EURGBP Short Term Buy IdeaH4 - Strong bullish momentum

No opposite signs

Expecting retraces and further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Eurgbplong

EURGBP Discretionary Analysis: Eyes on the SupplyIt's that feeling when you just know the tide's about to turn (like when you're waiting for the wind to pass but can already smell the rain). EURGBP is giving off that "Next stop? Supply zone" kind of vibe. I see it pushing up to test that level, like it's gearing up for a showdown. If I'm right, I'll be eyeing some clean entries to make a move. If I'm wrong, I'll just grab a coffee and wait for the next opportunity to roll in.

Just my opinion, not financial advice.

EURGBP: A Potential Short Opportunity Amidst ConsolidationEUR/GBP daily chart reveals a compelling narrative of consolidation followed by a potential bearish reversal. The pair has been trading within a defined range, bounded by key horizontal support and resistance zones (highlighted in blue). The recent price action suggests a rejection from the upper resistance zone, setting the stage for a possible short trade.

Key Observations:

Range-Bound Consolidation: The chart clearly shows EUR/GBP oscillating within a well-defined range. This pattern indicates a period of indecision, where neither buyers nor sellers have established a clear dominant trend.

Resistance Zone Test and Rejection: The price recently revisited the upper resistance zone. The subsequent price action, characterized by a sharp downward move, suggests a strong rejection from this level. This rejection is a critical signal that sellers are stepping in, potentially reversing the recent upward momentum.

Bearish Engulfing/Pin Bar Formation (Possible): While the chart doesn't explicitly highlight a candlestick pattern, the sharp rejection from the resistance zone suggests the formation of a bearish engulfing or a pin bar on a lower timeframe. This pattern reinforces the bearish bias.

Retracement and Entry Opportunity: The price has retraced a portion of the recent decline. This retracement presents a potential opportunity to enter a short position, capitalizing on the anticipated continuation of the bearish move.

Support Zones as Targets: The lower support zone serves as a primary target for the potential short trade. The intermediate support level (around 0.83727) can act as a partial profit-taking zone or a point to trail the stop loss.

Pattern Identification:

The dominant pattern observed is a range-bound consolidation followed by a potential bearish reversal triggered by a rejection from a key resistance zone. Trade Setup:

Entry: A short entry can be considered at the current price level (around 0.85021-0.85129) or on a break below the immediate support level (0.84772). A more conservative approach would be to wait for a clear bearish candlestick pattern confirmation on a lower timeframe (e.g., H4 or H1).

Stop Loss: The stop loss should be placed above the recent swing high (around 0.85867) to protect the trade from unexpected price reversals.

Take Profit: The primary target is the lower support zone (around 0.82537-0.82218). An intermediate target can be set at the 0.83727 level.

Risk-Reward Ratio: The potential trade offers a favorable risk-reward ratio, with a relatively small stop loss and a significant profit target.

EUR/GBP Analysis Double Bottom Breakout Toward TargetOverview of the Chart

This chart displays a EUR/GBP daily timeframe setup, highlighting a Double Bottom Pattern, a well-known bullish reversal formation. The pattern consists of two consecutive lows at a similar price level, followed by a breakout above a key resistance zone. This setup suggests a potential trend reversal from bearish to bullish.

Technical Analysis Breakdown

1. Double Bottom Formation (Reversal Signal)

Bottom 1: The first low was established after a prolonged downtrend, where the price found support and bounced higher.

Bottom 2: Price revisited the same support area but failed to break lower, indicating that sellers are losing strength and buyers are stepping in.

A double bottom pattern signals that the asset is forming a strong base and is likely to move higher after breaking the neckline (resistance level).

2. Support and Resistance Levels

Support Level (~0.8322):

This level acted as a demand zone, preventing further downside.

It marks the price area where buyers accumulated positions, leading to a reversal.

Resistance Level (~0.8500):

This level previously acted as a supply zone, where sellers controlled the price.

A breakout above this level is crucial to confirm the bullish trend continuation.

3. Breakout Confirmation & Retest Expectation

The price successfully broke above the resistance zone, confirming a bullish reversal.

A potential retest of the broken resistance (now turned support) could occur before further upside movement.

Traders often wait for this retest to confirm that the breakout is genuine before entering a position.

4. Price Target Projection

Based on the measured move strategy, the expected target is calculated by measuring the height of the double bottom pattern and projecting it above the breakout zone.

Target Price: 0.8742, aligning with historical resistance levels.

5. Stop Loss Placement

Stop loss at ~0.8322 (below the double bottom support).

This ensures risk is managed in case of an invalid breakout or a false move.

Trading Plan & Execution Strategy

📌 Entry Strategy:

✅ Breakout Entry: Buy after the breakout above resistance.

✅ Retest Entry: Wait for a pullback to the previous resistance (now support) before entering.

📌 Risk Management:

🔹 Stop Loss: Placed below the recent support at 0.8322 to limit downside risk.

🔹 Take Profit: First target at 0.8742 based on the double bottom structure.

📌 Market Outlook:

A successful breakout and bullish momentum could push prices toward the target.

If the price fails to hold above the breakout zone, a deeper retracement could occur before continuing higher.

Conclusion

The EUR/GBP pair has formed a bullish double bottom reversal pattern, signaling a potential uptrend continuation. The key levels to watch include 0.8500 (resistance turned support) and 0.8742 (target projection). Traders should monitor price action around the breakout zone for confirmation and consider risk management strategies before entering a position.

EURGBP is ready to take off ... the week of 07 Apr 2025Weekly chart – strongly bullish, broke above previous structure

Daily chart – strongly bullish, broke above previous structure

H4 chart – bullish, now pulling back towards previous resistance, now turned support.

The formation of a higher low on the daily adds to my confidence that we are headed higher. This is actually a breakout-retest setup. When/If price reaches this zone, I will be monitoring PA on H4 and H1 timeframes with a view to find evidence of a bullish continuation. We could easily have a much deeper retracement too. In the current uncertain world economic situation, it is vital to establish that control of the market has returned to the bulls, before taking a trade.

Stop may be larger than what I would like, but it will need to be below the nearest swing low. Target can be generous too – at 0.8613 or anywhere higher right up to 0.8750.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk, only trade with money you can afford to lose and carefully manage your capital and risk.

If you like my idea, please give a “boost” and follow me to get even more. Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

EUR/GBP: Inverse Head & Shoulders Breakout Towards TargetChart Overview

Asset: Euro / British Pound (EUR/GBP)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 19:21 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 0.83668

High: 0.83670

Low: 0.83260

Close: 0.83635

Change: -0.00035 (-0.04%)

Price on the Right Axis: The price scale ranges from approximately 0.83100 to 0.84447, with the current price around 0.83642 (ask) and 0.83635 (bid).

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of EUR/GBP, showing price movements from mid-March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a downtrend, declining from around 0.84200 (March 12) to a low of 0.83260 (March 25). This indicates a bearish trend leading into the pattern formation.

Following this decline, the price began to consolidate, forming the Inverse Head and Shoulders pattern, which suggests a potential reversal from bearish to bullish.

Recent Price Action:

On April 2, the price appears to have broken out above the neckline of the Inverse Head and Shoulders pattern, closing above the resistance level with a bullish candle. The current price of 0.83642 is above the breakout level, supporting the bullish thesis.

2. Chart Pattern: Inverse Head and Shoulders

Pattern Identification:

The chart highlights an Inverse Head and Shoulders pattern, a bullish reversal pattern that typically forms after a downtrend. It consists of three troughs:

Left Shoulder: A low around 0.83400 (March 20), followed by a bounce.

Head: A deeper low at 0.83260 (March 25), marking the lowest point of the pattern.

Right Shoulder: A higher low around 0.83400 (March 30), indicating diminishing selling pressure.

The neckline is drawn by connecting the highs between the shoulders (around 0.83600–0.83700), sloping slightly downward in this case.

Pattern Dynamics:

The Inverse Head and Shoulders pattern signals a shift from bearish to bullish sentiment. The left shoulder and head represent selling pressure, while the higher right shoulder indicates buyers stepping in at a higher level, showing increased demand.

The breakout occurs when the price closes above the neckline, confirming the reversal. In this chart, the breakout is confirmed around April 2, with the price closing above the neckline at approximately 0.83600–0.83700.

Breakout Confirmation:

The price broke above the neckline on April 2, with a strong bullish candle closing at 0.83635. The current price of 0.83642 is holding above the breakout level, which is a positive sign for bulls.

The breakout level aligns with the resistance zone, making the move significant as it also clears this key barrier.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 0.83425 (approximately 0.8340–0.8345).

This level corresponds to the lows of the left and right shoulders, where buyers stepped in to defend the price. It also aligns with the lower boundary of the pattern, reinforcing its importance.

Resistance Level:

A resistance zone is marked around 0.83700 (approximately 0.8365–0.8375).

This level corresponds to the neckline of the Inverse Head and Shoulders pattern and a previous high from March 19. It acted as a barrier during the pattern formation but has now been broken, turning it into potential support on a retest.

Target Level:

The target for the breakout is projected at 0.84447.

This target is calculated using the standard method for Head and Shoulders patterns: measuring the height of the pattern (from the head at 0.83260 to the neckline at 0.83700, which is 0.00440) and projecting that distance upward from the breakout point (0.83700 + 0.00440 = 0.84140). The target of 0.84447 is slightly higher, possibly adjusted for the next significant resistance.

The chart indicates a potential move of 0.00627 (0.75%), which aligns with the distance from the breakout level (0.83700) to the target (0.84447).

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 0.83425.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back below the neckline and the right shoulder, the trade is exited with a controlled loss.

The distance from the breakout level (0.83700) to the stop loss (0.83425) is 0.00275, representing the risk on the trade.

Risk-Reward Ratio:

The chart indicates a potential move of 0.00627 (0.75%) to the target.

The risk is 0.00275 (from 0.83700 to 0.83425), and the reward is 0.00627 (from 0.83700 to 0.84447), giving a risk-reward ratio of approximately 2.28:1 (0.00627 / 0.00275). This is a favorable ratio for a trading setup.

5. Additional Annotations

Pattern Components:

The chart labels the Left Shoulder, Head, and Right Shoulder, clearly identifying the structure of the Inverse Head and Shoulders pattern.

A blue arrow labeled “Inverse Head & Shoulder pattern” points to the formation, making it easy to recognize.

Arrows and Labels:

A green arrow labeled “Support Level” points to the 0.83425 zone, indicating where buyers have defended the price.

A red arrow labeled “Resistance Level” points to the 0.83700 zone, highlighting the neckline and the breakout area.

A blue arrow labeled “Target” points to 0.84447, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 0.83425, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 0.83642 (red) and bid price at 0.83635 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) EUR/GBP.

Entry Point: The setup suggests entering after the price breaks out above the neckline of the Inverse Head and Shoulders pattern, which occurred around April 2, 2025, at approximately 0.83700.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the neckline, with the current price at 0.83642, slightly below the high of 0.83670 but still above the breakout level. Traders might wait for a retest of the neckline (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 0.83425.

Rationale: This placement protects against a false breakout. If the price falls back below the neckline and breaches the right shoulder, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (0.83700) to the stop loss (0.83425) is 0.00275, or approximately 0.33% of the entry price.

Take Profit/Target:

Level: The target is set at 0.84447.

Rationale: This target is derived from the height of the pattern projected upward from the breakout point. It also aligns with a logical extension toward the next significant resistance.

Reward: The distance from the entry (0.83700) to the target (0.84447) is 0.00627, or approximately 0.75% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.28:1, which is attractive for a trading setup. For every unit of risk (0.00275), the potential reward is over 2 units (0.00627).

Trade Management:

Trailing Stop: Once the price approaches the target at 0.84447, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at a minor resistance level (e.g., 0.84000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the pattern was bearish, as evidenced by the decline from 0.84200 to 0.83260. The Inverse Head and Shoulders pattern suggests a potential reversal to the upside, with the breakout confirming this shift.

The price action after the breakout will be critical. A strong move toward 0.84000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of an Inverse Head and Shoulders breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

EUR/GBP is influenced by factors like Eurozone and UK economic data, interest rate differentials, and Brexit-related developments. On April 2, 2025, traders should consider:

Economic Data: Key releases like UK GDP, Eurozone inflation, or central bank statements around this time could impact the pair.

Geopolitical Events: Any developments related to UK-EU relations or global risk sentiment could drive volatility in EUR/GBP.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the neckline (0.83700) and falls back below the right shoulder, the setup is invalidated. The stop loss at 0.83425 mitigates this risk.

Resistance at 0.84000:

The price may encounter resistance around 0.84000, a psychological level and a previous high. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near this level.

Market Volatility:

EUR/GBP can be volatile on a 1-hour timeframe, especially around economic data releases. Unexpected news could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for EUR/GBP based on an Inverse Head and Shoulders pattern. The price has broken out above the neckline on April 2, 2025, signaling a potential move toward the target of 0.84447. Key levels include support at 0.83425 (where the stop loss is placed) and the neckline resistance at 0.83700, which the price must hold above to maintain the bullish thesis. The setup offers a favorable risk-reward ratio of 2.28:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on EUR/GBP or check the outcome of this setup, I can assist with that!

EUR/GBP Bullish Breakout from Falling Wedge – Buy Setup!Introduction

This EUR/GBP 4-hour chart analysis presents a high-probability bullish trading setup based on a falling wedge breakout. A falling wedge is a reliable bullish reversal pattern, signaling that selling pressure is fading, and buyers are regaining control. The price has now broken out of the wedge, confirming potential upside momentum.

This setup provides a well-defined entry, stop-loss, and target level, allowing traders to capitalize on the bullish breakout while maintaining a proper risk management strategy.

1. Chart Pattern: Falling Wedge (Bullish Reversal)

The primary pattern on the chart is a falling wedge, which is a bullish reversal pattern that forms after a downtrend. It is characterized by converging downward-sloping trendlines, indicating that sellers are gradually losing momentum.

🔹 Key Characteristics of the Falling Wedge Pattern:

Lower highs & lower lows within a narrowing price range.

Decreasing selling pressure, indicating a potential shift in trend.

A bullish breakout above the upper trendline confirms a reversal.

Typically followed by a strong price surge, aiming for previous resistance levels.

The price action confirms this pattern as it broke above the wedge's upper boundary, signaling the start of a bullish trend.

2. Key Technical Levels & Market Structure

🔹 Resistance Level (Target) – 0.84183

This level marks a previous strong resistance zone, where the price faced rejection multiple times.

It serves as the primary profit-taking area for this setup.

A successful breakout and close above this level could lead to further upside movement.

🔹 Support Level – 0.83154

This is the major demand zone where price previously bounced.

Strong buying pressure emerged at this level, leading to the recent breakout.

It serves as an important level to define risk and set stop-loss orders.

🔹 Stop-Loss Placement – Below 0.83154

A stop-loss is placed slightly below the support zone, ensuring a logical exit if the market reverses.

This prevents unnecessary losses while allowing room for normal price fluctuations.

🔹 Entry Point Consideration

Ideal entry: Around 0.83700, just after the breakout confirmation.

Confirmation: A strong bullish candle closing above the wedge.

3. Trade Execution Plan: Long Setup

📌 Trade Idea – Bullish Setup

📈 Buy Entry: 0.83600 – 0.83700 (After wedge breakout)

🎯 Target: 0.84183 (Major resistance level)

❌ Stop-Loss: 0.83154 (Below support level)

🔄 Risk-to-Reward Ratio (RRR): ~1:1

📊 Risk Management Strategy

Trade with discipline: Never risk more than 1-2% of your capital per trade.

Adjust position size: Based on risk tolerance and account balance.

Use trailing stops: To secure profits if price continues upward.

4. Market Sentiment & Price Action Analysis

Prior Uptrend: The price previously had a strong bullish rally, indicating overall bullish strength.

Corrective Move: The market entered a falling wedge correction, allowing for a healthy pullback before resuming the trend.

Breakout Confirmation: The breakout above the wedge's upper trendline confirms bullish momentum.

📊 Factors Supporting a Bullish Move:

✅ Breakout confirmation above the wedge pattern.

✅ Higher buying volume supporting the move.

✅ Support level holds strong, preventing further downside.

5. Trading Psychology & Risk Considerations

⚠️ Key Considerations Before Entering the Trade:

✔ Wait for confirmation – Ensure a strong breakout candle before entering.

✔ Avoid chasing the price – Enter at a reasonable pullback level post-breakout.

✔ Monitor economic events – Watch for news that could impact EUR/GBP volatility.

✔ Follow a strict risk-reward ratio – Stick to your predefined stop-loss and target.

6. Conclusion – Bullish Outlook

This falling wedge breakout on EUR/GBP suggests a bullish reversal, offering a high-probability long trade setup. The price is expected to move towards the 0.84183 resistance level, with 0.83154 as the key stop-loss level.

✅ Bias: Bullish

🎯 Target: 0.84183

❌ Stop Loss: 0.83154

📊 Risk-to-Reward: ~1:1

📌 TradingView Idea Title & Description

Title:

🚀 EUR/GBP Falling Wedge Breakout – Bullish Move Incoming!

Description:

📈 Bullish breakout confirmed! EUR/GBP has broken out of a falling wedge, signaling a trend reversal. A long position above 0.83600 targets the 0.84183 resistance level with a stop-loss at 0.83154. Watch for strong bullish momentum! 📊💹

💡 Risk Management: Stick to your stop-loss, and don’t chase price action. Manage your trade wisely! 🔥

EUR/GBP Weekly Forecast: Double Bottom Pattern, Bullish ReversalOverview of the Chart

This is a EUR/GBP daily chart, showcasing a Double Bottom Pattern, which is a classic bullish reversal formation in technical analysis. The pair has been in a downtrend for several months, but recent price action indicates a potential shift in momentum.

The double bottom pattern consists of two distinct lows (Bottom 1 & Bottom 2) at nearly the same level, forming a W-shaped structure. This suggests that sellers attempted to push the price lower twice but failed both times due to strong buying pressure at the support zone.

As the price starts to rise from the second bottom, the neckline resistance becomes a crucial level to watch. A confirmed breakout above this neckline would validate the pattern and signal a potential bullish rally.

Chart Breakdown & Key Components

1. Double Bottom Pattern Explanation

The first bottom formed in December 2024, marking the lowest price point where buyers stepped in.

The second bottom formed in March 2025, confirming strong demand in the support zone.

The pattern suggests bearish exhaustion, as sellers were unable to push the price lower.

The neckline at ~0.84778 acts as a key breakout level. Once price moves above it, the bullish reversal is confirmed.

🔹 Why is this pattern important?

It signals a trend reversal from bearish to bullish.

It attracts buying interest as traders recognize the formation.

The measured move suggests a potential target of 0.87307, aligning with previous resistance levels.

2. Key Support & Resistance Zones

✅ Support Zone (0.82249 - 0.82458)

This level has been tested twice, making it a strong demand area.

Buyers aggressively defended this zone, preventing further downside.

A break below this level would invalidate the bullish setup.

✅ Neckline Resistance (~0.84778)

This is the breakout level that confirms the double bottom pattern.

A strong bullish daily candle closing above 0.84778 would indicate a trend shift.

The price may retest this level after breaking out, offering a second entry opportunity.

✅ Major Resistance & Target Areas

0.86251 → The first major resistance zone, where price may face some selling pressure.

0.87307 → The final target based on the pattern projection, aligning with historical resistance.

3. Trading Setup & Execution Plan

🔹 Entry Strategy (Breakout Confirmation)

Enter a buy position after the price breaks and closes above the neckline (~0.84778).

A retest of the neckline provides a second chance to enter at a better price.

Look for high volume confirmation on the breakout for additional confidence.

🔹 Stop Loss Placement (Risk Management)

Place the stop-loss below 0.82249, just under the support zone.

This ensures protection against false breakouts.

Avoid placing the stop too tight, as price fluctuations can trigger early exits.

🔹 Take Profit Levels (Reward Calculation)

First Target: 0.86251 (Intermediate Resistance Level)

Final Target: 0.87307 (Measured Move Projection)

Partial profits can be taken at 0.86251, while runners target 0.87307.

🔹 Risk-Reward Analysis

Entry near 0.84778, stop loss below 0.82249, target at 0.87307.

This setup offers a risk-to-reward ratio (R:R) of over 3:1, making it a highly favorable trade.

4. Market Sentiment & Potential Scenarios

Bullish Scenario (High Probability) ✅

Price successfully breaks above the neckline at 0.84778.

Retests the neckline and holds as new support, leading to strong bullish momentum.

Moves toward 0.86251 first, then extends to 0.87307.

This scenario aligns with technical confirmation & volume breakout strategy.

Bearish Scenario (Low Probability) ❌

Price fails to break the neckline and faces rejection.

The pair revisits the support zone (0.82249 - 0.82458) for a third test.

If the support breaks, it could invalidate the bullish setup, leading to continued downtrend.

5. Final Thoughts & Summary 🎯

✅ Pattern Identified → Double Bottom, signaling bullish reversal.

✅ Breakout Level → Watch for confirmation above 0.84778.

✅ Risk Management → Stop loss below 0.82249.

✅ Profit Target → 0.86251 (Partial Profit), 0.87307 (Final Target).

✅ Trade Plan → Buy on breakout, retest entry for better positioning.

🔥 This is a high-probability bullish setup! Watch for breakout confirmation before entering a trade.

EUR/GBP Chart Analysis – Double Bottom Reversal & Breakout Setup1. Market Structure & Context

The EUR/GBP daily chart presents a well-defined double bottom reversal pattern, indicating a potential trend shift from a prolonged downtrend to an uptrend.

The pair has been in a bearish phase, as reflected by the descending trendline.

However, price action suggests a possible trend reversal, as buyers are stepping in near a key demand zone.

A successful neckline breakout would confirm the bullish reversal, potentially leading to significant upside movement.

2. Key Chart Patterns & Technical Levels

A. Double Bottom Formation (Bullish Reversal Pattern)

The double bottom is a powerful reversal pattern, often signaling the end of a downtrend. It consists of two similar low points, forming a "W" shape.

Bottom 1: The first low was established around 0.8200 - 0.8250, where buyers initially stepped in to push prices higher.

Bottom 2: Price retested this demand zone, but sellers failed to push it lower, confirming a strong support level.

Bullish Significance: The inability of sellers to break below the support zone suggests the exhaustion of selling pressure and increasing buy-side interest.

B. Neckline Resistance & Potential Breakout Zone

The neckline resistance is drawn around 0.8450 - 0.8500, a key level where previous price rallies were rejected.

A breakout above this zone, ideally with strong bullish volume, would validate the double bottom pattern and trigger a bullish breakout trade.

C. Descending Trendline Breakout Attempt

The long-term downtrend resistance (trendline) has been holding since mid-2024.

Price is currently testing this trendline; a clear breakout and retest would add further confidence to the bullish bias.

3. Trade Setup & Execution Plan

A. Entry Strategy

There are two possible entry strategies, depending on risk appetite:

Aggressive Entry: Buy immediately upon a breakout above 0.8500, anticipating a strong rally.

Conservative Entry: Wait for a breakout + retest of the neckline before entering, ensuring confirmation.

B. Stop Loss & Risk Management

Stop Loss (SL): Placed below the recent swing low at 0.82029.

This level acts as the last line of defense for bulls; if price drops below it, the bullish thesis is invalidated.

C. Take Profit (TP) Targets

TP1: 0.86122 (first resistance zone, a previous swing high).

TP2: 0.87284 (higher resistance level, next supply zone).

These levels serve as potential profit-taking areas where sellers may re-enter the market.

4. Additional Technical Confluences Supporting Bullish Bias

✔ Key Support Zone Holding Strong – The price has bounced twice from the demand zone (0.8200 - 0.8250), confirming strong buyer interest.

✔ Volume Confirmation Needed – A breakout with high volume increases the probability of sustained bullish momentum.

✔ RSI & Momentum Indicators – If RSI crosses above 50, it would further confirm bullish momentum, supporting the breakout trade.

✔ Favorable Risk-to-Reward Ratio (RRR) – A well-defined stop loss & take profit strategy ensures an optimal trade setup.

5. Summary & Final Trading Plan

Current Market Bias: Bullish if neckline breaks (Double Bottom Confirmation).

Entry Confirmation: Look for a breakout above 0.8500 with strong volume.

Profit Targets:

TP1: 0.8612

TP2: 0.8728

Stop-Loss Level: Below 0.8202 to protect against fake breakouts.

🚀 Final Tip for Traders:

Monitor price action & volume closely. A breakout without volume may lead to a false move. Confirmation with bullish momentum is essential for a high-probability trade setup.

EUR/GBP Chart Analysis – Inverse Head & Shoulders Bullish SetupThis EUR/GBP 1-hour chart showcases a classic Inverse Head & Shoulders (H&S) pattern, signaling a potential trend reversal from bearish to bullish. This pattern is considered one of the most reliable technical formations for spotting upcoming upward momentum, particularly after a prolonged downtrend.

🔎 Market Overview

Currency Pair: EUR/GBP

Timeframe: 1-Hour (H1)

Current Price: 0.83720

Trend: Transitioning from a downtrend to a potential bullish breakout

Key Pattern: Inverse Head & Shoulders

Trading Bias: Bullish (Pending breakout confirmation)

📊 Chart Breakdown & Technical Analysis

1️⃣ Market Structure & Trend Analysis

Before the formation of the Inverse Head & Shoulders, the market was in a strong downtrend, making lower highs and lower lows. However, buyers started stepping in near the 0.8350 level, preventing further decline. This rejection at key support has set the stage for a potential trend reversal.

Left Shoulder: Price formed a minor low around 0.8370, followed by a small bounce.

Head: Price made a deeper low around 0.8351, confirming strong support and buyer interest.

Right Shoulder: Price attempted another dip but failed to break below the previous low, forming a higher low near 0.8370, signaling increasing bullish pressure.

Neckline Resistance: 0.8385 - 0.8390 zone – a crucial level that price needs to break for confirmation of an uptrend.

2️⃣ Key Support & Resistance Levels

Support Level: 0.83513 (Major demand zone)

Resistance Levels:

Neckline: 0.8385 - 0.8390 (Breakout confirmation zone)

Major Resistance: 0.84308 (Target level)

Curve Zone: A dynamic resistance trendline that has been containing price action. A breakout above this curve signals a potential shift in trend.

📈 Trading Strategy – Bullish Breakout Plan

✅ Entry Strategy:

A long trade should be considered only after a confirmed breakout above the neckline (0.8385 - 0.8390). The confirmation comes when:

A strong bullish candle closes above the neckline.

Increased trading volume supports the breakout.

A possible retest of the neckline as new support (0.8385) before continuation.

🎯 Target Price & Stop Loss:

Take Profit (TP): 0.84308 (Projected move based on pattern size).

Stop Loss (SL): Below 0.83513 (Right Shoulder low).

Risk-to-Reward Ratio (RRR): 1:2 or higher, making this a high-probability trade setup.

🛑 Risk Management & Trade Confirmation:

Volume Confirmation: A breakout should be accompanied by a volume spike, confirming strong buyer interest.

Fakeout Warning: If price briefly breaks above the neckline but then falls back below, it could be a false breakout. In this case, waiting for a retest would be a safer approach.

Trailing Stop: Once price moves toward 0.8410, a trailing stop can help secure profits in case of market reversals.

🧐 Summary – Key Takeaways

✅ Inverse Head & Shoulders Identified – A reliable bullish reversal pattern.

✅ Breakout Zone: 0.8385 - 0.8390 (Watch for confirmation).

✅ Target Price: 0.84308 (Potential profit zone).

✅ Stop Loss: Below 0.83513 (Protect against downside risk).

✅ Risk-to-Reward Ratio: Favorable (1:2 or better).

✅ Trading Plan: Buy above the neckline, aim for 0.8430, and manage risk properly.

📌 Final Thought: If the neckline is broken with strong momentum, expect a bullish move toward 0.8430+. However, traders should remain cautious of potential fakeouts and manage risk accordingly.

📢 Share your thoughts in the comments! Are you bullish on EUR/GBP? 🚀📊

#EURGBP #ForexTrading #TechnicalAnalysis #TradingSetup #InverseHeadAndShoulders

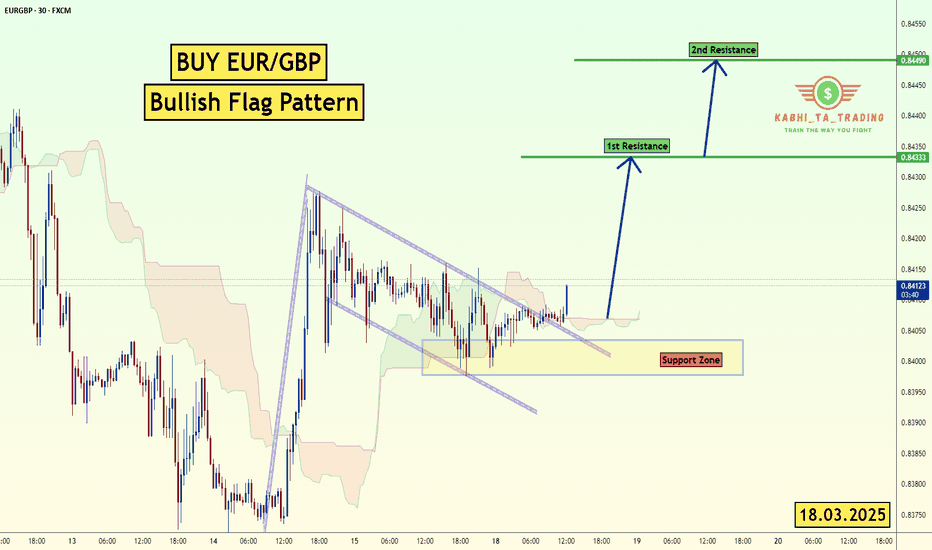

EUR/GBP Bullish Flag (18.3.25)The EUR/GBP pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Flag Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.8433

2nd Resistance – 0.8448

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

EUR/GBP Technical Analysis - 4H Chart

📌 Pair: EUR/GBP

📈 Current Price: 0.84092

Key Levels:

🔹 Support Zone: 0.83766 - A key area where price has previously bounced.

🔹 Resistance Zone: 0.84400 - A strong resistance level where price has faced rejection.

🔹 Target Level: 0.85004 - Potential bullish target if price breaks above resistance.

Market Structure & Trade Idea:

EUR/GBP has shown strong bullish momentum, breaking above the support zone (0.83766).

Currently, price is testing the resistance level. A slight pullback toward support could provide a new buying opportunity.

A break above resistance would confirm bullish continuation toward 0.85004.

Trading Plan:

✅ Bullish Scenario: Wait for a pullback to 0.83766 before entering long, targeting 0.85004.

✅ Bearish Scenario: If price breaks below 0.83766, a deeper retracement to 0.82652 may follow.

🔍 Watch for:

Breakout confirmation above resistance.

Strong rejection from support before entering a trade.

EURGBP uptrend - continuing⭐️Smart investment, Strong finance

⭐️EURGBP INFORMATION:

EUR/GBP extends its winning streak since March 3, hovering around 0.8440 during Tuesday’s European session. The pair gains momentum as the European Union (EU) considers boosting defense spending through joint borrowing, EU funds, and an expanded role for the European Investment Bank (EIB), with crucial decisions anticipated by June.

⭐️Personal comments NOVA:

EURGBP H1 breakout price zone retreats, continuing the uptrend

⭐️SET UP EURGBP PRICE:

🔥BUY eurgbp zone: 0.84200 - 0.84100 SL 0.83800

TP1: 0.84500

TP2: 0.84800

TP3: 0.85200

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Scenario on EURGBP 13.2.2025On this chart, I see the situation like this: if I should take a short, then the first sfp at the price level of 0.83800-0.84000, if I should be interested in a long position, then the first target that makes more sense to me is the sfp at the price of 0.8300, other scenarios are other alternatives where the market could react if certain conditions are met

EURGBP: What Are You Anticipating With This Volatile Pair?I am a swing trader, as you can probably tell from the timeframes I use in my posts. However, I do believe that EURGBP lends itself better to day trades or position trades, if you can stomach the movement. Considering it has made, for me, surprising reverses just when you think it would push further, I offer a couple of scenarios for both a sell and buy possibility. I do see EURGBP selling further but this is a pair you want to be prepared for movement in the opposite direction as well. Game plan, ready! What would be your move?

EURGBP - Long active !!Hello traders!

‼️ This is my perspective on EURGBP.

Technical analysis: Here we are in a bullish market structure from daily timeframe perspective, so I expect price to continue bullish price action after filling the imbalance and rejecting from bullish OB + institutional big figure 0.83000.

Fundamental news: On Thursday (GMT+2) we will see results of Interest Rate on GBP, news with high impact on currency.

Like, comment and subscribe to be in touch with my content!

EURGBP, First Long and after that Get Ready for ShortHello Traders, Hope you are doing great.

for upcoming weeks, we'll probably see continuation of upward momentum and after that we'll probably find an opportunity to Sell at one of these specified zones. so with a proper trigger we can open a long at first and after that a short position.

And finally tell me what do you think ? UP or DOWN ? leave your comment below this post.

If this post was helpful to you, please like it and share it with your friend.

THANKS.

EUR/GBP at Critical Resistance – Major Move Incoming?What’s great everyone!? Mr. Blue Ocean FX here, breaking down EUR/GBP with an in-depth analysis you don’t want to miss.

Starting from the higher timeframes, we’ve identified a major trendline resistance dating back to January 2023, which has been tested multiple times and is now being challenged again. After a massive impulse move from the 0.8275 area in late December, price has surged to the current levels around 0.8472, but signs of weakness are starting to emerge.

Looking closer at the daily timeframe, we’ve seen a clear rejection off the trendline with significant bearish volume stepping in yesterday—indicating strong selling pressure after a liquidity grab above 0.8444. With a confirmed daily close below 0.8434, we’re now eyeing potential downside targets.

Dropping down to the H1 timeframe, we’re observing a lower high formation, which could signal a continuation lower. I’ve already entered this trade with a high-risk, high-reward approach, placing stops above the recent high and targeting multiple liquidity areas below.

Key levels to watch:

• First target: 0.8433, sweeping liquidity.

• Next: 0.8413 (double bottom) and ultimately 0.8335 if momentum continues.

If we break below key support at 0.8410, this could trigger a much larger drop into untested levels from past price action, potentially targeting the 0.8146 area.

The next few candles will be crucial—will EUR/GBP hold this level or melt down further? Stay tuned and let’s see how it plays out!

If you’re finding value in these breakdowns, make sure to boost, share, and comment with your thoughts. Let’s make some moves!