Title: Geopolitical Tempest Navigating the EUR/ILS Currency PairThe EUR/ILS exchange rate is a crucial indicator of Israel's economic and geopolitical stability in relation to the Eurozone. Recently, it has been under substantial pressure due to escalating tensions between Israel and Iran. This dynamic interplay of geopolitical risks and economic factors creates a complex environment for the Israeli shekel (ILS) against the Euro (EUR).

Key Points

1. Geopolitical Background: The conflict between Israel and Iran, fueled by nuclear ambitions, proxy wars, and direct military engagements, has deep historical, religious, and political roots.

2. Economic Implications: Investor confidence, economic sanctions, and increased military expenditures are critical factors influencing the ILS. Geopolitical instability can reduce investor confidence, cause capital flight, and strain Israel's fiscal budget.

3. Impact on EUR/ILS Exchange Rate: Geopolitical risks lead to a flight to safety, with investors seeking stable currencies like the Euro. Inflationary pressures from supply chain disruptions and military spending can erode the ILS, while the Bank of Israel's interventions may be limited by persistent tensions.

Conclusion

The Israel-Iran conflict casts a long shadow over the Israeli economy and the strength of the ILS. As geopolitical tensions persist, the EUR/ILS exchange rate is likely to experience significant volatility. Investors and policymakers must remain vigilant, monitoring developments closely to mitigate risks and capitalize on opportunities in this uncertain environment.

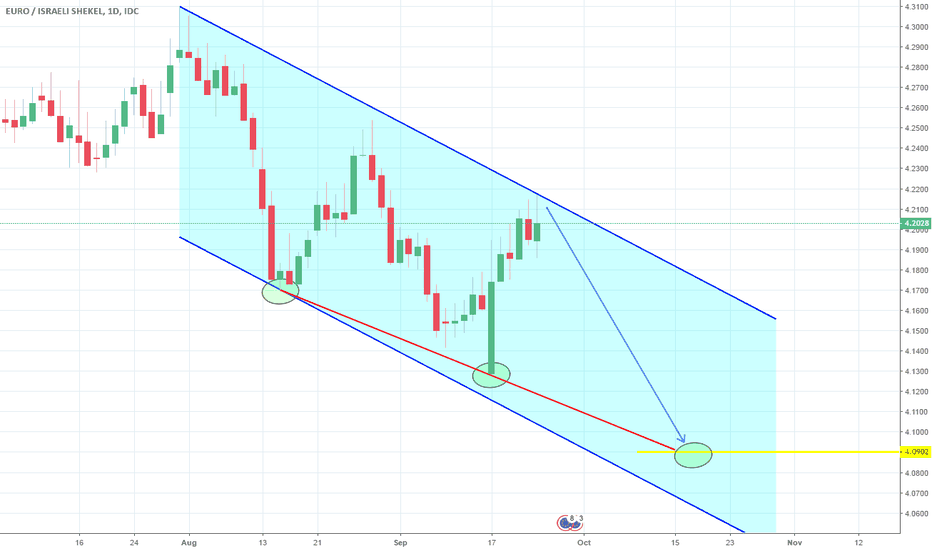

EURILS

EURILS: Sell entries.EURILS has been trading within a long term Channel Down since December 2018 (RSI = 38.590, MACD = -0.085, ADX = 31.136, Highs/Lows = -0.0915). At the moment it is trading around the 1D MA50 and on the Lower High trend line. We expect the price to be rejected back to the 3.7790 Support. If not, then the June - December 2018 fractal may be played out: rise towards 3.9500 and then rejection.

Previous call within the Channel Down:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURILS: Further downside expected.The pair is on a strong 1M Channel Down (RSI = 37.575, MACD = 0.082, Highs/Lows = -0.1355) since the beginning of the year. We are expecting another test of the 3.7870 1D Support. Based on the RSI (despite being a bullish divergence) we are expecting a symmetric low outside the Channel. That should be the 3.7870 contact.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.