

✅ Breakout Direction: Price has broken below support, confirming a downtrend.

✅ Trade Setup:

Sell below 0.83500 (or on retest at 0.83700).

Stop Loss: Above 0.84227 (previous resistance).

Take Profit: Targeting 0.82815 based on the pattern’s measured move.

✅ Risk-Reward: Favorable, offering 1:3 or higher RRR.

✅ Fundamental Drivers: GBP strength or EUR weakness could accelerate the downtrend.

📢 Final Thoughts

This symmetrical triangle breakdown offers a high-probability trading opportunity for short sellers, with a clear technical structure supporting the bearish move. However, traders should remain cautious of false breakouts and adjust stop-loss levels accordingly.

For best results:

✔ Wait for price action confirmation (retest rejection or bearish candle formations).

✔ Follow proper risk management (stop-loss placement and profit-taking levels).

✔ Monitor key economic events impacting EUR and GBP movements.

By combining technical analysis, fundamental insights, and sound risk management, traders can enhance their profitability and navigate the markets with confidence. 🚀📉

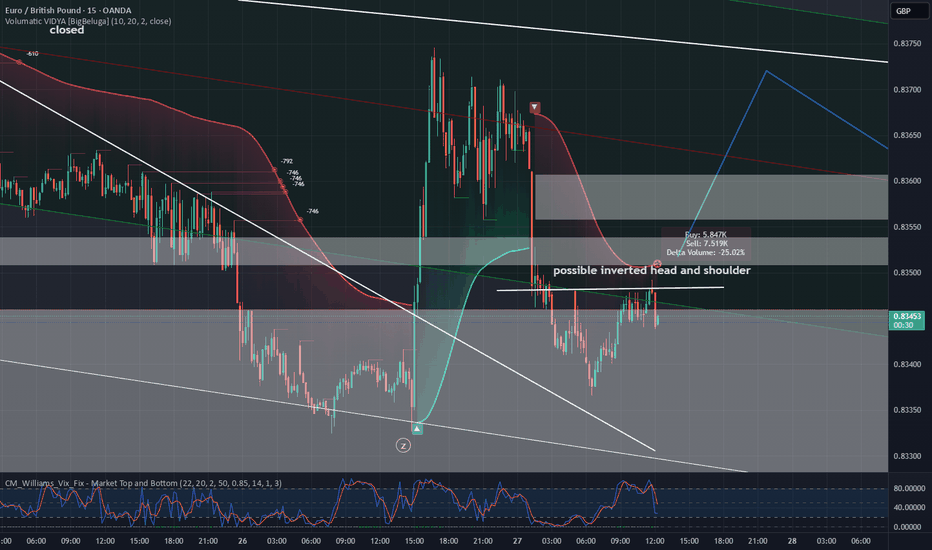

Why eurgbp will sell this newyork session!!In my analysis, we are observing signs of weakness in the Euro, as indicated by recent candlestick formations that reflect a notable lack of buying pressure. This behavior appears to be aligning with key Fibonacci retracement levels, suggesting a potential transition towards lower price levels. I anticipate that in the pre-New York session, we may witness a temporary fake-out before a subsequent downward movement. Traders should exercise caution and consider these factors in their decision-making process

Follow me for more breakdown!!

EURGBP SELLTracking EUR/GBP on the 15-minute timeframe, we see a potential short opportunity from a key supply zone.

Key Zones & Setup:

🟣 Bearish Order Block (Supply Zone): 0.83800 - 0.83830

This area acted as strong resistance, where institutional traders likely positioned sell orders.

Expecting price to push into this zone before reversing lower.

Break of Structure (BOS) on lower timeframes (M5/M1) is needed for confirmation.

🔵 Target Area (Demand Zone): 0.83450

If the supply zone holds, price could drop toward this key demand level.

This zone aligns with previous BOS levels and price reactions.

Trade Plan:

📈 Waiting for price to push into the supply zone (0.83800 - 0.83830).

🔎 Looking for BOS on lower timeframes (M5/M1) before shorting.

✅ Entering a sell position upon confirmation.

🎯 Targeting the 0.83450 demand zone.

⚠️ Stop-loss above 0.83830 to manage risk.

Market Outlook:

If price fails to break structure, we avoid shorts and reassess.

This setup follows smart money concepts (SMC) with a focus on BOS and order blocks.

💬 What do you think? Are you seeing the same setup? 🚀🔥

DeGRAM | EURGBP retest of supportEURGBP is in a descending channel between trend lines.

The price is moving from the lower boundary of the channel and now has fallen back to the support level.

The volatility of the chart has decreased.

On the 1H Timeframe, the indicators have formed a bullish convergence, which has not yet worked out.

We expect a rebound from the support.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP INTRADAY sideways consolidation capped at 0.8420The EUR/GBP pair continues to exhibit bearish sentiment, reinforced by the prevailing downtrend. The key intraday resistance level is at 0.8420, marking the current swing high.

Bearish Scenario:

An oversold rally from current levels, followed by a bearish rejection at 0.8420, would likely target downside support at 0.8353. A break below this level would open the door for further declines toward 0.8335 and 0.8300 in the longer timeframe.

Bullish Scenario:

Alternatively, a confirmed breakout above the 0.8420 resistance, accompanied by a daily close above this level, would invalidate the bearish outlook. This would pave the way for further rallies, with the next resistance levels at 0.8450 and 0.8490.

Conclusion:

The prevailing sentiment remains bearish as long as 0.8420 holds as resistance. Traders should watch for rejection at this level to confirm downside momentum. Conversely, a decisive breakout above 0.8420 would signal a potential shift to a bullish bias, targeting higher resistance levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

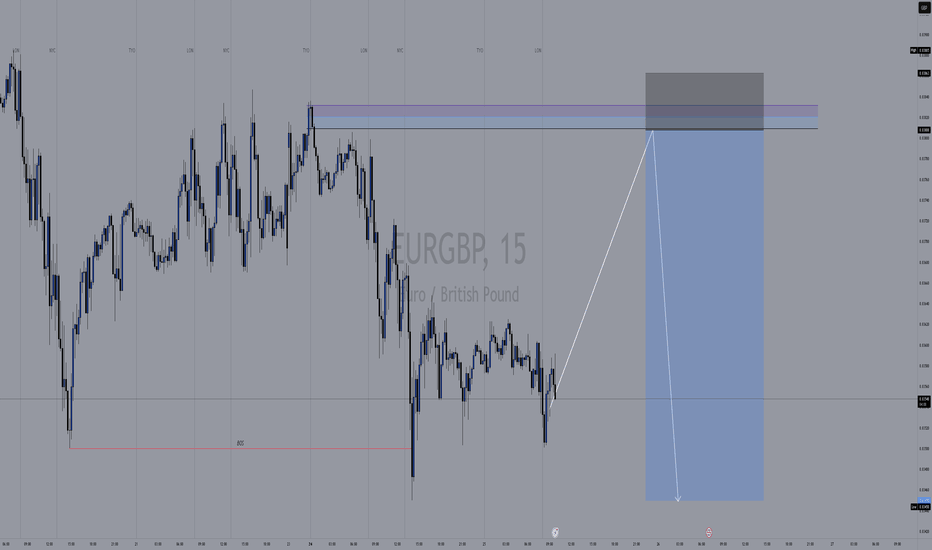

EUR/GBP Chart Analysis – Inverse Head & Shoulders Bullish SetupThis EUR/GBP 1-hour chart showcases a classic Inverse Head & Shoulders (H&S) pattern, signaling a potential trend reversal from bearish to bullish. This pattern is considered one of the most reliable technical formations for spotting upcoming upward momentum, particularly after a prolonged downtrend.

🔎 Market Overview

Currency Pair: EUR/GBP

Timeframe: 1-Hour (H1)

Current Price: 0.83720

Trend: Transitioning from a downtrend to a potential bullish breakout

Key Pattern: Inverse Head & Shoulders

Trading Bias: Bullish (Pending breakout confirmation)

📊 Chart Breakdown & Technical Analysis

1️⃣ Market Structure & Trend Analysis

Before the formation of the Inverse Head & Shoulders, the market was in a strong downtrend, making lower highs and lower lows. However, buyers started stepping in near the 0.8350 level, preventing further decline. This rejection at key support has set the stage for a potential trend reversal.

Left Shoulder: Price formed a minor low around 0.8370, followed by a small bounce.

Head: Price made a deeper low around 0.8351, confirming strong support and buyer interest.

Right Shoulder: Price attempted another dip but failed to break below the previous low, forming a higher low near 0.8370, signaling increasing bullish pressure.

Neckline Resistance: 0.8385 - 0.8390 zone – a crucial level that price needs to break for confirmation of an uptrend.

2️⃣ Key Support & Resistance Levels

Support Level: 0.83513 (Major demand zone)

Resistance Levels:

Neckline: 0.8385 - 0.8390 (Breakout confirmation zone)

Major Resistance: 0.84308 (Target level)

Curve Zone: A dynamic resistance trendline that has been containing price action. A breakout above this curve signals a potential shift in trend.

📈 Trading Strategy – Bullish Breakout Plan

✅ Entry Strategy:

A long trade should be considered only after a confirmed breakout above the neckline (0.8385 - 0.8390). The confirmation comes when:

A strong bullish candle closes above the neckline.

Increased trading volume supports the breakout.

A possible retest of the neckline as new support (0.8385) before continuation.

🎯 Target Price & Stop Loss:

Take Profit (TP): 0.84308 (Projected move based on pattern size).

Stop Loss (SL): Below 0.83513 (Right Shoulder low).

Risk-to-Reward Ratio (RRR): 1:2 or higher, making this a high-probability trade setup.

🛑 Risk Management & Trade Confirmation:

Volume Confirmation: A breakout should be accompanied by a volume spike, confirming strong buyer interest.

Fakeout Warning: If price briefly breaks above the neckline but then falls back below, it could be a false breakout. In this case, waiting for a retest would be a safer approach.

Trailing Stop: Once price moves toward 0.8410, a trailing stop can help secure profits in case of market reversals.

🧐 Summary – Key Takeaways

✅ Inverse Head & Shoulders Identified – A reliable bullish reversal pattern.

✅ Breakout Zone: 0.8385 - 0.8390 (Watch for confirmation).

✅ Target Price: 0.84308 (Potential profit zone).

✅ Stop Loss: Below 0.83513 (Protect against downside risk).

✅ Risk-to-Reward Ratio: Favorable (1:2 or better).

✅ Trading Plan: Buy above the neckline, aim for 0.8430, and manage risk properly.

📌 Final Thought: If the neckline is broken with strong momentum, expect a bullish move toward 0.8430+. However, traders should remain cautious of potential fakeouts and manage risk accordingly.

📢 Share your thoughts in the comments! Are you bullish on EUR/GBP? 🚀📊

#EURGBP #ForexTrading #TechnicalAnalysis #TradingSetup #InverseHeadAndShoulders

WHY EURNZD IS BULLISH AGAING ?? DETAILED ANALYSISEUR/NZD is currently trading at approximately 1.886, having completed a retesting phase following a bullish breakout. This technical development suggests the potential for a renewed upward movement toward the target price of 1.9300. With strong bullish momentum building, traders are closely watching for confirmation signals to enter long positions.

Fundamentally, the Reserve Bank of New Zealand (RBNZ) recently implemented a 50 basis point rate cut, reducing the benchmark rate to 3.75%, with indications of further easing to stimulate the economy. This dovish monetary policy stance tends to exert downward pressure on the New Zealand dollar, thereby supporting the EUR/NZD pair. Meanwhile, the Eurozone has maintained a more stable monetary policy, contributing to euro strength relative to the New Zealand dollar. This divergence in central bank policies enhances the bullish outlook for EUR/NZD.

Technical indicators further reinforce this perspective. The pair has been in a downward channel since mid-February; however, recent bullish candles indicate a potential short-term reversal or correction. The price has swiftly moved from the lower Bollinger Band to the upper band, breaking through the middle band in a strong bullish move. Additionally, EUR/NZD is currently testing the 50% Fibonacci retracement level, a key decision point for traders.

Considering these technical and fundamental factors, the EUR/NZD pair appears poised for a bullish wave toward the 1.9300 target. Traders should monitor key resistance levels and employ appropriate risk management strategies to capitalize on this potential upward movement. If momentum continues, this setup could present a profitable long trade opportunity in the coming sessions.

DeGRAM | EURGBP correction in the channelEURGBP is in a descending channel between the trend lines.

The price is moving from the lower boundary of the channel and dynamic support.

The chart has formed a harmonic pattern and is now holding above the 38.2% retracement level.

We expect the growth to the level of 0.84075.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EUR/GBP Analysis – Symmetrical Triangle Breakdown & Bearish MoveThis EUR/GBP chart on the 1-hour timeframe showcases a well-defined symmetrical triangle formation, a widely recognized pattern in technical analysis that signals potential breakout opportunities. The price action has respected the converging trendlines, indicating consolidation before a decisive move. Recently, the market has broken below the support zone, confirming a bearish breakdown and providing a strong signal for potential downside movement.

This analysis will cover pattern formation, key technical levels, trading strategy, risk management, and future market outlook to provide a comprehensive professional breakdown of this setup.

1. Chart Pattern Analysis – Symmetrical Triangle Formation

A symmetrical triangle consists of two converging trendlines that squeeze price action into a narrowing range, reflecting market indecision. This pattern is considered a continuation pattern, meaning that the price is likely to continue in the direction of the prevailing trend after the breakout.

Pattern Characteristics in This Chart:

✅ Lower Highs: Price fails to break previous peaks, indicating weakening bullish momentum.

✅ Higher Lows: Buyers step in at higher points, preventing aggressive declines.

✅ Volume Decrease: Typical of consolidation within a symmetrical triangle.

✅ Breakout Confirmation: A strong bearish candle broke below the support level, signaling further downside potential.

2. Key Technical Levels & Zones

📌 Resistance Level + All-Time High (ATH) – 0.8421

This level represents the highest point in the pattern, where price faced repeated rejections.

It aligns with a historical resistance zone, indicating a strong supply area.

A breakout above this level would shift the market to a bullish bias.

📌 Support Level – 0.8379 (Now Acting as Resistance)

Previously a key demand zone where buyers defended the price.

Price has now broken below this level, confirming it as new resistance in a bearish scenario.

A successful retest followed by rejection increases downside confirmation.

📌 Stop-Loss Placement – 0.8421

Located above the upper trendline and recent highs to avoid false breakouts.

If price regains this level, the bearish scenario will be invalidated.

📌 Target Zone – 0.82926 (Major Support Area)

This is the next strong support level, acting as a potential take-profit zone for short positions.

It aligns with a previous price reaction area, making it a logical target for sellers.

3. Trading Setup & Strategy – Bearish Trade Plan

The breakdown from the symmetrical triangle structure presents an opportunity to short the pair with a defined risk-to-reward setup.

📌 Entry Strategy:

Enter short positions after price breaks and retests the 0.8379 support level as resistance.

Confirmation should come from bearish candlestick patterns like engulfing candles or pin bars.

📌 Stop Loss:

Placed above 0.8421, above the last swing high, to protect against potential false breakouts.

📌 Take Profit (TP) Target:

First TP: 0.8325 (Intermediate support)

Final TP: 0.82926 (Major support and key structure level)

Alternative Scenario – Bullish Reversal Possibility

If price reclaims 0.8379 and closes above it consistently, the bearish breakdown might be a false move.

A move above 0.8421 would invalidate the bearish setup, leading to potential bullish momentum.

4. Risk Management & Trade Confirmation

✅ Volume Analysis

A significant increase in volume on the breakdown strengthens the bearish outlook.

Low volume retests may indicate a weak reversal attempt, favoring continuation downward.

✅ Bearish Price Action Confirmation

Lower highs and consistent lower lows reinforce a bearish sentiment.

Rejections from the broken support (now resistance) validate the trade setup.

✅ Risk-to-Reward Ratio (RRR)

The Stop-Loss (SL) is tight, and the profit target is significantly larger, making this a high RRR trade.

Ideally, a RRR of at least 2:1 or 3:1 should be maintained for proper risk control.

5. Market Sentiment & Future Outlook

Bearish Bias Strengths:

Trendline break indicates strong downside pressure.

Failed attempts to break resistance suggest weakening bulls.

Global macroeconomic factors and fundamental catalysts may favor GBP strength over EUR in the near term.

Reversal Risks:

A strong bullish breakout above 0.8421 would shift momentum to the upside.

Fundamental news events (e.g., ECB or BoE statements) can impact market direction unexpectedly.

6. Summary & Conclusion

🔹 The EUR/GBP 1-hour chart has broken below a symmetrical triangle pattern, confirming a bearish breakout.

🔹 Key levels to watch: Resistance at 0.8421, support at 0.82926.

🔹 Trading strategy favors short positions, with a target at 0.82926 and a stop loss at 0.8421.

🔹 Confirmation comes from trendline breaks, volume analysis, and lower highs/lows structure.

📌 Final Verdict:

The setup is bearish unless price reclaims 0.8379 and invalidates the structure.

Traders should monitor price action, volume, and news events for further confirmations.

🔥 Potential Profit Target: 80-90 Pips 📉

⚠️ Risk Management is Crucial – Always Use Stop Loss & Proper Position Sizing

EURGBP: Rectangle Top rejection. Sell opportunity.EURGBP is neutral on its 1D technical outlook (RSI = 52.272, MACD = 0.002, ADX = 25.202), going from an almost overbought RSI to neutral as it got rejected on the R1 Zone. That is the top of the 6 month Rectangle pattern, where the last rejection pulled the price all the way down to the S1 Zone. This time the presence of both the LH and HL trendlines makes us consider a slightly tighter trading range. The trade is short, TP = 0.82600.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

EUR/GBP Technical Analysis – Triangle Breakdown & Bearish MoveChart Overview

This EUR/GBP 1-hour chart highlights a symmetrical triangle pattern that has recently broken to the downside, signaling a potential bearish move. The chart includes key technical levels such as resistance, support, trendlines, and a projected price target. Let’s analyze each component in detail.

1. Formation of a Symmetrical Triangle

A symmetrical triangle is a continuation pattern, meaning it typically precedes a breakout in the direction of the prevailing trend. In this case:

The pair initially rallied sharply, forming a strong uptrend.

A consolidation phase followed, where price started forming lower highs and higher lows, creating a contracting triangle.

The triangle’s resistance and support levels were tested multiple times, confirming their significance.

Key takeaway: The more times price tests support and resistance without breaking through, the stronger the eventual breakout.

2. Breakdown from the Triangle – Bearish Signal

The price broke below the support level, triggering a breakdown from the symmetrical triangle.

This breakdown was accompanied by a strong bearish candlestick, indicating a decisive move to the downside.

The previous support is now acting as resistance, meaning any pullback to this zone could provide a shorting opportunity.

Why is this important?

A breakdown from a triangle often results in a sharp directional move, especially if it aligns with the broader market trend.

3. Trendline Analysis – Uptrend Reversal

The rising trendline that supported the price action has been broken, further confirming trend exhaustion and a shift to bearish momentum.

Before the breakdown, the price had been respecting the trendline as support.

After the breakdown, the trendline is invalidated, reinforcing the bearish outlook.

Technical Insight:

Trendlines act as dynamic support/resistance, and once broken, they often lead to strong directional movements.

4. Key Support & Resistance Levels

Resistance Level (Former Support Zone):

This level was previously a strong demand zone where buyers stepped in.

Now that price has fallen below it, this area could act as a resistance if price retests it.

Traders should watch for bearish rejections or reversal patterns (such as shooting stars or bearish engulfing candlesticks) before entering short positions.

Support Level & Bearish Target (0.829):

The chart highlights 0.829 as the next significant support area.

This level aligns with historical price action and provides a logical take-profit zone for short traders.

5. Expected Price Action – Bearish Continuation Scenario

Given the breakdown from the triangle, the expected movement is as follows:

A short-term pullback to the broken support (now resistance).

Rejection from this zone, leading to further downside momentum.

Price reaching the projected target near 0.829, where traders may look to take profits or reassess market conditions.

6. Trading Strategy & Risk Management

✅ Bearish Trade Setup

Entry: On a pullback to the broken support level (preferably with bearish confirmation signals).

Stop-Loss: Above the previous resistance level to avoid false breakouts.

Take-Profit: Around the 0.829 target or lower if momentum continues.

⚠ Risk Considerations

If price closes back above the broken support, it may indicate a false breakout, invalidating the bearish trade setup.

Fundamental news events (such as central bank decisions or economic data) could impact price movement unexpectedly.

Conclusion – Bearish Outlook with Defined Target

This chart presents a textbook triangle breakdown, reinforcing the bearish bias for EUR/GBP. The structure suggests that price will continue lower toward the 0.829 target, unless invalidated by a strong reversal. Traders should watch for pullbacks and rejection signals before entering short positions.

Key Levels to Watch:

✅ Resistance: 0.835 - 0.837 (Former Support Zone, Now Resistance)

✅ Target: 0.829 (Projected Price Target)

📉 Bias: Bearish

Final Thought

This setup provides a high-probability trade idea for traders looking to capitalize on momentum. As always, implementing proper risk management is crucial to navigate market uncertainties. 🚀

EURGBP: Bullish Continuation is Highly Probable! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURGBP.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️