EUR/JPY Bullish Continuation in an Ascending Channel

This EUR/JPY 4-hour chart shows a strong bullish trend within an ascending channel, indicating a potential continuation of upward momentum.

Key Highlights:

✅ Ascending Channel – Price is trading within a well-defined upward channel, showing steady bullish movement.

✅ Support Zones – Two key support areas marked, which could act as potential entry zones on a retracement.

✅ Target Level – The projected target is around 165.831, aligning with previous resistance zones.

✅ Price Action Expectation – A pullback to the support level within the channel before another bullish impulse toward the target.

Trading Plan:

📌 Bullish Bias: Wait for a retracement toward the marked support zones for a potential long entry.

📌 Invalidation: A strong break below the channel and support zones would invalidate the bullish setup.

Eurjpyanalysis

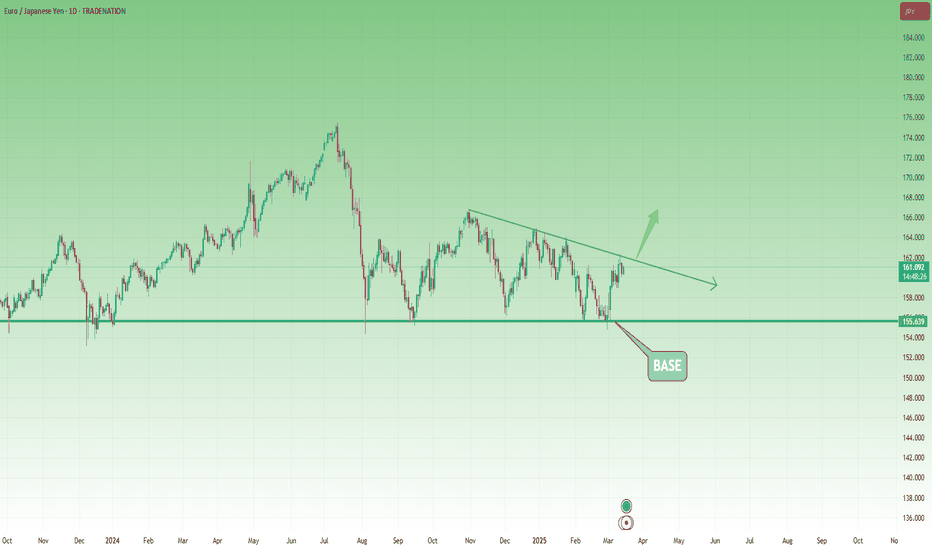

EUR/JPY Trade Setup: Buying the Dip Toward 160 for a 1:2.5 R/RSince reaching a low around 155 at the beginning of August, EUR/JPY has been trading within a defined range.

Earlier this March, the pair once again tested the lower boundary of this range and, as before, rebounded strongly. A higher low was established at the start of this week, suggesting that 159 may now serve as a new base of support.

In my view, EUR/JPY is likely to continue its upward trajectory, and a move toward 165 could materialize in the near future.

Conclusion:

Pullbacks toward the 160 area should be considered potential buying opportunities. With a stop-loss set around 158 and a target at 165, this setup offers an attractive risk-to-reward ratio of approximately 1:2.5.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

EUR/JPY "YUPPY" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "YUPPY" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (157.700) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA (or) placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 156.000 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 160.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

╰┈➤EUR/JPY "YUPPY" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟠Fundamental Analysis

1. Interest Rates: The European Central Bank (ECB) has maintained a hawkish stance, with interest rates expected to remain around 3.25%. The Bank of Japan (BOJ) has also maintained a dovish stance, with interest rates expected to remain around -0.10%

2. Inflation: Eurozone inflation is expected to be around 2.2% in 2025, while Japan's inflation is expected to be around 1.5%

3. GDP Growth: Eurozone GDP growth is expected to be around 1.2% in 2025, while Japan's GDP growth is expected to be around 1.1%

4. Trade Balance: The Eurozone has a significant trade surplus, while Japan has a trade deficit.

🟡Macroeconomic Factors

1. Monetary Policy: The ECB and BOJ's monetary policies have a significant impact on EUR/JPY.

2. Fiscal Policy: Government spending and taxation policies in the Eurozone and Japan can impact the economy and currency.

3. Global Events: Events like the COVID-19 pandemic, Brexit, and trade wars can impact EUR/JPY.

🔴COT Data

1. Non-Commercial Traders: These traders hold a net long position in EUR/JPY futures, with 55.1% of open interest.

2. Commercial Traders: Commercial traders hold a net short position in EUR/JPY futures, with 44.9% of open interest.

3. Open Interest: The total number of outstanding contracts is 233,111.

🟤Market Sentimental Analysis

1. Bullish Sentiment: 53.5% of investors are bullish on EUR/JPY.

2. Bearish Sentiment: 46.5% of investors are bearish on EUR/JPY.

3. Sentiment Index: The sentiment index is at 54.2, indicating a neutral market sentiment.

🟣Positioning Analysis

1. Long Positions: 56.3% of investors are holding long positions in EUR/JPY.

2. Short Positions: 43.7% of investors are holding short positions in EUR/JPY.

3. Retail Trader Sentiment: Retail traders are net long EUR/JPY, with a sentiment index of 57.1%.

4. Institutional Trader Sentiment: Institutional traders are net short EUR/JPY, with a sentiment index of 45.6%.

🔵Quantitative Analysis

1. Moving Averages: The 50-day moving average is above the 200-day moving average, indicating a bullish trend.

2. Relative Strength Index (RSI): The RSI is at 55.9, indicating a neutral market sentiment.

3. Bollinger Bands: The price is trading near the upper band, indicating a potential overbought condition.

🟢Intermarket Analysis

1. Correlation with Other Markets: EUR/JPY has a positive correlation with EUR/USD and a negative correlation with USD/JPY.

2. Commodity Prices: EUR/JPY has a positive correlation with gold prices and a negative correlation with oil prices.

⚫News and Events Analysis

1. ECB Meetings: The ECB's monetary policy decisions can significantly impact EUR/JPY.

2. BOJ Meetings: The BOJ's monetary policy decisions can also impact EUR/JPY.

3. Economic Data Releases: Releases of economic data, such as GDP growth and inflation, can influence EUR/JPY.

⚪Next Trend Move

Based on the analysis, the next trend move for EUR/JPY is likely to be bullish, with a potential target of 160.000.

🟡Future Prediction

Based on the analysis, the future prediction for EUR/JPY is bullish, with a potential target of 165.000 in the next 6-12 months.

🔴Overall Summary Outlook

EUR/JPY is expected to remain in a bullish trend, driven by the ECB's hawkish stance and the BOJ's dovish stance. However, investors should remain cautious of potential market volatility and economic uncertainties.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/JPY Technical AnalysisTrendline Breakout:

EUR/JPY has broken a long-standing descending trendline, which previously acted as dynamic resistance, pushing the price lower. The breakout indicates a potential trend reversal from bearish to bullish.

Retesting Support Zone:

After the breakout, the price has retraced back to a key support zone around 156.000, highlighted in purple. This area has previously acted as a strong demand zone, where buyers have stepped in multiple times. Retesting this zone is a natural price action movement before confirming further upside momentum.

Bullish Projection:

If the support at 156.000 holds, EUR/JPY is expected to resume its bullish movement towards key resistance levels at 158.000 and ultimately 160.000. These levels align with previous price reaction zones, making them crucial take-profit areas for buyers.

DeGRAM | EURJPY growth in the channelEURJPY is in a descending channel between trend lines.

The price is moving from the lower boundary of the channel and support level, and the 38.2% retracement level is the nearest obstacle to growth.

The chart retains a descending structure, but it has already formed a harmonic pattern.

On the 4H Timeframe, the indicators are pointing to a bullish convergence.

We expect growth in the channel after consolidation above the 38.2% retracement level.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

EUR/JPY Weekly Forecast – Liquidity Grab Before Bullish Move 🔍 Market Overview:

EUR/JPY is currently approaching a key weekly sell-side liquidity zone. We anticipate that institutions will sweep this liquidity before driving price higher for a long-term bullish trend.

🎯 Trade Plan:

✅ Wait for Liquidity Grab: Look for price to take out the weekly sell-side liquidity (SSL) before considering long positions.

✅ Confirmation Zone: Watch for a strong reversal signal near demand zones after the liquidity sweep.

✅ Bullish Targets:

Target 1: First supply zone after BOS (Break of Structure).

Target 2: Higher timeframe order block for extended bullish move.

📊 Key Market Confluences:

🔹 Liquidity Sweep: Institutions may clear weak buy-side traders before reversing.

🔹 Smart Money Concept (SMC): We need a clear Change of Character (ChoCH) for bullish confirmation.

🔹 Institutional Order Flow: Watch for high-volume rejections & price absorption signs.

🚀 Best Trading Sessions to Monitor:

📌 London & New York Overlap – High volatility expected for entry confirmation.

⚠️ Risk Management:

Patience is key! Wait for the liquidity grab and a strong bullish reaction before entering long positions. No FOMO!

💬 Do you see EUR/JPY flipping bullish after liquidity sweep? Comment below! 👇🔥

eurjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/JPY "The Yuppy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade always.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (160.000) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / swing low or high level Using the 3H timeframe (158.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 162.200 (or) Escape Before the Target

Final Target - 165.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/JPY "The Yuppy" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟡Fundamental Analysis

The EUR/JPY exchange rate is influenced by the Eurozone's economic growth, inflation, and interest rates, as well as Japan's economic performance. Currently, the Eurozone's economy is experiencing moderate growth, with a slight increase in inflation.

⚫Macroeconomic Analysis

The European Central Bank has maintained a hawkish stance, with interest rates expected to remain high in the short term. On the other hand, the Bank of Japan has kept interest rates at historic lows, supporting the economy.

🔴COT Data Analysis

The Commitments of Traders (COT) report shows that commercial traders are net short, while non-commercial traders are net long. This indicates a potential trend reversal

🟠Market Sentimental Analysis

Market sentiment is slightly bullish, with 55% of traders holding long positions. Institutional traders are holding long positions, while hedge funds are holding short positions. Retail traders are also holding long positions.

🟤Market Sentiment by Trader Type

- Institutional Traders: 60% bullish, 40% bearish

- Hedge Funds: 55% bearish, 45% bullish

- Retail Traders: 55% bullish, 45% bearish

🟢Positioning Data Analysis

Institutional traders are holding long positions, while corporate traders are holding short positions. Banks are maintaining a bearish stance.

🟣Overall Outlook

The EUR/JPY exchange rate is expected to remain volatile in the short term, with a slight bullish bias due to the Eurozone's economic growth and inflation. However, the pair's movement will largely depend on the overall performance of the Eurozone and Japanese economies, as well as global economic trends.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURJPY buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURJPY SHORTS My initial thoughts were to look for buy entries as we hit a low, with a double bottom on the 15-minute chart showing potential signs of upside movement. I entered a buy position but was stopped out in profit due to the formation of a double top, indicating that the overall daily downtrend could still be in play. This reinforces the importance of risk management.

Let me know your thoughts in the comments

DeGRAM | EURJPY the rising bottom is formedEURJPY is in a descending channel between the trend lines.

The price is moving from the lower trend line and support level.

The chart has formed a rising bottom.

We expect growth after the retest and consolidation above the support.

-------------------

Share your opinion in the comments, and support the idea with a like. Thanks for your support!

eurjpy. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurjpy analysis. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Expecting bullish volatility from this bearish contractionSupported by the daily rejection block, we're looking for bullish opportunities because we have cleared the immediate swing high at 158.000. This sentiment indicates a strong bullish market.

Anticipating this corrective movement to reduce further and mitigate the breaker block at 157.350 to activate buyers for a volatile bullish move.

- Entry: 157.350

- Stop Loss: 156.550 (80 pips risk)

- Target: 161.350 (400 pips potential gain)

This trade setup suggests a bullish opportunity with a risk-reward ratio of 1:5.

EURJPY The Week Ahead 17th Feb 25The EURJPY price action sentiment appears bearish, supported by the longer-term prevailing downtrend.

The key trading level is at 161.30, 50 Day Moving Average level. An oversold rally from the current levels and a bearish rejection from the 161.30 level could target the downside support at 158.85 followed by 15687 and 156.00 levels over the longer timeframe.

Alternatively, a confirmed breakout above 161.70 resistance and a daily close above that level would negate the bearish outlook opening the way for further rallies higher and a retest of 162.76 resistance followed by 163.70 levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Eur/Joy sell setup UsdJpy gave confluence to this. I'll be looking to go short from 159.788 you can wait for H4 rejection of the zone before looking for sell opportunities or you go aggressive, it depends on the kinda trader you are.

Taking the 159.5 as Inducement my point of interest looks valid and I'll be anticipating what price would do at that level.

Kindly boost if you find this insightful 🫴

EURJPY analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade