EURJPY: Bullish Rebound from Key Demand ZoneEURJPY has bounced off a critical demand zone and is showing signs of a bullish recovery. Despite the recent pullback, the pair’s structure remains fundamentally and technically bullish, driven by JPY weakness and EUR resilience.

Technical Analysis (4H Chart)

Pattern: Price tested a strong demand zone near 170.35–170.50 and rejected it aggressively.

Current Level: 170.77, starting a potential bullish leg toward higher resistance levels.

Key Support Levels:

170.35 – key demand zone and invalidation level for bulls.

169.90 – deeper support if demand zone breaks.

Resistance Levels:

172.17 – first bullish target and interim resistance.

173.64 – major target if bullish continuation sustains.

Projection: A successful rebound from 170.35 could drive price toward 172.17 initially, then 173.64 if momentum holds.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

EUR: ECB’s slower path toward easing supports EUR stability relative to JPY.

JPY: Weakness persists as BoJ maintains dovish bias, though FX intervention risk limits JPY downside speed.

Global Sentiment: Mild risk-on mood supports EUR strength against JPY.

Risks:

BoJ verbal intervention or actual FX intervention could trigger temporary JPY strength.

Sharp reversal in global risk sentiment could weaken EUR/JPY.

Key Events:

ECB speeches and data (CPI, growth updates).

BoJ FX comments and broader market risk appetite.

Leader/Lagger Dynamics

EUR/JPY is a leader among JPY pairs, often moving in sync with GBP/JPY and CHF/JPY. Its movement also tends to precede confirmation in risk-sensitive JPY crosses.

Summary: Bias and Watchpoints

EUR/JPY is bullish from the 170.35 demand zone, with a potential move toward 172.17 and 173.64. Key watchpoints include ECB communication, BoJ stance, and market risk sentiment. As long as 170.35 holds, bulls remain in control.

Eurjpyanalysis

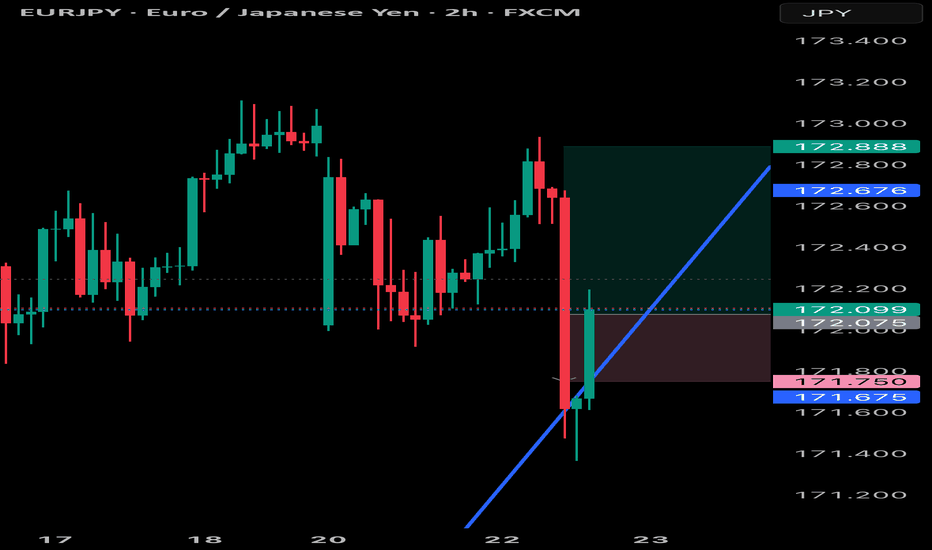

EUR/JPY Made Inverted H&S Pattern , Time To Buy And Get 150 PipsHere is my 2H Chart On EUR/JPY , The price created a very clear reversal pattern ( inverted head and shoulders pattern ) and the price closed above neckline so the pattern confirmed and we can buy it and targeting from 100: 200 pips , if we have a daily closure above 171.000 it will be a great confirmation telling us the price will continue to upside .

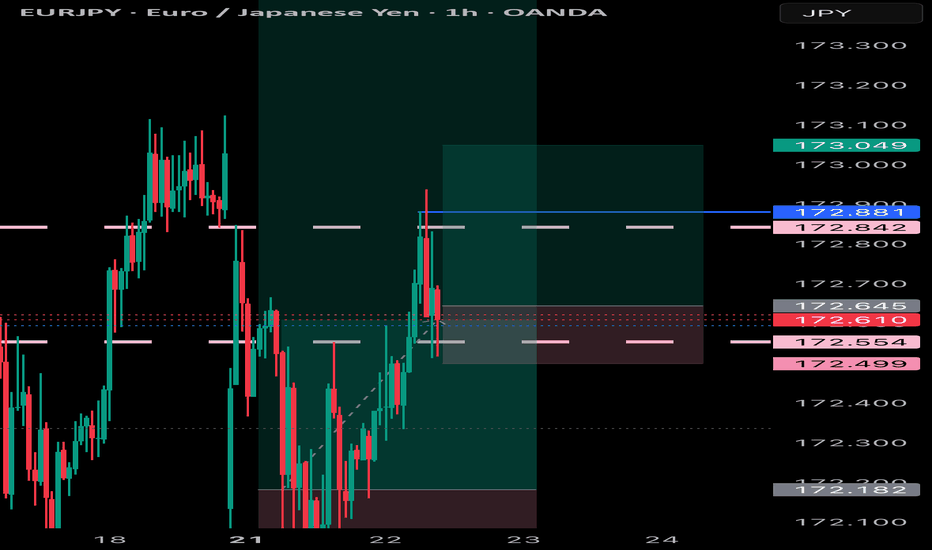

Possible Short Position Levels for EURJPYThe trade plan is as follows:

Action: Entering a short position, betting on the price to fall.

Entry: 171.886, anticipating a pullback to a previously broken support level.

Stop Loss: Placed at 172.406 to limit losses if the price unexpectedly rises and breaks the recent high.

Targets: Two take-profit levels are identified to secure profits as the price declines.

TP1: 170.780 (a recent support level).

TP2: 169.720 (a major previous low).

The setup is considered favorable because the potential profit is significantly larger than the potential risk.

Disclaimer

This analysis is for educational and informational purposes only and does not constitute financial advice. The provided trade idea is based on technical analysis and historical price action, and past performance is not indicative of future results. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. You could lose some or all of your initial investment. Seek advice from an independent financial advisor if you have any doubts. Any action you take upon the information on this chart and analysis is strictly at your own risk.

EUR/JPY Setup: Thief Trader's Stealth Bull Run to 173.000🔥💶 EUR/JPY Bullish Heist Plan 💶🔥

🧠 New Plan Unlocked – The EUR/JPY Bullish Mission is LIVE!

Thief Trader style means: No noise, no fluff — just pure sniper precision with layered limit orders. 🧤🔫

This isn’t trading… it’s a planned market robbery 💼💣

🧩 Asset: EUR/JPY

📊 Strategy: Bullish Bias with Stealth Layered Entries (Limit Order Gameplan)

🎯 Target: 173.000 — That’s the vault we’re cracking!

🛑 Stop Loss: 169.100 — Tight security, keep your escape route clean.

📍 Entry: No fixed door — we’re setting traps (limit orders) across key levels. Patience pays thieves.

Watch for pullbacks on lower timeframes: 15m, 30m, or even 1H — strike near support bounces & fakeout wicks. 🐍💥

🔍 Thief Logic:

This ain’t random — price is setting up for a high-stakes move north with JPY weakness fueling the getaway car.

Think smart, layer deep — sniper entries, not shotgun chaos. 🎯🔍

📌 Notes from the Safe House:

Trade with position sizing discipline – the market doesn’t owe you.

News events are motion sensors — avoid them or stay light! 🕵️♂️📉

Use trailing SLs once in profit — secure the bag and vanish. 💼💨

💣 Ready to steal pips, not hope? Hit that 👍, drop a 💬, and join the crew.

This is Thief Trading — we don’t follow markets, we outsmart them. 🧠💵

Stay sharp, stay silent… profit loud. 🐱👤📈💸

🔥 Tap Boost. Support the Heist. Run the Charts. #ThiefTrader 🧤💰

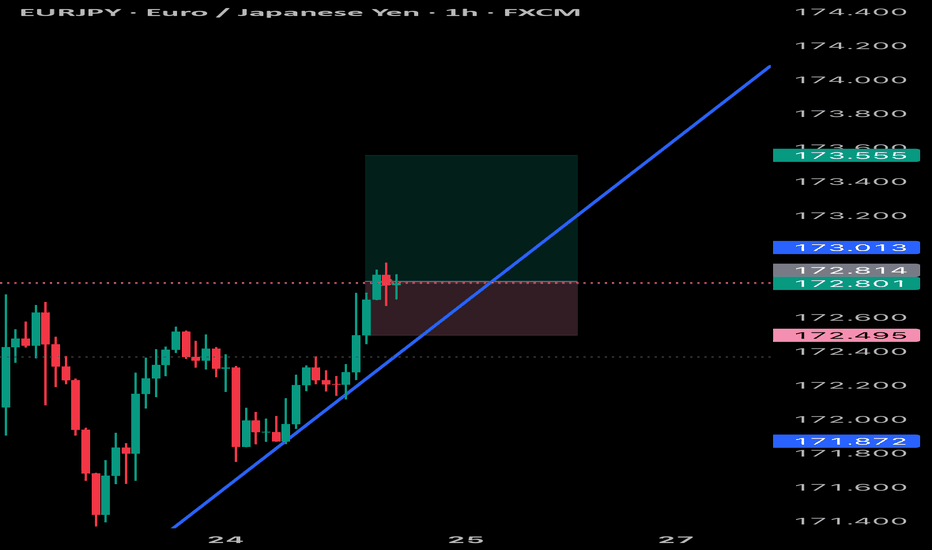

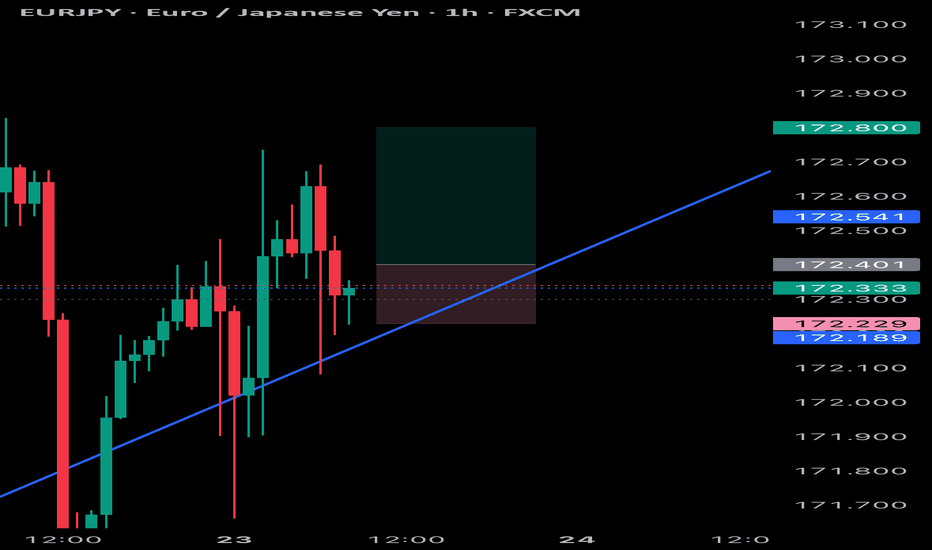

Trading the Pullback on EURJPY My Trade PlanThe EURJPY is clearly in a strong bullish trend 📈, as shown by a consistent pattern of higher highs and higher lows on the 1H timeframe ⏱️. In this video, I’m looking to capitalize on a pullback as a potential buy opportunity 🎯.

We dive into my entry strategy, explore how to align with the prevailing trend, and break down key concepts such as price action, market structure, and smart pullback zones 🧠📊.

⚠️ As always, this is for educational purposes only — not financial advice.

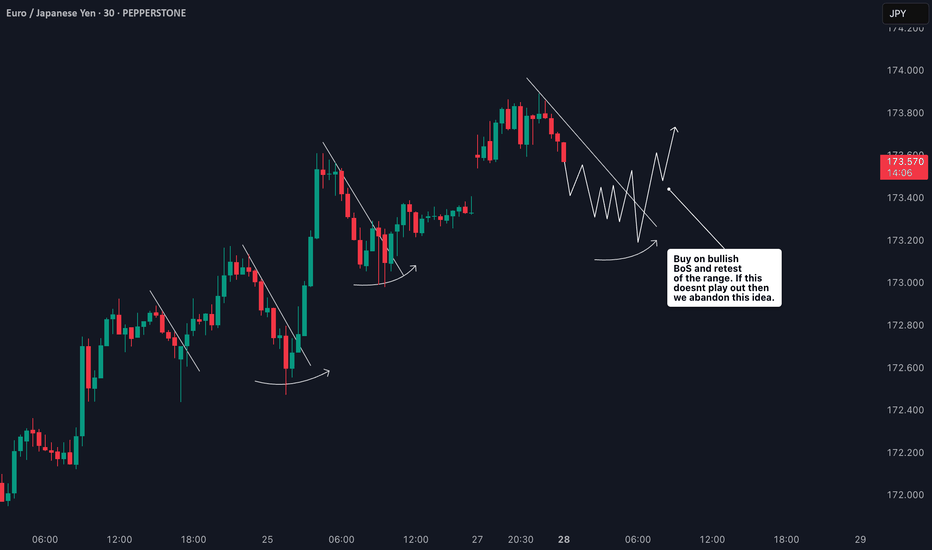

How I’m Trading the EURJPY Break of Structure Setup📈 EURJPY Analysis Update 🔍

I'm currently watching EURJPY closely. On the weekly timeframe, the pair is clearly in a strong bullish trend 🚀. Price has recently tapped into a previous daily bullish order block 🧱 — a key zone of interest.

Now, I’m watching for a break of structure (BoS) 📉 followed by a bullish continuation, especially if price pulls back into the fair value gap (FVG) 📊 near the current low.

As always, this setup — along with all key details and trade considerations — is fully broken down in the 🎥 video.

⚠️ This is for educational purposes only and not financial advice.

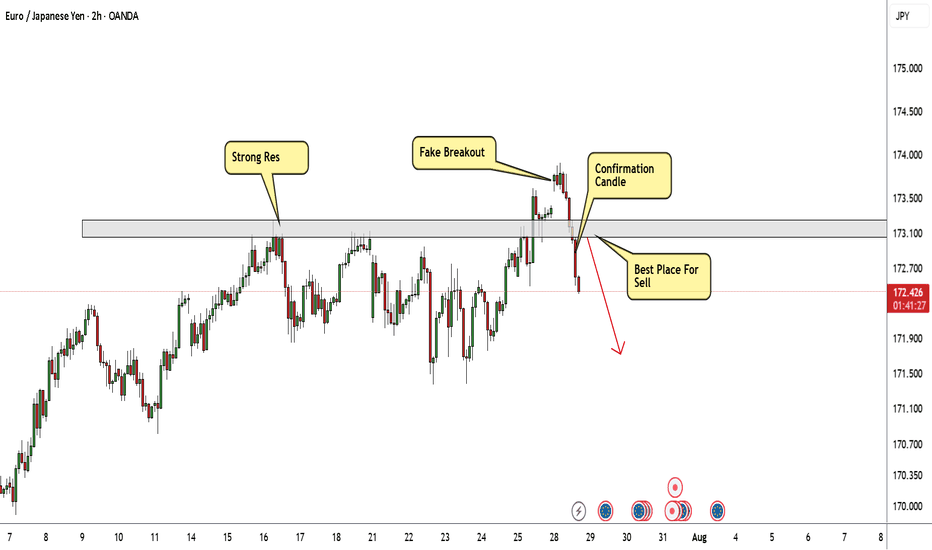

EUR/JPY Again Below My Res , Short Setup Valid To Get 150 Pips !Here is my opinion on EUR/JPY On 2H T.F , We have a fake breakout and Gap and the price back again below my res area and closed with 4H Candle below it , so i have a confirmation and i`m waiting the price to go back to retest this strong res and give me any bearish price action and then we can enter a sell trade and targeting 100 : 150 pips . if we have a daily closure above my res then this analysis will not be valid anymore .

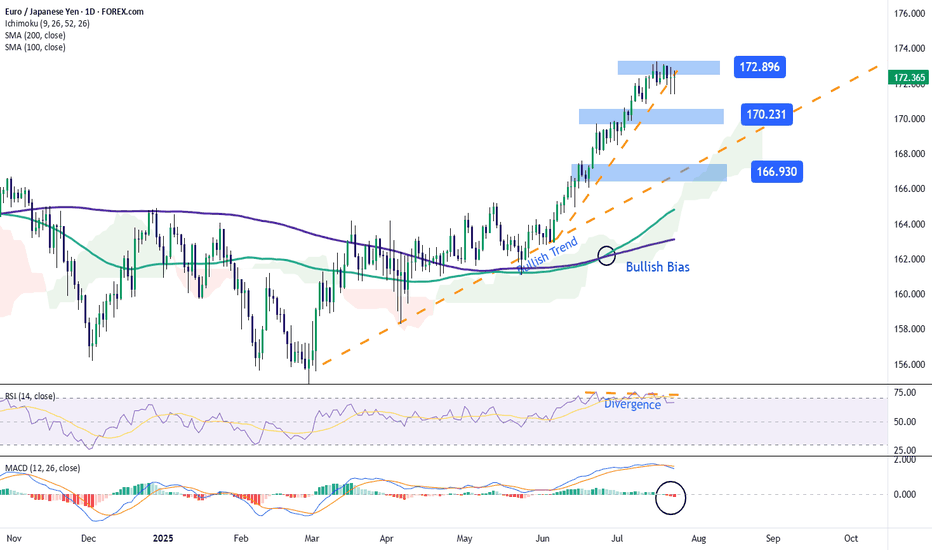

EUR/JPY: The Yen Begins to Gain GroundOver the past three trading sessions, the EUR/JPY pair has declined by up to 0.8%, as the yen has steadily gained strength, preventing the euro from maintaining its momentum in the short term. Selling pressure has held firm, especially after news that Japan finalized a new trade agreement with the United States, which lowered the initially proposed 25% tariff to 15%. This development has been perceived as a positive outcome for Japan and has supported strong demand for the yen in the latest trading session.

Uptrend Remains Intact

Despite the yen’s recent strength, it is important to note that the EUR/JPY pair remains in a well-defined uptrend, with sustained bullish momentum continuing to dominate the long-term outlook. Although some short-term selling corrections have emerged, they remain insufficient to break the current bullish structure. For now, the uptrend remains the most relevant technical formation in the chart and should continue to be monitored unless selling pressure becomes significantly stronger.

RSI

The RSI indicator has started to show lower highs, while price action continues to register higher highs. This event suggests the potential formation of a bearish divergence, which may indicate that the current selling correction could gain more traction in the coming sessions.

MACD

The MACD histogram remains close to the neutral zero line, indicating that no clear direction has formed in short-term moving average momentum. If this neutral setting continues, the chart could enter a more defined consolidation phase in the near term.

Key Levels to Watch:

172.896 – Resistance Level: This level corresponds to the recent high, and any buying momentum strong enough to break it could confirm a bullish continuation, supporting the long-standing uptrend currently in place.

170.231 – Nearby Support: This level aligns with a short-term neutral zone and may act as a temporary barrier, limiting any bearish corrections that may arise in the sessions ahead.

166.930 – Key Support: This is a critical level not seen since June of this year. If bearish pressure intensifies and the price falls to this point, it could seriously jeopardize the bullish structure that has been holding so far.

Written by Julian Pineda, CFA – Market Analyst

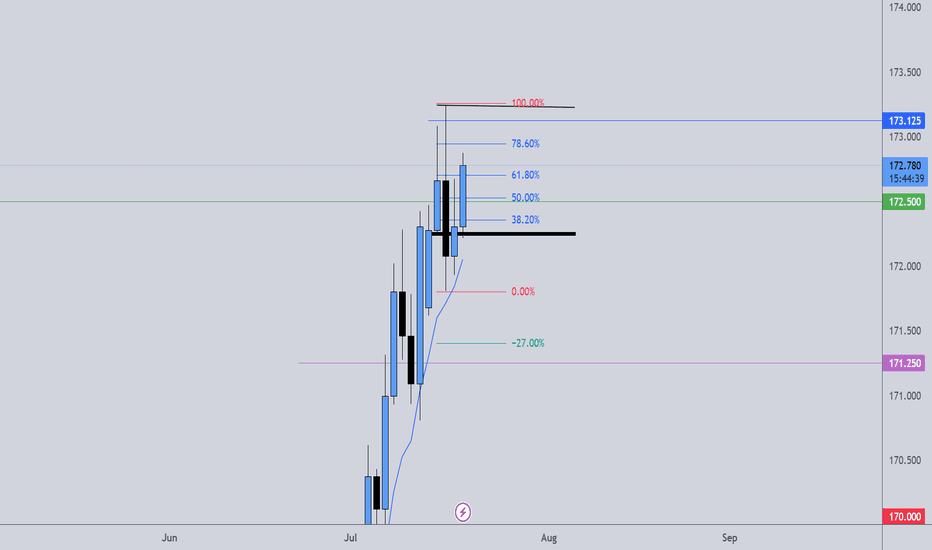

EURJPY Bullish Setup: Waiting for the Optimal Retrace EntryThe EURJPY is currently in a strong bullish trend 📈🔥. I’m anticipating a retracement into the Fibonacci 50–61.8% zone 🔄, which aligns with the equilibrium of the current price swing ⚖️. This potential pullback could present an optimal entry 🎯 — provided we see a bullish break of market structure 🔓📊 during the move down.

🛑 Stops and targets, as discussed in the video, are shared for educational purposes only — this is not financial advice 📚🚫. Please ensure you do your own analysis and risk assessment 🧠📉.

EURJPY: Bullish Trend ContinuationPrice remains in a strong uptrend, now trading above the 172.00 psychological level, targeting new liquidity above.

D1 Key Levels:

Support: 170.50 – 171.00 (daily demand zone + origin of breakout)

Resistance: Hasn't found a ceiling yet. Next key levels are psychological round numbers (173.00, 174.00).

H4 Demand Zone (Pullback Area): 171.20 – 171.50

Watch for retracement into this zone for a high-probability buy setup.

H1 OB: 171.30 – 171.50 (clean mitigation zone)

Monitor M15 for bullish BOS after price taps into this zone for confirmation.

M15 Optimal Plan:

Wait for pullback into 171.30–171.50

Confirm entry with M15 bullish BOS + displacement

🟢Entry Zone: 171.30 – 171.50 (after confirmation)

SL: 170.90

TP1: 172.80

TP2: 173.50

TP3: 174.20

Breakout Alternative: If price rallies above 172.80 early in the week, look for a breakout entry on retest.

Invalidation: H4 closes below 170.50

EURJPY–trend continuation, engulfing candle .. the week of 14/07Friday’s candle engulfed 2 previous days of price action. I interpret this as strongly bullish, especially since this happened in an already nicely bullish trend. However, the room to the upside it not unlimited - the ATH is at 175.421. We are likely to see sideways price action there due to some profit taking and maybe even some selling. IMO there are 2 possible options to get a 2R return:

- we may get a pullback before the bullish trend resumes.

- we drop down to the H1 chart and look for an opportunity to go long.

Either way, in my opinion, the trade should be closed before the ATH.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

EUR/JPY Hits 12-Month HighEUR/JPY Hits 12-Month High

As the chart indicates, the EUR/JPY pair has risen above ¥172 per euro — a level last seen in July 2024.

Since early June, the exchange rate has increased by approximately 5.6%. This upward movement is driven by a combination of factors, including:

→ Divergence in central bank policy: The European Central Bank’s key interest rate remains significantly higher than that of the Bank of Japan, making the euro more attractive in terms of yield compared to the yen.

→ US trade tariffs on Japan: The potential imposition of 25% tariffs by the United States on Japanese goods poses a threat to Japan’s export-driven economy, placing downward pressure on the national currency.

→ Eurozone expansion and consolidation: News of Bulgaria’s potential accession to the euro area is strengthening investor confidence in the single currency.

→ Weakness in the US dollar: As the US Dollar Index fell to its lowest level since early 2022 this July, demand for the euro has grown, positioning it as a key alternative reserve currency.

Can the rally continue?

Technical Analysis of EUR/JPY

For several months, the pair traded within a range of approximately ¥156–165 per euro, but has recently broken above the upper boundary of this channel. Based on technical analysis, the width of the previous range implies a potential price target in the region of ¥174 per euro.

It is noteworthy that the rally gained momentum (as indicated by the arrow) following the breakout above the psychological threshold of 170, a sign of bullish market dominance. At the same time, the RSI has surged to a multi-month high, signalling moderate overbought conditions.

Under these circumstances, the market may be vulnerable to a short-term correction, potentially:

→ Towards the lower boundary of the ascending channel (shown in orange);

→ To retest the psychological support around ¥170.

That said, a reversal of the prevailing trend would likely require a significant shift in the fundamental backdrop — for example, progress towards a trade agreement between Japan and the United States.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURJPY: Trading Above Major QP 170. Strong Bullish Trend EJ broke above the key psychological level of 170.00, and has not found major resistance yet. Expecting a bullish trend continuation as long as price stays above 169.

* M30 Bullish Choch

* Creating new HHs and HLs

* M30/H1 Bearish Break Block

* M30/H1 Bullish FVG (50% filled)

🟢Entry: 168.40 – 168.60

Stop Loss: 168.00

TP1: 169.80

TP2: 170.50

TP3: 171.20

Breakout Option: If price pushes above 170.50 early in the week, consider breakout entry on retest.

Invalidation: Bias shifts to neutral if H4 closes below 169.00.