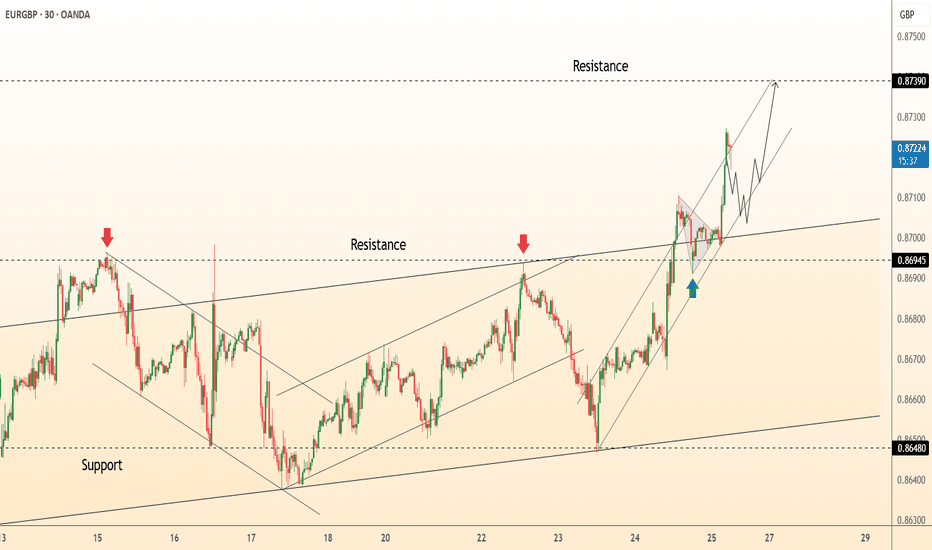

DeGRAM | EURGBP exited the channel📊 Technical Analysis

● Breakout: price burst from the July descending wedge, reclaimed 0.8695 former cap, and is now riding a steep intraday channel of higher-highs; the channel mid-line aligns with the broken wedge roof, adding fresh support.

● A pennant is consolidating just above 0.8695; its measured pole and the outer channel top converge at the next horizontal barrier 0.8739.

💡 Fundamental Analysis

● Softer UK July composite-PMI (47.9 vs 50.2 prior) revived BoE cut bets, while ECB speakers flagged “premature to talk easing,” narrowing the rate gap in the euro’s favour.

✨ Summary

Long 0.8695-0.8705; pennant break targets 0.8739. Bias void on a 30 m close below 0.8648.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

Eurgbpanalysis

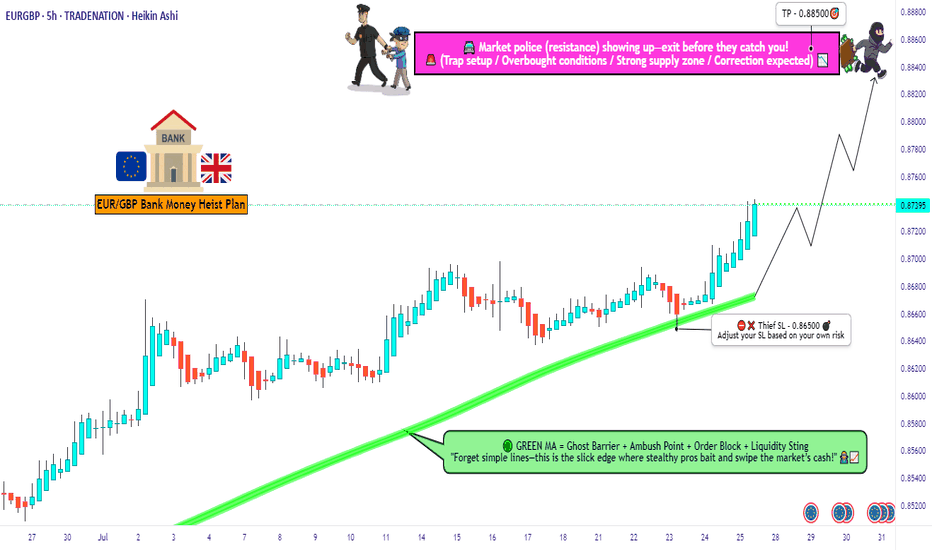

EUR/GBP Thief Trade: Swipe Profits Before Overbought Trap!🦹♂️ EUR/GBP "THE CHUNNEL HEIST" – BULLISH LOOT IN PROGRESS! 🚨💰

(Thief Trading Strategy – Escape Before the Cops Arrive!)

🎯 DEAR MARKET PIRATES & PROFIT SNATCHERS,

Based on our 🔥Thief Trading Style Analysis🔥, we’re executing a bullish heist on EUR/GBP ("The Chunnel"). The vault is wide open—time to swipe the loot before the high-risk resistance police barricade (aka overbought trap) shuts us down!

📜 THE MASTER PLAN:

✔ Entry (📈): "The Bullish Vault is Unlocked!"

Buy Limit Orders (15-30min TF) near recent swing lows/highs.

Thief’s DCA Trick: Layer entries like a pro robber—multiple limit orders for max loot.

✔ Stop Loss (🛑): "Hide Your Stash Wisely!"

SL at nearest 4H candle wick (0.86500)—adjust based on your risk appetite & lot size.

Remember: A good thief always has an escape route!

✔ Target (🎯): 0.88500 (or escape earlier if the cops get suspicious!)

🔎 SCALPERS & SWING BANDITS – LISTEN UP!

Scalpers: Stick to LONG-ONLY heists! Use trailing SL to protect profits.

Swing Thieves: If you’re low on cash, join the slow robbery—DCA & hold!

📡 WHY THIS HEIST IS HOT:

Bullish momentum in play (but BEWARE of overbought traps!).

Fundamental Drivers: Check COT Reports, Macro Data, & Sentiment.

🚨 TRADING ALERT: NEWS = POLICE RAID RISK!

Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits before volatility strikes.

💥 BOOST THIS HEIST – STRENGTHEN THE GANG!

👉 Smash the LIKE & BOOST button to fuel our next market robbery!

👉 Follow for more heists—profit awaits! 🚀💰

🦹♂️ Stay Sharp, Stay Ruthless… See You on the Next Heist!

DeGRAM | EURGBP exited the channel📊 Technical Analysis

● Fresh rejection at the blue resistance line (~3 435) pushed XAU back to the 3 355 mid-band, yet successive higher-lows (green arrows) keep price inside the May-origin rising channel.

● The pullback is probing 3 328-3 355 — confluence of the former flag roof and triangle top; holding this zone should launch another test of 3 400/3 435, with the channel crest targeting 3 500.

💡 Fundamental Analysis

● U-S S&P-Global PMIs softened, nudging 2-yr real yields to three-week lows, while cautious ECB rhetoric limits dollar gains — both supportive for gold.

✨ Summary

Long 3 328-3 355; above that aims 3 400 ➜ 3 435, stretch 3 500. Invalidate on an H4 close below 3 293.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

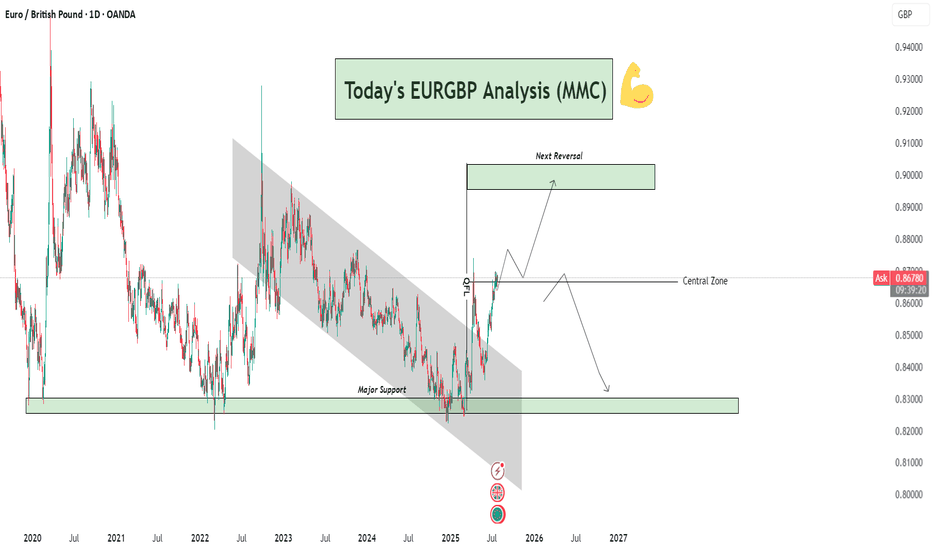

EURGBP Analysis : Breakout, Central Zone Flip & Reversal Target🧠 Overview:

This EURGBP daily chart clearly presents a bullish breakout from a long-term descending channel, a successful reclaim of the central structure zone, and a projection toward a key reversal level. This analysis incorporates Smart Money Concepts (SMC), Market Maker Concepts (MMC), and classic structural behavior.

🔍 Technical Breakdown:

📉 Long-Term Bearish Channel (2021–2025)

For nearly 4 years, EURGBP was trapped in a descending channel, forming consistent lower highs and lower lows.

This long-term bearish phase reflects strong supply-side control and institutional distribution.

The breakout above this structure is significant — marking a potential mid- to long-term trend reversal.

🔁 Major Support Zone (0.8300–0.8350)

Price bounced strongly from this historical demand zone multiple times (in 2021, 2022, and recently in 2025).

This zone is critical and acts as a high-volume accumulation area where smart money has stepped in.

The strong reaction from this level in 2025 triggered the breakout of the bearish structure.

🚀 Break of Structure + Retest

After breaking the descending channel, price retested the upper boundary, confirming a structure shift.

The breakout retest succeeded — marking the transition from a bearish phase to a bullish expansion.

📍 Central Zone Flip

The Central Zone, once a resistance/supply area during the downtrend, has now been reclaimed as support.

This is a powerful MMC concept – where the "central balance" of a structure flips and becomes a base for the next impulse.

Current price is sitting just above this zone, indicating bulls are still in control.

🎯 Next Reversal Zone (Target Area: 0.9000–0.9050)

The chart outlines a projected bullish move toward the Next Reversal Zone marked above.

This is a key supply area, likely to trigger profit-taking or institutional sell orders.

Expect price to range or wick into this zone before showing a possible bearish reversal.

🔄 Future Projection Scenarios:

Scenario 1 – Bullish Continuation:

Price continues to build bullish structure and approaches the 0.90 reversal zone.

Rejection from this zone may trigger consolidation or a minor retracement.

Scenario 2 – Major Reversal:

Upon hitting the next reversal zone, price could reverse and fall back toward the Central Zone or even the Major Support below, especially if macroeconomic fundamentals shift.

🔑 Confluences Supporting This Setup:

✅ Element 🧩 Description

🔹 Major Support Historical demand zone with repeated rejections

🔹 Channel Breakout Structure shift confirming bullish interest

🔹 Retest Success Technical confirmation of breakout validity

🔹 Central Zone Flip Old resistance → new support (MMC principle)

🔹 Reversal Zone Anticipated next profit-taking / supply area

📌 Strategic Insight:

Bias: Bullish short-term to mid-term

Entry Opportunity: Lower timeframe pullbacks into Central Zone (or retest zones)

Target: 0.9000–0.9050 area

Watch for Rejection: In reversal zone for potential bearish shift

⚠️ Risk Note:

Always wait for confirmation at reversal zones. Overextended moves without correction can quickly retrace. Manage your trades with stop-losses below key structural levels and maintain strict risk-reward planning.

🧠 Conclusion:

EURGBP has transitioned from a long bearish cycle into a bullish expansion phase. Smart Money accumulation at the base and a clean breakout with retest confirm a strong directional shift. Keep your focus on the Central Zone retests and the Reversal Zone reaction for optimal entries or exits.

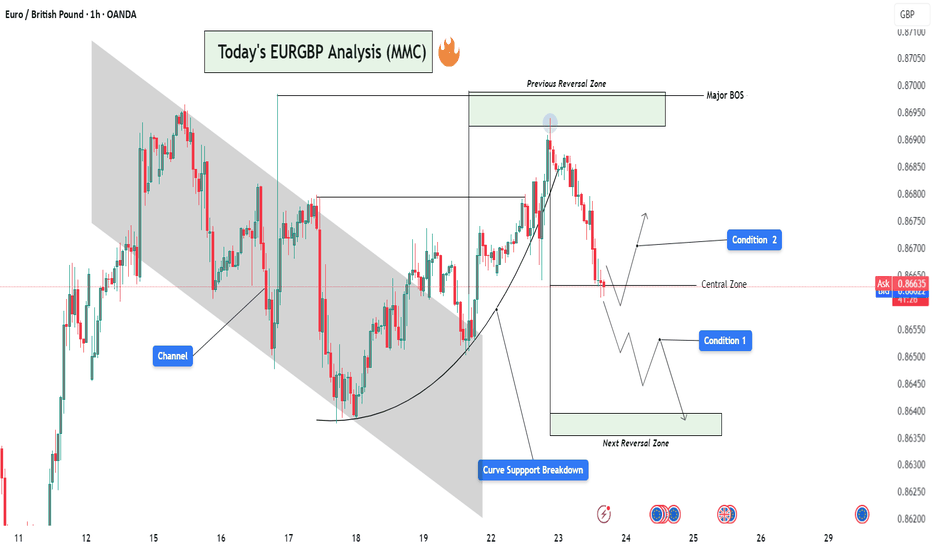

EURGBP Analysis : Curve Breakdown + Directional Setup + Target🧠 Institutional Context & Smart Money Bias

This EURGBP chart offers a masterclass in engineered liquidity and market traps. Institutions have created an illusion of bullish strength through:

A manipulated rounded accumulation curve

A controlled channel phase

A false breakout above the reversal zone

These are textbook signals that the retail crowd is being misled, while smart money is preparing for a deeper move. Let’s dissect it step by step.

📊 Phase-by-Phase Technical Breakdown

🔻 1. Bearish Channel – Sentiment Shaping Phase

From July 11 to July 21, the pair traded within a descending parallel channel, forming a bearish market structure.

This phase was not a genuine trend, but a sentiment builder—to:

Create a belief in continued bearishness

Gather liquidity around the channel boundaries

The upper and lower bounds of the channel were respected precisely, revealing market maker intent.

📈 2. Parabolic Curve Support – Trap Engineered

Price transitioned out of the channel into a rounded bullish curve—a visual cue suggesting accumulation and strength.

This curved trendline often misleads retail traders into thinking a breakout rally is coming.

Price surged aggressively toward the Previous Reversal Zone, further fueling FOMO buys.

But this move was not sustainable. Why?

➡️ Because it lacked a clean base and was built off a manipulated liquidity sweep. The curve was a setup.

🟥 3. Previous Reversal Zone & Major BOS – Institutional Exit Point

Price entered the Previous Reversal Zone, a marked area of prior supply.

This is where institutional orders were likely resting.

After briefly exceeding the previous high, the market instantly reversed with force—evidence of:

Stop hunts

Distribution

Smart money selling into retail breakout buyers

The Major BOS (Break of Structure) confirms the shift: The trend is no longer bullish.

⚠️ 4. Curve Support Breakdown – Structure Shift Triggered

After peaking, the price violated the curve support, confirming the bullish trap.

This breakdown signals a phase transition:

From accumulation illusion → distribution reality

From retail optimism → smart money unloading

🟨 5. Central Zone – Decision Point

Price is now hovering at the Central Zone, a region of equilibrium between buyers and sellers.

This is where market makers may:

Redistribute for another leg down

Fake a pullback before continuing lower

Temporarily rally to trap more longs

This area will determine short-term directional bias. That’s why your setup smartly outlines two conditions from this point.

🔀 Trade Scenarios – MMC Conditions

🔻 Condition 1: Bearish Continuation Toward Next Reversal Zone

If the price rejects the Central Zone and begins forming lower highs and bearish structures:

Expect further downside

This confirms the market is in redistribution mode

Target: Next Reversal Zone at 0.8630–0.8640

💡 Rationale: Institutions are driving price back into demand zones to grab new liquidity or fill leftover buy orders.

🔁 Condition 2: Temporary Recovery & Trap Continuation

If price holds above the Central Zone and breaks short-term highs:

A short-term bullish rally may occur

Likely targets: 0.8675–0.8685

This may act as a fake-out rally, creating more buying interest before a deeper dump

💡 Rationale: Smart money may induce more buyers to create fresh liquidity pockets before dropping toward the next reversal zone.

🔐 Key MMC Zones & Structure Levels

Zone/Level Purpose

0.8695–0.8700 Previous Reversal Zone / Major BOS – Institutional distribution area

0.8660–0.8665 Central Zone – Mid-point equilibrium & battle zone

0.8630–0.8640 Next Reversal Zone – Potential bullish interest area for demand

🧠 Smart Money Summary

This chart showcases a multi-stage smart money plan:

Create channel to shape bias

Form curve to generate false hope

Push into supply and trap late buyers

Break curve support to shift structure

Retest Central Zone to decide next manipulation leg

Deliver price toward true unfilled demand zones

This is how institutions engineer movement while retail gets trapped chasing direction.

EURGBP – WEEKLY FORECAST Q3 | W30 | Y25📊 EURGBP – WEEKLY FORECAST

Q3 | W30 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT FOREX ANALYSIS 📊

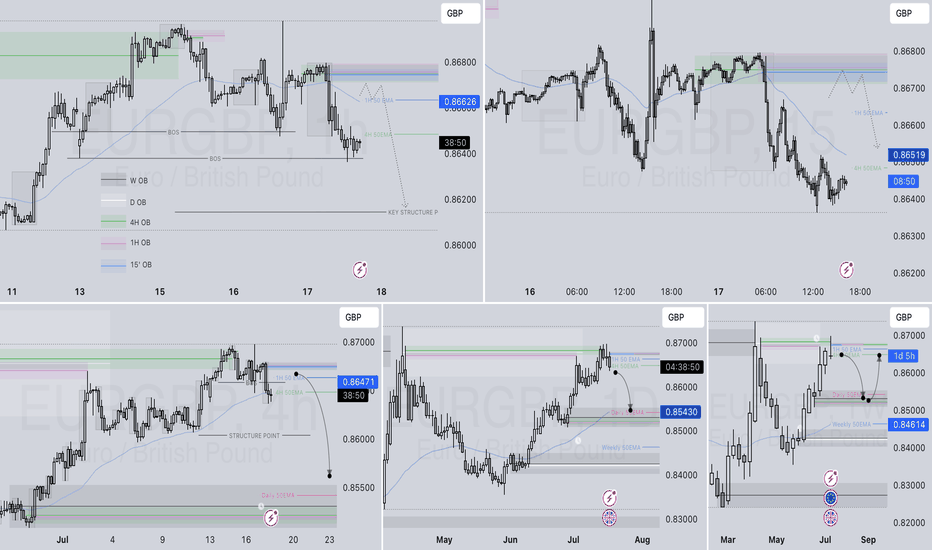

EURGBP SHORT – DAILY FORECAST Q3 | D17/18 | W29 | Y25💼 EURGBP SHORT – DAILY FORECAST

Q3 | D17/18 | W29 | Y25

FUN COUPON FRIDAY INCOMING !

📊 MARKET STRUCTURE SNAPSHOT

EURGBP is currently reacting from a key higher time frame supply zone, with price action showing weakness at premium levels. Momentum has slowed, and early signs of distribution are appearing. With structure aligning bearishly across multiple timeframes, the pair presents a short bias opportunity.

🔍 Confluences to Watch 📝

✅ Daily Order Block (OB)

Price reacted from a high-probability bearish OB.

Rejection wicks and a shift in candle body control point to supply dominance.

Momentum is fading, confirming the presence of smart money sellers.

✅ 4H Order Block

Clear mitigation of 4H OB followed by an internal break of structure (iBoS).

Price is respecting the OB zone, printing lower highs beneath key supply.

Perfect mid-timeframe confirmation of trend transition.

✅ 1H Order Block

1H structure shifted bearish, validating LTF trend alignment.

Price building supply chain with continued lower highs and bearish engulfing patterns.

Ideal zone for entry on pullback or liquidity sweep.

📈 Risk Management Protocols

🔑 Core Principles:

💰 Max 1% risk per trade

📍 Only execute at pre-identified zones

⏰ Set alerts — avoid impulsive trades

📉 Respect RR — minimum 1:2 per position

🧠 You're not paid for frequency. You're paid for discipline and execution quality.

🧠 Weekly FRGNT Insight

“Trade what the market gives, not what your ego wants.”

Stay mechanical, stay focused, and allow the probabilities to play out. Your job is to control risk — not the outcome.

🏁 Final Thoughts from FRGNT

📌 The structure is clear.

📌 The confluences are stacked.

📌 The bias is confirmed.

Let your execution reflect your discipline, not your emotions.

❤️ Good luck this week, and as always – I’ll see you at the very top.

DeGRAM | EURGBP broke out of the descending channel📊 Technical Analysis

● Price has punched through the month-long descending-channel roof and is holding the break, carving a tight bullish flag along a fresh up-trend line.

● Rebound from the 0.861 demand created an inverted H&S; its 1 : 1 projection aligns with the 0.8681 pivot and the March high at 0.8703, while RSI remains mid-range, leaving upside fuel.

💡 Fundamental Analysis

● Softer UK wage-growth and uptick in jobless claims revived talk of an August BoE cut, whereas a surprise rise in the Euro-area ZEW expectations index hints at stabilising growth, nudging rate-differential momentum toward the euro.

✨ Summary

Long 0.8650-0.8665; sustained trade above 0.8640 targets 0.8680 → 0.8703. Invalidate on an H1 close below 0.8610.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP – Waiting for the Market to Come to UsWe are patiently waiting for price to correct

and reach our level.

📌 If the price touches the level and gives us a valid signal,

we will buy.

📉 But if the level is broken, we don't panic —

we simply wait for a pullback and enter a short position.

🧠 No guessing, no stress.

We let the market come to us, and then we react — according to plan.

Ready to Raid the Chunnel? EUR/GBP Bullish Strategy Unveiled!🔥🤑 "THE CHUNNEL HEIST: EUR/GBP BULLISH LOOTING SEASON!" 🏴☠️💸

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

(Hi! Hola! Ola! Bonjour! Hallo! Marhaba!)

Based on the 🚨THIEF TRADING STYLE🚨 (a ruthless mix of technical & fundamental analysis), we’re plotting a major heist on EUR/GBP "The Chunnel"—time to LOOT THE BULLS!

🚨 HEIST BLUEPRINT (LONG ENTRY) 🚨

🎯 Escape Zone: High-risk RED MA Zone (Overbought? Reversal? Trap? Bears lurking? Cops are waiting!).

🏆 Take Profit & Run! You’ve earned it, outlaw! 💰🔥

🔓 ENTRY: "VAULT IS OPEN—SWIPE THE BULLISH LOOT!" after the breakout

Pullback Entry near the Moving average @0.84850

Buy Limit Orders preferred (15-30min timeframe).

Swing Low/High Pullbacks = Perfect Stealth Entry.

⛔ STOP LOSS (SL): "DON’T GET CAUGHT!"

📍 Thief SL: Recent swing low (4H timeframe) @ 0.84000 (Scalping/Day Trade Basis).

⚠️ Adjust based on your risk, lot size & multiple orders!

🎯 TARGET: 0.85850 (OR ESCAPE EARLY IF HEAT’S ON!)

📢 WHY THIS HEIST? (BULLISH CATALYSTS)

💥 EUR/GBP is BULLISH—backed by:

Fundamentals (COT Report, Macro Data)

Sentiment & Intermarket Trends

Quantitative Edge (Check out for full intel! 👉🌎🔗)

🚨 TRADING ALERT: NEWS = DANGER ZONE!

📉 Avoid New Trades During High-Impact News!

🔒 Use Trailing Stops—Lock profits, evade volatility traps!

💥 BOOST THIS HEIST! (SUPPORT THE MISSION)

🔥 Hit the "LIKE" & "BOOST" button—strengthen our Profit Robbery Squad!

🤑 Daily Market Heists = Easy Money (Thief Trading Style FTW!)

Stay tuned for the next heist plan! 🚀🐱👤💖

Ready to Raid the Chunnel? EUR/GBP Bullish Strategy Unveiled!🔐💸"The Chunnel Heist: EUR/GBP Bank Job with Thief Trading Style"💸🔐

Master Plan for Smart Money Robbers, Scalpers, and Swing Traders – Chart Ready Strategy to Boost Your TradingView Clout

🌍 Greetings, Global Hustlers & Strategic Traders!

Hola! Ola! Bonjour! Hallo! Marhaba! Ni Hao! Ciao! 👋🌟

Welcome to Thief Trading Style, where we treat the market like a high-stakes heist and every pip is precious loot! 🏦💰

This time, the target is the EUR/GBP Forex Vault – nicknamed "The Chunnel". It’s time to outsmart the system and execute a calculated plan that balances technical setups with a thief’s precision. 🐱👤🔥

🧠 Heist Blueprint: EUR/GBP Bullish Setup

🔍 Concept:

We're spotting a bullish bias with underlying momentum for a breakout heist.

This move is not for the faint-hearted – police traps (resistance zones) and bearish defenders are guarding the top, but our tools (TA + FA) suggest a strong breakout is brewing. ⚠️📊

🚀 Thief Strategy at a Glance:

🟢 Entry (Stealth Mode)

💥 "The vault is wide open – grab the bullish loot!"

Initiate BUY positions on pullbacks, using a layering/DCA style entry system.

📅 Recommended on 15m or 30m charts for precision.

🎯 Key Entry Zone: Recent swing lows/highs – the quieter, unguarded door into the vault.

🛑 Stop Loss (Silent Exit Strategy)

Set SL near the most recent 1D timeframe wick low – smart risk management is key.

Adjust size based on your risk tolerance, lot sizes, and how deep you’ve stacked the entries.

🏁 Target (Escape Route)

🎯 Main Target: 0.88000

But remember – sometimes it’s safer to exit early if things get hot. Use trailing SLs to secure your loot and dodge the heat. 🔥🚓

💸 Scalper Advisory – Quick Snatch & Run

Scalpers should only ride the bullish momentum.

If your wallet's heavy, jump in early. If not, trail the swing traders and plan your entry like a pro.

🛡 Use tight trailing SLs to keep your gains in the bag.

📈 Why the Chunnel Heist Now?

The market is shifting:

🔹 Overbought conditions

🔹 Signs of trend reversal

🔹 Bullish divergence + liquidity grab setups

🔹 Positioning based on COT reports, sentiment analysis, macroeconomic shifts, and intermarket flow

👉 Full FA/TA/COT breakdown liinkedd in the Klick 🔗🔗

📢 Heads-Up: News Alert 🚨

📰 Major news events ahead – stay sharp.

❌ Avoid fresh entries during high-impact announcements.

✅ Use trailing SLs to lock profits and reduce emotional exposure.

❤️ Support the Heist, Boost the Team

🔥 Smash the "Boost" button if you're down with the Thief Trading Style

– it powers our next robbery and keeps the strategy alive!

Each boost strengthens the team and spreads the loot. Let’s out-trade the market, not just survive it. 🚀💰

⚠️ Disclaimer (The Clean Getaway)

📌 This is an educational, entertainment-based strategic overview – not financial advice.

📌 Always do your own due diligence and trade based on your personal risk profile.

📌 Markets shift quickly – adapt, adjust, and don’t marry your trades.

💬 Leave a comment if you’re riding this plan or if you’ve got your eyes on the next target.

🎯 Follow for more Thief Trading Heists – the next plan drops soon!

Stay stealthy, stay profitable. See you at the vault! 🏦🐱👤💸

EURGBP: Is This The End Of The Bulls? The GBP/USD pair has exhibited a consistent bullish trend, driven by a remarkable price momentum that is unprecedented in recent history. However, we anticipate a potential bearish reversal, as the market is witnessing a confluence of bearish indicators and increasing volume. Historically, the British pound has held a dominant position in this market, and long-term bears are likely to gain control.

Therefore, it is crucial to closely monitor the incoming market volume and, most importantly, the prevailing market sentiment. Your continued support throughout this journey is greatly appreciated. If you wish to encourage us, kindly like and comment on our ideas.

Team Setupsfx_

❤️❤️🚀🚀

Market Analysis: EUR/GBP Accelerates HigherMarket Analysis: EUR/GBP Accelerates Higher

EUR/GBP is rising and might climb above the 0.8670 resistance.

Important Takeaways for EUR/GBP Analysis Today

- EUR/GBP is gaining pace and trading above the 0.8600 zone.

- There was a break above a contracting triangle with resistance at 0.8630 on the hourly chart at FXOpen.

EUR/GBP Technical Analysis

On the hourly chart of EUR/GBP at FXOpen, the pair started a decent increase from the 0.8500 zone. The Euro traded above the 0.8580 resistance level to enter a positive zone against the British Pound.

The pair settled above the 50-hour simple moving average and 0.8620. It traded as high as 0.8670 before a downside correction. There was a move below the 23.6% Fib retracement level of the upward move from the 0.8507 swing low to the 0.8670 high.

However, the pair is stable above the 0.8600 support zone. The next major support is near the 50% Fib retracement level of the upward move from the 0.8507 swing low to the 0.8670 high at 0.8590.

A downside break below 0.8590 might call for more downsides. In the stated case, the pair could drop toward the 0.8545 support level. Any more losses might call for an extended drop toward the 0.8505 pivot zone.

The EUR/GBP chart suggests that the pair is facing resistance near the 0.8635 zone. A close above the 0.8635 level might accelerate gains. In the stated case, the bulls may perhaps aim for a test of 0.8670. Any more gains might send the pair toward the 0.8700 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURGBP 8H Analysis : Breakdown + Smart Money Structure + Target🧠 Phase 1: Arc Formation – Accumulation by Smart Money

The arc (May to June) reflects an accumulation base where price made higher lows with consolidative wicks and slow momentum, ideal conditions for institutional orders to build long positions.

Liquidity is swept below swing lows, stopping out early longs — this is classic smart money accumulation.

Volume compression during the arc followed by expansion on breakout confirms smart interest.

🔑 Psychology: Retail was likely selling here due to lower highs, while smart money was accumulating quietly at the bottom of the arc.

🚀 Phase 2: Breakout & Rally to Previous Highs

Price cleanly breaks above the arc’s neckline and previous resistance (labeled as Previous Target).

Momentum accelerates rapidly toward the reversal zone, likely due to stop hunts and FOMO buyers entering after confirmation.

Structure shifts bullish, creating strong impulsive candles — but these are often final exit points for smart money.

📌 Key Sign: Breakout aligns perfectly with market inefficiencies being filled, often a sign of a short-term top formation brewing.

🔄 Phase 3 : Reversal Zone – Distribution Phase

Inside the Reversal Zone (0.8650–0.8680), price shows exhaustion with multiple upper wicks and slowing bullish momentum.

Distribution signs: choppy movement, lower highs, and eventual breakdown.

Retail is often caught entering longs here on confirmation, while institutions offload their positions.

🧠 MMC Insight: This is where Mind Market Curve transitions from bullish impulse to corrective leg down — phase of deception.

📉 Phase 4: Structure Breakdown & Bearish Market Behavior

Price breaks through short-term higher low structure — confirmation of bearish intent.

The formation of lower highs and lower lows marks the beginning of a bearish trend shift.

Market is now targeting Major Support (0.8500–0.8520 zone), which is currently being tested.

🧭 If price breaks below 0.8500 with volume and aggression, next level is likely near 0.8430–0.8450.

⚖️ Current Price Location: Major Support Test

We’re at a critical decision point.

If support holds → expect a bounce to 0.8600–0.8620.

If it breaks → expect continuation to next liquidity pool below 0.8450.

This zone is where buyers and sellers will battle. Wait for:

Bullish confirmation (reversal pattern / engulfing candle) to go long.

Bearish breakout (close below zone + retest) to go short.

🔁 Summary of Scenarios

Scenario Conditions Target

✅ Bullish Bounce Rejection at support with bullish engulfing/pin bar 0.8600–0.8620

❌ Bearish Break Close below 0.8500 + retest as resistance 0.8430–0.8450

🔖 Educational Takeaway

This chart teaches how to:

Identify accumulation via arc and understand smart money behavior.

Recognize false confirmation zones (where retail enters late).

Understand structure shift as a trend reversal signal.

Execute trades based on reaction zones, not emotions.

If you follow MMC (Mind Market Curve), this is a textbook transition from:

Accumulation →

Expansion →

Distribution →

Breakdown

EURGBP - Expecting Bullish Continuation In The Short TermH4 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

DeGRAM | EURGBP correction from the resistance area📊 Technical Analysis

● Price failed twice at 0.8580-0.8600 supply, completing a rising-wedge inside the larger downward channel; bearish divergence accompanies the second rejection.

● A clean drop back under the former breakout line (≈0.8560) turns it into fresh resistance; wedge depth and channel mid-line converge at 0.8525, with the April floor 0.8440 as next objective.

💡 Fundamental Analysis

● French election risk premium is pressuring the euro, while stronger-than-expected UK GDP proxy (ONS monthly estimate) narrows growth gap and supports sterling.

✨ Summary

Sell 0.8560-0.8570; hold below 0.8560 targets 0.8525 → 0.8440. Short view invalidated on an H4 close above 0.8600.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

DeGRAM | EURGBP broke the channel📊 Technical Analysis

● Price broke out of a six-day falling wedge and reclaimed the channel’s upper wall at 0.8538, flipping it into support and signalling trend reversal.

● A fresh sequence of higher-lows is guiding bids toward the 0.8558-0.8565 supply; a close above that zone exposes the next resistance cluster at 0.8577 → 0.8590 (wedge 1:1 objective).

💡 Fundamental Analysis

● Softer UK GDP revisions and firmer Euro-area CPI flash (still at 2.6 % y/y) narrow rate-differential expectations, underpinning EUR vs GBP.

✨ Summary

Long 0.8538-0.8550; targets 0.8577 then 0.8590. Bull view void on an H1 close below 0.8530.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

EURGBP WEEKLY HIGHER TIME FRAME FORECAST Q3 W27 Y25EURGBP WEEKLY HIGHER TIME FRAME FORECAST Q3 W27 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly 50EMA Rejection

✅Daily Order block identified

✅4H Order Block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

EURGBP LONG FORECAST Q2 W25 D16 Y25EURGBP LONG FORECAST Q2 W25 D16 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order block rejection

✅15' Order block to be confirmed

✅4H Order block identification

✅HTF 50 EMA support

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

Inverse H&S Breakout! EURGBP Eyes Resistance Zone Amid Eurozone EURGBP ( OANDA:EURGBP ) is moving between two Support zone(0.83870 GBP-0.83500 GBP) and Resistance zone(0.8511 GBP-0.8470 GBP) .

In terms of Classic Technical Analysis , EURGBP has managed to break the Neckline of the Inverse Head and Shoulders Pattern .

I expect EURGBP to rise to at least 0.84911 GBP and attack the Resistance zone(0.8511 GBP- 0.8470 GBP) .

-----------------------------------------------------------

EURGBP Fundamental Analysis:

1. Eurozone (EUR) Overview :

The Eurozone economy has shown moderate recovery signs after pandemic disruptions.

Inflation remains a concern, but the European Central Bank (ECB) is expected to maintain or even tighten monetary policy gradually to combat inflation.

Economic data such as GDP growth and industrial production are mixed but generally indicate slow growth.

Political stability in the Eurozone is relatively steady compared to the UK.

The ECB’s forward guidance leans towards cautious optimism, supporting EUR strength over time.

2. United Kingdom (GBP) Overview :

The UK economy faces several challenges, including slower growth prospects compared to the Eurozone.

Inflation has been high but the Bank of England (BoE) has been raising interest rates aggressively to control it.

Political uncertainties related to Brexit aftermath, trade deals, and fiscal policies have created some volatility.

Consumer confidence and retail sales have shown signs of weakness in recent months.

Overall, the BoE’s hawkish stance is strong, but economic fundamentals are less robust compared to the Eurozone.

3. Comparative Factors Favoring EUR Long :

The Eurozone's relatively better economic stability and growth prospects support EUR strength.

UK economic challenges and political uncertainties weaken GBP.

ECB’s more gradual tightening approach may prevent shocks, making EUR attractive.

Brexit-related trade issues continue to pose risks for GBP.

4. Risks to Consider :

Unexpected ECB dovish moves could weaken EUR.

Positive UK economic surprises or faster-than-expected BoE tightening might strengthen GBP.

External shocks like geopolitical tensions can affect risk sentiment, impacting both currencies.

-----------------------------------------------------------

Note: Stop Loss(SL)= 0.84221 GBP

Euro/British Pound Analyze (EURGBP), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

EURGBP possible long for 0.8675 even highereurgbp weekly chart formed double bottom. eurgbp retraced back to 0.8356 and hold the previous HL (higher low)0.8317, weekly key reversal bar formed , made a new low closed on the high. indication for long for coming days and weeks. stop loss below 0.8317, target 0.8675.