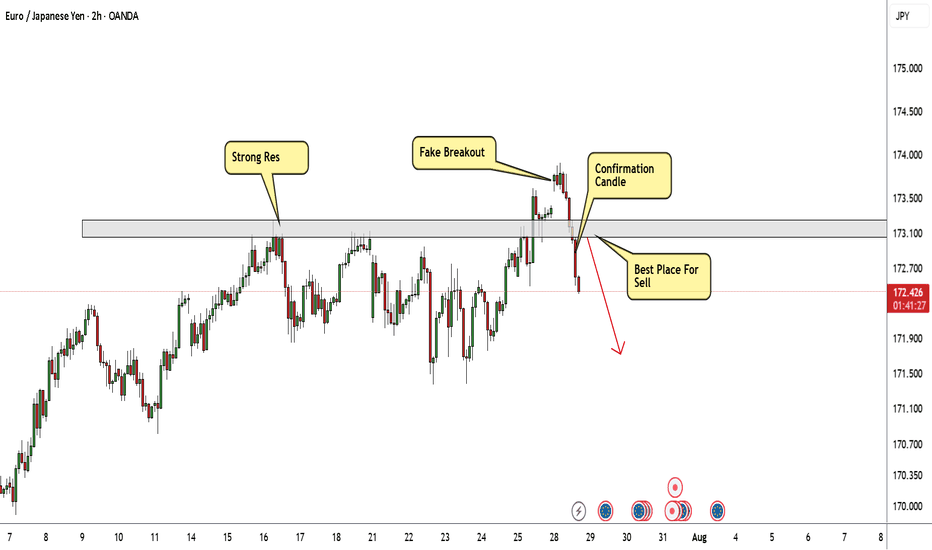

EUR/JPY Again Below My Res , Short Setup Valid To Get 150 Pips !Here is my opinion on EUR/JPY On 2H T.F , We have a fake breakout and Gap and the price back again below my res area and closed with 4H Candle below it , so i have a confirmation and i`m waiting the price to go back to retest this strong res and give me any bearish price action and then we can enter a sell trade and targeting 100 : 150 pips . if we have a daily closure above my res then this analysis will not be valid anymore .

Eurjpysetup

EURJPY Bullish Setup: Waiting for the Optimal Retrace EntryThe EURJPY is currently in a strong bullish trend 📈🔥. I’m anticipating a retracement into the Fibonacci 50–61.8% zone 🔄, which aligns with the equilibrium of the current price swing ⚖️. This potential pullback could present an optimal entry 🎯 — provided we see a bullish break of market structure 🔓📊 during the move down.

🛑 Stops and targets, as discussed in the video, are shared for educational purposes only — this is not financial advice 📚🚫. Please ensure you do your own analysis and risk assessment 🧠📉.

EUR/JPY Hits 12-Month HighEUR/JPY Hits 12-Month High

As the chart indicates, the EUR/JPY pair has risen above ¥172 per euro — a level last seen in July 2024.

Since early June, the exchange rate has increased by approximately 5.6%. This upward movement is driven by a combination of factors, including:

→ Divergence in central bank policy: The European Central Bank’s key interest rate remains significantly higher than that of the Bank of Japan, making the euro more attractive in terms of yield compared to the yen.

→ US trade tariffs on Japan: The potential imposition of 25% tariffs by the United States on Japanese goods poses a threat to Japan’s export-driven economy, placing downward pressure on the national currency.

→ Eurozone expansion and consolidation: News of Bulgaria’s potential accession to the euro area is strengthening investor confidence in the single currency.

→ Weakness in the US dollar: As the US Dollar Index fell to its lowest level since early 2022 this July, demand for the euro has grown, positioning it as a key alternative reserve currency.

Can the rally continue?

Technical Analysis of EUR/JPY

For several months, the pair traded within a range of approximately ¥156–165 per euro, but has recently broken above the upper boundary of this channel. Based on technical analysis, the width of the previous range implies a potential price target in the region of ¥174 per euro.

It is noteworthy that the rally gained momentum (as indicated by the arrow) following the breakout above the psychological threshold of 170, a sign of bullish market dominance. At the same time, the RSI has surged to a multi-month high, signalling moderate overbought conditions.

Under these circumstances, the market may be vulnerable to a short-term correction, potentially:

→ Towards the lower boundary of the ascending channel (shown in orange);

→ To retest the psychological support around ¥170.

That said, a reversal of the prevailing trend would likely require a significant shift in the fundamental backdrop — for example, progress towards a trade agreement between Japan and the United States.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

The Correlation Between EURJPY and NASDAQ You Shouldn't IgnoreCurrently keeping a close eye on EURJPY — price action has been bullish 📈, showing a strong upward push on the daily timeframe 🕒.

Right now, we’re seeing a bit of indecision 🤔, which is fairly typical for a Monday session as the market finds its footing.

🔍 I’m watching for continuation to the upside, as long as NASDAQ remains bullish. That said, NASDAQ is looking quite overextended 🧗, and a pullback could trigger a short-term retracement in the euro as well — these two tend to move in correlation 🔗, so keep a close watch on NAS100 for early clues.

If EURJPY consolidates sideways ⏸️, and we then get a clear break of market structure to the upside 🚀, I’ll be looking for a long setup on the retest and failure of the range floor — textbook continuation play 🎯.

As always, this is not financial advice — full breakdown in the video 🎥.

EURJPYAs our followers may remember, we already secured a great profit on EURJPY.

Now, we're once again waiting for price to revisit our key level — so we can potentially catch another high-probability setup.

📌 Always remember:

The market is unpredictable.

We're not here to predict — we're here to react, using technical analysis, clear setups, proper risk and trade management.

❌ If a level breaks, we don’t panic.

✅ Instead, we patiently wait for a pullback and take advantage of the next smart entry.

EURJPY: A Big Move In Making, Please Share Your Views! Date: 22/06/2025

Hello everyone,

I hope you’re all having a good weekend. As we previously discussed, we expected a sharp decline in Europe/JPY, but unfortunately, it didn’t work out in our favour due to the extremely bullish US dollar. This led to the crossing and invalidation of our two selling zones.

Looking at next week’s price projection, we can confirm that the price is heading towards 170.50 and may be selling at this level. Therefore, we will be keeping a stop loss at 171.50.

Once the trade is activated, we can set our target at 166.0, 163.50, and the final target will be placed at 158.50.

If you like our work, please like our idea.

Good luck and trade safely next week.

EUR/JPY Breakout Done , Long Setup Valid To Get 200 Pips !Here is my opinion on EUR/JPY , We have a very clear breakout and now i`m waiting for retest to broken res and new support and waiting for good bullish price action to enter a buy trade and targeting at least previous high , if the price go back below my support with daily closure then this idea will not be valid .

EURJPY Trade IdeaEURJPY is maintaining a strong bullish structure on the 1H chart, with price action consistently forming higher highs and higher lows.

My targets are set at the next resistance levels for partial and extended profits, with a final target at the upper resistance if bullish momentum persists.

Stop loss is placed just below the previous swing low.

EURJPY - Look for Short (SWING) 1:XX!It’s been a while since I last shared a trading idea — here’s one for you.

EURJPY has spent the past few weeks in an accumulation phase and now looks poised to shift into a distribution phase to the downside. Let’s see how it unfolds.

Disclaimer:

This is simply my personal technical analysis, and you're free to consider it as a reference or disregard it. No obligation! Emphasizing the importance of proper risk management—it can make a significant difference. Wishing you a successful and happy trading experience!

EUR/JPY "The Yuppy" Forex Bank Heist Plan (Scalping / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (163.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 30 mins timeframe (161.500) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 166.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

EUR/JPY "The Yuppy" Forex Market Heist Plan (Scalping / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/JPY "The Yuppy" Forex Market Money Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (161.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low or high level Using the 4H timeframe (158.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 165.700 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

EUR/JPY "The Yuppy" Forex market is currently experiencing a Bullish 🐃 trend,., driven by several key factors.

👉Fundamental Analysis

Fundamental analysis examines the economic and political factors driving currency value. For EUR/JPY, we focus on Eurozone vs. Japan.

👉Eurozone (EUR) Factors:

Interest Rates: Assume the European Central Bank (ECB) has maintained or raised rates by March 2025 to combat inflation or support growth. Higher rates attract capital inflows, strengthening EUR.

Inflation: If Eurozone inflation remains elevated (e.g., 2-3%), the ECB might tighten policy, supporting EUR.

GDP Growth: Strong growth (e.g., 2% annualized) signals economic health, boosting EUR.

Political Stability: Stable EU leadership and no major crises (e.g., elections or debt issues) favor EUR.

Trade Balance: A surplus in exports (e.g., German machinery) strengthens EUR.

👉Japan (JPY) Factors:

Interest Rates: The Bank of Japan (BoJ) historically keeps rates low or negative. If still near 0% or slightly positive by 2025, JPY remains weak.

Inflation: Japan’s chronic low inflation/deflation (e.g., 1%) limits JPY strength.

GDP Growth: Slow growth (e.g., 1%) due to aging population and export reliance weakens JPY.

Yen as Safe Haven: JPY gains during global risk-off events (e.g., wars, recessions). If 2025 is calm, JPY weakens.

Trade Balance: Japan’s export-driven economy (e.g., cars, tech) supports JPY if global demand holds.

Conclusion: At 160.000, EUR likely benefits from higher yields and growth, while JPY is pressured by low rates and risk-on sentiment.

👉Macroeconomic Factors

Macro trends influence long-term currency movements:

Global Growth: Strong global growth in 2025 favors risk assets, weakening JPY (a safe haven).

Commodity Prices: Rising oil/energy prices hurt Japan (net importer) more than the Eurozone, weakening JPY.

Central Bank Policies: ECB tightening vs. BoJ easing widens yield differentials, pushing EUR/JPY higher.

Geopolitics: Assume no major conflicts by March 2025; stability favors EUR over JPY.

Demographics: Japan’s aging population caps growth, while Eurozone’s diverse economies adapt better.

Conclusion: Macro trends lean bullish for EUR/JPY.

👉Global Market Analysis

Equity Markets: Rising global stocks (e.g., S&P 500, DAX) signal risk-on, weakening JPY.

Bond Yields: Higher Eurozone yields (e.g., German 10-year at 2.5%) vs. Japan’s (e.g., 0.5%) drive EUR strength.

FX Volatility: Low volatility favors carry trades (borrowing JPY to buy EUR), supporting EUR/JPY.

USD Impact: If USD weakens (e.g., Fed cuts rates), EUR may outperform JPY due to Eurozone resilience.

Conclusion: Risk-on global markets support a bullish EUR/JPY.

👉Commitment of Traders (COT) Data

COT reports show positioning of large speculators, commercials, and asset managers:

Speculators: If net long EUR/JPY increases (e.g., +50,000 contracts), it signals bullish sentiment.

Commercials: Hedgers shorting EUR/JPY (e.g., -30,000 contracts) suggest exporters locking in rates, a neutral signal.

Open Interest: Rising open interest with price indicates trend continuation (bullish if above 160.000).

Historical Context: Extreme positioning often precedes reversals; moderate longs suggest room to run.

Hypothetical Conclusion: Moderate bullish positioning supports further upside.

👉Intermarket Analysis

Intermarket relationships link forex to other assets:

EUR/JPY vs. Stocks: Positive correlation with risk assets (e.g., Nikkei 225, Euro Stoxx 50) favors bulls.

EUR/JPY vs. Yields: Strong correlation with Eurozone bond yields; rising yields push EUR/JPY up.

EUR/JPY vs. Gold: Inverse correlation; if gold falls (risk-on), EUR/JPY rises.

USD/JPY Impact: If USD/JPY rises (JPY weakens broadly), EUR/JPY follows suit.

Conclusion: Bullish intermarket signals align with EUR/JPY strength.

👉Quantitative Analysis

Quantitative models use data-driven metrics:

Interest Rate Differential: Assume ECB rate at 3% vs. BoJ at 0.5%; 2.5% differential favors EUR.

Purchasing Power Parity (PPP): Long-term fair value might be 140; at 160, EUR/JPY is overvalued but momentum-driven.

Volatility (ATR): Low 14-day ATR (e.g., 1.5) suggests steady uptrend, not exhaustion.

Moving Averages: If 50-day MA (e.g., 158) < 200-day MA (e.g., 155) < price (160), trend is bullish.

Conclusion: Quant metrics support a bullish bias.

👉Market Sentiment Analysis

Sentiment reflects trader psychology:

Retail Positioning: If 70% of retail traders are short EUR/JPY (per broker data), contrarian logic favors bulls.

News Flow: Positive Eurozone headlines (e.g., growth data) vs. neutral Japan news boost EUR.

Social Media (X): Assume X posts show optimism on EUR, pessimism on JPY carry trade unwind.

Conclusion: Sentiment leans bullish.

👉Positioning

Carry Trade: Low JPY rates make it a funding currency; longs in EUR/JPY profit from yield and appreciation.

Hedge Funds: Assume funds are net long EUR/JPY, per COT or market rumors.

Central Banks: BoJ intervention unlikely unless EUR/JPY spikes (e.g., to 170).

Conclusion: Positioning favors bulls.

👉Next Trend Move

Technical Levels: Resistance at 162.000, support at 158.000. Break above 162 signals strong bulls.

Catalysts: ECB hawkish statement or BoJ dovishness could push EUR/JPY to 165.000.

Risks: Sudden risk-off (e.g., stock crash) could drop it to 155.000.

Prediction: Uptrend to 162-165, barring shocks.

👉Overall Summary Outlook

Bullish Factors: ECB tightening, BoJ easing, risk-on markets, yield differentials, bullish positioning.

Bearish Risks: Global risk-off, BoJ intervention, or EUR overvaluation correction.

Outlook: Bullish. EUR/JPY likely rises to 162-165 by Q2 2025, assuming stability. Watch for reversals if risk sentiment shifts.

Real-Time Market Feed (Simulated)

Since I can’t access live data, here’s a hypothetical snapshot as of March 10, 2025, 12:00 UTC:

Bid/Ask: 159.980 / 160.020

1-Hour Change: +0.150 (+0.09%)

Daily High/Low: 160.300 / 159.700

Volume: Moderate, carry trade-driven.

👉Future Prediction

Short-Term : Bullish to 162-166.

Long-Term : Depends on global risk and policy shifts; potential correction to 150 if JPY strengthens.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/JPY "YUPPY" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "YUPPY" Forex Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Buy above (157.700) then make your move - Bullish profits await!"

however I advise to placing the Buy Stop Orders above the breakout MA (or) placing the Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 156.000 (swing Trade Basis) Using the 4H period, the recent / Swing Low or High level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 160.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

╰┈➤EUR/JPY "YUPPY" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟠Fundamental Analysis

1. Interest Rates: The European Central Bank (ECB) has maintained a hawkish stance, with interest rates expected to remain around 3.25%. The Bank of Japan (BOJ) has also maintained a dovish stance, with interest rates expected to remain around -0.10%

2. Inflation: Eurozone inflation is expected to be around 2.2% in 2025, while Japan's inflation is expected to be around 1.5%

3. GDP Growth: Eurozone GDP growth is expected to be around 1.2% in 2025, while Japan's GDP growth is expected to be around 1.1%

4. Trade Balance: The Eurozone has a significant trade surplus, while Japan has a trade deficit.

🟡Macroeconomic Factors

1. Monetary Policy: The ECB and BOJ's monetary policies have a significant impact on EUR/JPY.

2. Fiscal Policy: Government spending and taxation policies in the Eurozone and Japan can impact the economy and currency.

3. Global Events: Events like the COVID-19 pandemic, Brexit, and trade wars can impact EUR/JPY.

🔴COT Data

1. Non-Commercial Traders: These traders hold a net long position in EUR/JPY futures, with 55.1% of open interest.

2. Commercial Traders: Commercial traders hold a net short position in EUR/JPY futures, with 44.9% of open interest.

3. Open Interest: The total number of outstanding contracts is 233,111.

🟤Market Sentimental Analysis

1. Bullish Sentiment: 53.5% of investors are bullish on EUR/JPY.

2. Bearish Sentiment: 46.5% of investors are bearish on EUR/JPY.

3. Sentiment Index: The sentiment index is at 54.2, indicating a neutral market sentiment.

🟣Positioning Analysis

1. Long Positions: 56.3% of investors are holding long positions in EUR/JPY.

2. Short Positions: 43.7% of investors are holding short positions in EUR/JPY.

3. Retail Trader Sentiment: Retail traders are net long EUR/JPY, with a sentiment index of 57.1%.

4. Institutional Trader Sentiment: Institutional traders are net short EUR/JPY, with a sentiment index of 45.6%.

🔵Quantitative Analysis

1. Moving Averages: The 50-day moving average is above the 200-day moving average, indicating a bullish trend.

2. Relative Strength Index (RSI): The RSI is at 55.9, indicating a neutral market sentiment.

3. Bollinger Bands: The price is trading near the upper band, indicating a potential overbought condition.

🟢Intermarket Analysis

1. Correlation with Other Markets: EUR/JPY has a positive correlation with EUR/USD and a negative correlation with USD/JPY.

2. Commodity Prices: EUR/JPY has a positive correlation with gold prices and a negative correlation with oil prices.

⚫News and Events Analysis

1. ECB Meetings: The ECB's monetary policy decisions can significantly impact EUR/JPY.

2. BOJ Meetings: The BOJ's monetary policy decisions can also impact EUR/JPY.

3. Economic Data Releases: Releases of economic data, such as GDP growth and inflation, can influence EUR/JPY.

⚪Next Trend Move

Based on the analysis, the next trend move for EUR/JPY is likely to be bullish, with a potential target of 160.000.

🟡Future Prediction

Based on the analysis, the future prediction for EUR/JPY is bullish, with a potential target of 165.000 in the next 6-12 months.

🔴Overall Summary Outlook

EUR/JPY is expected to remain in a bullish trend, driven by the ECB's hawkish stance and the BOJ's dovish stance. However, investors should remain cautious of potential market volatility and economic uncertainties.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EUR/JPY "The Yuppy" Forex Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade always.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (160.000) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / swing low or high level Using the 3H timeframe (158.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 162.200 (or) Escape Before the Target

Final Target - 165.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

EUR/JPY "The Yuppy" Forex Market is currently experiencing a bullish trend,., driven by several key factors.

🟡Fundamental Analysis

The EUR/JPY exchange rate is influenced by the Eurozone's economic growth, inflation, and interest rates, as well as Japan's economic performance. Currently, the Eurozone's economy is experiencing moderate growth, with a slight increase in inflation.

⚫Macroeconomic Analysis

The European Central Bank has maintained a hawkish stance, with interest rates expected to remain high in the short term. On the other hand, the Bank of Japan has kept interest rates at historic lows, supporting the economy.

🔴COT Data Analysis

The Commitments of Traders (COT) report shows that commercial traders are net short, while non-commercial traders are net long. This indicates a potential trend reversal

🟠Market Sentimental Analysis

Market sentiment is slightly bullish, with 55% of traders holding long positions. Institutional traders are holding long positions, while hedge funds are holding short positions. Retail traders are also holding long positions.

🟤Market Sentiment by Trader Type

- Institutional Traders: 60% bullish, 40% bearish

- Hedge Funds: 55% bearish, 45% bullish

- Retail Traders: 55% bullish, 45% bearish

🟢Positioning Data Analysis

Institutional traders are holding long positions, while corporate traders are holding short positions. Banks are maintaining a bearish stance.

🟣Overall Outlook

The EUR/JPY exchange rate is expected to remain volatile in the short term, with a slight bullish bias due to the Eurozone's economic growth and inflation. However, the pair's movement will largely depend on the overall performance of the Eurozone and Japanese economies, as well as global economic trends.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Strong Downtrend in EURJPY—Here’s My Trade Plan!In this video, we take a quick look at the EURJPY currency pair, which is currently in a strong downtrend. On the four-hour timeframe, we can clearly see lower highs and lower lows. However, price has now reached a key support zone on the weekly and daily timeframes. While my bias remains bearish, I’ll be watching for a retracement toward previous swing highs for a potential entry, as the pair is trading into a significant liquidity pool and is likely to react at this level. This is not financial advice.

EURJPY - ShortEURJPY Analysis - SELL 👆

In this Chart EURJPY H3 Timeframe: By Nii_Billions.

❤️This Chart is for EURJPY market analysis.

❤️Entry, SL, and Target is based off our Strategy.

This chart analysis uses multiple timeframes to analyze the market and to help see the bigger picture on the charts.

The strategy uses technical and fundamental factors, and market sentiment to predict a BEARISH trend in EURJPY, with well-defined entry, stop loss, and take profit levels for risk management.

🟢This idea is purely for educational purposes.🟢

❤️Please, support our work with like & comment!❤️

EUR/JPY "The Dragon" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Dragon" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade after the MA Breakout,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2h period, the recent / nearest low or high level.

Goal 🎯: 167.000 (or) Escape before the target

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, the EUR/JPY pair is expected to move in a bullish trend, with the Euro expected to strengthen against the Yen. The Eurozone's improving economic indicators, accommodative monetary policy, and expansionary fiscal policy are expected to support the Euro, while Japan's slowing economic growth, low inflation rate, and contractionary fiscal policy are expected to weaken the Yen.

Economic Indicators: The Eurozone's economic indicators, such as GDP growth rate, inflation rate, and unemployment rate, are expected to improve in the coming months.

Monetary Policy: The European Central Bank (ECB) is expected to maintain its accommodative monetary policy, which could support the Euro.

Fiscal Policy: The Eurozone's fiscal policy is expected to be expansionary, which could support economic growth.

Trade Balance: The Eurozone's trade balance is expected to improve, which could support the Euro.

Interest Rates: The ECB is expected to keep interest rates low, which could support the Euro.

Japan's Economic Indicators

Economic Growth: Japan's economic growth is expected to slow down in the coming months.

Inflation Rate: Japan's inflation rate is expected to remain low, which could weaken the Yen.

Monetary Policy: The Bank of Japan (BOJ) is expected to maintain its accommodative monetary policy, which could weaken the Yen.

Fiscal Policy: Japan's fiscal policy is expected to be contractionary, which could weaken the economy.

Trade Balance: Japan's trade balance is expected to deteriorate, which could weaken the Yen.

Comparative Analysis

GDP Growth Rate: The Eurozone's GDP growth rate is expected to be higher than Japan's.

Inflation Rate: The Eurozone's inflation rate is expected to be higher than Japan's.

Interest Rates: The ECB's interest rates are expected to be higher than the BOJ's.

Trade Balance: The Eurozone's trade balance is expected to be better than Japan's.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

EUR/JPY "The Yuppy" Forex Market Heist Plan on Bullish🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EUR/JPY "The Yuppy" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 30min period, the recent / nearest low or high level.

Goal 🎯: 165.000

Scalpers, take note : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Based on the fundamental analysis, I would conclude that the EUR/JPY (Euro/Japanese Yen) pair is: Bullish

Reasons:

Interest rate differential: The European Central Bank's (ECB) interest rate (2.50%) is higher than the Bank of Japan's (BoJ) interest rate (0.10%), making the EUR more attractive to investors.

Economic growth: The Eurozone's economy is expected to grow at a faster pace than Japan's, driven by the strong labor market and increasing business investment.

Monetary policy: The ECB's hawkish stance and potential interest rate hikes are expected to support the EUR, while the BoJ's dovish stance and potential monetary policy easing could weaken the JPY.

Trade balance: The Eurozone's trade balance is expected to remain in surplus, driven by the strong demand for European exports, which could support the EUR.

Japanese economic slowdown: Japan's economy is expected to slow down, driven by the aging population and decreasing labor force, which could lead to a decline in the JPY.

However, it's essential to consider the following risks:

Global economic slowdown: A slowdown in global economic growth could reduce demand for the EUR and drive down prices.

Eurozone debt crisis: The Eurozone's debt crisis could resurface, potentially weakening the EUR and driving down prices.

Trade tensions: Escalating trade tensions between the Eurozone and other countries could negatively impact the EUR and drive down prices.

Bullish Scenario:

Interest rate differential, economic growth, and monetary policy support the EUR

Japanese economic slowdown and trade balance support the bullish case

Key Fundamental Indicators:

Eurozone GDP growth: 1.5% (2023 estimate)

Japan GDP growth: 0.5% (2023 estimate)

ECB interest rate: 2.50%

BoJ interest rate: 0.10%

Eurozone trade balance: €20 billion (2023 estimate)

Japan trade balance: ¥500 billion (2023 estimate)

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

EURJPY Bullish Trend: Key Levels, Entry Points & Targets👀 👉 The EURJPY pair has been trending bullish, which is evident on the daily timeframe. In the video, I discuss the trend, highlight key support and resistance levels where I’m considering entries, and outline my target and stop-loss levels. ⚠️ This content is for educational purposes only and does not constitute financial advice.