EURJPY Dual-Direction AnalysisWait for confirmation on level 129.500 for buy/sell

Overall Reasoning:

- Level 129.500 has shown good reactions in the past (Scroll back to see)

Sell Reasoning

- Trend line was broken with a strong bullish push causing a S&D imbalance which is expected to be filled and retest trendline

- Overall trend is still bearish (Unless price rejects level 129.500 and moves higher)

- Wait for a break and retest of 129.500 level to sell.

Buy Reasoning:

- Price formed a long-term double bottom on level 128.000

- Broke previous lover high (Red), waiting on a retest.

- If price retest level 129.500 with bullish confirmation, look to go long. (Aggressive)

- Wait for a considerable retracement between 129.000-129.5000

Eurjpysell

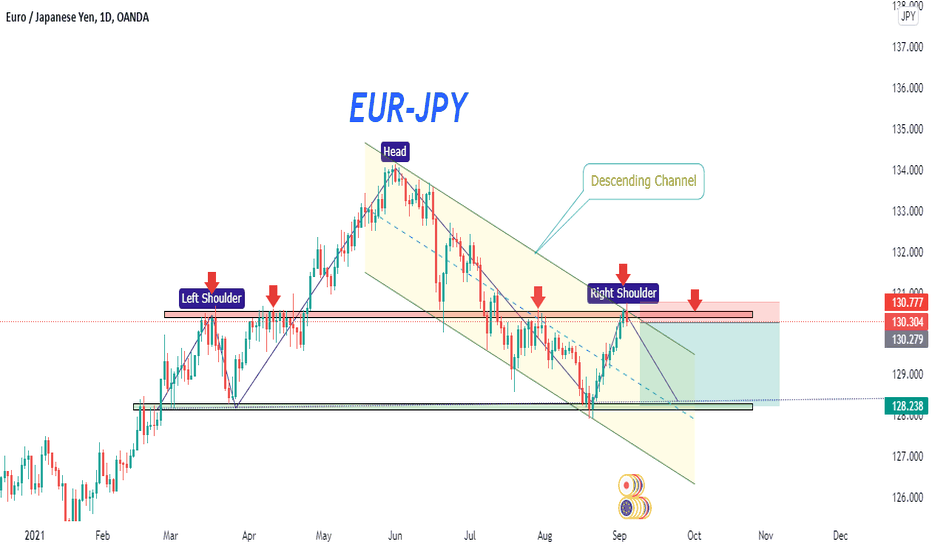

EUR/JPY Trying To Make Head And Shoulders , New Short Setup HereThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

EUR/JPY SELL IDEAHey tradomaniacs,

welcome to another free trading-setup.

Notice: This is meant to be a preparation. As always we will have to wait for a confirmation!

EUR/JPY: Daytrade-Preparation

Market-Sell: 130.160

Stop-Loss: 130.425

Point of Risk-Reduction: 129.875

Take-Profit:129.140

Stop-Loss:26 pips

Risk: 0,5% -1%

Risk-Reward: 4,0

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me

EUR/JPY Full Analysis And 2 Setups In This Video To Get 200 PipsThis is an educational + analytic content that will teach why and how to enter a trade

Make sure you watch the price action closely in each analysis as this is a very important part of our method

Disclaimer : this analysis can change at anytime without notice and it is only for the purpose of assisting traders to make independent investments decisions

EURJPY-Short#EURJPY

Market has pushed back from resistance level.

In daily timeframe market is repeating history.

Looking forwad that pair will form Heada&Shoulder pattern.

At the same spot i am seeing descending channel and currently market has pulled back into it from resistance.

So all things supporting strong sell. Don't miss opportunity.

EURJPY SELL STOP 130.515dont trade before SELL stop, if you get 20 to 30 pips kindly close,its good for investment 2% risks.

if you wanna more pips fully risks for urs.

we are only try to hit baby pips if you like this analysis,please support our idea by hitting the like button and share to ur frnz. we will support start to end trading

hava a great trading!

EUR/JPY:FUNDAMENTAL ANALYSIS+PRICE ACTION|NEXT TARGET|SHORT🔔🔔The Preliminary Japanese Jibun Bank Manufacturing PMI for August was reported at 52.4, the Preliminary Japanese Jibun Bank Services PMI at 43.5, and the Preliminary Japanese Jibun Bank Composite PMI at 45.9. Forex traders can compare this to the Japanese Jibun Bank Manufacturing PMI for July, reported at 53.0, the Japanese Jibun Bank Services PMI reported at 46.4, and the Japanese Jibun Bank Composite PMI reported at 48.8.

The Preliminary French Markit Manufacturing PMI for August is predicted at 57.3, the Preliminary French Markit Services PMI at 57.0, and the Preliminary French Markit Composite PMI at 56.5. Forex traders can compare this to the French Markit Manufacturing PMI for July, reported at 58.0, the French Markit Services PMI reported at 56.8, and the French Markit Composite PMI reported at 56.6.

The Preliminary German Markit Manufacturing PMI for August is predicted at 65.0, the Preliminary German Markit Services PMI at 61.0, and the Preliminary German Markit Composite PMI at 62.2. Forex traders can compare this to the German Markit Manufacturing PMI for July, reported at 65.9, the German Markit Services PMI reported at 61.8, and the German Markit Composite PMI reported at 62.4.

The Preliminary Eurozone Markit Manufacturing PMI for August is predicted at 62.0, the Preliminary Eurozone Markit Services PMI at 59.8, and the Preliminary Eurozone Markit Composite PMI at 59.7. Forex traders can compare this to the Eurozone Markit Manufacturing PMI for July, reported at 62.8, the Eurozone Markit Services PMI reported at 59.8, and the Eurozone Markit Composite PMI reported at 60.2.

Advanced Eurozone Consumer Confidence for August is predicted at -5.0. Forex traders can compare this to the previous Eurozone Consumer Confidence for July, reported at -4.4.

The forecast for the EUR/JPY remains bearish despite the massive sell-off, as inflationary pressures, supply chain disruptions, and the delta variant of Covid-19 keep downside pressure on the global economy.

Can bears remain in control over the EUR/JPY and force more selling?

You can find our Website/Telegram Links in Description Below ↓↓↓

EurJpy- Continuation to the down side?Since the beginning of June, EurJpy has started to drop, putting in lower highs and lower lows on our daily chart.

At this moment the pair is consolidating in a symmetrical triangle and we can expect continuation.

127 could be a good target for swing traders and only sustained buying pressure above 130.50 would put a pause to this scenario.

EUR/JPY:DOWNTREND|PRICE ACTION+FIBO ANALILYS|SHORT 🔔Welcome back Traders, Investors, and Community!

Check the Links in Description and If you LIKE this analysis, Please support our page and Ideas by hitting the LIKE 👍 button

Traders, if you like this idea or have your own opinion about it, please write your own in the comment box . We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

Have a Good Day Trading !

EURJPY positionThis entry was simply based on the trendline violation principles. of course other confluences had to be adapted before making an entry.

*Disclaimer*

This is not financial advice. Forex trading is a risky business. Trade at your own risk. Patience and risk management are always key

#Trade_Like_A_Magnate